UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

|

Filed by the Registrant

|

☒

|

|

|

|

|

Filed by a Party other than the Registrant

|

☐

|

|

|

|

|

Check the appropriate box:

|

|

|

|

☒

|

Preliminary Proxy Statement

|

|

|

☐

|

Confidential, For Use of the Commission Only (as Permitted by Rule 14a-6(e)(2))

|

|

|

☐

|

Definitive Proxy Statement

|

|

|

☐

|

Definitive Additional Materials

|

|

|

☐

|

Soliciting Material Pursuant to §240.14a-12

|

INNOVATIVE FOOD HOLDINGS

, I

NC

.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

☐

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

(5)

|

Total fee paid:

|

|

☐

|

Fee paid previously with preliminary materials.

|

|

☐

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing.

|

|

(1)

|

Amount Previously Paid:

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

(3)

|

Filing Party:

|

|

(4)

|

Date Filed:

|

INNOVATIVE FOOD HOLDINGS

, INC.

2

8411 RACE TRACK ROAD

BONITA SPRINGS

,

FL

34135

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON

OCTOBER 31

, 201

8

The Annual Meeting of Stockholders of Innovative Food Holdings, Inc. (the “Company”) will be held at _________________________________________, on October 31, 2018 at

, to consider and act upon the following matters:

|

(1)

|

To elect four (4) directors to serve for the ensuing year.

|

|

(2)

|

To ratify the selection by the Board of Directors of the firm of Liggett & Webb P.A., as the Company’s independent auditors for the current fiscal year.

|

|

|

|

|

(3)

|

To approve and authorize our Board of Directors to implement a reverse split of our outstanding Common Stock, at its discretion, in a ratio ranging from 1:2 to 1:10

|

|

|

|

|

(4)

|

To conduct an advisory vote on whether, commencing in 2019, the annual meeting of shareholders should be held on or before the end of the third quarter in each year.

|

|

|

|

|

(5)

|

To conduct an advisory vote on whether action by the Board of Directors should require the approval of a majority of Directors then in office, regardless of how many Directors are present at a meeting.

|

|

|

|

|

(6)

|

To conduct an advisory vote on whether the Board of Directors use reasonable efforts so that a majority of the Directors will be independent Directors and if there is not a majority of independent Directors at any given time, a special committee of Directors will be formed within ten business days to initiate a formal selection process to locate persons who could fill the independent Director position.

|

|

(7)

|

To conduct an advisory vote on whether the Board of Directors should consist of at least five Directors and if there is a vacancy, the Board of Directors should use reasonable good faith efforts to form a special Board of Directors committee within ten business days of such vacancy to initiate a formal search process to fill Board vacancies with qualified Directors.

|

|

(8)

|

To conduct an advisory vote on whether the following transactions shall require the approval of a designated Board committee comprised of independent Directors: (i) an acquisition in which 20% or more of the Company’s outstanding common stock, or 5% with respect to a related party transaction, are proposed to be issued, (ii) issuances of Company common stock which will result in a change of control of the Company, and (iii) a private placement involving common stock equal to or greater than 20% of the pre-issuance outstanding common stock at a price less than the greater of book value or market value.

|

|

(9)

|

To conduct an advisory vote on executive compensation.

|

|

(10)

|

To conduct an advisory vote on the frequency of future advisory votes on executive compensation.

|

|

(11)

|

To transact such other business as may properly come before the meeting or any adjournment thereof.

|

Stockholders of record as of the close of business on September 13, 2018 will be entitled to notice of and to vote at the meeting or any adjournment thereof. The stock transfer books of the Company will remain open.

By Order of the Board of Directors,

Ronit Wallerstein,

Secretary

Bonita Springs, Florida

October 1, 2018

WHETHER OR NOT YOU EXPECT TO ATTEND THE MEETING, PLEASE COMPLETE, DATE AND

SIGN THE ENCLOSED PROXY AND MAIL IT PROMPTLY IN THE ENCLOSED ENVELOPE

IN ORDER TO ENSURE REPRESENTATION OF YOUR SHARES. YOU MAY REVOKE THE

PROXY AT ANY TIME BEFORE THE AUTHORITY GRANTED THEREIN IS EXERCISED.

INNOVATIVE FOOD HOLDINGS, INC.

28411 RACE TRACK ROAD

BONITA SPRINGS, FL 34135

PROXY STATEMENT FOR THE 201

8

ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON

OCTOBER 31

, 201

8

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors of Innovative Food Holdings, Inc. (the “Company”) for use at the 2018 Annual Meeting of Stockholders to be held on October 31, 2018, and at any adjournment of that meeting (the “Annual Meeting”). Throughout this Proxy Statement, “we,” “us” and “our” are used to refer to the Company.

The shares of our common stock represented by each proxy will be voted in accordance with the stockholder’s instructions as to each matter specified thereon, unless no instruction is given, in which case, the proxy will be voted in favor of such matter. A proxy may be revoked by the stockholder at any time before it is exercised by delivery of written revocation or a subsequently dated proxy to our corporate Secretary or by voting in person at the Annual Meeting.

We are mailing this Proxy Statement to our stockholders on or about October 1, 2018, accompanied by our Annual Report to Stockholders for our fiscal year ended December 31, 2017.

Voting Securities and Votes Required

At the close of business on September 13, 2018, the record date for the determination of stockholders entitled to vote at the Annual Meeting, there were outstanding and entitled to vote an aggregate of 33,775,306 shares of our common stock, par value $.0001 per share. All holders of our common stock are entitled to one vote per share.

The affirmative vote of the holders of a plurality of the shares of our common stock present or represented by proxy at the Annual Meeting is required for election of directors. The affirmative vote of the holders of a majority of the shares of our common stock present or represented by proxy at the Annual Meeting is required for each of the agenda items. The voting on all items except for the election of directors, ratification of the auditors and authorization of the reverse split are only advisory, as hereinafter described.

With respect to approval of Proposals Nos. 4-10, while our Board will carefully consider the outcome of the vote expressed by our stockholders, the vote will not be binding upon them.

A majority of the outstanding shares of our common stock represented in person or by proxy at the Annual Meeting will constitute a quorum at the meeting. All shares of our common stock represented in person or by proxy (including shares which abstain or do not vote for any reason with respect to one or more of the matters presented for stockholder approval) will be counted for purposes of determining whether a quorum is present at the Annual Meeting. Abstentions will be treated as shares that are present and entitled to vote for purposes of determining the number of shares present and entitled to vote with respect to any particular matter, but will not be counted as a vote in favor of such matter. Accordingly, an abstention from voting on a matter has the same legal effect as a vote against the matter. If a broker or nominee holding stock in “street name” indicates on the proxy that it does not have discretionary authority to vote as to a particular matter (“broker non-votes”), those shares will not be considered as present and entitled to vote with respect to such matter. Accordingly, a broker non-vote on a matter has no effect on the voting on such matter.

