MBIA Inc. (NYSE:MBI) (the Company) today reported a consolidated

GAAP net loss of $146 million, or $(1.64) per share, for the second

quarter of 2018 compared to a consolidated GAAP net loss of $1.2

billion, or $(9.78) per share, for the second quarter of 2017. The

net loss for the second quarter of 2018 was driven by the losses

associated with the deconsolidation of certain variable interest

entities (VIEs) and the additional losses and loss adjustment

expenses related to our Puerto Rico exposures. The decrease in

year-over-year consolidated GAAP net loss was primarily due to the

full valuation allowance on the Company’s deferred tax asset for

the second quarter of 2017. On a pretax basis, net losses were

lower by $64 million, primarily due to lower loss and loss

adjustment expenses, favorable gains for the fair value of interest

rate swaps as a result of higher interest rates in 2018 and foreign

exchange gains in 2018 versus foreign exchange losses in 2017,

partially offset by losses associated with the deconsolidation of

certain VIEs.

Book value per share was $12.16 as of June 30, 2018 compared

with $15.44 as of December 31, 2017. The decrease in book value per

share since year-end 2017 was primarily due to the year-to-date net

loss and unrealized losses on investments and debt carried at fair

value that is included in accumulated other comprehensive loss.

The Company also reported Adjusted Net Loss (a non-GAAP measure

defined in the attached Explanation of Non-GAAP Financial Measures)

of $51 million or $(0.58) per diluted share for the second quarter

of 2018 compared with Adjusted Net Loss of $139 million or $(1.12)

per diluted share for the second quarter of 2017. The reduced

Adjusted Net Loss for the second quarter of 2018 versus the second

quarter of 2017 was primarily due to lower losses and loss

adjustment expenses at National, primarily related to its Puerto

Rico exposures.

Adjusted Book Value (ABV) per share (a non-GAAP measure defined

in the attached Explanation of Non-GAAP Financial Measures) was

$27.24 compared with $28.77 as of December 31, 2017. Those amounts

reflect an adjustment made in the second quarter of 2018 to remove

the unearned premium revenue that is netted from GAAP loss

reserves. (The previously reported ABV as of December 31, 2017 of

$29.32 has been revised to conform to the current presentation.)

The decrease in ABV per share since year-end 2017 was primarily due

to additional loss and loss adjustment expense reserves at National

that are primarily related to its Puerto Rico exposures.

Adjusted Net Income (Loss) and ABV per share provide investors

with views of the Company’s operating results that management uses

in measuring financial performance. Reconciliations of ABV per

share to book value per share, and Adjusted Net Income (Loss) to

net income, calculated in accordance with GAAP, are attached.

Statement from Company Representative

Bill Fallon, MBIA’s Chief Executive Officer noted, “This

quarter’s increase of National’s loss and loss adjustment expenses

associated with its Puerto Rico exposures contributed significantly

to the Adjusted Net Loss for the quarter.” Mr. Fallon added, “While

resolving our Puerto Rico exposures is our most significant

corporate objective, we have also made progress on other

objectives, such as reducing our consolidated operating expenses,

which are down 37% for the six months of this year compared to last

year’s first six months.”

Year-to-Date Results

The Company recorded a consolidated GAAP net loss of $244

million, or $(2.75) per diluted common share, for the six months

ended June 30, 2018 compared with a consolidated net loss of $1.3

billion, or $(10.13) per diluted common share, for the first six

months of 2017. The lower loss this year was primarily driven by

the valuation allowance established on the Company’s deferred tax

asset for the second quarter of 2017.

The Company’s non-GAAP Adjusted Net Loss for the six months

ended June 30, 2018 was $112 million or $(1.27) per diluted share

compared with Adjusted Net Loss of $130 million or $(1.02) per

diluted share for the first six months of 2017. The reduced

adjusted net loss for the first six months of 2018 was primarily

due to lower losses and loss adjustment expenses at National and

lower operating expenses for National and the Corporate segment,

partially offset by lower premium earnings at National.

MBIA Inc.

As of June 30, 2018, MBIA Inc.’s liquidity position totaled $389

million, down $30 million from March 31, 2018, consisting primarily

of cash and cash equivalents and other liquid invested assets. The

decrease in liquidity primarily relates to MBIA Inc. debt service

payments and operating expenses.

