Net Revenue Growth Drives Record 2Q

Operating Income of $174.5 Million and Net Income of $86.6

Million

Record 2Q BCF of $257.5 Million, Adjusted

EBITDA of $233.1 Million and Free Cash Flow of $148.2 Million,

Inclusive of One-Time Transaction Expenses

Repurchases 250,000 Shares During Second

Quarter

Nexstar Media Group, Inc. (NASDAQ: NXST) (“Nexstar” or “the

Company”) today reported record financial results for the second

quarter ended June 30, 2018 as summarized below.

Summary 2018 Second Quarter

Highlights

Three Months EndedJune

30,

Six Months Ended

June 30,

($ in thousands)

2018 2017 Change

2018 2017 Change Local Revenue $

198,560 $ 209,594 (5.3 )% $ 391,828 $ 388,070 +1.0 %

National Revenue $ 71,633 $ 77,256 (7.3 )% $ 138,678 $ 143,238 (3.2

)% Political Revenue $ 31,636 $ 5,488 +476.5 % $ 40,902 $ 7,184

+469.3 %

Television Ad Revenue $ 301,829

$ 292,338 +3.2 %

$ 571,408 $

538,492 +6.1 % Retransmission Fee Revenue $ 276,273 $

253,099 +9.2 % $ 552,214 $ 484,994 +13.9 % Digital Revenue $ 63,999

$ 63,045 +1.5 % $ 126,803 $ 108,410 +17.0 % Trade and Barter /

Other Revenue $ 18,222 $ 17,633 +3.3 % $ 25,234 $ 34,536 (26.9 )%

Net Revenue(1) $ 660,323 $

626,115 +5.5 %

$ 1,275,659 $

1,166,432 +9.4 %

Income from

Operations(2) $ 174,494 $

135,529 +28.8 %

$ 292,110 $

243,049 +20.2 %

Net income $

86,606 $ 48,455 +78.7 %

$

133,947 $ 53,399 +150.8 %

Broadcast

Cash Flow(3)

$ 257,495 $ 226,936

+13.5 %

$ 461,998 $ 415,149 +11.3 %

Broadcast Cash Flow Margin(4)

39.0 %

36.2 % 36.2 % 35.6 %

Adjusted EBITDA Before One-Time Transaction

Expenses(3)

$ 233,825 $ 208,284

+12.3 %

$ 415,916 $ 379,900 +9.5 %

Adjusted EBITDA(3)

$ 233,061 $

202,178 +15.3 %

$ 414,171 $

325,992 +27.0 %

Adjusted EBITDA Margin(4)

35.3

% 32.3 % 32.5 % 27.9

% Free Cash Flow Before One-Time Transaction

Expenses(3)

$ 148,926 $ 145,121

+2.6 %

$ 271,373 $ 247,864 +9.5 %

Free Cash Flow(3)

$ 148,162 $

139,015 +6.6 %

$ 269,628 $

193,956 +39.0 %

(1) Effective January 1, 2018, the Company adopted Accounting

Standards Update No. 2014-09, which resulted in certain changes in

the Company’s revenue recognition policies and the presentation of

certain revenue sources. The change reduced the barter revenue (and

the related barter expense) but did not impact the Company’s

current or prior year income from operations, net income, broadcast

cash flow, adjusted EBITDA or free cash flow. The discussion about

this adoption is on page 4.

(2) Effective January 1, 2018, the Company retrospectively

adopted Accounting Standards Update No. 2017-07 which requires

pension and other postretirement plans cost (credit), other than

service costs, to be presented outside of income from operations.

Thus, the income from operations during the three and six months

ended June 30, 2017 was decreased by a pension and other

postretirement plans credit of $3.2 million and $5.8 million,

respectively.

(3) Definitions and disclosures regarding non-GAAP financial

information including reconciliations are included at the end of

the press release.

(4) Broadcast cash flow margin is broadcast cash flow as a

percentage of net revenue. Adjusted EBITDA margin is Adjusted

EBITDA as a percentage of net revenue.

