REX American Resources Corporation (NYSE: REX) (“REX” or “the

Company”) today reported financial results for its fiscal 2018

second quarter (“Q2 ‘18”) ended July 31, 2018. REX management will

host a conference call and webcast today at 11:00 a.m. ET.

Conference Call:

(212) 231-2910

Webcast / Replay URL:

www.rexamerican.com/Corp/Page4.aspx

The webcast will be available for

replay for 30 days

REX American Resources’ Q2 ‘18 results principally reflect its

interests in six ethanol production facilities and its refined coal

operation. One Earth Energy, LLC (“One Earth”) and NuGen Energy,

LLC (“NuGen”) are consolidated, while those of its four other

ethanol plants are reported as equity in income of unconsolidated

ethanol affiliates. REX consolidates the refined coal entity

acquired by the Company in fiscal 2017. The Company reports results

for its two business segments as ethanol and by-products, and

refined coal.

REX’s Q2 ‘18 net sales and revenue were $128.8 million, compared

with $108.7 million in Q2 ‘17, primarily reflecting higher volumes

of ethanol gallons sold as well as higher average selling prices

for dried and modified distillers grains during the quarter, which

more than offset lower average selling prices for ethanol. The

Company’s Q2 ‘18 gross profit for its ethanol and by-products

segment increased to $13.7 million, from $10.8 million in the

comparable prior year period. In Q2 ’18, equity in income of

unconsolidated ethanol affiliates rose to $0.9 million, from $0.1

million in Q2 ’17. As a result, the ethanol and by-products segment

income before income taxes rose to $10.1 million in Q2 ‘18,

compared to $7.3 million in Q2 ‘17. The Company’s refined coal

operation incurred a $4.3 million gross loss and a $4.8 million

loss before income taxes in Q2 ’18 (the Company did not own the

refined coal entity in Q2’ 17). As a result, REX reported income

from continuing operations before income taxes and non-controlling

interests in Q2 ‘18 of $4.9 million, compared with $6.5 million in

Q2 ‘17. While the refined coal operation impacted gross profit and

income before income taxes, the Company recognized a lower

effective tax rate related to its refined coal operation.

Net income attributable to REX shareholders in Q2 ‘18 rose more

than three-fold to $9.2 million, from $2.9 million in Q2 ‘17,

primarily reflecting the year-over-year profit improvement in the

ethanol and by-products segment as well as lower tax rates related

to the Company’s refined coal operation and the December 2017

passage of the 2017 Tax Cuts and Jobs Act. Q2 ‘18 basic and diluted

net income per share attributable to REX common shareholders was

$1.43 per share, compared to $0.45 per share in Q2 ‘17.

Per share results in Q2 ‘18 and Q2 ‘17 are based on 6,466,000

and 6,593,000 diluted weighted average shares outstanding,

respectively.

Segment Income Statement Data:

Three Months Ended

Six MonthsEnded

($ in thousands)

July 31, July 31, 2018

2017 2018

2017 Net sales and revenue:

Ethanol & By-Products (1) $ 128,491 $ 108,744 $ 249,171

$ 221,887 Refined coal (2) (3)

266

- 406

- Total net sales and revenues

$ 128,757 $

108,744 $ 249,577

$ 221,887 Gross

profit (loss): Ethanol & By-Products (1) $ 13,669 $ 10,781

$ 27,215 $ 23,270 Refined coal (2)

(4,270

) -

(6,965 ) -

Total gross profit $ 9,399

$ 10,781 $

20,250 $ 23,270

Income (loss) before income taxes: Ethanol

& By-Products (1) $ 10,077 $ 7,330 $ 21,086 $ 16,253 Refined

coal (2) (4,788 ) - (7,647 ) - Corporate and other

(430 ) (857

) (931 )

(1,778 ) Total income (loss) before

income taxes

$ 4,859

$ 6,473 $

12,508 $ 14,475

Benefit (provision) for income taxes: Ethanol

& By-Products $ (2,029 ) $ (2,675 ) $ (3,449 ) $ (5,380 )

Refined coal 7,597 - 11,596 - Corporate and other

63 373

187 688 Total

benefit (provision) for income taxes

$

5,631 $ (2,302

) $ 8,334

$ (4,692 ) Segment

profit (loss): Ethanol & By-Products $ 6,561 $ 3,419 $

15,150 $ 8,561 Refined coal 3,018 - 4,289 - Corporate and other

(362 ) (478

) (726 )

(1,076 ) Net income attributable to REX

common shareholders

$ 9,217

$ 2,941 $

18,713 $ 7,485

(1)

Includes results attributable to

non-controlling interests of approximately 25% for One Earth and

approximately 1% for NuGen.

