Comparable sales growth of 5.9% coupled with

a 7.0% rise in consolidated revenues on a constant currency

basis1

Net income increased to $10.7 million from

$1.1 million in prior year1

Achieved a 7th consecutive

quarter of traffic growth

Arcos Dorados Holdings, Inc. (NYSE: ARCO) (“Arcos Dorados” or

the “Company”), Latin America’s largest restaurant chain and the

world’s largest independent McDonald’s franchisee, today reported

unaudited results for the second quarter ended June 30, 2018.

Second Quarter 2018 Key Results – Excluding Venezuela

- On a constant currency basis2,

consolidated revenues grew 7.0%. As reported consolidated revenues

decreased 5.7% to $734.5 million versus the second quarter of

2017.

- Systemwide comparable sales2 rose 5.9%

year-over-year.

- As reported, Adjusted EBITDA2 decreased

17.1% to $48.8 million compared with the prior-year quarter.

- Consolidated Adjusted EBITDA margin

contracted 100 basis points year-over-year to 6.6%.

- As reported, General and Administrative

(G&A) expenses decreased by 1.7% versus the prior year

quarter.

- As reported, net income increased to

$10.7 million, from $1.1 million in the second quarter of

2017.

________________________ 1 Excluding Venezuela 2 For

definitions please refer to page 13 of this document.

“Value-driven pricing, a compelling product mix, and the best

restaurant experience in the QSR industry continued to draw more

customers to our stores for the seventh consecutive quarter. While

a prolonged truck drivers’ strike impacted our ability to fully

leverage our scale, the Company’s performance in the second quarter

underscores the strength of our business, enabling us to deliver

steady results even in the face of short-term spikes in

volatility.

Despite the difficult economic climate in some of our key

markets, our strategy to drive top-line growth delivered a 7.0%

increase in consolidated revenues on a constant currency basis, and

we continue to believe that we will expand our Adjusted EBITDA

margin by 100 to 200 basis points over the next two to three

years.

We remain focused on bringing more guests to our restaurants

more often and, looking forward, our strong restaurant portfolio,

popular menu items and outstanding team continue to be our

strategic pillars to drive long term shareholder value," said

Sergio Alonso, Chief Executive Officer of Arcos Dorados.

Second Quarter 2018

Results

Consolidated

Figure 1. AD Holdings Inc

Consolidated: Key Financial Results

(In millions of U.S. dollars, except as

noted)

2Q17(a)

CurrencyTranslation-

Excl.Venezuela(b)

ConstantCurrencyGrowth

-Excl.Venezuela(c)

Venezuela(d)

2Q18(a+b+c+d)

% AsReported

% ConstantCurrency

Total Restaurants (Units) 2,160

2,191

1.4 % Sales by

Company-operated Restaurants 762.2 (94.3 ) 51.3 (0.8 ) 718.5 -5.7 %

259.3 % Revenues from franchised restaurants 36.5 (4.7 ) 3.4 0.3

35.5 -2.6 % 705.7 %

Total Revenues 798.7 (99.0

) 54.7 (0.5 ) 754.0 -5.6

% 279.7 % Systemwide Comparable Sales 363.1 %

Adjusted EBITDA 56.6 (4.6 ) (5.5

) (1.1 ) 45.4 -19.8 %

2857.4 % Adjusted EBITDA Margin 7.1 % 6.0 %

Net

income (loss) attributable to AD (4.1 )

(0.4 ) 10.1 (4.5 ) 1.1

125.9 % 37454.5 % No. of shares

outstanding (thousands) 210,881 210,580

EPS (US$/Share)

(0.02 )

0.01

(2Q18 = 2Q17 + Currency Translation Excl. Venezuela + Constant

Currency Growth Excl. Venezuela + Venezuela). Refer to

“Definitions” section for further detail.

Arcos Dorados’ consolidated results continue to be heavily

impacted by Venezuela’s macroeconomic volatility, including the

ongoing hyperinflationary environment and the country’s heavily

regulated currency. As such, reported results for the quarter

reflect significant non-cash accounting impacts from operations in

that market. Thus, the discussion of the Company’s operating

performance is focused on consolidated results, excluding

Venezuela.

