2018 Second Quarter Highlights:

Coastal Financial Corporation (NASDAQ: CCB) (the “Company”) today

reported unaudited financial results for the second quarter

2018. Net income for the second quarter of 2018 was $2.2

million, or $0.24 per diluted common share, compared with net

income of $1.8 million, or $0.20 per diluted share, for the first

quarter of 2018.

On July 18, 2018, the Company closed its initial public offering

of 2,577,500 shares of common stock, including the exercise of the

over-allotment of 427,500 shares, for net proceeds of $33.2 million

after deducting underwriting discounts, commissions, and estimated

offering expenses.

Eric Sprink, President and CEO, commented, “We are pleased with

our second quarter financial performance, especially our deposit

and loan growth. Historically, the second quarter has been a

tougher quarter to grow deposits due to customers withdrawing funds

to pay taxes. However, for the three months ended June 30,

2018 deposit growth on an annualized basis was 9.5% and loan growth

was 13.1%. We believe that the loan and deposit growth,

combined with the increase in net interest margin, positions us

well for continued growth in earnings.”

In addition, our initial public offering, which was completed on

July 20, 2018, was priced at $14.50 a share (which was near the top

of the offering range), and net proceeds were $33.2 million after

expenses. We intend to use the net proceeds from this

offering to support our growth, organically or through mergers and

acquisitions, and for general corporate purposes.”

The Company had net income of $4.0 million for the six months

ended June 30, 2018, or $0.44 per diluted common share, compared to

$3.2 million, or $0.35 per diluted common share for the six months

ended June 30, 2017.

Results of Operations

Net interest income was $8.3 million for the three months ended

June 30, 2018, an increase of 6.4% from $7.8 million for the first

quarter of 2018, and an increase of 15.3% from $7.2 million for the

second quarter of 2017. Increases over the prior quarter and prior

year were the result of growth in interest earning assets,

primarily loans, and improvements in net interest margin.

Net interest income for the six months ended June 30, 2018

totaled $16.1 million, an increase of 14.2% compared to the same

period last year. The $2.0 million increase in net interest income

over the same period last year was primarily related to growth in

loan balances. During the six months ended June 30, 2018, the

average balance of total loans receivable increased by $69.2

million, compared to the same period last year. This increase was

partially offset by increased deposit costs from the growth in the

balance of our deposits of $40.7 million and an increase in the

cost of deposit funds of 12 basis points, compared to the same

period last year.

Net interest margin for the quarter ended June 30, 2018

increased 14 basis points to 4.26% from 4.12% for the first quarter

of 2018 and from 4.12% for the second quarter of 2017. The increase

in net interest over the comparable period in the prior year was

primarily due to increases in loan volume as a percent of earning

assets and higher prepayment penalties and deferred fees recognized

on loans paid off, and to a lesser extent, increases in average

loan yields. The average loan receivable balance for the three

months ended June 30, 2018 was $689.0 million, an increase of 5.3%

compared to the prior quarter of 2018 and an increase of 13.5% from

the same quarter one year ago.

Net interest margin for the six months ended June 30, 2018

increased 12 basis points to 4.19% from 4.07% for the comparable

period last year. The increase in net interest over the comparable

period in the prior year was primarily due to increases in loan

volume as a percent of earning assets and higher prepayment

penalties and deferred fees recognized on loans paid off in the

first two quarters of 2018, and to a lesser extent, increases in

average loan yields.

Loan yields for the quarter ended June 30, 2018 were 5.11%, an

increase of four basis points from 5.07% for the quarter ended

March 31, 2018, and a 12 basis point increase from 4.99% for the

quarter ended June 30, 2017. Loan yields for the six months ended

June 30, 2018 were 5.09%, an increase of 13 basis points from 4.96%

for the six months ended June 30, 2017. Prepayment penalties and

deferred fees recognized on loans paid off in both the current

quarter and previous quarter were each 0.09% higher than the

quarter ended June 30, 2017. Contractual loan yields approximated

4.92% for the three months ended June 30, 2018, 4.88% for the three

months ended March 31, 2018, and 4.89% for the three months ended

June 30, 2017.

The following table shows the Company’s key performance ratios

for the periods indicated.

|

|

|

Three months ended |

|

Six months ended |

|

|

|

June 30, 2018 |

March 31, 2018 |

June 30, 2017 |

|

June 30, 2018 |

June 30, 2017 |

|

|

|

|

|

|

|

|

|

| Return on average

assets (1) |

|

1.09% |

0.93% |

1.03% |

|

1.02% |

0.88% |

| Return on average

shareholders’ equity (1) |

|

12.90% |

11.09% |

12.00% |

|

12.07% |

9.81% |

| Yield on earnings

assets (1) |

|

4.73% |

4.56% |

4.51% |

|

4.65% |

4.45% |

| Yield on loans

receivable (1) |

|

5.11% |

5.07% |

4.99% |

|

5.09% |

4.96% |

| Cost of funds (1) |

|

0.50% |

0.46% |

0.41% |

|

0.48% |

0.41% |

| Cost of deposits

(1) |

|

0.40% |

0.37% |

0.30% |

|

0.38% |

0.31% |

| Net interest margin

(1) |

|

4.26% |

4.12% |

4.12% |

|

4.19% |

4.07% |

| Noninterest expense to

average assets (1) |

|

3.15% |

3.07% |

3.32% |

|

3.12% |

2.98% |

| Efficiency ratio |

|

66.77% |

68.28% |

66.27% |

|

67.50% |

67.96% |

| Loans receivable to

deposits |

|

94.12% |

93.30% |

97.25% |

|

94.12% |

97.25% |

| |

|

|

|

|

|

|

|

| (1) annualized

calculations |

|

|

|

|

|

|

|

Noninterest income was $1.2 million for the second quarter of

2018, an increase of $106,000 from $1.1 million for the first

quarter of 2018 and an increase of $193,000 from $1.0 million for

the comparable period one year ago. The increase compared to the

prior quarter was primarily due to newly assessed point of sale/ATM

fees and increased activity in merchant services, which resulted in

an additional $84,000 of income during the quarter. The increase in

noninterest income compared to the same quarter one year ago was

primarily related to increases in existing deposit fees and the

introduction of new deposit fees to bring those fees in line with

the industry. Sublease and lease income decreased in the second

quarter 2018, as compared to both first quarter 2018 and second

quarter 2017, as a result of a long-term tenant electing to not

renew their lease.