(2)

Includes results attributable to

non-controlling interests of approximately 5%.

(3)

Refined coal sales are reported net of the

cost of coal.

REX American Resources’ Chief Executive Officer, Zafar Rizvi,

commented, “Although challenging ethanol crush spread trends

prevailed in the fiscal second quarter, we generated 18.2%

year-over-year growth in net sales and revenue, a 26.8% rise in

gross profit and a 37.5% increase in income before taxes from our

ethanol and by-products segment. These gains reflect an increase in

distillers grain pricing, the quality and efficiencies of our

plants and people, and our investments in expanding the output of

our consolidated plants which enabled us to increase the volume of

ethanol sold by 18.6% over last year’s second quarter. The growth

of our ethanol and by-products segment, combined with tax benefits

related to our refined coal operations and the enactment of the Tax

Cuts and Jobs Act, resulted in 213.4% growth in fiscal 2018 second

quarter net income attributable to REX common shareholders and a

217.8% rise in EPS attributable to REX common shareholders.

“The fiscal second quarter again demonstrated the value of our

ethanol operations and disciplined operating practices and we

remain confident that our refined coal investment will continue to

benefit our financial results. With our debt-free balance sheet and

healthy liquidity position, including cash and short-term

investments of $185.7 million, we allocated approximately $7.5

million to share repurchases during the quarter and we continue to

evaluate other near- and long-term opportunities to enhance

shareholder value.”

Balance Sheet and Share Repurchase Program

At July 31, 2018, REX had cash and cash equivalents and

short-term investments of $185.7 million, $54.0 million of which

was at the parent company, and $131.7 million of which was at its

consolidated production facilities. This compares with cash and

cash equivalents at January 31, 2018, of $191.0 million, $74.1

million of which was at the parent company, and $116.9 million of

which was at its consolidated ethanol production facilities.

On March 20, 2018, REX’s Board of Directors approved an increase

in the share repurchase plan providing the Company with the

authority to repurchase up to an additional 500,000 shares of its

common stock. During the second quarter of fiscal 2018, the Company

purchased 102,012 shares at an average cost of $73.72. REX is now

authorized to repurchase up to 427,181 shares of its common stock.

The Company had 6,351,739 shares outstanding at July 31, 2018.

Repurchases by the Company will be subject to available

liquidity, general market and economic conditions, alternate uses

for the capital and other factors. Share repurchases may be made

from time to time in open market transactions, block trades or in

private transactions in accordance with applicable securities laws

and regulations and other legal requirements. There is no minimum

number of shares that the Company is required to repurchase and the

repurchase program may be suspended or discontinued at any time

without prior notice. All shares purchased will be held in the

Company’s treasury for possible future use.

The following table summarizes select

data related to theCompany’s consolidated alternative energy

interests:

Three Months Ended

Six MonthsEnded

July 31, July 31,

2018

2017

2018

2017

Average selling price per gallon of ethanol $ 1.38 $ 1.45 $ 1.35 $

1.45 Average selling price per ton of dried distillers grains $

148.98 $ 95.39 $ 143.28 $ 97.81 Average selling price per pound of

non-food

grade corn oil

$

0.24

$

0.29

$

0.24

$

0.28

Average selling price per ton of modified distillers grains $ 63.72

$ 41.00 $ 67.81 $ 41.47 Average cost per bushel of grain $ 3.60 $

3.38 $ 3.55 $ 3.47 Average cost of natural gas (per mmbtu)

$ 2.86 $ 3.30 $ 3.16

$ 3.52

Supplemental Data Related to REX’s

Alternative Energy Interests:

REX American Resources CorporationEthanol

Ownership Interests/Effective Annual Gallons Shipped as of July 31,

2018

(gallons in millions)

Entity

Trailing TwelveMonths

GallonsShipped

Current

REXOwnershipInterest

REX’s Current Effective

Ownership of Trailing Twelve Month Gallons

Shipped

One Earth Energy, LLC(Gibson City,

IL)

