~ Second Quarter Revenue of $144.1 million

~

~ Operating Income of $12.9 million Compared

to $8.3 million in Prior Year; Adjusted Operating Income of

$14.6 million Compared to $12.9 million in Prior Year ~

~ Raises Outlook to Reflect First Half

Results and the Expected Acquisition of MVMT ~

Movado Group, Inc. (NYSE:MOV) today announced second quarter and

six-month results for the period ended July 31, 2018.

- Net sales increased 11.9% to $144.1

million, or 10.5% on a constant dollar basis

- Operating income of $12.9 million

versus $8.3 million in the prior year period; Adjusted operating

income of $14.6 million versus $12.9 million in the prior year

- Diluted EPS of $0.39; Adjusted diluted

EPS of $0.45 compared to $0.43 in prior year period

Efraim Grinberg, Chairman and Chief Executive Officer, stated,

“We are pleased to report another strong quarter with double-digit

increases in both sales and operating income combined with

significant progress against the priorities we set at the start of

the year. Sales growth had notable strength internationally in

Europe and Latin America, as our uniquely designed timepieces and

sought-after brands continue to resonate with consumers around the

world. Olivia Burton, which we acquired last July, continues to

perform very well, and we are extremely excited about the upcoming

addition of another brand that connects with millennials, the

direct-to-consumer brand, MVMT. We have an exciting product

pipeline for the second half of the year and believe we are well

positioned to capitalize on the upcoming holiday season. Our

balance sheet remains strong with $175.6 million of cash and no

debt before the MVMT acquisition, which is expected to close on or

about October 1, 2018. Given the strong results we’ve seen

year-to-date and the pending acquisition of MVMT, we are raising

our annual outlook.”

During the second quarter fiscal 2019, the Company recorded a

$0.7 million pre-tax charge, with a related tax benefit of $0.1

million, or $0.02 per diluted share, in association with the

previously-announced amortization of acquired intangible assets

related to the Olivia Burton brand. The Company also recorded a

$1.0 million pre-tax charge, with a related tax benefit of $0.2

million, or $0.04 per diluted share, associated with professional

fees in conjunction with the previously announced MVMT acquisition.

In the first quarter of fiscal 2019, the Company recorded a $0.8

million pre-tax expense, with a related tax benefit of $0.1

million, or $0.02 per diluted share, in association with the

amortization of acquired intangible assets related to the Olivia

Burton brand. During the second quarter of fiscal 2018, the Company

recorded a $4.5 million pre-tax charge, with a related tax benefit

of $0.1 million, or $0.19 per diluted share, in conjunction with

the acquisition of the Olivia Burton brand and a $0.1 million

pre-tax charge, related to cost savings initiatives. In the first

quarter of fiscal 2018, the Company recorded a $6.3 million pre-tax

charge, with a related tax benefit of $1.9 million, or $0.19 per

diluted share, related to its cost savings initiatives.

Second Quarter Fiscal 2019 (See

attached table for GAAP and Non-GAAP measures)

- Net sales increased 11.9% to $144.1

million compared to $128.8 million in the second quarter of fiscal

2018. Net sales in the second quarter of fiscal 2019 were

unfavorably impacted by $1.1 million due to the adoption of ASC

606, which increased the markdown and return allowances that would

have historically been recorded this period. Net sales on a

constant dollar basis increased 10.5% compared to net sales in the

second quarter of fiscal 2018.

- Gross profit was $77.8 million, or

54.0% of sales, compared to $66.1 million, or 51.3% of sales, in

the second quarter last year. Adjusted gross profit for the second

quarter fiscal 2018 was $66.4 million, or 51.6% of sales, which

excludes $0.3 million of amortization of acquisition accounting

adjustments related to the Olivia Burton brand. The increase in

gross margin percentage was primarily the result of changes in

channel and product mix, favorable changes in foreign currency

exchange rates and increased leverage on fixed costs due to

increased sales.

- Operating expenses were $65.0 million

compared to $57.8 million in the prior year period. Adjusted

operating expenses for the second quarter of fiscal 2019 were $63.2

million, which excludes $0.7 million of expenses associated with

the amortization of acquired intangible assets related to the

Olivia Burton brand and $1.0 million of expenses related to

professional fees in conjunction with the expected MVMT

acquisition. Adjusted operating expenses for the second quarter of

fiscal 2018 were $53.5 million, which excludes $4.2 million of

expenses and amortization related to the acquisition of the Olivia

Burton brand and $0.1 million of expenses related to the cost

savings initiatives. This increase in adjusted operating expenses

was primarily due to increased marketing investment, fluctuations

in foreign currency exchange rates and higher distribution and

selling costs resulting from increased net sales.

