UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________

FORM 8-A/A

Amendment No. 1

____________________

FOR REGISTRATION OF CERTAIN CLASSES OF SECURITIES

PURSUANT TO SECTION 12(b) OR 12(g) OF THE

SECURITIES EXCHANGE ACT OF 1934

Celanese Corporation

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

(State or other jurisdiction

of incorporation or organization)

|

|

98-0420726

(I.R.S. Employer

Identification No.)

|

|

|

|

|

|

|

|

|

|

222 W. Las Colinas Blvd., Suite 900N,

Irving, Texas

(Address of principal executive offices)

|

|

75039

(Zip Code)

|

Securities to be registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

Title of each class

to be so registered

|

|

Name of each exchange on which

each class is to be registered

|

|

|

|

|

|

|

|

Common Stock, par value $0.0001 per share

|

|

New York Stock Exchange

|

|

|

|

|

|

|

If this form relates to the registration of a class of securities pursuant to Section 12(b) of the Exchange Act and is effective pursuant to General Instruction A.(c), check the following box.

x

If this form relates to the registration of a class of securities pursuant to Section 12(g) of the Exchange Act and is effective pursuant to General Instruction A.(d), check the following box.

o

If this form relates to the registration of a class of securities concurrently with a Regulation A offering, check the following box.

o

Securities Act registration statement or Regulation A offering statement file number to which this form relates (if applicable):

Securities to be registered pursuant to Section 12(g) of the Act:

(Title of Class)

EXPLANATORY NOTE

This Amendment No. 1 to Registration Statement on Form 8-A amends and restates in its entirety the Description of Securities included in the Registration Statement on Form 8-A initially filed by Celanese Corporation (the "Company") with the Securities and Exchange Commission (the "SEC") on January 18, 2005, as set forth below.

On September 17, 2018, the Company filed with the Secretary of State of the State of Delaware a Certificate of Amendment (the "Certificate of Amendment") to its Second Amended and Restated Certificate of Incorporation, as amended (and as amended by the Certificate of Amendment, the "Amended Certificate"), to remove all references to the Company's Series B Common Stock therefrom and to redesignate the Company’s Series A Common Stock as “Common Stock.” Following the filing of the Certificate of Amendment, the Company no longer has series of its class of Common Stock. Each share of Common Stock is entitled to one vote per share and otherwise has the same designations, rights, powers and preferences as the shares of the Company's Series A Common Stock prior to the effectiveness of the Certificate of Amendment.

On February 22, 2010, the Company redeemed all of the shares of its then outstanding 4.25% Convertible Perpetual Preferred Stock. Since the redemption, no shares of Preferred Stock have been issued and no shares of Preferred Stock are outstanding.

The Company's Common Stock is listed on the New York Stock Exchange under symbol "CE".

Item 1. Description of Securities to be Registered.

The following is a summary of the rights of the Company's Common Stock and Preferred Stock. The summary is not complete and is qualified in its entirety by reference to the full text of the Amended Certificate, the Company's Fifth Amended and Restated By-laws (the "By-laws"), and Form of Certificate of Common Stock, copies of which are filed herewith as Exhibits 3.1, 3.2 and 4.1, respectively, and the terms of which are incorporated herein by reference.

Authorized Capitalization

Our authorized capital stock consists of 500,000,000 shares, consisting of (i) 400,000,000 shares of Common Stock, par value $0.0001 per share ("Common Stock"), and (ii) 100,000,000 shares of Preferred Stock, par value $0.01 per share ("Preferred Stock").

Common Stock

Voting Rights.

Holders of Common Stock are entitled to one vote per share on all matters with respect to which the holders of Common Stock are entitled to vote. The holders of Common Stock do not have cumulative voting rights in the election of directors.

Dividend Rights.

Holders of Common Stock shall be entitled to receive dividends if, as and when dividends are declared from time to time by our board of directors on the shares of Common Stock issued and outstanding from time to time out of funds legally available for that purpose, after payment of dividends required to be paid on outstanding Preferred Stock, as described below, if any. Agreements, contracts, indentures and other documents to which the Company is or may be subject from time to time impose and may impose restrictions on our ability to declare dividends on the shares of our Common Stock. Any decision to declare and pay dividends on the shares of Common Stock in the future will be made at the discretion of our board of directors and will depend on factors that our board of directors may deem relevant.

Liquidation Rights.

Upon liquidation, dissolution or winding up of the Company, the holders of Common Stock will be entitled to receive ratably the assets available for distribution to the stockholders after payment of any liquidation preferences on any outstanding Preferred Stock.

Conversion Rights.

The Common Stock has no conversion rights.

Other Matters.

