UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For the month of September, 2018.

Commission File Number 33-65728

CHEMICAL

AND MINING COMPANY OF CHILE INC.

(Translation of registrant’s

name into English)

El Trovador 4285, Santiago,

Chile (562) 2425-2000

(Address of principal executive

office)

Indicate by check mark whether the registrant files

or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F:

x

Form 40-F

¨

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

¨

Note: Regulation S-T Rule 101(b)(1) only permits

the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

¨

Note: Regulation S-T Rule 101(b)(7) only permits

the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer

must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized

(the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s

securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed

to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission

or other Commission filing on EDGAR.

Santiago, Chile, September 5, 2018

–Sociedad Química y Minera de Chile S.A. (SQM) (NYSE: SQM; Santiago Stock Exchange: SQM-B, SQM-A) announces that as

part of its investor day meeting it presented the following material. The following company representatives were present: Patricio

de Solminihac, CEO; Ricardo Ramos, CFO and Gerardo Illanes, VP Finance and IR.

www.sqm.com 2018 1 INVESTOR DAY 2018 NYSE September 5

www.sqm.com 2018 2 CUSTOMARY NOTE REGARDING FORWARD - LOOKING STATEMENTS Statements in this presentation concerning the Company’s business outlook, future economic performance, anticipated profitability, revenues, expenses, or other financial items, anticipated cost synergies and product or service line growth, together with other statements that are not historical facts, are “forward - looking statements” as that term is defined under the U . S . Private Securities Litigation Reform Act of 1995 . Any forward - looking statements are estimates, reflecting the best judgment of SQM management based on currently available information and involve a number of risks, uncertainties and other factors that are outside SQM ´ s control could cause actual results to differ materially from those stated in such statements . Risks, uncertainties, and factors that could affect the accuracy of such forward - looking statements are identified in SQM ´ s public filing made with the U . S . Securities and Exchange Commission, specifically SQM ´ s most recent annual report on Form 20 - F . All forward - looking statements are based on information available to SQM on the date hereof and SQM assumes no obligation to update such statements whether as a result of new information, future developments or otherwise, except as required by law .

www.sqm.com 2018 3 Patricio de Solminihac CEO INVESTOR DAY PROGRAM 01. Ricardo Ramos CFO 02. Gerardo Illanes VP Finance & IR 03. Q&A 04. Presentation is available on our website www.sqm.com

www.sqm.com 2018 4 PATRICIO DE SOLMINIHAC CEO

www.sqm.com 2018 5 Commercial exploitation of the caliche ore deposits in northern Chile began 1830 Maria Elena begins operations using the Guggenheim Method 1926 OUR HISTORY SQM is incorporated 1968 Listing of ADR Program on New York Stock Exchange SQM begins developing the Salar de Atacama 1993 1997 2005 Lean methodology adoption begins company - wide 2014 Joint venture with Kidman resources to develop the Mt. Holland Lithium Project in Australia 2017 New agreement with CORFO; announcement of lithium capacity expansion in Chile from 48k MT/year to 180k MT/year over next few years 2018 Celebrating 25 years listed on the NYSE Celebrating its 50th anniversary Lithium hydroxide production begins 1951 SQM constructs crystalized nitrates plant in Coya Sur Lithium carbonate production begins 1996 SQM begins iodine production in Nueva Victoria Production of potassium nitrate begins 1986

www.sqm.com 2018 6 CORPORATE STRATEGY Be a global company with people committed to excellence , dedicated to the extraction of minerals and selectively integrated in the production and sale of products for the industries essential for human development Ensure availability of key resources required to support current goals for medium and long - term business growth Consolidate a culture of lean operations (M1 excellence ) throughout the organization , including operations , sales and support areas Significantly increase nitrate sales for all its applications , and ensure consistency with the iodine sales strategy Successfully develop and implement all lithium expansion projects , acquire more assets to complement our current portfolio Strengthen the organizational structure to support the development of the strategic plan, focusing on the development of critical capabilities and the application of the corporate values of excellence , integrity and safety Develop and actively manage a robust risk control and mitigation process , while fousing on sustainable operations and the environment Improve our stakeholder management to establish links with the community , and communicate to Chile and the world our contribution to industries essential for human development Maximize the margins of each business line through appropriate pricing strategy