Consolidated – excluding Venezuela

Figure 2. AD Holdings Inc

Consolidated - Excluding Venezuela: Key Financial Results

(In millions of U.S. dollars, except as

noted)

2Q17(a)

CurrencyTranslation(b)

ConstantCurrencyGrowth(c)

2Q18(a+b+c)

% AsReported

% ConstantCurrency

Total Restaurants (Units) 2,030

2,061

1.5 % Sales by Company-operated

Restaurants 744.3 (94.3 ) 51.3 701.3 -5.8 % 6.9 % Revenues from

franchised restaurants 34.5 (4.7 ) 3.4 33.2 -3.8 % 9.7 %

Total

Revenues 778.8 (99.0 ) 54.7

734.5 -5.7 % 7.0 % Systemwide

Comparable Sales 5.9 %

Adjusted EBITDA 58.9

(4.6 ) (5.5 ) 48.8 -17.1

% -9.3 % Adjusted EBITDA Margin 7.6 % 6.6 %

Net income (loss) attributable to AD 1.1 (0.4

) 10.1 10.7 905.1 % 944.3

% No. of shares outstanding (thousands) 210,881 210,580

EPS (US$/Share) 0.01

0.05

Excluding the Company’s Venezuelan operation, as reported

revenues decreased 5.7% year-over-year, primarily due to the

negative impact of the 50% and 12% year-over-year average

depreciations of the Argentine peso and the Brazilian real,

respectively. This was partially offset by constant currency

revenue growth of 7.0%. Constant currency revenue growth was

supported by a 5.9% increase in systemwide comparable sales,

largely driven by average check growth combined with positive

traffic.

Second quarter consolidated as reported Adjusted EBITDA,

excluding Venezuela, decreased 17.1% or 9.3% in constant currency

terms. The Adjusted EBITDA margin contracted by 100 basis points to

6.6%, mainly driven by the step up in Royalty Fees as well as

higher G&A and Occupancy and Other Operating Expenses as a

percentage of revenues. These were partially offset by efficiencies

in Payroll and Food and Paper (F&P). Refranchising activity was

also higher during the same quarter of last year. Excluding the

Royalty Fee and refranchising comparisons, the Adjusted EBITDA

margin would have been nearly flat, year-over-year.

As reported, consolidated G&A decreased by 1.7%

year-over-year and increased by 30 basis points as a percentage of

revenues largely due to the timing of certain IT project

expenses.

Main variations in other operating income (expenses),

net

Included in Adjusted EBITDA: In the

second quarter of 2018, the Company recorded an inventory write

down of $14.7 million in Venezuela, compared to an inventory write

down of $3.5 million in the second quarter of 2017. Proceeds from

refranchising were less than $0.2 million in the second quarter of

2018, compared to $3.1 million in the prior year comparable

quarter.

Excluded from Adjusted EBITDA: In

the second quarter of 2018, the Company did not record proceeds

from its re-development initiative, compared with $4.2 million

recorded in the second quarter of 2017.

Non-operating Results

Non-operating results for the second quarter reflected a $3.0

million non-cash foreign currency exchange loss, versus a non-cash

loss of $15.6 million in 2017. Net interest expense was $10.6

million lower year-over-year, largely explained by the incurrence,

in the second quarter of last year, of certain transaction costs in

connection with the debt restructuring completed in April of

2017.

The Company reported an income tax expense of $2.2 million in

the quarter, compared to an income tax benefit of $6.0 million in

the prior year period.

Second quarter net income attributable to the Company totaled

$10.7 million ($1.1 million, including Venezuela), compared to net

income of $1.1 million (net loss of $4.1 million, including

Venezuela) in the same period of 2017. Last year’s higher operating

income, which included $4.2 million from the Company’s

re-development initiative compared with no re-development proceeds

in 2018, combined with a negative variance in income tax expenses,

was more than offset by positive variances in net interest

expenses, derivative instruments and foreign exchange results.

The Company reported earnings per share of $0.05 ($0.01,

including Venezuela) in the second quarter of 2018, compared to

earnings per share of $0.01 (loss per share of $0.02, including

Venezuela) in the previous corresponding period. Total weighted

average shares for the second quarter of 2018 were 210,579,612, as

compared to 210,881,194 in the prior year quarter.

Analysis by

Division:

Brazil Division

Figure 3. Brazil Division: Key Financial Results

(In millions of U.S. dollars, except as

noted)

2Q17(a)

CurrencyTranslation(b)

ConstantCurrencyGrowth(c)

2Q18(a+b+c)

% AsReported

% ConstantCurrency

Total Restaurants (Units) 910

933

2.5 % Total Revenues

354.9 (38.1 ) 0.1 317.0

-10.7 % 0.0 % Systemwide Comparable

Sales -1.0 %

Adjusted EBITDA 45.9 (4.1

) (7.3 ) 34.5 -24.8 %

-15.9 % Adjusted EBITDA Margin 12.9 %

10.9 %

Brazil’s as reported revenues decreased by 10.7%, impacted by

the 12% year-over-year average depreciation of the Brazilian real,

the truck drivers’ strike and, to a lesser extent, the FIFA World

Cup. Excluding currency translation, constant currency revenues

remained flat while systemwide comparable sales declined 1.0%.

Marketing activities in the quarter included the launch of the

FIFA World Cup-related “Sanduíches Campeões” campaign and the

Player Escort program. Also during the quarter, the Company

launched the McFlurry and McShake “Ouro Branco” along with the

“Triplo Chocolate Kopenhagen” in the Dessert category. The “Justice

League Action” and “Jurassic World" Happy Meal also performed

well.