There were no purchases of MBIA Inc. shares during the second

quarter of 2018. As of August 2, 2018, there was $236 million

remaining under the Company’s $250 million share repurchase

authorization that was approved on November 3, 2017 and 90.7

million of the Company’s common shares were outstanding. During the

second quarter, MBIA Inc. issued 1.3 million shares of MBIA common

shares, which includes 1.2 million shares that were issued in April

and 0.1 million shares that were issued in June, in accordance with

the net settlement exercise provisions of warrants related to 11.9

million of MBIA common shares. As of June 30, 2018, no warrants

related to MBIA Inc. shares remained outstanding.

National Public Guarantee Financial Corporation

National had statutory capital of $2.7 billion and claims-paying

resources totaling $4.1 billion as of June 30, 2018. National’s

total fixed income investments plus cash and cash equivalents had a

book/adjusted carrying value of $3.4 billion as of June 30, 2018.

National’s insured portfolio declined by $3 billion during the

quarter, ending the quarter with $64 billion of gross par

outstanding. National ended the quarter with a leverage ratio of

gross par to statutory capital of 24 to 1, down from 26 to 1 as of

year-end 2017.

MBIA Insurance Corporation

The statutory capital of MBIA Insurance Corporation as of June

30, 2018 was $489 million and claims-paying resources totaled $1.4

billion. As of June 30, 2018, MBIA Insurance Corporation’s

liquidity position (excluding resources from its subsidiaries and

branches) totaled $105 million consisting primarily of cash and

cash equivalents and other liquid invested assets. In May 2018, a

settlement agreement was entered into regarding the bankruptcy of

the Zohar CDOs that outlines processes and procedures for

monetizing the assets of the Zohar CDOs.

Conference Call

The Company will host a webcast and conference call for

investors tomorrow, Thursday, August 9, 2018 at 8:00 AM (ET) to

discuss its second quarter 2018 financial results and other matters

relating to the Company. The webcast and conference call will

consist of brief remarks followed by a question and answer

session.

The dial-in number for the call is (877) 694-4769 in the U.S.

and (404) 665-9935 from outside the U.S. The conference call code

is 2777679. A live webcast of the conference call will also be

accessible on www.mbia.com.

A replay of the conference call will become available

approximately two hours after the end of the call on August 9 and

will remain available until 11:59 p.m. on August 23 by dialing

(800) 585-8367 in the U.S. or (404) 537-3406 from outside the U.S.

The code for the replay of the call is also 2777679. In addition, a

recorded replay of the call will become available on the Company's

website approximately two hours after the completion of the

call.

Forward-Looking Statements

This release includes statements that are not historical or

current facts and are “forward-looking statements” made pursuant to

the safe harbor provisions of the Private Securities Litigation

Reform Act of 1995. The words “believe,, “anticipate,” “project,”

“plan,” “expect,” “estimate,” “intend,” “will,” “will likely

result,” “looking forward,” or “will continue,” and similar

expressions identify forward-looking statements. These statements

are subject to certain risks and uncertainties that could cause

actual results to differ materially from historical earnings and

those presently anticipated or projected, including, among other

factors, the possibility that MBIA Inc. or National will experience

increased credit losses or impairments on public finance

obligations issued by state, local and territorial governments and

finance authorities that are experiencing unprecedented fiscal

stress; the possibility that loss reserve estimates are not

adequate to cover potential claims; MBIA Inc.’s or National’s

ability to fully implement their strategic plan; and changes in

general economic and competitive conditions. These and other

factors that could affect financial performance or could cause

actual results to differ materially from estimates contained in or

underlying MBIA Inc.’s or National’s forward-looking statements are

discussed under the “Risk Factors” section in MBIA Inc.’s most

recent Annual Report on Form 10-K and Quarterly Report on Form

10-Q, which may be updated or amended in MBIA Inc.’s subsequent

filings with the Securities and Exchange Commission. MBIA Inc. and

National caution readers not to place undue reliance on any such

forward-looking statements, which speak only to their respective

dates. National and MBIA Inc. undertake no obligation to publicly

correct or update any forward-looking statement if it later becomes

aware that such result is not likely to be achieved.

MBIA Inc., headquartered in Purchase, New York is a holding

company whose subsidiaries provide financial guarantee insurance

for the public and structured finance markets. Please visit MBIA's

website at www.mbia.com.

Explanation of Non-GAAP Financial Measures

The following are explanations of why the Company believes that

the non-GAAP financial measures used in this press release, which

serve to supplement GAAP information, are meaningful to

investors.

