Profire Energy Reports Financial Results for Second Quarter Fiscal 2018

August 08 2018 - 4:27PM

Profire Energy, Inc. (NASDAQ: PFIE), a technology company (the

“Company”) which creates, installs and services burner and chemical

management solutions in the oil and gas industry, today reported

financial results for its fiscal quarter ended June 30, 2018. A

conference call will be held on Thursday, August 9, 2018 at 1:00

p.m. EDT to discuss the results.

Fiscal Q2 2018 Highlights

- Recognized Revenue of $11.3 million, The Second-Best Quarter in

9 Fiscal Quarters

- Net Income of $1.7 Million or $0.04 Per Share, a 31% Increase

From the Same Quarter Last Year

- Realized Gross Profit of $5.9 Million

- Cash and Liquid Investments at Period End totaled over $21

Million

- Remained Debt-Free

Fiscal Quarter Financial

Results

Total revenues for the period equaled $11.3 million or a 20%

increase from the same quarter a year ago. This increase is largely

attributed to our ability to leverage our expanding customer

base.

Total operating expenses were approximately $3.8 million or a 21%

increase over the same quarter last year which was highly

attributable to the growth in staff and additional R&D spend.

Compared with the same year ago quarter, operating expenses for

general and administrative increased 23%, R&D increased 15%,

and depreciation decreased slightly.

Gross profit increased to $5.9 million or 52.1% of total

revenues, as compared to $5 million or 52.6% of total revenues in

the year-ago quarter. Gross profit margins fluctuate slightly each

quarter due to product mix changes, increased direct labor costs,

and adjustments in our inventory and warranty reserves.

Net income was $1.7 million or $0.04 per share,

compared to a net income of $1.3 million or $0.03 per share in the

same year-ago quarter.

Cash and liquid investments totaled over $21

million at the end of the quarter and the Company continues to

operate debt-free.

Management Commentary

“We continually seek opportunities that can help further our

strategic goals and currently have the resources and balance sheet

to make investments that we believe will be beneficial to Profire

and its shareholders,” stated Ryan Oviatt, CFO of Profire. “Our

management team remains focused on allocating spending to meet

market demand and to accelerate growth potential. We have focused

our investment in R&D over the past year as we believe the new

SIL certification, which allows us to enter new markets that we

could not previously serve, and product enhancements will be

significant drivers for future growth.”

“In addition, we continue to look at merger and acquisition

opportunities that will complement our existing product offerings

and leverage our sales force and customer base,” said Brenton

Hatch, President and CEO of Profire Energy. “We have a renewed

focus on automation, including the exploration of the

internet-of-things capabilities, and other technologies that could

be used within our market. These adjacent technologies could allow

Profire to become a leader in not only burner management but in a

variety of processes within our industry.”

Conference Call

|

Profire Energy President and CEO Brenton Hatch and CFO Ryan Oviatt

will host the presentation, followed by a question and answer

period. |

|

|

| Date:

Thursday, August 9, 2018 |

| Time:

1:00 p.m. EDT (11:00 a.m. MDT) |

|

Toll-free dial-in number: 1-877-705-6003 |

|

International dial-in number: 1-201-493-6725 |

|

|

| The conference call

will be webcast live and available for replay via this

link: http://public.viavid.com/index.php?id=130900. The

webcast replay will be available for one year.Please call the

conference telephone number five minutes prior to the start time.

An operator will register your name and organization. If you have

any difficulty connecting the conference call, please contact Todd

Fugal at 1-801-796-5127.A replay of the call will be available via

the dial-in numbers below after 5:00 p.m. EDT on the same day

through August 16, 2018. |

|

|

|

Toll-free replay number: 1-844-512-2921 |

|

International replay number: 1-412-317-6671 |

| Replay Pin Number:

13682308 |

About Profire Energy,

Inc.Profire Energy assists energy production companies in

the safe and efficient production and transportation of oil and

natural gas. As energy companies seek greater safety for their

employees, compliance with more stringent regulatory standards, and

enhanced margins with their energy production processes, Profire

Energy's burner management and chemical injection systems are

increasingly becoming part of their solution. Profire Energy has

offices in Lindon, Utah; Houston, Texas; Homer, Pennsylvania;

Greeley, Colorado; and Spruce Grove, Alberta, Canada. For

additional information, visit www.profireenergy.com.