Security Ownership of Certain Beneficial Owners and Management

The following table sets forth certain information as of September 7, 2018 with respect to the beneficial ownership of our common stock by (1) each person known by us to own beneficially more than 5% of the outstanding shares of our common stock, (2) each of our directors, (3) each of our executive officers named in the Summary Compensation Table set forth under the caption “Executive Compensation”, below, and (4) all our directors and executive officers as a group.

|

Name and Address of Beneficial Owners

|

|

|

|

|

Number of Shares Beneficially Owned

|

|

|

Percent of Class

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sam Klepfish (Officer, Director)

|

|

|

(1)

|

|

|

1,896,628

|

|

|

|

5.6

|

%

|

|

Joel Gold (Director)

|

|

|

(2)

|

|

|

399,054

|

|

|

|

1.2

|

%

|

|

Justin Wiernasz (Director)

|

|

|

|

|

|

1,578,776

|

|

|

|

4.7

|

%

|

|

Hank Cohn (Director)

|

|

|

|

|

|

275,000

|

|

|

|

0.8

|

%

|

|

Yorkmont Capital Partners, LP

|

|

|

(3)

|

|

|

2,073,398

|

|

|

|

6.1

|

%

|

|

A group consisting of Denver J. Smith, CRC Founders Fund, LP, Donald E. Smith, Richard G. Hill, Samuel N. Jurrens, 73114 Investments, LLC, Youth Properties, LLC, and Paratus Capital, LLC

|

|

|

(4)

|

|

|

1,818,452

|

|

|

|

5.4

|

%

|

|

All officers and directors as a whole (4 persons)

|

|

|

(5)

|

|

|

4,149,458

|

|

|

|

12.3

|

%

|

|

(1)

|

Includes 1,880,378 shares of common stock held by Mr. Klepfish. Also includes 16,250 shares of common stock held by Mr. Klepfish’s spouse, ownership of which is disclaimed by Mr. Klepfish.

|

|

(2)

|

Includes 380,654 shares of common stock held by Mr. Gold. Also includes 18,400 shares of common stock held by Mr. Gold’s spouse.

|

|

(3)

|

Consists of 2,073,398 shares of common stock held by Yorkmont Capital Partners, LP. The address of Yorkmont Capital Partners, LP is 2313 Lake Austin Blvd. Suite 202, Austin, TX 78703. Information gathered from a Schedule 13G/A filed with the Securities and Exchange Commission on January 4, 2018.

|

|

|

|

|

(4)

|

Pursuant to a Schedule 13D/A file on May 24, 2018 with the Securities and Exchange Commission, Mr. Denver Smith, part of the group, reports beneficially owning 1,701,803 shares, although Mr. Denver Smith only has sole voting and dispositive power over 722,679 of such shares. Mr. Smith’s address is 52 Carlson Drive, Milford, CT 06460.

|

|

|

|

|

(5)

|

Includes 4,149,458 shares of common stock held by officers and directors. Also includes 34,650 shares of common stock held by the spouses of officers and directors. Does not include approximately an additional 2,650,000 shares for which management has proxies.

|

ELECTION OF DIRECTORS

(Proposal No. 1)

The persons named in the enclosed proxy will vote to elect as directors the four nominees named below, unless authority to vote for the election of any or all of the nominees is withheld by marking the proxy to that effect. All of the nominees have indicated their willingness to serve, if elected, but if any nominee should be unable to serve or for good cause will not serve, the proxies may be voted for a substitute nominee designated by management. Each director will be elected to hold office until the next annual meeting of stockholders or until his successor is elected and qualified. There are no family relationships between or among any of our executive officers or directors. Management recommends a vote “FOR” each of the director nominees.

Nominees

Set forth below for each nominee as a director is his name, age, and position with us, the Committee of the Board upon which he currently sits, his principal occupation and business experience during at least the past five years and the date of the commencement of his term as a director.

|

Name

|

|

Age

|

|

Position with the Company

|

|

Board Committee Membership

|

|

|

|

|

|

|

|

|

|

Sam Klepfish

|

|

43

|

|

Chief Executive Officer and Director

|

|

-

|

|

Justin Wiernasz

|

|

52

|

|

Director of Strategic Acquisitions and Director

|

|

-

|

|

Joel Gold

|

|

76

|

|

Director

|

|

Audit, Nominating/Corporate Governance, Compensation

|

|

Hank Cohen

|

|

48

|

|

Director

|

|

Compensation, Audit, Nominating/ Corporate Governance

|

Sam Klepfish

Mr. Klepfish has been a director since December 1, 2005. From November 2007 to present Mr. Klepfish is the CEO of Innovative Food Holdings and its subsidiaries. From March 2006 to November 2007 Mr. Klepfish was the interim president of the Company and its subsidiary. From February 2005 to January 2006 Mr. Klepfish was a Managing Partner at ISG Capital, a merchant bank. From May 2004 through February 2005 Mr. Klepfish served as a Managing Director of Technoprises, Ltd. From January 2001 to May 2004 he was a corporate finance analyst and consultant at Phillips Nizer, a New York law firm. From 1998 to December 2000, Mr. Klepfish was an asset manager for several investors in small-cap entities.

Joel Gold

Mr. Gold has been a director since 2004. Mr. Gold is currently a partner in a merchant banking firm, and has served on the board and committees of numerous companies. Prior to that, he was an investment banker at Buckman, Buckman and Reid located in New Jersey, a position he held since May 2010. Prior thereto, from October 2004, he was head of investment banking of Andrew Garrett, Inc. From January 2000 until September 2004, he served as Executive Vice President of Investment Banking of Berry Shino Securities, Inc., an investment banking firm also located in New York City. From January 1999 until December 1999, he was an Executive Vice President of Solid Capital Markets, an investment-banking firm also located in New York City. From September 1997 to January 1999, he served as a Senior Managing Director of Interbank Capital Group, LLC, an investment banking firm also located in New York City. From April 1996 to September 1997, Mr. Gold was an Executive Vice President of LT Lawrence & Co., and from March 1995 to April 1996, a Managing Director of Fechtor Detwiler & Co., Inc. Mr. Gold was a Managing Director of Furman Selz Incorporated from January 1992 until March 1995. From April 1990 until January 1992, Mr. Gold was a Managing Director of Bear Stearns and Co., Inc. (“Bear Stearns”). For approximately 20 years before he became affiliated with Bear Stearns, he held various positions with Drexel Burnham Lambert, Inc.

Hank Cohn

Hank Cohn is currently a managing partner of P1 Billing, LLC, a revenue cycle management services provider to ambulatory medical clinics. P1 Billing is a spinoff of PracticeOne Inc., (formerly PractieXpert, Inc., an OTCQB traded company), an integrated PMS and EMR software and services company for physicians. Mr. Cohn served as President and Chief Executive Officer of PracticeOne from December 2005 until December 2010, at which time he sold the company to a large global technology focused private equity firm. Mr. Cohn is also a principal at WTI Outsourcing LLC., a Business Process Outsourcing Company (BPO) with a focus in healthcare. Prior to PracticeOne, Mr. Cohn worked with a number of investment groups as a restructuring and workout specialist for public companies. Mr. Cohn previously served as vice president of Galaxy Ventures, LLC a closely-held investment fund concentrating in the areas of bond trading and early stage technology investments, where he acted as portfolio manager for investments. Hank holds an MBA in Finance and Investments from Baruch College.

