FORM 6-K

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

Report of Foreign Private

Issuer

Pursuant to Rule 13a-16

or 15d-16

of the Securities Exchange

Act of 1934

Date: August 8, 2018

Commission File Number 001-31528

IAMGOLD

Corporation

(Translation of registrant's name into English) |

| |

| 401 Bay Street Suite 3200, PO Box 153 |

| Toronto, Ontario, Canada M5H 2Y4 |

|

Tel: (416) 360-4710

(Address of principal executive offices) |

Indicate by check mark whether the registrant

files or will file annual reports under cover Form 20-F or Form 40-F.

Indicate by check mark if the

registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ____

| |

Note: Regulation

S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report

to security holders. |

Indicate by check mark if the

registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ____

| |

Note: Regulation

S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that

the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant

is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of

the home country exchange on which the registrant’s securities are traded, as long as the report or other document is

not a press release, is not required to be and has not been distributed to the registrant’s security holders, and, if

discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR. |

Indicate by check mark whether

by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission

pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

If

"Yes" is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- ________

Description

of Exhibit

Signatures

Pursuant to the requirements of the

Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| |

|

|

| |

IAMGOLD CORPORATION |

| |

|

|

| Date: August 8, 2018 |

By: |

/s/ Tim Bradburn |

| |

Tim Bradburn |

| |

Vice President, Legal and Corporate Secretary |

Exhibit 99.1

IAMGOLD Continues Successful Execution

of Growth Projects and Reports Solid Second Quarter 2018

All monetary amounts

are expressed in U.S. dollars, unless otherwise indicated.

For more information,

refer to the Management Discussion and Analysis (MD&A) and Unaudited Consolidated Interim Financial Statements for the six

months ended June 30, 2018.

TORONTO, Aug. 8, 2018 /CNW/ - IAMGOLD Corporation

("IAMGOLD" or the "Company") reported its consolidated financial and operating results for the quarter

ended June 30, 2018.

"Coming off an exceptional start to the

year, we had a solid second quarter," said Steve Letwin, President and CEO of IAMGOLD. "Operating performance to date

reaffirms our 2018 production and cost guidance established at the beginning of the year. The second quarter saw the completion

of Essakane's pre-feasibility study for heap leaching, which demonstrated an economically viable project, including a significant

increase in reserves. The incremental ounces more than replace this year's expected annual depletion for the entire company, and

Saramacca's reserves are yet to come. Supported by more than a billion dollars in liquidity, the steady execution of our growth

strategy continues, with our core projects on track and at the stage where we are finding opportunities to enhance expected returns."

Second Quarter 2018

Highlights

Operating Performance

- Attributable gold production of 214,000 oz, down 9,000

oz from Q2/17.

- Attributable gold sales of 215,000 oz, down 4,000 oz

from Q2/17.

- Cost of sales1 of $826/oz sold, up $59/oz

from Q2/17.

- All-in sustaining costs2 of $1,077/oz sold,

up $102/oz from Q2/17.

- Total cash costs2 of $812/oz produced, up

$77/oz from Q2/17.

- Gold margin2 of $487/oz, down $29/oz from

Q2/17.

- Production and cost guidance maintained for 2018.

- Capital expenditure guidance reduced by $40 million to

$325 million (±5%) for 2018; updated guidance primarily relates to the refinement of estimates for the expansion projects

and deferred timing of certain expenditures to early 2019, with no impact expected on overall project timelines.

Financial Results

- Revenues of $277.4 million, up $2.9 million from Q2/17.

- Gross profit of $29.6 million, down $6.3 million from

Q2/17.

- Net loss attributable to equity holders of $26.2 million,

or $0.06 per share; compared with net earnings of $506.5 million, or $1.09 per share in Q2/17, which included impairment charge

reversals relating to the Côté Gold Project and the Rosebel mine ($524.1 million).

- Adjusted net earnings attributable to equity holders2

of $13.1 million, or $0.03 per share2; up $8.8 million, or $0.02 per share2 from Q2/17.

- Net cash from operating activities of $50.6 million,

down $35.6 million from Q2/17.

- Net cash from operating activities before changes in

working capital2 of $73.4 million, up $5.5 million from Q2/17.

- Cash, cash equivalents, short-term investments in money

market instruments, and restricted cash of $803.9 million at June 30, 2018.

Strategic Developments

- On June 5, 2018, we reported a 39% increase in reserves,

before depletion, at Essakane based on positive results from the Heap Leach Project pre-feasibility study and higher grade intercepts

encountered during the drilling campaign. The results of the pre-feasibility study outlined an economically viable project that

increases average annual production by 16% to 480,000 ounces versus the previously disclosed mine plan, once heap leaching begins.

- On June 14, 2018, we announced further high-grade intersections

from infill drilling at the Monster Lake Project. Highlights included: 3.8 metres grading 23.96 g/t Au, 3.8 metres grading 39.24

g/t Au, 2.6 metres grading 72.17 g/t Au, and 5.3 metres grading 40.94 g/t Au.

Upcoming Growth Catalysts

- Mineral reserve estimate expected for Saramacca H2/18;

production start expected H2/19.

- Completion of Boto Gold Project feasibility study expected

H2/18.

- Commissioning of oxygen plant to improve recoveries at

Essakane expected Q4/18.

- Targeting initial resource estimate for Gossey satellite

prospect at Essakane in Q4/18.

- Expect to receive a $95 million cash payment from Sumitomo

Metal Mining Co., Ltd. by end of 2018 in conjunction with the sale of a 30% interest in the Côté Gold Project in June

2017.

- Completion of Essakane's Heap Leach Project feasibility

study expected Q1/19; production start expected 2020.

- Completion of feasibility study at Côté

Gold expected H1/19; expected production start 2021.

- Westwood ramp-up to full production expected by 2020.

