Third Quarter Highlights Include:

- Net Income Grew 40 Percent to $12.4

Million; Adjusted Net Income1 Increased 71 Percent to $15.1

Million

- Diluted EPS Improved to 70 Cents;

Adjusted Diluted EPS1 Totaled 86 Cents

- Operating Income Rose 58 Percent to

$19.2 Million from $12.2 Million

- Gross Profit Increased 33 Percent to

$33.1 Million from $24.9 Million

Looking Forward for Fiscal Year 2018:

- Greater than 20 Percent Growth in

Avocado Volumes

- Double-Digit Gross Profit Growth for

RFG

- Double-Digit Revenue Growth and

Triple-Digit Gross Profit Growth in Calavo Foods

- CEO Cole Reiterates Forecast of Record

Revenue, Double-Digit Increase in Adjusted Diluted EPS

Calavo Growers, Inc. (Nasdaq-GS: CVGW) today reported that

fiscal 2018 third quarter operating income rose 58 percent

year-over-year on a 33 percent increase in gross profit. The

company, a global avocado-industry leader and expanding provider of

value-added fresh food, said that results for the most recent

quarter increased net income and per-share results for the first

nine months of this fiscal year to new all-time highs.

For the three months ended July 31, 2018, net income reached

$12.4 million, equal to $0.70 per diluted share. Excluding certain

items impacting comparability, adjusted net income1 totaled $15.1

million, or $0.86 per diluted share, which compares with $8.8

million, or $0.50 per diluted share, in the corresponding quarter

last year.

Revenues in the most-recent quarter totaled $296.4 million, down

a slight 2 percent from the company’s all-time quarterly record

high of $301.6 million in the fiscal 2017 third period. Gross

profit advanced 33 percent to $33.1 million, equal to 11.2 percent

of revenues, from $24.9 million, or 8.2 percent of revenues, in the

corresponding quarter last year. The company’s operating income

soared by 58 percent to register $19.2 million versus $12.2 million

in the fiscal 2017 like quarter.

Chairman, President and Chief Executive Officer Lee E. Cole

stated: “Calavo posted another strong showing in the fiscal third

quarter. I am extremely pleased by the outstanding operating

performance in each of our three principal business segments which

contributed to our overall results. This solid execution is best

reflected in Calavo’s increase in net income and per-share results

and, by extension, income from operations that climbed by 58

percent year over year.”

Cole continued: “In our Fresh segment, we executed well,

increasing our volume of avocado units sold by 18 percent from last

year’s third period. While consumption tracked significantly

higher, the larger available fruit supply industry-wide resulted in

lower year-over-year fresh avocado market pricing which had the

effect of constraining Calavo’s sales growth in the most-recent

quarter.

“The Renaissance Food Group (RFG) business segment delivered

eight percent higher sales and increased gross profits by 46

percent in the third period. The RFG unit continued its path of

progress in the quarter, deepening penetration with customers and

expanding its portfolio of innovative refrigerated-fresh product

offerings. RFG segment sales and gross profit would have been

higher if not for a widely publicized melon recall.

“We are excited about the continued upward trend line in the

Calavo Foods business segment, which was a meaningful contributor

to overall growth in the quarter. Twenty-five percent revenue

growth in the most recent period is indicative of a great-tasting

lineup of prepared avocado products that are being widely embraced

by a strong client base in the retail grocery and foodservice

channels. Further, the segment continued during the fiscal third

quarter to maintain a gross profit margin percentage in line with

historical levels more commonly experienced in our Foods business.

When compared to last summer’s challenging input-cost conditions,

this translates into a nearly seven-fold expansion in

year-over-year gross profit,” Cole concluded.

Net income for the nine months ended July 31, 2018 increased by

$6.6 million, or 24 percent, to reach a record $33.6 million, or

$1.91 per diluted share, from $27.0 million, equal to $1.54 per

diluted share, in the corresponding period one year ago. Adjusted

net income for the first nine months of fiscal 2018 increased by 39

percent to $38.7 million, or $2.20 per diluted share.