- Operating income was $12.9 million

compared to operating income of $8.3 million in the second quarter

of fiscal 2018. For the second quarter of fiscal 2019, adjusted

operating income was $14.6 million, which excludes $0.7 million of

pre-tax expenses associated with the amortization of acquired

intangible assets related to the Olivia Burton brand and $1.0

million of expenses related to professional fees in conjunction

with the expected MVMT acquisition. For the second quarter of

fiscal 2018, adjusted operating income was $12.9 million, which

excludes $4.5 million of pre-tax expenses and amortization related

to the acquisition of the Olivia Burton brand and $0.1 million of

expenses related to the cost savings initiatives.

- The Company recorded a tax provision of

$3.6 million, which equates to an effective tax rate of 28.3%

compared to a tax provision of $2.6 million, or an effective tax

rate of 32.0%, in the second quarter of fiscal 2018. For the second

quarter of fiscal 2019, the Company recorded an adjusted tax

provision of $3.9 million or an adjusted tax rate of 27.1% compared

to an adjusted tax provision of $2.7 million or an adjusted tax

rate of 21.5% in the second quarter of fiscal 2018.

- Net income was $9.1 million, or $0.39

per diluted share, compared to $5.5 million, or $0.24 per diluted

share, in the second quarter of fiscal 2018. Adjusted net income in

the second quarter of fiscal 2019 was $10.6 million, or $0.45 per

diluted share, which excludes $0.6 million of amortization expense,

net of $0.1 million of tax, related to the acquisition of the

Olivia Burton brand, and $0.8 million associated with professional

fees in conjunction with the expected MVMT acquisition, net of $0.2

million of tax. Adjusted net income in the second quarter of fiscal

2018 was $9.9 million, or $0.43 per diluted share, which excludes

$4.4 million of expenses and amortization, net of $0.1 million of

tax, related to the acquisition of the Olivia Burton brand, and

$0.1 million associated with the cost savings initiatives.

First Half Fiscal 2019 (See attached

table for GAAP and Non-GAAP measures)

- Net sales were $271.2 million compared

to $228.0 million in the first six months of fiscal 2018, an

increase of 18.9%. Net sales in the fiscal 2019 period were

favorably impacted by $1.1 million due to the adoption of ASC 606,

which decreased the markdown and return allowances that would have

historically been recorded this period. Net sales on a constant

dollar basis increased 15.6% compared to net sales in the first six

months of fiscal 2018.

- Gross profit was $145.4 million, or

53.6% of sales, compared to $115.3 million, or 50.5% of sales in

the same period last year. Adjusted gross profit for the first six

months of fiscal 2018, which excludes $0.3 million of amortization

of acquisition accounting adjustments related to the Olivia Burton

brand and $1.4 million in charges related to the cost savings

initiatives, was $116.9 million, or 51.3% of sales. The increase in

adjusted gross margin from the first half of last year was

primarily the result of changes in channel and product mix,

favorable changes in foreign currency exchange rates and increased

leverage on fixed costs due to increased sales.

- Operating expenses were $124.4 million

as compared to $110.6 million in the first six months of last

fiscal year. For the first six months of fiscal 2019, adjusted

operating expenses were $121.9 million, which excludes $1.5 million

of amortization expense related to the acquisition of the Olivia

Burton brand and $1.0 million of expenses related to professional

fees in conjunction with the expected MVMT acquisition. For the

first six months of fiscal 2018, adjusted operating expenses were

$101.3 million, which excludes $4.2 million of expenses and

amortization related to the acquisition of the Olivia Burton brand

and $5.0 million of expenses related to the cost savings

initiatives. The increase in adjusted operating expenses was

primarily the result of increased marketing investment,

fluctuations in foreign currency exchange rates and higher

distribution and selling costs resulting from increased net

sales.

- Operating income was $21.0 million

compared to operating income of $4.7 million in the first six

months of fiscal 2018. Adjusted operating income for the first half

of fiscal 2019, which excludes $1.5 million of amortization expense

related to the acquisition of the Olivia Burton brand and $1.0

million of expenses related to professional fees in conjunction

with the expected MVMT acquisition, was $23.5 million compared to

adjusted operating income of $15.6 million for the first half of

fiscal 2018, which excludes $4.5 million of expenses and

amortization related to the acquisition of the Olivia Burton brand

and $6.4 million of expenses related to the cost savings

initiatives.