Adjusted Book Value: Adjusted Book Value (ABV), a

non-GAAP measure, is used by the Company to supplement its analysis

of GAAP book value. The Company uses ABV as a measure of

fundamental value and considers the change in ABV an important

measure of periodic financial performance. ABV adjusts GAAP book

value by removing the GAAP book value amounts for items that are

not expected to impact shareholder value and to add in the impact

of certain items which the Company believes will be realized in

GAAP book value in future periods. The Company has limited such

adjustments to those items that it deems to be important to

fundamental value and performance and which the likelihood and

amount can be reasonably estimated. ABV assumes no new business

activity. The Company has presented ABV to allow investors and

analysts to evaluate the Company using the same measure that MBIA’s

management regularly uses to measure financial performance. ABV is

not a substitute for and should not be viewed in isolation from

GAAP book value.

ABV per share represents that amount of ABV allocated to each

common share outstanding at the measurement date.

Claims-Playing Resources (CPR): CPR is a key measure of

the resources available to National and MBIA Corp. to pay claims

under their respective insurance policies. CPR consists of total

financial resources and reserves calculated on a statutory basis.

CPR has been a common measure used by financial guarantee insurance

companies to report and compare resources and continues to be used

by MBIA’s management to evaluate changes in such resources. The

Company has provided CPR to allow investors and analysts to

evaluate National and MBIA Corp. using the same measure that MBIA’s

management uses to evaluate their resources to pay claims under

their respective insurance policies. There is no directly

comparable GAAP measure.

Adjusted Net Income (Loss): Adjusted Net Income (Loss) is

a useful measurement of performance because it measures income from

the Company excluding its international and structured finance

insurance segment, which is not part of our ongoing business

strategy. Also excluded from Adjusted Net Income (Loss) are

investment portfolio realized gains and losses, gains and losses on

financial instruments at fair value and foreign exchange, and

realized gains and losses on extinguishment of debt. Adjusted Net

Income (Loss) eliminates the tax provision (benefit) as a result of

the establishment of a full valuation allowance against the

Company’s net deferred tax asset in 2017. Trends in the underlying

profitability of the Company’s businesses can be more clearly

identified without the fluctuating effects of the excluded items

previously noted. Adjusted Net Income (Loss) as defined by the

Company does not include all revenues and expenses required by

GAAP. Adjusted Net Income (Loss) is not a substitute for and should

not be viewed in isolation from GAAP net income.

Adjusted Net Income (Loss) per share represents that amount of

Adjusted Net Income (Loss) allocated to each fully diluted

weighted-average common share outstanding for the measurement

period.

MBIA INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(Unaudited)

(In millions except share and per share

amounts)

June 30, 2018 December 31, 2017

Assets Investments: Fixed-maturity securities held as

available-for-sale, at fair value (amortized cost $3,665 and

$3,728) $ 3,615 $ 3,712 Investments carried at fair value 225 200

Investments pledged as collateral, at fair value (amortized cost

$37 and $147) 36 148 Short-term investments, at fair value

(amortized cost $479 and $589) 478 589

Other investments (includes investments at

fair value of $- and $4)

1 6 Total investments 4,355

4,655 Cash and cash equivalents 179 122 Premiums receivable

349 369 Deferred acquisition costs 87 95 Insurance loss recoverable

1,359 511 Other assets 167 128 Assets of consolidated variable

interest entities: Cash 18 24 Investments held-to-maturity, at

amortized cost (fair value $892 and $916) 890 890 Investments

carried at fair value 169 182 Loans receivable at fair value 683

1,679 Loan repurchase commitments 415 407 Other assets 28

33

Total assets $

8,699 $

9,095 Liabilities and Equity

Liabilities: Unearned premium revenue $ 678 $ 752 Loss and loss

adjustment expense reserves 1,035 979 Long-term debt 2,184 2,121

Medium-term notes (includes financial instruments carried at fair

value of $149 and $115) 761 765 Investment agreements 312 337

Derivative liabilities 189 262 Other liabilities 205 165

Liabilities of consolidated variable interest entities: Variable

interest entity notes (includes financial instruments carried at

fair value of $981 and $1,069) 2,220 2,289

Total liabilities 7,584

7,670 Equity: Preferred stock, par value $1

per share; authorized shares--10,000,000; issued and

outstanding--none - - Common stock, par value $1 per share;

authorized shares--400,000,000; issued shares--283,625,689 and

283,717,973 284 284 Additional paid-in capital 3,154 3,171 Retained

earnings 1,018 1,095 Accumulated other comprehensive income (loss),

net of tax of $7 and $16 (255 ) (19 ) Treasury stock, at

cost--192,963,698 and 192,233,526 shares (3,098 ) (3,118 )