CEO Comment

Perry A. Sook, Chairman, President and Chief Executive Officer

of Nexstar Media Group commented, “Nexstar’s financial growth

momentum and focus on shareholder returns was evident again in the

second quarter as we delivered another period of record results

with top line, bottom line, and cash flow metrics exceeding

consensus expectations. The 5.5% rise in second quarter net revenue

reflects solid television advertising growth as well as continued

retransmission and digital revenue growth. Reflecting these

factors, Nexstar posted record second quarter BCF, adjusted EBITDA

and free cash flow with these metrics growing 13.5%, 15.3% and

6.6%, respectively on a year-over-year basis. Furthermore, our

enterprise-wide focus on efficiency and operating disciplines

enabled us to bring about 22% of every net revenue dollar to the

free cash flow line.

“Our commitment to apply our growing free cash flow to drive

shareholder returns was also evident again in the second quarter as

we allocated a total of approximately $84 million to return of

capital and leverage reduction initiatives. During the quarter, we

used $16.7 million of cash from operations to repurchase 250,000

Nexstar shares, paid our twenty-second consecutive quarterly cash

dividend which amounted to $17.2 million, and reduced debt by $50.6

million. With $269.6 million of year-to-date free cash flow and our

second half 2018 political revenue pacing very strongly, we remain

highly confident in meeting our target for average annual free cash

flow in excess of $600 million for the 2018/2019 cycle. At the same

time, our recent share repurchase activity has reduced our Class A

common stock outstanding (Nexstar’s only class of shares

outstanding) to approximately 45.5 million shares.

“Notably, excluding digital revenues and expenses, the 2018

second quarter is the first period since last year’s completion of

the Media General transaction where our reported results reflect a

pure same-station comparison. Our spot inventory optimization

strategies, which are focused on maximizing the political revenue

opportunity, served us well in the second quarter as total

television advertising revenue rose 3.2%, reflecting record second

quarter political revenue which more than offset the reduction in

inventory available for local and national spot sales. Reflecting

our presence in states with high levels of political spending

activity, 2018 second quarter political revenue outpaced our

budgets and consensus estimates and rose by 369% over the 2014

period, the last comparable mid-term election cycle. Importantly,

despite strong demand from candidates, PACs and other advertisers

early in this election cycle, our local and national spot revenue

improved on a quarterly sequential basis as our local sales teams

continue to generate healthy levels of new business across our

markets.

“Combined second quarter digital media and retransmission fee

revenue of $340.2 million rose 7.6% over the prior-year period and

accounted for 51.5% of net revenue, illustrating again the positive

and ongoing shift in our revenue mix and marking growth of 100

basis points in this metric from 2017 second quarter levels.

Overall, the year-over-year increase in second quarter

non-television advertising revenue reflects recent renewals of

distribution agreements with multichannel video programming

distributors and the establishment of distribution agreements with

OTT providers, the January 2018 accretive acquisition of LKQD, and

organic growth across our profitable digital operations. These

gains were partially offset by digital revenues included in the

comparable 2017 second quarter from certain legacy Media General

digital operations that were discontinued in the second half of

last year.

“The rise in second quarter station direct operating expenses

(net of trade expense) primarily reflects the growth in broadcast

ad sales as well as budgeted increases in network affiliation

expense and expenses for LKQD. The 6.7% decline in SG&A expense

reflects our previously disclosed reclassification of certain

digital administrative expenses to corporate expense. Second

quarter corporate expense excluding non-cash compensation expense

was in line with our expectations.

“Last week, Nexstar entered into definitive agreements to

acquire KRBK-TV, the FOX affiliate in Springfield, Missouri and

WHDF-TV, the CW affiliate in Huntsville, Alabama for an aggregate

purchase price of $19.45 million in accretive transactions. These

transactions allow Nexstar to generate incremental advertising and

net retransmission consent revenue growth without an increase in

our total U.S. television household reach. The purchase price

represents a highly attractive multiple of the pro forma

contribution to our operating results and the acquisitions are

leverage-neutral on a pro-forma basis. Nexstar expects both

transactions to close in the fourth quarter of 2018, subject to FCC

and other customary approvals. Our proven ability to significantly

expand free cash flow by identifying, executing and financing

accretive transactions highlights Nexstar's role in the industry as

the leading consolidator with an unrivaled record in terms of our

execution consistency, capital allocation and the enhancement of

shareholder value. In each transaction, large or small, we follow

our well-established playbook to enhance the operating results of

acquired assets, while delivering exceptional service to the local

communities where we operate.

