Company Raises 2018 Guidance

Nomad Foods Limited (NYSE: NOMD), today reported financial

results for the three and six month periods ended June 30,

2018. Key operating highlights and financial performance for the

second quarter 2018, when compared to the second quarter 2017,

include:

- Reported revenue increased 6.6% to

€488 million

- Organic revenue growth of

1.3%

- Reported Profit for the period of

€31 million

- Adjusted EBITDA increased 12% to €89

million

- Reported EPS of €0.18; Adjusted EPS

increased 22% to €0.28

- Company raises 2018 guidance to €365

to €370 million Adjusted EBITDA and €1.14 to €1.17 Adjusted

EPS

Management Comments

Stéfan Descheemaeker, Nomad Foods’ Chief Executive Officer,

stated, “We reported solid second quarter results, highlighted by

1.3% organic revenue growth, 90 basis points of Adjusted EBITDA

margin expansion and 22% Adjusted EPS growth. Performance was

particularly encouraging given this year's earlier Easter timing

and the highly publicized summer heat waves throughout Europe.

Recent acquisitions are proving complementary. Goodfella's is

performing well in our first few months of ownership and Aunt

Bessie's, which closed on July 2nd, is expected to be immediately

accretive. We are pleased with our year-to-date progress and are on

pace to deliver another year of top and bottom line growth."

Noam Gottesman, Nomad Foods’ Co-Chairman and Founder, commented,

“Second quarter results demonstrate the strength of our business

model and the execution ability of our management team. We remain

uniquely positioned to capitalize on the favorable macro trends

occurring within the frozen food space and are excited by the

potential of our portfolio in both the near and long-term."

Second Quarter of 2018 results compared to the Second Quarter

of 2017

- Revenue increased 6.6% to €488

million. Organic revenue growth of 1.3% was comprised of

1.5% growth in price and a 0.2% decline in volume/mix. Revenue

growth benefited 6.4 percentage points from the acquisition of

Goodfella's and was offset by 1.1 percentage points from foreign

exchange translation.

- Adjusted gross profit increased

6% to €154 million. Adjusted gross margin was unchanged at 31.5% as

positive mix and improved pricing and promotional efficiency were

offset by mix related to the acquisition of Goodfella’s.

- Adjusted operating expense

increased 2% to €76 million. Advertising and promotion expense

decreased 1% to €26 million. Indirect expense increased 4% to €50

million due to the acquisition of Goodfella's.

- Adjusted EBITDA increased 12% to

€89 million.

- Adjusted Profit after tax

increased 17% to €49 million reflecting interest savings.

Adjusted EPS increased 22% to €0.28, reflecting Adjusted

Profit growth and a lower share count resulting from prior year

share repurchases.

First Six Months of 2018 results compared to the First Six

Months of 2017

- Revenue increased 3.8% to €1,027

million. Organic revenue growth of 2.1% was comprised of

1.4% growth in price and 0.7% growth in volume/mix. Revenue growth

benefited 3.0 percentage points from the acquisition of Goodfella's

and was offset by 1.3 percentage points from foreign exchange

translation.

- Adjusted gross profit increased

8% to €325 million. Adjusted gross margin expanded 120 basis points

to 31.6% as positive mix and price increases more than offset

currency-driven inflation.

- Adjusted Operating expense

remained flat at €154 million. Advertising and promotion expense

was flat at €56 million reflecting seasonally balanced spending in

2018 versus 2017 while Indirect expense was also flat at €98

million.

- Adjusted EBITDA increased 14% to

€192 million.

- Adjusted Profit after tax

increased 27% to €111 million reflecting interest rate savings and

lower depreciation and amortization. Adjusted EPS increased

31% to €0.63, reflecting Adjusted Profit growth and a lower share

count resulting from prior year share repurchases.

2018 Guidance

The Company is raising 2018 guidance to include the expected

contribution from Aunt Bessie's, which was acquired on July 2,

2018. Management now expects Adjusted EBITDA of approximately €365

to €370 million and Adjusted EPS of approximately €1.14 to €1.17

per share. Full year guidance continues to assume organic revenue

growth at a low-single digit percentage range.

