Sales of $583 Million; Net Profit

of $66 Million, Adjusted EBITDA of $86

Million

Ferroglobe PLC (NASDAQ:GSM) (“Ferroglobe” or the “Company”), the

world’s leading producer of silicon metal, and a leading

silicon-and manganese-based specialty alloys producer, today

announced results for the second quarter of 2018.

In Q2 2018, Ferroglobe posted a net profit of $66.0

million, or $0.39 per share on a fully diluted basis. On an

adjusted basis, Q2 2018 net profit was $25.7 million, or $0.14 per

share on a fully diluted basis.

Q2 2018 reported EBITDA was $130.9 million, up from

$93.5 million in the prior quarter. On an adjusted basis, Q2 2018

EBITDA was $86.3 million, down 3.7% from Q1 2018 adjusted EBITDA of

$89.6 million. The Company reported adjusted EBITDA margin of 14.8%

for Q2 2018, compared to adjusted EBITDA margin of 16.0% for Q1

2018. Year-to-date (H1 2018) adjusted EBITDA was $175.9 million, up

135% from the same period in 2017.

The differences between reported and adjusted

figures derive from the bargain purchase gain that has been

recorded as a result of the Company’s acquisition of manganese

alloys plants at Mo I Rana, Norway and Dunkirk, France.

During the second quarter, cash flow used for

operations was $4.6 million, with working capital increasing by

$70.0 million during the period. As a consequence, net debt

was $475.3 million as of June 30, 2018, up from $449.3 million as

of March 31, 2018.

Sales in Q2 2018 totaled $583.0 million, up 4.0%

from $560.7 million in Q1 2018. During Q2 2018, the average selling

prices for:

- Silicon metal increased by 0.4% to

$2,773/MT in Q2 2018, as compared to $2,762/MT in Q1 2018;

- Silicon-based alloys decreased by 2.4% to $1,908/MT in Q2 2018,

as compared to $1,956/MT in Q1 2018; and

- Manganese-based alloys decreased by 5.2% to $1,304/MT in Q2

2018, as compared to $1,375/MT in Q1 2018.

While sales volumes of:

- Silicon metal experienced a 6.2% decrease

quarter-over-quarter,

- Silicon-based alloys experienced a 2.5% increase

quarter-over-quarter, and

- Manganese-based alloys experienced a 51.0% increase

quarter-over-quarter.