The Common Stock has no preemptive rights and, if fully paid, is not subject to further calls or assessment by us. There are no redemption or sinking fund provisions applicable to the Common Stock.

Preferred Stock

The Amended Certificate authorizes our board of directors to establish one or more series of Preferred Stock and to determine, with respect to any series of Preferred Stock, the terms and rights of that series, including:

|

|

|

|

•

|

the designation of the series;

|

|

|

|

|

•

|

the number of shares of the series, which our board of directors may, except where otherwise provided in the preferred stock designation, increase (but not above the total number of authorized shares of the class) or decrease (but not below the number of shares then outstanding);

|

|

|

|

|

•

|

whether dividends, if any, on the shares of the series will be cumulative or non-cumulative and the dividend rate of the series;

|

|

|

|

|

•

|

the dates at which dividends, if any, on the series will be payable;

|

|

|

|

|

•

|

the redemption rights and price or prices, if any, for shares of the series;

|

|

|

|

|

•

|

the terms and amounts of any sinking fund provided for the purchase or redemption of shares of the series;

|

|

|

|

|

•

|

the amounts payable on shares of the series in the event of any voluntary or involuntary liquidation, dissolution or winding-up of the affairs of our Company in preference to shares of Common Stock and shares of other series of Preferred Stock;

|

|

|

|

|

•

|

whether the shares of the series will be convertible into shares of any other class or series, or any other security, of our Company or any other corporation, and, if so, the specification of the other class or series or other security, the conversion price or prices or rate or rates, any conversion rate adjustments, the date or dates as of which the shares will be convertible and all other terms and conditions upon which the conversion may be made;

|

|

|

|

|

•

|

restrictions on the issuance of shares of the same series or of any other class or series; and

|

|

|

|

|

•

|

the voting rights, if any, of the holders of the series.

|

There is no provision included in the Amended Certificate, the By-laws or the General Corporation Law of the State of Delaware (the “DGCL”) restricting the repurchase or redemption of shares of Common Stock or Preferred Stock while there is any arrearage in the payment of dividends or sinking fund installments.

Anti-Takeover Effects of Certain Provisions of Our Amended Certificate and By-laws

Certain provisions of our Amended Certificate and By-laws, which are summarized in the following paragraphs, may have an anti-takeover effect and may delay, defer or prevent a tender offer or takeover attempt that a stockholder might consider in its best interest, including those attempts that might result in a premium over the market price for the shares held by stockholders.

Classified Board of Directors

Prior to the 2017 annual meeting of stockholders, our Amended Certificate provided that our board of directors will be divided into three classes of directors, with the classes to be as nearly equal in number as possible. In 2016, stockholders voted to eliminate the classified board provisions over a three-year period and our Certificate was amended to implement the phase-out. Accordingly, we currently have two classes of directors whose terms will expire at the 2019 annual meeting. Our Amended Certificate and the By-laws provide that the number of directors will be fixed from time to time pursuant to a resolution adopted by the board of directors, but must consist of not less than seven or more than fifteen directors.

Conflicts of Interest

As permitted by Delaware law, our Amended Certificate renounces any interest or expectancy that we have in, or right to be offered an opportunity to participate in, business opportunities specified in the Amended Certificate. Our Amended Certificate provides that none of any director who is not employed by us (including any non-employee director who serves as one of our officers in both his director and officer capacities) or his or her affiliates will have any duty to refrain from (i) engaging in a corporate opportunity in the same or similar lines of business in which we or our affiliates now engage or propose to engage or (ii) otherwise competing with us. In addition, in the event that any non-employee director acquires knowledge of a potential transaction or other business opportunity which may be a corporate opportunity for himself or his affiliates and for us or our affiliates, such non-employee director will have no duty to communicate or offer such transaction or business opportunity to us and may take any such opportunity for themselves or offer it to another person or entity. Our Amended Certificate does not renounce our interest in any business opportunity expressly offered to a non-employee director solely in his or her capacity as a director or officer of the Company. No business opportunity offered to any non-employee director will be deemed to be a potential corporate opportunity for us unless we would be permitted to undertake the opportunity under our Amended Certificate, we have sufficient financial resources to undertake the opportunity and the opportunity would be in line with our business.

Removal of Directors

Our Amended Certificate and By-laws provide that directors may be removed only for cause and only upon the affirmative vote of holders of at least 80% of the voting power of all the then outstanding shares of stock entitled to vote generally in the election of directors, voting together as a single class. In addition, our Amended Certificate also provides that any newly created directorships and any vacancies on our board of directors will be filled only by the affirmative vote of the majority of the remaining directors.

Calling of Special Meetings of Stockholders

Our Amended Certificate provides that a special meeting of our stockholders may be called at any time only by the chairman of the board of directors, the board of directors or a committee of the board of directors which has been granted such authority by the board.

