Company Meets

Q2 2018

Revenue, Gross Margin

Guidance, Exceeds EPS

Guidance

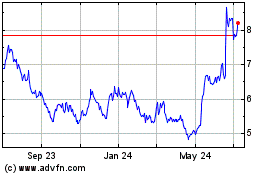

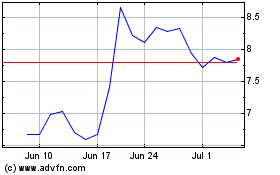

Himax Technologies, Inc. (Nasdaq: HIMX) (“Himax” or “Company”), a

leading supplier and fabless manufacturer of display drivers and

other semiconductor products, announced its financial results for

the second quarter ended June 30, 2018.

“The Company’s second quarter 2018 revenues and

gross margin met our guidance while IFRS earnings per diluted ADS

exceeded guidance. The anticipated sequential growth in revenue was

mainly driven by accelerating TDDI shipment in the smartphone

sector and further growth in the automotive sector in the small and

medium-sized display driver business. Furthermore, our WLO business

in the non-driver IC business rebounded as anticipated. Shipment

volume increased and WLO capacity utilization improved

subsequently,” said Mr. Jordan Wu, President and Chief Executive

Officer of Himax.

“Looking into the third quarter, we expect our

large display driver IC business will grow sequentially benefiting

from Chinese panel customers’ capacity expansion and the ramping of

new fabs. Our small and medium-sized business is likely to decline

as our growth in the automotive segment will be offset by the

significant decline of smartphone sales. The soft

smartphone sales was caused by our limited TDDI shipment due

to the constraint of industry pervasive capacity shortage issue and

the traditional discrete driver IC is being replaced quickly by

TDDI and AMOLED. To capture the TDDI opportunity, we have been

working very hard to source and qualify additional foundry

capacity. We expect the addition of new foundry capacity for TDDI

will start mass production toward early fourth quarter and will

substantially grow our TDDI revenue starting from Q4 2018.”

“For the non-driver areas, we expect the WLO

shipment for the second half of 2018 will increase significantly

versus the first half. As to our 3D sensing business, we are in

partnership with several leading smartphone names to enable their

3D sensing by providing optics, projector or total solution,

depending on customer’s needs and their in-house capabilities. The

projects we are involved in cover all three types of 3D sensing

technologies, namely structured light, active stereo camera (ASC),

and to a lesser extent, time-of-flight (ToF). 3D sensing for

Android smartphone market is still at a nascent stage with very

limited adoption in 2018. We expect the market adoption will

pick up starting 2019. With our comprehensive technology coverage,

proven manufacturing expertise, new solutions roadmap and alliances

with leading AP platform providers, we believe we are best

positioned to be the partner of choice for Android smartphone

makers in their 3D sensing projects,” said Mr. Jordan Wu.

Second Quarter 2018 Financial

Results

The second quarter revenues of $181.4 million

represented an increase of 11.4% sequentially and an increase of

19.5% year-over-year. Gross margin was 23.0%, up 0.5%

sequentially. IFRS earnings per diluted ADS were 1.2 cents,

better than the guidance range of 0.0 to 1.0 cent per diluted

ADS.

Revenue from large display drivers was $60.6

million, up 2.2% sequentially, and up 16.3% year-over-year, driven

by increasing 4K TV penetration and Chinese panel customers’

ramping of new LCD fabs. Large panel driver ICs accounted for 33.4%

of the company’s total revenues for the second quarter, compared to

36.4% in the first quarter of 2018 and 34.4% a year ago.

Revenue for small and medium-sized display

drivers came in at $89.3 million, up 24.5% sequentially and up

27.5% year-over-year. The driver ICs for small and medium-sized

applications accounted for 49.2% of total sales for the second

quarter, as compared to 44.0% in the first quarter of 2018 and

46.1% a year ago. Sales into smartphones were up 54.3% sequentially

and up 42.5% year-over-year. The growth was driven by accelerating

TDDI shipments and the anticipated smartphone makers’ inventory

replenishment for new product launches.

Driver IC revenue for automotive applications

recorded another historical quarter, up 15% sequentially and more

than 35% year-over-year. The quarterly revenue reached $28.7

million, accounting for more than 19% of our driver IC revenue.

Himax is happy with the strong momentum in this space.

Revenues from non-driver businesses were $31.5

million, down 1.1% sequentially but up 6.4% versus last year.

Non-driver products accounted for 17.4% of total revenues, as

compared to 19.6% in the first quarter of 2018 and 19.5% a year

ago. The sequential decline was mainly due to reduced NRE income.

The year-over-year increase was driven mainly by WLO shipment. The

Company expects WLO shipment to continue to rebound strongly in the

second half.

IFRS gross margin for the second quarter was

23.0%, up 50 basis points from 22.5% in the first quarter of 2018

but down 80 basis points from the same period last year. The

sequential increase was due mainly to improved product mix.

IFRS operating expenses were $41.3 million in

the second quarter of 2018, up 3.6% from the preceding quarter and

up 11.3% from a year ago. The year-over-year increase was primarily

the result of rising R&D expenses in the areas of 3D sensing,

WLO, TDDI, and high-end TV, as well as annual merit increase.

IFRS operating margin for the second quarter of

2018 was 0.3%, up from -0.6% in the same period last year and up

from -2.0% in the prior quarter. The sequential and the

year-over-year increase was both a result of revenue increase but

offset by increased operating expenses.

Second quarter non-IFRS operating income was

$0.8 million, or 0.5% of sales, up from -0.3% for the same period

last year and up from -1.8% a quarter ago.

IFRS profit for the second quarter was $2.0

million, or 1.2 cents per diluted ADS, compared to IFRS loss of

$2.8 million, or 1.6 cents per diluted ADS, in the previous quarter

and IFRS loss of $0.7 million, or 0.4 cents per diluted ADS, a year

ago. The sequential increase was a result of higher sales and

better gross margin.

Second quarter non-IFRS profit was $2.3 million,

or 1.3 cents per diluted ADS, compared to a loss of $2.6 million,

or 1.5 cents per diluted ADS last quarter and a loss of $0.3

million, or 0.2 cents per diluted ADS the same period last

year.

Balance Sheet and Cash Flow

Himax had $126.7 million of cash, cash

equivalents and other financial assets as of the end of June 2018,

compared to $185.9 million at the same time last year and $151.9

million a quarter ago. The cash position dropped $25.2 million due

primarily to (1) capex of $17.7 million, (2) cash outflow of $2.8

million from operations, and (3) Emza investment of $3.5 million.

On top of the above cash position, restricted cash was $147.0

million at the end of the quarter, as compared to $147.0 million in

the preceding quarter and $107.2 million a year ago. The restricted

cash is mainly used to guarantee the Company’s short-term

borrowings for the same amount.

Himax’s inventories as of June 30, 2018 were

$142.1 million, down from $148.0 million a quarter ago and down

from $147.7 million at the same time last year. Account receivables

at the end of June 2018 were $176.3 million as compared to $164.5

million a year ago and $166.6 million last quarter. DSO was 93 days

at the end of June 2018, as compared to 97 days a year ago and 92

days at end of the last quarter.

Net cash outflow from operating activities for

the second quarter was $2.8 million as compared to an outflow of

$1.2 million for the same period last year and an inflow of $2.3

million last quarter.