As reported Adjusted EBITDA decreased 24.8% year-over-year and

15.9% on a constant currency basis. The Adjusted EBITDA margin

contracted 200 basis points to 10.9%, with efficiencies in F&P

costs offset by increases in most other expense line items as a

percentage of sales. The second quarter of 2017 included $2.9

million from refranchising, compared with $0.2 million for the same

period in 2018. Excluding refranchising activity from both years,

the Adjusted EBITDA margin would have declined 130 basis

points.

NOLAD

Figure 4. NOLAD Division: Key Financial Results

(In millions of U.S. dollars, except as

noted)

2Q17(a)

CurrencyTranslation(b)

ConstantCurrencyGrowth(c)

2Q18(a+b+c)

% AsReported

% ConstantCurrency

Total Restaurants (Units) 515

522

1.4 % Total Revenues

96.1 (1.8 ) 4.7 99.0 3.0

% 4.9 % Systemwide Comparable Sales 5.3 %

Adjusted EBITDA 8.4 0.0 (1.1 )

7.3 -13.4 % -13.6 % Adjusted

EBITDA Margin 8.7 %

7.3 %

NOLAD’s as reported revenues increased 3.0% year-over-year,

supported by constant currency growth of 4.9%, partially offset by

a negative currency translation impact derived from a 5%

year-over-year average depreciation of the Mexican peso. Systemwide

comparable sales increased 5.3%, driven by traffic growth. Despite

the negative effect of the Easter calendar shift, Mexico guest

traffic continues to perform strongly, having recorded the fifth

consecutive quarter with positive comparable traffic growth. The

Company’s innovative marketing and digital initiatives, as well as

its focus on delivering an enhanced guest experience, continue to

drive the improved performance.

Marketing activities in the quarter included a new phase of the

affordability platform “McTrío 3x3” in Mexico and the introduction

of the “Cheesy Italiana” burger in Costa Rica, among others. The

dessert category performed well, with a new phase of the McFlurry

Crunch Rocks and the McFlurry Oreo. Also in the quarter, the

Company included “Justice League Action” and “The Amazing World of

Gumball” in the Happy Meal.

As reported Adjusted EBITDA decreased by 13.4%, or by 13.6% on a

constant currency basis. The Adjusted EBITDA margin contraction of

140 basis points to 7.3% in the second quarter mainly reflects the

increase in Royalty Fees, which caused a 90 basis point margin

reduction in the quarter. Additionally, efficiencies in F&P

costs were offset by an increase in other expense line items as a

percentage of revenues.

SLAD

Figure 5. SLAD Division: Key Financial Results

(In millions of U.S. dollars, except as

noted)

2Q17(a)

CurrencyTranslation(b)

ConstantCurrencyGrowth(c)

2Q18(a+b+c)

% AsReported

% ConstantCurrency

Total Restaurants (Units) 386

390

1.0 % Total Revenues

232.3 (61.5 ) 45.6 216.4

-6.9 % 19.6 % Systemwide Comparable

Sales 20.0 %

Adjusted EBITDA 17.9 (5.0

) 3.9 16.8 -6.1 % 21.6

% Adjusted EBITDA Margin 7.7 %

7.8 %

SLAD’s as reported revenues decreased 6.9% as constant currency

growth of 19.6% was more than offset by negative currency

translation impacts resulting from the 50% year-over-year average

depreciation of the Argentine peso. Systemwide comparable sales

increased 20.0%, in line with blended inflation, driven by the

combination of average check growth and an increase in traffic.

Marketing activities in the quarter included the introduction of

the Blue Cheese & Bacon premium burger in the Signature Line,

among others. Also in the quarter, the Company launched the FIFA

World Cup-related campaign “La Hinchada Pide Cuarto”, built on the

iconic Quarter Pounder burger. The dessert category performed well

with the introduction of the McFlurry Milka Almendras and McFlurry

Milka Triolade. The Happy Meal featured “Justice League Action” and

“The Amazing World of Gumball” during the quarter.

Adjusted EBITDA decreased 6.1% on an as reported basis and rose

21.6% in constant currency terms, which was above the division’s

blended inflation. The Adjusted EBITDA margin expanded 10 basis

points to 7.8%, as efficiencies in Payroll and Occupancy and Other

Operating Expenses were partially offset by higher Royalty Fees and

F&P costs as a percentage of revenues.