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Quarter Ended |

|

Quarter Ended |

|

Quarter Ended |

|

Six Months Ended |

|

Six Months Ended |

| |

|

June 30, 2018 |

|

March

31, 2018 |

|

June 30, 2017 |

|

June 30, 2018 |

|

June 30, 2017 |

| Shipments in metric

tons: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Silicon

Metal |

|

|

85,913 |

|

|

91,615 |

|

|

82,881 |

|

|

177,528 |

|

|

158,634 |

|

Silicon-based Alloys |

|

|

78,214 |

|

|

76,328 |

|

|

70,913 |

|

|

154,542 |

|

|

146,299 |

|

Manganese-based Alloys |

|

|

107,457 |

|

|

71,176 |

|

|

64,403 |

|

|

178,633 |

|

|

128,103 |

| Total

shipments* |

|

|

271,584 |

|

|

239,119 |

|

|

218,197 |

|

|

510,703 |

|

|

433,036 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Quarter Ended |

|

Quarter Ended |

|

Quarter Ended |

|

Six Months Ended |

|

Six Months Ended |

| |

|

June 30, 2018 |

|

March

31, 2018 |

|

June 30, 2017 |

|

June 30, 2018 |

|

June 30, 2017 |

| Average selling price

($/MT): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Silicon

Metal |

|

$ |

2,773 |

|

$ |

2,762 |

|

$ |

2,210 |

|

$ |

2,767 |

|

$ |

2,148 |

|

Silicon-based Alloys |

|

$ |

1,908 |

|

$ |

1,956 |

|

$ |

1,586 |

|

$ |

1,932 |

|

$ |

1,528 |

|

Manganese-based Alloys |

|

$ |

1,304 |

|

$ |

1,375 |

|

$ |

1,308 |

|

$ |

1,332 |

|

$ |

1,303 |

|

Total* |

|

$ |

1,943 |

|

$ |

2,092 |

|

$ |

1,741 |

|

$ |

2,013 |

|

$ |

1,688 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Quarter Ended |

|

Quarter Ended |

|

Quarter Ended |

|

Six Months Ended |

|

Six Months Ended |

| |

|

June 30, 2018 |

|

March

31, 2018 |

|

June 30, 2017 |

|

June 30, 2018 |

|

June 30, 2017 |

| Average selling price

($/lb.): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Silicon

Metal |

|

$ |

1.26 |

|

$ |

1.25 |

|

$ |

1.00 |

|

$ |

1.26 |

|

$ |

0.97 |

|

Silicon-based Alloys |

|

$ |

0.87 |

|

$ |

0.89 |

|

$ |

0.72 |

|

$ |

0.88 |

|

$ |

0.69 |

|

Manganese-based Alloys |

|

$ |

0.59 |

|

$ |

0.62 |

|

$ |

0.59 |

|

$ |

0.60 |

|

$ |

0.59 |

|

Total* |

|

$ |

0.88 |

|

$ |

0.95 |

|

$ |

0.79 |

|

$ |

0.91 |

|

$ |

0.77 |

* Excludes by-products and other

“This was a solid quarter for Ferroglobe,

culminating a first half of the year which confirms the improved

fundamentals of our business and validates the positive momentum in

the markets we are serving,” said Pedro Larrea, CEO of Ferroglobe.

“In the year to date we have significantly increased volumes and

selling prices and our EBITDA has more than doubled compared with

the same period last year. The steel industries in North America

and Europe - the main end markets for most of our alloys - are

experiencing strong demand and high capacity utilizations in the

wake of recent trade protection measures. Prices of our

products have remained broadly stable overall, and current

supply/demand dynamics in our industry should support continued

healthy pricing.”

Cash flow generation impacted by

acquisition related working capital

During the second quarter, cash flows used for

operations was $4.6 million, the main driver being a working

capital increase of $70.0 million during Q2 2018. Approximately

half of that increase is from the recently acquired manganese-alloy

plants that have built their operating working capital, with a

further increase from seasonally high raw materials and finished

products inventories in the rest of our operations.

Ferroglobe’s net debt was $475.3 million as of June

30, 2018, up from $449.3 million as of March 31, 2018. The increase

in net debt is mainly due to the $70 million working capital

increase noted above. Excluding the acquisition impact of the

manganese-alloy plants, net debt has decreased by $1.6 million as

compared with December 31, 2017.

“We continue to be focused on cash generation and

deleveraging the balance sheet,” said Phillip Murnane, Ferroglobe’s

CFO. “Although the first half of the year has required meaningful

cash investment in working capital for the new manganese assets, we

have a rigorous cash generation initiative in place that will

provide significant cash flow release in the second half of the

year.”

The Company has declared an

interim dividend

Ferroglobe’s Board of Directors has declared an

interim dividend of $0.06 per share, further reflecting its

confidence in the underlying strength of Ferroglobe’s business and

long-term outlook. The dividend will have a record date of

September 5, 2018 and a payment date of September 20, 2018.

Adjusted EBITDA:

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Quarter Ended |

|

Quarter Ended |

|

Quarter Ended |

|

Six Months Ended |

|

Six Months Ended |

| |

|

June 30, 2018 |

|

March

31, 2018 |

|

June 30, 2017 |

|

June 30, 2018 |

|

June 30, 2017 |

| Profit

(loss) attributable to the parent |

|

$ |

67,438 |

|

|

$ |

36,680 |

|

|

$ |

2,859 |

|

|

$ |

104,118 |

|

|

$ |

(3,695 |

) |

| Loss attributable to

non-controlling interest |

|

|

(1,408 |

) |

|

|

(1,066 |

) |

|

|

(1,859 |

) |

|

|

(2,474 |

) |

|

|

(3,420 |

) |

| Income tax expense

(benefit) |

|

|

14,302 |

|

|

|

15,668 |

|

|

|

(1,949 |

) |

|

|

29,970 |

|

|

|

(3,163 |

) |

| Net finance

expense |

|

|

14,412 |

|

|

|

13,156 |

|

|

|

14,547 |

|

|

|

27,568 |

|

|

|

27,517 |

|

| Financial derivatives

(gain) loss |

|

|

(2,832 |

) |

|

|

1,765 |

|

|

|

4,071 |

|

|

|

(1,067 |

) |

|

|

4,071 |

|

| Exchange

differences |

|

|

8,708 |

|

|

|

(729 |

) |

|

|

(7,263 |

) |

|

|

7,979 |

|

|

|

(7,243 |

) |

| Depreciation and

amortization charges, operating allowances and write-downs |

|

|

30,309 |

|

|

|

28,016 |

|

|

|

26,401 |

|

|

|

58,325 |

|

|

|

53,623 |

|

|

EBITDA |

|

|

130,929 |

|

|

|

93,490 |

|

|

|

36,807 |

|

|

|

224,419 |

|

|

|

67,690 |

|

| Non-controlling

interest settlement |

|

|

— |

|

|

|

— |

|

|

|

1,751 |

|

|

|

— |

|

|

|

1,751 |

|

| Power credit |

|

|

— |

|

|

|

— |

|

|

|

(3,696 |

) |

|

|

— |

|

|

|

(3,696 |

) |

| Long lived asset charge

due to reclassification of discontinued operations to continuing

operations |

|

|

— |

|

|

|

— |

|

|

|

2,608 |

|

|

|

— |

|

|

|

2,608 |

|

| Accrual of contingent

liabilities |

|

|

— |

|

|

|

— |

|

|

|

6,400 |

|

|

|

— |

|

|

|

6,400 |

|

| Bargain purchase

gain |

|

|

(44,633 |

) |

|

|

— |

|

|

|

— |

|

|

|

(44,633 |

) |

|

|

— |

|

| Share-based

compensation |

|

|

— |

|

|

|

(3,886 |

) |

|

|

— |

|

|

|

(3,886 |

) |

|

|

— |

|

|

Adjusted EBITDA |

|

$ |

86,296 |

|

|

$ |

89,604 |

|

|

$ |

43,870 |

|

|

$ |

175,900 |

|

|

$ |

74,753 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted profit attributable to Ferroglobe:

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Quarter Ended |

|

Quarter Ended |

|

Quarter Ended |

|

Six Months Ended |

|

Six Months Ended |

| |

|

June 30, 2018 |

|

March

31, 2018 |

|

June 30, 2017 |

|

June 30, 2018 |

|

June 30, 2017 |

| Profit

(loss) attributable to the parent |

|

$ |

67,438 |

|

|

$ |

36,680 |

|

|

$ |

2,859 |

|

|

|

104,118 |

|

|

$ |

(3,695 |

) |

| Tax rate

adjustment |

|

|

(11,404 |

) |

|

|

(742 |

) |

|

|

(1,645 |

) |

|

|

(12,146 |

) |

|

|

126 |

|

|

Non-controlling interest settlement |

|

|

— |

|

|

|

— |

|

|

|

1,191 |

|

|

|

— |

|

|

|

1,191 |

|

| Power

credit |

|

|

— |

|

|

|

— |

|

|

|

(2,513 |

) |

|

|

— |

|

|

|

(2,513 |

) |

| Long

lived asset charge due to reclassification of discontinued

operations to continuing operations |

|

|

— |

|

|

|

— |

|

|

|

1,773 |

|

|

|

— |

|

|

|

1,773 |

|

| Accrual

of contingent liabilities |

|

|

— |

|

|

|

— |

|

|

|

4,352 |

|

|

|

— |

|

|

|

4,352 |

|

| Bargain

purchase gain |

|

|

(30,350 |

) |

|

|

— |

|

|

|

— |

|

|

|

(30,350 |

) |

|

|

— |

|

|

Share-based compensation |

|

|

— |

|

|

|

(2,642 |

) |

|

|

— |

|

|

|

(2,642 |

) |

|

|

— |

|

|

Adjusted profit attributable to the

parent |

|

$ |

25,684 |

|

|

$ |

33,296 |

|

|

$ |

6,017 |

|

|

|

58,980 |

|

|

$ |

1,234 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted diluted profit per share:

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Quarter Ended |

|

Quarter Ended |

|

Quarter Ended |

|

Six Months Ended |

|

Six Months Ended |

| |

|

June 30, 2018 |

|

March

31, 2018 |

|

June 30, 2017 |

|

June 30, 2018 |

|

June 30, 2017 |

| Diluted

profit (loss) per ordinary share |

|

$ |

0.39 |

|

|

$ |

0.21 |

|

|

$ |

0.02 |

|

|

$ |

0.60 |

|

|

$ |

(0.02 |

) |

| Tax rate

adjustment |

|

|

(0.07 |

) |

|

|

— |

|

|

|

(0.01 |

) |

|

|

(0.07 |

) |

|

|

— |

|

|

Non-controlling interest settlement |

|

|

— |

|

|

|

— |

|

|

|

0.01 |

|

|

|

— |

|

|

|

0.01 |

|

| Power

credit |

|

|

— |

|

|

|

— |

|

|

|

(0.01 |

) |

|

|

— |

|

|

|

(0.01 |

) |

| Long

lived asset charge due to reclassification of discontinued

operations to continuing operations |

|

|

— |

|

|

|

— |

|

|

|

0.01 |

|

|

|

— |

|

|

|

0.01 |

|

| Accrual

of contingent liabilities |

|

|

— |

|

|

|

— |

|

|

|

0.03 |

|

|

|

— |

|

|

|

0.03 |

|

| Bargain

purchase gain |

|

|

(0.18 |

) |

|

|

— |

|

|

|

— |

|

|

|

(0.18 |

) |

|

|

— |

|

|

Share-based compensation |

|

|

— |

|

|

|

(0.02 |

) |

|

|

— |

|

|

|

(0.02 |

) |

|

|

— |

|

|

Adjusted diluted profit per ordinary

share |

|

$ |

0.14 |

|

|

$ |

0.19 |

|

|

$ |

0.05 |

|

|

$ |

0.33 |

|

|

$ |

0.02 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Conference

Call

Ferroglobe management will review the second

quarter results of 2018 during a conference call at 9 a.m.

Eastern Time on Wednesday, August 22, 2018.

The dial-in number for participants in the United

States is 877‑293‑5491 (conference ID 6293829). International

callers should dial +1 914‑495‑8526 (conference ID 6293829). Please

dial in at least five minutes prior to the call to register. The

call may also be accessed via an audio webcast available at

https://edge.media-server.com/m6/p/5bqj5wmw

About

Ferroglobe

Ferroglobe is one of the world’s leading suppliers

of silicon metal, silicon-based specialty alloys, and ferroalloys

serving a customer base across the globe in dynamic and

fast-growing end markets, such as solar, automotive, consumer

products, construction and energy. The Company is based in London.

For more information, visit http://investor.ferroglobe.com.

Forward-Looking

Statements

This release contains "forward-looking statements"

within the meaning of U.S. securities laws. Forward-looking

statements are not historical facts but are based on certain

assumptions of management and describe the Company’s future plans,

strategies and expectations. Forward-looking statements often use

forward-looking terminology, including words such as "anticipate",

"believe", "could", "estimate", "expect", "forecast", "guidance",

"intends", "likely", "may", "plan", "potential", "predicts",

"seek", "will" and words of similar meaning or the negative

thereof.

Forward-looking statements contained in this press

release are based on information currently available to the Company

and assumptions that management believe to be reasonable, but are

inherently uncertain. As a result, Ferroglobe’s actual results,

performance or achievements may differ materially from those

expressed or implied by these forward-looking statements, which are

not guarantees of future performance and involve known and unknown

risks, uncertainties and other factors that are, in some cases,

beyond the Company’s control.

Forward-looking financial information and other

metrics presented herein represent the Company’s goals and are not

intended as guidance or projections for the periods referenced

herein or any future periods.

All information in this press release is as of the

date of its release. Ferroglobe does not undertake any

obligation to update publicly any of the forward-looking statements

contained herein to reflect new information, events or

circumstances arising after the date of this press release. You

should not place undue reliance on any forward-looking statements,

which are made only as of the date of this press release.

Non-IFRS

Measures

EBITDA, adjusted EBITDA, adjusted diluted profit

(loss) per ordinary share and adjusted profit (loss) are non-IFRS

financial metrics that, we believe, are pertinent measures of

Ferroglobe’s success.

Ferroglobe has included these financial metrics to

provide supplemental measures of its performance. The Company

believes these metrics are important because they eliminate items

that have less bearing on the Company’s current and future

operating performance and highlight trends in its core business

that may not otherwise be apparent when relying solely on IFRS

financial measures.

INVESTOR CONTACT:

Phillip Murnane: +44 (0) 203 129 2265Chief Financial

OfficerEmail: phillip.murnane@ferroglobe.com

|

|

| Ferroglobe PLC and

SubsidiariesUnaudited Condensed Consolidated

Income Statement(in thousands of U.S. dollars,

except per share amounts) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Quarter Ended |

|

Quarter Ended |

|

Quarter Ended |

|

Six Months Ended |

|

Six Months Ended |

| |

|

June 30, 2018 |

|

March

31, 2018 |

|

June 30, 2017 |

|

June 30, 2018 |

|

June 30, 2017 |

| Sales |

|

$ |

582,977 |

|

|

$ |

560,704 |

|

|

$ |

425,810 |

|

|

$ |

1,143,681 |

|

|

$ |

821,847 |

|

| Cost of sales |

|

|

(343,817 |

) |

|

|

(320,678 |

) |

|

|

(250,279 |

) |

|

|

(664,495 |

) |

|

|

(491,417 |

) |

| Other operating

income |

|

|

8,511 |

|

|

|

6,786 |

|

|

|

4,008 |

|

|

|

15,297 |

|

|

|

5,637 |

|

| Staff costs |

|

|

(88,743 |

) |

|

|

(82,423 |

) |

|

|

(74,168 |

) |

|

|

(171,166 |

) |

|

|

(140,653 |

) |

| Other operating

expense |

|

|

(75,384 |

) |

|

|

(70,862 |

) |

|

|

(65,009 |

) |

|

|

(146,246 |

) |

|

|

(125,133 |

) |

| Depreciation and

amortization charges, operating allowances and write-downs |

|

|

(30,309 |

) |

|

|

(28,016 |

) |

|

|

(26,401 |

) |

|

|

(58,325 |

) |

|

|

(53,623 |

) |

| Bargain purchase

gain |

|

|

44,633 |

|

|

|

— |

|

|

|

— |

|

|

|

44,633 |

|

|

|

— |

|

| Other gain (loss) |

|

|

2,752 |

|

|

|

(37 |

) |

|

|

(3,555 |

) |

|

|

2,715 |

|

|

|

(2,591 |

) |

|

Operating profit |

|

|

100,620 |

|

|

|

65,474 |

|

|

|

10,406 |

|

|

|

166,094 |

|

|

|

14,067 |

|

| Net finance

expense |

|

|

(14,412 |

) |

|

|

(13,156 |

) |

|

|

(14,547 |

) |

|

|

(27,568 |

) |

|

|

(27,517 |

) |

| Financial derivatives

gain (loss) |

|

|

2,832 |

|

|

|

(1,765 |

) |

|

|

(4,071 |

) |

|

|

1,067 |

|

|

|

(4,071 |

) |

| Exchange

differences |

|

|

(8,708 |

) |

|

|

729 |

|

|

|

7,263 |

|

|

|

(7,979 |

) |

|

|

7,243 |

|

| Profit

(loss) before tax |

|

|

80,332 |

|

|

|

51,282 |

|

|

|

(949 |

) |

|

|

131,614 |

|

|

|

(10,278 |

) |

| Income tax (expense)

benefit |

|

|

(14,302 |

) |

|

|

(15,668 |

) |

|

|

1,949 |

|

|

|

(29,970 |

) |

|

|

3,163 |

|

| Profit

(loss) for the period |

|

|

66,030 |

|

|

|

35,614 |

|

|

|

1,000 |

|

|

|

101,644 |

|

|

|

(7,115 |

) |

| Loss attributable to

non-controlling interest |

|

|

1,408 |

|

|

|

1,066 |

|

|

|

1,859 |

|

|

|

2,474 |

|

|

|

3,420 |

|

| Profit

(loss) attributable to the parent |

|

$ |

67,438 |

|

|

$ |

36,680 |

|

|

$ |

2,859 |

|

|

$ |

104,118 |

|

|

$ |

(3,695 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| EBITDA |

|

$ |

130,929 |

|

|

$ |

93,490 |

|

|

$ |

36,807 |

|

|

$ |

224,419 |

|

|

$ |

67,690 |

|

| Adjusted EBITDA |

|

$ |

86,296 |

|

|

$ |

89,604 |

|

|

$ |

43,870 |

|

|

$ |

175,900 |

|

|

$ |

74,753 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares

outstanding |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

171,987 |

|

|

|

171,977 |

|

|

|

171,947 |

|

|

|

171,982 |

|

|

|

171,947 |

|

|

Diluted |

|

|

172,127 |

|

|

|

172,215 |

|

|

|

172,047 |

|

|

|

172,144 |

|

|

|

171,947 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Profit

(loss) per ordinary share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.39 |