Capital expenditures were $17.7 million in the

second quarter of 2018 versus $11.7 million a year ago and $18.6

million last quarter. The second quarter capex consisted mainly of

ongoing payments for the new building’s construction, WLO capacity

expansion and installation of active alignment equipment to support

the Company’s 3D sensing business. Other capex, primarily for

design tools and R&D related equipment for the Company’s

traditional IC design business, is around $2.5 million during the

quarter.

Share Buyback Update

As of June 30, 2018, Himax had 172.1 million ADS

outstanding, unchanged from last quarter. On a fully diluted basis,

the total ADS outstanding are 172.5 million.

Fiscal Year 2017 Dividend

Declaration

During the second quarter, the Company declared

an annual cash dividend of 10 cents per ADS, totaling $17.2

million, which has been paid out on July 31. The Company’s dividend

is determined primarily by the prior year’s profitability. Himax’s

decision to pay out 61.7% of last year’s net profit demonstrated

its continued support for the shareholder base and strong

confidence in the near term outlook for the Company’s newly

increased capex and the overall long-term growth prospects.

2018

Investor Outreach and Conferences

Ms. Jackie Chang, CFO, Ms. Ophelia Lin, internal

IR Deputy Director, Mr. Ken Liu, internal IR, and Mr. Greg

Falesnik, Himax’s US-based IR, will maintain corporate access for

shareholders and attend future investor conferences. If you are

interested in speaking with the management, please contact Himax’s

US or Taiwan-based investor relations contact at the numbers

below.

Q3 2018

Outlook

Comparing to the second quarter revenues, Himax expects single

digit growth for large driver ICs; mid single digit decline for

small and medium-sized driver IC and around 15% growth for its

non-driver IC business.

Display

Driver IC

MarketLDDICLarge

display driver IC business recorded low-single-digit growth in the

second quarter due mainly to the Company’s Chinese panel customers’

ongoing capacity expansion, a more favorable product mix driven by

the market’s 4K TV demands and shipment to a new panel customer who

recently started ramping up their first fab. Looking into the third

quarter, while the Chinese domestic market is relatively slow for

reasons such as weak currency, the western markets, especially in

the US, remain robust. Himax sees a single digit growth for the

third quarter as the Company continues to benefit from Chinese

panel customers’ capacity expansion and ramping of new fabs.

However, foundry capacity shortage remains an issue. While Himax is

making good progress in adding new capacity into its pool, the

ultimate ramping schedule will depend on how fast its panel

customers can go through their customer qualification, something

all the Company’s major customers are working very hard on.

Looking into the future, with the 2020 Tokyo

Olympics approaching and more Gen 10.5 fabs coming online to enable

very large screen 8K TVs, many TV manufacturers are rushing to

introduce consumer-grade super high end products with 8K

resolution. Capitalizing on the Company’s 4K TV success, Himax is

strongly positioned for this emerging market opportunity.

SMDDICThe trend for

full-screen, 18:9 display is already fully in place for smartphone

with phone makers now aggressively adopting such screens for their

2018 and 2019 models even for mid-end and entry-level products.

Himax’s comprehensive TDDI product portfolio positions it well to

support this trend. Himax is pleased that both its FHD+ and HD+

TDDI ICs enjoyed significant growth during Q2, with revenue and

shipment volume both more than tripled during the quarter, despite

being able to fulfill just a fraction of orders amid the severe

foundry capacity shortage. Capped by the very limited capacity, its

Q3 TDDI shipment will likely see some 10% decline from that of the

second quarter. TDDI’s foundry capacity shortage is even more

challenging than that of the large display driver IC. To capture

the TDDI opportunity, the Company has been working very hard to

source and qualify additional foundry capacity. The Company is on

track to complete the porting of its existing products into another

foundry vendor and start mass production toward early fourth

quarter. Himax expects the addition of the new foundry capacity

will substantially grow its TDDI revenue starting from Q4 with

further growth expected throughout 2019. In parallel, to further

widen its reach, the Company is working on new designs based on

additional foundry partners’ processes which, however, will only be

ready next year. The Company expects TDDI penetration will reach

40% in 2019 which represents an enormous growth opportunity for

Himax. TDDI has more than double the ASP of the traditional driver

IC with better margins. It will change Himax’s product mix for

smartphone display driver IC and make a very significant

contribution to its growth going forward. Looking into the third

quarter, sales for smartphones are likely to decline around 40%

sequentially as the TDDI shipment is constrained by capacity

shortage and the traditional discrete driver IC is being quickly

replaced by TDDI and AMOLED.

In automotive segment, the Company continued to

have new projects going into mass production which were design-wins

of the prior years. During the second quarter, sales into

automotive sector already accounted for more than 19% of its total

driver IC sales and close to 16% of its total revenues. On top of

the world’s first TDDI projects for automotives during the first

quarter, Himax’s team further successfully added AMOLED design-wins

during the second quarter. The Company has achieved a distant

number one market share position thanks to its superior product

quality, service and stable delivery. Q3 revenue in this segment is

set to grow around 20% sequentially.

For third quarter small and medium-sized driver

IC business, the company expects revenue to decline mid single

digit sequentially.

Non-Driver Product

CategoriesThe non-driver IC business segment has been the

Company’s most exciting growth area and a differentiator for Himax

in the past few years.

3D Sensing SolutionsSince the

Company announced 3D sensing as one of Himax’s long term growth

initiatives in 2017, 3D sensing, led by Apple’s iPhone X, is

gradually becoming a new industry trend as major Android smartphone

makers beginning to integrate it into flagship models,

although most of such projects are still in development stage.

Leading Android smartphone makers are exploring various 3D sensing

technologies, namely structured light, active stereo camera (ASC)

and, to a lesser extent, time-of-flight (ToF), trying to strike a

good balance of cost, specifications and application. More software

players are entering the ecosystem to develop 3D sensing

applications beyond the existing applications, namely facial

recognition, online payment and camera performance enhancement.

Being a leading player in the 3D sensing space, Himax is in

partnership with several leading smartphone names to enable their

3D sensing by providing optics, projector or total solution,

depending on the customer’s needs and their in-house capabilities.

The projects Himax is involved in cover all the three types of 3D

sensing technologies mentioned above. These efforts will facilitate

a broader adoption of 3D sensing on Android smartphone starting

2019. The Company’s goal is to ensure that the smartphones backed

by Himax 3D sensing technology will deliver the industry’s highest

standard in all of 3D depth accuracy, indoor/outdoor sensitivity,

power consumption, size, data security and eye safety.

SLiM™, Himax’s structured light 3D sensing

hardware total solution which the Company jointly announced with

Qualcomm in last August, targets premium smartphone market. The

Qualcomm/Himax solution brings together Qualcomm’s industry leading

3D algorithm with Himax’s cutting-edge design and manufacturing

capabilities in optics, NIR sensors, and ASIC, as well as the

Company’s unique know-how in 3D sensing system integration. It is

by far the highest quality 3D sensing total solution available for

the Android market right now. At present, Himax is working with

customers who are targeting to bring new 3D sensing applications to

smartphone, on top of facial unlock and online payment. The Company

is now targeting the end of the year or early 2019 for shipment to

the customers for their product launch in first half 2019, although

the actual shipment date will ultimately be dictated by end

customers. Another noteworthy update is that its SLiM™ total

solution can work on Qualcomm’s high end mobile platforms now, as

opposed to being limited to only the premium Snapdragon platform

when Himax first launched the technology, thereby lowering the

total cost barrier of 3D sensing.