Caribbean Division

Figure 6. Caribbean Division: Key Financial Results

(In millions of U.S. dollars, except as

noted)

2Q17(a)

CurrencyTranslation(b)

ConstantCurrencyGrowth(c)

2Q18(a+b+c)

% AsReported

% ConstantCurrency

Total Restaurants (Units) 349

346

-0.9 % Total Revenues

115.3 (2,177.0 ) 2,183.2 121.6

5.4 % 1893.6 % Systemwide Comparable

Sales 2735.5 %

Adjusted EBITDA 2.1 (1,623.6

) 1,625.0 3.5 67.1 %

76651.1 % Adjusted EBITDA Margin 1.8 %

2.9 %

The Caribbean division’s results continue to be heavily impacted

by Venezuela’s macroeconomic volatility, including the ongoing

hyperinflationary environment and the country’s heavily regulated

currency. As such, reported results in the quarter reflect

significant non-cash accounting impacts from operations in that

market. Thus, the discussion of the Caribbean division’s operating

performance is focused on results, excluding Venezuela.

Caribbean Division – excluding Venezuela

Figure 7. Caribbean Division -

Excluding Venezuela: Key Financial Results

(In millions of U.S. dollars, except as

noted)

2Q17

(a)

CurrencyTranslation(b)

ConstantCurrencyGrowth(c)

2Q18(a+b+c)

% AsReported

% ConstantCurrency

Total Restaurants (Units) 219

216

-1.4 % Total Revenues

95.4 2.5 4.2 102.1 7.1 %

4.4 % Systemwide Comparable Sales 5.1 %

Adjusted

EBITDA 4.4 0.3 2.3 7.0 56.8

% 51.1 % Adjusted EBITDA Margin

4.7 % 6.8 %

As reported revenues in the Caribbean division, excluding

Venezuela, increased 7.1%, driven by constant currency growth of

4.4% and a positive currency translation impact. Comparable sales

increased by 5.1%, well above blended inflation, driven by average

check growth. Marketing activities in the quarter included the

launch of the Buttermilk Crispy Tenders and the Bistró burger in

the premium category, among others. Also in the quarter, the

Company introduced the Malteada and McFlurry MiniChips in the

dessert category, and included “Justice League Action” in the Happy

Meal.

Adjusted EBITDA totaled $7.0 million, compared to $4.4 million

in the same period of 2017. The Adjusted EBITDA margin expanded 210

basis points to 6.8%, reflecting efficiencies in all cost line

items, except Royalty Fees. In addition, this quarter’s results

included an insurance recovery from the damages caused by last

year’s hurricanes in Puerto Rico and the US Virgin Islands.

New Unit Development

Figure 8. Total

Restaurants (eop)*

June

2018

March

2018

December

2017

September

2017

June

2017

Brazil 933 929 929

910 910 NOLAD 522 522 519 514 515 SLAD 390 391

390 386 386 Caribbean 346 348 350 350 349

TOTAL

2,191 2,190

2,188 2,160 2,160

* Considers Company-operated and franchised restaurants at

period-end

The Company opened 46 new restaurants during the twelve-month

period ended June 30, 2018, resulting in a total of 2,191

restaurants. Also during the period, the Company added 247 Dessert

Centers, bringing the total to 2,973. McCafés totaled 316 as of

June 30, 2018.

Balance Sheet & Cash Flow Highlights

Cash and cash equivalents, including short-term investments,

were $218.9 million at June 30, 2018. The Company’s total financial

debt (including derivative instruments) was $583.7 million. Net

debt (Total Financial Debt minus Cash and cash equivalents) was

$364.8 million and the Net Debt/Adjusted EBITDA ratio was 1.4x at

June 30, 2018.

Figure 9. Consolidated Financial Ratios

(In thousands of U.S. dollars, except

ratios)

June 30 December 31

2018 2017 Cash

& cash equivalents (i) 218,937 328,079 Total Financial Debt

(ii) 583,728 621,460 Net Financial Debt (iii) 364,791 293,381 Total

Financial Debt / LTM Adjusted EBITDA ratio 2.2 2.0 Net Financial

Debt / LTM Adjusted EBITDA ratio 1.4

1.0 (i) Cash & cash equivalents includes Short-term investment

(ii)Total financial debt includes long-term debt and derivative

instruments (including the asset portion of derivatives amounting

to $57.3 million and $35.1 million as a reduction of financial debt

as of June 30, 2018 and December 31, 2017, respectively). (iii)

Total financial debt less cash and cash equivalents.

Net cash provided by operating activities totaled $57.5 million

for the quarter, and cash used in net investing activities totaled

$29.3 million, which included capital expenditures of $39.4

million. Cash used in financing activities amounted to $32.6

million including $20.0 million of treasury stock purchases and

$10.6 million of dividend payments.

First Half 2018

Excluding the Venezuelan operation and for the six months ended

June 30, 2018, the Company’s as reported revenues decreased by 0.2%

to $1,537.3 million, as constant currency growth of 8.8% was offset

by negative currency translation. As reported Adjusted EBITDA was

$116.8 million, a 2.1% decrease compared to the first half of 2017.