- The Company recorded a tax provision in

the first six months of fiscal 2019 of $3.5 million as compared to

a tax provision of $2.9 million in the first six months of last

year. Based upon adjusted pre-tax income, the adjusted tax

provision was $3.9 million in the first half of fiscal 2019

compared to an adjusted tax provision of $4.9 million in the first

half of fiscal 2018.

- Net income was $17.3 million, or $0.73

per diluted share, compared to $1.3 million, or $0.06 per diluted

share, in the first six months of fiscal 2018. For the first half

of fiscal 2019, adjusted net income was $19.3 million, or $0.82 per

diluted share, which excludes $1.2 million in amortization expense,

net of tax, related to the acquisition of the Olivia Burton brand

and $0.8 million, net of tax, related to professional fees in

conjunction with the expected MVMT acquisition. This compares to

adjusted net income for the first six months of fiscal 2018 of

$10.2 million, or $0.44 per diluted share, which excludes $4.4

million in expenses and amortization, net of tax, related to the

acquisition of the Olivia Burton brand and $4.5 million, net of

tax, related to the cost savings initiatives.

MVMT Acquisition

On August 15, 2018, the Company announced that it entered into a

definitive agreement to acquire MVMT Watches Inc, the owner of

MVMT. MVMT is a fast-growing watch and accessory brand

headquartered in Los Angeles and has built an engaged social media

community with over 4.5 million followers on Facebook and

Instagram. The Company believes the MVMT acquisition adds a premier

digital brand that complements its existing portfolio as well as a

strong creative and digital team. The integration into Movado

Group’s infrastructure and systems, which the Company believes

should be completed in fiscal 2020, will allow MVMT to expand

globally and into select wholesale channels allowing for continued

omni channel development. The combination will allow for important

synergies in supply chain, logistics and fulfillment to help enable

MVMT’s long-term operating growth. This acquisition is a key

element of Movado Group’s digital strategy, which has been

progressing over the past year.

Updated Fiscal 2019

Outlook

The Company is updating its outlook for fiscal 2019 to reflect

the performance of the first half of the year and, assuming the

acquisition closes on October 1, 2018, the addition of four months

of the MVMT brand in the Company’s operations, excluding

transaction-related costs and the amortization of acquisition

accounting adjustments relating to the acquisition of Olivia Burton

and the expected acquisition of MVMT. For fiscal 2019, the Company

now anticipates that net sales will be in the range of $660.0

million to $675.0 million and operating income will be

approximately $75.0 million to $77.0 million. The Company

anticipates net income in fiscal 2019 to be approximately $58.0

million to $59.7 million, or $2.45 to $2.55 per diluted share,

reflecting a 22.0% anticipated effective tax rate. The Company's

outlook assumes no further significant fluctuations from prevailing

foreign currency exchange rates.

Quarterly Dividend and Share Repurchase

Program

The Company announced that on August 29, 2018, the Board of

Directors approved the payment on September 25, 2018 of a cash

dividend in the amount of $0.20 for each share of the Company’s

outstanding common stock and class A common stock held by

shareholders of record as of the close of business on September 11,

2018.

During the second quarter of fiscal 2019, the Company

repurchased 21,900 shares under its share repurchase program. As of

July 31, 2018, the Company had $46.0 million remaining under the

$50.0 million share repurchase authorization.

Conference Call

The Company’s management will host a conference call and audio

webcast to discuss its results today, August 29, 2018 at 9:00 a.m.

Eastern Time. The conference call may be accessed by dialing

(888)-204-4368. Additionally, a live webcast of the call can be

accessed at www.movadogroup.com. The webcast will be

archived on the Company’s website approximately one hour after the

conclusion of the call. Additionally, a telephonic re-play of the

call will be available at 12:00 p.m. ET on August 29, 2018 until

11:59 p.m. ET on September 5, 2018 and can be accessed by dialing

(844) 512-2921 and entering replay pin number 5255093.

Movado Group, Inc. designs, sources, and distributes MOVADO®,

OLIVIA BURTON®, EBEL®, CONCORD®, COACH®, TOMMY HILFIGER®, HUGO

BOSS®, LACOSTE®, SCUDERIA FERRARI®, REBECCA MINKOFF® and URI

MINKOFF® watches worldwide, and operates Movado company stores in

the United States.