- Advancing exploration at Brokolonko to confirm the presence

of mineralization and evaluate the resource potential.

| SUMMARY OF FINANCIAL AND OPERATING RESULTS |

| |

|

|

|

|

|

| |

Three months ended

June 30, |

Six months

ended June 30, |

|

|

|

|

| Financial Results ($ millions, except where noted) |

2018 |

2017 |

2018 |

2017 |

|

|

|

|

| Revenues |

$ |

277.4 |

$ |

274.5 |

$ |

591.9 |

$ |

535.0 |

|

|

|

|

| Cost of sales |

$ |

247.8 |

$ |

238.6 |

$ |

486.5 |

$ |

464.1 |

|

|

|

|

| Gross profit |

$ |

29.6 |

$ |

35.9 |

$ |

105.4 |

$ |

70.9 |

|

|

|

|

| Net earnings (loss) attributable to equity holders of IAMGOLD |

$ |

(26.2) |

$ |

506.5 |

$ |

16.1 |

$ |

488.5 |

|

|

|

|

| Net earnings (loss) attributable to equity holders ($/share) |

$ |

(0.06) |

$ |

1.09 |

$ |

0.03 |

$ |

1.06 |

|

|

|

|

| Adjusted net earnings attributable to equity holders of IAMGOLD1 |

$ |

13.1 |

$ |

4.3 |

$ |

52.8 |

$ |

9.4 |

|

|

|

|

| Adjusted net earnings attributable to equity holders ($/share)1 |

$ |

0.03 |

$ |

0.01 |

$ |

0.11 |

$ |

0.02 |

|

|

|

|

| Net cash from operating activities |

$ |

50.6 |

$ |

86.2 |

$ |

156.6 |

$ |

153.1 |

|

|

|

|

| Net cash from operating activities before changes in working capital1 |

$ |

73.4 |

$ |

67.9 |

$ |

193.0 |

$ |

152.3 |

|

|

|

|

| Key Operating Statistics |

|

|

|

|

|

|

|

|

| Gold sales – attributable (000s oz) |

215 |

219 |

450 |

431 |

|

|

|

|

| Gold production – attributable (000s oz) |

214 |

223 |

443 |

437 |

|

|

|

|

| Average realized gold price1 ($/oz) |

$ |

1,299 |

$ |

1,251 |

$ |

1,316 |

$ |

1,241 |

|

|

|

|

| Cost of sales2 ($/oz) |

$ |

826 |

$ |

767 |

$ |

781 |

$ |

768 |

|

|

|

|

| Total cash costs1 ($/oz) |

$ |

812 |

$ |

735 |

$ |

773 |

$ |

751 |

|

|

|

|

| All-in sustaining costs1 ($/oz) |

$ |

1,077 |

$ |

975 |

$ |

1,012 |

$ |

983 |

|

|

|

|

| Gold margin1 ($/oz) |

$ |

487 |

$ |

516 |

$ |

543 |

$ |

490 |

|

|

|

|

| |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| 1 |

This is a non-GAAP measure. Refer to the non-GAAP performance measures section of the MD&A. |

| 2 |

Cost of sales, excluding depreciation, as disclosed in note 31 of the Company's consolidated interim financial statements is on an attributable ounce sold basis (excluding the non-controlling interests of 10% at Essakane and 5% at Rosebel) and does not include Joint Ventures which are accounted for on an equity basis. |

SECOND QUARTER 2018

HIGHLIGHTS

Financial Performance

- Revenues for the second quarter 2018 were $277.4 million,

up $2.9 million from the same prior year period. The increase was primarily due to a higher realized gold price ($10.5 million)

and higher sales volume at Rosebel ($2.6 million), partially offset by lower sales volume at Essakane ($8.5 million) and Westwood

($0.8 million).

- Cost of sales for the second quarter 2018 was $247.8

million, up $9.2 million from the same prior year period. The increase was due to higher operating costs ($8.2 million), higher

depreciation expense ($0.8 million), and higher royalties ($0.2 million). Operating costs were higher primarily due to planned

maintenance at Essakane and Rosebel, a weaker U.S. dollar relative to the euro and the Canadian dollar, higher contractor costs

at Essakane given the long lead time for receiving mining equipment, higher energy costs, and the continued ramp-up at Westwood,

partially offset by higher capitalized stripping due to mine sequencing.

- Depreciation expense for the second quarter 2018 was

$72.3 million, up $0.8 million from the same prior year period. The increase was primarily due to higher depreciation on capital

spares and capitalized stripping, partially offset by an increase in reserves combined with lower production at Essakane and Rosebel.

- Income tax expense for the second quarter 2018 was $7.4

million, down $46.1 million from the same prior year period. Income tax expense for the second quarter 2018 comprised current income

tax expense of $11.4 million (Q2/17 - $19.7 million) and deferred tax recovery of $4.0 million (Q2/17 - expense of $33.8 million).

The decrease in income tax expense was primarily due to changes to deferred income tax assets and liabilities, differences in the

impact of fluctuations in foreign exchange, and differences in the level of taxable income in IAMGOLD's operating jurisdictions

from one period to the next.

- Net loss attributable to equity holders for the second

quarter 2018 was $26.2 million, or $0.06 per share compared to net earnings of $506.5 million, or $1.09 per share in the same prior

year period. The decrease was primarily due to reversals of impairment charges relating to the Côté Gold Project and

the Rosebel mine in the second quarter 2017 ($524.1 million), lower interest income, derivatives and other investment gains ($33.1

million), higher foreign exchange losses ($17.0 million), and lower gross profit ($6.3 million), partially offset by lower income

taxes ($46.1 million). Foreign exchange losses, which were substantially unrealized, were higher primarily due to the impact of

a weaker U.S. dollar relative to the euro and the Canadian dollar on non-U.S. dollar cash balances and short-term investments.

- Adjusted net earnings attributable to equity holders2

for the second quarter 2018 were $13.1 million, or $0.03 per share2, up $8.8 million, or $0.02 per share2,

from the same prior year period.

- Net cash from operating activities for the second quarter

2018 was $50.6 million, down $35.6 million from the same prior year period. The decrease was primarily due to changes in movements

in non-cash working capital items and non-current ore stockpiles ($41.1 million), and lower earnings after non-cash adjustments

($3.3 million), partially offset by higher net settlement of derivatives ($3.4 million), lower income taxes paid ($3.2 million),

and dividends received from Sadiola ($2.1 million).