Cautionary Note Regarding Forward-Looking

Statements. Statements made in this release that are not historical

are forward-looking statements. This release contains

forward-looking statements, including, but not limited to

statements regarding the Company holding a conference call on

August 9,2018, regarding the financial quarter results; and the

ability of the Company to support growth. Forward-looking

statements are not guarantees of future results or performance and

involve risks, assumptions and uncertainties that could cause

actual events or results to differ materially from the events or

results described in, or anticipated by, the forward-looking

statements. Factors that could materially affect such

forward-looking statements include certain economic, business,

public market and regulatory risks and factors identified in the

company's periodic reports filed with the Securities and Exchange

Commission. All forward-looking statements are made pursuant to the

safe harbor provisions of the Private Securities Litigation Reform

Act of 1995. All forward-looking statements are made only as of the

date of this release and the Company assumes no obligation to

update forward-looking statements to reflect subsequent events or

circumstances, except as required by law. Readers should not place

undue reliance on these forward-looking statements.

Contact:Profire Energy,

Inc.Ryan Oviatt, CFO(801) 796-5127

Three Part AdvisorsSteven Hooser,

Partner214-872-2710

| PROFIRE ENERGY, INC. AND

SUBSIDIARIES |

| Condensed Consolidated Balance Sheets |

|

|

|

As of |

|

|

|

June 30, 2018 |

|

December 31, 2017 |

|

|

|

(Unaudited) |

|

|

|

CURRENT ASSETS |

|

|

|

|

|

Cash and cash equivalents |

|

$9,298,677 |

|

|

$11,445,799 |

|

|

Short-term investments |

|

531,248 |

|

|

300,817 |

|

|

Short-term investments - other |

|

3,788,507 |

|

|

4,009,810 |

|

|

Accounts receivable, net |

|

7,311,689 |

|

|

8,069,255 |

|

|

Inventories, net |

|

8,281,125 |

|

|

6,446,083 |

|

|

Prepaid expenses & other current assets |

|

350,260 |

|

|

437,304 |

|

|

Income tax receivable |

|

191,369 |

|

|

— |

|

|

Total Current Assets |

|

29,752,875 |

|

|

30,709,068 |

|

|

|

|

|

|

|

|

LONG-TERM ASSETS |

|

|

|

|

|

Net deferred tax asset |

|

— |

|

|

72,817 |

|

|

Long-term investments |

|

8,024,247 |

|

|

8,517,182 |

|

|

Long-term investments - other |

|

— |

|

|

— |

|

|

Property and equipment, net |

|

7,801,954 |

|

|

7,197,499 |

|

|

Goodwill |

|

997,701 |

|

|

997,701 |

|

|

Intangible assets, net |

|

459,229 |

|

|

494,792 |

|

|

Total Long-Term Assets |

|

17,283,131 |

|

|

17,279,991 |

|

|

|

|

|

|

|

|

TOTAL ASSETS |

|

$47,036,006 |

|

|

$47,989,059 |

|

|

|

|

|

|

|

|

CURRENT LIABILITIES |

|

|

|

|

|

Accounts payable |

|

1,872,095 |

|

|

1,780,977 |

|

|

Accrued vacation |

|

257,149 |

|

|

196,646 |

|

|

Accrued liabilities |

|

1,048,487 |

|

|

1,044,284 |

|

|

Income taxes payable |

|

325,272 |

|

|

919,728 |

|

|

Total Current Liabilities |

|

3,503,003 |

|

|

3,941,635 |

|

|

|

|

|

|

|

|

LONG-TERM LIABILITIES |

|

|

|

|

|

Net deferred income tax liability |

|

19,073 |

|

|

— |

|

|

|

|

|

|

|

|

TOTAL LIABILITIES |

|

3,522,076 |

|

|

3,941,635 |

|

|

|

|

|

|

|

|

STOCKHOLDERS’ EQUITY |

|

|

|

|

|

Preferred shares: $0.001 par value, 10,000,000 shares authorized:

no shares issued or outstanding |

|

— |

|

|

— |

|

|

Common shares: $0.001 par value, 100,000,000 shares authorized:

54,685,119 issued and 48,082,423 outstanding at June 30, 2018 and

53,931,167 issued and 48,606,425 outstanding at December 31,

2017 |

|

54,685 |

|

|

53,931 |

|

|

Treasury stock, at cost |

|

(10,890,349 |

) |

|

(6,890,349 |

) |

|

Additional paid-in capital |

|

27,828,804 |

|

|

27,535,469 |

|

|

Accumulated other comprehensive loss |

|

(2,618,543 |

) |

|

(2,200,462 |

) |

|

Retained earnings |

|

29,139,333 |

|

|

25,548,835 |

|

|

TOTAL STOCKHOLDERS’ EQUITY |

|

43,513,930 |

|

|

44,047,424 |

|

|

|

|

|

|

|

|

TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

$47,036,006 |

|

|

$47,989,059 |

|

| |

|

|

|

|

|

|

These financial statements should be read in

conjunction with the Form 10-Q and accompanying footnotes.

