Knight Therapeutics Inc. (TSX:GUD) ("Knight"), a leading Canadian

specialty pharmaceutical company, today reported financial results

for its second quarter ended June 30, 2018.

Q2 2018 Highlights

Financials

- Revenues were $2,238, a decrease of $242 or 10% versus prior

period

- Net income was $4,019, an increase of $3,560 or 776% over prior

period

- Cash flows from operations at $4,059, an increase of $688 or

20% over prior period

- Cash, cash equivalents, and marketable securities of $806,746

as at June 30, 2018

Product

- Received regulatory approval from Health Canada for Probuphine™

for the treatment of opioid drug dependence

Strategic Lending and Investments

- Amended loan with 60P and disbursed US$647 out of a commitment

to lend up to an additional US$2,100

- Converted $500 Antibe debenture into 2,489,899 common shares

and sold the shares for proceeds of $1,011

- Received distributions of $1,856 from strategic fund

investments

Key Subsequent Events

- Received notice of reassessment from CRA

- Received $3,188 from Profound representing full loan repayment

and an early payment fee

- Entered into a licensing agreement with TherapeuticsMD, Inc.

(“TherapeuticsMD”) to commercialize two products in Canada and

Israel

- Invested USD$20,000 in common shares of TherapeuticsMD at a

price of US$5.10 per share

- Accepted the resignation of Dr. Sarit Assouline and appointed

Nancy Harrison to the Board of Directors

“I am pleased with our progress at strengthening Knight's

pipeline of innovative pharmaceuticals directed at touching the

lives of patients. Our recent strategic investment and license

agreement with TherapeuticsMD for two late stage, differentiated

women’s health products successfully leverages our strong balance

sheet to help Knight secure innovative pharmaceutical rights," said

Jonathan Ross Goodman, CEO of Knight Therapeutics Inc.

Select Financial Results

| |

Q2-18 |

Q2-17 |

Change |

|

|

Change |

|

|

|

$1 |

|

%2 |

YTD-18 |

YTD-17 |

|

$1 |

|

%2 |

| |

|

|

|

|

|

|

|

|

| Revenues |

2,238 |

|

2,480 |

|

(242 |

) |

10 |

% |

5,392 |

4,230 |

|

1,162 |

|

27 |

% |

| Gross margin |

1,900 |

|

2,008 |

|

(108 |

) |

5 |

% |

4,220 |

3,470 |

|

750 |

|

22 |

% |

| Operating expenses |

3,401 |

|

4,246 |

|

845 |

|

20 |

% |

6,774 |

7,493 |

|

719 |

|

10 |

% |

| Interest income |

4,746 |

|

5,698 |

|

(952 |

) |

17 |

% |

10,034 |

11,558 |

|

(1,524 |

) |

13 |

% |

| Share of net (loss)

income of associate |

(151 |

) |

96 |

|

(247 |

) |

N/A |

352 |

415 |

|

(63 |

) |

15 |

% |

| Net income |

4,019 |

|

459 |

|

3,560 |

|

776 |

% |

10,928 |

6,506 |

|

4,422 |

|

68 |

% |

| Basic earnings per

share |

0.028 |

|

0.003 |

|

(0.025 |

) |

833 |

% |

0.077 |

0.046 |

|

0.031 |

|

67 |

% |

1 A positive variance represents a

positive impact to net income and a negative variance represents a

negative impact to net income2

Percentage change is presented in absolute values

Revenue: Variance for the

quarter and the six-month period was mainly attributable to the

timing of sales for Impavido® and growth in Movantik® sales.

Gross margin: Change in gross

margin was attributable to revenues variances and product mix.

Operating expenses: The

decrease in Q2-18 was driven by a reduction in general and

administrative expenses mainly related to lower stock-based

compensation expense. For the six-month period, the decrease was

driven by a reduction in general and administrative expenses mainly

related to lower stock-based compensation expense, offset by

commercial activities including the promotion of Movantik®.