- Net cash from operating activities before changes in

working capital2 for the second quarter 2018 was $73.4 million, up $5.5 million from the same prior year period.

Financial Position

- We ended the second quarter in a strong financial position,

with cash, cash equivalents, short-term investments in money market instruments and restricted cash of $803.9 million at June 30,

2018, down $11.9 million from December 31, 2017. The decrease was primarily due to spending on property, plant and equipment ($118.4

million) and exploration and evaluation assets ($23.2 million), interest paid ($14.2 million), and other investing activities ($10.9

million), partially offset by cash generated from operating activities ($156.6 million).

Production and Costs

- Attributable gold production, inclusive of joint venture

operations, was 214,000 ounces for the second quarter 2018, down 9,000 ounces from the same prior year period. The decrease was

due to lower throughput at Rosebel (4,000 ounces) and Essakane (4,000 ounces) attributed to the timing of planned mill maintenance,

and lower head grades at Westwood (2,000 ounces), partially offset by higher throughput at the Joint Ventures (1,000 ounces).

- Attributable gold sales, inclusive of joint venture operations,

were 215,000 ounces for the second quarter 2018, down 4,000 ounces from the same prior year period. The decrease was due to lower

sales at Essakane (6,000 ounces) partially offset by higher sales at Rosebel (2,000 ounces).

- Cost of sales1 per ounce for the second quarter

2018 was $826, up 8% from the same prior year period. The increase was primarily due to planned maintenance at Essakane and Rosebel,

a weaker U.S. dollar relative to the euro and the Canadian dollar, higher contractor costs at Essakane given the long lead time

for receiving mining equipment, and higher energy costs, partially offset by higher capitalized stripping due to mine sequencing.

- Total cash costs2 per ounce produced for the

second quarter 2018 were $812, up 10% from the same prior year period. The increase was primarily due to the factors noted above.

- All-in sustaining costs2 per ounce sold for

the second quarter 2018 were $1,077, up 10% from the same prior year period. The increase was primarily due to higher sustaining

capital and higher cost of sales per ounce.

- Total cash costs2 and all-in sustaining costs2

for the second quarter 2018 included realized derivative gains from hedging programs of $14 per ounce produced and $15 per ounce

sold, respectively (Q2/17 - $nil and $nil).

Capital Expenditure

Guidance (Refer to MD&A for more detail)

- Capital expenditure guidance for 2018 has been reduced

by $40 million to $325 million (±5%). This is the result of a $20 million increase in sustaining capital expenditures and

a $60 million decrease in non-sustaining capital expenditures. The increase in sustaining capital primarily relates to higher capitalized

stripping at Essakane, which represents a shift from operating costs that will not impact all-in sustaining costs. The decrease

in non-sustaining capital is primarily due to refined work schedules for Saramacca and the Heap Leach Project at Essakane, with

both projects having amended procurement timelines resulting in the deferral of certain expenditures to 2019. Targeted completion

dates for both projects remain intact. The change in non-sustaining capital guidance also includes an increase of $10 million for

the Côté Gold Project reflecting the advancement of detailed engineering and equipment design.

Commitment to Zero Harm

Continues

- The DART rate3, representing the frequency

of all types of serious injuries across all sites and functional areas for the second quarter 2018 was on target at 0.50. Zero

Harm remains our number one priority, and this year we are accelerating the deployment of a new Health and Safety Management System

and new prevention initiatives across all sites.

| ATTRIBUTABLE GOLD PRODUCTION AND COSTS |

| |

|

|

|

|

|

|

|

|

|

| |

Gold Production

(000s oz) |

Cost of Sales1

($ per ounce) |

Total Cash Costs2

($ per ounce

produced) |

All-in Sustaining

Costs2

($ per ounce sold) |

|

|

|

|

|

|

|

|

| Three months ended June 30, |

2018 |

2017 |

2018 |

|

2017 |

2018 |

2017 |

2018 |

2017 |

|

|

|

|

|

|

|

|

| Owner-operator |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Essakane (90%) |