Justin Wiernasz

Mr. Wiernasz has been a director since November 1, 2013. Effective May 11, 2018 Mr. Wiernasz resigned his position as President and became the Director of Strategic Acquisitions. From July 31, 2008 through May 2018, Mr. Wiernasz was the President of Innovative Food Holdings, Inc. Prior thereto, since May 2007, he was the Executive Vice President of Marketing and Sales and Chief Marketing Officer of our operating subsidiary, Food Innovations, Inc., and the President of Food Innovations and our Chief Marketing Officer since December 2007. Prior thereto, he was at USF, our largest customer, for 13 years. From 2005 to 2007 he was the Vice President of Sales & Marketing, USF, Boston, and prior thereto, from 2003 to 2005 he was a National Sales Trainer at USF, Charleston SC, from 1996 to 2003 he was the District Sales Manager at USF, Western Massachusetts, and from 1993 to 1996 he was Territory Manager, USF, Northampton, Easthampton & Amherst, MA. Prior to that from 1989 to 1993 he was the owner and operator J.J.’s food and spirit, a 110 seat restaurant

.

Qualification of Directors

We believe that all of our directors are qualified for their positions and each brings a benefit to the board. Messrs. Klepfish as an officer of the company and Wiernasz, as Director of Strategic Acquisitions for the Company, are uniquely qualified to bring management’s perspective to the board’s deliberations. Mr. Gold, with his lengthy career working for broker/dealers, brings “Wall Street’s” perspective. Mr. Cohn, with his prior history of being an executive and his experience as a director of other companies, brings a well-rounded background and wealth of experience to our board.

Committees of the Board of Directors

The Board of Directors currently has an Audit Committee, a Compensation Committee, and a Nominating and Corporate Governance Committee. However, inasmuch as we only have two independent directors, each Committee only has two members. We are currently seeking to add additional qualified independent directors to the Board of Directors.

Audit Committee.

The primary functions of the Audit Committee are to select or to recommend to our Board the selection of outside auditors; to monitor our relationships with our outside auditors and their interaction with our management in order to ensure their independence and objectivity; to review, and to assess the scope and quality of, our outside auditor’s services, including the audit of our annual financial statements; to review our financial management and accounting procedures; to review our financial statements with our management and outside auditors; and to review the adequacy of our system of internal accounting controls. Messrs. Gold and Cohn are the current members of the Audit Committee and are each “independent” (as that term is defined in NASD Rule 4200(a)(14)), and are each able to read and understand fundamental financial statements. Mr. Gold, our audit committee financial expert, possesses the financial expertise required under Rule 401(h) of Regulation S-K of the Act and NASD Rule 4350(d)(2). He is further “independent”, as that term is defined under Item 7(d)(3)(iv) of Schedule 14A under the Exchange Act. Our Board has adopted a written charter for the Audit Committee and the Audit Committee reviews and reassesses the adequacy of that charter on an annual basis. The full text of the charter is available on our website at www.ivfh.com.

Compensation Committee.

The functions of the Compensation Committee are to make recommendations to the Board regarding compensation of management employees and to administer plans and programs relating to employee benefits, incentives, compensation and awards under our 2011 Stock Option Plan. Messrs. Gold and Cohn are the current members of the Compensation Committee. The Board has determined that each of them is “independent,” as defined under the applicable rules of the Nasdaq Stock Market. A copy of the Compensation Committee’s Charter is available on our website at www.ivfh.com. Executive officers that are members of our Board make recommendations to the Compensation Committee with respect to the compensation of other executive officers who are not on the Board. Except as otherwise prohibited, the Committee may delegate its responsibilities to subcommittees or individuals. The Compensation Committee has the authority, in its sole discretion, to retain or obtain advice from a compensation consultant, legal counsel or other advisor and is directly responsible for the appointment, compensation and oversight of such persons. The Company will provide the appropriate funding to such persons as determined by the Compensation Committee. The Compensation Committee also annually reviews the overall compensation of our executive officers for the purpose of determining whether discretionary bonuses should be granted.

Nominating and Corporate Governance Committee.

The functions of the Nominating and Corporate Governance Committee are to develop our corporate governance system and to review proposed new members of our Board of Directors, including those recommended by our stockholders. Messrs. Gold and Cohn are the current members of our Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee operates pursuant to a written charter adopted by the Board. The full text of the charter is available on our website at www.ivfh.com. The Board has determined that each member of this Committee is “independent,” as defined under the applicable rules of the Nasdaq Stock Market. The Nominating and Corporate Governance Committee will review, on an annual basis, the composition of our Board of Directors and the ability of its current members to continue effectively as directors for the upcoming fiscal year. In the ordinary course, absent special circumstances or a change in the criteria for Board membership, the Nominating and Corporate Governance Committee will renominate incumbent directors who continue to be qualified for Board service and who are willing to continue as directors. If that Committee decides it is in our best interests to nominate a new individual as a director in connection with an annual meeting of stockholders, or if a vacancy on the Board occurs between annual stockholder meetings or an incumbent director chooses not to run, the nominating committee will seek out potential candidates for Board appointment who meet the criteria for selection as a nominee and have the specific qualities or skills being sought. Director candidates will be selected based on input from members of the Board, our senior management and, if the Committee deems appropriate, a third-party search firm. The Nominating and Corporate Governance Committee will evaluate each candidate’s qualifications and check relevant references and each candidate will be interviewed by at least one member of that Committee. Candidates meriting serious consideration will meet with all members of the Board. Based on this input, the Nominating and Corporate Governance Committee will evaluate whether a prospective candidate is qualified to serve as a director and whether the Committee should recommend to the Board that this candidate be appointed to fill a current vacancy on the Board, or presented for the approval of the stockholders, as appropriate.

Meetings of the Board of Directors and Board Member Attendance at Annual Stockholder Meeting

During 2017, the Board of Directors met or acted without a meeting pursuant to written consent 7 times. All directors attended at least 75% of all board meetings and committee meetings of which they are members.

We do not have a formal written policy with respect to board members’ attendance at annual stockholder meetings, although we do encourage each of them to attend. We expect at least a majority of the directors currently serving and nominated for re-election to attend our 2018 Annual Stockholder Meeting.

Stockholder Communications

Stockholders interested in communicating with our Board may do so by writing to any or all directors, care of our Chief Executive Officer, at our principal executive offices. Our Chief Executive Officer will log in all stockholder correspondence and forward to the director addressee(s) all communications that, in his judgment, are appropriate for consideration by the directors. Any director may review the correspondence log and request copies of any correspondence. Examples of communications that would be considered inappropriate for consideration by the directors include, but are not limited to, commercial solicitations, trivial, obscene, or profane items, administrative matters, ordinary business matters, or personal grievances. Correspondence that is not appropriate for Board review will be handled by our Chief Executive Officer. All appropriate matters pertaining to accounting or internal controls will be brought promptly to the attention of our Audit Committee

Stockholder recommendations for director nominees are welcome and should be sent to our Chief Executive Officer, who will forward such recommendations to our Nominating and Corporate Governance Committee, and should include the following information: (a) all information relating to each nominee that is required to be disclosed pursuant to Regulation 14A under the Securities Exchange Act of 1934 (including such person’s written consent to being named in the proxy statement as a nominee and to serving as a director if elected); (b) the names and addresses of the stockholders making the nomination and the number of shares of our common stock which are owned beneficially and of record by such stockholders; and (c) appropriate biographical information and a statement as to the qualification of each nominee, and must be submitted in the time frame described under the caption, “Stockholder Proposals for 2019 Annual Meeting,” below. The Nominating and Corporate Governance Committee will evaluate candidates recommended by stockholders in the same manner as candidates recommended by other sources, using additional criteria, if any, approved by the Board from time to time. Our stockholder communication policy may be amended at any time with the consent of our Nominating and Corporate Governance Committee.