On a constant currency basis, Adjusted EBITDA increased by 3.4%.

The reported Adjusted EBITDA margin contracted by 20 basis points

to 7.6%, as efficiencies in F&P and Payroll mostly offset the

increase in Royalty Fees.

Year-to-date consolidated net income amounted to $24.3 million,

compared with net income of $42.1 million in the first half of

2017. The prior year result included $56.1 million from the

Company’s re-development initiative compared with $0.2 million this

year. The result also reflects lower net interest expenses, lower

losses from derivative instruments, lower income tax and a positive

variance in foreign currency exchange results in the first half of

2018.

During the first half of 2018, capital expenditures totaled

$63.1 million.

Quarter Highlights & Recent

Developments

Share Repurchase Program

On May 22, 2018, the Board of Directors approved the adoption of

a share repurchase program, pursuant to which the Company may

repurchase from time to time up to $60 million of issued and

outstanding Class A shares of no par value of the Company. The

repurchase program began on May 22, 2018 and will expire at the

close of business on May 22, 2019. As of June 30, 2018, the Company

purchased 2,656,552 shares with a total cost of $20 million.

Argentina accounting developments – highly

inflationary status

Effective July 1, 2018, Argentina is considered to be highly

inflationary. Under U.S. GAAP, an economy is considered to be

highly inflationary when the three-year cumulative rate of

inflation meets or exceeds 100%. Under the highly inflationary

basis of accounting, the financial statements of the Company’s

Argentine subsidiaries will be remeasured in accordance with ASC

830 "Foreign Currency Matters".

Dividends

On April 5, 2018, the Company paid the first of the two equal

installments of $0.05 per share to all Class A and Class B

shareholders of record as of April 2, 2018. The second installment

will be paid on October 5, 2018 to shareholders of record as of

October 2, 2018.

Definitions:

Systemwide comparable sales growth:

refers to the change, measured in constant currency, in our

Company-operated and franchised restaurant sales in one period from

a comparable period for restaurants that have been open for

thirteen months or longer. While sales by our franchisees are not

recorded as revenues by us, we believe the information is important

in understanding our financial performance because these sales are

the basis on which we calculate and record franchised revenues and

are indicative of the financial health of our franchisee base.

Constant currency basis: refers to

amounts calculated using the same exchange rate over the periods

under comparison to remove the effects of currency fluctuations

from this trend analysis. To better discern underlying business

trends, this release uses non-GAAP financial measures that

segregate year-over-year growth into two categories: (i) currency

translation, (ii) constant currency growth. (i) Currency

translation reflects the impact on growth of the appreciation or

depreciation of the local currencies in which we conduct our

business against the US dollar (the currency in which our financial

statements are prepared). (ii) Constant currency growth reflects

the underlying growth of the business excluding the effect from

currency translation.

Excluding Venezuela basis: due to

the ongoing political and macroeconomic uncertainty prevailing in

Venezuela, and in order to provide greater clarity and visibility

on the Company’s financial and operating overall performance, this

release focuses on the results on an “Excluding-Venezuela” basis,

which is non-GAAP measure.

Adjusted EBITDA: In addition to

financial measures prepared in accordance with the general accepted

accounting principles (GAAP), within this press release and the

accompanying tables, we use a non-GAAP financial measure titled

‘Adjusted EBITDA’. We use Adjusted EBITDA to facilitate operating

performance comparisons from period to period.

Adjusted EBITDA is defined as our operating income plus

depreciation and amortization plus/minus the following losses/gains

included within other operating income (expenses), net, and within

general and administrative expenses in our statement of income:

gains from sale or insurance recovery of property and equipment;

write-offs of property and equipment; impairment of long-lived

assets and goodwill; and incremental compensation related to the

modification of our 2008 long-term incentive plan.

We believe Adjusted EBITDA facilitates company-to-company

operating performance comparisons by backing out potential

differences caused by variations such as capital structures

(affecting net interest expense and other financial charges),

taxation (affecting income tax expense) and the age and book

depreciation of facilities and equipment (affecting relative

depreciation expense), which may vary for different companies for

reasons unrelated to operating performance. Figure 10 of this

earnings release include a reconciliation for Adjusted EBITDA. For

more information, please see Adjusted EBITDA reconciliation in Note

9 of our quarterly financial statements (6-K Form) filed today with

the S.E.C.

