Formula’s revenues for the first half increased 15% year over

year to $736.9 million and operating income for the first half

increased 63% year over year to $50.6 million

Formula Systems (1985) Ltd. (NASDAQ: FORTY), a global information

technology holding company engaged, through its subsidiaries and

affiliates, in providing software consulting services and

computer-based business solutions and developing proprietary

software products, today announced its results for the second

quarter and first half ended June 30, 2018, in accordance

with International Financial Reporting Standards (IFRS).

Financial Highlights for the Second

Quarter Ended June 30, 2018

- Consolidated revenues for the second quarter increased by 10.4%

to $363.5 million, compared to $329.1 million in the same

period last year.

- Consolidated operating income for the second quarter increased

by 66.5% to $24.8 million, compared to $14.9 million in

the same period last year.

- Consolidated net income attributable to Formula’s shareholders

for the second quarter was $7.6 million, or $0.51 per fully

diluted share, compared to $0.3 million, or $0.01 per fully

diluted share, in the same period last year.

Financial Highlights for

the Six-Month Period Ended June 30,

2018

- Consolidated revenues for the first half of 2018 increased by

15.1% to $736.9 million, compared to $640.0 million in

the same period last year.

- Consolidated operating income for the first half of 2018

increased by 62.6% to $50.6 million, compared to

$31.1 million in the same period last year.

- Consolidated net income attributable to Formula’s shareholders

for the first half of 2018 was $14.9 million, or $0.99 per

fully diluted share, compared to $0.8 million, or $0.06 per

fully diluted share, in the same period last

year.

- As of June 30, 2018, Formula held 49.18%, 48.25%, 47.12%, 100%,

50% and 90.09% of the outstanding ordinary shares of Matrix IT

Ltd., Sapiens International Corporation N.V, Magic Software

Enterprises Ltd., Michpal Micro Computers (1983) Ltd., TSG IT

Advanced Systems Ltd. and Insync Staffing Solutions, Inc.,

respectively.

- Consolidated cash, short-term investments in marketable

securities and bank deposits totaled to approximately

$251.8 million as of June 30, 2018.

- Total consolidated equity as of June 30, 2018, was

$772.9 million (representing 49.3% of the total balance

sheet).

- As of June 30, 2018, Formula was in compliance with all of its

financial covenants under the debentures issued by Formula and

under loans granted from other financial institutions.

Comments of Management

Commenting on the results, Guy Bernstein, CEO of

Formula Systems, said, “We are very pleased to report significant

growth in all major financial indices across our entire

portfolio.

"In the second quarter and first half of 2018,

Matrix achieved double-digit growth across all its key financial

indicators. Matrix reported revenues of NIS 762.2 million in the

second quarter of 2018, operating income of NIS 50.1 million, and

net income attributable to Matrix shareholders of NIS 32.7 million,

reflecting an increase of 14%, 22.1% and 43.3% respectively, year

over year.

“The increase in Matrix's revenues can be

credited to the strategic deals that it won over the past year,

including establishing a credit database for the Bank of Israel,

significant deals in the field of cyber and other successful

business initiatives. In the US, Matrix is beginning to reap the

benefits of its acquisitions and continues to see the US market as

a strategic market for its continued growth.

“Matrix also continued to focus on high-profit

activities and on developing new models in the field of employee

training and placement well as in the integration and

infrastructure solutions sector, which continues to expand and

enjoy increased demand.

“Sapiens’ improved margins and profitability in

the second quarter and first half of 2018 reflect its success in

making significant strides to getting back on track, including

cost-cutting programs and the effective leveraging of its global

assets. In the second quarter, Sapiens’ revenues totaled $72.2

million up 4.5% compared to last year, its operating margin

improved to 6.8% and its non-GAAP1 operating margin was 13.2%

up from (4.3%) and 4.7% respectively, year over year.

“Sapiens updated its guidance and forecasts that

its non-GAAP revenues will be in the range of $285 to $290 million

up from $280 to 285 million and the non-GAAP full year operating

margins will be in the range of 13.0% and 13.2% up from 12.0% to

13.0%.

