Securities Registration: Employee Benefit Plan (s-8)

August 17 2018 - 5:05PM

Edgar (US Regulatory)

As Filed With the Securities and Exchange Commission on August 17, 2018

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

FORM S‑8

REGISTRATION STATEMENT

Under

THE SECURITIES ACT OF 1933

Tandem Diabetes Care, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

Delaware

|

20-4327508

|

|

(State or other jurisdiction of

incorporation or organization)

|

(I.R.S. Employer

Identification No.)

|

11075 Roselle Street

San Diego, California 92121

(Address of principal executive offices)

Tandem Diabetes Care, Inc. Amended and Restated 2013 Stock Incentive Plan

Tandem Diabetes Care, Inc. Amended and Restated 2013 Employee Stock Purchase Plan

(Full titles of the Plans)

David B. Berger, Esq.

General Counsel

Tandem Diabetes Care, Inc.

11075 Roselle Street

San Diego, California 92121

(858) 366-6900

(Name and address of agent for service)

Copy to:

Ryan C. Wilkins, Esq.

Stradling Yocca Carlson & Rauth, P.C.

660 Newport Center Drive, Suite 1600

Newport Beach, California 92660

(949) 725-4000

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

|

☐

|

|

Accelerated filer

|

|

☐

|

|

|

|

|

|

|

Non-accelerated filer

|

|

☐

(Do not check if a smaller reporting company)

|

|

Smaller reporting company

|

|

☒

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Emerging growth company

|

|

☒

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.

☒

1

CALCULATION OF REGISTRATION FEE

|

Title of Securities to be Registered

|

|

Amount to be Registered (1)

|

|

Proposed Maximum Offering Price Per Share

|

|

Proposed Maximum Aggregate Offering Price

|

|

|

Amount of Registration Fee

|

|

|

Common Stock, par value $0.001 per share

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

To be issued under the 2013 Plan

|

|

|

1,141,280

|

|

(2)

|

|

$

|

31.43

|

|

(3)

|

|

$

|

35,870,430.40

|

|

|

$

|

4,465.87

|

|

|

Issued on June 14, 2018 under the 2013 Plan

|

|

|

811,800

|

|

(4)

|

|

$

|

2.59

|

|

(5)

|

|

$

|

2,102,562.00

|

|

|

$

|

261.77

|

|

|

Issued on June 14, 2018 under the 2013 Plan

|

|

|

3,389,300

|

|

(6)

|

|

$

|

18.86

|

|

(7)

|

|

$

|

63,922,198.00

|

|

|

$

|

7,958.31

|

|

|

Issued on June 15, 2018 under the 2013 Plan

|

|

|

57,660

|

|

(8)

|

|

$

|

19.91

|

|

(9)

|

|

$

|

1,148,010.60

|

|

|

$

|

142.93

|

|

|

Issued on July 16, 2018 under the 2013 Plan

|

|

|

67,200

|

|

(10)

|

|

$

|

26.93

|

|

(11)

|

|

$

|

1,809,696.00

|

|

|

$

|

225.31

|

|

|

Issued on August 15, 2018 under the 2013 Plan

|

|

|

32,760

|

|

(12)

|

|

$

|

33.03

|

|

(13)

|

|

$

|

1,082,062.80

|

|

|

$

|

134.72

|

|

|

To be issued under the 2013 ESPP

|

|

|

2,000,000

|

|

(14)

|

|

$

|

26.72

|

|

(15)

|

|

$

|

53,440,000.00

|

|

|

$

|

6,653.28

|

|

|

Total

|

|

|

7,500,000

|

|

|

|

|

|

|

|

$

|

159,374,959.80

|

|

|

$

|

19,842.19

|

|

|

(1)

|

Pursuant to Rule 416(a) under the Securities Act of 1933, as amended (the “

Securities Act

”), this Registration Statement shall also cover any additional shares of the registrant’s common stock, par value $0.001 per share (“

Common Stock

”) that become issuable under the Tandem Diabetes Care, Inc. Amended and Restated 2013 Stock Incentive Plan (the “

