KLXE to Begin Trading on the Nasdaq on September 17; Schedules Non-Deal Road Show September 25, 26 and 27 in Houston, New Yo...

September 17 2018 - 7:00AM

KLX Energy Services Holdings, Inc. (“KLX Energy Services” or the

“Company”) (NASDAQ: KLXE), a leading U.S. onshore provider of

value-added, mission critical oilfield services focused on

completion, intervention and production activities, completed the

spin-off from KLX Inc. into an independent, publicly-owned company

on Friday, September 14, 2018. On April 30, 2018, KLX Inc. agreed

to sell its Aerospace Solutions business to The Boeing Company in a

$4.25 billion all cash transaction valued at 15.7X 2017 EBITDA,

after having previously sold the KLX Inc. predecessor company, B/E

Aerospace to Rockwell Collins for $8.6 billion or approximately 14X

LTM EBITDA. The sale to The Boeing Company is expected to close in

the fourth calendar quarter of 2018.

Chairman and Chief Executive Officer of KLX Energy Services,

Amin J. Khoury commented, “As a stand-alone public company, we will

be focused on expanding our product service lines (“PSLs”) and

growing market shares within each geographic area. The Company also

plans to pursue sector consolidation in order to add new services

and product lines that are additive to the existing portfolio and

by continuing to develop next generation proprietary tools.”

Mr. Khoury continued, “As reported in the KLX Inc. second

quarter earnings release, the Energy Services business reported

strong results for the period ended July 31, 2018, with revenues up

approximately 60 percent and Adjusted EBITDA up approximately 600

percent, as compared to the same period of the prior year.”

KLX Energy Services will begin “regular-way” trading on the

NASDAQ on September 17, 2018. At the time of the spin-off, KLX

Energy Services will be well positioned financially with no funded

debt, $50 million of cash and an undrawn $100 million ABL Credit

Facility. The Company will host an investor conference in Houston

on Tuesday, September 25, at 9:00 AM (CT). A live audio webcast of

the presentation will be available on the investor relations page

of the Company’s website at www.klxenergy.com. The Company will

also host investors on September 26 and 27 in New York

and Boston, respectively.

| |

|

|

|

|

|

| RECONCILIATION OF ENERGY SERVICES GROUP

OPERATING EARNINGS (LOSS) |

|

| TO ADJUSTED OPERATING EARNINGS (LOSS) AND

ADJUSTED EBITDA |

|

| (In Millions) |

|

| |

|

|

|

|

|

| |

THREE MONTHS ENDED |

|

|

| |

July 31, 2018 |

|

July 31, 2017 |

|

|

| ESG operating earnings

(loss) |

$ |

12.2 |

|

$ |

(7.8 |

) |

|

|

| One-time costs

1 |

|

1.9 |

|

|

- |

|

|

|

| Adjusted ESG

operating earnings (loss) |

|

14.1 |

|

|

(7.8 |

) |

|

|

| Depreciation and

amortization |

|

9.6 |

|

|

8.6 |

|

|

|

| Non-cash

compensation |

|

2.5 |

|

|

3.0 |

|

|

|

| Adjusted EBITDA |

$ |

26.2 |

|

$ |

3.8 |

|

|

|

| |

|

|

|

|

|

| |

|

| Note: Reconciliation of pre-spin-off results of the KLX Energy

Services Group |

|

|

|

|

| 1

One-time costs related to the pending spin-off of ESG |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

CONTACT:Michael PerlmanTreasurer

and Senior Director, Investor RelationsKLX Inc.(561) 273-7148

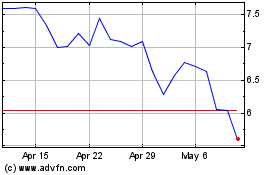

KLX Energy Services (NASDAQ:KLXE)

Historical Stock Chart

From Mar 2024 to Apr 2024

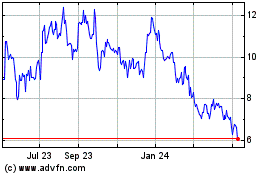

KLX Energy Services (NASDAQ:KLXE)

Historical Stock Chart

From Apr 2023 to Apr 2024