Noninterest income was $2.3 million for the six months ended

June 30, 2018, compared to $1.9 million for the six months ended

June 30, 2017. The increase is primarily related to newly assessed

deposit fees, as discussed above. Loan referral fee income, which

is earned when a borrower enters into an interest rate swap

agreement with a third party, totaled $244,000 for the six months

ended June 30, 2018, an increase of $202,000 from the same period

last year.

Total noninterest expense for the current quarter increased 4.9%

to $6.4 million from $6.1 million for the preceding quarter and

increased 16.4% from $5.5 million from the comparable period one

year ago. The increased expenses for the current quarter compared

to the prior quarter and previous quarter one year ago were

primarily due to increases in salary expenses. Full time equivalent

employees increased 7% during the current quarter and increased 14%

from the same quarter one year ago. Staffing increases are due to

the continued organic growth initiatives, and includes increases in

sales staff, including hiring new banking teams, and additional

back office staffing to support the incremental increases in

banking teams and for operation as a public company.

Total noninterest expense for the six months ended June 30, 2018

totaled $12.4 million, an increase of 14.8% compared to the same

period last year. The increase is primarily attributable to

increased salary expense, as discussed above and the addition of

our Woodinville branch in October 2017.

The provision for income taxes decreased 33.3% for the current

quarter and the six months ended June 30, 2018, compared to the

same periods last year, primarily due to the Tax Cuts and Jobs Act

legislation which was signed into law on December 22, 2017. The

Company began using the lower tax rate of 21.0% for the current

fiscal year.

Balance Sheet

The Company’s total assets increased $45.1 million, or 5.6%, to

$850.9 million at June 30, 2018 from $805.8 million at December 31,

2017 due to the Company’s organic growth initiatives.

Total loans receivable, net of allowance for loan losses,

increased $43.4 million, or 6.7%, to $692.2 million at June 30,

2018 from $648.8 million at December 31, 2017. The growth in

loans receivable was due primarily to increases in commercial real

estate loans of $36.6 million.

The following table summarizes the loan portfolio at the periods

indicated.

| |

|

|

|

| |

|

As of |

|

|

|

|

June 30, 2018 |

|

December 31, 2017 |

|

June 30, 2017 |

|

| (Dollars

in thousands) |

|

Balance |

% to Total |

|

Balance |

% to Total |

|

Balance |

% to Total |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Commercial and

industrial loans |

|

$ |

89,284 |

12.7% |

|

$ |

88,688 |

13.5% |

|

$ |

84,792 |

13.6% |

|

| Real estate: |

|

|

|

|

|

|

|

|

|

|

| Construction,

land and |

|

|

|

|

|

|

|

|

|

|

| land

development |

|

46,356 |

6.6 |

|

41,641 |

6.3 |

|

45,626 |

7.3 |

|

|

Residential |

|

88,422 |

12.6 |

|

87,031 |

13.3 |

|

69,478 |

11.1 |

|

| Commercial real

estate |

|

474,330 |

67.7 |

|

437,717 |

66.6 |

|

422,156 |

67.7 |

|

| Consumer and

other |

|

2,670 |

0.4 |

|

2,058 |

0.3 |

|

1,795 |

0.3 |

|

| Gross loans

receivable |

|

701,062 |

100.0% |

|

657,135 |

100.0% |

|

623,847 |

100.0% |

|

| Net deferred

origination fees |

|

(370) |

|

|

(347) |

|

|

(597) |

|

|

| Loans

receivable |

|

$ |

700,692 |

|

|

$ |

656,788 |

|

|

$ |

623,250 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

Total deposits increased $41.2 million, or 5.9%, to $744.5

million at June 30, 2018 from $703.3 million at December 31,

2017. The increase in deposits included increases in

non-interest bearing deposit accounts of $17.1 million, or 7.1%,

and total time deposits of $9.2 million, or 10.1%.

The following table shows the Company’s deposit composition for

the periods indicated.

|

|

|

|

As of |

| |

|

June 30, 2018 |

|

|

December 31, 2017 |

|

|

June 30, 2017 |

|

| (Dollars

in thousands) |

|

Balance |

% to Total |

|

|

Balance |

% to Total |

|

|

Balance |

% to Total |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Demand, non-interest

bearing |

|

$ |

259,449 |

34.9 |

% |

|

$ |

242,358 |

34.5 |

% |

|

$ |

219,872 |

34.3 |

% |

| Now and money

market |

|

336,666 |

45.2 |

|

|

326,412 |

46.4 |

|

|

305,984 |

47.8 |

|

| Savings |

|

48,509 |

6.5 |

|

|

43,876 |

6.2 |

|

|

43,152 |

6.7 |

|

| Time deposits less than

$250,000 |

|

65,393 |

8.8 |

|

|

60,445 |

8.6 |

|

|

51,899 |

8.1 |

|

| Time deposits $250,000

and over |

|

34,451 |

4.6 |

|

|

30,204 |

4.3 |

|

|

19,996 |

3.1 |

|

| Total |

|

$ |

744,468 |

100.0 |

% |

|

$ |

703,295 |

100.0 |

% |

|

$ |

640,903 |

100.0 |

% |

Total shareholders’ equity increased $3.8 million, or 5.8%, to

$69.5 million at June 30, 2018 from $65.7 million at December 31,

2017. The increase in shareholders’ equity was primarily due

to net income earned during the year.

