Today, BlackRock Resources & Commodities Strategy Trust

(NYSE: BCX), BlackRock Enhanced Equity Dividend Trust (NYSE: BDJ),

BlackRock Energy and Resources Trust (NYSE: BGR), BlackRock

Enhanced International Dividend Trust (NYSE: BGY), BlackRock Health

Sciences Trust (NYSE: BME), BlackRock Enhanced Global Dividend

Trust (NYSE: BOE), BlackRock Utilities, Infrastructure & Power

Opportunities Trust (NYSE: BUI), BlackRock Enhanced Capital and

Income Fund, Inc. (NYSE: CII), BlackRock Science and Technology

Trust (NYSE: BST), and BlackRock Enhanced Government Fund, Inc.

(NYSE: EGF) (collectively, the “Funds”) paid the following

distributions per share:

Fund

Pay Date Per Share BCX

August 31, 2018 $ 0.051600 BDJ August

31, 2018 $ 0.046700 BGR August 31, 2018

$ 0.077600 BGY August 31, 2018

$ 0.038000 BME August 31, 2018 $

0.200000 BOE August 31, 2018 $ 0.063000

BUI August 31, 2018 $ 0.121000 CII

August 31, 2018 $ 0.082800 BST

August 31, 2018 $ 0.150000 EGF

August 31, 2018 $ 0.041000

Each of the Funds have adopted a managed distribution plan (the

“Plan”) and employ an option over-write policy to support a level

distribution of income, capital gains and/or return of capital.

The fixed amounts distributed per share are subject to change at

the discretion of each Fund’s Board of Directors/Trustees.

Under its Plan, each Fund will distribute all available investment

income to its shareholders, consistent with its primary investment

objectives and as required by the Internal Revenue Code of 1986, as

amended. If sufficient investment income is not available on a

monthly basis, the Funds will distribute long-term capital gains

and/or return capital to their shareholders in order to maintain a

level distribution.

The Funds’ estimated sources of the distributions paid this

month and for their current fiscal year are as follows:

Estimated Allocations as of August 31, 2018

Fund Distribution

Net InvestmentIncome

Net RealizedShort-Term Gains

Net RealizedLong-Term Gains

Return of Capital BCX1 $0.051600

$0.047686 (92%) $0 (0%) $0 (0%)

$0.003914 (8%) BDJ $0.046700

$0.015632 (33%) $0 (0%)

$0.031068 (67%) $0 (0%) BGR1 $0.077600

$0.047159 (61%) $0 (0%)

$0 (0%) $0.030441 (39%) BGY $0.038000

$0.009405 (25%) $0 (0%)

$0.028595 (75%) $0 (0%) BME1 $0.200000

$0 (0%) $0 (0%) $0.193276

(97%) $0.006724 (3%) BOE1 $0.063000

$0.018280 (29%) $0 (0%)

$0 (0%) $0.044720 (71%) BUI1 $0.121000

$0.048624 (40%) $0 (0%)

$0 (0%) $0.072376 (60%) CII1 $0.082800

$0.015334 (19%) $0 (0%)

$0 (0%) $0.067466 (81%) BST $0.150000

$0 (0%) $0 (0%) $0.150000

(100%) $0 (0%) EGF1 $0.041000

$0.020109 (49%) $0 (0%) $0 (0%)

$0.020891 (51%)

Estimated Allocations for the

Fiscal Year through August 31, 2018 Fund

Distribution

Net InvestmentIncome

Net RealizedShort-Term Gains

Net RealizedLong-Term Gains

Return of Capital BCX1 $0.412800

$0.154592 (37%) $0 (0%) $0 (0%)

$0.258208 (63%) BDJ $0.373600

$0.120696 (32%) $0 (0%)

$0.252904 (68%) $0 (0%) BGR1 $0.620800

$0.176654 (28%) $0 (0%)

$0 (0%) $0.444146 (72%) BGY $0.304000

$0.133875 (44%) $0 (0%)

$0.170125 (56%) $0 (0%) BME1 $1.600000

$0.054347 (3%) $0 (0%)

$1.065758 (67%) $0.479895 (30%) BOE1

$0.594000 $0.223062 (38%) $0.005339

(1%) $0 (0%) $0.365599 (61%) BUI1

$0.968000 $0.348847 (36%)

$0 (0%) $0 (0%) $0.619153 (64%) CII1

$0.662400 $0.101813 (15%)

$0 (0%) $0 (0%) $0.560587 (85%) BST

$1.080000 $0 (0%) $0 (0%)

$1.080000 (100%) $0 (0%) EGF1

$0.287000 $0.170772 (60%) $0

(0%) $0 (0%) $0.116228 (40%)

1The Fund estimates that it has distributed more than its income

and net-realized capital gains in the current fiscal year;

therefore, a portion of your distribution may be a return of

capital. A return of capital may occur, for example, when some or

all of the shareholder’s investment is paid back to the

shareholder. A return of capital distribution does not necessarily

reflect the Fund's investment performance and should not be

confused with ‘yield’ or ‘income’. When distributions exceed total

return performance, the difference will reduce the Fund’s net asset

value per share.