About Arcos Dorados

Arcos Dorados is the world’s largest independent McDonald’s

franchisee in terms of systemwide sales and number of restaurants,

operating the largest quick service restaurant chain in Latin

America and the Caribbean. It has the exclusive right to own,

operate and grant franchises of McDonald’s restaurants in 20 Latin

American and Caribbean countries and territories, including

Argentina, Aruba, Brazil, Chile, Colombia, Costa Rica, Curaçao,

Ecuador, French Guyana, Guadeloupe, Martinique, Mexico, Panama,

Peru, Puerto Rico, St. Croix, St. Thomas, Trinidad & Tobago,

Uruguay and Venezuela. The Company operates or franchises over

2,190 McDonald’s-branded restaurants with over 90,000 employees and

is recognized as one of the best companies to work for in Latin

America. Arcos Dorados is traded on the New York Stock Exchange

(NYSE: ARCO). To learn more about the Company, please visit the

Investors section of our website: www.arcosdorados.com/ir

Cautionary Statement on Forward-Looking Statements

This press release contains forward-looking statements. The

forward-looking statements contained herein include statements

about the Company’s business prospects, its ability to attract

customers, its affordable platform, its expectation for revenue

generation and its outlook and guidance for 2018. These statements

are subject to the general risks inherent in Arcos Dorados'

business. These expectations may or may not be realized. Some of

these expectations may be based upon assumptions or judgments that

prove to be incorrect. In addition, Arcos Dorados' business and

operations involve numerous risks and uncertainties, many of which

are beyond the control of Arcos Dorados, which could result in

Arcos Dorados' expectations not being realized or otherwise

materially affect the financial condition, results of operations

and cash flows of Arcos Dorados. Additional information relating to

the uncertainties affecting Arcos Dorados' business is contained in

its filings with the Securities and Exchange Commission. The

forward-looking statements are made only as of the date hereof, and

Arcos Dorados does not undertake any obligation to (and expressly

disclaims any obligation to) update any forward-looking statements

to reflect events or circumstances after the date such statements

were made, or to reflect the occurrence of unanticipated

events.

Second Quarter 2018 Consolidated Results

(In thousands of U.S. dollars, except per share data)

Figure 10.

Second Quarter & First Half 2018 Consolidated Results

(In thousands of U.S. dollars, except per

share data)

For

Three-Months ended For Six-Months ended

June 30, June 30,

2018 2017

2018 2017 REVENUES

Sales by Company-operated restaurants

718,454 762,221 1,525,515 1,507,630 Revenues from franchised

restaurants 35,516

36,477 78,342 72,548

Total Revenues 753,970

798,698

1,603,857 1,580,178

OPERATING COSTS AND EXPENSES Company-operated restaurant

expenses: Food and paper (249,569 ) (272,741 ) (534,836 ) (536,205

) Payroll and employee benefits (156,150 ) (168,617 ) (329,264 )

(334,893 ) Occupancy and other operating expenses (199,923 )

(206,944 ) (416,545 ) (409,747 ) Royalty fees (38,603 ) (38,845 )

(80,774 ) (77,357 ) Franchised restaurants - occupancy expenses

(15,787 ) (16,540 ) (34,942 ) (32,651 ) General and administrative

expenses (59,268 ) (60,844 ) (116,918 ) (115,747 ) Other operating

(expenses) income, net (15,537 )

1,417 (59,374 ) 51,336

Total operating costs and expenses

(734,837 )

(763,114 ) (1,572,653 )

(1,455,264 ) Operating income

19,133

35,584 31,204

124,914 Net interest expense (12,457 ) (23,043

) (27,097 ) (39,458 ) Loss from derivative instruments (233 )

(6,589 ) (331 ) (7,231 ) Foreign currency exchange results (3,049 )

(15,552 ) 5,128 (24,111 ) Other non-operating expenses, net

(78 ) (430 ) (62 )

(1,125 )

Income (expense) before income taxes

3,316

(10,030 ) 8,842

52,989 Income tax (expense) benefit

(2,210 ) 5,987

(7,173 ) (16,351 )

Net income (loss)

1,106

(4,043 ) 1,669

36,638 (Less): Net income attributable to

non-controlling interests (40 )

(71 ) (85 ) (148 )

Net income

(loss) attributable to Arcos Dorados Holdings Inc.

1,066

(4,114 ) 1,584

36,490 Earnings per share information ($

per share): Basic net income per common share

$

0.01 $ (0.02 ) $ 0.01

$ 0.17 Weighted-average number of common shares

outstanding-Basic 210,579,612

210,881,194 210,824,698

210,796,678

Adjusted EBITDA

Reconciliation

Operating income 19,133 35,584 31,204 124,914

Depreciation and amortization 25,573 24,440 52,090 47,892 Operating

charges excluded from EBITDA computation 698

(3,426 ) 716

(53,524 )

Adjusted EBITDA

45,404 56,598

84,010 119,282

Adjusted EBITDA Margin as % of total revenues

6.0 % 7.1

% 5.2 % 7.5

%

Second Quarter 2018 Consolidated Results – Excluding

Venezuela

(In thousands of U.S. dollars, except per share data)

Figure 11. Second Quarter & First Half 2018

Consolidated Results - Excluding Venezuela

(In thousands of U.S. dollars, except per

share data)