|

|

$ |

0.21 |

|

|

$ |

0.02 |

|

|

$ |

0.61 |

|

|

$ |

(0.02 |

) |

|

Diluted |

|

$ |

0.39 |

|

|

$ |

0.21 |

|

|

$ |

0.02 |

|

|

$ |

0.60 |

|

|

$ |

(0.02 |

) |

| |

|

| Ferroglobe PLC and Subsidiaries |

|

| Unaudited Condensed Consolidated Statement of

Financial Position |

|

| (in thousands of U.S. dollars) |

|

| |

|

|

|

|

|

|

|

|

|

|

| |

|

June 30, |

|

March 30, |

|

December 31, |

|

| |

|

2018 |

|

2018 |

|

2017 |

|

| ASSETS |

|

| Non-current

assets |

|

|

|

|

|

|

|

|

|

|

|

Goodwill |

|

$ |

203,717 |

|

$ |

204,537 |

|

$ |

205,287 |

|

| Other

intangible assets |

|

|

57,897 |

|

|

61,774 |

|

|

58,658 |

|

| Property,

plant and equipment |

|

|

947,229 |

|

|

980,101 |

|

|

917,974 |

|

|

Non-current financial assets |

|

|

116,974 |

|

|

147,744 |

|

|

89,315 |

|

| Deferred

tax assets |

|

|

3,972 |

|

|

6,581 |

|

|

5,273 |

|

|

Non-current receivables from related parties |

|

|

2,332 |

|

|

2,464 |

|

|

2,400 |

|

| Other

non-current assets |

|

|

18,887 |

|

|

32,125 |

|

|

30,059 |

|

| Total

non-current assets |

|

|

1,351,008 |

|

|

1,435,326 |

|

|

1,308,966 |

|

| Current

assets |

|

|

|

|

|

|

|

|

|

|

|

Inventories |

|

|

532,574 |

|

|

493,108 |

|

|

361,231 |

|

| Trade and

other receivables |

|

|

151,062 |

|

|

142,641 |

|

|

111,463 |

|

| Current

receivables from related parties |

|

|

5,550 |

|

|

8,841 |

|

|

4,572 |

|

| Current

income tax assets |

|

|

10,405 |

|

|

6,524 |

|

|

17,158 |

|

| Current

financial assets |

|

|

854 |

|

|

897 |

|

|

2,469 |

|

| Other

current assets |

|

|

18,283 |

|

|

16,095 |

|

|

9,926 |

|

| Cash and

cash equivalents |

|

|

155,984 |

|

|

197,669 |

|

|

184,472 |

|

| Total current

assets |

|

|

874,712 |

|

|

865,775 |

|

|

691,291 |

|

| Total

assets |

|

$ |

2,225,720 |

|

$ |

2,301,101 |

|

$ |

2,000,257 |

|

| |

|

|

|

|

|

|

|

|

|

|

| EQUITY AND LIABILITIES |

|

|

Equity |

|

$ |

1,004,125 |

|

$ |

979,504 |

|

$ |

937,758 |

|

| Non-current

liabilities |

|

|

|

|

|

|

|

|

|

|

| Deferred

income |

|

|

5,387 |

|

|

7,321 |

|

|

3,172 |

|

|

Provisions |

|

|

78,767 |

|

|

82,957 |

|

|

82,397 |

|

| Bank

borrowings |

|

|

108,143 |

|

|

71,242 |

|

|

- |

|

|

Obligations under finance leases |

|

|

61,078 |

|

|

68,101 |

|

|

69,713 |

|

| Debt

instruments |

|

|

340,564 |

|

|

341,036 |

|

|

339,332 |

|

| Other

financial liabilities |

|

|

42,138 |

|

|

58,288 |

|

|

49,011 |

|

| Other

non-current liabilities |

|

|

21,178 |

|

|

64,457 |

|

|

3,536 |

|

| Deferred

tax liabilities |

|

|

64,689 |

|

|

64,733 |

|

|

65,142 |

|

| Total

non-current liabilities |

|

|

721,944 |

|

|

758,135 |

|

|

612,303 |

|

| Current

liabilities |

|

|

|

|

|

|

|

|

|

|

|

Provisions |

|

|

22,563 |

|

|

30,162 |

|

|

33,095 |

|

| Bank

borrowings |

|

|

1,241 |

|

|

850 |

|

|

1,003 |

|

|

Obligations under finance leases |

|

|

13,024 |

|

|

13,478 |

|

|

12,920 |

|

| Debt

instruments |

|

|

10,936 |

|

|

2,735 |

|

|

10,938 |

|

| Other

financial liabilities |

|

|

54,158 |

|

|

91,243 |

|

|

88,420 |

|

| Payables

to related parties |

|

|

17,599 |

|

|

10,671 |

|

|

12,973 |

|