“Sapiens continues to advance towards its key

objectives of expanding its P&C business in EMEA and North

America while improving profitability. Sapiens’ enhanced digital

insurance offering along with its proven products and personnel are

winning new business, particularly with its P&C platforms, and

is expanding its business with new and existing clients and

building its pipeline for future growth. This quarter’s results

demonstrate Sapiens’ ability to expand market leadership,

particularly in the areas with the greatest client demand in the

insurance market: digitalization, data analytics, and legacy

transformation.

“Magic’s record-breaking financial results for

the second quarter and first half of 2018 demonstrate that Magic is

continuing its impressive forward momentum across all of its

markets and regions, confirming that its strategic business

initiatives are paying off. The results for the second quarter

were at all-time highs with revenues of $70.2 million, operating

income of $8.0 million and non-GAAP2 operating income of $9.8

million, up 7%, 26% and 9% respectively, year over year, driven

exclusively by organic growth.

“TSG is expanding its partnerships to execute additional

strategic projects in Israel and around the world.

“Lastly, we are excited by Michpal's continuing

growth, with revenues for the first half of 2018 increasing by more

than 25% year over year, mainly as a result of the successful

January 2018 official launch of its new product and new service

line – "Michpal Pension" and "Michpal PensionPlus”. Over 1,500

existing Michpal customers have already adopted this new business

line, which is the first step in our business strategy to expand

Michpal’s offerings. We expect that Michpal’s strong financial

position, coupled with its activities towards promoting and growing

its business organically and through M&As, will continue the

company's momentum through 2018 and beyond.”

1 Non-GAAP measures as detailed in Sapiens’ press release

from August 7, 2018

2 Non-GAAP measures as detailed in Magic Software

Enterprises’ press release from August 8, 2018

About Formula

Formula Systems (1985) Ltd. is a global

information technology company engaged, through its subsidiaries

and affiliates, in providing software consulting services and

computer-based business solutions and developing proprietary

software products.

For more information, visit

www.formulasystems.com.

Press Contact:

Formula Systems (1985)

Ltd.+972-3-5389487ir@formula.co.il

Except for any historical information contained herein, matters

discussed in this press release might include forward-looking

statements that involve a number of risks and uncertainties.

Regarding any financial statements, actual results might vary

significantly based upon a number of factors including, but not

limited to, risks in product and technology development, market

acceptance of new products and continuing product conditions, both

locally and abroad, release and sales of new products by strategic

resellers and customers, and other risk factors detailed in

Formula's most recent annual report and other filings with the

Securities and Exchange Commission. These forward-looking

statements are made only as of the date hereof, and the Company

undertakes no obligation to update or revise the forward-looking

statements, whether as a result of new information, future events

or otherwise.

FORMULA SYSTEMS (1985) LTD.

CONSOLIDATED CONDENSED STATEMENTS OF PROFIT OR

LOSS U.S. dollars in thousands (except per share

data)

|

|

|

Six months ended |

|

|

Three months ended |

|

|

|

|

June 30, |

|

|

June 30, |

|

|

|

|

2018 |

|

|

2017 |

|

|

2018 |

|

|

2017 |

|

|

|

|

Unaudited |

|

|

Unaudited |

|

| Revenues |

|

|

736,858 |

|

|

|

639,971 |

|

|

|

363,483 |

|

|

|

329,093 |

|

| Cost of revenues |

|

|

572,616 |

|

|

|

501,154 |

|

|

|

282,581 |

|

|

|

256,605 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross

profit |

|

|

164,242 |

|

|

|

138,817 |

|

|

|

80,902 |

|

|

|

72,488 |

|

| Research

and development costs, net |

|

|

21,448 |

|

|

|

19,383 |

|

|

|

10,502 |

|

|

|

11,572 |

|

| Selling,

general and administrative expenses |

|

|

92,215 |

|

|

|

88,320 |

|

|

|

45,635 |

|

|

|

46,040 |

|

|

Operating income |

|

|

50,579 |

|

|

|

31,114 |

|

|

|

24,765 |

|

|

|

14,876 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Financial income (expenses), net |