The Company’s ASC 3D sensing solution, targeting

mass market smartphone models, achieved a significant milestone

during the second quarter. While structured light 3D sensing offers

outstanding depth precision for its complex projector design, ASC

3D sensing can also enable facial recognition with a simpler

projector. While it is somehow constrained by its limited depth

precision, it is a lower cost alternative for face authentication

and enjoys better software readiness since it is building on the

existing dual camera ecosystem. Himax is working with top tier

smartphone makers and leading platform partners concurrently on

multiple projects. Early shipment is targeted to begin toward the

end of the year with major ramp in 2019, although the actual

shipment date will ultimately be dictated by end customers. The

Company expects more design-wins in the coming months. It appears

that ASC 3D sensing, with its cost advantage and the existing dual

camera ecosystem, has a better chance of accelerating 3D sensing

adoption for facial recognition on Android smartphone market during

2019.

WLOAs anticipated, the shipment

volume to the Company’s WLO customer for the second quarter was a

lot higher versus that of the first quarter and its WLO capacity

utilization improved subsequently. Himax expects the shipment for

the second half to increase significantly versus that of the

first half. The overall 2018 shipment will increase considerably

year-over-year. Meanwhile, the Company is encouraged by the

progress of its new R&D projects with the said customer for

their next generation products centering around its exceptional

design know-how and mass production expertise in WLO technology.

Himax is very excited about the significant growth opportunities of

these projects.

While 3D sensing is the top priority of the

Company’s WLO business at present, Himax also has engineering

collaboration with select world-class technology leaders to develop

wave-guide for AR glasses and micro displays using its advanced WLO

technology. Himax expects to kick off new R&D projects during

the third quarter.

CAPEXThe Company announced the

increase of the Phase I capital expenditure budget, which is on top

of its regular capex for the IC design business, from $80 million

to $105 million in early 2018. The majority of the Phase I

investment is going to land and building, new equipment for the WLO

anchor customer, and an initial capacity of 2 million units per

month for 3D sensing. Of the $105 million budget, $33 million has

been paid out in 2017, followed by $17.5 million made in the first

quarter 2018 and another $15.2 million in the second quarter. The

payment for the remaining $39.3 million is to be made throughout

the rest of 2018. With the anticipation of broader 3D sensing

adoption in 2019, Himax expects to further expand production

capacity towards the end of the second half. Kick-off timing and

amount of the Phase II investment is still being evaluated,

depending on the customers’ projected volume and timetable.

As the Company mentioned in the previous

earnings calls, the capex budget will be funded through its

internal resources and banking facilities. Himax has more than

sufficient banking facilities with favorable cost for such capex

budget and will start to draw down some of them in Q3 2018.

CMOS Image SensorHimax has been

working with an industry leading fingerprint solution provider to

develop an under-display optical fingerprint product in the last

two years, targeting smartphones using OLED displays. Himax

provides a customized low-power image sensor in the solution. The

Company is pleased to announce that the solution has entered into

mass production with a major Android smartphone OEM for their new

flagship model with shipment expected in the coming months. The

CMOS image sensor used in the solution will have a notably higher

ASP than the Company’s traditional display driver IC products.

On other CMOS image sensor business update,

Himax continues to make great progress with its two machine vision

sensor product lines, namely, near infrared (“NIR”) sensor and

Always-on-Sensor (“AoSTM”). NIR sensor is a critical part for both

of our structured light and ASC 3D sensing solutions. The Company

expects significant growth in its CMOS image sensor business as 3D

sensing shipment gets started. On the AoSTM product line, the

acquisition of Emza enables Himax to be uniquely positioned to

provide ultra-low power imaging sensing solutions, leveraging

Himax’s industry leading super low power CIS design and Emza’s

unique AI-based computer vision algorithm. Himax is pleased with

the status of engagement with leading players in areas such as

connected home, smart building and security, all of which new

frontiers for Himax.

For traditional human vision segments, the

Company sees strong demands in laptop and increasing shipment for

multimedia applications such as car recorders, surveillance,

drones, home appliances, and consumer electronics, among

others.

LCOSHimax’s main focus areas

are AR goggle devices and head-up-displays (HUD) for automotives.

While AR will take a few years to fully realize its market

potential, the Company has seen many companies, be the top name

multinationals or new start-ups, invest heavily to develop the

ecosystem -- applications, software, operating system, system

electronics, and optics. Himax is slated to kick off another AR

goggle project with tailor-made micro display for a tier-1 tech

name during the third quarter. In addition, the Company continues

to make great progress in developing high-end holographic head-up

display for automotives. Timing for such revenue contribution would

be 2019 the earliest.

For non-driver IC business, the Company expects

revenue to increase around 15% sequentially in the third quarter

driven by WLO shipment.

Third Quarter 2018 GuidanceThe

Company is providing the following financial guidance for the third

quarter of 2018:

| Net Revenue: |

To be around flat

sequentially |

|

| Gross Margin: |

To be

around 22.5%, depending on final product mix |

| IFRS EPS: |

To be around -1.0 cent

per diluted ADS |

|

| Non-IFRS EPS(1): |

To be around 1.5 cents

per diluted ADS |

|

| (1) Non-IFRS EPS excludes share-based compensation and

acquisition-related charges |

|

As the Company has done in the past, its third

quarter IFRS earnings per diluted ADS guidance has taken into

account its expected 2018 grant of restricted share units, or RSUs,

to the team at the end of September. The 2018 RSUs, subject to its

Board approval, is now assumed to be around $4.5 million, almost

all of which, or 2.1 cents per diluted ADS, will be vested and

expensed immediately on September 30th, the grant date. In

comparison, the 2017 RSUs totaled $6.5 million, out of which $6.1

million was vested immediately. The grant of RSUs would lead to

higher third quarter IFRS operating expenses compared to the other

quarters of the year.

The Company’s bottom line has been substantially

affected by the drastic increase of R&D expenses since some two

years ago when Himax decided to enter into a number of new areas,

something the Company brought up to the market’s attention

repeatedly before. However, the Company believes its operation will

start to be out of the trough starting from the third quarter,

initially driven by the anticipated ramping of the new foundry for

the TDDI product line and, thereafter, shipment of 3D sensing

products in next year. 3D sensing, in particular, will represent a

paradigm shift in the Company’s business when it starts to achieve

a broader market adoption.

HIMAX TECHNOLOGIES SECOND QUARTER 2018

EARNINGS CONFERENCE CALL

|

DATE: |

Thursday, August 9, 2018 |

|

TIME: |

U.S.

8:00 a.m. EDT |

|

|

Taiwan 8:00 p.m. |

|

DIAL IN: |

U.S. +1 (866) 444-9147 |

|

|

INTERNATIONAL +1 (678) 509-7569 |

|

CONFERENCE ID: |

7399640 |

|

WEBCAST: |

https://edge.media-server.com/m6/p/hzg3keuv |

| |

|

A replay of the call will be available beginning two hours after

the call through 11:30 a.m. US EDT on August 16, 2018 (11:30 p.m.

Taiwan time, August 16, 2018) on www.himax.com.tw and by telephone

at +1 (855) 859-2056 (US Domestic) or +1 (404) 537-3406

(International). The conference ID number is 7399640. This call is

being webcast by Nasdaq and can be accessed by clicking on this

link or Himax’s website, where the webcast can be accessed through

August 8, 2019.

About Himax Technologies, Inc.

