Innovative Solutions & Support, Inc. (“IS&S” or the

“Company”) (ISSC) today announced its financial results for the

third quarter of fiscal 2018, ended June 30, 2018.

For the third quarter of fiscal 2018, the Company reported net

sales of $3.4 million, compared to third quarter fiscal 2017 sales

of $4.5 million. The Company reported a net loss of $1.0 million,

or ($0.06) per share, for the third quarter of 2018 compared to net

income of $19,000, or $0.00 per share, in the third quarter a year

ago. In the third quarter a year ago, the Company recorded a

$537,000 tax benefit related to a change in the anticipated

profitability in the year, while there was no similar benefit in

this year’s third quarter.

Geoffrey Hedrick, Chairman and Chief Executive Officer of

IS&S, said, “In the third quarter we took action to more

clearly focus the organization on those programs that we believe to

be critical and represent the greatest sales potential. Among the

programs in which we have the greatest confidence, we believe, is

our Autothrottle technology, an innovative breakthrough in

turboprop cockpit technology. With PC-12 certification in hand, we

are pursuing a second STC, for the King Air. This quarter we

purchased our own King Air aircraft, providing unfettered access to

an aircraft in an effort to help expedite certification. To support

these programs, we reorganized certain aspects of the business and

revamped our sales and marketing strategy. In addition, the Company

undertook a reduction in workforce. The goal of these actions was

to concentrate our resources around what we believe to be our

critical programs and reduce our operating expenses. We believe

that we are a stronger organization, more efficient, and more

focused on opportunities that have the greatest potential to unlock

the value inherent in our innovative technology.”

At June 30, 2018, the Company had $20.9 million of cash on hand.

The Company used $2.4 million of cash to acquire a King Air

airplane in the quarter.

The Company recorded a $259,000 charge in the third quarter as a

result of a reduction in workforce/reorganization. Beginning in

fiscal 2019, the Company currently expects to realize a savings of

$3.5 million on an annual basis in payroll and related costs

compared to historical levels and currently expects research and

development costs will decrease to 20% of current net sales which

is approaching a more historical ratio than the 30% of current net

sales seen in recent periods.

New orders in the third quarter of fiscal 2018 were $3.6 million

and backlog as of June 30, 2018 was $4.0 million. Backlog excludes

potential future sole-source production orders from the Pilatus

PC-24, and the KC-46A, all of which the Company expects to remain

in production for a decade following completion of their respective

development phases. The Company expects that these contracts will

add to production sales already in backlog.

Shahram Askarpour, President of IS&S, added, "During the

third quarter we continued to advance our AutoThrottle technology

for the King Air aircraft, for which we are working on a new

certification. A flight test with the FAA is scheduled in August

which we currently expect will ultimately result in certification

of our ThrustSense® AutoThrottle for that platform. We believe

IS&S is now a leaner and more focused organization that boasts

a portfolio of the some of the industry’s best

price-for-performance technology that targets opportunities in the

commercial air transport, military and general aviation

markets.”

Nine Months Results

Total net sales for the nine months ended June 30, 2018 were

$10.2 million, compared to $12.6 million for the nine months ended

June 30, 2017. For the nine months ended June 30, 2018, the net

loss was ($3.2) million compared to net income of $4.8 million for

the first nine months of fiscal 2017. Nine month results for fiscal

2017 include the benefit of a $3.6 million reduction to selling,

general and administrative expenses as well as $4.1 million of

other income, both arising from the settlement of a lawsuit.

Conference Call

The Company will be hosting a conference call on Thursday,

August 9, 2018 at 10:00 a.m. ET to discuss these results and its

business outlook. Please use the following dial in number to

register your name and company affiliation for the conference call:

877-883-0383 and enter the PIN Number 8271296. The call will also

be carried live on the Investor Relations page of the Company web

site at www.innovative-ss.com.

About Innovative Solutions & Support, Inc.

Headquartered in Exton, Pa., Innovative Solutions & Support,

Inc. (www.innovative-ss.com) is a systems integrator that designs

and manufactures flight guidance and cockpit display systems for

Original Equipment Manufacturers (OEMs) and retrofit applications.

The company supplies integrated Flight Management Systems (FMS) and

advanced GPS receivers for precision low carbon footprint

navigation.

Certain matters contained herein that are not descriptions of

historical facts are “forward-looking” (as such term is defined in

the Private Securities Litigation Reform Act of 1995). Because such

statements include risks and uncertainties, actual results may

differ materially from those expressed or implied by such

forward-looking statements. Factors that could cause results to

differ materially from those expressed or implied by such

forward-looking statements include, but are not limited to, those

discussed in filings made by the Company with the Securities and

Exchange Commission. Many of the factors that will determine the

Company’s future results are beyond the ability of management to

control or predict. Readers should not place undue reliance on

forward-looking statements, which reflect management’s views only

as of the date hereof. The Company undertakes no obligation to

revise or update any forward-looking statements, or to make any

other forward-looking statements, whether as a result of new

information, future events or otherwise.