2013 Plan

”) and the Tandem Diabetes Care, Inc. Amended and Restated 2013 Employee Stock Purchase Plan (the “

2013 ESPP

”), by reason of any stock dividend, stock split, recapitalization or other similar transaction effected without the receipt of consideration that results in an increase in the number of outstanding shares of Common Stock.

|

|

(2)

|

Represents

1,141,280

additional shares of Common Stock reserved for issuance pursuant to the 2013

Plan

and not subject to awards previously issued pursuant to the 2013 Plan

. Shares available for issuance under the 2013 Plan were previously registered on registration statements on Form S-8 filed with the Securities and Exchange Commission (the “

SEC

”) on November 19, 2013 (File No. 333-192406), February 24, 2015 (File No. 333-202254), February 24, 2016 (File No. 333-209685), March 8, 2017 (File No. 333-216529) and March 1, 2018 (File No. 333-223377). See “Explanatory Note” for additional information.

|

|

(3)

|

Estimated solely for the purpose of calculating the amount of the registration fee pursuant to Rule 457(c) and Rule 457(h) promulgated under the Securities Act on the basis of the average of the high and low prices of the Common Stock as reported on the NASDAQ Global Market on August 13, 2018.

|

|

(4)

|

Represents shares of Common Stock reserved for issuance pursuant to stock option awards issued on June 14, 2018, which were originally granted on December 1, 2017, subject to and conditioned upon stockholder approval of an increase in the number of shares of Common Stock reserved for issuance under the 2013 Plan.

|

|

(5)

|

Estimated solely for the purpose of calculating the amount of the registration fee pursuant to Rule 457(h) promulgated under the Securities Act on the basis of $2.59 per share, which represents the exercise price of the stock option awards granted on December 1, 2017 as described in footnote 4.

|

|

(6)

|

Represents shares of Common Stock reserved for issuance pursuant to stock option awards issued on June 14, 2018

following stockholder approval of an increase in the number of shares of Common Stock reserved for issuance under the 2013 Plan.

|

|

(7)

|

Estimated sole

ly for the purpose of calculating the amount of the registration fee pursuant to Rule 457(h) promulgated under the Securities Act on the basis of $18.86 per share, which represents the exercise price of the stock option awards issued on

June 14, 2018 as described in footnote 6.

|

|

(8)

|

Represents shares of Common Stock reserved for issuance pursuant to stock option awards issued on June 15, 2018

following stockholder approval of an increase in the number of shares of Common Stock reserved for issuance under the 2013 Plan.

|

|

(9)

|

Estimated solely for the purpose of calculating the amount of the registration fee pursuant to Rule 457(h) promulgated under the Securities Act on the basis of $19.91 per share, which represents the exercise price of the stock option awards issued on June 15, 2018 as described in footnote 8.

|

|

(10)

|

Represents shares of Common Stock reserved for issuance pursuant to stock option awards issued on July 16, 2018

following stockholder approval of an increase in the number of shares of Common Stock reserved for issuance under the 2013 Plan.

|

2

|

(11)

|

Estimated solely for the purpose of calculating the amount of the registration fee pursuant to Rule 457(h) promulgated under the Securities Act on the basis of $26.93 per share, which represents the exercise price of the

stock option awards issued on July 16, 2018 as described in footnote 10.

|

|

(12)

|

Represents shares of Common Stock reserved for issuance pursuant to stock option awards issued on August 15, 2018 following stockholder approval of an increase in the number of shares of Common Stock reserved for issuance under the 2013 Plan.

|

|

(13)

|

Estimated solely for the purpose of calculating the amount of the registration fee pursuant to Rule 457(h) promulgated under the Securities Act on the basis

of $33.03 per share, which represents

the exercise price of the stock option awards issued on August 15, 2018 as described in footnote 12.

|

|

(14)

|

Represents 2,000,000 additional shares of Common Stock reserved for issuance pursuant to the 2013 ESPP. Shares available for issuance under the 2013 ESPP were previously registered on registration statements on Form S-8 filed with the SEC on November 19, 2013 (File No. 333-192406), February 24, 2015 (File No. 333-202254), February 24, 2016 (File No. 333-209685), March 8, 2017 (File No. 333-216529) and March 1, 2018 (File No. 333-223377). See “Explanatory Note” for additional information.