Himax Technologies, Inc. (NASDAQ:HIMX) is a

fabless semiconductor solution provider dedicated to display

imaging processing technologies. Himax is a worldwide market leader

in display driver ICs and timing controllers used in TVs, laptops,

monitors, mobile phones, tablets, digital cameras, car navigation,

virtual reality (VR) devices and many other consumer electronics

devices. Additionally, Himax designs and provides controllers for

touch sensor displays, in-cell Touch and Display Driver Integration

(TDDI) single-chip solutions, LED driver ICs, power management ICs,

scaler products for monitors and projectors, tailor-made video

processing IC solutions, silicon IPs and LCOS micro-displays for

augmented reality (AR) devices and heads-up displays (HUD) for

automotive. The Company also offers digital camera solutions,

including CMOS image sensors and wafer level optics for AR devices,

3D sensing and machine vision, which are used in a wide variety of

applications such as mobile phone, tablet, laptop, TV, PC camera,

automobile, security, medical devices and Internet of Things.

Founded in 2001 and headquartered in Tainan, Taiwan, Himax

currently employs around 2,200 people from three Taiwan-based

offices in Tainan, Hsinchu and Taipei and country offices in China,

Korea, Japan, Israel and the US. Himax has 2,997 patents granted

and 442 patents pending approval worldwide as of June 30, 2018.

Himax has retained its position as the leading display imaging

processing semiconductor solution provider to consumer electronics

brands worldwide.

http://www.himax.com.tw

Forward Looking Statements

Factors that could cause actual events or

results to differ materially include, but not limited to, general

business and economic conditions and the state of the semiconductor

industry; market acceptance and competitiveness of the driver and

non-driver products developed by the Company; demand for end-use

applications products; reliance on a small group of principal

customers; the uncertainty of continued success in technological

innovations; our ability to develop and protect our intellectual

property; pricing pressures including declines in average selling

prices; changes in customer order patterns; changes in estimated

full-year effective tax rate; shortages in supply of key

components; changes in environmental laws and regulations; exchange

rate fluctuations; regulatory approvals for further investments in

our subsidiaries; our ability to collect accounts receivable and

manage inventory and other risks described from time to time in the

Company's SEC filings, including those risks identified in the

section entitled "Risk Factors" in its Form 20-F for the year ended

December 31, 2017 filed with the SEC, as may be amended.

Company Contacts:

Jackie Chang, CFOHimax

Technologies, Inc.Tel: +886-2-2370-3999 Ext.22300 OrUS Tel:

+1-949-585-9838 Ext.252Fax: +886-2-2314-0877Email:

jackie_chang@himax.com.twwww.himax.com.tw

Ophelia Lin, Investor

RelationsHimax Technologies, Inc.Tel: +886-2-2370-3999

Ext.22202Fax: +886-2-2314-0877 Email:

ophelia_lin@himax.com.tw www.himax.com.tw

Ken Liu, Investor RelationsHimax Technologies,

Inc.Tel: +886-2-2370-3999 Ext.22513Fax: +886-2-2314-0877 Email:

ken_liu@himax.com.twwww.himax.com.tw

Investor Relations - US RepresentativeGreg

Falesnik, Managing DirectorMZ North AmericaTel:

+1-212-301-7130Email: greg.falesnik@mzgroup.us www.mzgroup.us

-Financial Tables-

| Himax Technologies, Inc. |

| Unaudited Condensed Consolidated Statements

of Profit or

Loss |

| (These interim financials do not fully comply

with IFRS because they omit all

interim disclosure required by

IFRS) |

| (Amounts in Thousands of U.S. Dollars,

Except Share and Per Share

Data) |

| |

|

|

Three Months

Ended June 30, |

|

Three Months Ended

March

31, |

|

|

|

2018 |

|

|

|

2017 |

|

|

|

2018 |

|

|

|

|

|

|

|

|

|

Revenues |

$ |

181,365 |

|

|

$ |

151,730 |

|

|

$ |

162,851 |

|

|

|

|

|

|

|

|

|

Costs and expenses: |

|

|

|

|

|

| Cost of

revenues |

|

139,571 |

|

|

|

115,556 |

|

|

|

126,254 |

|

| Research

and development |

|

30,444 |

|

|

|

27,923 |

|

|

|

30,040 |

|

| General

and administrative |

|

5,632 |

|

|

|

4,521 |

|

|

|

4,906 |

|

| Sales and

marketing |

|

5,218 |

|

|

|

4,647 |

|

|

|

4,895 |

|

|

Total costs and expenses |

|

180,865 |

|

|

|

152,647 |

|

|

|

166,095 |

|

|

|

|

|

|

|

|

|

Operating income (loss) |

|

500 |

|

|

|

(917 |

) |

|

|

(3,244 |

) |

|

|

|

|

|

|

|

|

Non operating income

(loss): |

|

|

|

|

|

| Interest

income |

|

672 |

|

|

|

619 |

|

|

|

549 |

|

| Changes

in fair value of financial assets at fair value through profit or

loss |

|

(25 |

) |

|

|

37 |

|

|

|

1 |

|

| Share of

losses of associates |

|

(1,099 |

) |

|

|

(697 |

) |

|

|

(844 |

) |

| Foreign

currency exchange gains (losses), net |

|

242 |

|

|

|

(23 |

) |

|

|

(258 |

) |

| Finance

costs |

|

(265 |

) |

|

|

(190 |

) |

|

|

(252 |

) |

| Other

income (loss), net |

|

1,677 |

|

|

|

(41 |

) |

|

|

4 |

|

|

|

|

1,202 |

|

|

|

(295 |

) |

|

|

(800 |

) |

|

Profit (loss) before income

taxes |

|

1,702 |

|

|

|

(1,212 |

) |

|

|

(4,044 |

) |

| Income

tax expense (benefit) |

|

306 |

|

|

|

(179 |

) |

|

|

(728 |

) |

|

Profit (loss) for the period |

|

1,396 |

|

|

|

(1,033 |

) |

|

|

(3,316 |

) |

|

Loss attributable to noncontrolling

interests |

|

650 |

|

|

|

353 |

|

|

|

487 |

|

| Profit (loss)

attributable to Himax Technologies, Inc. stockholders |

$ |

2,046 |

|

|

$ |

(680 |

) |

|

$ |

(2,829 |

) |

|

|

|

|

|

|

|

| Basic earnings

(loss) per ADS attributable to Himax Technologies, Inc.

stockholders |

$ |

0.012 |

|

|

$ |

(0.004 |

) |

|

$ |

(0.016 |

) |

| Diluted

earnings (loss) per ADS attributable to Himax Technologies, Inc.