“With our focus on generating free cash flow, we remain

disciplined in managing costs, while paying dividends, repurchasing

shares and pursuing additional selective accretive acquisitions. In

concert with our return of capital policies, we remain focused on

actively managing our capital structure as another means of

enhancing shareholder value. In this regard, during the first six

months of 2018 we allocated approximately $166 million toward debt

reduction, opportunistic share repurchases and cash dividends while

funding $97 million to acquire fast growing LKQD Technologies for

our digital tech stack. With our year-to-date progress on debt

reduction and the biggest mid-term election cycle in the Company’s

history before us, we continue to expect Nexstar’s net leverage,

absent additional strategic activity and discretionary capital

returns, to decline to the mid/high 3x range by year-end.

“Nexstar’s organization-wide commitment to excellence in local

content for viewers and users as well as unparalleled marketing

results for our advertisers has been fundamental to our success and

growth. We are executing well on all facets of our business plan,

including elevated levels of local original content and service to

local viewers and advertisers, continued operational improvements

and further optimizing the Company’s capital structure and cost of

capital. As we continue to benefit from what are expected to be

record levels of political advertising in 2018, the ongoing renewal

of our retransmission consent agreements and completion of recently

announced tuck-in transactions, we have excellent visibility to

delivering on or exceeding our free cash flow targets and a clear

path for the continued near- and long-term enhancement of

shareholder value.”

The consolidated debt of Nexstar, its wholly owned subsidiaries,

Mission Broadcasting, Inc., Marshall Broadcasting Group, Inc. and

Shield Media, LLC (collectively, the “Company”) at June 30, 2018,

was $4,287.6 million including senior secured debt of $2,719.9

million. The Company’s total net leverage ratio at June 30, 2018

was 4.69x and first lien net leverage ratio at June 30, 2018 was

2.92x compared to a covenant of 4.50x.

The table below summarizes the Company’s debt obligations (net

of financing costs and discounts):

($ in millions)

6/30/2018

12/31/2017 Revolving Credit Facilities $ - $ 3.0 First Lien

Term Loans $ 2,719.9 $ 2,791.9 6.125% Senior Unsecured Notes $

273.2 $ 273.0 5.875% Senior Unsecured Notes $ 407.2 $ 408.1 5.625%

Senior Unsecured Notes $ 887.3 $ 886.5

Total Funded Debt

$ 4,287.6 $ 4,362.5 Cash on

Hand $ 147.7 $ 115.7

Share Repurchase Program

On May 1, 2018 the Company’s Board of Directors approved an

expansion of the Company’s share repurchase authorization for up to

an additional $200 million of repurchases of its Class A common

stock. The expansion brought the total capacity under Nexstar’s

share repurchase program to approximately $218.6 million when

combined with the approximate $18.6 million remaining under its

prior authorization. In the second quarter of 2018, Nexstar

repurchased a total of 250,000 shares of its Class A common stock

at an average purchase price of $66.80 for a total cost of $16.7

million following the repurchase of approximately 500,000 shares of

its Class A common stock at an average purchase price of $67.40 for

a total cost of $33.8 million in the first quarter of 2018. Share

repurchases were funded from cash flow from operations. Reflecting

the shares repurchased to date, Nexstar has approximately 45.5

million shares of Class A common stock outstanding (the only class

of shares outstanding). As of June 30, 2018, the remaining

available amount under the share repurchase authorization was

$201.9 million.

Change in Revenue Reporting Under FASB ASU No.

2014-09

Effective January 1, 2018, the Company adopted Accounting

Standards Update No. 2014-09, the new revenue accounting guidance

issued by the Financial Accounting Standards Board. The adoption

resulted in certain changes in the Company’s revenue recognition

policies and the presentation of certain revenue sources in the

quarterly financial results. Beginning with the first quarter of

2018, the Company no longer recognizes barter revenue and barter

expense arising from the exchange of advertising time for certain

program material. During the three and six months ended June 30,

2017, the Company recognized barter revenue (and related barter

expense) of $9.9 million and $20.1 million, respectively. In

addition, the Company now presents local, national, digital and

political revenues, exclusive of related agency commissions. The

change in accounting for barter reduced the amount of revenue and

related expense in 2018. The change in the presentation of local,

national, digital and political revenue did not impact the

Company’s net revenue. These changes did not impact the Company’s

current or prior year income from operations, net income, broadcast

cash flow, adjusted EBITDA and free cash flow.

Second Quarter Conference Call

Nexstar will host a conference call at 10:00 a.m. ET today.