|

|

| PROFIRE ENERGY, INC. AND

SUBSIDIARIES |

| Condensed Consolidated Statements of Operations and

Other Comprehensive Income |

| (Unaudited) |

|

|

|

For the Three Months Ended June 30, |

|

For the Six Months Ended June 30, |

|

|

|

2018 |

|

2017 |

|

2018 |

|

2017 |

|

REVENUES |

|

|

|

|

|

|

|

|

|

Sales of goods, net |

|

$10,724,409 |

|

|

$8,834,650 |

|

$22,179,024 |

|

|

$16,126,879 |

|

Sales of services, net |

|

615,352 |

|

|

630,301 |

|

1,330,454 |

|

|

1,162,568 |

|

Total Revenues |

|

11,339,761 |

|

|

9,464,951 |

|

23,509,478 |

|

|

17,289,447 |

|

|

|

|

|

|

|

|

|

|

|

COST OF SALES |

|

|

|

|

|

|

|

|

|

Cost of goods sold-product |

|

4,959,539 |

|

|

4,035,528 |

|

10,517,249 |

|

|

7,090,828 |

|

Cost of goods sold-services |

|

471,555 |

|

|

452,591 |

|

953,422 |

|

|

854,613 |

|

Total Cost of Goods Sold |

|

5,431,094 |

|

|

4,488,119 |

|

11,470,671 |

|

|

7,945,441 |

|

|

|

|

|

|

|

|

|

|

|

GROSS PROFIT |

|

5,908,667 |

|

|

4,976,832 |

|

12,038,807 |

|

|

9,344,006 |

|

|

|

|

|

|

|

|

|

|

|

OPERATING EXPENSES |

|

|

|

|

|

|

|

|

|

General and administrative expenses |

|

3,364,826 |

|

|

2,739,055 |

|

6,706,726 |

|

|

5,682,368 |

|

Research and development |

|

317,002 |

|

|

275,776 |

|

720,221 |

|

|

479,520 |

|

Depreciation and amortization expense |

|

129,070 |

|

|

130,838 |

|

257,787 |

|

|

279,913 |

|

Total Operating Expenses |

|

3,810,898 |

|

|

3,145,669 |

|

7,684,734 |

|

|

6,441,801 |

|

|

|

|

|

|

|

|

|

|

|

INCOME FROM OPERATIONS |

|

2,097,769 |

|

|

1,831,163 |

|

4,354,073 |

|

|

2,902,205 |

|

|

|

|

|

|

|

|

|

|

|

OTHER INCOME (EXPENSE) |

|

|

|

|

|

|

|

|

|

Gain on sale of fixed assets |

|

21,254 |

|

|

46,374 |

|

86,085 |

|

|

48,476 |

|

Other income (expense) |

|

(4,164 |

) |

|

18,798 |

|

(5,956 |

) |

|

13,385 |

|

Interest income |

|

174,771 |

|

|

54,840 |

|

225,479 |

|

|

86,118 |

|

Total Other Income |

|

191,861 |

|

|

120,012 |

|

305,608 |

|

|

147,979 |

|

|

|

|

|

|

|

|

|

|

|

INCOME BEFORE INCOME TAXES |

|

2,289,630 |

|

|

1,951,175 |

|

4,659,681 |

|

|

3,050,184 |

|

|

|

|

|

|

|

|

|

|

|

INCOME TAX EXPENSE |

|

575,363 |

|

|

638,528 |

|

1,069,183 |

|

|

1,137,465 |

|

|

|

|

|

|

|

|

|

|

|

NET INCOME |

|

$1,714,267 |

|

|

$1,312,647 |

|

$3,590,498 |

|

|

$1,912,719 |

|

|

|

|

|

|

|

|

|

|

|

OTHER COMPREHENSIVE INCOME (LOSS) |

|

|

|

|

|

|

|

|

|

Foreign currency translation gain (loss) |

|

$(427,307 |

) |

|

$238,543 |

|

$(394,072 |

) |

|

$313,656 |

|

Unrealized gains (losses) on investments |

|

9,226 |

|

|

26,659 |

|

(24,009 |

) |

|

62,947 |

|

Total Other Comprehensive Income (Loss) |

|

(418,081 |

) |

|

265,202 |

|

(418,081 |

) |

|

376,603 |

|

|

|

|

|

|

|

|

|

|

|

NET COMPREHENSIVE INCOME |

|

$1,296,186 |

|

|

$1,577,849 |

|

$3,172,417 |

|

|

$2,289,322 |

|

|

|

|

|

|

|

|

|

|

|

BASIC EARNINGS PER SHARE |

|

$0.04 |

|

|

$0.03 |

|

$0.07 |

|

|

$0.04 |

|

|

|

|

|

|

|

|

|

|

|

FULLY DILUTED EARNINGS PER SHARE |

|

$0.03 |

|

|

$0.03 |

|

$0.07 |

|

|

$0.04 |

|

|

|

|

|

|

|

|

|

|

|

BASIC WEIGHTED AVG NUMBER OF SHARES OUTSTANDING |

|

48,266,199 |

|

|

49,678,917 |

|

48,467,136 |

|

|

50,152,958 |

|

|

|

|

|

|

|

|

|

|

|

FULLY DILUTED WEIGHTED AVG NUMBER OF SHARES OUTSTANDING |

|

49,095,575 |

|

|

50,283,144 |

|

49,237,938 |

|

|

50,757,185 |

| |

|

|

|

|

|

|

|

|

|

|

These financial statements should be read in

conjunction with the Form 10-Q and accompanying footnotes.