97 |

101 |

$ |

771 |

$ |

750 |

$ |

728 |

$ |

698 |

$ |

1,003 |

$ |

922 |

|

|

|

|

|

|

|

|

| Rosebel (95%) |

70 |

74 |

862 |

752 |

|

842 |

|

722 |

|

1,035 |

|

923 |

|

|

|

|

|

|

|

|

| Westwood (100%)3 |

31 |

33 |

924 |

843 |

|

929 |

|

800 |

|

1,129 |

|

995 |

|

|

|

|

|

|

|

|

| Owner-operator4 |

198 |

208 |

$ |

826 |

$ |

767 |

$ |

799 |

$ |

723 |

$ |

1,086 |

$ |

975 |

|

|

|

|

|

|

|

|

| Joint Ventures |

16 |

15 |

|

|

|

962 |

|

910 |

|

968 |

|

965 |

|

|

|

|

|

|

|

|

| Total operations |

214 |

223 |

|

|

$ |

812 |

$ |

735 |

$ |

1,077 |

$ |

975 |

|

|

|

|

|

|

|

|

| Cost of sales1 ($/oz) |

|

$ |

826 |

$ |

767 |

|

|

|

|

|

|

|

|

|

|

|

|

| Cash costs, excluding royalties |

|

|

|

$ |

756 |

$ |

682 |

|

|

|

|

|

|

|

|

|

|

| Royalties |

|

|

|

|

56 |

53 |

|

|

|

|

|

|

|

|

|

|

| Total cash costs2 |

|

|

|

$ |

812 |

$ |

735 |

|

|

|

|

|

|

|

|

|

|

| All-in sustaining costs2 |

|

|

|

|

|

|

|

$ |

1,077 |

$ |

975 |

|

|

|

|

|

|

|

|

| |

|

|

|

| |

Gold Production

(000s oz) |

Cost of Sales1

($ per ounce) |

Total Cash Costs2

($ per ounce

produced) |

All-in Sustaining

Costs2

($ per ounce sold) |

| Six months ended June 30, |

2018 |

2017 |

2018 |

2017 |

2018 |

2017 |

2018 |

|

2017 |

| Owner-operator |

|

|

|

|

|

|

| Essakane (90%) |

206 |

194 |

$ |

739 |

$ |

770 |

$ |

695 |

$ |

730 |

$ |

956 |

$ |

946 |

| Rosebel (95%) |

135 |

148 |

831 |

745 |

836 |

724 |

976 |

904 |

| Westwood (100%)3 |

71 |

63 |

808 |

818 |

809 |

780 |

984 |

980 |

| Owner-operator4 |

412 |

405 |

$ |

781 |

$ |

768 |

$ |

761 |

$ |

736 |

$ |

1,017 |

$ |

983 |

| Joint Ventures |

31 |

32 |

|

|

|

933 |

937 |

947 |

988 |

| Total operations |

443 |

437 |

|

|

$ |

773 |

$ |

751 |

$ |

1,012 |

$ |

983 |

| Cost of sales1 ($/oz) |

|

$ |

781 |

$ |

768 |

|

|

|

|

|

|

| Cash costs, excluding royalties |

|

|

|

|

$ |

715 |

$ |

699 |

|

|

|

|

| Royalties |

|

|

|

|

|

58 |

|

52 |

|

|

| Total cash costs2 |

|

|

|

|

$ |

773 |

$ |

751 |

|

|

|

|

| All-in sustaining costs2 |

|

|

|

|

|

|

|

|

$ |

1,012 |

$ |

983 |

| |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 1 |

Cost of sales, excluding depreciation, as disclosed in note 31 of the Company's consolidated interim financial statements is on an attributable ounce sold basis (excluding the non-controlling interests of 10% at Essakane and 5% at Rosebel) and does not include Joint Ventures which are accounted for on an equity basis. |

| 2 |

This is a non-GAAP measure. Refer to the non-GAAP performance measures section of the MD&A. Consists of Essakane, Rosebel, Westwood and the Joint Ventures on an attributable basis. |

| 3 |

There was no normalization of costs of sales per ounce for Westwood for the three and six months ended June 30, 2018 (three and six months ended June 30, 2017 - $nil and $12 per ounce, respectively). Normalization of costs ended at the onset of the second quarter 2017. |

| 4 |

Owner-operator cost of sales and all-in sustaining costs include corporate general and administrative costs. Refer to all-in sustaining costs reconciliation on page 26 of the MD&A. |

OPERATIONS ANALYSIS

BY MINE SITE

Essakane Mine - Burkina Faso (IAMGOLD interest

- 90%)

Essakane produced 97,000 attributable ounces

in the second quarter 2018, 4% lower the same prior year period. The decrease was primarily due to lower throughput resulting from

planned mill maintenance on the crushing and grinding circuit. Mining activities were lower compared to the same prior year period

due to longer hauling distances as a result of increased mining activity at Falagountou and lower equipment availability.

Cost of sales of $771 per ounce sold and total

cash costs of $728 per ounce produced for the second quarter 2018 were higher than the same prior year period by 3% and 4%, respectively.

The increases were primarily due to lower sales and production volumes, higher contractor costs given the long lead time for receiving

mining equipment, a weaker U.S. dollar relative to the euro, and planned mill maintenance, partially offset by higher capitalized

stripping.

All-in sustaining costs of $1,003 per ounce

sold for the second quarter 2018 were 9% higher than the same prior year period. The increase was primarily due to higher sustaining

capital expenditures and higher cost of sales per ounce.

Total cash costs and all-in sustaining costs

for the second quarter 2018 included the impact of realized derivative gains from hedging programs of $22 per ounce produced and

$24 per ounce sold, respectively (Q2/17 - $nil and $nil).

The oxygen plant, which is expected to increase

recoveries through improved leach kinetics and improve the efficiency of the circuit by reducing reagent consumption, is on track

for commissioning in the fourth quarter 2018.

Sustaining capital expenditures for the second

quarter 2018 of $24.2 million included capitalized stripping of $15.8 million, capital spares of $2.9 million, resource development

of $2.1 million, mobile equipment of $1.9 million, and other sustaining capital expenditures of $1.5 million. Non-sustaining capital

expenditures of $9.3 million included tailings liners of $6.8 million, oxygen plant of $1.4 million, and other non-sustaining capital

expenditures of $1.1 million.

Outlook

We maintain full-year 2018 production guidance

of 380,000 to 395,000 attributable ounces. Capital expenditures are expected to be approximately $140 million, comprising $90 million

of sustaining capital and $50 million of non-sustaining capital. The sustaining capital expenditure guidance reflects an increase

of $15 million in capitalized stripping, which represents a shift from operating costs that will not impact all-in sustaining costs.

The non-sustaining capital expenditure guidance reflects a decrease of $25 million, of which $20 million is related to the Heap

Leach Project, which is currently undergoing a feasibility study. Procurement activities have been deferred to 2019 until after

the completion of the feasibility study expected in the first quarter 2019, thus resulting in the decrease in guidance for 2018.

Production timelines for the Heap Leach Project remain intact.

Heap Leach Project

On June 5, 2018, we announced positive results

from the pre-feasibility study (PFS) for the Heap Leach Project. The PFS presented a heap leach-based extraction scenario in combination

with the existing Essakane operation. (see news release dated June 5, 2018). A National Instrument 43-101 technical

report summarizing the PFS was filed on SEDAR on July 19, 2018.

Based on the results of the PFS, and on a 100%

basis, Essakane's probable reserves increased by 39%, or 1.3 million ounces, to 4.7 million ounces, before depletion. Indicated

resources (inclusive of reserves) increased by 19%, or 0.8 million ounces, to 5.1 million ounces, and inferred resources increased

by 54%, or 0.2 million ounces, to 0.6 million ounces. The mineral reserves and resources reported in the June 5, 2018 news release

were before mining depletion, whereas the evaluation presented in the technical report included depletion from January 1, 2018

to June 5, 2018.