Capital Ratios

The Company and the Bank remain well capitalized at June 30,

2018, as summarized in the following table.

| |

|

|

|

|

|

|

| Capital

Ratios: |

|

Coastal Community Bank |

|

Coastal Financial Corporation |

|

Financial Institution Basel III Regulatory

Guidelines |

| |

|

|

|

|

|

|

| Tier 1

leverage capital |

10.18% |

|

9.21% |

|

5.00% |

| Tier 1

risk-based capital |

11.30% |

|

10.24% |

|

8.00% |

| Common

Equity Tier 1 risk-based capital |

11.30% |

|

9.76% |

|

6.50% |

| Total

risk-based capital |

12.50% |

|

12.82% |

|

10.00% |

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

Asset Quality

The allowance for loan losses was 1.22% of loans receivable at

June 30, 2018, compared to 1.22% at December 31, 2017. Provision

for loan losses totaled $392,000 for the current quarter, $501,000

for the preceding quarter, and there was no provision for the same

quarter in the prior year. Net charge-offs totaled $370,000 for the

six months ended June 30, 2018 compared to net charge-offs of

$94,000 for six months ended June 30, 2017.

Non-performing assets were $2.1 million, or 0.24% of total

assets, at June 30, 2018, compared to $2.1 million, or 0.26% of

total assets at December 31, 2017. There were no repossessed

assets or other real estate owned at June 30, 2018.

Non-performing loans to loans receivable ratio was 0.30% at June

30, 2018, compared to 0.32% at December 31, 2017. Classified

loans were $8.6 million at June 30, 2018, an increase of $700,000,

as compared to $7.9 million at December 31, 2017.

The following table details the Company’s non-performing assets

for the periods indicated.

|

|

|

As of |

|

|

|

June 30, |

|

December 31, |

|

June 30, |

| (Dollars in

thousands) |

|

2018 |

|

2017 |

|

2017 |

| |

|

|

|

|

|

|

| Non-accrual

loans: |

|

|

|

|

|

|

| Commercial and

industrial loans |

|

$ |

703 |

|

$ |

372 |

|

$ |

284 |

| Real estate: |

|

|

|

|

|

|

| Construction,

land and land development |

|

- |

|

- |

|

- |

|

Residential |

|

75 |

|

88 |

|

151 |

| Commercial real

estate |

|

- |

|

345 |

|

579 |

| Commercial real

estate - troubled debt restructure |

|

1,290 |

|

1,315 |

|

1,340 |

| Consumer and other

loans |

|

- |

|

- |

|

- |

| Total

non-accrual loans |

|

2,068 |

|

2,120 |

|

2,354 |

| Total accruing

loans past due 90 days or more |

|

- |

|

- |

|

- |

| Total

non-performing loans |

|

2,068 |

|

2,120 |

|

2,354 |

| |

|

|

|

|

|

|

| Other real estate

owned |

|

- |

|

- |

|

- |

| Repossessed assets |

|

- |

|

- |

|

- |

| |

|

|

|

|

|

|

| Total non-performing

assets |

|

$ |

2,068 |

|

$ |

2,120 |

|

$ |

2,354 |

| |

|

|

|

|

|

|

| Troubled debt

restructurings, accruing |

|

- |

|

- |

|

3,999 |

| |

|

|

|

|

|

|

| Total non-performing

loans to loans receivable |

|

0.30% |

|

0.32% |

|

0.38% |

| |

|

|

|

|

|

|

| Total non-performing

assets to total assets |

|

0.24% |

|

0.26% |

|

0.32% |

| |

|

|

|

|

|

|

About Coastal Financial

Coastal Financial Corporation is an Everett-based Washington

State bank holding company with Coastal Community Bank (the

“Bank”), a full-service commercial bank, as its sole wholly-owned

banking subsidiary. The Bank operates through its 13 branches

in Snohomish, Island, and King Counties, the Internet and its

mobile banking application. More information about the Bank

can be found on its website at www.coastalbank.com and its investor

relations page.

Contact

Eric Sprink, President & Chief Executive Officer, (425)

357-3659Joel Edwards, Executive Vice President & Chief

Financial Officer, (425) 357-3687

Forward-Looking Statements

This earnings release contains forward-looking statements. These

forward-looking statements reflect our current views with respect

to, among other things, future events and our financial

performance. Any statements about our management’s expectations,

beliefs, plans, predictions, forecasts, objectives, assumptions or

future events or performance are not historical facts and may be

forward-looking. These statements are often, but not always, made

through the use of words or phrases such as “anticipate,”

“believes,” “can,” “could,” “may,” “predicts,” “potential,”

“should,” “will,” “estimate,” “plans,” “projects,” “continuing,”

“ongoing,” “expects,” “intends” and similar words or phrases. Any

or all of the forward-looking statements in this earnings release

may turn out to be inaccurate. The inclusion of forward-looking

information in this earnings release should not be regarded as a

representation by us or any other person that the future plans,

estimates or expectations contemplated by us will be achieved. We

have based these forward-looking statements largely on our current

expectations and projections about future events and financial

trends that we believe may affect our financial condition, results

of operations, business strategy and financial needs. Our actual

results could differ materially from those anticipated in such

forward-looking statements.

