Report of Foreign Issuer (6-k)

September 07 2018 - 9:05AM

Edgar (US Regulatory)

UNITED STATES SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

6-K

REPORT OF

FOREIGN PRIVATE ISSUER

PURSUANT TO RULE

13a-16

OR

15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the Month of September 2018

Commission File Number:

001-36697

DBV TECHNOLOGIES S.A.

(Translation of registrant’s name into English)

177-181

avenue Pierre Brossolette

92120 Montrouge France

(Address of principal executive office)

Indicate by check mark whether

the registrant files or will file annual reports under cover of Form

20-F

or Form

40-F:

☒ Form

20-F ☐ Form

40-F

Indicate by check mark if the registrant is submitting the Form

6-K

in paper as permitted by Regulation

S-T

Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form

6-K

in paper as permitted by Regulation

S-T

Rule 101(b)(7): ☐

EXHIBIT LIST

|

|

|

|

|

Exhibit

|

|

Description

|

|

|

|

|

99.1

|

|

Press Release dated September 7, 2018.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DBV TECHNOLOGIES S.A.

|

|

|

|

|

|

|

Date: September 7, 2018

|

|

|

|

By:

|

|

/s/ David Schilansky

|

|

|

|

|

|

|

|

Name:

|

|

David Schilansky

|

|

|

|

|

|

|

|

Title:

|

|

Deputy Chief Executive Officer

|

Exhibit 99.1

DBV Technologies Reports First Half 2018 Financial Results

DBV Technologies (Euronext: DBV – ISIN: FR0010417345 – Nasdaq Stock Market: DBVT), a clinical-stage biopharmaceutical company, today

reported first half 2018 financial results. The interim financial report is available on the Investor Relations section of the Company’s website,

https://www.dbv-technologies.com/investor-relations/

. First half 2018 financial statements were subject to a limited review by the Company’s external auditors.

Cash Position:

cash and cash equivalents as of June 30, 2018, were €202.2 million, compared to €137.9 million as of

December 31, 2017, an increase of €64.4 million. The increase in the cash position is attributable to the increase in the net cash from financing activities pursuant to the Company’s March 2018 public offering.

Operating Income:

operating income was €7.3 million for the first half 2018 compared to €7.6 million for the prior-year period. In

the first half 2018, as well as in the first half 2017, income was primarily generated from the Company’s Research Tax Credit (Crédit Impôt Recherche) and by income recognized under the collaboration agreement with Nestlé

Health Science.

Research

& Development Expenses:

research and development expenses decreased

by €2.6 million, or 4.9%, to €49.9 million in the first half 2018, compared to €52.5 million in the first half 2017, reflecting the decrease in expenses following the completion of the Phase III and Phase II

clinical trials of Viaskin Peanut and Viaskin Milk, respectively, as well as a decrease in manufacturing expenses due to the completion of a new manufacturing machine in the first half 2017. During the first half 2018, the Company continued to

increase its R&D activity for both

pre-clinical

research and clinical development, as well as reinforcing the teams dedicated to R&D.

Sales

& Marketing Expenses:

sales and marketing expenses were €9.7 million for the first half 2018

compared to €8.5 million for the first half 2017, reflecting an increase of €1.2 million, or 14.1%, compared to the prior-year period. The increase in sales and marketing expenses resulted from an increase in expenses

related to the potential commercialization of Viaskin Peanut in North America, if approved, as well as an increase in share-based compensation.

General

& Administrative

Expenses:

general and administrative expenses were €21.1 million for the first half 2018, compared to €17.7 million for the first half 2017. The increase in general and administrative expenses was primarily attributable

to an increase in personnel-related expenses as a result of increased global employee headcount and increased costs associated with legal and professional services, partially offset by decreases in share-based compensation.

Net Loss:

net loss was €(72.1) million for the first half 2018, compared to €(72.5) million for the first half 2017. Loss

per share (based on the weighted average number of shares outstanding over the period) was €(2.60) and €(2.94) in first half 2018 and 2017, respectively.

About DBV Technologies

DBV Technologies is developing

Viaskin

®

, a proprietary technology platform with broad potential applications in immunotherapy. Viaskin is based on epicutaneous immunotherapy, or EPIT

®

, DBV’s method of delivering biologically active compounds to the immune system through intact skin. With this new class of self-administered and

non-invasive

product candidates, the company is dedicated to safely transforming the care of food allergic patients, for whom there are no approved treatments. DBV’s food allergies programs include

ongoing clinical trials of Viaskin Peanut and Viaskin Milk, and preclinical development of Viaskin Egg. DBV is also pursuing a human

proof-of-concept

clinical study of

Viaskin Milk for the treatment of Eosinophilic Esophagitis, and exploring potential applications of its platform in vaccines and other immune diseases. DBV Technologies has global headquarters in Montrouge, France and New York, NY. Company shares

are traded on segment A of Euronext Paris (Ticker: DBV, ISIN code: FR0010417345), part of the SBF120 index, and traded on the Nasdaq Global Select Market in the form of American Depositary Shares (each representing

one-half

of one ordinary share) (Ticker: DBVT). For more information on DBV Technologies, please visit our website:

www.dbv-technologies.com

DBV Investor Relations Contact

Sara Blum Sherman

Senior Director, Investor Relations & Strategy

+1 212-271-0740

sara.sherman@dbv-technologies.com

DBV Media Contact

Raul Damas

Partner, Brunswick Group

+1-212-333-3810

DBV@brunswickgroup.com

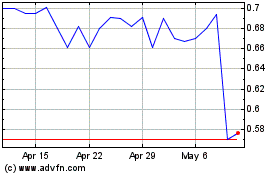

DBV Technologies (NASDAQ:DBVT)

Historical Stock Chart

From Mar 2024 to Apr 2024

DBV Technologies (NASDAQ:DBVT)

Historical Stock Chart

From Apr 2023 to Apr 2024