Code of Ethics

We have a Code of Ethics that applies to all our employees, officers and directors. This code was filed as an exhibit to our Annual Report on Form 10-KSB/A for the fiscal year ended December 31, 2006. This code is posted on our website,

www.ivfh.

com

.

Executive Officers

Our executive officers are elected by our Board of Directors and serve pursuant to the terms of their respective employment agreements. One of our executive officers, Sam Klepfish, is also a director of the Company. See the section above entitled “Nominees” for biographical information about this officer.

Key Employees

John McDonald

Mr. McDonald, age 55, has been our principal accounting officer since November 2007; from November 2007 through October 2017, he was also our Chief Information Officer. From 2004 through 2007, Mr. McDonald worked as a consultant with Softrim Corporation of Estero, Florida where he created custom applications for a variety of different industries and assisted in building interfaces to accounting applications. Since 1999 he has also been President of McDonald Consulting Group, Inc. which provides consulting on accounts receivable, systems and accounting services.

Section 16(a) Beneficial Ownership Reporting Compliance

During 2017, Messrs. Gold, Cohn, and Klepfish did not file four Forms 4, Mr. Wiernasz did not file five Forms 4, and Mr. McDonald did not file one Form 4. None of the unfiled Forms 4 related to the public sale of securities.

The following table sets forth information concerning the compensation for services rendered to us for the year ended December 31, 2017, of our Chief Executive Officer and our other executive officers whose annual compensation exceeded $100,000 in the fiscal year ended December 31, 2017, if any. We refer to the Chief Executive Officer and these other officers as the named executive officers.

SUMMARY COMPENSATION TABLE

|

Name and

Principal

Position

|

|

Year

|

|

Salary

($)

|

|

|

Bonus

($)

|

|

|

|

Stock

Awards

($)

|

|

|

|

Option

Awards

($)

|

|

|

|

Non-Equity

Incentive Plan

Compensation

($)

|

|

|

Nonqualified

Deferred

Compensation

Earnings

($)

|

|

|

All Other

Compensation

($)

|

|

|

|

Total

($)

|

|

|

Sam Klepfish

|

|

2017

|

|

$

|

376,997

|

|

|

$

|

-

|

|

|

|

$

|

117,060

|

|

(j)

|

|

$

|

-

|

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

18,084

|

|

(a)

|

|

$

|

512,141

|

|

|

CEO

|

|

2016

|

|

$

|

362,550

|

|

|

$

|

-

|

|

|

|

$

|

375,297

|

|

(b)

|

|

$

|

-

|

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

2,229

|

|

(a)

|

|

$

|

740,075

|

|

|

|

|

2015

|

|

$

|

317,709

|

|

|

$

|

85,000

|

|

(c)

|

|

$

|

644,835

|

|

(b)

|

|

$

|

-

|

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

|

$

|

1,047,544

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Justin Wiernasz

|

|

2017

|

|

$

|

376,997

|

|

|

$

|

65,000

|

|

(d)

|

|

$

|

76,190

|

|

(e)

|

|

$

|

-

|

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

12,960

|

|

(a)

|

|

$

|

531,147

|

|

|

President

|

|

2016

|

|

$

|

346,920

|

|

|

$

|

50,000

|

|

(f)

|

|

$

|

308,192

|

|

(g)

|

|

$

|

-

|

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

8,056

|

|

(a)

|

|

$

|

713,168

|

|

|

|

|

2015

|

|

$

|

312,119

|

|

|

$

|

124,800

|

|

(h)

|

|

$

|

667,780

|

|

(i)

|

|

$

|

-

|

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

8,016

|

|

(a)

|

|

$

|

1,112,715

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

John McDonald

|

|

2017

|

|

$

|

199,301

|

|

|

$

|

69,000

|

|

(j1)

|

|

$

|

-

|

|

|

|

$

|

-

|

|

(n)

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

8,415

|

|

(a)

|

|

$

|

276,716

|

|

|

Principal Accounting Officer

|

|

2016

|

|

$

|

181,182

|

|

|

$

|

30,000

|

|

(j1)

|

|

$

|

43,660

|

|

(k)

|

|

$

|

992

|

|

(l)

|

|

|

|

|

|

|

|

|

|

$

|

7,959

|

|

(a)

|

|

$

|

263,794

|

|

|

|

|

2015

|

|

$

|

163,611

|

|

|

$

|

38,407

|

|

(m)

|

|

$

|

-

|

|

|

|

$

|

-

|

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

8,016

|

|

(a)

|

|

$

|

210,034

|

|

(a) Consists of cash payments for health care benefits.

(b) Consists of the portion of RSUs which were recognized as a period cost during the year.

(c) Consists of a cash bonus paid during the year for services performed in 2014.

(d) Consists of a cash bonus paid during the year for services performed in 2016.

(e) Consists of the portion of restricted stock awards which were recognized as a period cost during the year for services as an executive officer. Does not include $7,826 of restricted stock awards which were recognized as a period cost during the year for services as a board member.

(f) Consists of a cash bonus paid during the year for services performed in 2015. Does not include $65,000 in cash bonuses for services performed in 2016 but not paid during the year.

(g) Consists of the portion of RSUs which were recognized as a period cost during the year for services as an executive officer. Does not include $55,304 of RSUs which were recognized as a period cost during the year for services as a board member.

(h) Consists of a cash bonus paid during the year for services performed in 2015. Does not include $50,000 in cash bonuses and 116,279 of RSUs with a fair value of $75,000 for services performed in 2015 but not paid during the year.

(i) Consists of the portion of RSUs which were recognized as a period cost during the year for services as an executive officer. Does not include $163,826 of RSUs which were recognized as a period cost during the year for services as a board member.

(j) Consists of the portion of restricted stock awards which were recognized as a period cost during the year for services as an executive officer.

(j1) Consists of a cash bonus paid during the year for services performed in 2016.

(k) Consists of 90,959 shares of common stock with a fair value of $43,660.

(l) Consists of options to purchase 200,000 shares of common stock with a fair value of $992.

(m) Consists of a cash bonus paid during the year for services performed in 2014. Does not include $30,000 in cash bonuses and 46,512 RSUs with a fair value of $30,000 for services performed in 2015 but not paid during the year.