www.sqm.com 2018 7 • Water soluble fertilizer market growing at ~ 10% per year • SQM volume growth outpacing the market in 2018, over 10%, 2019 will see continued increase • Expanding nitrates production from 1 to 1.5 million MT/year. Currently at 1.3 million MT/year • Two new NPK plants: Italy and Mexico SPECIALTY PLANT NUTRITION Potassium Nitrate (KNO 3 ) • Currently 16 WSNPK plants; further market development • New production plants • Continued cost improvement for all products • Add value to KNO 3 As a result of Lean M1 Operations, in May 2018 the port of Tocopilla shipped 250,000 MT, setting a new shipping record In 2017, SQM and the Ayllu Wine Program worked with farmers and the Indigenous Association to produce over 7,500 bottles of wine in the Salar de Atacama 2017 Recap SUSTAINABILITY & INNOVATION LTM CONTRIBUTION TO: 20% 34% GROSS PROFIT REVENUES

www.sqm.com 2018 8 POTASSIUM CHLORIDE Approximately 15% of our employees are women, more than double the average in the Chilean mining industry SUSTAINABILITY & INNOVATION 95.8% of the energy required for our operations is solar • Low - cost raw material for our growing potassium nitrate business • Market growing, expected to reach ~63 - 64 million MT • 2018 sales volumes estimated to be less than 1 million MT, lower in 2019 as result of increased lithium and potassium nitrate production • Approximately 1/3 of SQM sales to Brazil in 2018 MOP • Kore Potash project • Continued cost improvements for all products 2017 Recap MOP (KCL) LTM CONTRIBUTION TO: 7% 14% GROSS PROFIT REVENUES

www.sqm.com 2018 9 IODINE & DERIVATIVES Best safety record over the last 12 months New uses for iodine help keep demand growing consistently SUSTAINABILITY & INNOVATION • Market demand will grow close to 3% in 2018 • Sales volumes up, expected to surpass 13k MT in 2018 • Expansion project from 11 - 14k MT/year was completed • More SQM iodine projects in pipeline; preparing to meet future market demand IODINE • More than 35% market share; >12k MT sales volumes in 2017 • New capacity expansion • Look for new projects in iodine derivatives 2017 Recap MOP Iodine (I 2 ) LTM CONTRIBUTION TO: 10% 12% GROSS PROFIT REVENUES

www.sqm.com 2018 10 INDUSTRIAL CHEMICALS Over 61, 000 hours of training completed in 2018. Important geographical growth related to the use of solar salts: Spain, USA, South Africa, Morocco, Israel, Chile, UAE, Saudi Arabia and others. SUSTAINABILITY & INNOVATION • Market growth coming from solar salts for CSP (concentrated solar power) projects • Goal for 2020 volumes to reach 200,000 MT • 2017 sales volumes expected 100,000 MT 2017 Recap MOP Solar Salts (KNO 3 , NaNO 3 ) LTM CONTRIBUTION TO: 6% 6% GROSS PROFIT REVENUES

www.sqm.com 2018 11 • Market growth in 2018 expected to surpass 20% • Sales volumes in 2018 will surpass 50k MT • First stage of lithium carbonate expansion in Chile completed on time and on budget (~US$75 million) • 70k to 120k MT in 2019 (US$200 million) • 120k to 180k MT in 2021 (US$250 million) • Lithium hydroxide expansion in Chile from 6k to 13.5k to be completed this year. LITHIUM & DERIVATIVES Will be able to almost quadruple lithium production without extracting more brine from the Salar de Atacama Continued development of large - scale lithium projects in Chile and abroad SUSTAINABILITY & INNOVATION • Exar project • JV with Kidman Resources (Mt. Holland, Australia) • Look for new lithium projects outside Chile • Leadership position in the market 2017 Recap MOP Li 2 CO 3 LiOH LTM CONTRIBUTION TO: 58% 30% GROSS PROFIT REVENUES

www.sqm.com 2018 12 • Agreement reached with CORFO to maintain the lease through 2030 • Total production quota : 2.2 million MT of LCE • New rent scheme became effective April 10, 2018 • Major investments and expansions in Chile CORFO & CONTRACT NEGOTIATIONS IN THE FUTURE 0% 5% 10% 15% 20% 25% 30% 35% 40% 45% 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 Fee, % of price Li 2 CO 3 Price, US$/kg CORFO RENTAL FEE (LITHIUM CARBONATE) Rental Fee, contract % of price Rental Fee, weighted average %

