USD Partners LP (NYSE: USDP) (the “Partnership”) announced today

its operating and financial results for the three and six months

ended June 30, 2018. Financial highlights with respect to the

second quarter of 2018 include the following:

- Generated Net Cash Provided by

Operating Activities of $11.5 million, Adjusted EBITDA of $15.0

million and Distributable Cash Flow of $12.2 million

- Reported Net Income of $6.7

million

- Increased quarterly cash distribution

to $0.3550 per unit ($1.42 per unit on an annualized basis),

representing an increase of 4.4% over the second quarter of

2017

- Ended quarter with $203.9 million of

available liquidity and distribution coverage of approximately

1.3x

“We are proud to announce another successful quarter at the

Partnership. During the quarter, the Partnership announced the

execution of an early extension with one of its investment grade

customers at the Hardisty Terminal as well as the thirteenth

consecutive increase of its quarterly distribution, which was

supported by strong distribution coverage of approximately 1.3x,”

said Dan Borgen, the Partnership’s Chief Executive Officer. “Our

customers’ interest in negotiating extended, long-term commitments

at Hardisty well in advance of their existing contract expirations

strongly validates our strategic commercial vision, and we look

forward to updating the market with continued progress in the near

future.”

Recent Commercial Developments

On June 26, 2018, the Partnership announced that it had entered

into a multi-year renewal and extension of approximately 25% of the

capacity at its Hardisty rail terminal with one of its existing

investment grade customers. The renewal contains consistent

take-or-pay terms with minimum monthly payments and rates that

exceed those of the original terminalling services agreement.

As previously mentioned, customer activity at the Hardisty

origination terminal has increased substantially over the last

several months. Current market demand for the services provided at

the Hardisty terminal exceeds the available capacity, as

substantially all of the terminal’s capacity was previously

contracted by customers under multi-year agreements through

mid-2019 or mid-2020. As a result, the Partnership’s sponsor is

evaluating a potential expansion to meet customer demand. The

Partnership is also actively negotiating with current customers to

extend the terms of their existing take-or-pay agreements.

On June 7, 2018, USD Group LLC (“USDG”) and the Partnership

announced that USDG had executed a five-year, take-or-pay

terminalling services agreement with a high quality refiner

customer. The agreement is for trans-loading capacity at the

Hardisty rail terminal with an expected start date in late 2018.

This new agreement could support the construction of additional

capacity at the Hardisty terminal pursuant to USDG’s existing

development rights.

Second Quarter 2018 Liquidity, Operational and Financial

Results

Substantially all of the Partnership’s cash flows are generated

from multi-year, take-or-pay terminalling services agreements

related to its crude oil terminals, which include minimum monthly

commitment fees. The Partnership’s customers include major

integrated oil companies, refiners and marketers, the majority of

which are investment-grade rated.

The Partnership’s results during the second quarter of 2018

relative to the same quarter in 2017 were primarily influenced by

additional revenues and costs related to the commencement of

operations at the Stroud terminal in October 2017 and the

conclusion of customer agreements at the Partnership’s San Antonio

facility in May 2017 and its Casper terminal in August 2017. In

addition, as a result of a substantial increase in customer

activity at its Hardisty terminal, the Partnership incurred

additional operating costs during the second quarter of 2018.

Net Cash Provided by Operating Activities increased by 21%

relative to the second quarter of 2017, primarily due to the timing

of receipts and payments on accounts receivable, accounts payable

and deferred revenue balances.

Adjusted EBITDA decreased by 3% and Distributable Cash Flow

increased by 2% relative to the second quarter of 2017.

Net income for the quarter decreased by 22% as compared to the

second quarter of 2017, primarily as a result of a decrease in the

Partnership’s estimated benefit from income taxes of approximately

$1.4 million.

As of June 30, 2018, the Partnership had total available

liquidity of $203.9 million, including $8.9 million of unrestricted

cash and cash equivalents and undrawn borrowing capacity of $195.0

million on its $400.0 million senior secured credit facility,

subject to continued compliance with financial covenants. The

Partnership is in compliance with its financial covenants and has

no maturities under its senior secured credit facility until

October 2019.

On July 27, 2018, the Partnership declared a quarterly cash

distribution of $0.3550 per unit ($1.42 per unit on an annualized

basis), which represents growth of 0.7% relative to the first

quarter of 2018 and 4.4% relative to the second quarter of 2017.