In this release, the Company presents certain financial measures

that are not calculated according to generally accepted accounting

principles in the United States (“GAAP”). Specifically, the Company

is presenting adjusted gross profit, adjusted gross margin,

adjusted operating expenses and adjusted operating income, which

are gross profit, gross margin, operating expenses and operating

income, respectively, under GAAP, adjusted to eliminate the

expenses and amortization of acquisition accounting adjustments

related to the Olivia Burton brand acquisition, professional fees

related to the expected acquisition of MVMT and charges for the

Company’s cost savings initiatives. The Company is also presenting

adjusted tax provision, which is the tax provision under GAAP,

adjusted to eliminate the impact of charges for the Olivia Burton

brand acquisition, the expected MVMT acquisition and the Company’s

cost savings initiatives. The Company believes these adjusted

measures are useful because they give investors information about

the Company’s financial performance without the effect of certain

items that the Company believes are not characteristic of its usual

operations. The Company is also presenting adjusted net income,

adjusted earnings per share and adjusted effective tax rate, which

are net income, earnings per share and effective tax rate,

respectively, under GAAP, adjusted to eliminate the after-tax

impact of amortization of acquisition accounting adjustments

related to the Olivia Burton brand acquisition, the MVMT

acquisition and the Company’s cost savings initiatives. The Company

believes that adjusted net income, adjusted earnings per share and

adjusted effective tax rate are useful measures of performance

because they give investors information about the Company’s

financial performance without the effect of certain items that the

Company believes are not characteristic of its usual operations.

Additionally, the Company is presenting constant currency

information to provide a framework to assess how its business

performed excluding the effects of foreign currency exchange rate

fluctuations in the current period. Comparisons of financial

results on a constant dollar basis are calculated by translating

each foreign currency at the same US dollar exchange rate as in

effect for the prior-year period for both periods being compared.

The Company believes this information is useful to investors to

facilitate comparisons of operating results. These non-GAAP

financial measures are designed to complement the GAAP financial

information presented in this release. The non-GAAP financial

measures presented should not be considered in isolation from or as

a substitute for the comparable GAAP financial measures, and the

methods of their calculation may differ substantially from

similarly titled measures used by other companies.

This press release contains certain forward-looking statements

within the meaning of the Private Securities Litigation Reform Act

of 1995. The Company has tried, whenever possible, to identify

these forward-looking statements using words such as “expects,”

“anticipates,” “believes,” “targets,” “goals,” “projects,”

“intends,” “plans,” “seeks,” “estimates,” “may,” “will,” “should”