Outstanding Equity Awards at Fiscal Year-End as of December 31, 2017

|

|

|

Option Awards

|

|

Stock Awards

|

|

|

Name

|

|

Number of Securities Underlying Unexercised Options

(#)

Exercisable

|

|

|

Number of Securities Underlying Unexercised Options(#)Unexercisable

|

|

|

Equity Incentive Plan Awards: Number of Securities Underlying Unexercised Unearned Options(#)

|

|

|

Option Exercise Price ($)

|

|

Option Expiration Date

|

|

Number of Shares or Units of Stock That Have Not Vested

(#)

|

|

|

|

Market Value of Shares or Units of Stock That Have Not Vested ($)

|

|

|

|

Equity Incentive Plan Awards: Number of Unearned Shares, Units or Other Rights That Have Not Vested (#)

|

|

|

Equity Incentive Plan Awards: Market or Payout Value of Unearned Shares, Units or Other Rights That Have Not Vested

($)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sam Klepfish

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

300,000

|

|

(a)

|

|

$

|

357,000

|

|

(b)

|

|

|

|

|

|

|

|

|

|

Sam Klepfish

|

|

|

125,000

|

|

|

|

|

|

|

|

|

|

|

$

|

1.600

|

|

01/01/18

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Justin Wiernasz

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Justin Wiernasz

|

|

|

125,000

|

|

|

|

-

|

|

|

|

-

|

|

|

$

|

1.600

|

|

01/01/18

|

|

|

-

|

|

|

|

|

-

|

|

|

|

|

-

|

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

John McDonald

|

|

|

25,000

|

|

|

|

-

|

|

|

|

-

|

|

|

$

|

0.570

|

|

01/01/18

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

John McDonald

|

|

|

60,000

|

|

|

|

-

|

|

|

|

-

|

|

|

$

|

1.600

|

|

01/01/18

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

John McDonald

|

|

|

75,000

|

|

|

|

-

|

|

|

|

-

|

|

|

$

|

1.700

|

|

04/04/18

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

John McDonald

|

|

|

50,000

|

|

|

|

-

|

|

|

|

-

|

|

|

$

|

2.000

|

|

04/04/18

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

John McDonald

|

|

|

37,500

|

|

|

|

-

|

|

|

|

-

|

|

|

$

|

2.500

|

|

04/04/18

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

John McDonald

|

|

|

37,500

|

|

|

|

-

|

|

|

|

-

|

|

|

$

|

3.500

|

|

04/04/18

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(a) Restricted stock awards vest according to the following schedule: An additional 125,000 restricted stock awards will vest contingent upon the attainment of a stock price of $2.00 per share for 20 consecutive trading days, and an additional 175,000 restricted stock awards will vest contingent upon the attainment of a stock price of $3.00 per share for 20 consecutive trading days.

(b) Amounts are calculated by multiplying the number of shares shown in the table by $1.19 per share, which is the closing price of common stock on December 31, 2017 (the last trading day of the 2016 fiscal year).

Compensation of Directors

The following table sets forth the compensation we paid to our non-employee directors for our fiscal year ended December 31, 2017:

Director Compensation

|

Name

|

|

Fees

Earned

or Paid

in Cash ($)

|

|

|

Stock

Awards

($) (a)

|

|

|

|

Option

Awards

($) (b)

|

|

|

Non-Equity

Incentive Plan

Compensation

($)

|

|

|

Nonqualified

Deferred

Compensation

Earnings

($)

|

|

|

All Other

Compensation

($)

|

|

|

Total

($)

|

|

|

Joel Gold

|

|

$

|

-

|

|

|

$

|

-

|

|

(a)

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

Sam Klepfish

|

|

$

|

-

|

|

|

$

|

-

|

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

Hank Cohn

|

|

$

|

-

|

|

|

$

|

-

|

|

(a)

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

Justin Wiernasz

|

|

$

|

-

|

|

|

$

|

-

|

|

(a)

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

(a) Does not include 270,000 RSUs at $1.00 per share granted to each director and included in 2014 for service in years 2015, 2016, and 2017. These RSUs are contingent upon being a member of the board in those years. The amount of $163,826 was included as a period cost for these RSUs in 2015. Mr. Klepfish has declined this grant of RSUs which the Company offered to all Directors in 2014.

Employment Agreements

Our subsidiary, Food Innovations, has employment agreements with certain officers and certain employees. The employment agreements provide for salaries and benefits, including stock grants and extend up to five years. In addition to salary and benefit provisions, the agreements include defined commitments should the employer terminate the employee with or without cause.

SAM KLEPFISH

On November 20, 2012 we entered into an employment agreement with Mr. Klepfish, the Corporation’s CEO, having an effective date of January 1, 2013 and terminating on December 31, 2015. The agreement provides a base compensation in the amount of $198,312 in cash plus an additional $27,937 in restricted stock units for year one, $223,987 in cash plus an additional $24,875 in restricted stock units for year two, and $260,075 in cash plus an additional $13,688 in restricted stock units for year three. The agreement also provides for annual bonuses including bonuses based on increases in EBITDA (as defined in the agreement) of our various subsidiaries; additional bonuses upon the occurrence of certain events such as: listing on specific stock exchanges, spin-offs, investments and stock trading and volume levels. The agreement also provides for stock options with exercise prices ranging from $0.40 - $1.60 and an award of restricted stock, which only vests if certain volume and pricing milestones with respect to our common stock are met. Mr. Klepfish also has the option of receiving any portion of his salary or bonus in the form of equity. The agreement also contains non-compete and non-solicitation provisions.

On August 7, 2014, our board of directors approved the amendment of the Employment Agreement with Mr. Klepfish effective as of August 13, 2014. The employment agreement was amended as follows: (i) it has been extended by one year to December 31, 2016; (ii) it provides for 10% annual increases of Base Salary commencing in 2014; (iii) certain performance based bonuses in the employment agreement are eliminated; (iv) stock grants previously issued with vesting based upon performance or stock price are cancelled; (v) a new performance based bonus structure to partially replace the previous structure, based upon meeting certain Cash EBITDA (earnings before interest, taxes, depreciation, and amortization and non-cash compensation charges) targets, the new bonus will have a cash portion and a stock portion and all Base Salary can be paid in cash or in stock at the option of Mr. Klepfish, and (vi) 125,00 restricted stock units which vest if the 30 day average closing price of our common stock is $2.00 or above and there is a 50,000 average daily volume or there is a 50,000 average daily volume for 14 straight trading days; and 175,000 restricted stock units which vest if the 30 day average closing price of our common stock is $3.00 or above and there is a 50,000 average daily volume for 14 straight trading days. Mr. Klepfish will have the option, on an annual basis, to take all or part of the cash portion of the bonus, or any part of Base Salary in the form of stock at a valuation based upon the closing stock price on the last trading day of the prior year. The decision on how much, if any, of the bonus to take in stock must be made by May 1 of each year, unless earlier required. The Cash EBITDA target levels do not include the effect of any potential future acquisitions and also do not include certain one time or non-recurring expenses in the calculation of the Cash EBITDA. If a Cash EBITDA target is missed by 3% or less, the bonus for the target so missed shall be reduced by 20% and if it is missed by 3.1% -5%, the bonus for such target shall be reduced by 30%, except in both cases, Mr. Klepfish has negative discretion to further reduce the bonuses or even cancel them. In March 2016, Mr. Klepfish’s employment agreement was extended for another year under the same terms.