stockholders |

$ |

0.012 |

|

|

$ |

(0.004 |

) |

|

$ |

(0.016 |

) |

|

|

|

|

|

|

|

|

Basic Weighted Average Outstanding ADS |

|

172,499 |

|

|

|

172,399 |

|

|

|

172,499 |

|

|

Diluted Weighted Average Outstanding ADS |

|

172,539 |

|

|

|

172,462 |

|

|

|

172,536 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

| Himax Technologies, Inc. |

|

| Unaudited Condensed Consolidated Statements of

Profit or Loss |

|

| (Amounts in Thousands of U.S. Dollars, Except

Share and Per Share Data) |

|

| |

|

|

|

|

Six Months

Ended June 30, |

|

|

|

|

|

2018 |

|

|

|

2017 |

|

|

|

|

|

|

|

|

|

Revenues |

|

|

$ |

344,216 |

|

|

$ |

306,940 |

|

|

|

|

|

|

|

|

|

Costs and expenses: |

|

|

|

|

|

| Cost of

revenues |

|

|

|

265,825 |

|

|

|

234,865 |

|

| Research

and development |

|

|

|

60,484 |

|

|

|

53,256 |

|

| General

and administrative |

|

|

|

10,538 |

|

|

|

9,122 |

|

| Sales and

marketing |

|

|

|

10,113 |

|

|

|

9,016 |

|

|

Total costs and expenses |

|

|

|

346,960 |

|

|

|

306,259 |

|

|

|

|

|

|

|

|

|

Operating income (loss) |

|

|

|

(2,744 |

) |

|

|

681 |

|

|

|

|

|

|

|

|

|

Non operating income

(loss): |

|

|

|

|

|

| Interest

income |

|

|

|

1,221 |

|

|

|

1,162 |

|

| Changes

in fair value of financial assets at fair value through profit or

loss |

|

|

|

(24 |

) |

|

|

107 |

|

| Share of

losses of associates |

|

|

|

(1,943 |

) |

|

|

(831 |

) |

| Foreign

currency exchange losses, net |

|

|

|

(16 |

) |

|

|

(1,149 |

) |

| Finance

costs |

|

|

|

(517 |

) |

|

|

(404 |

) |

| Other

income, net |

|

|

|

1,681 |

|

|

|

7 |

|

|

|

|

|

|

402 |

|

|

|

(1,108 |

) |

|

Loss before income

taxes |

|

|

|

(2,342 |

) |

|

|

(427 |

) |

| Income

tax benefit |

|

|

|

(422 |

) |

|

|

(57 |

) |

|

Loss for the period |

|

|

|

(1,920 |

) |

|

|

(370 |

) |

|

Loss attributable to noncontrolling

interests |

|

|

|

1,137 |

|

|

|

906 |

|

| Profit (loss)

attributable to Himax Technologies, Inc. stockholders |

|

|

$ |

(783 |

) |

|

$ |

536 |

|

|

|

|

|

|

|

|

| Basic earnings

(loss) per ADS attributable to Himax Technologies, Inc.

stockholders |

|

|

$ |

(0.005 |

) |

|

$ |

0.003 |

|

| Diluted

earnings (loss) per ADS attributable to Himax Technologies, Inc.

stockholders |

|

|

$ |

(0.005 |

) |

|

$ |

0.003 |

|

|

|

|

|

|

|

|

|

Basic Weighted Average Outstanding ADS |

|

|

|

172,499 |

|

|

|

172,399 |

|

|

Diluted Weighted Average Outstanding ADS |

|

|

|

172,538 |

|

|

|

172,444 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Himax Technologies, Inc. |

| Unaudited Supplemental Financial Information

|

| (Amounts in Thousands of U.S.

Dollars) |

| |

|

|

|

| The amount of

share-based compensation included in applicable

statements of profit or loss categories is

summarized as follows: |

Three

MonthsEnded June

30, |

|

Three MonthsEnded

March 31, |

| |

|

2018 |

|

|

|

2017 |

|

|

|

2018 |

|

| Share-based

compensation |

|

|

|

|

|

| Cost of

revenues |

$ |

12 |

|

|

$ |

25 |

|

|

$ |

12 |

|

| Research

and development |

|

58 |

|

|

|

139 |

|

|

|

57 |

|

| General

and administrative |

|

9 |

|

|

|

37 |

|

|

|

9 |

|

| Sales and

marketing |

|

14 |

|

|

|

30 |

|

|

|

13 |

|

| Income

tax benefit |

|

(13 |

) |

|

|

(38 |

) |

|

|

(12 |

) |

| Total |

$ |

80 |

|

|

$ |

193 |

|

|

$ |

79 |

|

| |

|

|

|

|

|

| The amount

of acquisition-related charges

included in applicable statements of

profit or loss categories is summarized as

follows: |

|

|

|

|

|

| |

|

|

|

|

|

| Acquisition-related

charges |

|

|

|

|

|

| Research

and development |

$ |

246 |

|

|

$ |

246 |

|

|

$ |

246 |

|

| Income

tax benefit |

|

(71 |

) |

|

|

|

(98 |

) |

|

|

(71 |

) |

| Total |

$ |

175 |

|

|

$ |

148 |

|

|

$ |

175 |

|

| |

|

|

|

|

|

| Himax Technologies, Inc. |

| Unaudited Supplemental Financial Information

|

| (Amounts in Thousands of U.S.

Dollars) |

| |

|

| The

amount of share-based compensation included in applicable

statements of profit or loss categories is

summarized as follows: |

|

|

Six Months Ended June

30, |

| |

|

|

|

2018 |

|

|

|

2017 |

|

| Share-based

compensation |

|

|

|

|

|

| Cost of

revenues |

|

|

$ |

24 |

|

|

$ |

50 |

|

| Research

and development |

|

|

|

115 |

|

|

|

278 |

|

| General

and administrative |

|

|

|

18 |

|

|

|

75 |

|

| Sales and

marketing |

|

|

|

27 |

|

|

|

58 |

|

| Income

tax benefit |

|

|

|

(25 |

) |

|

|

(74 |

) |

| Total |

|

|

$ |

159 |

|

|

$ |

387 |

|

| |

|

|

|

|

|

| The

amount of acquisition-related charges

included in applicable statements of

profit or loss categories is summarized as

follows: |

|

|

|

|

| |

|

|

|

|

|

| Acquisition-related

charges |

|

|

|

|

|

| Research

and development |

|

|

$ |

492 |

|

|

$ |

492 |

|

| Income

tax benefit |

|

|

|

|

(142 |

) |

|

|

(197 |

) |

| Total |

|

|

$ |

350 |

|

|

$ |

295 |

|

| |

|

|

|

|

|

| |

| Himax Technologies, Inc. |

| IFRS Unaudited

Condensed Consolidated

Statements

of Financial

Position |

| (Amounts in Thousands of U.S.

