Northern Trust’s 5-Year Forecast Sees Economic Conditions Generating Global Stock Returns in 5.5% - 8.8% Range

September 17 2018 - 11:00AM

Business Wire

Growth Cycle to Continue, Inflation and Rates

to Remain Low

The global economy will experience 2.5 percent real average

annualized growth over the next five years, along with controlled

inflation and accommodative monetary policy, according to Northern

Trust’s Capital Market Assumptions five-year outlook,

www.capitalmarketassumptions.com. The firm predicts that, interest

rates will remain low and below investor expectations, with

inflation continuing to be held in check by the same structural

forces, including technology, that have kept it muted for

years.

The report foresees “good-but-not-great” returns from equities

and low-but-mostly-positive fixed-income returns. The highest

average annualized equity return is forecast for Asian emerging

markets at 8.8%, with overall emerging markets at 8.3%. The U.K.

and Europe are at 6.3%, and Japan is at 6.0%. The U.S. is at 5.8%

and Canada is lowest at 5.5%. On a global basis, Northern Trust’s

equity forecast is higher than current stock valuations suggest.

Its expectation for modest fixed-income returns across the globe is

based on interest rates remaining low with a small difference

between short-term and long-term rates.

The Capital Markets Assumptions report, featuring long-term

asset class return expectations and forecasts, is produced annually

and informs the investment decisions and asset allocation

recommendations made by Northern Trust, which has $1.1 trillion in

assets under management.

Investment Themes

The asset class forecasts are informed by six themes identified

by Northern Trust that are driving markets. The report points to

aging populations, transitioning emerging economies and elevated

debt levels as causes behind the global economy’s slow growth

trajectory, and notes that many investors see a recession soon

approaching. “We see that some investors, concerned about that the

length and pace of the current growth cycle, are increasingly

focused on a potential recession – but we feel they may be

suffering from a case of Mild Growth Myopia, Northern Trust Chief

Investment Strategist Jim McDonald said. “The same forces

that have been keeping a lid on growth have helped to both buffer

downturns and extend the cycle itself.”

Rooted in the firm’s deep capital market analysis, the forecast

includes Northern Trust’s expectation that interest rates will

remain below what many investors are anticipating. Stuckflation is

the investment theme that they see largely responsible for low

rates.

“Over the course of this nearly 10-year expansion period, we’ve

seen investors respond to persistently low and durable structural

inflation by altering their investment behaviors,” Northern Trust

Chief Investment Officer Bob Browne said. “Add to this mix the fact

that most central banks fell well short of their two percent annual

targets over the past decade, and we don’t see an immediate change

on the horizon.” The report states that monetary policy adjustments

and trade frictions will produce uncertainties and pockets of

inflation, but that companies and consumers will continue to find

ways to alleviate such pricing pressures.

Pass/Fail Monetarism is a third investment theme the firm

believes investors must watch in the years ahead. Central banks are

operating in an environment that differs from historic norms, when

aggressive or active policy making was expected in reaction to

financial market conditions. Now, with stricter financial market

regulations in place, central banks should act more cautiously than

in the past.

“We believe central banks are really in uncharted territory.

Without a clear map for policy normalization, it’s not possible to

grade the efforts of central banks. But, let’s be clear: in order

to pass, they simply must not fail,” said Browne. “To stay out of

the spotlight, central banks should – and will – pay less attention

to any potential pockets of cyclical inflation and more attention

to avoiding a premature end to this lackluster economic expansion.

A premature end could result if central banks raise rates in order

to be prepared for the next downturn.”

The full report, which outlines the firm’s long-term asset class

return expectations and forecasts for the next five years, is

available at capitalmarketassumptions.com.

About Northern Trust

Northern Trust Corporation (Nasdaq: NTRS) is a leading provider

of wealth management, asset servicing, asset management and banking

to corporations, institutions, affluent families and individuals.

Founded in Chicago in 1889, Northern Trust has offices in the

United States in 19 states and Washington, D.C., and 23

international locations in Canada, Europe, the Middle East and the

Asia-Pacific region. As of June 30, 2018, Northern Trust had assets

under custody/administration of US$10.7 trillion, and assets under

management of US$1.1 trillion. For more than 125 years, Northern

Trust has earned distinction as an industry leader for exceptional

service, financial expertise, integrity and innovation. Visit

northerntrust.com or follow us on Twitter @NorthernTrust.

Northern Trust Corporation, Head Office: 50 South La Salle

Street, Chicago, Illinois 60603 U.S.A., incorporated with limited

liability in the U.S. Global legal and regulatory information can

be found at https://www.northerntrust.com/disclosures.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180917005129/en/

Northern Trust CorporationUS & Canada Contact:Tom Pinto+1

212 339 7288Tom_Pinto@ntrs.comorEurope, Middle East, Africa &

Asia-Pacific Contacts:Camilla Greene+44 (0) 207 982

2176Camilla_Greene@ntrs.comorMat Barling+44 (0) 207 982

1445Mat_Barling@ntrs.comhttp://www.northerntrust.com

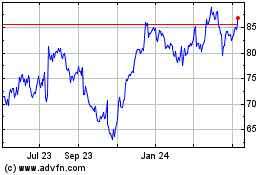

Northern (NASDAQ:NTRS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Northern (NASDAQ:NTRS)

Historical Stock Chart

From Apr 2023 to Apr 2024