In November 2014, the employment agreement of Mr. Klepfish was amended (i) in the event of a change of control (as defined below) all equity based compensation (including options and restricted stock units) payable pursuant to such employment agreements, shall immediately vest and/or restrictions thereon shall lapse, and (ii) to provide that in the event of a termination without Cause (as defined in the employment agreement) they shall receive a lump sum payment equal to the greater of (x) the salary payable over the last six months of the term of the agreement, or (y) the Base Salary (as defined in the employment agreement) remaining through the end of the then-current term of the agreement. The definition of change of control shall mean the occurrence of any of the following events: (w) the sale or transfer by the Company for at least $25 million (such consideration consisting of cash, cash equivalents, notes or securities) of more than 50% of its Voting Securities (as defined below) or substantially all of its assets; or (x) the acquisition, other than from the Company or employees of it or any of its subsidiaries, by any individual, entity or group (within the meaning of Section 13(d)(3) or 14(d)(2) of the Securities Exchange Act of 1934) (other than an employee benefit plan of the Company) of beneficial ownership (within the meaning of Rule 13d-3 promulgated under the Exchange Act) of more than 50% of the combined voting power of the then outstanding voting securities of the Company entitled to vote generally in the election of directors (the “Voting Securities”); or (y) the approval by the stockholders of the Company of a reorganization, merger, consolidation or recapitalization of the Company (a “Business Combination”), other than a Business Combination in which more than 50% of the combined voting power of the outstanding Voting Securities of the surviving or resulting entity immediately following the Business Combination is held by the persons who, immediately prior to the Business Combination, were the holders of the Voting Securities; or (z) the approval by the stockholders of the Company of a complete liquidation or dissolution of the Company, or a sale of all or substantially all of the assets of the Company.

Mr. Klepfish was awarded, as a special bonus, effective November 17, 2014, an aggregate of 1,000,000 restricted stock units (“RSU”) subject to time and performance vesting conditions, with the timing conditions as follows: 150,000 RSUs vest on each of July 1 and December 31, 2015; 300,000 RSUs vest on December 31, 2016 and 400,000 RSUs vest on July 1, 2017, and the performance conditions are as follows: for the RSUs vesting in 2015, the Corporation, on a consolidated basis, must have four months with sales above $2,500,000 during 2015, for the RSUs vesting in 2016, the Corporation, on a consolidated basis, must have four months with sales above $2,500,000 during 2016 and for the RSUs vesting in 2017, the Corporation, on a consolidated basis, must have four months with sales above $2,500,000 during 2017, provided however, that if the performance condition is not met in any year, the RSUs scheduled to vest in such year will still vest if the Corporation, on a consolidated basis, has six months with sales of at least $2,500,000 during the following year. The company’s board of directors will modify and increase the performance requirements, with the consent of executive, if warranted and appropriate.

Effective March 29, 2017, we entered into a new employment agreement with Mr. Klepfish. The new agreement, which runs through December 31, 2019 maintains the current base salary, and provides for all bonuses and salary increases to be approved by a compensation committee.

JUSTIN WIERNASZ

On November 20, 2012 we entered into an employment agreement with Mr. Wiernasz, the Company’s President, having an effective date of January 1, 2013 and terminating on December 31, 2015 The agreement is for a term of three years, and provides a base compensation in the amount of $226,250 per annum for year one, $248,875 per annum for year two, and $273,763 per annum for year three. The agreement also provides for annual bonuses including bonuses based on increases in EBITDA (as defined in the agreement) of our various subsidiaries; additional bonuses upon the occurrence of certain events such as: listing on specific stock exchanges, spin-offs, investments and stock trading and volume levels. The agreement also provides for stock options with exercise prices ranging from $0.40 - $1.60 and an award of restricted stock, which only vests if certain volume and pricing milestones with respect to our common stock are met. Mr. Wiernasz also has the option of receiving any portion of his salary or bonus in the form of equity. The agreement also contains non-compete and non-solicitation provisions.

On August 7, 2014, our board of directors approved the amendment of the Employment Agreement with Mr. Wiernasz effective as of August 13, 2014. The employment agreement was amended as follows: (i) it has been extended by one year to December 31, 2016; (ii) it provides for 10% annual increases of Base Salary commencing in 2014; (iii) certain performance based bonuses in the employment agreement are eliminated; (iv) stock grants previously issued with vesting based upon performance or stock price are cancelled; (v) a new performance based bonus structure to partially replace the previous structure, based upon meeting certain Cash EBITDA (earnings before interest, taxes, depreciation, and amortization and non-cash compensation charges) targets, the new bonus will have a cash portion and a stock portion and all Base Salary can be paid in cash or in stock at the option of Mr. Wiernasz, and (vi) an award of 75,000 restricted stock units which vest on January 1, 2015 and 75,000 restricted stock units which vest on May 1, 2016. Mr. Wiernasz will have the option, on an annual basis, to take all or part of the cash portion of the bonus, or any part of Base Salary in the form of stock at a valuation based upon the closing stock price on the last trading day of the prior year. The decision on how much, if any, of the bonus to take in stock must be made by May 1 of each year, unless earlier required. The Cash EBITDA target levels do not include the effect of any potential future acquisitions and also do not include certain one time or non-recurring expenses in the calculation of the Cash EBITDA. If a Cash EBITDA target is missed by 3% or less, the bonus for the target so missed shall be reduced by 20% and if it is missed by 3.1% -5%, the bonus for such target shall be reduced by 30%. In March 2016, Mr. Wiernasz’s employment agreement was extended for another year under the same terms.

The employment agreement of Mr. Wiernasz was amended (i) in the event of a change of control (as defined below) all equity based compensation (including options and restricted stock units) payable pursuant to such employment agreements, shall immediately vest and/or restrictions thereon shall lapse, and (ii) to provide that in the event of a termination without Cause (as defined in the employment agreement) they shall receive a lump sum payment equal to the greater of (x) the salary payable over the last six months of the term of the agreement, or (y) the Base Salary (as defined in the employment agreement) remaining through the end of the then-current term of the agreement. The definition of change of control shall mean the occurrence of any of the following events: (w) the sale or transfer by the Company for at least $25 million (such consideration consisting of cash, cash equivalents, notes or securities) of more than 50% of its Voting Securities (as defined below) or substantially all of its assets; or (x) the acquisition, other than from the Company or employees of it or any of its subsidiaries, by any individual, entity or group (within the meaning of Section 13(d)(3) or 14(d)(2) of the Securities Exchange Act of 1934) (other than an employee benefit plan of the Company) of beneficial ownership (within the meaning of Rule 13d-3 promulgated under the Exchange Act) of more than 50% of the combined voting power of the then outstanding voting securities of the Company entitled to vote generally in the election of directors (the “Voting Securities”); or (y) the approval by the stockholders of the Company of a reorganization, merger, consolidation or recapitalization of the Company (a “Business Combination”), other than a Business Combination in which more than 50% of the combined voting power of the outstanding Voting Securities of the surviving or resulting entity immediately following the Business Combination is held by the persons who, immediately prior to the Business Combination, were the holders of the Voting Securities; or (z) the approval by the stockholders of the Company of a complete liquidation or dissolution of the Company, or a sale of all or substantially all of the assets of the Company.