Dollars) |

| |

| |

|

June

30,

2018 |

|

March

31,

2018 |

|

June

30,

2017 |

|

Assets |

|

|

|

|

|

|

| Current

assets: |

|

|

|

|

|

|

| Cash and

cash equivalents |

|

$ |

114,480 |

|

|

$ |

139,806 |

|

|

$ |

177,206 |

|

| Financial

assets at amortized cost |

|

|

12,154 |

|

|

|

11,753 |

|

|

|

5,306 |

|

| Financial

assets at fair value through profit or loss |

|

|

66 |

|

|

|

361 |

|

|

|

3,357 |

|

| Accounts

receivable, net |

|

|

176,286 |

|

|

|

166,603 |

|

|

|

164,516 |

|

|

Inventories |

|

|

142,077 |

|

|

|

147,962 |

|

|

|

147,680 |

|

| Income

taxes receivable |

|

|

45 |

|

|

|

45 |

|

|

|

41 |

|

|

Restricted deposit |

|

|

147,000 |

|

|

|

147,000 |

|

|

|

107,201 |

|

| Other

receivable from related parties |

|

|

2,803 |

|

|

|

3,515 |

|

|

|

4,150 |

|

| Other

current assets |

|

|

18,743 |

|

|

|

19,609 |

|

|

|

12,288 |

|

|

Total current assets |

|

|

613,654 |

|

|

|

636,654 |

|

|

|

621,745 |

|

| Financial

assets at fair value through profit or loss |

|

|

1,574 |

|

|

|

1,600 |

|

|

|

10,562 |

|

| Financial

assets at fair value through other

comprehensive income |

|

|

802 |

|

|

|

1,522 |

|

|

|

1,680 |

|

| Equity method

investments |

|

|

9,964 |

|

|

|

9,905 |

|

|

|

4,055 |

|

|

Property, plant and

equipment, net |

|

|

106,041 |

|

|

|

95,953 |

|

|

|

53,852 |

|

| Deferred

tax assets |

|

|

7,834 |

|

|

|

8,199 |

|

|

|

7,882 |

|

|

Goodwill |

|

|

28,138 |

|

|

|

28,138 |

|

|

|

28,138 |

|

| Other

intangible assets, net |

|

|

13,525 |

|

|

|

3,027 |

|

|

|

3,340 |

|

| Restricted

deposit |

|

|

460 |

|

|

|

481 |

|

|

|

460 |

|

| Other

non-current assets |

|

|

3,660 |

|

|

|

8,579 |

|

|

|

4,684 |

|

|

|

|

|

171,998 |

|

|

|

157,404 |

|

|

|

114,653 |

|

|

Total assets |

|

$ |

785,652 |

|

|

$ |

794,058 |

|

|

$ |

736,398 |

|

|

Liabilities and

Equity |

|

|

|

|

| Current

liabilities: |

|

|

|

|

|

|

|

Short-term borrowings |

|

$ |

147,000 |

|

|

$ |

147,000 |

|

|

$ |

107,000 |

|

| Financial

liability at amortized cost |

|

|

5,003 |

|

|

|

4,920 |

|

|

|

- |

|

| Accounts

payable |

|

|

128,862 |

|

|

|

134,970 |

|

|

|

113,670 |

|

| Income

taxes payable |

|

|

1,872 |

|

|

|

4,920 |

|

|

|

8,304 |

|

| Other

payable to related party |

|

|

2,200 |

|

|

|

1,900 |

|

|

|

- |

|

| Other

current liabilities |

|

|

58,113 |

|

|

|

44,701 |

|

|

|

72,335 |

|

|

Total current liabilities |

|

|

343,050 |

|

|

|

338,411 |

|

|

|

301,309 |

|

| Financial

liability at amortized

cost |

|

|

- |

|

|

|

- |

|

|

|

4,678 |

|

| Net defined

benefit liabilities |

|

|

1,125 |

|

|

|

1,178 |

|

|

|

1,113 |

|

| Deferred tax

liabilities |

|

|

2,795 |

|

|

|

106 |

|

|

|

1,368 |

|

| Other

non-current liabilities |

|

|

2,888 |

|

|

|

3,672 |

|

|

|

1,436 |

|

|

|

|

|

6,808 |

|

|

|

4,956 |

|

|

|

8,595 |

|

|

Total liabilities |

|

|

349,858 |

|

|

|

343,367 |

|

|

|

309,904 |

|

|

Equity |

|

|

|

|

|

|

| Ordinary

shares |

|

|

107,010 |

|

|

|

107,010 |

|

|

|

107,010 |

|

|

Additional paid-in capital |

|

|

106,644 |

|

|

|

104,533 |

|

|

|

103,913 |

|

| Treasury

shares |

|

|

(8,878 |

) |

|

|

(8,878 |

) |

|

|

(9,020 |

) |

|

Accumulated other comprehensive income |

|

|

(1,497 |

) |

|

|

(322 |

) |

|

|

(1,025 |

) |

| Retained

earnings |

|

|

235,410 |

|

|

|

250,574 |

|

|

|

226,065 |

|

|

Equity attributable to owners of Himax

Technologies, Inc. |

|

|

438,689 |

|

|

|

452,917 |

|

|

|

426,943 |

|

| Noncontrolling

interests |

|

|

(2,895 |

) |

|

|

(2,226 |

) |

|

|

(449 |

) |

|

Total equity |

|

|

435,794 |

|

|

|

450,691 |

|

|

|

426,494 |

|

|

Total liabilities and equity |

|

$ |

785,652 |

|

|

$ |

794,058 |

|

|

$ |

736,398 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Himax Technologies, Inc. |

| Unaudited Condensed

Consolidated Statements of Cash Flows |

| (Amounts

in Thousands of

U.S.

