UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 12b-25

NOTIFICATION OF LATE FILING

SEC FILE NUMBER 000-24525

CUSIP NUMBER 231082 801

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Check one:)

|

¨

|

|

Form 10-K

|

¨

|

Form 20-F

|

¨

|

Form 11-K

|

ý

|

Form 10-Q

|

¨

|

Form 10-D

|

¨

|

Form N-SAR

|

|

|

¨

|

|

Form N-CSR

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Period Ended: June 30, 2018

|

|

|

|

|

|

|

|

|

|

¨

|

Transition Report on Form 10-K

|

|

|

|

|

|

|

|

|

|

¨

|

Transition Report on Form 20-F

|

|

|

|

|

|

|

|

|

|

¨

|

Transition Report on Form 11-K

|

|

|

|

|

|

|

|

|

|

¨

|

Transition Report on Form 10-Q

|

|

|

|

|

|

|

|

|

|

¨

|

Transition Report on Form N-SAR

|

|

|

|

|

|

|

|

|

|

For the Transition Period Ended _______________________________________

|

|

|

|

|

|

|

|

|

|

|

Read Instruction (on back page) Before Preparing Form. Please Print or Type.

|

|

|

|

|

|

|

|

Nothing in this form shall be construed to imply that the Commission has verified any information contained herein.

|

|

|

|

|

|

|

|

If the notification relates to a portion of the filing checked above, identify the Item(s) to which the notification relates: ____________________________________________________________________________

|

PART I - REGISTRANT INFORMATION

Cumulus Media Inc.

Full Name of Registrant

N/A

Former Name if Applicable

3280 Peachtree Road, N.W., Suite 2200

Address of Principal Executive Office

(Street and Number)

Atlanta, Georgia 30305

City, State and Zip Code

PART II - RULES 12b-25(b) AND (c)

If the subject report could not be filed without unreasonable effort or expense and the registrant seeks relief pursuant to Rule 12b-25(b), the following should be completed. (Check box if appropriate)

|

|

|

|

|

|

|

|

|

|

|

(a)

|

|

The reason described in reasonable detail in Part III of this form could not be eliminated without unreasonable effort or expense;

|

|

ý

|

|

(b)

|

|

The subject annual report, semi-annual report, transition report on Form 10-K, Form 20-F, Form 11-K, Form N-SAR or Form N-CSR, or portion thereof, will be filed on or before the fifteenth calendar day following the prescribed due date; or the subject quarterly report or transition report on Form 10-Q or subject distribution report on Form 10-D, or portion thereof, will be filed on or before the fifth calendar day following the prescribed due date; and

|

|

|

|

(c)

|

|

The accountant’s statement or other exhibit required by Rule 12b-25(c) has been attached if applicable.

|

PART III - NARRATIVE

State below in reasonable detail why Forms 10-K, 20-F, 11-K, 10-Q, N-SAR, N-CSR, or the transition report or portion thereof, could not be filed within the prescribed time period.

Cumulus Media Inc. (the “Company”) is filing this Notification of Late Filing on Form 12b-25 with respect to its Quarterly Report on Form 10-Q for the quarter ended June 30, 2018 (the “Form 10-Q”).

As previously disclosed, on November 29, 2017, CM Wind Down Topco Inc. (f/k/a Cumulus Media Inc.) (“Old Cumulus”), and certain of its direct and indirect subsidiaries (collectively with Old Cumulus, the “Debtors”), filed voluntary petitions for relief under Chapter 11 of Title 11 of the U.S. Code (the “Bankruptcy Code”) in the United States Bankruptcy Court for the Southern District of New York (the “Bankruptcy Court”). The Debtors’ Chapter 11 cases (the “Chapter 11 Cases”) were jointly administered under the caption In re: Cumulus Media Inc., et al., Case No. 17-13381.

On May 10, 2018, the Bankruptcy Court entered the Findings of Fact, Conclusions of Law and Order Confirming the Debtors’ First Amended Joint Chapter 11 Plan of Reorganization [Docket No. 769] (the “Confirmation Order”), which confirmed the First Amended Joint Plan of Reorganization of Cumulus Media Inc. and its Debtor Affiliates Pursuant to Chapter 11 of the Bankruptcy Code [Docket No. 446] (the “Plan”), as modified by the Confirmation Order. On June 4, 2018 (the “Effective Date”), Old Cumulus satisfied the conditions to effectiveness of the Plan set forth in the Confirmation Order and in the Plan, the Plan became effective in accordance with its terms and Old Cumulus and the other Debtors emerged from Chapter 11 as the Company.

During the pendency of the Chapter 11 Cases and following the date of the Company’s emergence from bankruptcy pursuant to the Plan, in addition to their regular financial reporting duties, the Company’s management team and other finance and accounting personnel have devoted significant time and attention to matters relating to and on the preparation of certain materials required in connection with the Chapter 11 Cases and the Plan, including the preparation of financial statements based on “fresh start” accounting rules. Because of the complexities of the application of fresh-start accounting to the Company’s financial statements, including the presentation of predecessor and successor periods, the Company is unable to complete the preparation of its consolidated financial statements and related disclosures to be included in the Form 10-Q to have them properly certified by its principal executive and principal financial officers in order to timely file the Form 10-Q. Consequently, the Company will not be able to timely file the Form 10-Q, without unreasonable effort or expense. The Company expects to file the Form 10-Q on or before August 20, 2018, consistent with the five-day time period prescribed in Rule 12b-25 promulgated under the Securities Exchange Act of 1934.