The amounts and sources of distributions reported are only

estimates and are not provided for tax reporting purposes. The

actual amounts and sources of the amounts for tax reporting

purposes will depend upon each Fund’s investment experience during

the remainder of its fiscal year and may be subject to changes

based on tax regulations. The Fund will send you a Form 1099-DIV

for the calendar year that will tell you how to report these

distributions for federal income tax purposes.

Fund Performance and Distribution

Rate Information:

Fund

Average annualtotal return (inrelation

toNAV)for the5-year periodending on7/31/2018

Annualized currentdistribution

rateexpressed as apercentage of NAV asof 7/31/2018

Cumulative totalreturn (in relationto NAV)

for thefiscal year through7/31/2018

Cumulative fiscalyear distributionsas a

percentageof NAV as of7/31/2018

BCX 3.22% 6.22% 1.12%

3.63% BDJ 9.85% 5.67%

3.66% 3.31% BGR (1.20)%

5.99% 6.14% 3.50% BGY

3.16% 7.15% (2.77)%

4.17% BME 14.05% 6.29%

10.02% 3.67% BOE 5.47%

6.25% (2.42)% 4.39% BUI

8.13% 7.25% 0.87%

4.23% CII 12.09% 5.61%

6.11% 3.27% BST* 20.99%

5.64% 15.45% 2.92% EGF

1.70% 3.61% (0.58)%

2.11%

* Portfolio launched within the past 5 years; the performance

and distribution rate information presented for this Fund reflects

data from inception to 7/31/2018.

Shareholders should not draw any conclusions about a Fund’s

investment performance from the amount of the Fund’s current

distributions or from the terms of the Fund’s Plan.

BlackRock Income Trust, Inc. (NYSE:BKT) effective August 2018

has adopted a Plan whereby the Fund will make fixed monthly

distributions to common stockholders and will distribute all

available investment income to its stockholders, consistent with

its investment objective and as required by the Internal Revenue

Code of 1986, as amended. If sufficient investment income is not

available on a monthly basis, the Fund will distribute long-term

capital gains and/or return capital to its stockholders in order to

maintain its managed distribution level. The Fund is currently not

relying on any exemptive relief from Section 19(b) of the

Investment Company Act of 1940, as amended. The Fund expects that

distributions under the Plan will exceed investment income and

capital gain and thus expects that such distributions will likely

include return of capital for the foreseeable future. No

conclusions should be drawn about the Fund’s investment performance

from the amount of the Fund’s distributions or from the terms of

the Fund’s Plan.

BKT’s estimated sources of the distributions paid as of August

31, 2018 and for its current fiscal year is as follows:

Estimated Allocations as of August 31, 2018

Fund Distribution

Net InvestmentIncome

Net RealizedShort-Term Gains

Net RealizedLong-Term Gains

Return of Capital

BKT $0.034400 $0.029649 (86%)

$0 (0%) $0 (0%) $0.004751 (14%)

Estimated Allocations for the Fiscal Year through August 31,

2018 Fund Distribution

Net InvestmentIncome

Net RealizedShort-Term Gains

Net RealizedLong-Term Gains

Return of Capital BKT $0.325900

$0.321149 (99%) $0 (0%) $0 (0%)

$0.004751 (1%)

The amounts and sources of distributions reported are only

estimates and are not provided for tax reporting purposes. The

actual amounts and sources of the amounts for tax reporting

purposes will depend upon each BKT’s investment experience during

the remainder of its fiscal year and may be subject to changes

based on tax regulations. The Fund will send you a Form 1099-DIV

for the calendar year that will tell you how to report these

distributions for federal income tax purposes

Fund Performance and Distribution Rate Information:

Fund

Average annual totalreturn (in relationto

NAV) for the5-year period endingon 7/31/2018

Annualized currentdistribution

rateexpressed as apercentage of NAVas of 7/31/2018

Cumulative totalreturn (in relationto NAV)

for thefiscal year through7/31/2018

Cumulativefiscal yeardistributionsas a

percentageof NAV as of7/31/2018

BKT 2.58% 6.56% (1.88)%

4.63%

The amount distributed per share is subject to change at the

discretion of the Fund’s Board. The Plan will be subject to

ongoing review by the Board to determine whether the Plan should be

continued, modified or terminated. The Board may amend the terms of

the Plan or suspend or terminate the Plan at any time without prior

notice to the Fund’s stockholders if it deems such actions to be in

the best interest of the Fund or its stockholders. The amendment or

termination of the Plan could have an adverse effect on the market

price of the Fund's shares.