The distribution is payable on August 14, 2018, to unitholders of

record at the close of business on August 7, 2018.

Effective January 1, 2018, the Partnership adopted the

requirements of Accounting Standards Update 2014-09, or ASC 606,

which provides a single comprehensive model for entities to use in

accounting for revenue arising from contracts with customers. The

Partnership adopted ASC 606 by applying the full retrospective

approach, resulting in the restatement of prior period financial

statements to comply with the new standard.

Second Quarter 2018 Conference Call Information

The Partnership will host a conference call and webcast

regarding second quarter 2018 results at 11:00 a.m. Eastern Time

(10:00 a.m. Central Time) on Tuesday, August 7, 2018.

To listen live over the Internet, participants are advised to

log on to the Partnership’s website at www.usdpartners.com and

select the “Events & Presentations” sub-tab under the

“Investors” tab. To join via telephone, participants may dial (877)

266-7551 domestically or +1 (339) 368-5209 internationally,

conference ID 7588437. Participants are advised to dial in at least

five minutes prior to the call.

An audio replay of the conference call will be available for

thirty days by dialing (800) 585-8367 domestically or +1 (404)

537-3406 internationally, conference ID 7588437. In addition, a

replay of the audio webcast will be available by accessing the

Partnership's website after the call is concluded.

About USD Partners LP

USD Partners LP is a fee-based, growth-oriented master limited

partnership formed in 2014 by US Development Group, LLC (“USDG”) to

acquire, develop and operate midstream infrastructure and

complementary logistics solutions for crude oil, biofuels and other

energy-related products. The Partnership generates substantially

all of its operating cash flows from multi-year, take-or-pay

contracts with primarily investment grade customers, including

major integrated oil companies and refiners. The Partnership’s

principal assets include a network of crude oil terminals that

facilitate the transportation of heavy crude oil from Western

Canada to key demand centers across North America. The

Partnership’s operations include railcar loading and unloading,

storage and blending in on-site tanks, inbound and outbound

pipeline connectivity, truck transloading, as well as other related

logistics services. In addition, the Partnership provides customers

with leased railcars and fleet services to facilitate the

transportation of liquid hydrocarbons and biofuels by rail.

USDG, which owns the general partner of USD Partners LP, is

engaged in designing, developing, owning, and managing large-scale

multi-modal logistics centers and energy-related infrastructure

across North America. USDG solutions create flexible market access

for customers in significant growth areas and key demand centers,

including Western Canada, the U.S. Gulf Coast and Mexico. Among

other projects, USDG is currently pursuing the development of a

premier energy logistics terminal on the Houston Ship Channel with

capacity for substantial tank storage, multiple docks (including

barge and deepwater), inbound and outbound pipeline connectivity,

as well as a rail terminal with unit train capabilities. For

additional information, please visit texasdeepwater.com.

Non-GAAP Financial Measures

The Partnership defines Adjusted EBITDA as Net Cash Provided by

Operating Activities adjusted for changes in working capital items,

interest, income taxes, foreign currency transaction gains and

losses, and other items which do not affect the underlying cash

flows produced by the Partnership’s businesses. Adjusted EBITDA is

a non-GAAP, supplemental financial measure used by management and

external users of the Partnership’s financial statements, such as

investors and commercial banks, to assess:

- the Partnership’s liquidity and the

ability of the Partnership’s businesses to produce sufficient cash

flows to make distributions to the Partnership’s unitholders;

and

- the Partnership’s ability to incur and

service debt and fund capital expenditures.

The Partnership defines Distributable Cash Flow, or DCF, as

Adjusted EBITDA less net cash paid for interest, income taxes and

maintenance capital expenditures. DCF does not reflect changes in

working capital balances. DCF is a non-GAAP, supplemental financial

measure used by management and by external users of the

Partnership’s financial statements, such as investors and

commercial banks, to assess:

- the amount of cash available for making

distributions to the Partnership’s unitholders;

- the excess cash flow being retained for

use in enhancing the Partnership’s existing business; and

- the sustainability of the Partnership’s

current distribution rate per unit.

The Partnership believes that the presentation of Adjusted

EBITDA and DCF in this press release provides information that

enhances an investor's understanding of the Partnership’s ability

to generate cash for payment of distributions and other purposes.