and variations of such words and similar expressions. Similarly,

statements in this press release that describe the Company's

business strategy, outlook, objectives, plans, intentions or goals

are also forward-looking statements. Accordingly, such

forward-looking statements involve known and unknown risks,

uncertainties and other factors that could cause the Company's

actual results, performance or achievements and levels of future

dividends to differ materially from those expressed in, or implied

by, these statements. These risks and uncertainties may include,

but are not limited to the satisfaction of the conditions to

closing set forth in the MVMT acquisition agreement, general

economic and business conditions which may impact disposable income

of consumers in the United States and the other significant markets

(including Europe) where the Company’s products are sold,

uncertainty regarding such economic and business conditions, trends

in consumer debt levels and bad debt write-offs, general

uncertainty related to possible terrorist attacks, natural

disasters, the stability of the European Union (including the

impact of the United Kingdom’s process to exit from the European

Union) and defaults on or downgrades of sovereign debt and the

impact of any of those events on consumer spending, changes in

consumer preferences and popularity of particular designs, new

product development and introduction, decrease in mall traffic and

increase in e-commerce, the ability of the Company to successfully

implement its business strategies, competitive products and

pricing, the impact of “smart” watches and other wearable tech

products on the traditional watch market, seasonality, availability

of alternative sources of supply in the case of the loss of any

significant supplier or any supplier’s inability to fulfill the

Company’s orders, the loss of or curtailed sales to significant

customers, the Company’s dependence on key employees and officers,

the ability to successfully integrate the operations of acquired

businesses (including Olivia Burton and MVMT) without disruption to

other business activities, the possible impairment of acquired

intangible assets including goodwill if the carrying value of any

reporting unit were to exceed its fair value, the continuation of

the company’s major warehouse and distribution centers, the

continuation of licensing arrangements with third parties, losses

possible from pending or future litigation, the ability to secure

and protect trademarks, patents and other intellectual property

rights, the ability to lease new stores on suitable terms in

desired markets and to complete construction on a timely basis, the

ability of the Company to successfully manage its expenses on a

continuing basis, information systems failure or breaches of

network security, the continued availability to the Company of

financing and credit on favorable terms, business disruptions,

general risks associated with doing business outside the United

States including, without limitation, import duties, tariffs,

quotas, political and economic stability, changes to existing laws

or regulations, and success of hedging strategies with respect to

currency exchange rate fluctuations, and the other factors

discussed in the Company’s Annual Report on Form 10-K and other

filings with the Securities and Exchange Commission. These

statements reflect the Company's current beliefs and are based upon

information currently available to it. Be advised that developments

subsequent to this press release are likely to cause these

statements to become outdated with the passage of time. The Company

assumes no duty to update its forward looking statements and this

release shall not be construed to indicate the assumption by the

Company of any duty to update its outlook in the future.

(Tables to follow)

MOVADO GROUP, INC. CONSOLIDATED STATEMENTS OF

OPERATIONS (In thousands, except per share data)

(Unaudited) Three Months

Ended Six Months Ended July 31, July 31,

2018

2017

2018

2017

Net sales $ 144,093 $ 128,781 $ 271,242 $ 228,046

Cost of sales 66,259 62,655 125,884

112,783 Gross profit 77,834 66,126

145,358 115,263 Operating expenses 64,974

57,809 124,359 110,594

Operating income 12,860 8,317 20,999 4,669 Interest expense

(162 ) (390 ) (384 ) (746 ) Interest income 57

129 114 251 Income before income

taxes 12,755 8,056 20,729 4,174 Provision for income taxes

3,615 2,574 3,474 2,851

Net income attributed to Movado Group, Inc.

9,140 5,482 17,255 1,323

Per Share Information: Net income attributed to

Movado Group, Inc. $ 0.39 $ 0.24 $ 0.73 $ 0.06 Weighted

diluted average shares outstanding 23,712 23,218 23,585 23,253

MOVADO GROUP, INC. GAAP AND NON-GAAP

MEASURES (In thousands, except for percentage data)

(Unaudited) As

Reported % Change Three Months Ended %

Change Constant July 31, As

Reported Dollar

2018

2017

Total Net sales $144,093 $128,781 11.9% 10.5%

As Reported % Change Six Months Ended %

Change Constant July 31, As

Reported Dollar

2018

2017

Total Net sales $271,242 $228,046 18.9% 15.6%

MOVADO GROUP, INC. GAAP AND NON-GAAP MEASURES (In

thousands, except per share data) (Unaudited)

Net Sales

Gross Profit

Operating Income

Pre-tax Income

Provision for Income

Taxes

Net Income Attributed

to Movado Group, Inc.

EPS Three Months Ended July 31, 2018 As Reported

(GAAP) $ 144,093 $ 77,834 $ 12,860 $ 12,755 $ 3,615 $ 9,140 $

0.39 Olivia Burton Costs (1) 719 719 137 582 0.02 MVMT Costs (2)

1,020 1,020 174 846

0.04

Adjusted Results (Non-GAAP) $ 144,093 $ 77,834 $

14,599 $ 14,494 $ 3,926 $ 10,568 $ 0.45

Three Months

Ended July 31, 2017 As Reported (GAAP) $ 128,781 $

66,126 $ 8,317 $ 8,056 $ 2,574 $ 5,482 $ 0.24 Olivia Burton Costs

(1) 279 4,515 4,515 124 4,391 0.19 Cost Savings Initiatives (3)

85 85 19 66 0.00

Adjusted Results (Non-GAAP) $ 128,781 $ 66,405 $ 12,917 $

12,656 $ 2,717 $ 9,939 $ 0.43

Six Months Ended July 31,

2018 As Reported (GAAP) $ 271,242 $ 145,358 $ 20,999 $

20,729 $ 3,474 $ 17,255 $ 0.73 Olivia Burton Costs (1) 1,486 1,486

282 1,204 0.05 MVMT Costs (2) 1,020

1,020 174 846 0.04

Adjusted Results

(Non-GAAP) $ 271,242 $ 145,358 $ 23,505 $ 23,235 $ 3,930 $

19,305 $ 0.82

Six Months Ended July 31, 2017 As

Reported (GAAP) $ 228,046 $ 115,263 $ 4,669 $ 4,174 $ 2,851 $

1,323 $ 0.06 Olivia Burton Costs (1) 279 4,515 4,515 124 4,391 0.19

Cost Savings Initiatives (3) 1,402 6,419

6,419 1,936 4,483 0.19

Adjusted

Results (Non-GAAP) $ 228,046 $ 116,944 $ 15,603 $ 15,108 $

4,911 $ 10,197 $ 0.44 (1) FY 2019 expense relates to

the amortization of certain acquired finite lived assets for the

Olivia Burton brand. FY 2018 expense includes the aforementioned

amortization expenses as well as transaction charges, and the

amortization of certain accounting adjustments associated with the

acquisition of the Olivia Burton brand. (2) Related to costs

associated with the acquisition of MVMT brand. (3) Related to a

charge for severance and payroll related, other expenses and

occupancy expenses.