Mr. Wiernasz was awarded, as a special bonus, effective November 17, 2014, an aggregate of 1,000,000 restricted stock units (“RSU”) subject to time and performance vesting conditions, with the timing conditions as follows: 150,000 RSUs vest on each of July 1 and December 31, 2015; 300,000 RSUs vest on December 31, 2016 and 400,000 RSUs vest on July 1, 2017, and the performance conditions are as follows: for the RSUs vesting in 2015, the Corporation, on a consolidated basis, must have four months with sales above $2,500,000 during 2015, for the RSUs vesting in 2016, the Corporation, on a consolidated basis, must have four months with sales above $2,500,000 during 2016 and for the RSUs vesting in 2017, the Corporation, on a consolidated basis, must have four months with sales above $2,500,000 during 2017, provided however, that if the performance condition is not met in any year, the RSUs scheduled to vest in such year will still vest if the Corporation, on a consolidated basis, has six months with sales of at least $2,500,000 during the following year. The company’s board of directors will modify and increase the performance requirements, with the consent of executive, if warranted and appropriate.

On March 21, 2017, the board of directors approved a $65,000 cash bonus for Mr. Wiernasz with respect to his performance in 2016.

Effective March 29, 2017, we entered into a new employment agreement with Mr. Wiernasz. The new agreement, which runs through December 31, 2019 maintains the current base salary, and provides for all bonuses and salary increases to be approved by the board of directors’ compensation committee.

On May 11, 2018, as part of a realignment towards focusing on certain specific growth initiatives and growth opportunities, the President of the Company was named as the Director of Strategic Acquisitions, whose responsibilities include: (i) identifying and assisting in the acquisition and integration of strategic assets; (ii) identifying and executing on new growth opportunities; and (iii) identifying and executing growth initiatives for the Company. In order to allow for the Executive to devote his full time to his new responsibilities, the President of the Company resigned from his role as President of the Company and its subsidiaries.

Compensation Committee Interlocks and Insider Participation

None of our executive officers has served as a director or member of a compensation committee (or other board committee performing equivalent functions) of any other entity, one of whose executive officers served as a director or a member of our Compensation Committee.

RATIFICATION OF THE APPOINTMENT OF

INDEPENDENT CERTIFIED PUBLIC ACCOUNTANTS

(Proposal No.

2

)

Upon the recommendation of our Audit Committee, our Board of Directors has appointed the firm of Liggett & Webb P.A. as our principal independent auditors for the fiscal year ending December 31, 2018, subject to ratification by the stockholders. Liggett & Webb P.A. has been our independent auditors since November 9, 2012. Management recommends a vote “FOR” this proposal.

If the appointment of Liggett & Webb P.A. is not ratified or if it declines to act or their engagement is otherwise discontinued, the Board of Directors will appoint other independent auditors. Representatives of Liggett & Webb P.A. are not expected to be present at the Annual Meeting, but via telephonic hookup will have the opportunity to make a statement at the Annual Meeting, if they so desire, and will be available to respond to appropriate questions from stockholders.

During the year, ended December 31, 2017 and 2016, Liggett & Webb P.A. billed us audit fees of approximately $85,200 and $104,200, respectively.

Audit-Related Fees

The aggregate fees billed in each of the last two fiscal years for assurance and related services by Liggett & Webb P.A. that are reasonably related to the performance of the audit or review of our consolidated financial statements including our quarterly interim reviews on Form 10-Q and are reported under Audit Fees above.

Tax Fees

Liggett & Webb P.A. tax fees were $10,000 and $10,000 for the years ended December 31, 2017 and 2016, respectively.

All Other Fees

Liggett & Webb P.A. has not billed any other fees since their engagement on November 9, 2012.

For the fiscal years ended December 31, 2017 and 2016 the board of directors considered the audit fees, audit-related fees, tax fees and other fees paid to our accountants, as disclosed above, and determined that the payment of such fees was compatible with maintaining the independence of the accountants. Our board of directors pre-approves all auditing services and all permitted non-auditing services (including the fees and terms thereof) to be performed by our independent registered public accounting firm, except for de minimis non-audit services that are approved by the board of directors prior to the completion of the audit.

TO APPROVE AND AUTHORIZE A REVERSE SPLIT OF OUR COMMON STOCK

IN A RATIO RANGING FROM 2:1 TO

1

0

:1 AT THE DISCRETION OF THE BOARD

(Proposal No. 3)

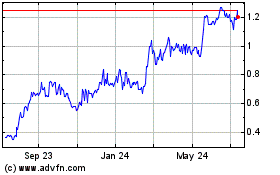

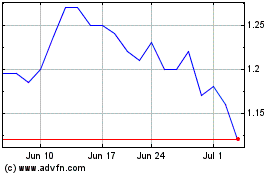

Purpose and Effect of the Reverse Stock Split

The proposed Reverse Stock Split is intended to raise the market price of our common stock to qualify to have our common stock listed on NASDAQ or on another stock exchange. The Company is currently considering listing its common stock on NASDAQ or on another stock exchange and the Reverse Split is intended to provide the Company the flexibility it may need as it relates to its stock price to qualify for such a listing.

Under economic theory, and as experience shows, the market price of our common stock should rise in an inverse amount to the ratio of the reverse split. However, the market price of our common stock is also based on factors that may be unrelated to the number of shares outstanding. These factors include our performance, general economic and market conditions and other factors, many of which are beyond our control. Accordingly, following the initial expected rise following the implementation of the reverse split, the market price of our stock may fall resulting in a loss of net value to your portfolio.

The Reverse Stock Split will affect all of our shareholders uniformly. We will not issue fractional shares, but rather will round up any fractional shares to the next highest full share as a consequence of the Reverse Stock Split.

After the effective date of the Reverse Stock Split (as will be determined in the discretion of our Board of Directors, but no later than the record date of our next annual meeting of stockholders), each stockholder will own a reduced number of shares of our common stock, but will hold the same percentage of the outstanding shares as such stockholder held prior to the effective date. The number of shares of our common stock that may be issued upon the exercise of outstanding rights to receive shares of our common stock or conversion of an outstanding convertible note and the per share conversion prices thereof, will be adjusted appropriately to give effect to the Reverse Stock Split as of the effective date.

The liquidity of our common stock may be adversely affected by the reduced number of freely trading shares outstanding after the Reverse Stock Split. In addition, the split will increase the number of shareholders who own odd-lots. An odd-lot is fewer than 100 shares. Such shareholders may experience an increase in the cost of selling their shares and may have greater difficulty in making sales.

The Reverse Stock Split will not affect the par value of our common stock. As a result, on the effective date of any such implementation, the stated capital on our balance sheet attributable to our common stock will be reduced in proportion with the exchange ratio for the Reverse Stock Split (as will be determined in the discretion of our Board of Directors, but no later than the record date of our next annual meeting of shareholders) and our additional paid-in capital account will be credited with the amount by which the stated capital is reduced. These accounting entries will have no impact on total shareholders' equity. All share and per share information will be retroactively adjusted following the effective date to reflect the Reverse Stock Split for all periods presented in future filings.

It is not possible for the Board to predict at this time the appropriate size of any reverse split that might be necessary to consummate a potential future listing on NASDAQ or another other stock exchange should the Company decide to pursue a listing. Accordingly, we are asking for approval to give our Board discretion to implement a reverse split within the range of 2:1 to 10:1 based upon the determination by our Board of Directors of the appropriate ratio based upon the relevant factors at such time. Management recommends a vote “FOR” this proposal .