www.sqm.com 2018 13 • Annual contribution of US $ 11 - 19 million for R&D efforts • Annual contribution of US $ 10 - 15 million for neighboring communities of the Salar de Atacama • Annual contribution of 1 . 7 % of SQM Salar’s sales per year for regional development CONTRIBUTIONS TO THE DEVELOPMENT AND COMMUNITIES

www.sqm.com 2018 14 • Mt . Holland, 50 / 50 JV with Kidman Resources • Estimated to contain 189 million tons of 1 . 50 % Li 2 O or 7 . 03 million tons of LCE (according to JORC Code* standards) • One of the world’s most significant hard rock lithium deposits . Expected to be at the low end of the global hard rock cost curve • Exclusive option to lease a premier site in Kwinana , Western Australia to build a refinery and produce battery - grade refined lithium • Production focus on lithium hydroxide • Capacity : 45 k MT of LiOH /year • Estimated commission date : 2020 - spodumene concentrate, 2021 - LiOH • Current status : advancing on feasibility studies for mine, concentrator and refinery LITHIUM EXPANSION IN AUSTRALIA *The Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves (‘the JORC Code’)

www.sqm.com 2018 15 On track to capture opportunities in SPN, lithium, iodine and industrial chemicals business lines CONCLUSION 01. 02. 03. Lithium is, and will continue to be, our main business line We will continue to make decisions to maximize SQM value in the long - term

www.sqm.com 2018 16 RICARDO RAMOS CFO

www.sqm.com 2018 17 GROSS PROFIT EVOLUTION - 200 400 600 800 1,000 1,200 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Fertilizers (SPN+KCL) Iodine Lithium Industrial Chemicals 2010 - 2014: Iodine boom Market growth 2 - 4% 2016 - : Lithium boom Market growth 15 - 20% 2007 - 2013: Fertilizer boom Market growth 1 - 2%

www.sqm.com 2018 18 Demand growth has been led by energy storage related to electronic devices and power tools. Further growth will be related to electric vehicles. Source: SQM Estimates A CLOSER LOOK AT THE LITHIUM MARKET LITHIUM CHEMICALS DEMAND COMPARISON 0 50 100 150 200 250 2010 2011 2012 2013 2014 2015 2016 2017 KMT - LCE Lithium Demand Evolution 2010 - 2017 Other applications Energy Storage (kMT-LCE) 20 10 T otal D emand: 9 8 k 2017 T otal D emand: 212k

www.sqm.com 2018 19 • Annual vehicle growth ~ 2% • EV penetration is expected to be from ~ 3% to 9% - 11% • Average battery size from ~ 40 to 50 kWh ( ~ 0.7 – 0.8 kg LCE/kWh) ; EV Lithium demand is expected to be higher than 400k MT in 2025 • Other batteries uses: CAGR ~ 11% • Others : CAGR ~ 4% Source: SQM Estimates A CLOSER LOOK AT THE LITHIUM MARKET EVEN HIGHER EXPECTED DEMAND GROWTH 200 300 400 500 600 700 800 900 2018 2019 2020 2021 2022 2023 2024 2025 57 - 68 73 - 94 116 - 141 Lithium Expected Demand , kMT 750 - 850 CAGR: 15% - 17% 45 - 52

www.sqm.com 2018 20 A CLOSER LOOK AT THE LITHIUM MARKET* Demand is growing, and new capacity is needed. SQM Ž s Strategy : • Chile: capacity increase (48k ; 70k ; 120k ; 180k MT) • Australia: 45k MT ; B e prepared for higher demand growth rates • The best quality ( physical and chemical ), looking at the long - term requirements • Focus on technological development , cost reduction and environmental sustainability • Value - added relationships with our customers • Potential M&A activities * Source : SQM Estimates