Senior management will discuss the financial results and host a

question and answer session. The dial in number for the audio

conference call is 719/325-4801, conference ID 7118403 (domestic

and international callers). Participants can also listen to a live

webcast of the call through the “Events and Presentations” section

under “Investor Relations” on Nexstar’s website at www.nexstar.tv.

A webcast replay will be available for 90 days following the live

event at www.nexstar.tv.

Definitions and Disclosures Regarding non-GAAP Financial

Information

Broadcast cash flow is calculated as net income, plus interest

expense (net), loss on extinguishment of debt, income tax expense

(benefit), depreciation, amortization of intangible assets and

broadcast rights (excluding barter), (gain) loss on asset disposal,

corporate expenses, other expense (income) and goodwill and

intangible assets impairment, minus pension and other

postretirement plans credit (net), reimbursement from the FCC

related to station repack and broadcast rights payments. We

consider broadcast cash flow to be an indicator of our assets’

operating performance. We also believe that broadcast cash flow and

multiples of broadcast cash flow are useful to investors because it

is frequently used by industry analysts, investors and lenders as a

measure of valuation for broadcast companies.

Adjusted EBITDA is calculated as broadcast cash flow, plus

pension and other postretirement plans credit (net), minus

corporate expenses. We consider Adjusted EBITDA to be an indicator

of our assets’ operating performance and a measure of our ability

to service debt. It is also used by management to identify the cash

available for strategic acquisitions and investments, maintain

capital assets and fund ongoing operations and working capital

needs. We also believe that Adjusted EBITDA is useful to investors

and lenders as a measure of valuation and ability to service

debt.

Free cash flow is calculated as net income, plus interest

expense, (net), loss on extinguishment of debt, income tax expense

(benefit), depreciation, amortization of intangible assets and

broadcast rights (excluding barter), (gain) loss on asset disposal,

stock-based compensation expense, non-cash compensation expense,

stock-based compensation expense, goodwill and intangible assets

impairment, other expense (income) and proceeds from disposals of

property and equipment, minus payments for broadcast rights, cash

interest expense, capital expenditures, proceeds from disposals of

property and equipment, and net operating cash income taxes. We

consider Free Cash Flow to be an indicator of our assets’ operating

performance. In addition, this measure is useful to investors

because it is frequently used by industry analysts, investors and

lenders as a measure of valuation for broadcast companies, although

their definitions of Free Cash Flow may differ from our

definition.

For a reconciliation of these non-GAAP financial measurements to

the GAAP financial results cited in this news announcement, please

see the supplemental tables at the end of this release.

With respect to our forward-looking guidance, no reconciliation

between a non-GAAP measure to the closest corresponding GAAP

measure is included in this release because we are unable to

quantify certain amounts that would be required to be included in

the GAAP measure without unreasonable efforts and we believe such

reconciliations would imply a degree of precision that would be

confusing or misleading to investors. In particular, reconciliation

of forward-looking Free Cash Flow to the closest corresponding GAAP

measure is not available without unreasonable efforts on a

forward-looking basis due to the high variability, complexity and

low visibility with respect to the charges excluded from these

non-GAAP measures such as the measures and effects of stock-based

compensation expense specific to equity compensation awards that

are directly impacted by unpredictable fluctuations in our stock

price and other non-recurring or unusual items such as impairment

charges, transaction-related costs and gains or losses on sales of

assets. We expect the variability of these items to have a

significant, and potentially unpredictable, impact on our future

GAAP financial results.

About Nexstar Media Group, Inc.

Nexstar Media Group is a leading diversified media company that

leverages localism to bring new services and value to consumers and

advertisers through its traditional media, digital and mobile media

platforms. Nexstar owns, operates, programs or provides sales and

other services to 171 television stations and related digital

multicast signals reaching 100 markets or nearly 39% of all U.S.

television households. Nexstar’s portfolio includes primary

affiliates of NBC, CBS, ABC, FOX, MyNetworkTV and The CW. Nexstar’s

community portal websites offer additional hyper-local content and

verticals for consumers and advertisers, allowing audiences to

choose where, when and how they access content while creating new

revenue opportunities. For more information please visit

www.nexstar.tv.

Forward-Looking Statements

This communication includes forward-looking statements. We have

based these forward-looking statements on our current expectations

and projections about future events. Forward-looking statements

include information preceded by, followed by, or that includes the

words "guidance," "believes," "expects," "anticipates," "could," or

similar expressions. For these statements, Nexstar claims the

protection of the safe harbor for forward-looking statements

contained in the Private Securities Litigation Reform Act of 1995.