The infill drilling program, conducted to upgrade

targeted lower-grade inferred resources in support of the PFS, intersected higher than anticipated grades in several areas. These

higher-grade intercepts accounted for more than one-third of the 39% increase in reserves.

The PFS outlined an economically viable project

that has the potential to:

- extend the life of the Essakane mine by three years to

2026 from the life-of-mine reported in the 2016 Technical Report, and

- once heap leaching begins, increase average annual production

by 16% from the previously disclosed plan to 480,000 ounces at a projected all-in sustaining cost of $946 per ounce.

The PFS recommended that a feasibility study

("FS") be completed to further optimize the development design of the project, secure long lead equipment and optimize

project economics. The recommended FS has been initiated, and, in addition to the heap leach scenario, will consider additional

development alternatives, such as a gravity circuit upgrade and an increase in grinding capacity to increase throughput and recovery

of the carbon-in-leach and gravity circuits. The FS is expected to be completed in the first quarter 2019.

During the second quarter, approximately 23,900

metres of reverse circulation and diamond drilling were completed on the mine lease and surrounding concessions. On the mine lease,

a further phase of infill drilling was initiated at the Essakane Main Zone in support of the ongoing FS.

On the surrounding concessions, a second phase

of delineation drilling was completed during the second quarter at the Gossey prospect, located approximately 15 kilometres northwest

of the Essakane operation. The results of this drilling program will support the completion of a mineral resource estimate expected

later this year.

Rosebel Mine - Suriname (IAMGOLD interest

- 95%)

Attributable gold production of 70,000 ounces

for the second quarter 2018 was 5% lower than the same prior year period, primarily due to lower throughput. Mill throughput was

lower mainly due to planned mill maintenance on the crushing and grinding circuit, combined with an increase in the hard rock blend.

Cost of sales of $862 per ounce sold and total

cash costs of $842 per ounce produced for the second quarter 2018 were higher than the same prior year period by 15% and 17%, respectively.

The increases were primarily the result of planned mine and mill maintenance, higher energy costs, and lower capitalized stripping

due to mine sequencing.

All-in sustaining costs of $1,035 per ounce

sold for the second quarter 2018 were 12% higher than the same prior year period. The increase was primarily due to higher cost

of sales per ounce and higher sustaining capital expenditures.

Total cash costs and all-in sustaining costs

for the second quarter 2018 included the impact of realized derivative gains from hedging programs of $11 per ounce produced and

sold (June 30, 2017 - $nil and $nil).

Sustaining capital expenditures for the second

quarter 2018 of $12.7 million included capital spares of $4.2 million, capitalized stripping of $1.9 million, mobile equipment

of $1.8 million, pit infrastructure of $1.3 million, tailings management of $0.9 million, mill equipment of $0.7 million, and other

sustaining capital expenditures of $1.9 million. Non-sustaining capital expenditures were $6.5 million related to the Saramacca

Project.

Outlook

We maintain full-year 2018 production guidance

of 295,000 to 310,000 attributable ounces. Capital expenditures are expected to be approximately $90 million, comprising $45 million

of sustaining capital and $45 million of non-sustaining capital. The non-sustaining capital expenditure guidance reflects a decrease

of $40 million for the Saramacca Project, reflecting deferred procurement activity to early 2019 as a result of more specific scheduling

of construction work based on detailed engineering studies. Production timelines for the Saramacca Project remain intact.

Saramacca and Brokolonko

The Saramacca Project development is progressing

according to schedule. On July 31, 2018, the Environmental and Social Impact Assessment (ESIA) was submitted to the National Institute

for Environment and Development in Suriname (NIMOS). Optimization of the detailed engineering for the haul road construction has

been initiated, allowing for the selection of the haul fleet and a reduction in the road distance. A comprehensive metallurgical

testing program is also in progress to refine the recovery assumptions and to test the crushing and grinding characteristics of

the mineralization.

During the second quarter 2018, we completed

approximately 7,950 metres of reverse circulation and diamond drilling on the Saramacca property. The drilling program continued

to infill the deposit to upgrade the resources and target potential resource extensions or the discovery of additional zones of

mineralization along strike of the deposit.

We continued to revise the resource model for

Saramacca, incorporating infill drilling results obtained since the maiden resource estimate disclosed in September 2017 (see

news release dated September 5, 2017). The updated resource model will be used to support the ongoing engineering studies.

We intend to generate a mineral reserve estimate

for Saramacca during the second half of 2018 and to advance toward initial production in the second half of 2019.

During the second quarter, 4,550 metres of

reverse circulation and diamond drilling was completed on the adjacent Brokolonko property where a first pass drilling program

was initiated late in the quarter ahead of the rainy season.

Westwood Mine - Canada (IAMGOLD interest

- 100%)

Westwood produced 31,000 ounces in the second

quarter 2018, 2,000 ounces lower than the same prior year period. The decrease was due to mining lower grade stopes as part of

the mine plan. The head grade at 4.76 g/t Au was lower than the same prior year period due to the processing of a greater proportion

of marginal ore stockpiles to leverage available mill capacity as the mine continued to ramp-up. Excluding marginal ore, the head

grade in the second quarter 2018 was 6.26 g/t Au (Q2/17 - 8.60 g/t Au).

Underground development continued in the second

quarter 2018 to open up access to new mining areas with lateral and vertical development of approximately 2,700 and 100 metres,

respectively, averaging 31 metres per day. Westwood plans to complete 11,500 metres of underground development in 2018 (10,800

metres lateral and 700 metres vertical), with a focus on ramp breakthroughs on the central ramp as well as on level 132, which

is expected to provide access to high-grade domains for 2019. Infrastructure development continues in future development blocks

at lower levels, specifically including the 180 West level from which production is also expected in 2019.

Cost of sales of $924 per ounce sold and total

cash costs of $929 per ounce produced for the second quarter 2018 were higher than the same prior year period by 10% and 16%, respectively.

The increases were primarily due to a weaker U.S. dollar relative to the Canadian dollar.