Accordingly, we caution you that any such

forward-looking statements are not a guarantee of future

performance and that actual results may prove to be materially

different from the results expressed or implied by the

forward-looking statements due to a number of factors. Such factors

include, without limitation, those listed from time to time in

reports that the Company files with the Securities and Exchange

Commission. These forward-looking statements are made as of

the date of this communication, and the Company does not intend,

and assumes no obligation, to update any forward-looking statement

to reflect events or circumstances after the date on which the

statement is made or to reflect the occurrence of unanticipated

events or circumstances, except as required by law.

| |

| COASTAL FINANCIAL CORPORATIONCONDENSED CONSOLIDATED STATEMENTS

OF FINANCIAL CONDITION(Dollars in thousands; unaudited) |

| |

| ASSETS |

|

|

|

|

June 30, |

|

March 31, |

|

December 31, |

|

|

|

|

2018 |

|

2018 |

|

2017 |

| Cash and due from banks |

|

$ |

14,217 |

|

$ |

13,589 |

|

$ |

13,787 |

| Interest-bearing deposits with other banks |

|

77,232 |

|

80,980 |

|

75,964 |

| Investment securities, available for sale, at fair value |

|

36,013 |

|

36,015 |

|

36,927 |

| Investment securities, held to maturity, at amortized cost |

|

1,304 |

|

1,323 |

|

1,409 |

| Other investments |

|

3,766 |

|

3,766 |

|

3,680 |

| Loans receivable |

|

700,692 |

|

678,515 |

|

656,788 |

| Allowance for loan losses |

|

(8,540) |

|

(8,423) |

|

(8,017) |

| Total loans receivable, net |

|

692,152 |

|

670,092 |

|

648,771 |

| Premises and equipment, net |

|

12,963 |

|

13,000 |

|

13,121 |

| Accrued interest receivable |

|

2,290 |

|

1,968 |

|

2,274 |

| Bank-owned life insurance, net |

|

6,592 |

|

6,546 |

|

6,500 |

| Deferred tax asset, net |

|

2,253 |

|

2,277 |

|

2,092 |

| Other assets |

|

2,140 |

|

1,406 |

|

1,228 |

| |

Total

assets |

|

$ |

850,922 |

|

$ |

830,962 |

|

$ |

805,753 |

|

|

|

|

|

|

|

|

|

| LIABILITIES AND SHAREHOLDERS’

