Eagle Point Credit Company Inc. (the “Company”) (NYSE: ECC,

ECCA, ECCB, ECCX, ECCY) today announced financial results for the

quarter ended June 30, 2018, net asset value (“NAV”) as of June 30,

2018 and certain portfolio activity through August 8, 2018.

SECOND QUARTER 2018 HIGHLIGHTS

- Net investment income (“NII”) net of

realized capital gains from the Company’s portfolio and capital

losses from financing activities of $0.34 per weighted average

common share1.

- NAV per common share of $16.51 as of

June 30, 2018.

- Second quarter 2018 GAAP net income

(inclusive of unrealized mark-to-market gains) of $9.5 million, or

$0.44 per weighted average common share.

- Weighted average effective yield of the

Company’s collateralized loan obligation (“CLO”) equity portfolio

was 14.08% as of June 30, 2018.

- Deployed $31.3 million in net capital

and received $35.4 million in cash distributions from the Company’s

investment portfolio in the second quarter of 2018.

- 8 of the Company’s CLO investments were

reset and 1 of the Company’s CLO investments was refinanced during

the second quarter of 2018.

- Completed an underwritten public

offering of $67.3 million in aggregate principal amount of its

6.6875% notes due 2028 (ECCX), including a partial exercise of the

underwriters’ overallotment option, resulting in net proceeds to

the Company of approximately $64.9 million.

- Fully redeemed its 7.00% notes due 2020

(ECCZ).

SUBSEQUENT EVENTS

- NAV per common share estimated to be

between $16.64 and $16.74 as of July 31, 2018.

- Deployed $8.4 million in gross capital

from July 1, 2018 through August 8, 2018; received cash

distributions from the Company’s investment portfolio of $20.6

million over the same period.

“We remain proactive with respect to managing our portfolio and

balance sheet as we seek to unlock additional long-term value for

our stockholders,” said Thomas Majewski, Chief Executive Officer.

“During the second quarter, we completed the effective refinancing

of our 7.00% ECCZ notes with our new 6.6875% ECCX notes, further

lowering our cost of capital and extending the weighted average

maturity of our outstanding notes and preferred stock to

approximately eight years. Additionally, we continued to focus on

CLO resets to take advantage of our Adviser’s deep investing

experience, completing 8 during the quarter and thus further

lengthening the reinvestment period in each transaction and locking

in lower cost CLO debt. During the second quarter, we also deployed

$78.4 million opportunistically into new investments, while selling

certain investments where we saw particularly strong demand and

pricing.”

“We recorded NII net of realized capital gains and losses per

share in the second quarter of $0.34, which was impacted by the

acceleration of unamortized deferred debt issuance costs associated

with the ECCZ redemption and our election to recognize expenses

related to the ECCX issuance in the period they were incurred,”

noted Mr. Majewski. “Non-recurring losses and costs related to the

early repayment of ECCZ and the new ECCX issuance totaled

approximately $0.20 per share during the quarter. With the pace of

spread compression continuing to slow, we are actively managing our

portfolio and, when appropriate, pursuing additional CLO resets in

an effort to lock in longer and lower cost liabilities.”

SECOND QUARTER 2018 RESULTS

The Company’s NII net of realized capital gains and losses for

the quarter ended June 30, 2018 was $0.34 per weighted average

common share. This compared to $0.50 per weighted average common

share for the quarter ended March 31, 2018, and $0.53 per weighted

average common share for the quarter ended June 30, 2017.

The Company’s NII net of realized capital gains and losses for

the quarter ended June 30, 2018 is net of $4.3 million or $0.20 per

weighted average common share of non-recurring loss and expenses

related to the accelerated amortization associated with the

redemption of the ECCZ notes and offering expenses related to the

ECCX issuance.

For the quarter ended June 30, 2018, the Company recorded GAAP

net income of $9.5 million, or $0.44 per weighted average common

share. Net income was comprised of total investment income of $17.4

million and net unrealized appreciation (or unrealized

mark-to-market gain on investments) of $2.3 million, offset by net

realized capital loss of $0.7 million and total expenses of $9.5

million.

NAV as of June 30, 2018 was $358.3 million, or $16.51 per common

share, which is $0.14 per common share lower than the Company’s NAV

as of March 31, 2018, and $1.02 per common share lower than the

Company’s NAV as of June 30, 2017.

During the quarter ended June 30, 2018, the Company deployed

$78.4 million in gross capital and $31.3 million in net capital.