Stockholder Action by Written Consent

The DGCL permits stockholder action by written consent unless otherwise provided by the Amended Certificate of Incorporation. Our Amended Certificate precludes stockholder action by written consent.

Advance Notice Requirements for Stockholder Proposals and Director Nominations

Our By-laws provide that stockholders seeking to nominate candidates for election as directors or to bring business before an annual meeting of stockholders must provide timely notice of their proposal in writing to the corporate secretary. To be timely, such notice must generally be received at our principal executive offices not less than 90 days nor more than 120 days prior to the first anniversary date on which the proxy materials for the previous year's annual meeting were first mailed.

Supermajority Provisions

Our Amended Certificate provides that the following provisions in the Amended Certificate and By-laws may be amended only by a vote of at least 80% of the voting power of all of the outstanding shares of our stock entitled to vote in the election of directors, voting together as a single class:

|

|

|

|

•

|

the number and terms of the directors;

|

|

|

|

|

•

|

the resignation and removal of directors;

|

|

|

|

|

•

|

the provisions regarding stockholder action by written consent;

|

|

|

|

|

•

|

the ability to call a special meeting of stockholders being vested solely in our board of directors, a committee of our board of directors (if duly authorized to call special meetings), and the chairman of our board of directors;

|

|

|

|

|

•

|

filling of vacancies on our board of directors and newly created directorships;

|

|

|

|

|

•

|

the advance notice requirements for stockholder proposals and director nominations; and

|

|

|

|

|

•

|

the amendment provision requiring that the above provisions be amended only with an 80% supermajority vote.

|

In addition, our Amended Certificate grants our board of directors the authority to amend and repeal our By-laws without a stockholder vote in any manner not inconsistent with the laws of the State of Delaware or our Amended Certificate.

Limitations on Liability and Indemnification of Officers and Directors

As permitted by the DGCL, our Amended Certificate includes a provision that eliminates the personal liability of directors for monetary damages for actions taken as a director, except for liability:

|

|

|

|

•

|

for breach of duty of loyalty;

|

|

|

|

|

•

|

for acts or omissions not in good faith or involving intentional misconduct or knowing violation of law;

|

|

|

|

|

•

|

under Section 174 of the DGCL (unlawful dividends or stock repurchases and redemptions); or

|

|

|

|

|

•

|

for transactions from which the director derived improper personal benefit.

|

Our Amended Certificate and By-laws provide that we must indemnify our directors and officers to the fullest extent authorized by the DGCL. We are also required to advance certain expenses (including attorneys' fees and disbursements and court costs) to

directors and officers and are authorized to carry directors' and officers' insurance providing indemnification for our directors, officers and certain employees for some liabilities.

Delaware Anti-takeover Statute

We are a Delaware corporation and are subject to Section 203 of the DGCL. Subject to specified exceptions, Section 203 prohibits a publicly held Delaware corporation from engaging in a "business combination" with an "interested stockholder" for a period of three years after the date of the transaction in which the person became an interested stockholder. "Business combinations" include mergers, asset sales and other transactions resulting in a financial benefit to the "interested stockholder." Subject to various exceptions, an "interested stockholder" is a person who together with his or her affiliates and associates, owns, or within three years did own, 15% or more of the corporation's outstanding voting stock. These restrictions generally prohibit or delay the accomplishment of mergers or other takeover or change in control attempts.

Item 2. Exhibits.

|

|

|

|

|

|

|

|

Exhibit

Number

|

|

|

|

|

Description

|

|

3.1

|

|

|

|

|

3.1(a)

|

|

|

|

|

3.1(b)

|

|

|

|

|

3.2

|

|

|

|

|

4.1‡

|

|

|

|

______________________________

‡ Filed herewith.

SIGNATURES

Pursuant to the requirements of Section 12 of the Securities Exchange Act of 1934, the registrant has duly caused this registration statement to be signed on its behalf by the undersigned, thereto duly authorized.

Date: September 18, 2018

|

|

|

|

|

|

|

|

|

|

CELANESE CORPORATION

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ James R. Peacock III

|

|

|

|

|

Name: James R. Peacock III

|

|

|

|

|

Title: Vice President, Deputy General Counsel & Corporate Secretary

|

|

|

|

|

|

|

|

|

|

|

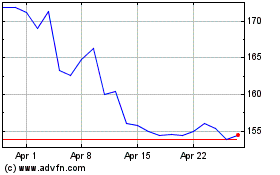

Celanese (NYSE:CE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Celanese (NYSE:CE)

Historical Stock Chart

From Apr 2023 to Apr 2024