Dick's Says Under Armour, New Gun-Sales Policy Dragged on Results -- Update

August 29 2018 - 5:57PM

Dow Jones News

By Allison Prang

Dick's Sporting Goods Inc. said weaker sales of Under Armour

Inc. apparel and a decision to pull back from the hunting business

dragged on the retailer's latest quarterly results.

Comparable-store sales fell 4%, Dick's said. Not adjusting for

the 53rd week last year, the company's same-store sales declined

1.9%.

The weaker-than-expected results bucked a trend in the retail

sector, which largely has benefited from a surge in consumer

spending fueled by a booming economy.

Consumer confidence for August, measured by the Conference

Board's consumer confidence index, was the highest its been in

about 18 years. That sentiment, along with other factors, has

powered companies such as Walmart Inc. and Target Corp. to their

best quarterly results in more than a decade.

Dick's said part of the company's sales problems were a result

of Under Armour's decision to sell in more stores including Kohl's.

Under Armour declined to comment.

Also hurting sales was Dick's decision to tighten its policy on

gun sales after 17 people were killed in a February shooting at a

Parkland, Fla., high school. The retailer halted sales of any

firearms to people under age 21 at all of its 845 Dick's and Field

& Stream stores, and stopped selling assault-style weapons at

Field & Stream.

Under Armour's results accounted for three percentage points of

declining sales at Dick's, while weakness in the hunting and

electronics categories contributed two percentage points of

decline. When excluding Under Armour and the hunting and

electronics business, comparable-store sales fell 1%.

"Notwithstanding these challenges, the health of our core

business is relatively strong, and we're confident sales trends

will improve next year as these headwinds are expected to subside,"

Dick's Chief Executive Edward Stack said on a call with analysts to

discuss the results.

Shares in Dick's, up 26% year to date, were off less 1% on

Wednesday afternoon.

Mr. Stack said hunting is a low-margin business that was

underperforming. As Dick's clears out products from more stores, he

said, it will use the space to expand into more profitable areas

such as baseball gear.

Mr. Stack also said Under Armour is likely to be "much less of a

drag" in 2019. Dick's plans to expand a merchandise line with the

actor Dwayne "The Rock" Johnson that is sold by only Dick's and

Under Armour, Mr. Stack said on the call. He said "there hasn't

been any meaningful change in the relationship" between the

companies.

Net income rose 6.2% to $119.4 million for the company's second

quarter ended Aug. 4, compared with a year earlier. Dick's reported

earnings of $1.20 a share, up from $1.03 a share. Analysts polled

by Thomson Reuters had expected the company to post earnings of

$1.05 a share.

Net sales rose 1% to $2.18 billion. Analysts had expected $2.24

billion.

Dick's said it expects its earnings for the year to be between

$3.02 a share and $3.20 a share. The company had previously

expected earnings of between $2.92 and $3.12 a share. The company

said it now expects same-store sales to fall between 3% and 4%. It

had previously expected same-store sales to be roughly flat to down

by a low-single-digit percentage. Dick's now expects net capital

expenditures to be $225 million for the year. It had previously

expected them to be $250 million.

Selling, general and administrative expenses rose 5.3% to $495.3

million.

Write to Allison Prang at allison.prang@wsj.com

(END) Dow Jones Newswires

August 29, 2018 17:42 ET (21:42 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

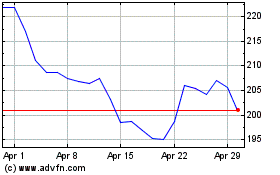

Dicks Sporting Goods (NYSE:DKS)

Historical Stock Chart

From Mar 2024 to Apr 2024

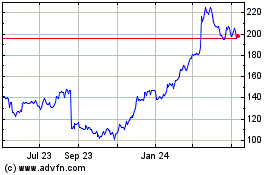

Dicks Sporting Goods (NYSE:DKS)

Historical Stock Chart

From Apr 2023 to Apr 2024