Total shareholders' equity of MBIA Inc. 1,103 1,413 Preferred stock

of subsidiary 12 12

Total equity

1,115 1,425 Total

liabilities and equity $

8,699 $

9,095

MBIA INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS (Unaudited) (In

millions except share and per share amounts)

Three Months Ended June 30,

Six Months Ended June 30, 2018 2017

2018 2017 Revenues: Premiums

earned: Scheduled premiums earned $ 29 $ 28 $ 52 $ 56 Refunding

premiums earned 7 16 24

37 Premiums earned (net of ceded premiums of $1, $1,

$3 and $3) 36 44 76 93 Net investment income 34 37 65 89 Fees and

reimbursements - 6 6 8 Change in fair value of insured derivatives:

Realized gains (losses) and other settlements on insured

derivatives (25 ) (3 ) (44 ) (34 ) Unrealized gains (losses) on

insured derivatives 18 6 32

(16 ) Net change in fair value of insured derivatives

(7 ) 3 (12 ) (50 ) Net gains (losses) on financial instruments at

fair value and foreign exchange 22 (61 ) 13 (44 ) Net investment

losses related to other-than-temporary impairments: Investment

losses related to other-than-temporary impairments - (54 ) - (54 )

Other-than-temporary impairments recognized in accumulated other

comprehensive income (loss) (1 ) 43 (2

) 41 Net investment losses related to

other-than-temporary impairments (1 ) (11 ) (2 ) (13 ) Net gains

(losses) on extinguishment of debt - - - 8 Other net realized gains

(losses) - 34 (1 ) 37 Revenues of consolidated variable interest

entities: Net investment income 8 6 16 12 Net gains (losses) on

financial instruments at fair value and foreign exchange 13 14 17

(19 ) Other net realized gains (losses) (93 ) -

(93 ) 28 Total revenues 12 72 85 149

Expenses: Losses and loss adjustment 59 170 131 264

Amortization of deferred acquisition costs 4 8 8 15 Operating 19 32

39 61 Interest 52 50 103 98 Expenses of consolidated variable

interest entities: Operating 3 3 5 5 Interest 21

19 41 36 Total expenses

158 282 327 479

Income (loss) before income taxes (146 ) (210 ) (242 ) (330

) Provision (benefit) for income taxes - 1,019

2 971

Net income (loss) $

(146 ) $

(1,229 ) $

(244

) $

(1,301 ) Net income (loss) per

common share: Basic $ (1.64 ) $ (9.78 ) $ (2.75 ) $ (10.13 )

Diluted $ (1.64 ) $ (9.78 ) $ (2.75 ) $ (10.13 )

Weighted

average number of common shares outstanding: Basic 89,131,760

125,653,189 88,865,272 128,511,897 Diluted 89,131,760 125,653,189

88,865,272 128,511,897

ADJUSTED NET

INCOME (LOSS) RECONCILIATION(1)

(In millions except per share amounts)

Three Months Ended Six Months Ended June

30, June 30, 2018 2017 2018

2017 Net income (loss) $ (146 ) $ (1,229 ) $ (244 ) $

(1,301 ) Less: adjusted net income (loss) adjustments: Income

(loss) before income taxes of the international and structured

finance insurance segment and eliminations (120 ) (20 ) (156 ) (185

) Adjustments to income before income taxes of the U.S. public

finance insurance and corporate segments: Mark-to-market gains

(losses) on financial instruments(2) 5 (16 ) 27 16 Foreign exchange

gains (losses)(2) 26 (32 ) 13 (39 ) Net gains (losses) on sales of

investments(2) (6 ) 13 (11 ) 15 Net investment losses related to

OTTI (1 ) (11 ) (2 ) (13 ) Net gains (losses) on extinguishment of

debt - - - 8 Other net realized gains (losses) - (1 ) (2 ) (2 )

Adjusted net income adjustment to the (provision) benefit for

income tax(3) 1 (1,023 ) (1 )

(971 ) Adjusted net income (loss) $ (51 ) $ (139 ) $ (112 ) $ (130

) Adjusted net income (loss) per diluted common share $

(0.58 ) $ (1.12 ) $ (1.27 ) $ (1.02 ) (1) - A

non-GAAP measure; please see Explanation of non-GAAP Financial

Measures. (2) - Reported within “Net gains (losses) on financial

instruments at fair value and foreign exchange” on the Company’s

consolidated statements of operations. (3) - Reported within

“Provision (benefit) for income taxes” on the Company’s

consolidated statements of operations.