Revenues in the initial nine months this year rose to a record

$808.8 million, an increase from $798.4 million for the like period

in fiscal 2017. Gross profit rose by 10 percent, registering $91.3

million, equal to 11.3 percent of revenues, which compares with

$83.0 million, or 10.4 percent of revenues, in the first nine

months last year. Operating income climbed to $49.1 million, a 19

percent increase from $41.1 million last year.

Sales in the company’s Fresh business segment totaled $149.8

million in the fiscal 2018 third quarter. This compares with Fresh

segment sales of $168.9 million in the third quarter one year ago.

Segment gross profit equaled $14.9 million, or 10.0 percent of

segment sales, in the most-recent period versus $16.9 million, or

10.0 percent of segment sales, in the fiscal 2017 third quarter. As

stated in CEO Cole’s comments above, Fresh segment sales were

impacted principally by lower industry-wide fresh avocado market

prices versus one year ago and, more modestly, by lower

industry-wide tomato market prices. Double-digit unit sales growth

in all Fresh product categories—namely avocados and

tomatoes—resulted in 20 percent increase in total volume to 4.9

million units in the most-recent quarter from 4.1 million in the

like period of fiscal 2017.

In the RFG business segment, sales rose by 8 percent to $121.2

million from $112.5 million in the third quarter last year. RFG

segment gross profit climbed $3.2 million, or 46 percent, growing

to $10.0 million, equal to 8.2 percent of segment sales, from $6.8

million, or 6.1 percent of segment sales, in the year-ago third

period. The company stated that RFG’s year-over-year gross profit

improvements are indicative of progress in attaining operating

efficiencies and economies of scale at production facilities that

opened and expanded last year, as well as continued development of

new fresh food programs with retail customers.

The Calavo Foods business segment saw sales expand in the

most-recent quarter to $25.3 million, a 25 percent increase from

$20.3 million in the fiscal 2017 third period. Gross profit

increased to $8.1 million, or 32.1 percent of segment sales, from

$1.1 million, equal to 5.3 percent of sales, in the third quarter

last year. The top-line improvement is underpinned primarily by an

increase in volume of prepared avocado products sold in the third

quarter. Gross profit and margin both benefited from higher sales,

as well as fruit input costs that, while seasonally higher than in

the second quarter, tracked below last year’s third-quarter

record-high avocado input cost.

Calavo’s total selling, general and administrative (SG&A)

expense in the most recent quarter was higher at $13.9 million, or

4.7 percent of total revenues, from $12.7 million, approximating

4.2 percent of total revenues, in the fiscal 2017 third period. The

rise in SG&A expense owed mainly to higher year-over-year

management incentive plan accruals.

Income (loss) from unconsolidated subsidiaries decreased by $4.2

million to a loss of $3.7 million in the most-recent quarter. This

primarily represents the recording of $3.5 million in non-cash

losses from FreshRealm, LLC. Certain details regarding FreshRealm,

will be included in Calavo’s quarterly report on Form 10-Q soon to

be filed with the U.S. Securities and Exchange Commission for the

three months ended July 31, 2018.

Outlook

Looking toward the fourth quarter and ahead to fiscal 2019, CEO

Cole said he remains “highly confident and enthusiastic about

Calavo’s prospects moving forward. Our proven, complementary

multi-platform model, which is focused on high-growth fresh food

businesses, serves us well and leaves me extremely optimistic about

our future.”

Cole continued: “As the avocado industry continues in a

long-term expansion mode, we are well positioned—with our

best-in-class sourcing, selling and distribution capabilities—to

remain a category leader. The industry continues to forecast

avocado volume growth of more than 20 percent for 2018, and a

strong, all-source supply in fiscal 2019. With our diversified

sourcing model and ample packing capacity in California and Mexico,

we are poised to once again deliver strong volume growth in fiscal

2019.

“Turning to RFG, through Calavo’s extensive investments over the

past several years, we have developed a best-in-class portfolio of

fresh food products with a national footprint that enabled us to

partner with many of the largest retailers in the U.S. As fresh

food continues to gain market share among consumers, RFG remains

very well positioned to expand its existing retail partnerships and

to build meaningful new long-term relationships with retailers. At

the same time, our team remains committed to continued improvement

in manufacturing operation efficiency. Year-over-year sales and

gross profit growth through the remainder of the year is expected

to be generally in line with the growth experienced this quarter,

and we remain very excited for RFG’s prospects continuing into

fiscal 2019.

