Lexington Realty Trust (NYSE: LXP) (“Lexington” or “the Company”),

a real estate investment trust (REIT) focused on single-tenant

industrial real estate investments, today announced that it

disposed of a 21-office asset portfolio (“the Properties”) for $726

million at GAAP and cash capitalization rates of 8.6% and 8.1%,

respectively to a joint venture between affiliates of Davidson

Kempner Capital Management LP (“DKCM”) and Lexington. DKCM is a

U.S.-registered investment firm based in New York with affiliate

offices in London, Hong Kong and Dublin. Following the transaction,

Lexington’s percentage of industrial assets based on consolidated

revenue is expected to increase to 60% from 44% at year-end 2017.

T. Wilson Eglin, Chief Executive Officer of

Lexington stated, “This transaction marks a major step forward as

we execute on our strategy to efficiently recycle capital out of

suburban office properties and concentrate our portfolio on

single-tenant net-leased industrial properties. We intend to use

transaction proceeds to continue to acquire high-quality industrial

properties and repay our revolving credit facility and other debt,

which we believe is the best path to create meaningful long-term

shareholder value.”

Lexington received net cash proceeds of

approximately $565 million at closing (with $38 million held in

escrow for the Richmond, Virginia asset pending lender confirmation

that it is a permitted transfer and $264 million held by a

qualified section 1031 intermediary). The joint venture is 80%

owned by affiliates of DKCM with Lexington retaining a 20%

interest. Additionally, Lexington will collect asset

management fees to manage the Properties and will participate in a

promote structure created by the joint venture.

The Properties are 98.6% leased and are

comprised of approximately 3.8 million square feet with a

weighted-average remaining lease term of approximately 9.5 years

and a weighted-average age of 23 years. For the six months ended

June 30, 2018, GAAP and cash net operating income and Adjusted

Company Funds from Operations available to all equityholders and

unitholders – diluted (“Adjusted Company FFO”) for the Properties

totaled approximately $30.7 million, $28.5 million and $27.9

million, respectively.

The joint venture is expected to assume

approximately $57 million of non-recourse financing secured by the

Richmond, Virginia asset. Additionally, the joint venture assumed

approximately $46 million of non-recourse financing secured by the

Charlotte, North Carolina asset and obtained a $363 million

non-recourse mortgage loan secured by the remaining 19 assets,

which provides for an additional $10.0 million of borrowings for

future leasing activity. This new mortgage loan has an

initial term of three years, but may be extended by the joint

venture for two additional terms of one year each, and bears

interest at a rate of one-month LIBOR plus 200 basis points, with

an additional 15-basis points spread for each extension

option. The joint venture purchased a two-year interest rate

cap for the new mortgage, which caps one-month LIBOR at 4%.

A presentation with supplemental information on

the transaction is available at www.lxp.com within the Investors

section under the title Office Disposition – September 2018

Investor Presentation.

2018 Disposition Guidance

Update

As a result of the transaction, Lexington’s

revised disposition guidance for 2018 is expected to be up to an

estimated $1 billion at average GAAP and cash capitalization rates

of 8.7% and 8.3%, respectively. Year-to-date, the Company has

completed $966 million of dispositions at average GAAP and cash

capitalization rates of 8.5% and 8.1%, respectively.

2018 Earnings Guidance

Update

Lexington now estimates that its net income

attributable to common shareholders per diluted common share for

the year ended December 31, 2018 will be within an expected range

of $0.94 to $0.96.

Additionally, Lexington now estimates its

Adjusted Company FFO for the year ended December 31, 2018 is

expected to be within a range of $0.92 to $0.94 per diluted common

share, which is a decrease from its previous guidance of $0.95 to

$0.98 per diluted common share. This guidance is forward looking,

excludes the impact of certain items and is based on current

expectations. Adjusted Company FFO is a non-GAAP financial

measure, which is defined and reconciled later in this press

release.

Dividend Update

Lexington intends to maintain its common

share/unit dividend/distribution for each quarter ended September

30, 2018 and December 31, 2018. Commencing with the quarter ended

March 31, 2019, the quarterly dividend/distribution paid in April

2019 is expected to be adjusted in-line with taxable income and to

be within an estimated range of 55% to 65% of 2019 Adjusted Company

FFO. All dividends are subject to authorization by Lexington’s

Board of Trustees and subject to change based on Lexington’s

transaction activity for the remainder of 2018 and into 2019.