|

|

(3,261 |

) |

|

|

(13,435 |

)(*) |

|

|

(1,290 |

) |

|

|

(6,408 |

)(*) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income

before taxes on income |

|

|

47,318 |

|

|

|

17,679 |

(*) |

|

|

23,475 |

|

|

|

8,468 |

(*) |

| Taxes on

income |

|

|

11,723 |

|

|

|

6,330 |

|

|

|

5,605 |

|

|

|

3,397 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income

after taxes |

|

|

35,595 |

|

|

|

11,349 |

(*) |

|

|

17,870 |

|

|

|

5,071 |

(*) |

| Equity

in gains (losses) of affiliated companies, net |

|

|

(63 |

) |

|

|

410 |

|

|

|

(133 |

) |

|

|

198 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net

income |

|

|

35,532 |

|

|

|

11,759 |

(*) |

|

|

17,737 |

|

|

|

5,269 |

(*) |

| Net

income attributable to redeemable non-controlling interests |

|

|

3,111 |

|

|

|

1,176 |

(*) |

|

|

1,582 |

|

|

|

569 |

(*) |

| Net

income attributable to non-controlling interests |

|

|

17,571 |

|

|

|

9,784 |

(*) |

|

|

8,544 |

|

|

|

4,446 |

(*) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net

income attributable to Formula Systems’ shareholders |

|

|

14,850 |

|

|

|

799 |

(*) |

|

|

7,611 |

|

|

|

254 |

(*) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings per share

(basic) |

|

|

1.01 |

|

|

|

0.06 |

(*) |

|

|

0.52 |

|

|

|

0.02 |

(*) |

| Earnings per share

(diluted) |

|

|

0.99 |

|

|

|

0.06 |

(*) |

|

|

0.51 |

|

|

|

0.01 |

(*) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Number

of shares used in computing earnings per share (basic) |

|

|

14,730,449 |

|

|

|

14,320,595 |

|

|

|

14,730,865 |

|

|

|

14,338,451 |

|

| Number

of shares used in computing earnings per share (diluted) |

|

|

15,568,811 |

|

|

|

14,711,056 |

|

|

|

15,569,517 |

|

|

|

14,711,079 |

|

|

|

*) |

Adjustment to comparative data |

FORMULA SYSTEMS (1985) LTD.