Conference Call and Webcast

The Company will host a conference call with members of the

executive management team to discuss these results today, Thursday,

August 9, 2018 at 1:30 p.m. GMT time (8:30 a.m. Eastern time).

Investors interested in participating in the live call can dial

+1-800-289-0438 from the U.S. International callers can dial

+1-323-794-2423.

In addition, the call will be broadcast live over the Internet

hosted at the “Investor Relations” section of the Company’s website

at http://www.nomadfoods.com. The webcast will be archived

for 30 days. A replay of the conference call will be available on

the Company website for two weeks following the event and can be

accessed by listeners in North America by dialing +1-844-512-2921

and by international listeners by dialing +1-412-317-6671; the

replay pin number is 9559512.

About Nomad Foods

Nomad Foods (NYSE: NOMD) is a leading frozen foods company

building a global portfolio of best-in-class food companies and

brands within the frozen category and across the broader food

sector. The company's portfolio of iconic brands, which includes

Birds Eye, Findus, Iglo Aunt Bessie's and Goodfella's, have been a

part of consumers' meals for generations, standing for great

tasting food that is convenient, high quality and nutritious. Nomad

Foods is headquartered in the United Kingdom. Additional

information may be found at www.nomadfoods.com.

Non-IFRS Financial Information

Nomad Foods is presenting Adjusted and Organic financial

information, which is considered non-IFRS financial information,

for the three and six months ended June 30, 2018 and for

comparative purposes, the three and six months ended June 30,

2017.

Adjusted financial information for the three and six months

ended June 30, 2018 and 2017 presented in this press release

reflects the historical reported financial statements of Nomad

Foods, adjusted primarily for share based payment charges, M&A

related costs, acquisition purchase price adjustments, exceptional

items and foreign currency exchange charges/gains.

EBITDA is profit or loss for the period before taxation, net

financing costs, depreciation and amortization. Adjusted EBITDA is

EBITDA adjusted to exclude, when they occur, the impacts of exited

markets, acquisition purchase price adjustments, trading day

impacts, chart of account (“CoA”) alignments and exceptional items

such as restructuring charges, goodwill and intangible asset

impairment charges, charges relating to the Founders Preferred

Shares Annual Dividend Amount, charges relating to the redemption

of warrants and other unusual or non-recurring items. In addition,

we exclude other adjustments such as the impact of share based

payment charges and M&A related costs, because we do not

believe they are indicative of our normal operating costs, can vary

significantly in amount and frequency, and are unrelated to our

underlying operating performance. The Company believes Adjusted

EBITDA provides important comparability of underlying operating

results, allowing investors and management to assess operating

performance on a consistent basis.

Adjusted EBITDA should not be considered as an alternative to

profit/(loss) for the period, determined in accordance with IFRS,

as an indicator of the Company’s operating performance.

Adjusted EPS is defined as basic earnings per share excluding,

when they occur, the impacts of exited markets, acquisition

purchase price adjustments, trading day impacts, chart of account

(“CoA”) alignments and exceptional items such as restructuring

charges, goodwill and intangible asset impairment charges, unissued

preferred share dividends, as well as certain other items

considered unusual or non-recurring in nature. In addition, we

exclude other adjustments such as the impact of share based payment

charges and M&A related costs, because we do not believe they

are indicative of our normal operating costs, can vary

significantly in amount and frequency, and are unrelated to our

underlying operating performance. The Company believes Adjusted EPS

provides important comparability of underlying operating results,

allowing investors and management to assess operating performance

on a consistent basis.

Organic revenue for the three and six months ended June 30,

2018 and 2017 presented in this press release reflects reported

revenue adjusted for currency translation and non-comparable

trading items such as expansion, acquisitions, disposals, closures,

chart of account (“CoA”) alignments, trading day impacts or any

other event that artificially impact the comparability of our

results.

Adjustments for currency translation are calculated by

translating data of the current and comparative periods using a

budget foreign exchange rate that is set once a year as part of the

Company's internal annual forecast process.

Adjusted and Organic non-IFRS financial information should be

read in conjunction with the unaudited financial statements of

Nomad Foods included in this press release as well as the

historical financial statements of the Company previously filed

with the SEC.

