Independence Realty Trust, Inc. Reports Minimal Damage to Communities from Hurricane Florence

September 18 2018 - 8:48AM

Business Wire

Independence Realty Trust, Inc. (NYSE: IRT) (“IRT” or “the

Company”) today announced the Company’s owned and managed apartment

communities in the Carolinas and Georgia are operational and did

not suffer any significant damage as a result of Hurricane

Florence. At this time, the Company does not expect any material

impact on financial performance.

“We are grateful to report that all of our residents and

employees in the impacted areas are safe, and that we have not

sustained any substantial damage to our communities,” said Scott

Schaeffer, Chairman and CEO of IRT. “Our on-site teams were

integral in preparing our communities for this storm and we thank

them for their support. We will keep our stakeholders abreast of

the status of our communities as we assess any residual impact from

the hurricane and update you in a timely manner should the risk of

cresting rivers cause any material damage.”

About Independence Realty Trust, Inc.

Independence Realty Trust (NYSE: IRT) is a real estate

investment trust that owns and operates 58 multifamily apartment

communities, totaling 15,860 units, across non-gateway U.S.

markets, including Atlanta, Louisville, Memphis, and Raleigh. IRT's

investment strategy is focused on gaining scale within key amenity

rich submarkets that offer good school districts, high-quality

retail and major employment centers. IRT aims to provide

stockholders attractive risk-adjusted returns through diligent

portfolio management, strong operational performance, and a

consistent return of capital through distributions and capital

appreciation.

Forward-Looking Statements

This press release contains certain forward-looking statements

within the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. Such forward-looking statements can generally be

identified by our use of forward-looking terminology such as “may,”

“will,” “expect,” “intend,” “anticipate,” “estimate,” “believe,”

“seek,” “outlook,” “assumption,” “projected,” “strategy,”

“guidance” or other, similar words. Because such forward-looking

statements involve significant risks, uncertainties and

contingencies, many of which are not within IRT’s control, actual

results may differ materially from the expectations, intentions,

beliefs, plans or predictions of the future expressed or implied by

such statements. These forward-looking statements are based upon

the current judgements and expectations of IRT’s management. Risks

and uncertainties that might cause IRT’s actual results to differ

materially from those expressed or implied by forward-looking

statements include, but are not limited to: adverse changes in

national, regional and local economic climates; changes in market

demand for rental apartment homes and pricing pressures from

competitors that could limit our ability to lease units or increase

rents; competition that could adversely affect our ability to

acquire additional properties; volatility in capital and credit

markets, including changes that reduce availability, and increase

costs, of capital; unexpected changes in the assumptions underlying

our 2018 EPS and CFFO guidance; delays in completing, and cost

overruns incurred in connection with, the value add initiatives and

failure to achieve projected rent increases on account of the

initiatives; risks associated with pursuit of strategic

acquisitions, including risks associated with the need to raise

additional capital to fund the acquisitions and failure of

acquisitions to produce expected returns; unexpected costs of REIT

qualification compliance; costs and disruptions as the result of a

cybersecurity incident or other technology disruption; and share

price fluctuations. Additional risks and uncertainties that could

cause our actual results to differ materially from those expressed

or implied by the forward-looking statements in this press release

are discussed in IRT’s filings with the Securities and Exchange

Commission (“SEC”), including those under the heading “Risk

Factors” in IRT’s most recently filed Annual Report on Form 10-K.

Dividends are subject to the discretion of IRT’s Board of

Directors, and will depend on IRT’s financial condition, results of

operations, capital requirements, compliance with applicable laws

and agreements and any other factors deemed relevant by IRT’s

Board. IRT undertakes no obligation to update these forward-looking

statements to reflect events or circumstances after the date hereof

or to reflect the occurrence of unanticipated events, except as may

be required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180918005587/en/

Independence Realty Trust, Inc.Edelman Financial

Communications & Capital MarketsTed McHugh and Lauren

Tarola212-277-4322IRT@edelman.com

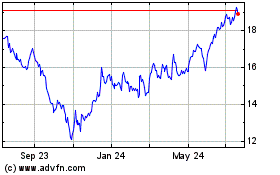

Independence Realty (NYSE:IRT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Independence Realty (NYSE:IRT)

Historical Stock Chart

From Apr 2023 to Apr 2024