| Trade and

other payables |

|

|

276,289 |

|

|

298,438 |

|

|

192,859 |

|

| Current

income tax liabilities |

|

|

4,210 |

|

|

5,889 |

|

|

7,419 |

|

| Other

current liabilities |

|

|

99,631 |

|

|

109,996 |

|

|

90,569 |

|

| Total current

liabilities |

|

|

499,651 |

|

|

563,462 |

|

|

450,196 |

|

| Total equity

and liabilities |

|

$ |

2,225,720 |

|

$ |

2,301,101 |

|

$ |

2,000,257 |

|

| |

|

|

|

|

|

|

|

|

|

|

| Ferroglobe PLC and Subsidiaries |

|

| Unaudited Condensed Consolidated Statement of

Cash Flows |

|

| (in thousands of U.S. dollars) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Quarter Ended |

|

Quarter Ended |

|

Quarter Ended |

|

Six Months Ended |

|

Six Months Ended |

|

| |

|

June 30, 2018 |

|

March 31, 2018 |

|

June 30, 2017 |

|

June 30, 2018 |

|

June 30, 2017 |

|

| Cash flows from

operating activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Profit (loss)

for the period |

|

$ |

66,030 |

|

|

$ |

35,614 |

|

|

$ |

1,000 |

|

|

$ |

101,644 |

|

|

$ |

(7,115 |

) |

|

| Adjustments to

reconcile net profit (loss) to net cash (used)

provided by operating activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income

tax expense (benefit) |

|

|

14,302 |

|

|

|

15,668 |

|

|

|

(1,949 |

) |

|

|

29,970 |

|

|

|

(3,163 |

) |

|

|

Depreciation and amortization charges, operating allowances and

write-downs |

|

|

30,309 |

|

|

|

28,016 |

|

|

|

26,401 |

|

|

|

58,325 |

|

|

|

53,623 |

|

|

| Net

finance expense |

|

|

14,412 |

|

|

|

13,156 |

|

|

|

14,547 |

|

|

|

27,568 |

|

|

|

27,517 |

|

|

| Financial

derivatives (gain) loss |

|

|

(2,832 |

) |

|

|

1,765 |

|

|

|

4,071 |

|

|

|

(1,067 |

) |

|

|

4,071 |

|

|

| Exchange

differences |

|

|

8,708 |

|

|

|

(729 |

) |

|

|

(7,263 |

) |

|

|

7,979 |

|

|

|

(7,243 |

) |

|

| Bargain

purchase gain |

|

|

(44,633 |

) |

|

|

— |

|

|

|

— |

|

|

|

(44,633 |

) |

|

|

— |

|

|

|

Share-based compensation |

|

|

33 |

|

|

|

699 |

|

|

|

— |

|

|

|

732 |

|

|

|

— |

|

|

| Other

adjustments |

|

|

(2,752 |

) |

|

|

37 |

|

|

|

3,556 |

|

|

|

(2,715 |

) |

|

|

2,592 |

|

|

| Changes in

operating assets and liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Increase) decrease in inventories |

|

|

(59,050 |

) |

|

|

(107,481 |

) |

|

|

(11,943 |

) |

|

|

(166,531 |

) |

|

|

(4,835 |

) |

|

|

(Increase) decrease in trade receivables |

|

|

(19,257 |

) |

|

|

(513 |

) |

|

|

9,456 |

|

|

|

(19,770 |

) |

|

|

13,221 |

|

|

| Increase

in trade payables |

|

|

476 |

|

|

|

70,375 |

|

|

|

(8,943 |

) |

|

|

70,851 |

|

|

|

9,213 |

|

|

|

Other |

|

|

6,817 |

|

|

|

(49,770 |

) |

|

|

(506 |

) |

|

|

(42,953 |

) |

|

|

(35,051 |

) |

|

| Income taxes paid |

|

|

(14,186 |

) |

|

|

(9,982 |

) |

|

|

(3,919 |

) |

|

|

(24,168 |

) |

|

|

(6,216 |

) |

|

| Interest paid |

|

|

(2,957 |

) |

|

|

(17,301 |

) |

|

|

(4,378 |

) |

|

|

(20,258 |

) |

|

|

(14,107 |

) |

|

| Net cash (used)

provided by operating activities |

|

|

(4,580 |

) |

|

|

(20,446 |

) |

|

|

20,130 |

|

|

|

(25,026 |

) |

|

|

32,507 |

|

|

| Cash flows from

investing activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Payments due to