CONSOLIDATED STATEMENTS OF FINANCIAL POSITION

U.S. dollars in thousands

|

|

|

June 30, |

|

|

December 31, |

|

|

|

|

2018 |

|

|

2017 |

|

|

|

|

(Unaudited) |

|

|

|

|

| ASSETS |

|

|

|

|

|

|

| CURRENT ASSETS: |

|

|

|

|

|

|

| Cash

and cash equivalents |

|

|

238,774 |

|

|

|

245,936 |

|

|

Marketable securities |

|

|

11,919 |

|

|

|

14,138 |

|

|

Short-term deposits |

|

|

1,111 |

|

|

|

735 |

|

|

Trade receivables |

|

|

380,706 |

|

|

|

385,778 |

|

|

Other accounts receivable and prepaid expenses |

|

|

48,576 |

|

|

|

44,915 |

|

|

Inventories |

|

|

3,587 |

|

|

|

3,299 |

|

| Total

current assets |

|

|

684,673 |

|

|

|

694,801 |

|

|

|

|

|

|

|

|

|

|

|

|

LONG-TERM ASSETS: |

|

|

|

|

|

|

|

|

|

Deferred taxes |

|

|

15,330 |

|

|

|

15,878 |

|

|

Prepaid expenses and other accounts receivables |

|

|

20,121 |

|

|

|

16,581 |

|

| Total

long-term assets |

|

|

35,451 |

|

|

|

32,459 |

|

|

|

|

|

|

|

|

|

|

|

|

INVESTMENTS IN COMPANIES ACCOUNTED FOR AT EQUITY METHOD |

|

|

25,248 |

|

|

|

25,315 |

|

|

|

|

|

|

|

|

|

|

|

|

PROPERTY, PLANTS AND EQUIPMENT, NET |

|

|

29,668 |

|

|

|

29,807 |

|

|

|

|

|

|

|

|

|

|

|

| NET

INTANGIBLE ASSETS AND GOODWILL |

|

|

793,863 |

|

|

|

781,255 |

|

|

|

|

|

|

|

|

|

|

|

| TOTAL

ASSETS |

|

|

1,568,903 |

|

|

|

1,563,637 |

|

|

|

|

|

|

|

|

|

|

|

| CURRENT

LIABILITIES: |

|

|

|

|

|

|

|

|

|

Liabilities to banks and others |

|

|

108,948 |

|

|

|

70,819 |

|

|

Debentures |

|

|

53,418 |

|

|

|

4,826 |

|

|

Trade payables |

|

|

77,778 |

|

|

|

95,339 |

|

|

Deferred revenue and customer advances |

|

|

69,490 |

|

|

|

58,905 |

|

|

Employees and payroll accrual |

|

|

100,689 |

|

|

|

111,707 |

|

|

Other accounts payable |

|

|

48,118 |

|

|

|

53,145 |

|

|

Liabilities related to business combinations |

|

|

5,061 |

|

|

|

6,811 |

|

|

Redeemable non-controlling interests |

|

|

36,686 |

|

|

|

31,395 |

|

| Total

current liabilities |

|

|

500,188 |

|

|

|

432,947 |

|

|

|

|

|

|

|

|

|

|

|

|

LONG-TERM LIABILITIES: |

|

|

|

|

|

|

|

|

|

Liabilities to banks and others |

|

|

92,482 |

|

|

|

135,616 |

|

|

Other long-term liabilities |

|

|

7,315 |

|

|

|

7,244 |

|

|

Debentures, net of current maturities |

|

|

116,154 |

|

|

|

133,739 |

|

|

Deferred taxes |

|

|

34,477 |

|

|

|

36,605 |

|

|

Deferred revenues |

|

|

6,763 |

|

|

|

9,340 |

|

|

Liabilities related to business combinations |

|

|

8,380 |

|

|

|

4,711 |

|

|

Redeemable non-controlling interests |

|

|

21,376 |

|

|

|

21,481 |

|

|

Employee benefit liabilities |

|

|

8,836 |

|

|

|

9,032 |

|

| Total

long-term liabilities |

|

|

295,783 |

|

|

|

357,768 |

|

|

|

|

|

|

|

|

|

|

|

| EQUITY |

|

|

|

|

|

|

|

|

|

Equity attributable to Formula Systems’ shareholders |

|

|

359,458 |

|

|

|

359,202 |

|

|

Non-controlling interests |

|

|

413,474 |

|

|

|

413,720 |

|

| Total

equity |

|

|

772,932 |

|

|

|

772,922 |

|

|

|

|

|

|

|

|

|

|

|

| TOTAL

LIABILITIES AND EQUITY |

|

|

1,568,903 |

|

|

|

1,563,637 |

|

FORMULA SYSTEMS (1985) LTD. STANDALONE

FINANCIAL DATA HIGHLIGHTS U.S. dollars in

thousands

| |

|

June 30, |

|

|

December 31, |

|

| |

|

2018 |

|

|

2017 |

|

| |

|

(Unaudited) |

|

| |

|

|

|

|

|

|

| Debentures |

|

|

91,194 |

|

|

|

59,503 |

|

| |

|

|

|

|

|

|

|

|

| Other

financial liabilities |

|

|

24,854 |

|

|

|

38,911 |

|

| |

|

|

|

|

|

|

|

|

| Formula

shareholders’ equity |

|

|

359,458 |

|

|

|

359,202 |

|

| |

|

|

|

|

|

|

|

|

| Cash,

cash equivalents and short-term marketable securities |

|

|

38,293 |

|

|

|

14,842 |

|

| |

|

|

|

|

|

|

|

|

| Fair

market value of equity holdings in publicly traded

subsidiaries |

|

|

732,485 |

|

|

|

835,400 |

|

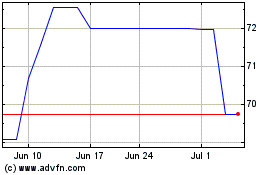

Formula Systems 1985 (NASDAQ:FORTY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Formula Systems 1985 (NASDAQ:FORTY)

Historical Stock Chart

From Apr 2023 to Apr 2024