For Three-Months ended For

Six-Months ended June 30, June 30,

2018 2017 2018

2017 REVENUES Sales by

Company-operated restaurants 701,294 744,252 1,466,250 1,471,271

Revenues from franchised restaurants 33,240

34,546 71,039 68,467

Total Revenues

734,534 778,798

1,537,289 1,539,738 OPERATING COSTS AND

EXPENSES Company-operated restaurant expenses: Food and paper

(246,306) (262,098) (510,416) (517,961) Payroll and employee

benefits (155,693) (166,628) (325,337) (330,240) Occupancy and

other operating expenses (195,070) (201,693) (402,330) (399,109)

Royalty fees (39,082) (38,405) (82,190) (76,003) Franchised

restaurants - occupancy expenses (15,150) (15,804) (32,929)

(31,284) General and administrative expenses (57,918) (58,933)

(113,492) (111,786) Other operating (expenses) income, net

(555) 4,389 (2,780) 54,881

Total operating costs and expenses

(709,774) (739,172) (1,469,474)

(1,411,502) Operating income

24,760 39,626 67,815

128,236 Net interest expense (12,426) (23,048)

(27,066) (39,485) Loss from derivative instruments (233) (6,589)

(331) (7,231) Foreign currency exchange results 755 (12,679)

(1,070) (21,042) Other non-operating expenses, net

(78) (439) (64) (1,125)

Income

(expense) before income taxes 12,778

(3,129) 39,284

59,353 Income tax (expense) benefit (2,034)

4,265 (14,930) (17,134)

Net

income 10,744 1,136

24,354 42,219 (Less): Net income

attributable to non-controlling interests (40)

(71) (85) (148)

Net income attributable to

Arcos Dorados Holdings Inc. 10,704

1,065 24,269 42,071

Earnings per share information ($ per share): Basic net

income per common share

$ 0.05 $ 0.01 $ 0.12

$ 0.20 Weighted-average number of common shares

outstanding-Basic 210,579,612

210,881,194 210,824,698 210,796,678

Adjusted

EBITDA Reconciliation

Operating income 24,760 39,626 67,815

128,236 Depreciation and amortization 24,367 22,722 49,323 44,642

Operating charges excluded from EBITDA computation

(301) (3,428) (291) (53,519)

Adjusted EBITDA 48,826

58,920 116,847 119,359

Adjusted EBITDA Margin as % of total revenues

6.6% 7.6% 7.6%

7.8%

Second Quarter 2018 Results by Division

(In thousands of U.S. dollars)

Figure 12. Second Quarter & First Half 2018

Consolidated Results by Division

(In thousands of U.S. dollars)

2Q 1H Three-Months

ended % Incr.

Constant Six-Months ended %

Incr. Constant June 30,

/ Currency June

30, / Currency

2018 2017

(Decr)

Incr/(Decr)% 2018 2017

(Decr)

Incr/(Decr)% Revenues

Brazil 316,973 354,939 -10.7 % 0.0 % 681,656 714,934

-4.7 % 2.3 % Caribbean 121,568 115,297 5.4 % 1893.6 % 268,442

222,515 20.6 % 1292.7 % Caribbean - Excl. Venezuela 102,132 95,397

7.1 % 4.4 % 201,874 182,075 10.9 % 7.5 % NOLAD 99,009 96,126 3.0 %

4.9 % 196,160 180,468 8.7 % 8.2 % SLAD 216,420 232,336 -6.9 % 19.6

% 457,599 462,261 -1.0 % 19.7 %

TOTAL 753,970

798,698 -5.6 % 279.7 %

1,603,857 1,580,178 1.5 % 189.8

% TOTAL - Excl. Venezuela 734,534

778,798 -5.7 % 7.0 %

1,537,289 1,539,738 -0.2 % 8.8

% Operating Income (loss)

Brazil 21,926 32,652 -32.8 % -25.0 % 56,987 63,959 -10.9 % -5.3 %

Caribbean (3,124 ) (4,039 ) 22.7 % 40240.6 % (34,891 ) (4,305 )

-710.5 % 46802.2 % Caribbean - Excl. Venezuela 2,503 3 83333.3 %

78300.0 % 1,720 (983 ) 275.0 % 234.2 % NOLAD 2,004 7,052 -71.6 %

-73.2 % 3,954 58,208 -93.2 % -92.9 % SLAD 12,137 14,084 -13.8 %

14.3 % 30,007 30,942 -3.0 % 18.2 % Corporate and Other (13,810 )