| |

| PROFIRE ENERGY, INC. AND

SUBSIDIARIES |

| Condensed Consolidated Statements of Cash

Flows |

| (Unaudited) |

|

|

|

For the Six Months Ended June 30, |

|

|

|

2018 |

|

2017 |

|

OPERATING ACTIVITIES |

|

|

|

|

|

Net income |

|

$3,590,498 |

|

|

$1,912,719 |

|

|

Adjustments to reconcile net income to net cash provided by

operating activities: |

|

|

|

|

|

Depreciation and amortization expense |

|

442,959 |

|

|

458,293 |

|

|

Gain on sale of fixed assets |

|

(76,703 |

) |

|

(48,255 |

) |

|

Bad debt expense |

|

141,348 |

|

|

121,015 |

|

|

Stock awards issued for services |

|

861,189 |

|

|

372,086 |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

|

Changes in accounts receivable |

|

548,419 |

|

|

(1,107,574 |

) |

|

Changes in income taxes receivable/payable |

|

(790,946 |

) |

|

1,327,884 |

|

|

Changes in inventories |

|

(2,074,974 |

) |

|

(646,870 |

) |

|

Changes in prepaid expenses |

|

114,907 |

|

|

(205,781 |

) |

|

Changes in deferred tax asset/liability |

|

91,890 |

|

|

(134,427 |

) |

|

Changes in accounts payable and accrued liabilities |

|

274,744 |

|

|

716,436 |

|

|

Net Cash Provided by Operating Activities |

|

3,123,331 |

|

|

2,765,526 |

|

|

|

|

|

|

|

|

INVESTING ACTIVITIES |

|

|

|

|

|

Proceeds from sale of equipment |

|

159,449 |

|

|

112,183 |

|

|

Sale of investments |

|

368,379 |

|

|

66,045 |

|

|

Purchase of fixed assets |

|

(1,184,126 |

) |

|

(181,566 |

) |

|

Net Cash Used in Investing Activities |

|

(656,298 |

) |

|

(3,338 |

) |

|

|

|

|

|

|

|

FINANCING ACTIVITIES |

|

|

|

|

|

Value of equity awards surrendered by employees for tax

liability |

|

(736,160 |

) |

|

(20,800 |

) |

|

Cash received in exercise of stock options |

|

174,002 |

|

|

— |

|

|

Purchase of Treasury stock |

|

(4,000,000 |

) |

|

(2,840,932 |

) |

|

Net Cash Used in Financing Activities |

|

(4,562,158 |

) |

|

(2,861,732 |

) |

|

|

|

|

|

|

|

Effect of exchange rate changes on cash |

|

(51,997 |

) |

|

94,403 |

|

|

|

|

|

|

|

|

NET DECREASE IN CASH |

|

(2,147,122 |

) |

|

(5,141 |

) |

|

CASH AT BEGINNING OF PERIOD |

|

11,445,799 |

|

|

7,621,708 |

|

|

CASH AT END OF PERIOD |

|

$9,298,677 |

|

|

$7,616,567 |

|

|

|

|

|

|

|

|

SUPPLEMENTAL DISCLOSURES OF CASH FLOW INFORMATION |

|

|

|

|

|

|

|

|

|

|

|

CASH PAID FOR: |

|

|

|

|

|

Interest |

|

$— |

|

|

$— |

|

|

Income taxes |

|

$1,691,397 |

|

|

$67,078 |

|

| |

|

|

|

|

|

|

These financial statements should be read in

conjunction with the Form 10-Q and accompanying footnotes

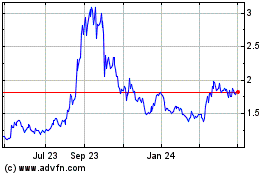

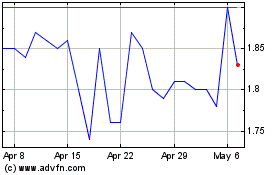

Profire Energy (NASDAQ:PFIE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Profire Energy (NASDAQ:PFIE)

Historical Stock Chart

From Apr 2023 to Apr 2024