Sales at Kohl's Rise Amid Robust Consumer Spending --3rd Update

August 21 2018 - 1:05PM

Dow Jones News

By Suzanne Kapner and Allison Prang

Retailers extended their run of good news on Tuesday with Kohl's

Corp. and the parent of T.J. Maxx reporting strong quarterly

results.

Kohl's sales excluding newly opened or closed locations rose

3.1% in the three months to Aug. 4. Same-store sales would have

increased 4.3% for the period excluding the effects of a promotion

that shifted into the first quarter this year from the second

quarter last year.

Net sales rose 3.9% to $4.31 billion. Net income rose 40% to

$292 million, compared with $208 million a year ago.

TJX Cos. posted a 6% increase in same-store sales. Sales grew

across all categories, including a 7% increase in its division that

includes the T.J. Maxx and Marshalls chains. Chief Executive Ernie

Herrman said foot traffic was up for the 16th consecutive quarter.

He said the company was attracting new, younger customers and

gaining market share, and noted that the current quarter was "off

to a strong start."

Net sales increased 11.6% to $9.3 billion. Net income rose

nearly 34% to $740 million, compared with $553 million a year

ago

Both companies increased their guidance for the current fiscal

year.

Kohl's results weren't good enough to please investors, who had

already pushed the stock up 45% this year. The shares fell more

than 3% in morning trading to $76.22. TJX shares jumped more than

4% to $106.

"I'm confident the strategies we have in place will position us

for long-term growth," Kohl's Chief Executive Michelle Gass told

analysts on a conference call.

Ms. Gass said the results were driven by a recovery in apparel,

particularly women's clothing. She also noted that Kohl's private

brands had their best performance in over five years.

Americans are spending more on everything from jeans to handbags

to home furnishings as rising wages and lower unemployment boost

disposable income.

The spending spree is helping retailers recover after several

difficult years. Last week, Walmart Inc. said its quarterly sales

rose at the fastest pace in more than a decade. Other retailers,

including Nordstrom Inc. and Home Depot Inc., also reported strong

results.

Kohl's has taken steps to compete in a world increasingly

dominated by online retailers. Last year, it joined with Amazon.com

Inc. to allow shoppers to return items they bought from the online

retailer at a limited number of Kohl's stores. The pilot has since

been expanded to 100 stores.

In September, Kohl's is launching a brand designed in

partnership with Popsugar, a media and technology company. Ms. Gass

said Popsugar will use data from its millennial customers to help

inform the designs.

Next year, Kohl's will introduce the Nine West shoe, handbag and

apparel brands to its stores.

Kohl's now expects earnings per share for the fiscal year to be

$4.96 to $5.36, up from a previous range of $4.86 to $5.31. The

figures include a loss from the extinguishment of debt.

Like other retailers, Kohl's year-over-year comparisons are

skewed by an extra week in fiscal 2017, the result of dividing the

retail calendar in 52 weeks of seven days each, which leaves an

extra day each year.

TJX now forecasts fiscal earnings per share of $4.83 to $4.88,

up from its previous guidance of $4.75 to $4.83.

Write to Suzanne Kapner at Suzanne.Kapner@wsj.com and Allison

Prang at allison.prang@wsj.com

(END) Dow Jones Newswires

August 21, 2018 12:50 ET (16:50 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

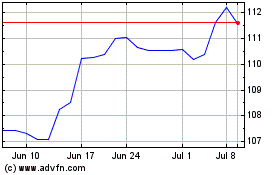

TJX Companies (NYSE:TJX)

Historical Stock Chart

From Mar 2024 to Apr 2024

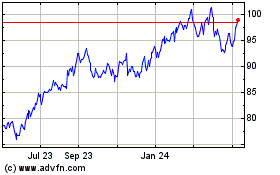

TJX Companies (NYSE:TJX)

Historical Stock Chart

From Apr 2023 to Apr 2024