EQUITY |

| LIABILITIES |

|

|

|

|

|

|

| Deposits |

|

$ |

744,468 |

|

$ |

727,268 |

|

$ |

703,295 |

| Federal Home Loan Bank (FHLB) advances |

|

20,000 |

|

20,000 |

|

20,000 |

| Subordinated debt |

|

9,957 |

|

9,954 |

|

9,950 |

| Junior subordinated debentures |

|

3,580 |

|

3,580 |

|

3,579 |

| Deferred compensation |

|

1,127 |

|

1,151 |

|

1,175 |

| Accrued interest payable |

|

241 |

|

229 |

|

228 |

| Other liabilities |

|

2,059 |

|

1,853 |

|

1,815 |

|

|

Total

liabilities |

|

781,432 |

|

764,035 |

|

740,042 |

| |

|

|

|

|

|

|

|

| SHAREHOLDERS’ EQUITY |

|

|

|

|

|

|

| Common stock |

|

52,946 |

|

52,592 |

|

52,521 |

| Retained earnings |

|

18,364 |

|

16,163 |

|

14,134 |

| Accumulated other comprehensive loss, net of tax |

|

(1,820) |

|

(1,828) |

|

(944) |

| |

Total

shareholders’ equity |

|

69,490 |

|

66,927 |

|

65,711 |

| |

Total

liabilities and shareholders’ equity |

|

$ |

850,922 |

|

$ |

830,962 |

|

$ |

805,753 |

| |

|

|

|

|

|

|

|

| COASTAL FINANCIAL

CORPORATIONCONDENSED CONSOLIDATED STATEMENTS OF INCOME(Dollars in

thousands, except per share amounts; unaudited) |

|

|

|

|

|

|

Three months ended |

|

|

|

June 30, 2018 |

March 31, 2018 |

June 30, 2017 |

|

| INTEREST

AND DIVIDEND INCOME |

|

|

|

|

| Interest

and fees on loans |

$ |

8,778 |

$ |

8,189 |

$ |

7,557 |

|

| Interest

on interest-bearing deposits with other banks |

236 |

255 |

149 |

|

| Interest

on investment securities |

155 |

152 |

132 |

|

| Dividends

on other investments |

62 |

11 |

63 |

|

| Total

interest and dividend income |

9,231 |

8,607 |

7,901 |

|

| INTEREST

EXPENSE |

|

|

|

|

| Interest

on deposits |

712 |

646 |

492 |

|

| Interest

on borrowed funds |

216 |

183 |

185 |

|

| Total

interest expense |

928 |

829 |

677 |

|

| Net

interest income |

8,303 |

7,778 |

7,224 |

|

|

PROVISION FOR LOAN LOSSES |

392 |

501 |

- |

|

| Net

interest income after provision for loan losses |

7,911 |

7,277 |

7,224 |

|

|

NONINTEREST INCOME |

|

|

|

|

| Deposit

service charges and fees |

771 |

687 |

651 |

|

| Loan

referral fees |

114 |

130 |

42 |

|

| Mortgage

broker fees |

69 |

37 |

74 |

|

| Sublease

and lease income |

4 |

57 |

55 |

|

| Gain on

sale of loans |

78 |

64 |

58 |

|

|

Other |

177 |

132 |

140 |

|

| Total

noninterest income |

1,213 |

1,107 |

1,020 |

|

|

NONINTEREST EXPENSE |

|

|

|

|

| Salaries

and employee benefits |

3,910 |

3,735 |

3,174 |

|

|

Occupancy |

804 |

823 |

740 |

|

| Data

processing |

492 |

479 |

447 |

|

| Director

and staff expenses |

136 |

144 |

137 |

|

| Excise

taxes |

134 |

124 |

112 |

|

|

Marketing |

86 |

57 |

83 |

|

| Legal and

professional fees |

130 |

80 |

104 |

|

| Federal

Deposit Insurance Corporation (FDIC) assessments |

79 |

85 |

78 |

|

| Business

development |

72 |

88 |

60 |

|

|

Other |

511 |

452 |

528 |

|

| Total

noninterest expense |

6,354 |

6,067 |

5,463 |

|

| Income

before provision for income taxes |

2,770 |

2,317 |

2,781 |

|

|

PROVISION FOR INCOME TAXES |

569 |

474 |

905 |

|

| NET

INCOME |

$ |

2,201 |

$ |

1,843 |

$ |

1,876 |

|

|

|

|

|

|

|

| Basic

and diluted earnings per share |

$ |

0.24 |

$ |

0.20 |

$ |

0.20 |

|

| Weighted

average number of common shares outstanding: |

|

|

|

|

|

Basic |

9,263,302 |

9,242,839 |

9,233,738 |

|

|

Diluted |

9,282,816 |

9,248,428 |

9,236,815 |

|

|

|

|

|

|

|

| |

|

| COASTAL FINANCIAL

CORPORATIONCONDENSED CONSOLIDATED STATEMENTS OF INCOME(Dollars in

thousands, except per share amounts; unaudited) |

|

|

|

Six months ended |

|

|

June 30, 2018 |

June 30, 2017 |

| INTEREST

AND DIVIDEND INCOME |

|

|

| Interest

and fees on loans |

$ |

16,967 |

$ |

14,833 |

|

Interest on interest-bearing deposits with other

banks |

491 |

287 |

|

Interest on investment securities |

307 |

250 |

|

Dividends on other investments |

73 |

74 |

| Total

interest and dividend income |

17,838 |

15,444 |

|

INTEREST EXPENSE |

|

|

|

Interest on deposits |

1,358 |

986 |

|

Interest on borrowed funds |

399 |

359 |

|

Total interest expense |

1,757 |

1,345 |

| Net

interest income |

16,081 |

14,099 |

|

PROVISION FOR LOAN LOSSES |

893 |

439 |

| Net

interest income after provision for loan losses |

15,188 |

13,660 |

|

NONINTEREST INCOME |

|

|

|

Deposit service charges and fees |

1,458 |

1,199 |

|

Loan referral fees |

244 |

42 |

|

Mortgage broker fees |

106 |

115 |

|

Sublease and lease income |

61 |

111 |

| Gain on

sale of loans |

142 |

84 |

|

Other |

309 |

300 |

|

Total noninterest income |

2,320 |

1,851 |

|

NONINTEREST EXPENSE |

|

|

|

Salaries and employee benefits |

7,645 |

6,456 |

|

Occupancy |

1,627 |

1,469 |

|

Data processing |

971 |

848 |

|

Director and staff expenses |

280 |

278 |

|

Excise taxes |

258 |

225 |

|

Marketing |

143 |

150 |

|

Legal and professional fees |

210 |

194 |

|

Federal Deposit Insurance Corporation (FDIC)