Nomad Foods believe its non-IFRS financial measures provide an

important additional measure with which to monitor and evaluate the

Company’s ongoing financial results, as well as to reflect its

acquisitions. Nomad Foods’ calculation of these financial measures

may be different from the calculations used by other companies and

comparability may therefore be limited. The Adjusted and Organic

financial information presented herein is based upon certain

assumptions that Nomad Foods believes to be reasonable and is

presented for informational purposes only and is not necessarily

indicative of any anticipated financial position or future results

of operations that the Company will experience. You should not

consider the Company’s non-IFRS financial measures an alternative

or substitute for the Company’s reported results and are cautioned

not to place undue reliance on these results and information as

they may not be representative of our actual or future results as a

Company.

Please see on pages 8 to 16, the non-IFRS reconciliation tables

attached hereto and the schedules accompanying this release for an

explanation and reconciliation of the Adjusted and Organic

financial information to the most directly comparable IFRS

measure.

Nomad Foods Limited As Reported

Statements of Profit or Loss

(unaudited)

Three months ended June 30, 2018 and

June 30, 2017

Three months endedJune 30,

2018

Three months endedJune 30,

2017

€ millions € millions Revenue 488.2 458.1 Cost of

sales (336.7 ) (313.8 )

Gross profit 151.5

144.3 Other operating expenses (85.8 ) (75.3 ) Exceptional

items (6.1 ) (11.5 )

Operating profit 59.6

57.5 Finance income — 5.0 Finance costs (17.9 ) (37.3 )

Net financing costs (17.9 ) (32.3

) Profit before tax 41.7 25.2 Taxation

(10.7 ) (5.9 )

Profit for the period 31.0

19.3 Basic earnings per share Profit for the

period in € millions 31.0 19.3 Weighted average shares outstanding

in millions 175.6 181.7

Basic earnings per share in €

0.18 0.11 Diluted earnings per share Profit

for the period in € millions 31.0 19.3 Weighted average shares

outstanding in millions 175.6 181.7

Diluted earnings per share

in € 0.18 0.11

Statements of Profit or Loss

(unaudited)

Six months ended June 30, 2018 and

June 30, 2017

Six months endedJune 30,

2018

Six months endedJune 30,

2017

€ millions € millions Revenue 1,027.4 989.4 Cost of

sales (704.6 ) (689.0 )

Gross profit 322.8

300.4 Other operating expenses (168.6 ) (156.2 ) Exceptional

items (7.6 ) (11.4 )

Operating profit 146.6

132.8 Finance income 3.1 5.6 Finance costs (27.1 ) (54.0 )

Net financing costs (24.0 ) (48.4

) Profit before tax 122.6 84.4 Taxation

(29.2 ) (17.1 )

Profit for the period 93.4

67.3 Basic earnings per share Profit for the

period in € millions 93.4 67.3 Weighted average shares outstanding

in millions 175.5 182.7

Basic earnings per share in €

0.53 0.37 Diluted earnings per share Profit

for the period in € millions 93.4 67.3 Weighted average shares

outstanding in millions 175.5 182.7

Diluted earnings per share

in € 0.53 0.37

Nomad Foods Limited As Reported

Statements of Financial

Position

As at June 30, 2018 (unaudited)

and December 31, 2017 (audited)