PART IV - OTHER INFORMATION

(1) Name and telephone number of person to contact in regard to this notification.

|

|

|

|

|

|

|

Richard S. Denning

|

(404)

|

949-0700

|

|

(Name)

|

(Area Code)

|

(Telephone Number)

|

(2) Have all other periodic reports required under Section 13 or 15(d) of the Securities Exchange Act of 1934 or Section 30 of the Investment Company Act of 1940 during the preceding 12 months or for such shorter period that the registrant was required to file such report(s) been filed? If the answer is no, identify report(s).

Yes

ý

No

¨

(3) Is it anticipated that any significant change in results of operations from the corresponding period for the last fiscal year will be reflected by the earnings statements to be included in the subject report or portion thereof?

Yes

ý

No

¨

|

|

|

|

|

If so, attach an explanation of the anticipated change, both narratively and quantitatively, and, if appropriate, state the reasons why a reasonable estimate of the results cannot be made.

|

Upon emergence from Chapter 11 on the Effective Date, the Company adopted fresh-start accounting in accordance with Accounting Standards Codification 852 - Reorganizations. As a result of the application of fresh start accounting and the effects of the implementation of the Plan, a new entity for financial reporting purposes was created and, as such, the consolidated financial statements prepared in accordance with GAAP on and after June 4, 2018 will not be comparable to the consolidated financial statements prior to that date.

As described above, the Company’s management team and other finance and accounting personnel have been devoting significant time and attention to the preparation of the financial statements based on fresh start accounting rules. However, as of the date hereof, and given the complexities of the application of fresh-start accounting to the Company’s financial statements, the Company is unable to finalize such financial statements and related disclosures in order to timely file the Form 10-Q. Notwithstanding this, since the Plan did not result in the divestiture of any of the Company’s radio stations or network advertising assets, the Company expects that certain operating results, including the Company’s revenues, and key operating performance measures will not be materially impacted by the reorganization.

The Company expects that certain other metrics, namely interest expense, reorganization items, net, income tax expense (benefit), depreciation and amortization will differ materially from those amounts recorded in the quarter ended June 30, 2017 primarily as a result of the application of fresh start accounting, although the Company is not yet able to finalize those amounts and related disclosures and to have them properly certified by its principal executive and financial officers.

The foregoing information is based on the Company’s preliminary estimates of its results of operations for the period ended June 30, 2018 and anticipated changes from the prior year period. The Company’s estimates are subject to change, and actual results may differ significantly from these estimates. As described above, the Company expects to finalize all such amounts and file the Form 10-Q on or before August 20, 2018, consistent with the five-day time period prescribed in Rule 12b-25 promulgated under the Securities Exchange Act of 1934.

Cautionary Statements Regarding Forward-Looking Information

Certain statements in this Notification of Late Filing on Form 12b-25 constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended. Statements that are not historical fact are forward-looking statements. Certain of these forward-looking statements can be identified by the use of words such as “believes,” “anticipates,” “expects,” “intends,” “plans,” “projects,” “estimates,” “assumes,” “may,” “should,” “could,” “would,” “shall,” “will,” “seeks,” “targets,” “future,” or other similar expressions. Such forward-looking statements involve known and unknown risks, uncertainties and other important factors, and the Company's actual results, performance or achievements could differ materially from results, performance or achievements expressed in these forward-looking statements.

These forward-looking statements are based on the Company’s current beliefs, intentions and expectations and are not guarantees or indicative of future performance. Important assumptions and other important factors that could cause actual results to differ materially from those forward-looking statements include, but are not limited to, those factors, risks and uncertainties described in more detail under the heading “Risk Factors” and elsewhere in the Company’s annual and quarterly reports, including amendments thereto, and other filings with the Securities and Exchange Commission.

Cumulus Media Inc.

(Name of Registrant as Specified in Charter)

has caused this notification to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

|

August 14, 2018

|

By:

|

|

/s/ Richard S. Denning

|

|

|

|

Richard S. Denning

|

|

|

|

Senior Vice President, Secretary and General Counsel

|

|

|

|

|

|

|

|

INSTRUCTION: The form may be signed by an executive officer of the registrant or by any other duly authorized representative. The name and title of the person signing the form shall be typed or printed beneath the signature. If the statement is signed on behalf of the registrant by an authorized representative (other than an executive officer), evidence of the representative’s authority to sign on behalf of the registrant shall be filed with the form.

|

|

|

|

|

|

|

ATTENTION

|

|

|

Intentional misstatements or omissions of fact constitute Federal Criminal Violations (See 18 U.S.C. 1001).

|

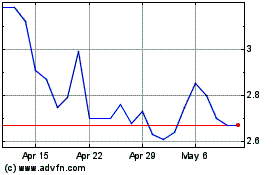

Cumulus Media (NASDAQ:CMLS)

Historical Stock Chart

From Mar 2024 to Apr 2024

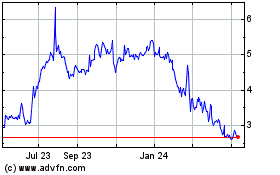

Cumulus Media (NASDAQ:CMLS)

Historical Stock Chart

From Apr 2023 to Apr 2024