ABOUT LEXINGTON REALTY TRUST

Lexington Realty Trust (NYSE: LXP) is a publicly

traded real estate investment trust (REIT) that owns a diversified

portfolio of real estate assets consisting primarily of equity

investments in single-tenant net-leased industrial properties

across the United States. Lexington seeks to expand its industrial

portfolio through build-to-suit transactions, sale-leaseback

transactions and other transactions, including acquisitions. For

more information or to follow Lexington on social media, visit

www.lxp.com.

This release contains certain forward-looking

statements which involve known and unknown risks, uncertainties or

other factors not under Lexington's control which may cause actual

results, performance or achievements of Lexington to be materially

different from the results, performance, or other expectations

implied by these forward-looking statements. Factors that could

cause or contribute to such differences include, but are not

limited to, those discussed under the headings “Management's

Discussion and Analysis of Financial Condition and Results of

Operations” and “Risk Factors” in Lexington's periodic reports

filed with the Securities and Exchange Commission, including risks

related to: (1) the authorization by Lexington's Board of Trustees

of future dividend declarations, including without limitation, the

amount of such dividends, (2) Lexington's ability to achieve any

guidance, including, without limitation, its estimates of net

income attributable to common shareholders and Adjusted Company FFO

for the year ending December 31, 2018, (3) the successful

consummation of any lease, acquisition, build-to-suit, disposition,

financing or other transaction, (4) the failure to continue to

qualify as a real estate investment trust, (5) changes in general

business and economic conditions, including the impact of any

legislation, (6) competition, (7) increases in real estate

construction costs, (8) changes in interest rates, (9) changes in

accessibility of debt and equity capital markets, (10) future

impairment charges, and (11) completion of the disposition of the

Richmond, Virginia property. Copies of the periodic reports

Lexington files with the Securities and Exchange Commission are

available on Lexington's web site at www.lxp.com. Forward-looking

statements, which are based on certain assumptions and describe

Lexington's future plans, strategies and expectations, are

generally identifiable by use of the words “believes,” “expects,”

“intends,” “anticipates,” “estimates,” “projects”, “may,” “plans,”

“predicts,” “will,” “will likely result,” “is optimistic,” “goal,”

“objective” or similar expressions. Except as required by law,

Lexington undertakes no obligation to publicly release the results

of any revisions to those forward-looking statements which may be

made to reflect events or circumstances after the occurrence of

unanticipated events. Accordingly, there is no assurance that

Lexington's expectations will be realized.

Non-GAAP Financial Measures - Definitions

Lexington has used non-GAAP financial measures

as defined by the Securities and Exchange Commission Regulation G

in this press release and in other public disclosures.

Lexington believes that the measures defined

below are helpful to investors in measuring our performance or that

of an individual investment. Since these measures exclude certain

items which are included in their respective most comparable

measures under generally accepted accounting principles (“GAAP”),

reliance on the measures has limitations; management compensates

for these limitations by using the measures simply as supplemental

measures that are weighed in balance with other GAAP measures.

These measures are not necessarily indications of our cash flow

available to fund cash needs. Additionally, they should not be used

as an alternative to the respective most comparable GAAP measures

when evaluating Lexington's financial performance or cash flow from

operating, investing or financing activities or liquidity.

Funds from Operations (“FFO”) and Adjusted

Company FFO: Lexington believes that Funds from Operations, or FFO,

which is a non-GAAP measure, is a widely recognized and appropriate

measure of the performance of an equity REIT. Lexington believes

FFO is frequently used by securities analysts, investors and other

interested parties in the evaluation of REITs, many of which

present FFO when reporting their results. FFO is intended to

exclude GAAP historical cost depreciation and amortization of real

estate and related assets, which assumes that the value of real

estate diminishes ratably over time. Historically, however, real

estate values have risen or fallen with market conditions. As a

result, FFO provides a performance measure that, when compared year

over year, reflects the impact to operations from trends in

occupancy rates, rental rates, operating costs, development

activities, interest costs and other matters without the inclusion

of depreciation and amortization, providing perspective that may

not necessarily be apparent from net income.