As at June 30, 2018

As at December 31, 2017 € millions € millions

Non-current assets Goodwill 1,828.8 1,745.6 Intangibles

1,880.8 1,724.4 Property, plant and equipment 321.0 295.4 Other

receivables 3.2 4.3 Derivative financial instruments 24.5 18.6

Deferred tax assets 61.5 64.3

Total non-current

assets 4,119.8 3,852.6 Current

assets Cash and cash equivalents 403.7 219.2 Inventories 333.5

306.9 Trade and other receivables 165.1 147.1 Indemnification

assets 79.7 73.8 Derivative financial instruments 14.3 2.1

Total current assets 996.3 749.1

Total assets 5,116.1 4,601.7

Current liabilities Trade and other payables 482.1

477.5 Current tax payable 177.5 145.3 Provisions 65.9 68.0 Loans

and borrowings 6.2 3.3 Derivative financial instruments 1.7

7.8

Total current liabilities 733.4

701.9 Non-current liabilities Loans and

borrowings 1,761.1 1,395.1 Employee benefits 194.9 188.4 Trade and

other payables 1.8 1.8 Provisions 64.7 72.8 Derivative financial

instruments 44.0 61.4 Deferred tax liabilities 350.8 327.7

Total non-current liabilities 2,417.3

2,047.2 Total liabilities 3,150.7

2,749.1 Net assets 1,965.4

1,852.6 Equity attributable to equity

holders Share capital — — Capital reserve 1,745.2 1,623.7 Share

based compensation reserve 8.5 2.9 Founder Preferred Share Dividend

reserve 372.6 493.4 Translation reserve 89.6 83.2 Cash flow hedging

reserve 9.8 (3.0 ) Accumulated deficit (260.3 ) (347.6 )

Total

equity 1,965.4 1,852.6

Nomad Foods Limited As Reported

Statements of Cash Flows

(unaudited)

For the six months ended June 30, 2018

and the six months ended June 30, 2017

For the six months endedJune 30,

2018

For the six months endedJune 30,

2017

€ millions € millions Cash flows from operating

activities Profit for the period 93.4 67.3

Adjustments for: Exceptional items 7.6 11.4 Non-cash fair value

purchase price adjustment of inventory 2.1 — Share based payment

expense 6.4 2.1 Depreciation and amortization 21.2 21.8 Loss on

disposal and impairment of property, plant and equipment 0.2 0.2

Finance costs 27.1 54.0 Finance income (3.1 ) (5.6 ) Taxation 29.2

17.1

Operating cash flow before changes in working

capital, provisions and exceptional items 184.1

168.3 (Increase)/decrease in inventories (15.3 ) 13.2

(Increase)/decrease in trade and other receivables (27.1 ) 6.9

(Decrease)/increase in trade and other payables (5.9 ) 11.7

Decrease in employee benefits and other provisions (0.4 ) (0.9 )

Cash generated from operations before tax and exceptional

items 135.4 199.2 Cash flows relating to

exceptional items (17.2 ) (46.4 ) Tax paid (9.3 ) (14.5 )

Net

cash generated from operating activities 108.9

138.3 Cash flows from investing activities

Purchase of subsidiaries, net of cash acquired (237.0 ) — Purchase

of property, plant and equipment (8.7 ) (16.8 ) Purchase of

intangibles (1.4 ) (2.5 )

Cash used in investing activities

(247.1 ) (19.3 ) Cash flows from

financing activities Issuance of new share capital 0.1 —

Repurchase of ordinary shares — (93.9 ) Issuance of new loan

principal 354.8 1,470.5 Repayment of loan principal (5.9 ) (1,469.5

) Payment of finance leases — (1.6 ) Proceeds on settlement of

derivatives 1.7 0.1 Payment of financing fees (3.2 ) (13.6 )

Interest paid (24.0 ) (25.2 ) Interest received — 0.3

Net cash generated from/(used in) financing activities

323.5 (132.9 ) Net

increase/(decrease) in cash and cash equivalents 185.3

(13.9 ) Cash and cash equivalents at

beginning of period 219.2 329.5 Effect of

exchange rate fluctuations (0.8 ) (15.1 )

Cash and cash

equivalents at end of period 403.7 300.5

Nomad Foods LimitedAdjusted Financial

Information(In € millions, except per share data)

The following table reconciles adjusted financial information

for the three months ended June 30, 2018 to the reported results of

Nomad Foods for such period.

