Current Report Filing (8-k)

September 11 2018 - 4:03PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________________

FORM 8-K

_________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

September 11, 2018

RAMACO RESOURCES, INC.

(Exact name of Registrant as specified in its charter)

|

Delaware

|

001-38003

|

38-4018838

|

|

(State or other jurisdiction of

|

(Commission

|

(I.R.S. Employer

|

|

incorporation or organization)

|

File Number)

|

Identification No.)

|

|

|

|

|

|

|

|

|

|

|

250 West Main Street, Suite 1800

|

|

|

|

Lexington, Kentucky 40507

|

|

|

|

(Address of principal executive offices)

|

|

|

|

(Zip Code)

|

|

|

|

Registrant’s Telephone Number, including area code:

(859) 244-7455

|

|

Not Applicable

(Former name, former address and former fiscal year, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

|

Item 7.01.

|

Regulation FD Disclosure.

|

On September 11, 2018, Ramaco Resources, Inc. (the “Company”) issued a press release announcing updated information regarding its Berwind mine complex. The Company previously announced that it encountered a sandstone intrusion in the Berwind mine, which required the Company to explore relocating its original mining route in the Pocahontas #3 Seam to reach the more prolific Pocahontas #4 Seam. Today, the Company announced that, after new exploratory drilling at the Berwind mine, the Company has further defined the extent of the sandstone formation and has implemented an alternative mine plan to mine around it and ramp up into the Pocahontas #4 Seam. It will now continue to mine in an alternate path through the Pocahontas #3 Seam at an expected annualized rate of approximately 200,000 tons per year. These developmental tons are expected to be sold at current pricing levels into the low volatile metallurgical market. The Company now estimates that it will reach the thicker Pocahontas #4 Seam low volatile reserve in the second quarter of 2020, as opposed to the third quarter of 2019. When reached then, the level of production anticipated from both the Pocahontas #3 and #4 reserves remains as originally forecast at approximately 800,000 tons per year.

The Company also announced that it has now entered into new commitments for the sale and delivery in calendar 2019 of approximately 1,240,000 tons of various qualities of metallurgical coal to domestic customers. These commitments are subject to customary final documentation and approvals and are subject to change. The average price of these sales is approximately $113 per ton FOB mine, which compares to the Company’s 2018 average sales price to domestic customers of $79 per ton FOB mine, an increase of roughly 43% year over year. The Company also contracted earlier this year with various export customers for the sale of an additional 200,000 tons of metallurgical coal for delivery in the first half of 2019, at prices set against various index prices.

A copy of the press release is attached hereto as Exhibit 99.1 and incorporated herein by reference.

Limitation on Incorporation by Reference:

In accordance with general instruction B.2 of Form 8-K, the information in this report, including exhibits, is furnished pursuant to Item 7.01 and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, or otherwise subject to the liability of that section.

Cautionary Statement Regarding Forward-Looking Statements

Certain statements contained in this Form 8-K constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements represent Ramaco Resources’ expectations or beliefs concerning future events, and it is possible that the results described in this Form 8-K will not be achieved. These forward-looking statements are subject to risks, uncertainties and other factors, many of which are outside of Ramaco Resources’ control, which could cause actual results to differ materially from the results discussed in the forward-looking statements. Any forward-looking statement speaks only as of the date on which it is made, and, except as required by law, Ramaco Resources does not undertake any obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise. New factors emerge from time to time, and it is not possible for Ramaco Resources to predict all such factors. When considering these forward-looking statements, you should keep in mind the risk factors and other cautionary statements found in Ramaco Resources’ filings with the Securities and Exchange Commission (“SEC”), including its Annual Report on Form 10-K. The risk factors and other factors noted in Ramaco Resources’ SEC filings could cause its actual results to differ materially from those contained in any forward-looking statement.

|

Item 9.01.

|

Financial Statements and Exhibits.

|

|

|

|

|

(d)

|

Exhibits

.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

RAMACO RESOURCES, INC.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Randall W. Atkins

|

|

|

|

Name:

|

Randall W. Atkins

|

|

|

|

Title:

|

Executive Chairman and Chief Financial Officer

|

|

|

|

|

|

|

Date: September 11, 2018

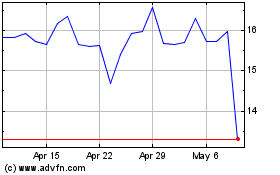

Ramaco Resources (NASDAQ:METC)

Historical Stock Chart

From Mar 2024 to Apr 2024

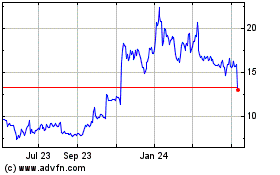

Ramaco Resources (NASDAQ:METC)

Historical Stock Chart

From Apr 2023 to Apr 2024