About BlackRock

BlackRock helps investors build better financial futures. As a

fiduciary to our clients, we provide the investment and technology

solutions they need when planning for their most important goals.

As of June 30, 2018, the firm managed approximately $6.3 trillion

in assets on behalf of investors worldwide. For additional

information on BlackRock, please visit www.blackrock.com | Twitter:

@blackrock | Blog: www.blackrockblog.com | LinkedIn:

www.linkedin.com/company/blackrock.

Availability of Fund Updates

BlackRock will update performance and certain other data for the

Funds on a monthly basis on its website in the “Closed-end Funds”

section of www.blackrock.com as well as certain other material

information as necessary from time to time. Investors and others

are advised to check the website for updated performance

information and the release of other material information about the

Funds. This reference to BlackRock’s website is intended to allow

investors public access to information regarding the Funds and does

not, and is not intended to, incorporate BlackRock’s website in

this release.

Forward-Looking Statements

This press release, and other statements that BlackRock or a

Fund may make, may contain forward-looking statements within the

meaning of the Private Securities Litigation Reform Act, with

respect to a Fund’s or BlackRock’s future financial or business

performance, strategies or expectations. Forward-looking statements

are typically identified by words or phrases such as “trend,”

“potential,” “opportunity,” “pipeline,” “believe,” “comfortable,”

“expect,” “anticipate,” “current,” “intention,” “estimate,”

“position,” “assume,” “outlook,” “continue,” “remain,” “maintain,”

“sustain,” “seek,” “achieve,” and similar expressions, or future or

conditional verbs such as “will,” “would,” “should,” “could,” “may”

or similar expressions.

BlackRock cautions that forward-looking statements are subject

to numerous assumptions, risks and uncertainties, which change over

time. Forward-looking statements speak only as of the date they are

made, and BlackRock assumes no duty to and does not undertake to

update forward-looking statements. Actual results could differ

materially from those anticipated in forward-looking statements and

future results could differ materially from historical

performance.

With respect to the Funds, the following factors, among others,

could cause actual events to differ materially from forward-looking

statements or historical performance: (1) changes and volatility in

political, economic or industry conditions, the interest rate

environment, foreign exchange rates or financial and capital

markets, which could result in changes in demand for the Funds or

in a Fund’s net asset value; (2) the relative and absolute

investment performance of a Fund and its investments; (3) the

impact of increased competition; (4) the unfavorable resolution of

any legal proceedings; (5) the extent and timing of any

distributions or share repurchases; (6) the impact, extent and

timing of technological changes; (7) the impact of legislative and

regulatory actions and reforms, including the Dodd-Frank Wall

Street Reform and Consumer Protection Act, and regulatory,

supervisory or enforcement actions of government agencies relating

to a Fund or BlackRock, as applicable; (8) terrorist activities,

international hostilities and natural disasters, which may

adversely affect the general economy, domestic and local financial

and capital markets, specific industries or BlackRock; (9)

BlackRock’s ability to attract and retain highly talented

professionals; (10) the impact of BlackRock electing to provide

support to its products from time to time; and (11) the impact of

problems at other financial institutions or the failure or negative

performance of products at other financial institutions.

Annual and Semi-Annual Reports and other regulatory filings of

the Funds with the Securities and Exchange Commission (“SEC”) are

accessible on the SEC's website at www.sec.gov and on

BlackRock’s website at www.blackrock.com, and may discuss

these or other factors that affect the Funds. The information

contained on BlackRock’s website is not a part of this press

release.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180831005029/en/

BlackRock1-800-882-0052

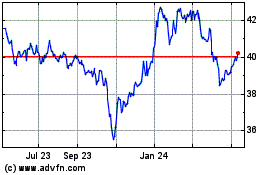

BlackRock Health Sciences (NYSE:BME)

Historical Stock Chart

From Mar 2024 to Apr 2024

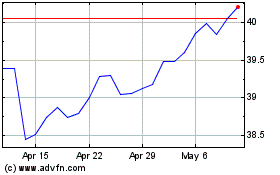

BlackRock Health Sciences (NYSE:BME)

Historical Stock Chart

From Apr 2023 to Apr 2024