The weighted average effective yield of new CLO equity investments

made by the Company during the quarter, which includes a provision

for credit losses, was 16.31% as measured at the time of

investment. Additionally, during the quarter, the Company received

$47.1 million of proceeds from the sale of investments and

converted 3 of its existing loan accumulation facilities into

CLOs.

During the quarter ended June 30, 2018, the Company received

$35.4 million of cash distributions from its investment portfolio,

or $1.65 per weighted average common share, including amounts

received from called investments. Excluding proceeds from called

investments, the Company received cash distributions of $1.18 per

weighted average common share during the quarter, which was in

excess of the Company’s common distribution and other recurring

operating costs.

During the quarter ended June 30, 2018, 8 of the Company’s CLO

investments were reset and 1 of the Company’s CLO investments was

refinanced, bringing the total number of such CLO equity positions

that were reset or refinanced since January 1, 2017 to 18 and 27,

respectively. The majority of the Company’s current portfolio has

been reset, refinanced or both.

As of June 30, 2018, the weighted average effective yield on the

Company’s CLO equity portfolio was 14.08%, a decrease from 14.54%

as of March 31, 2018. As of June 30, 2017, that measure stood at

15.68%.

Pursuant to the Company’s “at-the-market” offering program under

which the Company may issue shares of common stock and 7.75% Series

B Term Preferred Stock due 2026 (“Series B Term Preferred Stock”),

the Company sold 360,232 shares of common stock at a premium to NAV

during the second quarter for total net proceeds to the Company of

approximately $6.4 million.

PORTFOLIO STATUS

As of June 30, 2018 on a look-through basis, and based on the

most recent CLO trustee reports received by such date, the Company

had indirect exposure to approximately 1,332 unique corporate

obligors. The largest look-through obligor represented 0.98% of the

Company’s CLO equity and loan accumulation facility portfolio. The

top-ten largest look-through obligors together represented 6.4% of

the Company’s CLO equity and loan accumulation facility

portfolio.

The look-through weighted average spread of the loans underlying

the Company’s CLO equity and related investments was 3.56% as of

June 2018.

As of June 30, 2018, the Company had debt and preferred

securities outstanding which totaled approximately 35% of its total

assets (less current liabilities). Over the long term, management

expects the Company to operate under current market conditions

generally with leverage within a range of 25% to 35% of total

assets. Based on applicable market conditions at any given time, or

should significant opportunities present themselves, the Company

may incur leverage outside of this range, subject to applicable

regulatory limits.

THIRD QUARTER 2018 PORTFOLIO ACTIVITY THROUGH AUGUST 8, 2018

AND OTHER UPDATES

From July 1, 2018 through August 8, 2018, the Company received

$20.6 million of cash distributions from its investment portfolio,

or $0.93 per weighted average common share, including amounts

received from called investments. Excluding proceeds from called

investments, the Company received cash distributions of $0.86 per

weighted average common share for the same period. As of August 8,

2018, some of the Company’s investments had not yet reached their

payment date for the quarter. Also from July 1, 2018 through August

8, 2018, the Company deployed $8.4 million in gross capital in new

CLO equity and debt investments. Additionally, in the same period,

the Company issued 561,595 shares of its common stock pursuant to

the “at-the-market” offering, for total net proceeds to the Company

of approximately $10.1 million.

From July 1, 2018 through August 8, 2018, 2 of the Company’s CLO

investments were reset and 1 of the Company’s CLOs was

refinanced.

As of August 8, 2018, the Company has approximately $32.8

million of cash available for investment.

As previously published on the Company’s website, management’s

estimate of the Company’s range of NAV per common share as of July

31, 2018 was $16.64 to $16.74.

PREVIOUSLY DECLARED DISTRIBUTIONS AND ADDITIONAL

UPDATES

The Company paid a monthly distribution of $0.20 per common

share on July 31, 2018 to stockholders of record as of July 12,

2018. Additionally, and as previously announced, the Company

declared distributions of $0.20 per share of common stock payable

on August 31, 2018 and September 28, 2018, to stockholders of

record as of August 13, 2018 and September 12, 2018,

respectively.

The Company paid distributions of $0.161459 per share of the

Company’s 7.75% Series A Term Preferred Stock (NYSE: ECCA) and

Series B Term Preferred Stock (NYSE: ECCB) on July 31, 2018, to

stockholders of record as of July 12, 2018. The distributions

represented a 7.75% annualized rate, based on the $25 liquidation

preference per share for each series of preferred stock.

