Chief Financial Officer Michele Santana to

leave in 2019 following appointment of a successor and an orderly

transition period

Signet Jewelers Limited (“Signet”) (NYSE:SIG), the world’s

largest retailer of diamond jewelry, today announced that Chief

Financial Officer Michele Santana will leave the company in 2019

after eight years of service to pursue other opportunities.

Signet has initiated an external executive search and expects to

appoint a new CFO by the end of the company’s fiscal year. Santana

will continue as CFO until her successor is appointed and will

remain with Signet in an advisory role until next year to ensure a

smooth transition.

“Since 2010, Michele has been a highly valued member of our

Senior Leadership Team and has played a central role in many of our

major strategic initiatives that lay the foundation of our future

success,” said Virginia C. Drosos, Chief Executive Officer. “As

Signet advances on its path to becoming a share-gaining,

omni-channel jewelry category leader, we’re very grateful to

Michele for her financial leadership and her many contributions,

and look forward to continuing to benefit from her financial acumen

and deep institutional knowledge through the transition

period.”

Santana joined Signet as Senior Vice President and Financial

Controller in 2010 and was appointed CFO in 2014 where she was

responsible for Signet’s financial strategy and planning, including

tax, treasury, accounting, financial services, investor relations,

and internal audit. She oversaw the acquisitions of Ultra Stores,

Inc., Zale Corporation and R2Net, and most recently executed

Signet’s strategic priority of outsourcing credit financing,

allowing the company to focus on its core retail business. In

addition, she led the development of the financial foundation,

including the three-year cost optimization program, for Signet’s

Path to Brilliance transformation plan.

“I am proud to have been part of Signet and am particularly

gratified that, alongside my talented colleagues, we have

positioned the business for success through on-going execution of

Signet’s transformation plan,” said Santana. “I see this as the

right time for me to move on to new challenges, and I look forward

to facilitating a smooth transition. I am confident that Signet is

well positioned to reach exciting new heights.”

About Signet and Safe Harbor Statement: Signet Jewelers

Limited is the world's largest retailer of diamond jewelry. Signet

operates nearly 3,500 stores primarily under the name brands of Kay

Jewelers, Zales, Jared The Galleria Of Jewelry, H.Samuel, Ernest

Jones, Peoples, Piercing Pagoda, and JamesAllen.com. Further

information on Signet is available at www.signetjewelers.com. See

also www.kay.com, www.zales.com, www.jared.com, www.hsamuel.co.uk,

www.ernestjones.co.uk, www.peoplesjewellers.com, www.pagoda.com,

and www.jamesallen.com. This release contains statements which are

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. These statements, based

upon management’s beliefs and expectations as well as on

assumptions made by and data currently available to management,

appear in a number of places throughout this document and include

statements regarding, among other things, Signet’s results of

operation, financial condition, liquidity, prospects, growth,

strategies and the industry in which Signet operates. The use of

the words “expects,” “intends,” “anticipates,” “estimates,”

“predicts,” “believes,” “should,” “potential,” “may,” “forecast,”

“objective,” “plan,” or “target,” and other similar expressions are

intended to identify forward-looking statements. These

forward-looking statements are not guarantees of future performance

and are subject to a number of risks and uncertainties, including

but not limited to, our ability to implement Signet's

transformation initiative, the effect of federal tax reform and

adjustments relating to such impact on the completion of our

quarterly and year-end financial statements, changes in

interpretation or assumptions, and/or updated regulatory guidance

regarding the U.S. tax reform, the benefits and outsourcing of the

credit portfolio sale including technology disruptions, future

financial results and operating results, the impact of

weather-related incidents on Signet’s business, the benefits and

integration of R2Net, general economic conditions, potential

regulatory changes or other developments following the United

Kingdom’s announced intention to negotiate a formal exit from the

European Union, a decline in consumer spending, the merchandising,

pricing and inventory policies followed by Signet, the reputation

of Signet and its banners, the level of competition in the jewelry

sector, the cost and availability of diamonds, gold and other

precious metals, regulations relating to customer credit,

seasonality of Signet’s business, financial market risks,

deterioration in customers’ financial condition, exchange rate

fluctuations, changes in Signet’s credit rating, changes in

consumer attitudes regarding jewelry, management of social, ethical

and environmental risks, the development and maintenance of

Signet’s omni-channel retailing, security breaches and other

disruptions to Signet’s information technology infrastructure and

databases, inadequacy in and disruptions to internal controls and

systems, changes in assumptions used in making accounting estimates

relating to items such as extended service plans and pensions,

risks related to Signet being a Bermuda corporation, the impact of

the acquisition of Zale Corporation on relationships, including

with employees, suppliers, customers and competitors, an adverse

decision in legal or regulatory proceedings, deterioration in the

performance of individual businesses or of the Company's market

value relative to its book value, resulting in impairments of fixed

assets or intangible assets or other adverse financial

consequences, including tax consequences related thereto,

especially in view of the Company’s recent market valuation and our

ability to successfully integrate Zale Corporation’s operations and

to realize synergies from the transaction.

For a discussion of these and other risks and uncertainties

which could cause actual results to differ materially from those

expressed in any forward-looking statement, see the "Risk Factors"

section of Signet's Fiscal 2018 Annual Report on Form 10-K filed

with the SEC on April 2, 2018 and quarterly reports on Form 10-Q

filed with the SEC. Signet undertakes no obligation to update or

revise any forward-looking statements to reflect subsequent events

or circumstances, except as required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180830005375/en/

Signet Jewelers LimitedInvestors:Randi Abada, +1

330-668-3489SVP Corporate Finance Strategy & Investor

Relationsrandi.abada@signetjewelers.comorMedia:David

Bouffard, +1 330-668-5369VP Corporate

Affairsdavid.bouffard@signetjewelers.com

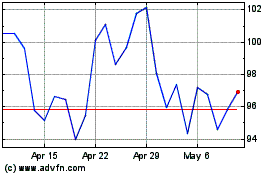

Signet Jewelers (NYSE:SIG)

Historical Stock Chart

From Mar 2024 to Apr 2024

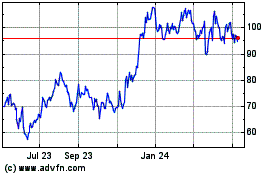

Signet Jewelers (NYSE:SIG)

Historical Stock Chart

From Apr 2023 to Apr 2024