Adjusted Statements of Profit or Loss

(unaudited)

Three Months Ended June 30,

2018

€ in millions, except per share data

As reported for thethree months

endedJune 30, 2018

Adjustments

As adjusted for thethree months

endedJune 30, 2018

Revenue 488.2 — 488.2 Cost of sales (336.7 ) 2.1 (a) (334.6

)

Gross profit 151.5 2.1 153.6 Other

operating expenses (85.8 ) 9.9 (b) (75.9 ) Exceptional items (6.1 )

6.1 (c) —

Operating profit 59.6

18.1 77.7 Finance income — — — Finance costs (17.9 )

4.0 (13.9 )

Net financing costs (17.9 )

4.0 (d)

(13.9 ) Profit before

tax 41.7 22.1 63.8 Taxation (10.7 ) (3.8 )

(e) (14.5 )

Profit for the period 31.0

18.3 49.3 Weighted average shares

outstanding in millions - basic 175.6 175.6

Basic earnings per

share 0.18 0.28 Weighted average shares

outstanding in millions - diluted 175.6 175.6

Diluted earnings

per share 0.18 0.28

(a) Adjustments to add back the non-cash charge related to the

increase in inventory fair value recorded as part of the

Goodfella's Pizza purchase price accounting.(b) Adjustment to add

back the share based payment charge of €4.2 million and

non-operating M&A related costs of €5.7 million.(c) Adjustment

to add back exceptional items. See Note 6, Exceptional items,

within ‘Exhibit 99.2 - Condensed Consolidated Interim Financial

Statements’ for a detailed list of exceptional items.(d) Adjustment

to eliminate €1.7 million of costs incurred as part of the issuance

of new debt drawn down on June 20, 2018, €1.3 million of non-cash

foreign exchange translation losses and €1.0 million of foreign

exchange losses on derivatives.(e) Adjustment to reflect the tax

impact of the above at the applicable tax rate for each adjustment,

determined by the nature of the item and the jurisdiction in which

it arises.

Nomad Foods LimitedAdjusted Financial

Information(In € millions)

The following table reconciles EBITDA and Adjusted EBITDA for

the three months ended June 30, 2018 to the reported results of

Nomad Foods for such period.

EBITDA and Adjusted EBITDA

(unaudited)

Three Months Ended June 30,

2018

€ in millions

Three months endedJune 30,

2018

Profit for the period 31.0 Taxation 10.7 Net

financing costs 17.9 Depreciation 9.5 Amortization 1.7

EBITDA 70.8 Acquisition purchase price adjustments

2.1 (a) Exceptional items 6.1 (b) Other Adjustments 9.9 (c)

Adjusted EBITDA (d) 88.9

(a) Adjustment to add back the non-cash charge related to the

increase in inventory fair value recorded as part of the

Goodfella's Pizza purchase price accounting.(b) Adjustment to add

back exceptional items. See Note 6, Exceptional items, within

‘Exhibit 99.2 - Condensed Consolidated Interim Financial

Statements’ for a detailed list of exceptional items.(c) Other

adjustments include the elimination of share-based payment charges

of €4.2 million and elimination of non-operating M&A related

costs of €5.7 million.(d) Adjusted EBITDA margin of 18.2% for the

three months ended June 30, 2018 is calculated by dividing Adjusted

EBITDA by revenue of €488.2 million per page 8.

Nomad Foods LimitedAdjusted Financial

Information(In € millions, except per share data)

The following table reconciles adjusted financial information

for the three months ended June 30, 2017 to the reported results of

Nomad Foods for such period.

Adjusted Statements of Profit or Loss

(unaudited)

Three Months Ended June 30,

2017

€ in millions, except per share data

As reported for thethree months

endedJune 30, 2017

Adjustments

As adjusted for thethree months

endedJune 30, 2017

Revenue 458.1 — 458.1 Cost of sales (313.8 ) — (313.8 )

Gross profit 144.3 — 144.3 Other

operating expenses (75.3 ) 0.8 (a) (74.5 ) Exceptional items (11.5

) 11.5 (b) —

Operating profit 57.5

12.3 69.8 Finance income 5.0 (5.0 ) — Finance costs

(37.3 ) 22.4 (14.9 )

Net financing costs (32.3

) 17.4 (c)

(14.9 ) Profit

before tax 25.2 29.7 54.9 Taxation (5.9 )

(6.7 ) (d) (12.6 )

Profit for the period 19.3

23.0 42.3 Weighted average shares

outstanding in millions - basic 181.7 181.7

Basic earnings per

share 0.11 0.23 Weighted average shares

outstanding in millions - diluted 181.7 181.7

Diluted earnings

per share 0.11 0.23

(a) Adjustment to add back the share-based payment charge.(b)

Adjustment to add back exceptional items. See Note 6,

Exceptional items, within ‘Exhibit 99.2 - Condensed Consolidated

Interim Financial Statements’ for a detailed list of exceptional

items.(c) Adjustment to eliminate €19.5 million of costs incurred

in conjunction with the refinancing on May 3, 2017, €3.5 million of

non-cash foreign exchange translation losses and €5.6 million

foreign exchange gains on derivatives.(d) Adjustment to reflect the

tax impact of the above at the applicable tax rate for each

exceptional item, determined by the nature of the item and the

jurisdiction in which it arises.