MOVADO GROUP, INC.

CONSOLIDATED BALANCE SHEETS (In thousands)

(Unaudited) July 31, January

31, July 31,

2018

2018

2017

ASSETS

Cash and cash equivalents $ 175,583 $ 214,811 $

162,417 Trade receivables, net 83,818 83,098 81,513 Inventories

171,417 151,676 176,967 Other current assets 37,852

32,015 31,825 Total current assets 468,670

481,600 452,722 Property, plant and equipment, net

24,533 24,671 31,412 Deferred and non-current income taxes 8,074

6,443 24,924 Goodwill 55,744 60,269 56,116 Other intangibles, net

19,976 23,124 23,184 Other non-current assets 50,251

49,273 45,715 Total assets $ 627,248 $ 645,380 $ 634,073

LIABILITIES AND

EQUITY

Loans payable to bank, current $ - $ 25,000 $ 5,000

Accounts payable 34,578 24,364 35,174 Accrued liabilities 50,054

47,943 44,192 Income taxes payable 5,996 2,989

1,730 Total current liabilities 90,628 100,296

86,096 Loans payable to bank - - 25,000 Deferred and

non-current income taxes payable 29,718 33,063 7,759 Other

non-current liabilities 43,548 41,686 37,060 Shareholders' equity

463,354 470,335 478,158 Total liabilities and

equity $ 627,248 $ 645,380 $ 634,073

MOVADO

GROUP, INC. CONDENSED CONSOLIDATED STATEMENTS OF CASH

FLOWS (In thousands) (Unaudited) Six

Months Ended July 31,

2018

2017

Cash flows from operating activities: Net income $ 17,255 $

1,323 Depreciation and amortization 6,495 6,009 Other non-cash

adjustments 1,860 2,884 Cost savings initiatives - 6,419 Changes in

working capital (22,063 ) (26,355 ) Changes in non-current assets

and liabilities 584 (302 )

Net cash

provided by / (used in) operating activities

4,131 (10,022 ) Cash

flows from investing activities: Capital expenditures (5,060 )

(2,005 ) Acquisition, net of cash acquired - (78,991 ) Restricted

cash deposits - 1,018 Trademarks and other intangibles (217

) (463 )

Net cash (used in) investing activities

(5,277 ) (80,441 )

Cash flows from financing activities: Repayments of bank

borrowings (25,000 ) - Dividends paid (9,229 ) (5,967 ) Stock

repurchase (2,057 ) (1,655 ) Other financing 4,825

(733 )

Net cash (used in) financing activities

(31,461 ) (8,355 ) Effect

of exchange rate changes on cash, cash equivalents, and restricted

cash (6,621 ) 4,956 Net change in cash, cash equivalents, and

restricted cash (39,228 ) (93,862 ) Cash, cash equivalents, and

restricted cash at beginning of period 215,411

256,879

Cash, cash equivalents, restricted cash at

end of period $ 176,183 $

163,017 Reconciliation of cash, cash

equivalents, and restricted cash: Cash and cash equivalents

175,583 162,417 Restricted cash included in other non-current

assets 600 600

Cash, cash

equivalents, and restricted cash $ 176,183

$ 163,017

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180829005180/en/

ICR, Inc.Rachel Schacter / Allison Malkin, 203-682-8200

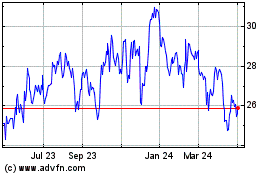

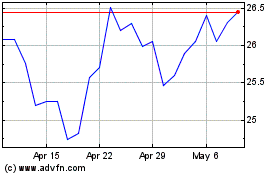

Movado (NYSE:MOV)

Historical Stock Chart

From Mar 2024 to Apr 2024

Movado (NYSE:MOV)

Historical Stock Chart

From Apr 2023 to Apr 2024