Current Report Filing (8-k)

August 21 2018 - 2:44PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section

13 OR 15(d) of the Securities Exchange Act of 1934

Date of Report (Date

of earliest event reported):

August 17, 2018

DarkPulse, Inc.

(Exact name of registrant as specified in its charter)

|

Delaware

|

000-18730

|

87-0472109

|

|

(State or other jurisdiction of incorporation)

|

(Commission File Number)

|

(IRS Employer Identification Number)

|

|

8760 Virginia Meadows Dr.

|

|

20109

|

|

Manassas, Virginia

|

|

(Zip Code)

|

|

(Address of principal executive offices)

|

|

|

(800) 436-1436

(Registrant’s telephone

number, including area code)

_________________________

(former name or former

address, if changed since last report)

Check the appropriate box below if the Form

8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions

(see General Instruction A.2. below):

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

☐

|

Precommencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

☐

|

Precommencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

☐

If an emerging growth company, indicate by

check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☐

ITEM 1.01 ENTRY INTO MATERIAL

DEFINITIVE AGREEMENT.

The

disclosure in Item 2.01 below is incorporated by reference into this Item 1.01.

ITEM 2.01 COMPLETION OF

ACQUISITION OR DISPOSITION OF ASSETS.

As disclosed in the registrant’s

Current Report on Form 8-K filed on May 1, 2018, on April 27, 2018, the registrant, formerly known as Klever Marketing, Inc. and

now known as DarkPulse, Inc. (the “

Company

”), DarkPulse Technologies Inc., a New Brunswick corporation (the

“

Private Company

”), and DPTH Acquisition Corporation, a Utah corporation and wholly owned subsidiary of Parent

(the “

Merger Subsidiary

”) entered into an Agreement and Plan of Merger (the “

Agreement

”),

pursuant to which the Merger Subsidiary would merge with and into the Private Company and the Private Company would be the surviving

corporation and become a wholly owned subsidiary of the Company (the “

Subsidiary Merger

”). As disclosed in the

registrant’s Current Report on Form 8-K filed on July 24, 2018, on July 18, 2018, the Company closed the Subsidiary Merger

and filed Articles of Merger merging the Merger Subsidiary into the Private Company, the Private Company paid the Company $150,000

as required by the Agreement, and the Company issued 88,235 shares of its Series D Preferred Stock (the “

Shares

”)

to the Private Company shareholders in consideration of their shares of the Private Company, with the Private Company becoming

a wholly owned subsidiary of the Company.

On August 17, 2018, the

parties determined to further amend the Agreement to modify the mechanism by which the Company acquired the Private Company, with

the Company acquiring 100% of the Private Company by direct share exchange rather than by subsidiary merger, effective as of the

original closing on July 18, 2018. No economic terms, representations, covenants or other terms regarding the transaction were

modified, and the Private Company is still considered a wholly owned subsidiary of the Company as of July 18, 2018. The only modification

is that the Company has now acquired the Private Company by share exchange rather than by subsidiary merger, with the Shares having

been issued to the Private Company shareholders in consideration of the Private Company shareholders having transferred their shares

of the Private Company to the Company as of July 18, 2018.

The foregoing description

of the amendment is qualified in its entirety by reference to the full text of the amendment, filed as Exhibit 2.1 to and incorporated

by reference in this report.

|

|

ITEM 9.01

|

FINANCIAL STATEMENTS AND EXHIBITS.

|

(d) Exhibits

The exhibits listed in the following Exhibit Index

are filed as part of this report:

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

DarkPulse, Inc.

|

|

|

|

|

|

Dated: August 21, 2018

|

By:

|

/s/ Dennis M. O’Leary

|

|

|

|

Dennis M. O’Leary

|

|

|

|

CEO & Chairman

|

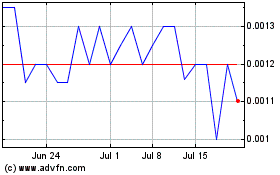

DarkPulse (PK) (USOTC:DPLS)

Historical Stock Chart

From Mar 2024 to Apr 2024

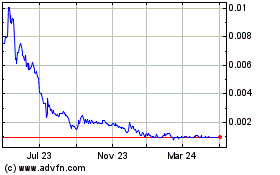

DarkPulse (PK) (USOTC:DPLS)

Historical Stock Chart

From Apr 2023 to Apr 2024