All-in sustaining costs of $1,129 per ounce

sold for the second quarter 2018 were 13% higher than the same prior year period. The increase was primarily due to higher cost

of sales per ounce and higher sustaining capital expenditures.

Total cash costs and all-in sustaining costs

for the second quarter 2018, included the impact of realized derivative gains from hedging programs of $7 per ounce produced and

$9 per ounce sold, respectively (Q2/17 - of $nil and $nil).

Sustaining capital expenditures for the second

quarter 2018 of $6.0 million included deferred development of $4.0 million and other sustaining capital expenditures of $2.0 million.

Non-sustaining capital expenditures for the second quarter 2018 of $8.9 million included deferred development of $5.4 million,

underground construction of $1.7 million, development drilling of $1.2 million, and other non-sustaining capital expenditures of

$0.6 million.

Outlook

We maintain full-year 2018 production guidance

of 125,000 to 135,000 ounces. Capital expenditures are expected to be approximately $65 million, comprising $25 million of sustaining

capital and $40 million of non-sustaining capital. The shift of $5 million in capital expenditure guidance from non-sustaining

to sustaining reflects increased development work being performed on production blocks. Expansion development work continues to

open up access to areas of future production deeper within the mine.

Sadiola Mine - Mali (IAMGOLD interest -

41%)

Attributable gold production of 16,000 ounces

for the second quarter 2018 was 14% higher than the same prior year period mainly due to higher throughput. Total cash costs of

$970 per ounce produced and all-in sustaining costs of $979 per ounce sold for the second quarter 2018 were 8% and 5% higher than

the same prior year period, respectively, as a result of higher energy costs and mill maintenance.

Sadiola is expected to produce between 50,000

and 60,000 ounces in 2018.

During the quarter, the operation entered a

restricted exploitation phase as excavation activity ceased and the demobilization of the mining contractor commenced. The site

continues to process the remaining oxide ore stockpiles and marginal stockpiles which are expected to be depleted by mid-2019.

Discussions with the Government of Mali continue

regarding the Sadiola Sulphide Project. Despite the Company's efforts and the benefits the Project would generate for all stakeholders,

including the Government of Mali, there has been no resolution around the terms critical to moving the Project forward. If an agreement

with the Government of Mali is not reached, the operation will enter a phase of suspended exploitation (care and maintenance) after

the stockpiles are exhausted.

DEVELOPMENT PROJECTS

Côté Gold Joint Venture Project,

Canada

The Côté Gold Project is a 70:30

joint venture between the operator IAMGOLD and Sumitomo Metal Mining Co., Ltd. The Project hosted estimated mineral reserves as

at December 31, 2017 on a 100% project basis comprising probable reserves of 196.1 million tonnes grading 0.94 g/t Au for 5.9 million

ounces. Also on a 100% project basis, indicated resources (inclusive of reserves) are estimated at 281.2 million tonnes grading

0.89 g/t Au for 8.0 million ounces of gold and inferred resources of 76.5 million tonnes grading 0.50 g/t Au for 1.2 million ounces

(see news release dated February 12, 2018).

During the second quarter, the Joint Venture

working with the Wood Group (formerly Amec Foster Wheeler) continued to advance a feasibility study which is expected to be completed

in the first half of 2019. The delineation drilling program initiated in 2017 to further refine the resource model was completed

at the end of the first quarter 2018. The results are being incorporated into the resource model to support an updated resource

estimate for use in the ongoing feasibility study. Geotechnical investigations to evaluate pit slope stability and to investigate

proposed locations of key project infrastructure were completed during the second quarter 2018 and the results are being incorporated

into the project design.

Subject to an acceptable feasibility study,

a favourable development environment and a positive construction decision by the Joint Venture, commercial production is expected

to begin in 2021.

Regional exploration activities, including

the completion of approximately 1,700 metres of diamond drilling, also continued during the quarter within the 516-square-kilometre

property surrounding the Côté Gold deposit. The purpose is to develop and assess exploration targets that could further

maximize the Company's flexibility with respect to any future development decisions.

EXPLORATION

In the second quarter 2018, we spent $21.9

million on exploration and project studies ($11.1 million expensed and $10.8 million capitalized) compared to $17.3 million in

the same prior year period. The increase is primarily due to increased spending related to a larger planned exploration program

and project studies. The following summarizes the status of our most advanced greenfield projects:

Wholly-Owned Projects

Boto - Senegal

Effective December 31, 2017, the Boto Gold

Project hosted estimated mineral reserves comprising probable reserves of 26.8 million tonnes grading 1.64 g/t Au for 1.4 million

ounces of gold. Indicated resources (inclusive of reserves) are estimated at 37.4 million tonnes grading 1.60 g/t Au for 1.9 million

ounces of gold and inferred resources are estimated at 11.0 million tonnes grading 1.66 g/t Au for 594,000 ounces of gold (see

news release dated February 12, 2018).

During the second quarter, we continued to

advance the feasibility study ("FS") to validate and detail the elements of the development concept set out in the previously

disclosed pre-feasibility study (see news release dated February 12, 2018). The FS will include additional drilling, metallurgical

testing, engineering and environmental studies, including hydrological, hydrogeological and geotechnical analyses. The FS is expected

to be completed in the second half of 2018. Importantly, the FS contemplates mill throughput 25% higher than was used for the PFS.

Exploration activities supporting the FS and

evaluating priority targets for additional mineral resources continued during the quarter, with approximately 5,500 metres of diamond

and reverse circulation drilling completed. Results will be incorporated into the resource model and used to guide further exploration.

Siribaya - Mali

Effective December 31, 2017, total resources

estimated for the Siribaya Project comprised indicated resources of 2.1 million tonnes grading 1.9 g/t Au for 129,000 ounces of

gold, and inferred resources of 19.8 million tonnes grading 1.7 g/t Au for 1.1 million ounces of gold (see news release dated

February 12, 2018).

During the second quarter 2018, we completed

approximately 8,800 metres of diamond and reverse circulation drilling. The drilling program is designed to test for and confirm

resource expansions at the Diakha deposit as well as evaluate other identified exploration targets on the property. The drilling

results will be incorporated into the resource model and used to update the mineral resources in 2018.