Dollars) |

|

|

|

Three Months Ended June

30, |

|

ThreeMonthsEndedMarch

31, |

|

|

|

|

2018 |

|

|

|

2017 |

|

|

|

2018 |

|

|

|

|

|

|

|

|

|

| Cash flows from

operating activities: |

|

|

|

|

|

|

| Profit (loss) for the

period |

|

$ |

1,396 |

|

|

$ |

(1,033 |

) |

|

$ |

(3,316 |

) |

| Adjustments for: |

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

5,180 |

|

|

|

3,471 |

|

|

|

5,098 |

|

| Bad debt

expense |

|

|

190 |

|

|

|

- |

|

|

|

- |

|

|

Share-based compensation expenses |

|

|

93 |

|

|

|

232 |

|

|

|

91 |

|

| Gain on

re-measurement of the pre-existing relationships in a business

combination |

|

|

(1,662 |

) |

|

|

- |

|

|

|

- |

|

| Changes

in fair value of financial assets at fair value through profit or

loss |

|

|

25 |

|

|

|

(37 |

) |

|

|

(1 |

) |

| Interest

income |

|

|

(672 |

) |

|

|

(619 |

) |

|

|

(549 |

) |

| Finance

costs |

|

|

265 |

|

|

|

190 |

|

|

|

252 |

|

| Income

tax expense (benefit) |

|

|

306 |

|

|

|

(179 |

) |

|

|

(728 |

) |

| Share of

losses of associates |

|

|

1,099 |

|

|

|

697 |

|

|

|

844 |

|

|

Inventories write downs |

|

|

3,567 |

|

|

|

2,487 |

|

|

|

2,954 |

|

| Foreign

currency exchange losses (gains) of financial assets |

|

|

340 |

|

|

|

- |

|

|

|

(222 |

) |

| |

|

|

10,127 |

|

|

|

5,209 |

|

|

|

4,423 |

|

| Changes in: |

|

|

|

|

|

|

| Accounts

receivable |

|

|

(9,872 |

) |

|

|

4,621 |

|

|

|

22,171 |

|

|

Inventories |

|

|

2,318 |

|

|

|

(1,907 |

) |

|

|

(15,716 |

) |

| Other

receivable from related parties |

|

|

(8 |

) |

|

|

- |

|

|

|

(15 |

) |

| Other

current assets |

|

|

1,205 |

|

|

|

1,611 |

|

|

|

(1,672 |

) |

| Accounts

payable |

|

|

(6,108 |

) |

|

|

(2,271 |

) |

|

|

(4,963 |

) |

| Accounts

payable to related party |

|

|

- |

|

|

|

(1,098 |

) |

|

|

- |

|

| Other

payable to related party |

|

|

300 |

|

|

|

- |

|

|

|

(300 |

) |

| Net

defined benefit liabilities |

|

|

(53 |

) |

|

|

(2 |

) |

|

|

26 |

|

| Other

current liabilities |

|

|

1,318 |

|

|

|

100 |

|

|

|

(1,629 |

) |

| Other

non-current liabilities |

|

|

167 |

|

|

|

(509 |

) |

|

|

(7 |

) |

|

Cash generated from operating activities |

|

|

(606 |

) |

|

|

5,754 |

|

|

|

2,318 |

|

| Interest

received |

|

|

1,014 |

|

|

|

1,110 |

|

|

|

166 |

|

| Interest

paid |

|

|

(182 |

) |

|

|

(113 |

) |

|

|

(170 |

) |

| Income

tax paid |

|

|

(3,032 |

) |

|

|

(7,986 |

) |

|

|

(37 |

) |

|

Net cash provided by (used in) operating

activities |

|

|

(2,806 |

) |

|

|

(1,235 |

) |

|

|

2,277 |

|

|

|

|

|

|

|

|

|

| Cash flows from

investing activities: |

|

|

|

|

|

|

|

Acquisitions of property, plant and equipment |

|

|

(17,745 |

) |

|

|

(11,701 |

) |

|

|

(18,550 |

) |

|

Acquisitions of intangible assets |

|

|

(109 |

) |

|

|

(218 |

) |

|

|

(94 |

) |

|

Acquisitions of financial assets at amortized cost |

|

|

(1,135 |

) |

|

|

(303 |

) |

|

|

(1,897 |

) |

| Proceeds

from disposals of financial assets at amortized cost |

|

|

303 |

|

|

|

298 |

|

|

|

754 |

|

|

Acquisitions of financial assets at fair value through profit or

loss |

|

|

(7,445 |

) |

|

|

(15,676 |

) |

|

|

(4,330 |

) |

| Proceeds

from disposals of financial assets at fair value through profit or

loss |

|

|

7,693 |

|

|

|

16,199 |

|

|

|

26,506 |

|

|

Acquisition of business |

|

|

- |

|

|

|

- |

|

|

|

(700 |

) |

|

Acquisition of a subsidiary, net of cash used |

|

|

(3,301 |

) |

|

|

- |

|

|

|

- |

|

|

Acquisition of equity method investments |

|

|

- |

|

|

|

(2,230 |

) |

|

|

- |

|

| Decrease

(increase) in refundable deposits |

|

|

6 |

|

|

|

284 |

|

|

|

(1 |

) |

| Releases

(pledges) of restricted deposit |

|

|

21 |

|

|

|

(115 |

) |

|

|

(11 |

) |

| |

| |

| Himax Technologies, Inc. |

| Unaudited Condensed

Consolidated Statements of Cash Flows |

| (Amounts

in Thousands of

U.S.

Dollars) |

|

|

|

Three Months Ended June

30, |

|

Three Months Ended March

31, |

|

|

|

|

2018 |

|

|

|

2017 |

|

|

|

2018 |

|

| Cash paid

for loan made to related parties |

|

$ |

(530 |

) |

|

$ |

- |

|

|

$ |

(250 |

) |

| Cash

received from loan made to related party |

|

|

- |

|

|

|

1,500 |

|

|

|

- |

|

| Income

tax paid for disposal of financial assets at fair value through

profit or loss |

|

|

- |

|

|

|

- |

|

|

|

(2,187 |

) |

|

Net cash used in investing activities |

|

|

(22,242 |

) |

|

|

(11,962 |

) |

|

|

(760 |

) |

|

|

|

|

|

|

|

|

| Cash flows from

financing activities: |

|

|

|

|

|

|

| Proceeds

from issuance of new shares by subsidiary |

|

|

- |

|

|

|

- |

|

|

|

11 |

|

|

Acquisitions of noncontrolling interests |

|

|

- |

|

|

|

(1 |

) |

|

|

- |

|

| Proceeds

from short-term borrowings |

|

|

27,000 |

|

|

|

27,000 |

|

|

|

- |

|

|

Repayments of short-term borrowings |

|

|

(27,000 |

) |

|

|

(27,000 |

) |

|

|

- |

|

|

Net cash provided by (used in) financing

activities |

|

|

- |

|

|

|

(1 |

) |

|

|

11 |

|

| Effect

of foreign currency exchange rate

changes on cash and cash equivalents |

|

|

(278 |

) |

|

|

59 |

|

|

|

255 |

|

| Net

increase

(decrease) in

cash and cash equivalents |

|

|

(25,326 |

) |

|

|

(13,139 |

) |

|

|

1,783 |

|

| Cash and cash

equivalents at beginning of period |

|

|

139,806 |

|

|

|

190,345 |

|

|

|

138,023 |

|

| Cash and cash

equivalents at end of period |

|

$ |

114,480 |

|

|

$ |

177,206 |

|

|

$ |

139,806 |

|

| |

|

|

|

|

|

|

| |

| Himax Technologies, Inc. |

| Unaudited Condensed

Consolidated Statements of Cash Flows |

| (Amounts

in Thousands of

U.S.