investments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other

intangible assets |

|

|

(2,221 |

) |

|

|

(703 |

) |

|

|

— |

|

|

|

(2,924 |

) |

|

|

(410 |

) |

|

| Property,

plant and equipment |

|

|

(29,778 |

) |

|

|

(22,531 |

) |

|

|

(14,319 |

) |

|

|

(52,309 |

) |

|

|

(26,681 |

) |

|

|

Other |

|

|

(8 |

) |

|

|

— |

|

|

|

— |

|

|

|

(8 |

) |

|

|

(14 |

) |

|

|

Disposals: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other

non-current assets |

|

|

12,734 |

|

|

|

— |

|

|

|

— |

|

|

|

12,734 |

|

|

|

— |

|

|

|

Other |

|

|

1,904 |

|

|

|

4,010 |

|

|

|

— |

|

|

|

5,914 |

|

|

|

— |

|

|

| Acquisition of

subsidiary |

|

|

— |

|

|

|

(20,379 |

) |

|

|

— |

|

|

|

(20,379 |

) |

|

|

— |

|

|

| Interest and finance

income received |

|

|

2,273 |

|

|

|

79 |

|

|

|

211 |

|

|

|

2,352 |

|

|

|

564 |

|

|

| Net cash used

by investing activities |

|

|

(15,096 |

) |

|

|

(39,524 |

) |

|

|

(14,108 |

) |

|

|

(54,620 |

) |

|

|

(26,541 |

) |

|

| Cash flows from

financing activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Dividends paid |

|

|

(10,321 |

) |

|

|

— |

|

|

|

— |

|

|

|

(10,321 |

) |

|

|

— |

|

|

| Payment for debt

issuance costs |

|

|

— |

|

|

|

(4,476 |

) |

|

|

(3,078 |

) |

|

|

(4,476 |

) |

|

|

(13,555 |

) |

|

| Repayment of other

financial liabilities |

|

|

(33,096 |

) |

|

|

— |

|

|

|

— |

|

|

|

(33,096 |

) |

|

|

— |

|

|

| Proceeds from debt

issuance |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

350,000 |

|

|

|

Increase/(decrease) in bank borrowings: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Borrowings |

|

|

37,668 |

|

|

|

182,364 |

|

|

|

30 |

|

|

|

220,032 |

|

|

|

31,455 |

|

|

|

Payments |

|

|

— |

|

|

|

(106,514 |

) |

|

|

(15,300 |

) |

|

|

(106,514 |

) |

|

|

(387,680 |

) |

|

| Proceeds from stock

option exercises |

|

|

240 |

|

|

|

— |

|

|

|

— |

|

|

|

240 |

|

|

|

— |

|

|

| Other amounts paid due

to financing activities |

|

|

(4,648 |

) |

|

|

(2,987 |

) |

|

|

(10,694 |

) |

|

|

(7,635 |

) |

|

|

(17,905 |

) |

|

| Net cash (used)

provided by financing activities |

|

|

(10,157 |

) |

|

|

68,387 |

|

|

|

(29,042 |

) |

|

|

58,230 |

|

|

|

(37,685 |

) |

|

| Total net cash

flows for the period |

|

|

(29,833 |

) |

|

|

8,417 |

|

|

|

(23,020 |

) |

|

|

(21,416 |

) |

|

|

(31,719 |

) |

|

| Beginning

balance of cash and cash equivalents |

|

|

197,669 |

|

|

|

184,472 |

|

|

|

193,031 |

|

|

|

184,472 |

|

|

|

196,982 |

|

|

| Exchange

differences on cash and cash equivalents in foreign currencies |

|

|

(11,852 |

) |

|

|

4,780 |

|

|

|

13,550 |

|

|

|

(7,072 |

) |

|

|

18,298 |

|

|

| Ending balance

of cash and cash equivalents |

|

$ |

155,984 |

|

|

$ |

197,669 |

|

|

$ |

183,561 |

|

|

$ |

155,984 |

|

|

$ |

183,561 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

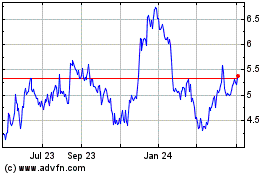

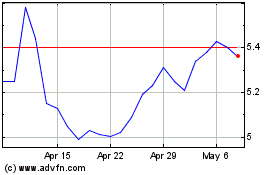

Ferroglobe (NASDAQ:GSM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ferroglobe (NASDAQ:GSM)

Historical Stock Chart

From Apr 2023 to Apr 2024