134.8 75.1% 101.2

NuGen Energy, LLC(Marion, SD)

138.4 99.5% 137.7

Big River Resources West Burlington,

LLC(West Burlington, IA)

108.6 10.3% 11.2

Big River Resources Galva, LLC

(Galva, IL)

128.5 10.3% 13.2

Big River United Energy, LLC

(Dyersville, IA)

129.8 5.7% 7.4

Big River Resources Boyceville,

LLC(Boyceville, WI)

57.3 10.3% 5.9

Total 697.4 n/a

276.6

Second Quarter Conference Call

REX will host a conference call at 11:00 a.m. ET today. Senior

management will discuss the financial results and host a question

and answer session. The dial in number for the audio conference

call is 212/231-2910 (domestic and international callers).

Participants can also listen to a live webcast of the call on

the Company’s website, www.rexamerican.com/Corp/Page4.aspx.

A webcast replay will be available for 30 days following the live

event at www.rexamerican.com/Corp/Page4.aspx.

About REX American Resources Corporation

REX American Resources has interests in six ethanol production

facilities, which in aggregate shipped approximately 697 million

gallons of ethanol over the twelve month period ended July 31,

2018. REX’s effective ownership of the trailing twelve month

gallons shipped (for the twelve months ended July 31, 2018) by the

ethanol production facilities in which it has ownership interests

was approximately 277 million gallons. In addition, the Company

acquired a refined coal operation on August 10, 2017. Further

information about REX is available at www.rexamerican.com.

This news announcement contains or may contain forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995. Such statements can be identified by use of

forward-looking terminology such as “may,” “expect,” “believe,”

“estimate,” “anticipate” or “continue” or the negative thereof or

other variations thereon or comparable terminology. Readers are

cautioned that there are risks and uncertainties that could cause

actual events or results to differ materially from those referred

to in such forward-looking statements. These risks and

uncertainties include the risk factors set forth from time to time

in the Company’s filings with the Securities and Exchange

Commission and include among other things: the impact of

legislative changes, the price volatility and availability of corn,

dried and modified distillers grains, ethanol, corn oil, gasoline

and natural gas, ethanol and refined coal plants operating

efficiently and according to forecasts and projections, changes in

the international, national or regional economies, weather, results

of income tax audits, changes in income tax laws or regulations and

the effects of terrorism or acts of war. The Company does not

intend to update publicly any forward-looking statements except as

required by law.

- statements of operations follow -

REX AMERICAN RESOURCES CORPORATION AND

SUBSIDIARIESConsolidated Statements of Operations(in

thousands, except per share amounts)Unaudited

Three Months Ended

Six Months Ended

July 31, July 31,

2018

2017

2018

2017

Net sales and revenue $ 128,757 $ 108,744 $ 249,577 $ 221,887 Cost

of sales

119,358

97,963 229,327

198,617 Gross profit 9,399 10,781 20,250

23,270 Selling, general and administrative expenses (6,110 ) (4,779

) (10,663 ) (10,181 ) Equity in income of unconsolidated ethanol

affiliates 874 137 1,571 837 Interest and other income

696 334

1,350 549 Income

from continuing operations before income taxes and non-controlling

interests

4,859

6,473

12,508

14,475

Benefit (provision) for income taxes

5,631

(2,302 )

8,334 (4,692 )

Net income including non-controlling interests 10,490 4,171 20,842

9,783 Net income attributable to non-controlling interests

(1,273 ) (1,230

) (2,129 )

(2,298 ) Net income attributable to REX

common shareholders

$ 9,217

$ 2,941 $

18,713 $ 7,485

Weighted average shares outstanding – basic and diluted

6,466 6,593

6,517 6,592

Basic and diluted net income per share attributable to REX

common shareholders

$

1.43

$

0.45

$

2.87

$

1.14

- balance sheets follow -

REX AMERICAN RESOURCES CORPORATION AND

SUBSIDIARIESConsolidated Balance Sheets(in

thousands) Unaudited

July 31, Jan.