TABLES TO FOLLOW

Innovative Solutions and Support, Inc.

Consolidated Balance Sheets June 30, September

30, 2018 2017 (unaudited)

ASSETS

Current assets Cash and cash equivalents $ 20,879,412 $ 24,680,301

Accounts receivable 1,780,829 2,748,597 Unbilled receivables

1,039,879 1,480,822 Inventories 4,685,652 4,179,654 Prepaid

expenses and other current assets 874,375 1,092,064

Total current assets 29,260,147 34,181,438 Property and

equipment, net 8,890,643 6,669,011 Other assets 184,026 187,315

Total assets $ 38,334,816 $ 41,037,764

LIABILITIES AND

SHAREHOLDERS' EQUITY

Current liabilities Accounts payable $ 1,329,859 $ 1,321,251

Accrued expenses 1,899,774 1,760,037 Deferred revenue 406,748

280,354 Total current liabilities 3,636,381 3,361,642

Non-current deferred income taxes 129,587 67,742

Total liabilities 3,765,968 3,429,384

Commitments and contingencies (See Note 6)

Shareholders' equity

Preferred stock, 10,000,000 shares

authorized, $.001 par value, of which 200,000 shares are authorized

as Class A Convertible stock. No shares issued and outstanding at

June 30, 2018 and September 30, 2017

$ - $ -

Common stock, $.001 par value: 75,000,000

shares authorized, 18,937,050 and 18,879,580 issued at June 30,

2018 and September 30, 2017, respectively

18,937 18,880 Additional paid-in capital 51,783,779

51,583,841 Retained earnings 4,134,669 7,374,196

Treasury stock, at cost, 2,096,451 shares

at June 30, 2018 and September 30, 2017

(21,368,537 ) (21,368,537 ) Total shareholders'

equity 34,568,848 37,608,380 Total liabilities and

shareholders' equity $ 38,334,816 $ 41,037,764

Innovative Solutions and Support,

Inc. Consolidated Statements of Operations

(unaudited) Three months ended Nine months ended June

30, June 30, 2018 2017 2018 2017 Gross sales $ 3,389,663 $

4,541,421 $ 10,204,851 $ 13,117,200 Returns and allowances -

- - (556,009 ) Net Sales

3,389,663 4,541,421 10,204,851 12,561,191 Cost of sales

1,806,980 2,164,140 5,482,596

6,294,623 Gross profit 1,582,683

2,377,281 4,722,255 6,266,568 Operating expenses: Research

and development 1,028,271 1,236,184 2,983,614 3,391,181 Selling,

general and administrative 1,626,640 1,682,286

5,005,941 2,025,952 Total

operating expenses 2,654,911 2,918,470 7,989,555 5,417,133

Operating (loss) income (1,072,228 ) (541,189 ) (3,267,300 )

849,435 Interest income 15,164 7,682 36,469 27,505 Other

income 16,128 15,628 53,224

4,174,953 (Loss) income before income taxes

(1,040,936 ) (517,879 ) (3,177,607 ) 5,051,893 Income tax

expense (benefit) 101 (537,099 ) 61,920

297,220 Net (loss) income $ (1,041,037

) $ 19,220 $ (3,239,527 ) $ 4,754,673 Net

(loss) income per common share: Basic $ (0.06 ) $ 0.00 $

(0.19 ) $ 0.28 Diluted $ (0.06 ) $ 0.00 $ (0.19 ) $

0.28 Weighted average shares outstanding: Basic

16,816,838

16,755,082 16,800,070

16,735,533 Diluted

16,816,838 16,870,404

16,800,070

16,847,305

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180808005789/en/

Innovative Solutions & Support, Inc.Relland WinandChief

Financial Officer610-646-0350rwinand@innovative-ss.com

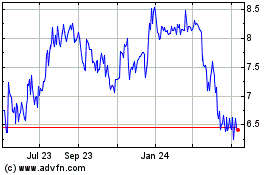

Innovative Solutions and... (NASDAQ:ISSC)

Historical Stock Chart

From Mar 2024 to Apr 2024

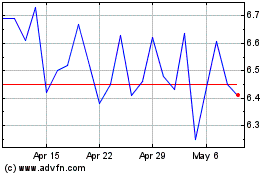

Innovative Solutions and... (NASDAQ:ISSC)

Historical Stock Chart

From Apr 2023 to Apr 2024