Cleveland-Cliffs Completes the Sale of its Asia Pacific Iron Ore Assets

August 28 2018 - 9:13AM

Business Wire

Cleveland-Cliffs Inc. (NYSE: CLF) (“Cliffs” or the “Company”)

announced today that it has closed the sale of its Asia Pacific

Iron Ore assets to Mineral Resources Limited (“MRL”). With the

transaction, Cliffs’ previously disclosed costs of closing the

Australian operations were reduced by approximately $85

million. Included in this amount are asset retirement obligations

assumed by MRL.

As a result of the transaction, in the third quarter Cliffs will

be recording a reversal of its currency translation adjustment,

which will result in a positive contribution to net income of

approximately $230 million, or income of approximately $0.75 per

diluted share.

Lourenco Goncalves, Cliffs' Chairman, President and Chief

Executive Officer said, "With the closure of the sale of the

Australian assets, we have now completed our multi-year

transformation back to our roots as a supplier of high-grade iron

units to the Great Lakes steel industry." Mr. Goncalves added: "I

must again thank our APIO team for their crucial role and

contribution to our successful turnaround over the last four years.

This positive attitude and full engagement of our entire workforce

will continue to allow us to be successful as we grow and evolve to

supply high quality metallics to electric arc furnaces.”

About Cleveland-Cliffs Inc.

Founded in 1847, Cleveland-Cliffs Inc. is the largest and oldest

independent iron ore mining company in the United States. We are a

major supplier of iron ore pellets to the North American steel

industry from our mines and pellet plants located in Michigan and

Minnesota. By 2020, Cliffs expects to be the sole producer of hot

briquetted iron (HBI) in the Great Lakes region with the

development of its first production plant in Toledo, Ohio. Driven

by the core values of safety, social, environmental and capital

stewardship, our employees endeavor to provide all stakeholders

with operating and financial transparency. For more information,

visit http://www.clevelandcliffs.com.

Forward-Looking Statements

This release contains statements that constitute

"forward-looking statements" within the meaning of the federal

securities laws. As a general matter, forward-looking statements

relate to anticipated trends and expectations rather than

historical matters. Forward-looking statements are subject to

uncertainties and factors relating to Cliffs’ operations and

business environment that are difficult to predict and may be

beyond our control. Such uncertainties and factors may cause actual

results to differ materially from those expressed or implied by the

forward-looking statements. These statements speak only as of the

date of this release, and we undertake no ongoing obligation, other

than that imposed by law, to update these statements. Uncertainties

and risk factors that could affect Cliffs’ future performance and

cause results to differ from the forward-looking statements in this

release include, but are not limited to: uncertainty and weaknesses

in global economic conditions, including downward pressure on

prices caused by oversupply or imported products, reduced market

demand and risks related to U.S. government actions with respect to

Section 232 of the Trade Expansion Act (as amended by the Trade Act

of 1974), the North American Free Trade Agreement and/or other

trade agreements, treaties or policies; continued volatility of

iron ore and steel prices and other trends, including the supply

approach of the major iron ore producers, affecting our financial

condition, results of operations or future prospects, specifically

the impact of price-adjustment factors on our sales contracts; our

ability to cost-effectively achieve planned production rates or

levels, including at our HBI production plant; our ability to

successfully identify and consummate any strategic investments or

development projects, including our HBI production plant; the

impact of our customers reducing their steel production due to

increased market share of steel produced using other methods or

lighter-weight steel alternatives; risks related to former

international operations, including our ability to successfully

conclude the CCAA process in Canada and to close

our Asia Pacific business in a manner that minimizes cash

outflows and associated liabilities, including, among other things,

our ability to successfully complete the sale of the assets of our

Asia Pacific Iron Ore business and our ability to reach negotiated

settlements with other third parties in Australia; our ability to

successfully diversify our product mix and add new customers beyond

our traditional blast furnace clientele; our actual economic iron

ore reserves or reductions in current mineral estimates, including

whether any mineralized material qualifies as a reserve; our

ability to maintain appropriate relations with unions and

employees; the outcome of any contractual disputes with our

customers, joint venture partners or significant energy, material

or service providers or any other litigation or arbitration; the

ability of our customers and joint venture partners to meet their

obligations to us on a timely basis or at all; problems or

uncertainties with productivity, tons mined, transportation,

mine-closure obligations, environmental liabilities,

employee-benefit costs and other risks of the mining industry; our

ability to reach agreement with our customers regarding any

modifications to sales contract provisions, renewals or new

arrangements; our actual levels of capital spending; our level of

indebtedness could limit cash flow available to fund working

capital, capital expenditures, acquisitions and other general

corporate purposes or ongoing needs of our business; availability

of capital and our ability to maintain adequate liquidity; changes

in sales volume or mix; events or circumstances that could impair

or adversely impact the viability of a mine and the carrying value

of associated assets, as well as any resulting impairment charges;

impacts of existing and increasing governmental regulation and

related costs and liabilities, including failure to receive or

maintain required operating and environmental permits, approvals,

modifications or other authorization of, or from, any governmental

or regulatory entity and costs related to implementing improvements

to ensure compliance with regulatory changes; uncertainties

associated with natural disasters, weather conditions,

unanticipated geological conditions, supply or price of energy,

equipment failures and other unexpected events; adverse changes in

currency values, currency exchange rates, interest rates and tax

laws; and the potential existence of significant deficiencies or

material weakness in our internal control over financial

reporting.

For additional factors affecting the business

of Cliffs, refer to Part I – Item 1A. Risk Factors of our

Annual Report on Form 10-K for the year ended December 31, 2017.

You are urged to carefully consider these risk factors.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180828005472/en/

Cleveland-Cliffs Inc.MEDIA CONTACTPatricia Persico,

216-694-5316Director, Corporate CommunicationsorINVESTOR

CONTACTPaul Finan, 216-694-6544Director, Investor Relations

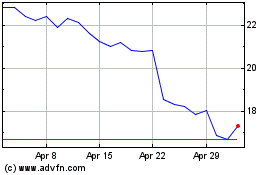

Cleveland Cliffs (NYSE:CLF)

Historical Stock Chart

From Mar 2024 to Apr 2024

Cleveland Cliffs (NYSE:CLF)

Historical Stock Chart

From Apr 2023 to Apr 2024