Interest income: Interest

income was driven by the sum of interest income and interest

accretion. Interest income (excluding accretion) for the quarter

was $4,746, an increase of 3% or $154 versus the prior quarter

while interest income (excluding accretion) for the six-month

period was $10,034, an increase of 7% or $660 versus the prior

period. The increases are explained by an increase in the average

cash, cash equivalents, and marketable securities balances and an

increase in interest rates, offset by a lower average loan

balance.

Net income: Net income for the

quarter was driven by the above-mentioned items as well as a net

gain on the revaluation of financial assets measured at fair value

through profit or loss of $2,884. Similarly, net income for the

six-month period was impacted by (i) a net gain on revaluation of

financial assets measured at fair value through profit or loss of

$3,425, (ii) other income of $1,388 due to the early repayment of

fees on the Medimetriks loan, and (iii) a foreign exchange gain of

$2,548 from the relative gains on certain U.S. dollar denominated

financial assets as the Canadian dollar weakened.

Product Updates

On April 18, 2018, Probuphine™ was approved by Health Canada for

the treatment of opioid dependence. Probuphine™ is a subdermal

implant designed to deliver buprenorphine continuously for six

months following a single treatment, promoting patient compliance

and retention. Knight expects to launch Probuphine™ by the end of

2018.

On July 31, 2018, Knight entered into an exclusive licensing

agreement for the commercial rights of TX-004HR and TX-001HR in

Canada and Israel. TX-004HR is TherapeuticsMD's FDA-approved

product, marketed as Imvexxy™ (estradiol vaginal inserts) in the

U.S., for the treatment of moderate-to-severe dyspareunia (vaginal

pain associated with sexual activity), a symptom of vulvar and

vaginal atrophy (VVA), due to menopause. TX-001HR is

TherapeuticsMD's investigational bio-identical hormone therapy

combination of estradiol and progesterone in a single, oral softgel

for the treatment of moderate-to-severe vasomotor symptoms due to

menopause. Knight expects to submit both products to Health Canada

for regulatory approval in 2019.

Strategic Lending

Update

On April 24, 2018, Knight amended its loan agreement with 60P

and committed to lend an additional amount of up to US$2,100, at an

interest rate of 15%, to support the regulatory approval and

commercialization of tafenoquine. As consideration for the

amendment, 60P committed to pay Knight an additional US$3,000 plus

annual interest of 9% on April 23, 2023 (“60P Commitment”).

Under the terms of the 60P Commitment, Knight has the right to

convert the 60P Commitment into common shares of 60P at a

pre-determined exercise price at any time prior to the maturity

date. Furthermore, Knight obtained the rights to commercialize

tafenoquine in Latin America.

Corporate Update

Dr. Sarit Assouline resigned from Knight’s Board of Directors

and Nancy Harrison was appointed. “We are grateful to Sarit for her

time on our board and wish her every continued success,” Mr.

Goodman commented, “Nancy’s experience as a life sciences

specialist in the Canadian venture capital industry will be an

asset to Knight and we are fortunate to have her join our

board.”

Nancy Harrison is former Co-founder and President of MSI

Methylation Sciences, a private venture backed development company

with a novel treatment of depression in a Phase II clinical trial.

She is a former Partner and Senior Vice President of Ventures West

Management Inc. Ms. Harrison spent 13 years with Ventures West

leading its life sciences practice in Canada and the U.S. She is

one of the most experienced life sciences investors in the Canadian

venture capital industry and was instrumental in Ventures West’s

involvement in the sector and with companies such as Angiotech

Pharmaceuticals Inc., AnorMed Inc., Salmedix Inc. and Oncogenix

Pharmaceuticals Inc., Celator Pharmaceuticals Inc., and Caprion

BioSciences. During her time with Ventures West, the firm grew from

approximately $80 million to over $750 million. Ms. Harrison has an

undergraduate degree in Engineering from Queen’s University and an

MBA from McGill University.

TherapeuticsMD Transaction

A presentation with additional information about the

TherapeuticsMD transaction can be found on Knight's website

at www.gudknight.com under Presentations and will remain

available for 30 days.

Conference Call

Notice

Knight will host a conference call and audio webcast to discuss

its first quarter results today at 8:30 am ET. Knight cordially

invites all interested parties to participate in this call.