www.sqm.com 2018 21 KEY ASSUMPTIONS: • Other Players: Wodgina , Pilbara, other minerals and other brines From 155 to 385k MT ; CAGR ~ 14% • Big Players: SQM, Albemarle & Tianqi ( Salar de Atacama & Talison ) CAGR: ~ 11% ( ~ 8% in 2019/2020, ~ 3% in 2021/2022, ~1 5% in 2023/2024, ~ 25% in 2025) GLOBAL LITHIUM SUPPLY EVOLUTION - 100 200 300 400 500 600 700 800 900 2018 2019 2020 2021 2022 2023 2024 2025 Expected Supply , kMT Other Producers Big Players 310 385 * Source : SQM Estimates 150 155

www.sqm.com 2018 22 • 2024 - 2025 , market will need new projects or the big players will have to increase their market share • Systematically , new projects have been delayed longer than expected and related production has been less than projected • High quality battery grade lithium is very difficult to obtain during the early production years . Quality restrictions in the future are expected to be greater than today • In the past we have underestimated the demand . Small variations in the penetration of the EVs can have significant effect on lithium demand GLOBAL LITHIUM SUPPLY & DEMAND EVOLUTION * Source : SQM Estimates 200 300 400 500 600 700 800 2018 2019 2020 2021 2022 2023 2024 2025 Supply & Demand , kMT Supply Demand at CAGR 15% Demand at CAGR 17%

www.sqm.com 2018 23 SUMMARY NEW CAPACITY IN CHILE & SQM JV CAPACITY All projects at low - end of cost curve 01. 02. Capex in Chile is approximately US$4,000/ton As leading player in market, we want to have capacity and flexibility to respond to market SQM medium term projects and capacity: • Current Capacity: 70k MT/year (Chile) • End of 2019: +50k MT/year = 120k MT/year (Chile) • End of 2021: +60k MT/year=180k MT/year (Chile) • End of 2021: +22.5k MT/year=202.5k MT/year ( Chile+AUS ) Highly talented professionals Experience and know - how in process development We have the size, the people, the distribution network and the resources Capex on time and on budget ; focus and priority SQM Dz s Sustainable Competitive Advantages 03.

www.sqm.com 2018 24 GERARDO ILLANES VP FINANCE & IR

www.sqm.com 2018 25 REVIEW OF RESULTS SPN Iodine Lithium I.Chem . Potassium PRICE QUANTITY Prices increased in all business lines in the 2Q2018 compared to the same period of 2017. Significantly increased lithium prices outweighed the impact of lower sales volumes in the 1H2018. US$ Million 180 12 13 15 9 (5) 1 224 100 150 200 250 300 350 Gross Profit Contribution 2Q2018/2Q2017 Revenue Contribution 2Q2018/2Q2017 505 37 22 33 31 8 3 639 400 500 600 700 800 US$ Million

www.sqm.com 2018 26 STRONG FINANCIAL POSITION 2.4 2.4 2.4 2.1 1.0 2.0 3.0 4.0 Jun 17 Dec 17 Mar 18 Jun 18 Accounts Receivables ( Months of Sales) 8.3 7.8 8.0 7.4 4.0 8.0 12.0 16.0 Jun 17 Dec 17 Mar 18 Jun 18 Inventory ( Months of Sales ) 4.2 3.3 3.2 3.6 2.0 3.0 4.0 5.0 6.0 Jun 17 Dec 17 Mar 18 Jun 18 Liquidity ( Current Assets / Current Liabilities ) 6.1 4.5 7.3 6.2 0.0 2.0 4.0 6.0 8.0 10.0 Jun 17 Dec 17 Mar 18 Jun 18 Cash / Short - Term Financial Debt 0.4 0.2 0.1 0.4 0.0 0.5 1.0 1.5 2.0 Jun 17 Dec 17 Mar 18 Jun 18 Net Financial Debt / EBITDA 0.8 0.9 0.9 1.0 0.5 1.0 1.5 2.0 Jun 17 Dec 17 Mar 18 Jun 18 Leverage

www.sqm.com 2018 27 Historical Maintenance CAPEX: ~US$100 million 2016 - 2018: Lithium Hydroxide Expansion to 13.5k MT: ~US$30 million 2017 - 2018: Potassium Nitrate Expansion to 1.5m MT: ~US$50 million 2017 - 2021: Lithium Carbonate Expansion to 180k MT: ~US$525 million 2017 - 2018: Iodine capacity expansion to 14k MT: ~US$30 million 2018 CAPEX in Chile: ~US$360 million CAPEX

www.sqm.com 2018 28 CONTACT INFORMATION Gerardo Illanes VP OF FINANCE gerardo.illanes@sqm.com Kelly O’Brien HEAD OF INVESTOR RELATIONS kelly.obrien@sqm.com Irina Axenova INVESTOR RELATIONS irina.axenova@sqm.com