The National Association of Real Estate

Investment Trusts, or NAREIT, defines FFO as “net income (or loss)

computed in accordance with GAAP, excluding gains (or losses) from

sales of property, plus real estate depreciation and amortization

and after adjustments for non-consolidated partnerships and joint

ventures.” NAREIT clarified its computation of FFO to exclude

impairment charges on depreciable real estate owned directly or

indirectly. FFO does not represent cash generated from operating

activities in accordance with GAAP and is not indicative of cash

available to fund cash needs.

Lexington presents FFO available to common

shareholders and unitholders - basic and also presents FFO

available to all equityholders and unitholders - diluted on a

company-wide basis as if all securities that are convertible, at

the holder's option, into Lexington’s common shares, are converted

at the beginning of the period. Lexington also presents Adjusted

Company FFO available to all equityholders and unitholders -

diluted which adjusts FFO available to all equityholders and

unitholders - diluted for certain items which we believe are not

indicative of the operating results of Lexington's real estate

portfolio. Lexington believes this is an appropriate presentation

as it is frequently requested by security analysts, investors and

other interested parties. Since others do not calculate these

measures in a similar fashion, these measures may not be comparable

to similarly titled measures as reported by others. These measures

should not be considered as an alternative to net income as an

indicator of Lexington’s operating performance or as an alternative

to cash flow as a measure of liquidity.

Net Operating Income (“NOI”): NOI is a measure

of operating performance used to evaluate the individual

performance of an investment. This measure is not presented or

intended to be viewed as a liquidity or performance measure that

presents a numerical measure of Lexington's historical or future

financial performance, financial position or cash flows. Lexington

defines NOI as operating revenues (rental income (less GAAP rent

adjustments and lease termination income), tenant reimbursements

and other property income) less property operating expenses. Other

REITs may use different methodologies for calculating NOI, and

accordingly, Lexington's NOI may not be comparable to other

companies. Because NOI excludes general and administrative

expenses, interest expense, depreciation and amortization,

acquisition-related expenses, other non-property income and losses,

and gains and losses from property dispositions, it provides a

performance measure that, when compared year over year, reflects

the revenues and expenses directly associated with owning and

operating commercial real estate and the impact to operations from

trends in occupancy rates, rental rates, and operating costs,

providing a perspective on operations not immediately apparent from

net income. Lexington believes that net income is the most directly

comparable GAAP measure to NOI.

| |

|

| LEXINGTON

REALTY TRUST AND CONSOLIDATED SUBSIDIARIES |

|

| RECONCILIATION

OF NON-GAAP MEASURES |

|

| |

|

| 2018 EARNINGS

GUIDANCE |

|

| |

|

| |

Twelve Months Ended |

| |

December 31, 2018 |

| |

Range |

| |

|

|

|

|

|

|

|

| Estimated: |

|

|

|

|

|

|

|

| Net income attributable

to common shareholders per diluted common share(1) |

$ |

0.94 |

|

|

$ |

0.96 |

|

| Depreciation and

amortization |

|

0.71 |

|

|

|

0.71 |

|

| Impact of capital

transactions |

|

(0.73 |

) |

|

|

(0.73 |

) |

| Estimated Adjusted

Company FFO per diluted common share |

$ |

0.92 |

|

|

$ |

0.94 |

|

| |

|

|

|

|

|

|

|

| (1)Assumes all

convertible securities are dilutive. |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

Contact:Investor or Media Inquiries for Lexington

Realty Trust:Heather Gentry, Senior Vice President of Investor

RelationsLexington Realty TrustPhone: (212) 692-7200 E-mail:

hgentry@lxp.com

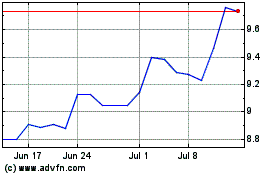

LXP Industrial (NYSE:LXP)

Historical Stock Chart

From Mar 2024 to Apr 2024

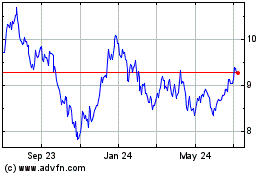

LXP Industrial (NYSE:LXP)

Historical Stock Chart

From Apr 2023 to Apr 2024