|

|

(15)

|

Estimated solely for the purpose of calculating the amount of the registration fee pursuant to Rule 457(c) and Rule 457(h) promulgated under the Securities Act on the basis of the average of the high and low prices of the Common Stock as reported on the NASDAQ Global Market on August 13, 2018 multiplied by 85%, which is the percentage of the trading price per share applicable to purchasers under the 2013 ESPP.

|

3

EXPLAN

ATORY NOTE

REGISTRATION OF ADDITIONAL SHARES

Tandem Diabetes Care, Inc. is filing this Registration Statement on Form S-8 (this “

Registration Statement

”) with the Securities and Exchange Commission (the “

SEC

”) for the purpose of registering an additional (i) 5,500,000 shares of Common Stock that have been reserved for issuance under the Tandem Diabetes Care, Inc. Amended and Restated 2013 Stock Incentive Plan (the “

2013 Plan

”),

which includes (1) 4,358,720 sh

ares subject to awards previously issued pursuant to the 2013 Plan, and (2) 1,141,280 shares reserved for issuance pursuant to the 2013 Plan and not subject to awards previously issued pursuant to the 2013 Plan,

and (ii) 2,000,000 shares of Common Stock that have been reserved for issuance under the Tandem Diabetes Care, Inc. Amended and Restated 2013 Employee Stock Purchase Plan (the “

2013 ESPP

”). Pursuant to General Instruction E of Form S-8, this Registration Statement hereby incorporates by reference the contents of the registrant’s registration statements on Form S-8 filed with the SEC on November 19, 2013 (File No. 333-192406), February 24, 2015 (File No. 333-202254), February 24, 2016 (File No. 333-209685), March 8, 2017 (File No. 333-216529) and March 1, 2018 (File No. 333-223377).

4

EXHIBIT INDEX

|

|

|

|

|

Incorporated by Reference

|

|

|

|

|

|

Exhibit Number

|

|

Exhibit Description

|

|

Form

|

|

File No.

|

|

Date of First Filing

|

|

Exhibit Number

|

|

Provided Herewith

|

|

4.1

|

|

Specimen Certificate for Common Stock.

|

|

S-1/A

|

|

333-191601

|

|

November 4, 2013

|

|

4.1

|

|

|

|

4.2

|

|

Amended and Restated Certificate of Incorporation of Tandem Diabetes Care, Inc., as currently in effect.

|

|

S-1/A

|

|

333-222553

|

|

January 29, 2018

|

|

3.1

|

|

|

|

4.3

|

|

Amended and Restated Bylaws of Tandem Diabetes Care, Inc., as currently in effect.

|

|

S-1/A

|

|

333-191601

|

|

November 4, 2013

|

|

3.5

|

|

|

|

4.4

|

|

Tandem Diabetes Care, Inc. Amended and Restated 2013 Stock Incentive Plan.

|

|

DEF 14A

|

|

001-36189

|

|

April 26, 2018

|

|

Appendix B

|

|

|

|

4.5

|

|

Form of Stock Option Agreement under 2013 Plan.

|

|

S-1/A

|

|

333-191601

|

|

November 4, 2013

|

|

10.7

|

|

|

|

4.6

|

|

Form of Stock Option Agreement under 2013 Plan (Non-Employee Directors).

|

|

S-1/A

|

|

333-191601

|

|

November 4, 2013

|

|

10.8

|

|

|

|

4.7

|

|

Tandem Diabetes Care, Inc. Amended and Restated 2013 Employee Stock Purchase Plan.

|

|

DEF 14A

|

|

001-36189

|

|

April 26, 2018

|

|

Appendix C

|

|

|

|

5.1

|

|

Opinion of Stradling Yocca Carlson & Rauth, P.C.

|

|

|

|

|

|

|

|

|

|

X

|

|

23.1

|

|

Consent of independent registered public accounting firm.