COMPONENTS OF

ADJUSTED BOOK VALUE PER SHARE(1)(2)

As ofJune 30, 2018

As ofDecember 31, 2017

Reported Book Value per Share $ 12.16 $ 15.44 Book value per

share adjustments: Remove negative book value of MBIA Corp. (3)

10.56 8.84 Remove net unrealized (gains) losses on

available-for-sale securities included in other comprehensive

income (loss) 0.63 0.26 Add net unearned premium revenue in excess

of expected losses (4)(5) 3.89 4.23 Total book value

per share adjustments 15.08 13.33

Adjusted book

value per share $ 27.24 $ 28.77 Shares outstanding in

millions 90.7 91.5 (1) A non-GAAP measure; please see

Explanation of Non-GAAP Financial Measures. (2) We have modified

our calculation of ABV as of June 30, 2018 and revised the prior

year's calculation to conform to the current presentation. The net

unearned premium revenue component of ABV has been adjusted to

remove the amount of unearned premium revenue that is used in the

GAAP calculation of our insurance loss reserves. (3) The book value

of the MBIA Corp. does not provide significant economic or

shareholder value to MBIA Inc. The amounts being reversed exclude

all deferred taxes available to MBIA Inc., net of valuation

allowance. (4) The discount rate on financial guarantee installment

premiums was the risk-free rate as defined by GAAP for financial

guarantee insurance contracts. (5) The amounts consist of financial

guarantee premiums in excess of expected losses, net of the related

deferred acquisition costs.

INSURANCE

OPERATIONS

Selected

Financial Data Computed on a Statutory Basis

(Dollars in millions)

National Public

Finance Guarantee Corporation

June 30, 2018 December 31, 2017 Policyholders'

surplus $ 2,105 $ 2,166 Contingency reserves 561

594 Statutory capital 2,666 2,760 Unearned

premiums 543 585 Present value of installment premiums (1)

162 164 Premium resources (2) 705 749

Net loss and loss adjustment expense reserves (1) 250 227 Salvage

reserves 430 387 Gross loss and loss

adjustment expense reserves 680 614

Total claims-paying resources $ 4,051 $ 4,123

Net debt service outstanding $ 118,158 $ 129,668 Capital

ratio (3) 44:1 47:1 Claims-paying ratio (4) 30:1 33:1

MBIA Insurance

Corporation

June 30, 2018 December 31, 2017 Policyholders’

surplus $ 275 $ 237 Contingency reserves 214

227 Statutory capital 489 464 Unearned premiums 177

195

Present value of installment premiums (5)

(7)

176 192

Premium resources (2)

353 387 Net loss and loss adjustment expense reserves (5)

(855 ) (792 ) Salvage reserves (6) 1,419 1,428

Gross loss and loss adjustment expense reserves 564

636 Total claims-paying resources $ 1,406

$ 1,487 Net debt service outstanding $ 18,501

$ 20,151 Capital ratio (3) 38:1 43:1 Claims-paying

ratio (4) 13:1 14:1 (1) Calculated using a discount

rate of 3.25% as of June 30, 2018 and December 31, 2017. (2)

Includes financial guarantee and insured credit derivative related

premiums. (3) Net debt service outstanding divided by statutory

capital. (4) Net debt service outstanding divided by the sum of

statutory capital, unearned premium reserve (after-tax), present

value of installment premiums (after-tax), net loss and loss

adjustment expense reserves and salvage reserves. (5) Calculated

using a discount rate of 5.20% as of June 30, 2018 and December 31,

2017. (6) This amount primarily consists of expected recoveries

related to the Company's excess spread, put-backs and CDOs. (7)

Based on the Company's estimate of the remaining life for its

insured exposures.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180808005667/en/

MBIA Inc.Greg Diamond, 914-765-3190Investor and Media

Relationsgreg.diamond@mbia.com

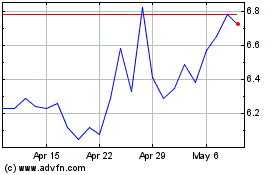

MBIA (NYSE:MBI)

Historical Stock Chart

From Mar 2024 to Apr 2024

MBIA (NYSE:MBI)

Historical Stock Chart

From Apr 2023 to Apr 2024