Date: Thursday, August 9,

2018Time: 8:30 a.m. ESTTelephone:

Toll Free 1-877-855-7766 or International 248-847-2346

Webcast:

www.gudknight.com or https://tinyurl.com/y8wmkzkr This is a

listen-only audio webcast. Media Player is required to listen to

the broadcast.Replay: An archived replay will be

available for 30 days at www.gudknight.com

Currency

All dollar amounts are in thousands except for share and per

share amounts. All currencies are Canadian unless otherwise

specified.

About Knight Therapeutics

Inc.

Knight Therapeutics Inc., headquartered in Montreal, Canada, is

a specialty pharmaceutical company focused on acquiring or

in-licensing and commercializing innovative pharmaceutical products

for the Canadian and select international markets. Knight

Therapeutics Inc.'s shares trade on TSX under the symbol GUD. For

more information about Knight Therapeutics Inc., please visit the

company's web site at www.gudknight.com or www.sedar.com.

Forward-Looking Statement

This document contains forward-looking statements for Knight

Therapeutics Inc. and its subsidiaries. These forward-looking

statements, by their nature, necessarily involve risks and

uncertainties that could cause actual results to differ materially

from those contemplated by the forward-looking statements. Knight

Therapeutics Inc. considers the assumptions on which these

forward-looking statements are based to be reasonable at the time

they were prepared but cautions the reader that these assumptions

regarding future events, many of which are beyond the control of

Knight Therapeutics Inc. and its subsidiaries, may ultimately prove

to be incorrect. Factors and risks, which could cause actual

results to differ materially from current expectations are

discussed in Knight Therapeutics Inc.'s Annual Report and in Knight

Therapeutics Inc.'s Annual Information Form for the year ended

December 31, 2017. Knight Therapeutics Inc. disclaims any intention

or obligation to update or revise any forward-looking statements

whether as a result of new information or future events, except as

required by law.

CONTACT INFORMATION:

Knight Therapeutics Inc. Samira Sakhia President and Chief

Financial Officer T: 514-678-8930 F: 514-481-4116

info@gudknight.com www.gudknight.com

INTERIM CONSOLIDATED BALANCE

SHEETS[In thousands of Canadian dollars][Unaudited]

|

As at |

June 30,2018 |

December 31, 2017 |

|

ASSETS |

|

|

|

Current |

|

|

| Cash and cash

equivalents |

418,358 |

496,460 |

| Marketable

securities |

318,388 |

232,573 |

| Trade and other

receivables |

6,298 |

9,176 |

| Inventories |

966 |

1,224 |

| Other current financial

assets |

25,438 |

58,848 |

| Income

taxes receivable |

1,002 |

792 |

|

Total current assets |

770,450 |

799,073 |

| |

|

|

| Marketable

securities |

70,000 |

36,000 |

| Property and

equipment |

710 |

633 |

| Intangible assets |

15,506 |

12,576 |

| Other financial

assets |

90,676 |

76,988 |

| Investment in

associate |

78,990 |

75,983 |

| Deferred

income tax assets |

2,801 |

4,730 |

|

Total assets |

1,029,133 |

1,005,983 |

|

|

|

|

| LIABILITIES AND

SHAREHOLDERS’ EQUITY |

|

|

|

Current |

|

|

| Accounts payable and

accrued liabilities |

4,100 |

5,025 |

| Income taxes

payable |

8,911 |

7,599 |

| Other balances

payable |

1,418 |

1,354 |

| Deferred

other income |

268 |

282 |

|

Total current liabilities |

14,697 |

14,260 |

|

|

|

|

| Deferred other

income |

42 |

167 |

| Other balances

payable |

1,085 |

348 |

|

Total liabilities |

15,824 |

14,775 |

|

|

|

|

| Shareholders’

equity |

|

|

| Share capital |

761,595 |

761,490 |

| Warrants |

785 |

785 |

| Contributed

surplus |

13,383 |

12,196 |

| Accumulated other

comprehensive income |

18,575 |

20,907 |

| Retained

earnings |

218,971 |

195,830 |

|

Total shareholders’ equity |

1,013,309 |

991,208 |

|

Total liabilities and shareholders’ equity |

1,029,133 |

1,005,983 |

INTERIM CONSOLIDATED STATEMENTS OF

INCOME[In thousands of Canadian dollars, except for share

and per share amounts][Unaudited]

