Signet Surges After Surprise Sales Growth

August 30 2018 - 4:49PM

Dow Jones News

By Kimberly Chin

Shares of Signet Jewelers Ltd. surged 25% on Thursday after the

world's largest retailer of diamond jewelry reported positive

same-store sales growth for the first time in a year, fueled by

increased consumer confidence.

Same-store sales for the parent of Kay Jewelers and Zales rose

1.7% in the second quarter from the prior year. Analysts polled by

Consensus Metrix were expecting a 4.2% decline. Overall, revenue

rose 1.5% to $1.42 billion.

This surprise sales growth comes as retailers have seen

consumers, increasingly confident about their economic prospects,

spending more money on a range of items such as designer handbags

and apparel.

Rising demand in the U.S. market, supported by wage growth and

low unemployment, helped lift comparable sales at some of the

largest luxury brands, such as Tiffany & Co., LVMH Moët

Hennessy Louis Vuitton, and Kering SA, parent of Gucci, Yves Saint

Laurent and Balenciaga.

Chief Executive Virginia Drosos said that promotions and the

addition of new items helped prop up sales in North American for

the quarter.

For Signet, the positive growth comes as the retailer tries to

return to profitability in the midst of a three-year turnaround

plan. For instance, Signet sold its consumer-lending portfolio to

raise money and sharpen its focus on its core jewelry business.

In the second quarter, Signet reported a loss of $31.2 million,

or 56 cents a share, in the quarter, compared with a profit of

$85.2 million, or $1.34 a share, in the same period a year earlier.

The loss was driven by higher selling and administrative expenses

as well as costs related to restructuring and the outsourcing of

its credit operations.

On an adjusted basis, Signet reported a profit of 52 cents a

share. Analysts had expected 20 cents a share, according to a

Thomson Reuters poll.

Signet also announced Thursday Chief Financial Officer Michele

Santana is planning to leave at the end of the year to "pursue

other opportunities." Signet will look externally for candidates to

fill Ms. Santana's position.

Signet, along with Tiffany, has been pouring money into

revamping its stores and sales and marketing strategies to reduce

its dependence on shoppers walking into physical locations. As part

of its turnaround, Signet has also invested in improving its

e-commerce and omnichannel capabilities. E-commerce sales increased

83% to $150.3 million in the most recent quarter.

With Thursday's gains, Signet shares, recently trading at

$68.54, swung into positive trading territory for the year.

Write to Kimberly Chin at kimberly.chin@wsj.com

(END) Dow Jones Newswires

August 30, 2018 16:34 ET (20:34 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

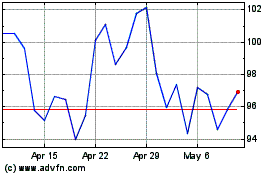

Signet Jewelers (NYSE:SIG)

Historical Stock Chart

From Mar 2024 to Apr 2024

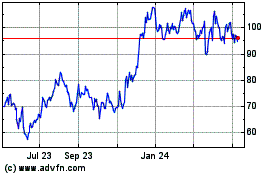

Signet Jewelers (NYSE:SIG)

Historical Stock Chart

From Apr 2023 to Apr 2024