Dollars) |

|

|

|

|

|

Six Months Ended June

30, |

|

|

|

|

|

|

2018 |

|

|

|

2017 |

|

|

|

|

|

|

|

|

|

| Cash flows from

operating activities: |

|

|

|

|

|

|

| Loss for the

period |

|

|

|

$ |

(1,920 |

) |

|

$ |

(370 |

) |

| Adjustments for: |

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

|

|

10,278 |

|

|

|

6,910 |

|

| Bad debt

expense |

|

|

|

|

190 |

|

|

|

- |

|

|

Share-based compensation expenses |

|

|

|

|

184 |

|

|

|

461 |

|

| Gain on

disposals of property, plant and equipment |

|

|

|

|

- |

|

|

|

(28 |

) |

| Gain on

re-measurement of the pre-existing relationships in a business

combination |

|

|

|

|

(1,662 |

) |

|

|

- |

|

| Changes

in fair value of financial assets at fair value through profit or

loss |

|

|

|

|

24 |

|

|

|

(107 |

) |

| Interest

income |

|

|

|

|

(1,221 |

) |

|

|

(1,162 |

) |

| Finance

costs |

|

|

|

|

517 |

|

|

|

404 |

|

| Income

tax benefit |

|

|

|

|

(422 |

) |

|

|

(57 |

) |

| Share of

losses of associates |

|

|

|

|

1,943 |

|

|

|

831 |

|

|

Inventories write downs |

|

|

|

|

6,521 |

|

|

|

5,534 |

|

| Foreign

currency exchange losses of financial assets |

|

|

|

|

118 |

|

|

|

- |

|

| |

|

|

|

|

14,550 |

|

|

|

12,416 |

|

| Changes in: |

|

|

|

|

|

|

| Accounts

receivable |

|

|

|

|

12,299 |

|

|

|

28,094 |

|

|

Inventories |

|

|

|

|

(13,398 |

) |

|

|

(3,466 |

) |

| Other

receivable from related parties |

|

|

|

|

(23 |

) |

|

|

- |

|

| Other

current assets |

|

|

|

|

(467 |

) |

|

|

733 |

|

| Accounts

payable |

|

|

|

|

(11,071 |

) |

|

|

(28,599 |

) |

| Accounts

payable to related party |

|

|

|

|

- |

|

|

|

(576 |

) |

| Net

defined benefit liabilities |

|

|

|

|

(27 |

) |

|

|

39 |

|

| Other

current liabilities |

|

|

|

|

(311 |

) |

|

|

2,727 |

|

| Other

non-current liabilities |

|

|

|

|

160 |

|

|

|

(14 |

) |

|

Cash generated from operating activities |

|

|

|

|

1,712 |

|

|

|

11,354 |

|

| Interest

received |

|

|

|

|

1,180 |

|

|

|

1,160 |

|

| Interest

paid |

|

|

|

|

(352 |

) |

|

|

(250 |

) |

| Income

tax paid |

|

|

|

|

(3,069 |

) |

|

|

(8,039 |

) |

|

Net cash provided by

(used in) operating activities |

|

|

|

|

(529 |

) |

|

|

4,225 |

|

|

|

|

|

|

|

|

|

| Cash flows from

investing activities: |

|

|

|

|

|

|

|

Acquisitions of property, plant and equipment |

|

|

|

|

(36,295 |

) |

|

|

(13,699 |

) |

| Proceeds

from disposals of property, plant and equipment |

|

|

|

|

- |

|

|

|

28 |

|

|

Acquisitions of intangible assets |

|

|

|

|

(203 |

) |

|

|

(229 |

) |

|

Acquisitions of financial assets at amortized cost |

|

|

|

|

(3,032 |

) |

|

|

(757 |

) |

| Proceeds

from disposals of financial assets at amortized cost |

|

|

|

|

1,057 |

|

|

|

744 |

|

|

Acquisitions of financial assets at fair value through profit or

loss |

|

|

|

|

(11,775 |

) |

|

|

(20,323 |

) |

| Proceeds

from disposals of financial assets at fair value through profit or

loss |

|

|

|

|

34,199 |

|

|

|

22,273 |

|

|

Acquisition of business |

|

|

|

|

(700 |

) |

|

|

- |

|

|

Acquisition of a subsidiary, net of cash used |

|

|

|

|

(3,301 |

) |

|

|

- |

|

|

Acquisition of equity method investments |

|

|

|

|

- |

|

|

|

(2,230 |

) |

| Decrease

(increase) in refundable deposits |

|

|

|

|

5 |

|

|

|

(26 |

) |

| Releases

(pledges) of restricted deposit |

|

|

|

|

10 |

|

|

|

(337 |

) |

| |

| |

| Himax Technologies, Inc. |

| Unaudited Condensed

Consolidated Statements of Cash Flows |

| (Amounts

in Thousands of

U.S.

Dollars) |

|

|

|

|

|

Six Months Ended June

30, |

|

|

|

|

|

|

2018 |

|

|

|

2017 |

|

| Cash paid

for loan made to related parties |

|

|

|

$ |

(780 |

) |

|

$ |

- |

|

| Cash

received from loan made to related party |

|

|

|

|

- |

|

|

|

3,000 |

|

| Income

tax paid for disposal of financial assets at fair value through

profit or loss |

|

|

|

|

(2,187 |

) |

|

|

- |

|

|

Net cash used in investing activities |

|

|

|

|

(23,002 |

) |

|

|

(11,556 |

) |

|

|

|

|

|

|

|

|

| Cash flows from

financing activities: |

|

|

|

|

|

|

| Proceeds

from issuance of new shares by subsidiary |

|

|

|

|

11 |

|

|

|

- |

|

| Proceeds

from disposals of subsidiary shares to noncontrolling interests by

Himax Imaging, Inc. |

|

|

|

|

- |

|

|

|

4 |

|

|

Acquisitions of noncontrolling interests |

|

|

|

|

- |

|

|

|

(1 |

) |

| Release

of restricted deposit |

|

|

|

|

- |

|

|

|

31,000 |

|

| Proceeds

from short-term borrowings |

|

|

|

|

27,000 |

|

|

|

54,161 |

|

|

Repayments of short-term borrowings |

|

|

|

|

(27,000 |

) |

|

|

(85,161 |

) |

|

Net cash provided by

financing activities |

|

|

|

|

11 |

|

|

|

3 |

|

| Effect

of foreign currency exchange rate

changes on cash and cash equivalents |

|

|

|

|

(23 |

) |

|

|

82 |

|

| Net

decrease in cash and cash

equivalents |

|

|

|

|

(23,543 |

) |

|

|

(7,246 |

) |

| Cash and cash

equivalents at beginning of period |

|

|

|

|

138,023 |

|

|

|

184,452 |

|

| Cash and cash

equivalents at end of period |

|

|

|

$ |

114,480 |

|

|

$ |

177,206 |

|

| |

|

|

|

|

|

|

| Himax Technologies, Inc. |

| Non-IFRS

Unaudited Supplemental Data – Reconciliation

Schedule |

| (Amounts in Thousands of U.S.

Dollars) |

|

|

|

Gross Margin, Operating Margin and Net Margin Excluding

Share-Based Compensation and

Acquisition-Related Charges: |

|

|

Three Months Ended June

30, |

|

ThreeMonths EndedMarch

31, |

|

|

|

2018 |

|

|

|

2017 |

|

|

|

2018 |

|

| Revenues |

$ |

181,365 |

|

|

$ |

151,730 |

|

|

$ |

162,851 |

|

| Gross profit |

|

41,794 |

|

|

|

36,174 |

|

|

|

36,597 |

|

| Add: Share-based

compensation – cost of revenues |

|

12 |

|

|

|

25 |

|

|

|

12 |

|

| Gross profit excluding

share-based compensation |

|

41,806 |

|

|

|

36,199 |

|

|

|

36,609 |

|

| Gross margin excluding

share-based compensation |

|

23.1 |

% |

|

|

23.9 |

% |

|

|

22.5 |

% |

| Operating income

(loss) |

|

500 |

|

|

|

(917 |

) |

|

|

(3,244 |

) |

| Add: Share-based

compensation |

|

93 |

|

|

|

231 |

|

|

|

91 |

|

| Operating income (loss)

excluding share-based compensation |

|

593 |

|

|

|

(686 |

) |

|

|

(3,153 |

) |

| Add:

Acquisition-related charges –intangible assets amortization |

|

246 |

|

|

|

246 |

|

|

|

246 |

|

| Operating income (loss)

excluding share-based compensation and acquisition-related

charges |

|

839 |

|

|

|

(440 |

) |

|

|

(2,907 |

) |

| Operating margin

excluding share-based compensation and acquisition-related

charges |

|

0.5 |

% |

|

|

(0.3 |

%) |

|

|

(1.8 |

%) |

| Profit (loss)

attributable to Himax Technologies, Inc. stockholders |

|

2,046 |

|

|

|

(680 |

) |

|

|

(2,829 |

) |

| Add: Share-based

compensation, net of tax |

|

80 |

|

|

|

193 |

|

|

|

79 |

|

| Add:

Acquisition-related charges, net of tax |

|

175 |

|

|

|

148 |

|

|

|

175 |

|

| Profit (loss)

attributable to Himax Technologies, Inc. stockholders excluding

share-based compensation and acquisition-related charges |

|

2,301 |

|

|

|

(339 |

) |

|

|

(2,575 |

) |

| Net margin attributable

to Himax Technologies, Inc. stockholders excluding share-based

compensation and acquisition-related charges |

|

1.3 |

% |

|

|

(0.2 |

%) |

|

|

(1.6 |

%) |

| |

|

|

|

|

|

| *Gross

margin excluding share-based compensation equals gross profit

excluding share-based compensation divided by revenues |

| *Operating

margin excluding share-based compensation and acquisition-related

charges equals operating income (loss) excluding share-based

compensation and acquisition-related charges divided by

revenues |

| *Net

margin attributable to Himax Technologies, Inc. stockholders

excluding share-based compensation and acquisition-related charges

equals profit (loss) attributable to Himax Technologies, Inc.

stockholders excluding share-based compensation and