assessments |

164 |

181 |

|

Business development |

160 |

127 |

|

Other |

963 |

911 |

|

Total noninterest expense |

12,421 |

10,839 |

|

Income before provision for income taxes |

5,087 |

4,672 |

|

PROVISION FOR INCOME TAXES |

1,043 |

1,483 |

| NET

INCOME |

$ |

4,044 |

$ |

3,189 |

|

|

|

|

| Basic

and diluted earnings per share |

$ |

0.44 |

$ |

0.35 |

| Weighted

average number of common shares outstanding: |

|

|

|

Basic |

9,253,095 |

9,232,444 |

|

Diluted |

9,265,647 |

9,235,521 |

|

|

|

|

| COASTAL

FINANCIAL CORPORATIONAVERAGE BALANCES, YIELDS, AND RATES –

QUARTERLY(Dollars in thousands; unaudited) |

|

|

| |

For the Three Months Ended |

| |

June 30, 2018 |

|

March 31, 2018 |

|

June 30, 2017 |

| |

Average |

Interest & |

Yield / |

|

Average |

Interest & |

Yield / |

|

Average |

Interest & |

Yield / |

| |

Balance |

Dividends |

Cost (4) |

|

Balance |

Dividends |

Cost (4) |

|

Balance |

Dividends |

Cost (4) |

|

Assets |

|

|

|

|

|

|

|

|

|

|

|

| Interest earning

assets: |

|

|

|

|

|

|

|

|

|

|

|

|

Interest-bearing deposits |

$ |

50,750 |

$ |

236 |

1.87% |

|

$ |

68,160 |

$ |

255 |

1.52% |

|

$ |

56,240 |

$ |

149 |

1.06% |

|

Investment securities (1) |

39,642 |

155 |

1.57 |

|

39,717 |

152 |

1.55 |

|

36,288 |

132 |

1.46 |

| Other

Investments |

3,200 |

62 |

7.77 |

|

2,912 |

11 |

1.53 |

|

2,975 |

63 |

8.49 |

| Loans

receivable (2) |

688,975 |

8,778 |

5.11 |

|

654,570 |

8,189 |

5.07 |

|

607,197 |

7,557 |

4.99 |

| Total interest earning

assets |

$ |

782,567 |

$ |

9,231 |

4.73 |

|

$ |

765,359 |

$ |

8,607 |

4.56 |

|

$ |

702,700 |

$ |

7,901 |

4.51 |

| Noninterest earning

assets: |

|

|

|

|

|

|

|

|

|

|

|

| Allowance

for loan losses |

(8,522) |

|

|

|

(8,121) |

|

|

|

(7,861) |

|

|

| Other

noninterest earning assets |

36,277 |

|

|

|

36,077 |

|

|

|

38,094 |

|

|

| Total

assets |

$ |

810,322 |

|

|

|

$ |

793,315 |

|

|

|

$ |

732,933 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Liabilities and

Shareholders’ Equity |

|

|

|

|

|

|

|

|

|

|

|

| Interest bearing

liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

Interest-bearing deposits |

$ |

464,133 |

$ |

712 |

0.62% |

|

$ |

464,219 |

$ |

646 |

0.56% |

|

$ |

422,166 |

$ |

492 |

0.47% |

| Subordinated debt |

9,955 |

147 |

5.92 |

|

9,952 |

144 |

5.87 |

|

9,941 |

148 |

5.97 |

| Junior subordinated

debentures |

3,580 |

39 |

4.37 |

|

3,579 |

35 |

3.97 |

|

3,578 |

30 |

3.36 |

| FHLB advances and other

borrowings |

5,972 |

30 |

2.01 |

|

793 |

4 |

2.05 |

|

2,544 |

7 |

1.10 |

| Total interest-bearing

liabilities |

$ |

483,640 |

$ |

928 |

0.77 |

|

$ |

478,543 |

$ |

829 |

0.70 |

|

$ |

438,229 |

$ |

677 |

0.62 |

| Non-interest bearing

deposits |

255,615 |

|

|

|

245,273 |

|

|

|

229,084 |

|

|

| Other liabilities |

2,610 |

|

|

|

2,845 |

|

|

|

2,889 |

|

|

| Total shareholders'

equity |

68,457 |

|

|

|

66,654 |

|

|

|

62,731 |

|

|

| Total liabilities

and |

|

|

|

|

|

|

|

|

|

|

|

|

shareholders' equity |

$ |

810,322 |

|

|

|

$ |

793,315 |

|

|

|

$ |

732,933 |

|

|

| Net interest

income |

|

$ |

8,303 |

|

|

|

$ |

7,778 |

|

|

|

$ |

7,224 |

|

| Interest rate

spread |

|

|

3.96% |

|

|

|

3.86% |

|

|

|

3.89% |

| Net interest margin

(3) |

|

|

4.26% |

|

|

|

4.12% |

|

|

|

4.12% |

| |

|

|

|

|

|

|

|

|

|

|

|

| (1) For

presentation in this table, average balances and the corresponding

average rates for investment securities are based upon historical

cost, adjusted for amortization of premiums and accretion of

discounts. |

| (2)

Includes nonaccrual loans |

| (3) Net

interest margin represents net interest income divided by the

average total interest-earning assets |

| (4) Yields

and rates are annualized |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| COASTAL

FINANCIAL CORPORATIONAVERAGE BALANCES, YIELDS, AND RATES –

YEAR-TO-DATE(Dollars in thousands; unaudited) |

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

For the Six Months Ended |

| |

June 30, 2018 |

|

June 30, 2017 |

| |

Average |

Interest & |

Yield / |

|

Average |

Interest & |

Yield / |

| |

Balance |

Dividends |

Cost (4) |

|

Balance |

Dividends |

Cost(4) |

|

Assets |

|

|

|

|

|

|

|

| Interest earning

assets: |

|

|

|

|

|

|

|

|

Interest-bearing deposits |

$ |

59,407 |

$ |

491 |

1.67% |

|

$ |

57,466 |

|

|

$ |

287 |

1.01% |

|

Investment securities (1) |

39,679 |

307 |

1.56 |

|

36,336 |

250 |

1.39 |

| Other

Investments |

3,057 |

73 |

4.82 |

|

2,790 |

74 |

5.35 |

| Loans

receivable (2) |

671,867 |

16,967 |

5.09 |

|

602,619 |

14,833 |

4.96 |

| Total interest earning

assets |

$ |

774,010 |

$ |

17,838 |

4.65 |

|

$ |

699,211 |

|

|

$ |

15,444 |

4.45 |

| Noninterest earning

assets: |

|

|

|

|

|

|

|

| Allowance

for loan losses |

(8,323) |

|

|

|

(7,771) |

|

|

| Other

noninterest earning assets |

36,178 |

|

|

|

41,361 |

|

|

|

Total assets |

$ |

801,865 |

|

|

|

$ |

732,801 |

|

|

| |

|

|

|

|

|

|

|

| Liabilities and

Shareholders’ Equity |

|

|

|

|

|

|

|

| Interest bearing

liabilities: |

|

|

|

|

|

|

|

|

Interest-bearing deposits |

$ |

464,176 |

$ |

1,358 |

0.59% |

|

$ |

423,501 |

|

|

$ |

986 |

0.47% |

| Subordinated debt |

9,954 |

291 |

5.90 |

|

9,940 |

291 |

5.90 |

| Junior subordinated

debentures |

3,580 |

74 |

4.17 |

|

3,578 |

58 |

3.27 |

| FHLB advances and other

borrowings |

3,397 |

34 |

2.02 |

|

1,611 |

10 |

1.25 |

| Total interest-bearing

liabilities |

$ |

481,107 |

$ |

1,757 |

0.74 |

|

$ |

438,630 |

|

|

$ |

1,345 |

0.62 |

| Non-interest bearing

deposits |

250,473 |

|

|

|

225,769 |

|

|

| Other liabilities |

2,724 |

|

|

|

2,820 |

|

|

| Total shareholders'