|

|

Three months ended June 30, |

Six months ended June 30, |

| |

2018 |

|

2017 |

|

2018 |

|

2017 |

|

| |

|

|

|

|

|

Revenues |

2,238 |

|

2,480 |

|

5,392 |

|

4,230 |

|

| Cost of goods sold |

338 |

|

472 |

|

1,172 |

|

760 |

|

| Gross margin |

1,900 |

|

2,008 |

|

4,220 |

|

3,470 |

|

| |

|

|

|

|

|

Expenses |

|

|

|

|

| Selling and

marketing |

892 |

|

1,050 |

|

1,681 |

|

1,413 |

|

| General and

administrative |

1,937 |

|

2,329 |

|

4,032 |

|

4,797 |

|

| Research and development |

572 |

|

867 |

|

1,061 |

|

1,283 |

|

| |

(1,501 |

) |

(2,238 |

) |

(2,554 |

) |

(4,023 |

) |

| |

|

|

|

|

|

Depreciation of property and equipment |

19 |

|

— |

|

35 |

|

— |

|

|

Amortization of intangible assets |

445 |

|

320 |

|

886 |

|

646 |

|

| Interest

income |

(4,746 |

) |

(5,698 |

) |

(10,034 |

) |

(11,558 |

) |

| Other

income |

(37 |

) |

(334 |

) |

(1,388 |

) |

(642 |

) |

| Net loss

(gain) on financial assets |

— |

|

1,056 |

|

— |

|

(2,319 |

) |

| Net gain on

financial assets measured at fair value through profit or loss |

(2,884 |

) |

— |

|

(3,425 |

) |

— |

|

| Share of

net loss (income) of associate |

151 |

|

(96 |

) |

(352 |

) |

(415 |

) |

| Foreign

exchange loss (gain) |

49 |

|

1,306 |

|

(2,548 |

) |

1,549 |

|

| Income before income taxes |

5,502 |

|

1,208 |

|

14,272 |

|

8,716 |

|

| |

|

|

|

|

|

Income tax expense |

|

|

|

|

|

Current |

911 |

|

628 |

|

1,552 |

|

1,108 |

|

| Deferred |

572 |

|

121 |

|

1,792 |

|

1,102 |

|

| Net income for the period |

4,019 |

|

459 |

|

10,928 |

|

6,506 |

|

|

|

|

|

|

|

|

|

|

| Basic

earnings per share |

0.028 |

|

0.003 |

|

0.077 |

|

0.046 |

|

| Diluted

earnings per share |

0.028 |

|

0.003 |

|

0.076 |

|

0.045 |

|

| |

|

|

|

|

| Basic |

142,819,960 |

|

142,760,357 |

|

142,816,677 |

|

142,740,562 |

|

| Diluted |

143,270,324 |

|

143,557,171 |

|

143,247,377 |

|

143,177,337 |

|

INTERIM CONSOLIDATED STATEMENT OF CASH

FLOWS[In thousands of Canadian dollars][Unaudited]