The forward-looking statements contained in this communication,

concerning, among other things, future financial performance,

including changes in net revenue, cash flow and operating expenses,

involve risks and uncertainties, and are subject to change based on

various important factors, including the impact of changes in

national and regional economies, the ability to service and

refinance our outstanding debt, successful integration of acquired

television stations and digital businesses (including achievement

of synergies and cost reductions), pricing fluctuations in local

and national advertising, future regulatory actions and conditions

in the television stations' operating areas, competition from

others in the broadcast television markets, volatility in

programming costs, the effects of governmental regulation of

broadcasting, industry consolidation, technological developments

and major world news events. Nexstar undertakes no obligation to

update or revise any forward-looking statements, whether as a

result of new information, future events or otherwise. In light of

these risks, uncertainties and assumptions, the forward-looking

events discussed in this communication might not occur. You should

not place undue reliance on these forward-looking statements, which

speak only as of the date of this release. For more details on

factors that could affect these expectations, please see Nexstar’s

other filings with the SEC.

Nexstar Media Group, Inc.

Condensed Consolidated Statements of

Operations

(in thousands, except per share amounts,

unaudited)

Three Months Ended June

30,

Six Months Ended June

30,

2018 2017 2018 2017 Net

revenue $ 660,323 $ 626,115 $ 1,275,659 $ 1,166,432

Operating expenses (income): Corporate expenses 27,384 27,914

53,727 94,944 Direct operating expenses, net of trade 270,200

248,880 545,679 464,940 Selling, general and administrative

expenses, excluding corporate 111,519 119,527 227,081 229,430 Trade

and barter expense 4,239 13,655 7,723 26,555 Depreciation 25,090

26,292 50,904 48,518 Amortization of intangible assets 37,181

38,557 73,483 86,715 Amortization of broadcast rights, excluding

barter 15,913 15,761 32,013 29,997 Reimbursement from the FCC

related to station repack (5,697 ) - (7,061 ) - Gain on disposal of

stations, net - - - (57,716 ) Total

operating expenses 485,829 490,586 983,549

923,383 Income from operations 174,494 135,529 292,110

243,049 Interest expense, net (56,281 ) (55,685 ) (110,870 )

(134,922 ) Loss on debt extinguishment (481 ) (1,323 ) (1,486 )

(33,127 ) Pension and other postretirement plans credit, net 2,950

3,156 5,900 5,787 Other expenses (812 ) (900 )

(939 ) (1,007 ) Income before income taxes 119,870 80,777

184,715 79,780 Income tax expense (33,264 ) (32,322 )

(50,768 ) (26,381 ) Net income 86,606 48,455 133,947

53,399 Net loss (income) attributable to noncontrolling interests

1,126 (4,463 ) 1,907 (3,358 ) Net

income attributable to Nexstar $ 87,732 $ 43,992 $ 135,854 $ 50,041

Net income per common share attributable to Nexstar Media

Group, Inc.: Basic $ 1.92 $ 0.94 $ 2.96 $ 1.10 Diluted $ 1.86 $

0.91 $ 2.87 $ 1.07 Weighted average number of common shares

outstanding: Basic 45,631 46,931 45,852 45,573 Diluted 47,147

48,195 47,414 46,815 Dividends declared per common share $

0.375 $ 0.30 $ 0.75 $ 0.60

Nexstar Media Group, Inc.

Reconciliation of Broadcast Cash Flow

and Adjusted EBITDA (Non-GAAP Measures)

UNAUDITED (in thousands)

Three Months Ended June

30,

Six Months Ended June

30,

Broadcast Cash Flow and Adjusted EBITDA: 2018

2017 2018 2017 Net income $

86,606 $ 48,455 $ 133,947 $ 53,399 Add (Less): Interest

expense, net 56,281 55,685 110,870 134,922 Loss on extinguishment

of debt 481 1,323 1,486 33,127 Income tax expense 33,264 32,322

50,768 26,381 Depreciation 25,090 26,292 50,904 48,518 Amortization

of intangible assets 37,181 38,557 73,483 86,715 Amortization of

broadcast rights, excluding barter 15,913 15,761 32,013 29,997 Gain

on asset disposal, net (332 ) (973 ) (391 ) (58,595 ) Corporate

expenses 27,384 27,914 53,727 94,944 Other expense 812 900 939

1,007 Pension and other postretirement plans credit, net (2,950 )