equity |

67,561 |

|

|

|

65,582 |

|

|

| Total liabilities

and |

|

|

|

|

|

|

|

|

shareholders' equity |

$ |

801,865 |

|

|

|

$ |

732,801 |

|

|

| Net interest

income |

|

$ |

16,081 |

|

|

|

|

|

$ |

14,099 |

|

| Interest rate

spread |

|

|

3.91% |

|

|

|

3.84% |

| Net interest margin

(3) |

|

|

4.19% |

|

|

|

4.07% |

|

|

|

|

|

|

|

|

|

| (1) For

presentation in this table, average balances and the corresponding

average rates for investment securities are based upon historical

cost, adjusted for amortization of premiums and accretion of

discounts. |

|

|

| (2)

Includes nonaccrual loans |

|

|

| (3) Net

interest margin represents net interest income divided by the

average total interest-earning assets |

|

|

| (4) Yields and rates

are annualized |

|

|

|

|

|

|

|

| |

|

|

|

|

|

| COASTAL FINANCIAL

CORPORATIONQUARTERLY STATISTICS(Dollars in thousands, except per

share amounts; unaudited) |

|

|

|

|

|

| |

|

|

|

|

|

| |

Three Months Ended |

| |

June 30, |

March 31, |

December 31, |

September 30, |

June 30, |

| |

2018 |

2018 |

2017 |

2017 |

2017 |

| Income

Statement Data: |

|

|

|

|

|

| Interest and dividend

income |

$ |

9,231 |

$ |

8,607 |

$ |

8,452 |

$ |

8,217 |

$ |

7,901 |

| Interest expense |

928 |

829 |

798 |

732 |

677 |

| Provision for loan

losses |

392 |

501 |

366 |

65 |

- |

| Net interest income

after |

|

|

|

|

|

|

provision for loan losses |

7,911 |

7,277 |

7,288 |

7,420 |

7,224 |

| Noninterest income |

1,213 |

1,107 |

1,053 |

1,250 |

1,020 |

| Noninterest

expense |

6,354 |

6,067 |

5,785 |

5,809 |

5,463 |

| Provision for income

tax |

569 |

474 |

2,213 |

957 |

905 |

| Net income |

2,201 |

1,843 |

343 |

1,904 |

1,876 |

| Adjusted net income

(1) |

2,201 |

1,843 |

1,638 |

1,904 |

1,876 |

|

|

|

|

|

|

|

| |

As of Period End or for the three month

period |

| |

June 30, |

March 31, |

December 31, |

September 30, |

June 30, |

| |

2018 |

2018 |

2017 |

2017 |

2017 |

| Balance Sheet

Data: |

|

|

|

|

|

| Cash and

cash-equivalents |

$ |

91,449 |

$ |

94,569 |

$ |

89,751 |

$ |

86,531 |

$ |

58,198 |

| Investment

securities |

37,317 |

37,338 |

38,336 |

40,201 |

35,280 |

| Loans receivable |

700,692 |

678,515 |

656,788 |

630,442 |

623,250 |

| Allowance for loan

losses |

(8,540) |

(8,423) |

(8,017) |

(7,947) |

(7,889) |

| Total assets |

850,922 |

830,962 |

805,753 |

778,609 |

738,049 |

| Interest-bearing

deposits |

485,019 |

473,268 |

460,937 |

438,592 |

421,031 |

| Noninterest-bearing

deposits |

259,449 |

254,000 |

242,358 |

242,607 |

219,872 |

| Total deposits |

744,468 |

727,268 |

703,295 |

681,199 |

640,903 |

| Total borrowings |

33,537 |

33,534 |

33,529 |

28,526 |

30,521 |

| Total shareholders’