|

|

|

|

|

|

|

|

|

|

X

|

|

23.2

|

|

Consent of Stradling Yocca Carlson & Rauth, P.C. (contained in Exhibit 5.1 hereto).

|

|

|

|

|

|

|

|

|

|

X

|

|

24.1

|

|

Power of Attorney (included in signature page hereto).

|

|

|

|

|

|

|

|

|

|

X

|

5

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, as amended, the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized in San Diego, California on August 17, 2018.

|

Tandem Diabetes Care, Inc.

|

|

|

|

|

|

By:

|

|

/s/ Kim D. Blickenstaff

|

|

|

|

Kim D. Blickenstaff

|

|

|

|

President, Chief Executive Officer and Director

|

POWER OF ATTORNEY

KNOW ALL PERSONS BY THESE PRESENTS that each individual whose signature appears below constitutes and appoints Kim D. Blickenstaff, Leigh A. Vosseller and David B. Berger, and each or any of them, acting individually, his or her true and lawful attorney-in-fact and agent, with full power of substitution, for him or her and in his or her name, place and stead, in any and all capacities, to sign any and all amendments (including post-effective amendments) to this Registration Statement, and to file the same, with all exhibits thereto and other documents in connection therewith, with the Securities and Exchange Commission, granting unto said attorneys-in-fact and agents, and each of them, full power and authority to do and perform each and every act and thing requisite and necessary to be done in connection therewith, as fully to all intents and purposes as he or she might or could do in person, hereby ratifying and confirming all that said attorneys-in-fact and agents, or any of them, or his, her or their substitute or substitutes, may lawfully do or cause to be done or by virtue hereof.

Pursuant to the requirements of the Securities Act of 1933, as amended, this Registration Statement has been signed by the following persons in the capacities and on the date indicated.

|

|

|

|

|

|

|

Signature

|

|

Title

|

|

Date

|

|

|

|

|

|

/s/ KIM D. BLICKENSTAFF

Kim D. Blickenstaff

|

|

President, Chief Executive Officer and Director

(Principal Executive Officer)

|

|

August 17,

2018

|

|

|

|

|

|

/s/ LEIGH A. VOSSELLER

Leigh A. Vosseller

|

|

Executive Vice President, Chief Financial Officer and Treasurer (Principal Financial and Accounting Officer)

|

|

August 17,

2018

|

|

|

|

|

|

/s/ DICK P. ALLEN

Dick P. Allen

|

|

Director and Chairman of the Board

|

|

August 17,

2018

|

|

|

|

|

|

/s/ EDWARD L. CAHILL

Edward L. Cahill

|

|

Director

|

|

August 17,

2018

|

|

|

|

|

|

/s/ FRED E. COHEN

Fred E. Cohen, M.D., D.Phil, F.A.C.P.

|

|

Director

|

|

August 17,

2018

|

|

|

|

|

|

/s/ HOWARD E. GREENE, JR.

Howard E. Greene, Jr.

|

|

Director

|

|

August 17,

2018

|

|

|

|

|

|

/s/ DOUGLAS A. ROEDER

Douglas A. Roeder

|

|

Director

|

|

August 17,

2018

|

|

|

|

|

|

/s/ CHRISTOPHER J. TWOMEY

Christopher J. Twomey

|

|

Director

|

|

August 17,

2018

|

|

/s/ RICHARD P. VALENCIA

|

|

Director

|

|

August 17,

2018

|

|

Richard P. Valencia

|

|

|

|

|

6

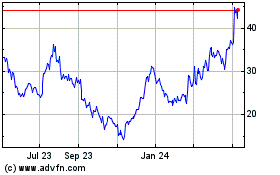

Tandem Diabetes Care (NASDAQ:TNDM)

Historical Stock Chart

From Mar 2024 to Apr 2024

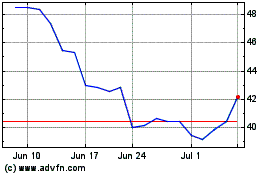

Tandem Diabetes Care (NASDAQ:TNDM)

Historical Stock Chart

From Apr 2023 to Apr 2024