By Suzanne Kapner and Sarah Nassauer

So much for the retail apocalypse.

Buoyed by rising wages and employment as well as tax cuts,

Americans are spending more on everything from jeans and handbags

to wall paint. That has translated to rising sales at chains

ranging from Walmart Inc. to Home Depot Inc. to Coach owner

Tapestry Inc., which each reported stronger results this week.

On Thursday, Walmart said its quarterly sales rose at the

fastest rate in over a decade as the world's largest retailer

continues to draw more people to stores and benefit from shoppers

having more disposable income.

"Customers tell us that they feel better about the current

health of the U.S. economy as well as their personal finances,"

Walmart Chief Executive Doug McMillon told investors Thursday.

"They're more confident about their employment opportunities."

Walmart, which gets more than half of its U.S. revenue from

groceries and staples, often tracks its home economy. Gross

domestic product -- the value of all goods and services produced

across the U.S. -- rose 4.1% in the second quarter, the fastest

pace in nearly four years.

"The retail apocalypse that everyone had been talking about

really hasn't happened," said Eric Rosenthal, a senior director of

leveraged finance at Fitch Ratings.

Walmart, which booked $128 billion in global quarterly revenue,

has drawn more shoppers to its supercenters as it remodels stores

and lowers prices. It also reported a 40% jump in U.S. e-commerce

sales. Though e-commerce is a sliver of its business, the growth

showed the company's heavy investments are helping the chain hold

its ground against Amazon.com Inc.

Walmart shares surged about 10% in Thursday morning trading,

giving a boost to the entire retail sector. While Walmart's shares

have lagged behind, many retail stocks have surged this year as

sales have stabilized and investors' fears have eased.

That's not to say traditional retailers aren't still facing

challenges from Amazon, whose rapid growth and discounting has

squeezed industry profits. Analysts also caution potential tariffs

could force retailers to raise prices and eventually crimp demand.

The key test of the industry's health -- and shoppers' appetite to

spend -- has yet to come: The holiday quarter drives the lion's

share of the retail business.

The improving economy isn't lifting everyone. J.C. Penney Co. on

Thursday said its sales fell and its loss doubled to $101 million

in the second quarter. The chain, which is searching for a CEO,

also lowered its forecasts for the year. Its shares plunged 26% in

morning trading to $1.75.

Retailers that have pulled out of the slump have had a sharp

focus on their core customers and invested in serving them better

by plowing money both into their physical stores and online

operations. They have gotten smarter about how they manage their

inventory, leaving them with fewer surplus goods and markdowns at

the end of a season. And they have secured more exclusive brands

that can't be found elsewhere.

Investors can be punishing when retailers show even the

slightest sign of weakness. Macy's Inc. shares fell 16% on

Wednesday, after the chain reported that same-store sales rose just

0.5%. The small gain was due to the shift of a promotional event to

the first quarter, and the chain's profit jumped 50%.

Troubled retailers continue to close locations at a rapid pace.

More than 11,360 U.S. stores have shut since the beginning of 2017,

roughly double the number of openings, according to Coresight

Research.

And a steady parade of chains have filed for bankruptcy this

year, including Toys 'R' Us Inc., regional department-store Bon-Ton

and teen chain Claire's.

Those moves weeded out weaker players and cleared out some of

the overcapacity that has plagued the industry. As a result, the

remaining chains are on more solid footing and are getting a boost

from a stronger economy, analysts say.

Heading into the critical Christmas holidays, the National

Retail Federation raised its 2018 sales forecast to a minimum of

4.5% growth compared with last year. Previously, the trade group

had expected sales to increase 3.8% to 4.4%.

As shoppers tightened their purse strings in recent years, one

of the biggest categories to take a hit was apparel. But that trend

is reversing, with apparel sales up 5.2% from January through July,

compared with the same period a year earlier, on track to have its

best year since 2011, according to Craig Johnson, president of the

consulting firm Customer Growth Partners.

"The single biggest driver for retail growth is growth in

disposable income, and disposable income is much stronger than it

was five years ago," Mr. Johnson said.

Joanne Charles, of Valley Stream, N.Y., said she is spending the

extra money in her paycheck from the tax cuts. The 50-year-old

event planner said she recently bought four dresses at Macy's and

is splurging on makeup and other nonnecessities.

On Wednesday, Ms. Charles browsed the Macy's in Manhattan with

her daughter Jonelle Carrera, who was shopping for clothes for a

new job at a nonprofit that she starts next week. The 30-year-old

Ms. Carrera said that when she graduated from college in 2010, "it

was hard to find a job, but there are more positions posted

today."

Some of that extra spending has been fueled by borrowing, which

has pushed household debt to record highs, according to Beth Ann

Bovino, chief U.S. economist at S&P Global Ratings. But Ms.

Bovino said that when taken as a percentage of disposable income,

household debt is the lowest it has been since the recessionary

peak.

"I feel great about the economy," said Sally Wiggins, of New

City, N.Y. While the 57-year-old, who works in hotel sales, said

she is buying more clothes and shoes for her three college-aged

children, her biggest purchase has been a home on the Gulf Coast

that she and her husband are using as a vacation rental. She said

the property has been booked all summer, "so other people must be

feeling good about the economy too."

Write to Suzanne Kapner at Suzanne.Kapner@wsj.com and Sarah

Nassauer at sarah.nassauer@wsj.com

(END) Dow Jones Newswires

August 16, 2018 11:54 ET (15:54 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

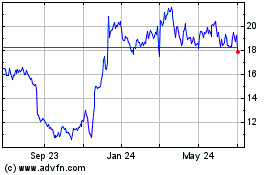

Macys (NYSE:M)

Historical Stock Chart

From Mar 2024 to Apr 2024

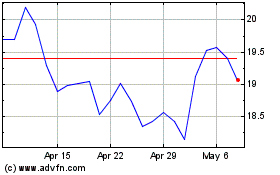

Macys (NYSE:M)

Historical Stock Chart

From Apr 2023 to Apr 2024