(3,156 ) (5,900 ) (5,787 ) Reimbursement from the FCC related to

station repack (5,697 ) - (7,061 ) - Payments for broadcast rights

(16,538 ) (16,144 ) (32,787 ) (29,479 )

Broadcast cash flow 257,495 226,936 461,998 415,149 Margin %

39.0 % 36.2 % 36.2 % 35.6 % Add (Less): Pension and other

postretirement plans credit, net 2,950 3,156 5,900 5,787 Corporate

expenses, excluding one-time transaction expenses (26,620 )

(21,808 ) (51,982 ) (41,036 ) Adjusted

EBITDA before one-time transaction expenses 233,825 208,284 415,916

379,900 Margin % 35.4 % 33.3 % 32.6 % 32.6 % Add (Less):

Corporate one-time transaction expenses (764 ) (6,106

) (1,745 ) (53,908 ) Adjusted EBITDA $ 233,061

$ 202,178 $ 414,171 $ 325,992 Margin % 35.3 % 32.3 % 32.5 % 27.9 %

Nexstar Media Group, Inc.

Reconciliation of Free Cash Flow

(Non-GAAP Measure)

UNAUDITED (in thousands)

Three Months Ended June

30,

Six Months Ended June

30,

Free Cash Flow: 2018 2017 2018

2017 Net income $ 86,606 $ 48,455 $ 133,947 $

53,399 Add (Less): Interest expense, net 56,281 55,685

110,870 134,922 Loss on extinguishment of debt 481 1,323 1,486

33,127 Income tax expense 33,264 32,322 50,768 26,381 Depreciation

25,090 26,292 50,904 48,518 Amortization of intangible assets

37,181 38,557 73,483 86,715 Amortization of broadcast rights,

excluding barter 15,913 15,761 32,013 29,997 Gain on asset

disposal, net (332 ) (973 ) (391 ) (58,595 ) Non-cash compensation

expense 673 - 1,233 - Stock-based compensation expense 8,195 6,499

14,595 11,309 Corporate one-time transaction expenses 764 6,106

1,745 53,908 Other expense 812 900 939 1,007 Payments for broadcast

rights (16,538 ) (16,144 ) (32,787 ) (29,479 ) Cash interest

expense(1) (53,670 ) (53,218 ) (105,633 ) (110,190 ) Capital

expenditures, excluding station repack and CVR spectrum(2) (13,514

) (14,181 ) (28,167 ) (27,691 ) Capital expenditures related to

station repack (1,471 ) - (6,895 ) - Proceeds from disposals of

property and equipment 1,027 14,171 3,874 14,575 Operating cash

income taxes, net of refunds(3) (31,836 ) (16,434 )

(30,611 ) (20,039 ) Free cash flow before

one-time transaction expenses 148,926 145,121 271,373 247,864

Add (Less): Corporate one-time transaction expenses

(764 ) (6,106 ) (1,745 ) (53,908 ) Free

cash flow $ 148,162 $ 139,015 $ 269,628 $ 193,956

(1) Excludes payments of $19.6 million in one-time fees in

January 2017 associated with the financing of the Company’s merger

with Media General.

(2) During the three and six months ended June 30, 2018, capital

expenditures related to relinquishment of the CVR spectrum were

$0.3 million and $1.3 million, respectively.

(3) Excludes the payment of $2.2 million in taxes during the

three months ended June 30, 2018 related to tax liabilities assumed

in an acquisition.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180808005123/en/

Nexstar Media Group, Inc.Thomas E. Carter, 972-373-8800Chief

Financial OfficerorJCIRJoseph Jaffoni, Jennifer Neuman,

212-835-8500nxst@jcir.com

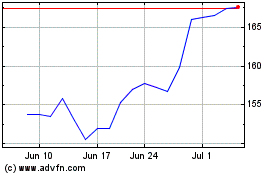

Nexstar Media (NASDAQ:NXST)

Historical Stock Chart

From Mar 2024 to Apr 2024

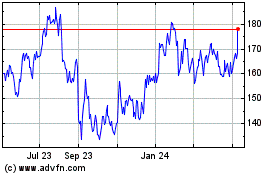

Nexstar Media (NASDAQ:NXST)

Historical Stock Chart

From Apr 2023 to Apr 2024