Current Report Filing (8-k)

September 11 2018 - 6:03AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported):

September 10, 2018

Genuine

Parts Company

(Exact name of registrant as specified in its charter)

|

Georgia

|

|

001-05690

|

|

58-0254510

|

(State or other jurisdiction

of incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

|

|

2999 Wildwood Pkwy

Atlanta, Georgia

|

|

30339

|

|

|

|

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code

678.934.5000

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (

see

General Instruction

A.2. below):

|

|

☐

|

Written communications pursuant to Rule 425 under the

Securities Act (17 CFR 230.425)

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the

Exchange Act (17 CFR 240.14a-12)

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the

registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or

Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.02 Termination of a Material Definitive Agreement.

The Merger Agreement

On September 10, 2018, Essendant Inc. (“

Essendant

”)

notified Genuine Parts Company (“

GPC

”) that (i) on September 9, 2018, Essendant’s board of directors

determined that the proposal from Staples, Inc. to acquire all of the outstanding shares of Essendant common stock for $12.80

per share in cash is a Superior Proposal (as defined in the previously announced Agreement and Plan of Merger (the “

Merger

Agreement

”) dated as of April 12, 2018 by and among GPC, Rhino SpinCo, Inc. (“

SpinCo

”), Essendant

and Elephant Merger Sub Corp.) and (ii) Essendant’s board of directors intends to cause Essendant to terminate the Merger

Agreement pursuant to Section 9.01(g) thereof. Under the terms of the Merger Agreement, this notice commences a three-day match

period, during which GPC intends to evaluate its rights under the existing Merger Agreement. GPC continues to believe the Merger

Agreement represents a superior proposal and will not make any counterproposals. Therefore, GPC anticipates that the Merger Agreement

will terminate at the end of the three-day match period. Upon termination of the Merger Agreement, Essendant will be required

to pay a termination fee to GPC in the amount of $12 million.

The Separation Agreement

Under the terms of the previously announced Separation Agreement

(the “

Separation Agreement

”) dated as of April 12, 2018 between GPC and SpinCo, the Separation Agreement will

terminate without further action at any time before the closing of the transactions contemplated thereby upon termination of the

Merger Agreement. Accordingly, GPC anticipates that the Separation Agreement will also terminate upon termination of the Merger

Agreement.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits.

The following exhibit is being furnished, and is not deemed

to be filed:

Cautionary Statement

This document contains forward-looking statements, which

are intended to provide management’s current expectations or plans for our future operating and financial performance,

based on assumptions currently believed to be valid. Forward-looking statements may include references to goals, plans,

strategies, objectives, projected costs or savings, anticipated future performance, and/or results. These forward-looking

statements are based on management’s current expectations, forecasts and assumptions. This means they involve a number

of risks and uncertainties that could cause actual results to differ materially from those expressed or implied here,

including but not limited to: the occurrence of events that may give rise to a right of one or both of GPC and Essendant to

challenge the termination of, or other actions taken pursuant to, the Merger Agreement; negative effects resulting from the

transaction process, significant transaction costs and/or unknown liabilities; risks associated with other transaction

related litigation; and the ability of GPC to retain and hire key personnel. Stockholders, potential investors and other

readers are urged to consider these risks and uncertainties in evaluating forward-looking statements and are cautioned not to

place undue reliance on the forward-looking statements. For additional information on identifying factors that may cause

actual results to vary materially from those stated in forward-looking statements, please see GPC’s reports on Forms

10-K, 10-Q and 8-K filed with or furnished to the SEC and other written statements made by GPC from time to time.

The forward-looking information provided by GPC is given as of this date only, and GPC does not undertake any obligation to

revise or update it.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

GENUINE PARTS COMPANY

|

|

|

|

|

|

|

Date: September 10, 2018

|

/s/ Carol B. Yancey

|

|

|

|

Name: Carol B. Yancey

Title: Executive Vice President and Chief Financial

Officer

|

|

EXHIBIT INDEX

|

Exhibit

Number

|

|

Exhibit

Description

|

|

|

|

|

|

99.1

|

|

Press Release dated September 10, 2018.

|

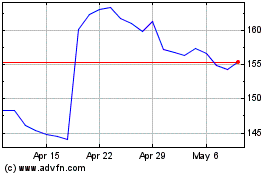

Genuine Parts (NYSE:GPC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Genuine Parts (NYSE:GPC)

Historical Stock Chart

From Apr 2023 to Apr 2024