“Calavo Foods continues to track strongly, with sales growth for

the year still expected to be in the high teens for fiscal 2018.

While higher seasonal input prices may contribute to a slightly

lower gross profit margin in the final quarter compared to the

most-recent period, we expect gross profit margin will remain

generally in line with year-to-date results, which should once

again lead to very robust year-over-year growth in gross profit in

our fourth quarter.”

Cole stated: “We remain optimistic about FreshRealm—an

unconsolidated subsidiary in which Calavo continues to hold a

meaningful ownership stake. During the most recent quarter Calavo

invested an additional $3.5 million into FreshRealm (as part of a

larger equity round) and committed up to $12 million in new debt

financing. We are closely monitoring FreshRealm’s progress and

believe that this additional financing should help give it the

capital infusion to make a meaningful step forward in its

operations.”

FreshRealm CEO Michael Lippold added: “The timing of the capital

infusion coincides with FreshRealm investing further in its own

national infrastructure to support B2B fresh prepped meal-kits, new

business development initiatives, and expanded customer

programs.”

“In sum, with its deep breadth of resources—operating, financial

and human capital—we are poised for growth now and into the future.

Calavo remains on target to post record revenues and gross profit,

accompanied by greater than 20 percent growth in adjusted earnings

per share in fiscal 2018. I look forward to reporting our continued

success,” Cole concluded.

About Calavo Growers, Inc.

Calavo Growers, Inc. is a global avocado-industry leader and an

expanding provider of value-added fresh food serving retail

grocery, foodservice, club stores, mass merchandisers, food

distributors and wholesalers worldwide. The Company’s Fresh segment

procures and markets fresh avocados and select other fresh produce,

including tomatoes and papayas. The Renaissance Food Group (RFG)

segment creates, markets and distributes a portfolio of healthy,

fresh foods, including fresh-cut fruit, fresh-cut vegetables and

prepared foods. The Foods segment manufactures and distributes

guacamole and salsa. Founded in 1924, Calavo’s fresh food products

are sold under the respected Calavo brand name as well as Garden

Highway, Chef Essentials and a variety of private label and store

brands.

Safe Harbor Statement

This news release contains statements relating to future events

and results of Calavo (including certain projections and business

trends) that are "forward-looking statements," as defined in the

Private Securities Litigation and Reform Act of 1995, that involve

risks, uncertainties and assumptions. If any of the risks or

uncertainties ever materialize or the assumptions prove incorrect,

the results of Calavo may differ materially from those expressed or

implied by such forward-looking statements and assumptions. All

statements, other than statements of historical fact, are

statements that could be deemed forward-looking statements,

including, but not limited to, any projections of revenue, gross

profit, expenses, income (loss) from unconsolidated entities,

earnings, earnings per share, tax provisions, cash flows, currency

exchange rates, the impact of acquisitions or other financial

items; any statements of the plans, strategies and objectives of

management for future operations, including execution of

restructuring and integration (including information technology

systems integration) plans; any statements regarding current or

future macroeconomic trends or events and the impact of those

trends and events on Calavo and its financial performance, whether

attributable to Calavo or any of its unconsolidated entities; any

statements regarding pending investigations, legal claims or tax

disputes; any statements of expectation or belief; and any

statements of assumptions underlying any of the foregoing. Risks,

uncertainties and assumptions include the impact of macroeconomic

trends and events; the competitive pressures faced by Calavo's

businesses; the development and transition of new products and

services (and the enhancement of existing products and services) to

meet customer needs; integration and other risks associated with

business combinations; the hiring and retention of key employees;

the resolution of pending investigations, legal claims and tax

disputes; and other risks, including, without limitation, those

items discussed in Calavo’s latest filed Annual Report on Form 10-K

and those detailed from time to time in our other filings with the

Securities and Exchange Commission. These forward-looking

statements are made only as of the date hereof, and the company

undertakes no obligation to update or revise the forward-looking

statements, whether as a result of new information, future events

or otherwise.

