Kinder Morgan to Apply Trans Mountain Proceeds to Debt Reduction

September 04 2018 - 5:10PM

Business Wire

Announces Intention to Vote its Shares in

Support of KML Board Proposals

Kinder Morgan, Inc., (NYSE: KMI) today announced its intention

to vote in favor of the Kinder Morgan Canada Limited (TSX: KML)

board’s proposals that will facilitate the distribution of

approximately $2.0 billion of Trans Mountain net sale proceeds as a

return of capital to KMI; and reiterated its intention to use the

proceeds to pay down debt. As a result, KMI currently expects to

end the year at a Net Debt-to-Adjusted EBITDA ratio of

approximately 4.6 times, and expects to have reduced its

consolidated net debt by approximately $7.8 billion since the third

quarter of 2015.

“Today, we are revising our long-term leverage target from at or

below 5.0 times to around 4.5 times, which is consistent with where

we expect to end the year,” said KMI President Kim Dang. “We have

been very successful over the last several years in substantially

improving our balance sheet to enhance our financial strength, and

we expect that to be recognized by the ratings agencies.”

Kinder Morgan, Inc. (NYSE: KMI) is one of the largest energy

infrastructure companies in North America. We own an interest in or

operate approximately 84,000 miles of pipelines and

152 terminals. Our pipelines transport natural gas, refined

petroleum products, crude oil, condensate, CO2 and other products,

and our terminals transload and store liquid commodities including

petroleum products, ethanol and chemicals, and bulk products,

including petroleum coke, metals and ores. For more information

please visit www.kindermorgan.com.

Non-GAAP Financial

Measures

The non-generally accepted accounting principles (non-GAAP)

financial measure of net income before interest expense, taxes,

DD&A and Certain Items (Adjusted EBITDA) is presented

herein.

Certain Items as used to calculate

our Non-GAAP measures, are items that are required by GAAP to be

reflected in net income, but typically either (1) do not have a

cash impact (for example, asset impairments), or (2) by their

nature are separately identifiable from our normal business

operations and in our view are likely to occur only sporadically

(for example certain legal settlements, enactment of new tax

legislation and casualty losses).

Adjusted EBITDA is calculated by

adjusting net income before interest expense, taxes, and DD&A

(EBITDA) for Certain Items, noncontrolling interests before Certain

Items, and KMI’s share of certain equity investees’ DD&A (net

of consolidating joint venture partners’ share of DD&A) and

book taxes. Adjusted EBITDA is used by management and external

users, in conjunction with our net debt, to evaluate certain

leverage metrics. Therefore, we believe Adjusted EBITDA is useful

to investors. We believe the GAAP measure most directly comparable

to Adjusted EBITDA is net income.

Our non-GAAP measures described above should not be considered

alternatives to GAAP net income or other GAAP measures and have

important limitations as analytical tools. Our computations of

Adjusted EBITDA may differ from similarly titled measures used by

others. You should not consider non-GAAP measures in isolation or

as substitutes for an analysis of our results as reported under

GAAP. Management compensates for the limitations of non-GAAP

measures by reviewing our comparable GAAP measures, understanding

the differences between the measures and considers this information

in its analysis and its decision-making processes.

Important Information Relating to

Forward-Looking Statements

This news release includes forward-looking statements within the

meaning of the U.S. Private Securities Litigation Reform Act of

1995 and Section 21E of the Securities and Exchange Act of 1934.

Generally the words “expects,” “believes,” “anticipates,” “plans,”

“will,” “shall,” “estimates,” and similar expressions identify

forward-looking statements, which are generally not historical in

nature. Forward-looking statements are subject to risks and

uncertainties and are based on the beliefs and assumptions of

management, based on information currently available to them.

Although KMI believes that these forward-looking statements are

based on reasonable assumptions, it can give no assurance that any

such forward-looking statements will materialize. Important factors

that could cause actual results to differ materially from those

expressed in or implied by these forward-looking statements include

the risks and uncertainties described in KMI’s reports filed with

the Securities and Exchange Commission (SEC), including its Annual

Report on Form 10-K for the year-ended December 31, 2017 (under the

headings “Risk Factors” and “Information Regarding Forward-Looking

Statements” and elsewhere) and its subsequent reports, which are

available through the SEC’s EDGAR system at www.sec.gov and on our

website at ir.kindermorgan.com. Forward-looking statements speak

only as of the date they were made, and except to the extent

required by law, KMI undertakes no obligation to update any

forward-looking statement because of new information, future events

or other factors. Because of these risks and uncertainties, readers

should not place undue reliance on these forward-looking

statements.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180904005754/en/

Kinder Morgan, Inc.Dave Conover, (713) 420-6397Media

RelationsNewsroom@kindermorgan.comorInvestor Relations(800)

348-7320km_ir@kindermorgan.comwww.kindermorgan.com

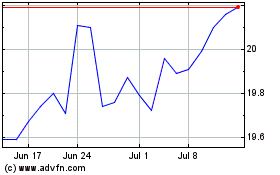

Kinder Morgan (NYSE:KMI)

Historical Stock Chart

From Mar 2024 to Apr 2024

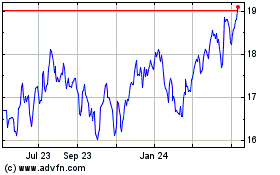

Kinder Morgan (NYSE:KMI)

Historical Stock Chart

From Apr 2023 to Apr 2024