equity |

69,490 |

66,927 |

65,711 |

65,558 |

63,600 |

| |

|

|

|

|

|

| Share and Per

Share Data (2)(3): |

|

|

|

|

|

| Earnings per share –

basic |

$ |

0.24 |

$ |

0.20 |

$ |

0.04 |

$ |

0.21 |

$ |

0.20 |

| Earnings per share –

diluted |

$ |

0.24 |

$ |

0.20 |

$ |

0.04 |

$ |

0.21 |

$ |

0.20 |

| Adjusted earnings per

share - diluted (4) |

|

|

$ |

0.18 |

|

|

| Dividends per

share |

- |

- |

- |

- |

- |

| Book value per share

(5) |

$ |

7.47 |

$ |

7.23 |

$ |

7.10 |

$ |

7.09 |

$ |

6.88 |

| Tangible book value per

share (6) |

$ |

7.47 |

$ |

7.23 |

$ |

7.10 |

$ |

7.09 |

$ |

6.88 |

| Weighted avg

outstanding shares – basic |

9,263,302 |

9,242,766 |

9,237,660 |

9,235,344 |

9,233,738 |

| Weighted avg

outstanding shares – diluted |

9,282,816 |

9,248,365 |

9,240,737 |

9,238,421 |

9,236,815 |

| Shares outstanding at

end of period |

9,298,553 |

9,253,303 |

9,248,901 |

9,249,006 |

9,245,546 |

| |

|

|

|

|

|

| Credit Quality

Ratios: |

|

|

|

|

|

| Nonperforming assets to

total assets |

0.24% |

0.20% |

0.26% |

0.32% |

0.32% |

| Nonperforming assets to

loans receivable |

|

|

|

|

|

| and

OREO |

0.30% |

0.25% |

0.32% |

0.40% |

0.38% |

| Nonperforming loans to

total loans receivable |

0.30% |

0.25% |

0.32% |

0.40% |

0.38% |

| Allowance for loan

losses to nonperforming loans |

412.96% |

495.76% |

378.16% |

316.49% |

335.13% |

| Allowance for loan

losses to total loans receivable |

1.22% |

1.24% |

1.22% |

1.26% |

1.27% |

| Net charge-offs

(recoveries) to average loans (7) |

0.16% |

0.06% |

0.18% |

0.01% |

-0.06% |

| |

|

|

|

|

|

| Capital

Ratios: |

|

|

|

|

|

| Tier 1 leverage

capital |

9.21% |

9.07% |

8.95% |

9.31% |

9.22% |

| Tier 1 risk-based

capital |

10.24% |

10.25% |

10.50% |

10.75% |

10.43% |

| Common equity Tier 1

risk-based capital |

9.76% |

9.75% |

9.98% |

10.21% |

9.89% |

| Total risk-based

capital |

12.82% |

12.90% |

13.24% |

13.54% |

13.21% |

| |

|

|

|

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

| (1) Adjusted net income is a non-GAAP financial measure that

excludes the impact of the revaluation of our deferred tax assets

as a result of the reduction in the corporate income tax rate under

the Tax Cuts and Jobs Act. The most directly comparable GAAP

measure is net income. See our reconciliation of non-GAAP financial

measures to their most directly comparable GAAP financial measures

under the caption “Non-GAAP Financial Measures.” |

| (2) Share and per share amounts are based on total common

shares outstanding, which includes common stock and nonvoting

common stock. |

| (3) Share and per share information has been adjusted to give

effect to a one-for-five reverse stock split of our common shares

completed effective May 4, 2018. |

| (4) Adjusted earnings per share is a non-GAAP financial

measure that excludes the impact of the revaluation of our deferred

tax assets as a result of the reduction in the corporate income tax

rate under the Tax Cuts and Jobs Act. The most directly comparable

GAAP measure is earnings per share. See our reconciliation of

non-GAAP financial measures to their most directly comparable GAAP

financial measures under the caption “Non-GAAP Financial

Measures.” |

| (5) We calculate book value per share as total shareholders’

equity at the end of the relevant period divided by the outstanding

number of our common shares, which includes common stock and

nonvoting common stock, at the end of each period. |

| (6) Tangible book value per share is a non-GAAP financial

measure. We calculate tangible book value per share as total

shareholders’ equity at the end of the relevant period, less

goodwill and other intangible assets, divided by the outstanding

number of our common shares, which includes common stock and

nonvoting common stock, at the end of each period. The most

directly comparable GAAP financial measure is book value per share.

We had no goodwill or other intangible assets as of any of the

dates indicated. As a result, tangible book value per share is the

same as book value per share as of each of the dates

indicated. |

| (7) Annualized

calculations |

|

|

|

|

|

Non-GAAP Financial Measures

This earnings release contains certain non-GAAP (“Generally

Accepted Accounting Principles”) financial measures in addition to

results presented in accordance with GAAP. These measures include

the following:

“Adjusted net income” is a non-GAAP measure defined as net

income increased by the additional income tax expense that resulted

from the revaluation of deferred tax assets as a result of the

reduction in the corporate income tax rate under the recently

enacted Tax Cuts and Jobs Act. The most directly comparable GAAP

measure is net income.

“Adjusted earnings per share” is a non-GAAP measure defined as

net income, plus additional income tax expense, divided by weighted

average outstanding shares (diluted). The most directly comparable

GAAP measure is earnings per share.

The Company also presented comparable earnings information using

GAAP financial measures. Reconciliations of the GAAP and non-GAAP

measures are presented below.

| |

|

|

| (Dollars in thousands,

except share and per share data) |

|

As of and for three Months ended December 31,

2017 |

| Adjusted net

income: |

|

|

| Net

income |

|

$ |

343 |

| Plus:

additional income tax expense |

|

1,295 |

| Adjusted

net income |

|

$ |

1,638 |

|

Adjusted earnings per share – diluted: |

|

|

| Net

income |

|

$ |

343 |

| Plus:

additional income tax expense |

|

1,295 |

| Adjusted

net income |

|

$ |

1,638 |

| Weighted

average common shares outstanding– diluted (1) |

|

9,240,737 |

| Adjusted

earnings per share – diluted (1) |

|

$ |

0.18 |

| |

|

|

| |

|

|

|

| (1) Share

and per share information has been adjusted to give effect to a

one-for-five reverse stock split of our common shares completed

effective May 4, 2018. |

| |

|

|

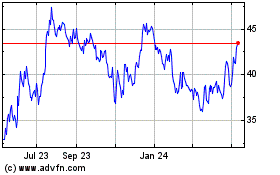

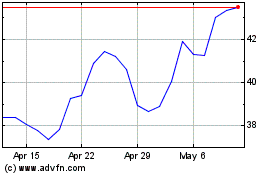

Coastal Financial (NASDAQ:CCB)

Historical Stock Chart

From Mar 2024 to Apr 2024

Coastal Financial (NASDAQ:CCB)

Historical Stock Chart

From Apr 2023 to Apr 2024