|

|

Three months ended June 30, |

Six months ended June 30, |

| |

2018 |

|

2017 |

|

2018 |

|

2017 |

|

|

OPERATING ACTIVITIES |

|

|

|

|

| Net

income for the period |

4,019 |

|

459 |

|

10,928 |

|

6,506 |

|

| Adjustments

reconciling net income to operating cash flows: |

|

|

|

|

| Deferred tax |

572 |

|

121 |

|

1,792 |

|

1,102 |

|

| Share-based compensation expense |

642 |

|

1,018 |

|

1,187 |

|

1,864 |

|

| Depreciation and amortization |

464 |

|

320 |

|

921 |

|

646 |

|

| Accretion of interest |

— |

|

(1,106 |

) |

— |

|

(2,184 |

) |

| Net (gain) loss on financial assets |

(2,884 |

) |

1,056 |

|

(3,425 |

) |

(2,319 |

) |

| Foreign exchange loss (gain) |

49 |

|

1,344 |

|

(2,548 |

) |

1,549 |

|

| Share of net loss (income) of associate |

151 |

|

(96 |

) |

(352 |

) |

(415 |

) |

| Other income |

— |

|

155 |

|

— |

|

— |

|

| Deferred other income |

(45 |

) |

(84 |

) |

(139 |

) |

(231 |

) |

| |

2,968 |

|

3,187 |

|

8,364 |

|

6,518 |

|

| Changes in

non-cash working capital related to operations |

1,091 |

|

(2,341 |

) |

2,559 |

|

(1,436 |

) |

| Dividends from associate |

— |

|

2,525 |

|

— |

|

2,525 |

|

| Cash inflow from operating

activities |

4,059 |

|

3,371 |

|

10,923 |

|

7,607 |

|

| |

|

|

|

|

|

INVESTING ACTIVITIES |

|

|

|

|

| Purchase of

marketable securities |

(232,762 |

) |

(98,182 |

) |

(283,517 |

) |

(142,473 |

) |

| Purchase of

intangible |

— |

|

— |

|

(3,000 |

) |

— |

|

| Purchase of

property and equipment |

(44 |

) |

— |

|

(86 |

) |

— |

|

| Issuance of

loans receivables |

(831 |

) |

(1,807 |

) |

(831 |

) |

(1,807 |

) |

| Purchase of

equities |

(310 |

) |

(120 |

) |

(710 |

) |

(2,939 |

) |

| Investment

in funds |

(9,925 |

) |

(6,190 |

) |

(14,202 |

) |

(10,331 |

) |

| Proceeds on

maturity of marketable securities |

64,091 |

|

106,073 |

|

165,409 |

|

126,559 |

|

| Proceeds

from repayments of loans receivable |

1,594 |

|

2,266 |

|

35,034 |

|

30,324 |

|

| Proceeds

from disposal of equities |

1,015 |

|

2,806 |

|

1,015 |

|

3,515 |

|

| Proceeds

from distribution of funds |

5,756 |

|

1,222 |

|

6,099 |

|

3,376 |

|

| Cash (outflow) inflow from investing

activities |

(171,416 |

) |

6,068 |

|

(94,789 |

) |

6,224 |

|

| |

|

|

|

|

|

FINANCING ACTIVITIES |

|

|

|

|

| Proceeds

from exercise of stock options |

— |

|

— |

|

— |

|

345 |

|

| Proceeds

from contributions to share purchase plan |

42 |

|

50 |

|

91 |

|

93 |

|

| Cash inflow from financing

activities |

42 |

|

50 |

|

91 |

|

438 |

|

|

|

|

|

|

|

|

(Decrease) Increase in cash during the period |

(167,315 |

) |

9,489 |

|

(83,775 |

) |

14,269 |

|

| Cash and

cash equivalents, beginning of the period |

583,408 |

|

519,522 |

|

496,460 |

|

514,942 |

|

| Net foreign exchange difference |

2,265 |

|

(1,132 |

) |

5,673 |

|

(1,332 |

) |

| Cash and cash equivalents, end of the

period |

418,358 |

|

527,879 |

|

418,358 |

|

527,879 |

|

|

|

|

|

|

|

| Cash and cash

equivalents |

418,358 |

|

527,879 |

|

|

|

| Short-term

marketable securities |

318,388 |

|

233,282 |

|

|

|

| Long-term marketable securities |

70,000 |

|

— |

|

|

|

| |

806,746 |

|

761,161 |

|

|

|

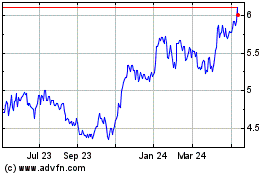

Knight Therapeutics (TSX:GUD)

Historical Stock Chart

From Mar 2024 to Apr 2024

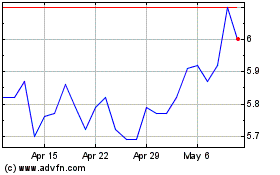

Knight Therapeutics (TSX:GUD)

Historical Stock Chart

From Apr 2023 to Apr 2024