Additionally, and as previously announced, the Company declared

distributions of $0.161459 per share on each series of preferred

stock, payable on each of August 31, 2018 and September 28, 2018,

to stockholders of record as of August 13, 2018 and September 12,

2018, respectively.

The Company elected to account for its ECCX notes issuance

utilizing the Fair Value Option (“FVO”) under FASB ASC Subtopic

825-10 Fair Value Option. Upfront offering costs related to

instruments for which the FVO has been elected are recognized in

earnings as incurred. The Company has changed its accounting policy

to allow similar elections in the future.

CONFERENCE CALL

The Company will host a conference call at 10:00 a.m. (Eastern

Time) today to discuss the Company’s financial results for the

quarter ended June 30, 2018, as well as a portfolio update.

All interested parties may participate in the conference call by

dialing (833) 231-8253 (domestic) or (647) 689-4099

(international), and entering Conference ID 3678587 approximately

10 to 15 minutes prior to the call. A live webcast will also be

available on the Company’s website

(www.eaglepointcreditcompany.com) – please go to the Investor

Relations section at least 15 minutes prior to the call to

register, download and install any necessary audio software.

An archived replay of the call will be available shortly

afterwards until September 13, 2018. To hear the replay, please

dial (800) 585-8367 (domestic) or (416) 621-4642 (international).

For the replay, enter conference ID 3678587.

ADDITIONAL INFORMATION

The Company has made available on its website,

www.eaglepointcreditcompany.com (in the financial statements and

reports section) its semiannual stockholder report for the period

ended June 30, 2018 (which includes the Company’s unaudited

consolidated financial statements as of and for the period ended

June 30, 2018). The Company has also filed this report with the

Securities and Exchange Commission. The Company also published on

its website (in the investor presentations and portfolio

information section) an investor presentation which contains

additional information about the Company and its portfolio as of

and for the quarter ended June 30, 2018.

ABOUT EAGLE POINT CREDIT COMPANY

The Company is a non-diversified, closed-end management

investment company. The Company’s investment objectives are to

generate high current income and capital appreciation primarily

through investment in equity and junior debt tranches of

collateralized loan obligations. The Company is externally managed

and advised by Eagle Point Credit Management LLC.

The Company makes certain unaudited portfolio information

available each month on its website in addition to making certain

other unaudited financial information available on its website

(www.eaglepointcreditcompany.com). This information includes (1) an

estimated range of the Company’s net investment income (“NII”) and

realized capital gains or losses per weighted average share of

common stock for each calendar quarter end, generally made

available within the first fifteen days after the applicable

calendar month end, (2) an estimated range of the Company’s NAV per

share of common stock for the prior month end and certain

additional portfolio-level information, generally made available

within the first fifteen days after the applicable calendar month

end, and (3) during the latter part of each month, an updated

estimate of NAV, if applicable, and, with respect to each calendar

quarter end, an updated estimate of the Company’s NII and realized

capital gains or losses for the applicable quarter, if

available.

FORWARD-LOOKING STATEMENTS

This press release may contain “forward-looking statements”

within the meaning of the Private Securities Litigation Reform Act

of 1995. Statements other than statements of historical facts

included in this press release may constitute forward-looking

statements and are not guarantees of future performance or results

and involve a number of risks and uncertainties. Actual results may

differ materially from those in the forward-looking statements as a

result of a number of factors, including those described in the

Company’s filings with the U.S. Securities and Exchange Commission

(“SEC”). The Company undertakes no duty to update any

forward-looking statement made herein. All forward-looking

statements speak only as of the date of this press release.

1 “Per weighted average common share” data are on a weighted

average basis based on the average daily number of shares of common

stock outstanding for the period and “per common share” refers to

per share of the Company’s common stock.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180814005167/en/

Investor and Media

Relations:ICR203-340-8510IR@EaglePointCredit.comwww.eaglepointcreditcompany.com

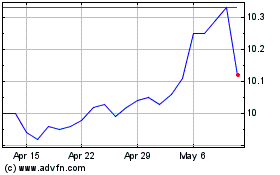

Eagle Point Credit (NYSE:ECC)

Historical Stock Chart

From Mar 2024 to Apr 2024

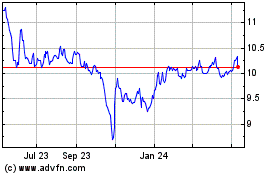

Eagle Point Credit (NYSE:ECC)

Historical Stock Chart

From Apr 2023 to Apr 2024