31, ASSETS: ASSETS

2018

2018

CURRENT ASSETS: Cash and cash equivalents $ 73,761 $ 190,988

Short-term investments 111,969 - Restricted cash 778 354 Accounts

receivable 14,648 12,913 Inventory 25,171 20,755 Refundable income

taxes 8,371 6,612 Prepaid expenses and other

7,716 7,412 Total

current assets 242,414 239,034 Property and equipment-net 190,823

197,827 Other assets 7,816 7,454 Equity method investments

35,117 34,549 TOTAL

ASSETS

$ 476,170 $

478,864 LIABILITIES AND EQUITY

CURRENT LIABILITIES: Accounts payable – trade $ 11,595 $

8,149 Accrued expenses and other current liabilities

10,555 13,716 Total

current liabilities

22,150

21,865 LONG TERM LIABILITIES: Deferred taxes

13,768 21,706 Other long term liabilities

4,004

3,367 Total long term liabilities

17,772 25,073

COMMITMENTS AND CONTINGENCIES EQUITY: REX shareholders’ equity:

Common stock, 45,000 shares authorized, 29,853 shares issued at par

299 299 Paid in capital 148,212 146,923 Retained earnings 566,626

547,913 Treasury stock, 23,502 and 23,287 shares, respectively

(329,999 )

(313,643 ) Total REX shareholders’ equity

385,138 381,492 Non-controlling interests

51,110 50,434 Total

equity

436,248

431,926 TOTAL LIABILITIES AND EQUITY

$ 476,170 $

478,864

- statements of cash flows follow -

REX AMERICAN RESOURCES CORPORATION AND

SUBSIDIARIESConsolidated Statements of Cash Flows(in

thousands) Unaudited

Six Months Ended July 31,

2018

2017

CASH FLOWS FROM OPERATING ACTIVITIES: Net income $ 20,842 $ 9,783

Adjustments to reconcile net income to net cash provided by

operating activities: Depreciation 12,033 9,955 Income from equity

method investments (1,571 ) (837 ) Dividends received from equity

method investments 1,003 2,005 Accrued interest income (815 ) -

Deferred income tax (7,938 ) 537 Stock based compensation expense

443 350 Loss (gain) on disposal of property and equipment 104 (13 )

Loss on sale of investment - 13 Changes in assets and liabilities:

Accounts receivable (1,735 ) 886 Inventory (4,416 ) (5,034 ) Other

assets (2,443 ) (953 ) Accounts payable-trade 4,002 1,678 Other

liabilities

(1,262 )

(4,828 ) Net cash provided by operating

activities

18,247

13,542 CASH FLOWS FROM INVESTING ACTIVITIES:

Capital expenditures (5,813 ) (14,366 ) Purchase of short-term

investments (111,154 ) - Other

18

219 Net cash used in investing activities

(116,949 )

(14,147 ) CASH FLOWS FROM FINANCING

ACTIVITIES: Treasury stock acquired (16,648 ) - Payments to

non-controlling interests holders (1,699 ) (1,725 ) Capital

contributions from minority investor

246

- Net cash used in financing activities

(18,101 )

(1,725 ) NET DECREASE IN CASH, CASH

EQUIVALENTS AND RESTRICTED CASH (116,803 ) (2,330 ) CASH, CASH

EQUIVALENTS AND RESTRICTED CASH-Beginning of year

191,342 188,706

CASH, CASH EQUIVALENTS AND RESTRICTED CASH-End of year

$ 74,539 $

186,376 Non cash investing activities – Accrued

capital expenditures

$ 469

$ 744 Non cash financing

activities – Stock awards accrued

$ 335

$ 281 Non cash investing

activities – Stock awards issued

$

1,473

$ 1,195

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180828005128/en/

For REX American Resources CorporationDouglas Bruggeman,

937-276-3931Chief Financial OfficerorJCIRJoseph Jaffoni, Norberto

Aja, 212-835-8500rex@jcir.com

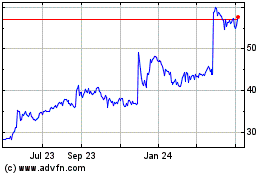

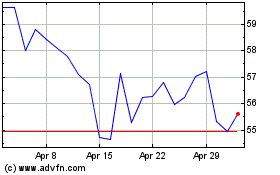

REX American Resources (NYSE:REX)

Historical Stock Chart

From Mar 2024 to Apr 2024

REX American Resources (NYSE:REX)

Historical Stock Chart

From Apr 2023 to Apr 2024