Pitangui - Brazil

Effective December 31, 2017, reported mineral

resources at the São Sebastião deposit comprised an inferred resource of 5.4 million tonnes grading 4.7 g/t Au for

819,000 ounces of gold (see news release dated February 12, 2018).

In the second quarter 2018, just over 4,900

metres of diamond drilling was completed with the objective of expanding resources at the São Sebastião deposit and

testing priority exploration targets for additional zones of mineralization.

Joint Venture Projects

Following are the highlights for our joint

venture exploration projects. The agreements are typically structured in a way that gives us the option of increasing our ownership

interest over time, with the decision dependent upon the exploration results as time progresses.

Monster Lake - Canada (Option Agreement

with TomaGold Corporation)

Effective February 26, 2018, reported mineral

resources for the Monster Lake Project, on a 100% basis, comprised 1.1 million tonnes of inferred resources grading 12.14 g/t Au

for 433,300 ounces of contained gold, assuming an underground mining scenario (see news release dated March 28, 2018). A

supporting NI 43-101 Technical Report was filed on SEDAR on May 10, 2018.

In the second quarter 2018, we reported the

results from approximately 8,300 metres of diamond drilling completed during the first quarter of 2018. Highlights included:

3.8 metres grading 23.96 g/t Au; 3.8 metres grading 39.24 g/t Au; 2.6 metres grading 72.17 g/t Au and 5.3 metres grading 40.94

g/t Au (see new release dated June 14, 2018). The drilling results will be incorporated into the resource model and

used to guide further drilling programs in the deposit area. Exploration continues with the objective to identify additional

target areas which may be favourable to host additional zones of mineralization.

Nelligan - Canada (Option Agreement with

Vanstar Mining Resources Inc.)

During the second quarter 2018, we completed

nearly 3,700 metres of diamond drilling to evaluate the resource potential of a recently discovered mineralization system, referred

to as the Renard Zone, located immediately north of the previously known Liam and Dan zones. Assay results will be reported

once they are received, validated and compiled. The objective of the 2018 drilling program is to evaluate the resource potential

of the project with the aim of declaring an initial NI 43-101 compliant resource estimate.

Eastern Borosi - Nicaragua (Option Agreement

with Calibre Mining Corporation)

During the second quarter 2018, we reported

an updated NI 43-101 resource estimate incorporating an additional 26,000 metres of drilling completed by the Joint Venture over

the last four years. The estimate included initial resource estimates for the Blag, East Dome, Guapinol, and Vancouver veins, as

well as updated mineral resource estimates for the Riscos de Oro and La Luna veins. The resource models assumed open pit extraction

for the La Luna veins, and underground mining extraction for the other veins. The underground resource estimate comprised, on a

100% basis, inferred resources totaling 3.2 million tonnes grading 6.03 g/t Au and 104 g/t Ag for 624,000 ounces of contained gold

and 10,758,500 ounces of contained silver. The open pit resource estimate comprised, on a 100% basis, inferred resources totaling

1.2 million tonnes grading 1.98 g/t Au and 16 g/t Ag, for 76,500 ounces of contained gold and 601,000 ounces of contained silver,

respectively. The effective date of this resource estimate was March 15, 2018 (see news release dated April 3, 2018). A

supporting NI 43-101 Technical Report was filed on SEDAR on May 14, 2018.

During the second quarter, approximately 4,000

metres of diamond drilling was completed, targeting select mineralized zones for potential extensions as well as other priority

targets for the presence of mineralization.

Other

Loma Larga (formerly Quimsacocha) - Ecuador

IAMGOLD, through its 35.6% equity ownership

of INV Metals Inc. ("INV Metals"), has an indirect interest in the Loma Larga gold, silver and copper project in southern

Ecuador. INV Metals has completed a preliminary feasibility study ("PFS") supporting the proposed development of an underground

mine with an anticipated production rate of 3,000 tonnes per day, average annual gold production of 150,000 ounces, and a mine

life of approximately 12 years (see INV Metals news release dated July 14, 2016). Based on the results of the PFS, INV Metals

commenced a feasibility study that is expected to be completed at the end of 2018 (see INV Metals news release dated June 22,

2017).

End Notes (excluding tables)

| 1 |

Cost of sales, excluding depreciation, as disclosed in note 31 of the Company's consolidated interim financial statements is on an attributable ounce sold basis (excluding the non-controlling interests of 10% at Essakane and 5% at Rosebel) and does not include Joint Ventures which are accounted for on an equity basis. |

| 2 |

This is a non-GAAP measure. Refer to the reconciliation in the non-GAAP performance measures section of the MD&A. |

| 3 |

The DART refers to the number of days away, restricted duty or job transfer incidents that occur per 100 employees. |

CONFERENCE CALL

A conference call will be held on Thursday,

August 9, 2018 at 8:30 a.m. (Eastern Daylight Time) for a discussion with management regarding IAMGOLD's second quarter 2018 operating

performance and financial results. A webcast of the conference call will be available through IAMGOLD's website - www.iamgold.com.

Conference Call Information: North America

Toll-Free: 1-800-319-4610 or 1-604-638-5340.

A replay of this conference call will be accessible

for one month following the call by dialling: North America toll-free: 1-800-319-6413 or 1-604-638-9010, passcode: 2449#.