1) Adjusted financial metrics, such as adjusted net income

and adjusted EPS, used throughout this release are non-GAAP

measures that exclude items affecting comparability.

Reconciliations of non-GAAP financial measures to GAAP financial

measures are provided in the financial tables that accompany this

release.

CALAVO GROWERS, INC.

CONSOLIDATED BALANCE SHEETS

(in thousands)

July 31, October 31,

2018

2017

Assets Current assets: Cash and cash equivalents $ 2,029 $

6,625

Accounts receivable, net of allowances of

$3,787 (2018) and $2,490 (2017)

73,412 69,750 Inventories, net 35,857 30,858 Prepaid expenses and

other current assets 6,688 6,872 Advances to suppliers 5,321 4,346

Income taxes receivable

-

1,377 Total current assets 123,307 119,828 Property,

plant, and equipment, net 121,309 120,072 Investment in Limoneira

Company 47,121 40,362 Investment in unconsolidated entities 33,121

33,019 Deferred income taxes 4,778 9,783 Goodwill 18,262 18,262

Other assets

25,035 22,791

$ 372,933 $

364,117 Liabilities and Shareholders' equity

Current liabilities: Payable to growers $ 22,025 $ 16,524 Trade

accounts payable 16,338 22,911 Accrued expenses 35,799 39,946

Income taxes payable 976 - Short-term borrowings 8,000 20,000

Dividend payable - 16,657 Current portion of long-term obligations

118 129 Total current

liabilities 83,256 116,167 Long-term liabilities: Long-term

obligations, less current portion 350 439 Deferred rent 2,782 2,732

Deferred income taxes

- 657

Total long-term liabilities 3,132 3,828 Commitments and

contingencies Total shareholders’ equity

286,545 244,122 $

372,933 $ 364,117

CALAVO GROWERS, INC.

CONSOLIDATED STATEMENTS OF

INCOME

(in thousands, except per share

amounts)

Three months endedJuly

31,

Nine months endedJuly

31,

2018 2017

2018 2017

Net sales $ 296,419 $ 301,645 $ 808,752 $ 798,361 Cost of

sales

263,349

276,793 717,403

715,332 Gross profit 33,070 24,852

91,349 83,029 Selling, general and administrative

13,893 12,698

42,285 41,950

Operating income 19,177 12,154 49,064 41,079 Interest expense (135

) (227 ) (654 ) (797 ) Other income (loss), net

406 96

831 462 Income

before provision for income taxes and Income (loss) from

unconsolidated entities

19,448

12,023

49,241

40,744

Provision for income taxes 3,403 3,719 12,469 13,883 Income (loss)

from unconsolidated entities

(3,677

) 492

(3,399 ) 90

Net income 12,368 8,796 33,373 26,951

Less: Net loss - noncontrolling

interest

(18 ) 14

238 53

Net income attributable to Calavo Growers, Inc.

$

12,350 $ 8,810

$ 33,611 $

27,004 Calavo Growers, Inc.’s net income

per share: Basic

$ 0.71

$ 0.51 $

1.92 $ 1.55

Diluted

$ 0.70 $

0.50 $ 1.91

$ 1.54

Number of shares used in per share

computation:

Basic

17,481 17,428

17,475 17,412

Diluted

17,581

17,544 17,567

17,507

CALAVO GROWERS, INC.

NET SALES AND GROSS PROFIT BY BUSINESS

SEGMENT

Fresh

products

CalavoFoods

RFG

Total

Three months ended July 31, 2018 Net sales $ 149,834

$ 25,340 $ 121,245 $ 296,419 Cost of sales

134,903 17,199

111,247 263,349 Gross profit

$ 14,931 $

8,141 $ 9,998 $

33,070 Three months ended July 31, 2017

Net sales $ 168,919 $ 20,251 $ 112,475 $ 301,645 Cost of sales

151,971 19,175

105,647 276,793 Gross profit

$ 16,948 $

1,076 $ 6,828 $

24,852

For the three months ended July 31, 2018 and 2017, inter-segment

sales and cost of sales of $0.3 million and $0.6 million

between Fresh products and RFG were eliminated. For the three

months ended July 31, 2018 and 2017, inter-segment sales and cost

of sales of $0.8 million and $0.9 million between Calavo Foods

and RFG were eliminated. For the three months ended July 31, 2018,

inter-segment sales and cost of sales of $0.1 million between

Fresh products and Calavo Foods were eliminated.