Because the Reverse Stock Split will result in an increased number of authorized but unissued shares of our common stock, it may be construed as having an anti-takeover effect. Although the Reverse Stock Split is not being proposed by the Board for this purpose, in the future the Board of Directors could, subject to its fiduciary duties and applicable law, use the increased number of authorized but unissued shares to frustrate persons seeking to take over or otherwise gain control of the Company, for example, by privately placing shares with purchasers who might side with the Board in opposing a hostile takeover bid. Shares of common stock could also be issued to a holder who would thereafter have sufficient voting power to assure that any proposal to amend or repeal our Bylaws or certain provisions of our Articles of Incorporation would not receive the requisite vote. Such uses of our common stock could render more difficult, or discourage, an attempt to acquire control of our Company if the Board opposed such transactions.

The Reverse Stock Split will have the following effects upon our common stock:

☐ The number of shares owned by each holder of common stock on the record date of a reverse split will be proportionally reduced by a factor between 50% and 90%, but the shareholder’s percentage ownership of the Company will remain unchanged;

☐ The number of shares of common stock we are authorized to issue will remain at 500,000,000;

☐ The par value of our common stock will remain the same; and

☐ Shares of our common stock underlying our outstanding convertible notes, options and warrants will be reduced proportionally and the conversion and exercise prices increased proportionally.

The shares of our common stock to be issued following the Reverse Stock Split will be fully paid and non-assessable. The Reverse Stock Split will not change any of the rights of the shareholders of our common stock. The new shares will have the same voting rights and rights to dividends and distributions and will be identical in all other respects to the shares of our common stock that were issued prior to the Reverse Stock Split. Each shareholder's percentage ownership will not be altered as a result of the Reverse Stock Split, but each shareholder could incur dilution, which could be substantial, as a result of additional corporate issuances of extra available shares as a result of the Reverse Stock Split.

On the record date of September 13, 2018 described above, there were 33,775,306 shares of our common stock issued and validly outstanding and an additional 650,000 shares underlying outstanding options.

The following table sets forth the number of Common Shares issued and outstanding as of the record date of this Proxy Statement and upon implementation of a Reverse Split at a ratio of 2:1, 5:1 and 10:1. Inasmuch as we cannot predict at this time the actual ratio that our Board will select, these examples will provide information with respect to the highest, lowest and mid-range of the possible ratios. We currently have 500 million authorized shares of common stock.

|

|

2:1

|

5:1

|

10:1

|

|

Number of outstanding shares

|

16,887,653

|

6,755,061

|

3,377,531

|

|

Number of authorized but unissued shares

|

483,112,347

|

493,244,939

|

496,622,469

|

|

Number of outstanding shares – fully diluted

|

17,212,653

|

6,885,061

|

3,442,531

|

|

Number of authorized but unissued shares - fully diluted

|

482,787,347

|

493,114,939

|

496,557,469

|

Proposals

4

-

8

The Board of Directors wants to express its appreciation to shareholders who made suggestions and offered advice to the company in connection with some of the following Proposals submitted for consideration. The company invites both formal and informal proposals and suggestions for future meetings. Ours is an endeavor shared by management, our employees and our shareholders, all of whom have contributed to our achievements and can contribute to our future success.

At the impetus of certain shareholders, the following five proposals were developed following consultations with management, counsel and investment professionals and input from certain shareholders and are being presented to the shareholders, purely on an advisory basis, so that the Board can gauge the interest of the shareholders for each of these items and after seeing the results and after further review and contemplation to determine which, if any, to adopt. As each proposal has both potential advantages and disadvantages, management is not taking a position with respect to any of these proposals as it does not want to unduly influence the voting results.

ADVISORY VOTE ON WHETHER,

COMMENCING IN 2019, THE ANNUAL MEETING OF SHAREHOLDERS

SHOULD BE HELD ON OR BEFORE THE END OF THE THIRD QUARTER IN EACH YEAR

(Proposal No.

4

)

ADVISORY VOTE ON WHETHER

ACTION BY THE BOARD OF DIRECTORS SHOULD REQUIRE THE APPROVAL OF A MAJORITY OF DIRECTORS THEN IN OFFICE, REGARDLESS OF HOW MANY DIRECTORS ARE PRESENT AT A MEETING

(Proposal No.

5

)

ADVISORY VOTE ON WHETHER

THE BOARD OF DIRECTORS

SHOULD

USE REASONABLE EFFORTS SO THAT A MAJORITY OF THE DIRECTORS WILL BE INDEPENDENT DIRECTORS AND IF THERE IS NOT A MAJORITY OF INDEPENDENT DIRECTORS AT ANY GIVEN TIME, A SPECIAL COMMITTEE OF DIRECTORS

SHOULD

BE FORMED WITHIN TEN BUSINESS DAYS TO INITIATE A FORMAL SELECTION PROCESS TO LOCATE PERSONS WHO COULD FILL THE INDEPENDENT DIRECTOR POSITION

(Proposal No.

6

)

ADVISORY VOTE ON WHETHER

THE BOARD OF DIRECTORS SHOULD CONSIST OF AT LEAST FIVE DIRECTORS AND IF THERE IS A VACANCY, THE BOARD OF DIRECTORS SHOULD USE REASONABLE GOOD FAITH EFFORTS TO FORM A SPECIAL BOARD OF DIRECTORS COMMITTEE WITHIN TEN BUSINESS DAYS OF SUCH VACANCY TO INITIATE A FORMAL SEARCH PROCESS TO FILL BOARD VACANCIES WITH QUALIFIED DIRECTORS

(Proposal No.

7

)

ADVISORY VOTE ON WHETHER

THE FOLLOWING TRANSACTIONS SHALL REQUIRE THE APPROVAL OF A DESIGNATED BOARD COMMITTEE COMPRISED OF INDEPENDENT DIRECTORS: (I) AN ACQUISITION IN WHICH 20% OR MORE OF THE COMPANY’S OUTSTANDING COMMON STOCK, OR 5% WITH RESPECT TO A RELATED PARTY TRANSACTION, ARE PROPOSED TO BE ISSUED, (II) ISSUANCES OF COMPANY COMMON STOCK WHICH WILL RESULT IN A CHANGE OF CONTROL OF THE COMPANY, AND (III) A PRIVATE PLACEMENT INVOLVING COMMON STOCK EQUAL TO OR GREATER THAN 20% OF THE PRE-ISSUANCE OUTSTANDING COMMON STOCK AT A PRICE LESS THAN THE GREATER OF BOOK VALUE OR MARKET VALUE.

(Proposal No.

8

)

ADVISORY VOTE ON THE COMPANY'S EXECUTIVE COMPENSATION

(Proposal No.

9

)

Our stockholders are being provided the opportunity to cast a non-binding, advisory vote (commonly known as "say on pay") on the compensation of the executive officers named in the "Summary Compensation Table" above (collectively, the "named executive officers"). This vote is not intended to address any specific item of compensation, but rather the overall compensation of our named executive officers and the executive compensation policies and practices described in this proxy statement, through consideration of the following non-binding advisory resolution:

“Resolved, that the stockholders advise that they approve the compensation of the Company's named executive officers as disclosed pursuant to Item 402 of Regulation S-K, including the Compensation Discussion and Analysis and the compensation tables and related narrative discussion.”