Nomad Foods LimitedAdjusted Financial

Information(In € millions)

The following table reconciles EBITDA and Adjusted EBITDA for

the three months ended June 30, 2017 to the reported results of

Nomad Foods for such period.

EBITDA and Adjusted EBITDA

(unaudited)

Three Months Ended June 30,

2017

€ in millions

Three months endedJune 30,

2017

Profit for the period 19.3 Taxation 5.9 Net financing

costs 32.3 Depreciation 8.1 Amortization 1.4

EBITDA

67.0 Exceptional items 11.5 (a) Other Adjustments 0.8 (b)

Adjusted EBITDA(c) 79.3

(a) Adjustment to add back exceptional items. See Note 6,

Exceptional items, within ‘Exhibit 99.2 - Condensed Consolidated

Interim Financial Statements’ for a detailed list of exceptional

items.(b) Other adjustments include the elimination of the

share-based payment charges of €0.8 million.(c) Adjusted EBITDA

margin 17.3% for the three months ended June 30, 2017 is calculated

by dividing Adjusted EBITDA by revenue of €458.1 million per page

10.

Nomad Foods LimitedAdjusted Financial

Information(In € millions, except per share data)

The following table reconciles adjusted financial information

for the six months ended June 30, 2018 to the reported results of

Nomad Foods for such period.

Adjusted Statements of Profit or Loss

(unaudited)

Six Months Ended June 30, 2018

€ in millions, except per share data

As reported for thesix months

endedJune 30, 2018

Adjustments

As adjusted for thesix months

endedJune 30, 2018

Revenue 1,027.4 — 1,027.4 Cost of sales (704.6 ) 2.1 (a)

(702.5 )

Gross profit 322.8 2.1 324.9

Other operating expenses (168.6 ) 14.6 (b) (154.0 ) Exceptional

items (7.6 ) 7.6 (c) —

Operating profit

146.6 24.3 170.9 Finance income 3.1 (3.1 ) —

Finance costs (27.1 ) 0.1 (27.0 )

Net financing costs

(24.0 ) (3.0 ) (d)

(27.0

) Profit before tax 122.6 21.3

143.9 Taxation (29.2 ) (3.3 ) (e) (32.5 )

Profit for the

period 93.4 18.0 111.4

Weighted average shares outstanding in millions - basic

175.5 175.5

Basic earnings per share 0.53 0.63

Weighted average shares outstanding in millions - diluted 175.5

175.5

Diluted earnings per share 0.53 0.63

(a) Adjustments to add back the non-cash charge related to the

increase in inventory fair value recorded as part of the

Goodfella's Pizza purchase price accounting.(b) Adjustment to add

back the share-based payment charge of €6.4 million and

non-operating M&A related costs of €8.2 million.(c) Adjustment

to add back exceptional items. See Note 6, Exceptional items,

within ‘Exhibit 99.2 - Condensed Consolidated Interim Financial

Statements’ for a detailed list of exceptional items.(d) Adjustment

to eliminate €1.7 million of costs incurred in conjunction with the

issuance of new debt drawn down on June 20, 2018, eliminate €0.2

million of non-cash foreign exchange translation losses and €4.9

million of foreign exchange gains on derivatives.(e) Adjustment to

reflect the tax impact of the above at the applicable tax rate for

each adjustment, determined by the nature of the item and the

jurisdiction in which it arises.

Nomad Foods LimitedAdjusted Financial

Information(In € millions)

The following table reconciles EBITDA and Adjusted EBITDA for

the six months ended June 30, 2018 to the reported results of Nomad

Foods for such period.