CAUTIONARY STATEMENT ON FORWARD-LOOKING

INFORMATION

All information included in this news release,

including any information as to the Company's future financial or operating performance, and other statements that express management's

expectations or estimates of future performance, other than statements of historical fact, constitute forward looking information

or forward-looking statements and are based on expectations, estimates and projections as of the date of this news release. For

example, forward-looking statements contained in this news release are found under, but are not limited to being included

under, the headings "Upcoming Growth Catalysts", "Operations Analysis by Mine Site", "Development Project",

and "Exploration", and include, without limitation, statements with respect to: the Company's guidance for production,

cost of sales, total cash costs, all-in sustaining costs, depreciation expense, effective tax rate, capital expenditures, operations

outlook, cost management initiatives, development and expansion projects, exploration, the future price of gold, the estimation

of mineral reserves and mineral resources, the realization of mineral reserve and mineral resource estimates, the timing and amount

of estimated future production, costs of production, permitting timelines, currency fluctuations, requirements for additional capital,

government regulation of mining operations, environmental risks, unanticipated reclamation expenses, title disputes or claims and

limitations on insurance coverage. Forward-looking statements are provided for the purpose of providing information about

management's current expectations and plans relating to the future. Forward-looking statements are generally identifiable by, but

are not limited to the use of the words "may", "will", "should", "continue", "expect",

"estimate", "plan", "guidance", "outlook", "potential", "transformation",

"targets", "significant", "outstanding", "strategy" or "project" or the negative

of these words or other variations on these words or comparable terminology. Forward-looking statements are necessarily based upon

a number of estimates and assumptions that, while considered reasonable by management, are inherently subject to significant business,

economic and competitive uncertainties, and contingencies, and, as such, undue reliance must not be placed on them. The Company

cautions the reader that reliance on such forward-looking statements involve risks, uncertainties and other factors that may cause

the actual financial results, performance or achievements of IAMGOLD to be materially different from the Company's estimated future

results, performance or achievements expressed or implied by those forward-looking statements. Forward-looking statements are in

no way guarantees of future performance. These risks, uncertainties and other factors include, but are not limited to, changes

in the global prices for gold, copper, silver or certain other commodities (such as diesel, and electricity); changes in U.S. dollar

and other currency exchange rates, interest rates or gold lease rates; risks arising from holding derivative instruments; the level

of liquidity and capital resources; access to capital markets, and financing; mining tax regimes; ability to successfully integrate

acquired assets; legislative, political or economic developments in the jurisdictions in which the Company carries on business;

operating or technical difficulties in connection with mining or development activities; laws and regulations governing the protection

of the environment; employee relations; availability and increasing costs associated with mining inputs and labour; the speculative

nature of exploration and development, including the risks of diminishing quantities or grades of reserves; adverse changes in

the Company's credit rating; contests over title to properties, particularly title to undeveloped properties; and the risks involved

in the exploration, development and mining business. Risks and unknowns inherent in IAMGOLD's operations and projects include the

inaccuracy of estimated reserves and resources, metallurgical recoveries, capital and operating costs, and the future price of

gold. Exploration and development projects have no operating history upon which to base estimates of future cash flows. The capital

expenditures and time required to develop new mines or other projects are considerable, and changes in the price of gold, costs

or construction schedules can affect project economics. Actual costs and economic returns may differ materially from IAMGOLD's

estimates or IAMGOLD could fail to obtain the governmental approvals necessary for the continued development or operation of a

project.

For a comprehensive discussion of the risks

faced by the Company, and which may cause the actual financial results, operating performance or achievements of IAMGOLD to be

materially different from the company's estimated future results, operating performance or achievements expressed or implied by

forward-looking information or forward-looking statements, please refer to the Company's latest Annual Information Form, filed

with Canadian securities regulatory authorities at www.sedar.com, and filed under Form 40-F with the United States Securities

Exchange Commission at www.sec.gov/edgar.shtml. The risks described in the Annual Information Form (filed and viewable on

www.sedar.com and www.sec.gov/edgar.shtml, and available upon request from the Company) are hereby incorporated by

reference into this news release.

The Company disclaims any intention or obligation

to update or revise any forward-looking statements whether as a result of new information, future events or otherwise except as

required by applicable law.

Qualified Person Information

The technical information relating to exploration

activities disclosed in this news release was prepared under the supervision of, and reviewed and verified by, Craig MacDougall,

P.Geo., Senior Vice President, Exploration, IAMGOLD. Mr. MacDougall is a Qualified Person as defined by National Instrument

43-101.

About IAMGOLD

IAMGOLD (www.iamgold.com) is a mid-tier

mining company with four operating gold mines on three continents. A solid base of strategic assets in North and South America

and West Africa is complemented by development and exploration projects and continued assessment of accretive acquisition opportunities.

IAMGOLD is in a strong financial position with extensive management and operational expertise.

For further information please contact:

Ken Chernin, VP Investor Relations,

IAMGOLD Corporation

Tel: (416) 360-4743 Mobile: (416) 388-6883

Laura Young, Director, Investor Relations,

IAMGOLD Corporation

Tel: (416) 933-4952 Mobile: (416) 670-3815

Martin Dumont, Senior Analyst, Investor

Relations, IAMGOLD Corporation

Tel: (416) 933-5783 Mobile: (647) 967-9942

Toll-free: 1-888-464-9999 info@iamgold.com

Please note:

This entire news release may be accessed via

fax, e-mail, IAMGOLD's website at www.iamgold.com and through CNW Group's website at www.newswire.ca. All material information

on IAMGOLD can be found at www.sedar.com or at www.sec.gov.

Si vous désirez obtenir la version française

de ce communiqué de presse, veuillez consulter le http://www.iamgold.com/French/accueil/default.aspx.

View

original content:http://www.prnewswire.com/news-releases/iamgold-continues-successful-execution-of-growth-projects-and-reports-solid-second-quarter-2018-300694303.html

View

original content:http://www.prnewswire.com/news-releases/iamgold-continues-successful-execution-of-growth-projects-and-reports-solid-second-quarter-2018-300694303.html

SOURCE IAMGOLD Corporation

View original content: http://www.newswire.ca/en/releases/archive/August2018/08/c6266.html

%CIK: 0001203464

CO: IAMGOLD Corporation

CNW 17:05e 08-AUG-18

This regulatory filing also includes additional resources:

ex991.pdf

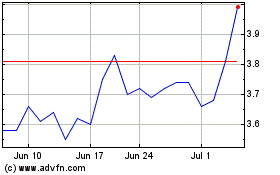

Iamgold (NYSE:IAG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Iamgold (NYSE:IAG)

Historical Stock Chart

From Apr 2023 to Apr 2024