Freshproducts

CalavoFoods

RFG

Total

Nine months ended July 31, 2018 Net sales $ 410,554 $

66,290 $ 331,908 $ 808,752 Cost of sales

366,246 44,622

306,535 717,403 Gross profit

$ 44,308 $

21,668 $ 25,373

$ 91,349 Nine months ended July

31, 2017 Net sales $ 436,601 $ 53,876 $ 307,884 $ 798,361 Cost

of sales

388,005 42,108

285,219 715,332 Gross

profit

$ 48,596 $

11,768 $ 22,665

$ 83,029

For the nine months ended July 31, 2018 and 2017, inter-segment

sales and cost of sales of $0.9 million between Fresh products

and RFG were eliminated. For the nine months ended July 31, 2018

and 2017, inter-segment sales and cost of sales of

$2.5 million and $2.3 million between Calavo Foods and RFG

were eliminated. For the nine months ended July 31, 2018,

inter-segment sales and cost of sales of $0.2 million between

Fresh products and Calavo Foods were eliminated.

CALAVO GROWERS, INC.

RECONCILIATION OF ADJUSTED NET INCOME

AND EPS

(in thousands, except per share

amounts)

Three months endedJuly

31,

Nine months endedJuly

31,

2018 2017

2018 2017 Net income

attributable to Calavo Growers, Inc. $ 12,350 $ 8,810 $ 33,611 $

27,004 Non-GAAP adjustments: Non-cash losses recognized from

FreshRealm (a) 3,515 - 3,515 -

One-time, non-cash tax charges from Tax

Cuts and Jobs Act (b)

- - 1,702 - Certain management transition expenses (c) - - 891

1,172 Tax impact of adjustments (d)

(758

) - (1,035

) (398 ) Adjusted net

income attrib. to Calavo Growers, Inc.

$

15,107 $ 8,810

$ 38,684 $

27,778 Calavo Growers Inc. net income

per share: Diluted EPS (GAAP)

$ 0.70

$ 0.50 $

1.91 $ 1.54

Adjusted Diluted EPS

$ 0.86

$ 0.50 $ 2.20

$ 1.59

Number of shares used in per share

computation:

Diluted

17,581

17,544 17,567

17,507 (a) For the three months

ended July 31, 2018, FreshRealm incurred losses totaling $7.1

million, of which we recorded $3.5 million of non-cash losses

during our third fiscal quarter of 2018. Certain details regarding

FreshRealm will be included in Calavo’s quarterly report on Form

10-Q soon to be filed with the U.S. Securities and Exchange

Commission for the three months ended July 31, 2018. (b)

First quarter of fiscal 2018 results include the company’s estimate

for the effects of the Tax Cuts and Jobs Act. Calavo recorded a

one-time, non-cash charge due to the revaluation of our net

deferred tax assets and the transition tax on the deemed

repatriation of foreign earnings. (c) First quarter of

fiscal 2018 and 2017 results include higher stock-based

compensation related to senior management transitions, which does

not impact the underlying cost structure of the company. (d)

Tax impact of non-GAAP adjustments are based on the prevailing tax

rates in each period. For the three and nine months ended July 31,

2018 the prevailing tax rates were 21.6% and 23.5%. For the three

and nine months ended July 31, 2017 the prevailing tax rates were

29.7% and 34.0%.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180905005341/en/

Calavo Growers, Inc.Lee E. Cole, 805-525-1245Chairman, President

and CEO

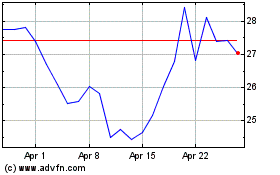

Calavo Growers (NASDAQ:CVGW)

Historical Stock Chart

From Mar 2024 to Apr 2024

Calavo Growers (NASDAQ:CVGW)

Historical Stock Chart

From Apr 2023 to Apr 2024