About SQM

SQM´s business strategy is to be

a global company, with people committed to excellence, dedicated to the extraction of minerals and selectively integrated in the

production and sale of products for the industries essential for human development (e.g. food, health, technology). This strategy

was built on the following five principles:

|

|

•

|

ensure availability of key resources required to support current goals and medium and long-term

growth of the business;

|

|

|

•

|

consolidate a culture of lean operations (M1 excellence) through the entire organization, including

operations, sales and support areas;

|

|

|

•

|

significantly increase nitrate sales in all its applications and ensure consistency with iodine

commercial strategy;

|

|

|

•

|

maximize the margins of each business line through appropriate pricing strategy;

|

|

|

•

|

successfully develop and implement all lithium expansion projects of the Company, acquire more

lithium and potassium assets to generate a competitive portfolio.

|

These principles are based on the following

key concepts:

|

|

•

|

strengthen the organizational structure to supports the development of the Company's strategic

plan, focusing on the development of critical capabilities and the application of the corporate values of Excellence, Integrity

and Safety;

|

|

|

•

|

develop a robust risk control and mitigation process to actively manage business risk;

|

|

|

•

|

improve our stakeholder management to establish links with the community and communicate to Chile

and worldwide our contribution to industries essential for human development.

|

For further information, contact:

Gerardo Illanes 56-2-24252022 /

gerardo.illanes@sqm.com

Kelly O’Brien 56-2-24252074 /

kelly.obrien@sqm.com

Irina Axenova 56-2-24252280 /

irina.axenova@sqm.com

For media inquiries, contact:

Carolina García Huidobro /

carolina.g.huidobro@sqm.com

Alvaro Cifuentes /

alvaro.cifuentes@sqm.com

Tamara Rebolledo /

tamara.rebolledo@sqm.com

(Northern

Region)

Cautionary Note Regarding Forward-Looking

Statements

This news release contains “forward-looking

statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995.

Forward-looking statements can be identified by words such as: “anticipate,” “plan,” “believe,”

“estimate,” “expect,” “strategy,” “should,” “will” and similar references

to future periods. Examples of forward-looking statements include, among others, statements we make concerning the Company’s

business outlook, future economic performance, anticipated profitability, revenues, expenses, or other financial items, anticipated

cost synergies and product or service line growth.

Forward-looking statements are neither

historical facts nor assurances of future performance. Instead, they are estimates that reflect the best judgment of SQM management

based on currently available information. Because forward-looking statements relate to the future, they involve a number of risks,

uncertainties and other factors that are outside of our control and could cause actual results to differ materially from those

stated in such statements. Therefore, you should not rely on any of these forward-looking statements. Readers are referred to the

documents filed by SQM with the United States Securities and Exchange Commission, specifically the most recent annual report on

Form 20-F, which identifies important risk factors that could cause actual results to differ from those contained in the forward-looking

statements. All forward-looking statements are based on information available to SQM on the date hereof and SQM assumes no obligation

to update such statements, whether as a result of new information, future developments or otherwise.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act

of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

CHEMICAL AND MINING COMPANY

OF CHILE INC.

(Registrant)

|

Date: September 5, 2018

|

/s/ Ricardo Ramos

|

By: Ricardo

Ramos

CFO & Vice-President of Development

Persons who are to respond to the collection

of information contained SEC 1815 (04-09) in this form are not required to respond unless the form displays currently valid OMB

control number.

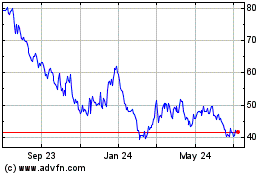

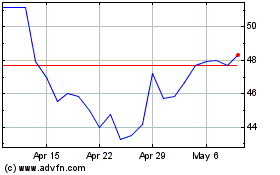

Sociedad Quimica y Miner... (NYSE:SQM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Sociedad Quimica y Miner... (NYSE:SQM)

Historical Stock Chart

From Apr 2023 to Apr 2024