EBITDA and Adjusted EBITDA

(unaudited)

Six Months Ended June 30, 2018

€ in millions

Six months endedJune 30,

2018

Profit for the period 93.4 Taxation 29.2 Net

financing costs 24.0 Depreciation 18.0 Amortization 3.2

EBITDA 167.8 Acquisition purchase price adjustments

2.1 (a) Exceptional items 7.6 (b) Other Adjustments 14.6 (c)

Adjusted EBITDA (d) 192.1

(a) Adjustment to add back the non-cash charge related to the

increase in inventory fair value recorded as part of the

Goodfella's Pizza purchase price accounting.(b) Adjustment to add

back exceptional items. See Note 6, Exceptional items, within

‘Exhibit 99.2 - Condensed Consolidated Interim Financial

Statements’ for a detailed list of exceptional items.(c) Other

adjustments include the elimination of the share-based payment

charge of €6.4 million and non-operating M&A related costs of

€8.2 million.(d) Adjusted EBITDA margin of 18.7% for the six months

ended June 30, 2018 is calculated by dividing Adjusted EBITDA by

revenue of €1,027.4 million per page 12.

Nomad Foods LimitedAdjusted Financial

Information(In € millions)

The following table reconciles Adjusted financial information

for the six months ended June 30, 2017 to the reported results of

Nomad Foods for such period.

Adjusted Statements of Profit or Loss

(unaudited)

Six Months Ended June 30, 2017

€ in millions, except per share data

As reported for thesix months

endedJune 30, 2017

Adjustments

As Adjusted for thesix months

endedJune 30, 2017

Revenue 989.4 — 989.4 Cost of sales (689.0 ) — (689.0 )

Gross profit 300.4 — 300.4 Other

operating expenses (156.2 ) 2.1 (a) (154.1 ) Exceptional items

(11.4 ) 11.4 (b) —

Operating profit

132.8 13.5 146.3 Finance income 5.6 (5.4 ) 0.2

Finance costs (54.0 ) 21.4 (32.6 )

Net financing

costs (48.4 ) 16.0 (c)

(32.4

) Profit before tax 84.4 29.5

113.9 Taxation (17.1 ) (9.1 ) (d) (26.2 )

Profit for the

period 67.3 20.4 87.7

Weighted average shares outstanding in millions - basic 182.7 182.7

Basic earnings per share 0.37 0.48 Weighted

average shares outstanding in millions - diluted 182.7 182.7

Diluted earnings per share 0.37 0.48

(a) Adjustment to add back the share based payment charge.(b)

Adjustment to add back exceptional items. See Note 6,

Exceptional items, within ‘Exhibit 99.2 - Condensed Consolidated

Interim Financial Statements’ for a detailed list of exceptional

items.(c) Adjustment to eliminate €19.5 million of costs incurred

as part of the refinancing on the May 3, 2017, €2.5 million of

foreign exchange translation losses and €6.0 million of foreign

currency gains on derivatives.(d) Adjustment to reflect the tax

impact of the above at the applicable tax rate for each adjustment,

determined by the nature of the item and the jurisdiction in which

it arises.

Nomad Foods LimitedAdjusted Financial

Information(In € millions)

The following table reconciles EBITDA and Adjusted EBITDA for

the six months ended June 30, 2017 to the reported results of Nomad

Foods for such period:

EBITDA and Adjusted EBITDA

(unaudited)

Six Months Ended June 30, 2017

€ in millions

Six months endedJune 30,

2017

Profit for the period 67.3 Taxation 17.1 Net

financing costs 48.4 Depreciation 18.0 Amortization 3.8

EBITDA 154.6 Exceptional items 11.4 (a) Other

Adjustments 2.1 (b)

Adjusted EBITDA(c) 168.1

(a) Adjustment to add back exceptional items. See Note 6,

Exceptional items, within ‘Exhibit 99.2 - Condensed Consolidated

Interim Financial Statements’ for a detailed list of exceptional

items.(b) Other adjustments include the elimination of the

share-based payment charge.(c) Adjusted EBITDA margin of 17.0% for

the six months ended June 30, 2017 is calculated by dividing

Adjusted EBITDA by revenue of €989.4 million per page 14.