(14,165 ) 2.5 % -31.2 % (24,853 ) (23,890 ) -4.0 % -34.3 %

TOTAL 19,133 35,584 -46.2 %

4523.4 % 31,204 124,914 -75.0

% 1564.9 % TOTAL - Excl. Venezuela

24,760 39,626 -37.5 % -33.7

% 67,815 128,236 -47.1 %

-45.0 % Adjusted

EBITDA Brazil 34,502 45,892 -24.8 % -15.9 % 83,229

90,654 -8.2 % -2.1 % Caribbean 3,542 2,120 67.1 % 76651.1 % (22,109

) 7,758 -385.0 % 25958.1 % Caribbean - Excl. Venezuela 6,964 4,442

56.8 % 51.1 % 10,728 7,835 36.9 % 28.6 % NOLAD 7,251 8,369 -13.4 %

-13.6 % 14,546 13,575 7.2 % 7.7 % SLAD 16,799 17,881 -6.1 % 21.6 %

39,784 38,501 3.3 % 24.0 % Corporate and Other (16,690 ) (17,664 )

5.5 % -18.1 % (31,440 ) (31,206 ) -0.7 % -21.0 %

TOTAL

45,404 56,598 -19.8 % 2857.4

% 84,010 119,282 -29.6 %

1689.8 % TOTAL - Excl. Venezuela

48,826 58,920

-17.1 % -9.3 %

116,847 119,359

-2.1 % 3.4

% Figure 13. Average Exchange Rate per

Quarter* Brazil

Mexico Argentina

2Q18 3.61 19.40 23.51 2Q17

3.21 18.55 15.72 * Local

$ per 1 US$

Summarized Consolidated Balance Sheets

(In thousands of U.S. dollars)

Figure 14. Summarized Consolidated Balance Sheets

(In thousands of U.S. dollars)

June

30 December 31

2018 2017 ASSETS

Current assets

Cash and cash equivalents 208,932 308,491 Short-term investment

10,005 19,588 Accounts and notes receivable, net 73,637 111,302

Other current assets (1) 147,505

213,656

Total current assets

440,079 653,037

Non-current assets Property and equipment, net 813,389

890,736 Net intangible assets and goodwill 38,898 47,729 Deferred

income taxes 70,765 74,299 Other non-current assets (2)

149,468 137,942

Total

non-current assets 1,072,520

1,150,706 Total assets

1,512,599 1,803,743

LIABILITIES AND EQUITY

Current liabilities Accounts payable

195,928 303,452 Taxes payable (3) 84,172 136,918 Accrued payroll

and other liabilities 100,294 119,088 Other current liabilities (4)

21,771 23,715 Provision for contingencies 2,197 2,529 Financial

debt (5) 14,453 19,881

Total current liabilities 418,815

605,583 Non-current

liabilities Accrued payroll and other liabilities 33,074 29,366

Provision for contingencies 26,172 25,427 Financial debt (6)

626,597 636,648 Deferred income taxes 10,639

10,577

Total non-current liabilities

696,482 702,018

Total liabilities 1,115,297

1,307,601 Equity Class A

shares of common stock 379,693 376,732 Class B shares of common

stock 132,915 132,915 Additional paid-in capital 13,165 14,216

Retained earnings 377,774 401,134 Accumulated other comprehensive

losses (486,644 ) (429,347 ) Common stock in treasury

(20,000 ) 0

Total Arcos Dorados Holdings

Inc shareholders’ equity 396,903

495,650 Non-controlling interest in

subsidiaries 399 492

Total equity 397,302

496,142 Total liabilities and equity

1,512,599

1,803,743 (1) Includes "Other receivables",

"Inventories", "Prepaid expenses and other current assets", and

"McDonald's Corporation's indemnification for contingencies". (2)

Includes "Miscellaneous", "Collateral deposits", "Derivative

Instruments", and "McDonald´s Corporation indemnification for

contingencies". (3) Includes "Income taxes payable" and "Other

taxes payable". (4) Includes "Royalties payable to McDonald´s

Corporation" and "Interest payable". (5) Includes "Short-term

debt", "Current portion of long-term debt" and "Derivative

instruments". (6) Includes "Long-term debt, excluding current

portion" and "Derivative instruments".

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180808005052/en/

Arcos Dorados Holdings, Inc.Investor RelationsArcos

DoradosDaniel Schleiniger, +54 11 4711 2675Vice President of

Corporate Communications & Investor

Relationsdaniel.schleiniger@ar.mcd.comorMediaInspIR

GroupBarbara Cano, +1

646-452-2334barbara@inspirgroup.comwww.arcosdorados.com/ir

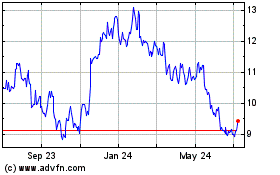

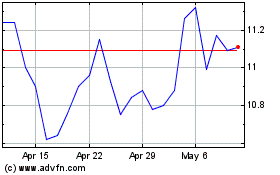

Arcos Dorados (NYSE:ARCO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Arcos Dorados (NYSE:ARCO)

Historical Stock Chart

From Apr 2023 to Apr 2024