Nomad Foods Limited

Adjusted Financial Information

(continued)

Appendix 1: Reconciliation from

reported to organic revenue growth

Year on Year Growth - June 30,

2018 compared with June 30, 2017:

Three Months EndedJune 30,

2018

Six Months EndedJune 30,

2018

YoY Growth YoY Growth Reported Revenue Growth

6.6 % 3.8 % Of which: - Organic Revenue

Growth 1.3 % 2.1 % - Acquisitions 6.4 % 3.0 % - Translational FX

(a) (1.1 )% (1.3 )%

Total 6.6 % 3.8

%

(a) Translational FX is calculated by translating data of the

current and comparative periods using a budget foreign exchange

rate that is set once a year as part of the Company's internal

annual forecast process.

Forward-Looking

Statements

Forward-Looking Statements and Disclaimers

Certain statements in this announcement are forward-looking

statements which are based on the Company’s expectations,

intentions and projections regarding its future performance,

anticipated events or trends and other matters that are not

historical facts, including expectations regarding (i) the

Company’s ability to expand its presence and market share in the

frozen foods market; (ii) the success of the Company’s strategic

initiatives including focus on core products, product enhancements

and media investments; (iii) the timing and success of new product

launches such as Veggie Power, Good For You, Pulses and PEASE; (iv)

completion of successful acquisitions in the same and adjacent

categories; (v) the future operating and financial performance of

the Company including organic growth rate and our guidance with

respect to Adjusted EBITDA and Adjusted EPS, gross margins and

operating expenses; and (vi) synergies and other benefits from the

Goodfella's and Aunt Bessie's acquisitions, including an increase

in the size and scale of the Company’s U.K. business and the level

of additional revenue, earnings and EBITDA generated by these

businesses in 2018 . These statements are not guarantees of future

performance and are subject to known and unknown risks,

uncertainties and other factors that could cause actual results to

differ materially from those expressed or implied by such

forward-looking statements, including (i) economic conditions,

competition and other risks that may affect the Company’s future

performance; (ii) the risk that securities markets will react

negatively to actions by the Company; (iii) the ability to

recognize the anticipated benefits to the Company of strategic

initiatives; (iv) the successful completion of strategic

acquisitions; (v) changes in applicable laws or regulations; and

(vi) the other risks and uncertainties disclosed in the Company’s

public filings and any other public disclosures by the Company.

Given these risks and uncertainties, prospective investors are

cautioned not to place undue reliance on forward-looking

statements. Forward-looking statements speak only as of the date of

such statements and, except as required by applicable law, the

Company does not undertake any obligation to update or revise

publicly any forward-looking statements, whether as a result of new

information, future events or otherwise.

No Offer or Solicitation

This release and referenced conference call is provided for

informational purposes only and does not constitute an offer to

sell, or an invitation to subscribe for, purchase or exchange, any

securities or the solicitation of any vote or approval in any

jurisdiction, nor shall there be any sale, issuance, exchange or

transfer of the securities referred to in this press release in any

jurisdiction in contravention of applicable law.

The release, publication or distribution of this announcement in

certain jurisdictions may be restricted by law and therefore

persons in such jurisdictions into which this announcement is

released, published or distributed should inform themselves about

and observe such restrictions.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180809005030/en/

Nomad Foods ContactsInvestor Relations

ContactsNomad Foods LimitedTaposh Bari, CFA,

+1-718-290-7950orICRJohn Mills, +1-646-277-1254PartnerorMedia

ContactGladstone Place PartnersFelipe Ucros / Max Dutcher,

+1-212-230-5930

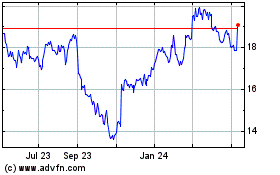

Nomad Foods (NYSE:NOMD)

Historical Stock Chart

From Mar 2024 to Apr 2024

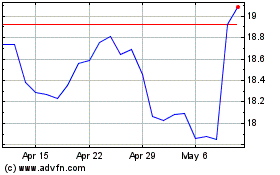

Nomad Foods (NYSE:NOMD)

Historical Stock Chart

From Apr 2023 to Apr 2024