The GAAP measure most directly comparable to Adjusted EBITDA and

DCF is Net Cash Provided by Operating Activities. Adjusted EBITDA

and DCF should not be considered alternatives to Net Cash Provided

by Operating Activities or any other measure of liquidity presented

in accordance with GAAP. Adjusted EBITDA and DCF exclude some, but

not all, items that affect Net Cash Provided by Operating

Activities and these measures may vary among other companies. As a

result, Adjusted EBITDA and DCF may not be comparable to similarly

titled measures of other companies.

Cautionary Note Regarding Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of U.S. federal securities laws, including statements

with respect to the amount and timing of the Partnership’s second

quarter 2018 cash distribution, as well as statements regarding

production growth in Western Canada, demand for rail takeaway

capacity in Western Canada and the Partnership’s ability to meet

that demand, the Partnership’s ability to achieve long-term

contracts and contract renewals and the ability of the

Partnership’s Sponsor to commercialize and develop expansion

capacity at the Hardisty terminal. Words and phrases such as “is

expected,” “is planned,” “believes,” “projects,” and similar

expressions are used to identify such forward-looking statements.

However, the absence of these words does not mean that a statement

is not forward-looking. Forward-looking statements relating to the

Partnership are based on management’s expectations, estimates and

projections about the Partnership, its interests and the energy

industry in general on the date this press release was issued.

These statements are not guarantees of future performance and

involve certain risks, uncertainties and assumptions that are

difficult to predict. Therefore, actual outcomes and results may

differ materially from what is expressed or forecast in such

forward-looking statements. Factors that could cause actual results

or events to differ materially from those described in the

forward-looking statements include those as set forth under the

heading “Risk Factors” in the Partnership’s most recent Annual

Report on Form 10-K and in our subsequent filings with the

Securities and Exchange Commission. The Partnership is under no

obligation (and expressly disclaims any such obligation) to update

or alter its forward-looking statements, whether as a result of new

information, future events or otherwise.

USD Partners LP

Consolidated Statements of

Income

For the Three and Six Months Ended June 30, 2018 and 2017

(unaudited)

For the Three Months Ended For the Six Months

Ended June 30, June 30,

2018

2017

2018

2017

(in thousands)

Revenues Terminalling services $ 22,169 $

21,981 $ 43,832 $ 45,658 Terminalling services — related party

5,003 2,614 9,699 4,354 Fleet leases — 643 — 1,286 Fleet leases —

related party 983 891 1,967 1,781 Fleet services 81 467 425 935

Fleet services — related party 228 279 455 558 Freight and other

reimbursables 1,111 208 2,928 365 Freight and other reimbursables —

related party 2 — 4

1

Total revenues 29,577

27,083 59,310

54,938 Operating costs Subcontracted rail

services 3,311 1,795 6,373 3,808 Pipeline fees 5,118 5,109 10,842

10,829 Fleet leases 987 1,534 1,977 3,067 Freight and other

reimbursables 1,113 208 2,932 366 Operating and maintenance 1,169

594 2,193 1,301 Selling, general and administrative 2,455 2,362

5,449 4,677 Selling, general and administrative — related party

1,917 1,396 3,747 2,828 Depreciation and amortization 5,260

4,969 10,536 9,910

Total operating costs 21,330

17,967 44,049

36,786 Operating income 8,247

9,116 15,261 18,152 Interest expense 2,713

2,513 5,198 5,120 Loss (gain) associated with derivative

instruments (386 ) 401 (1,410 ) 612 Foreign currency transaction

loss (gain) 117 (100 ) (94 ) (70 ) Other expense (income), net

1 (3 ) 72 (13 )

Income before income taxes

5,802 6,305 11,495 12,503 Benefit from

income taxes (910 ) (2,336 ) (1,817 )

(1,201 )

Net income $ 6,712 $

8,641 $ 13,312 $

13,704 USD Partners LP

Consolidated Statements of Cash Flows For the Three and

Six Months Ended June 30, 2018 and 2017 (unaudited)

For the

Three Months Ended For the Six Months Ended June

30, June 30,

2018

2017

2018

2017

(in thousands)

Cash flows from operating activities:

Net income $ 6,712 $ 8,641 $ 13,312 $ 13,704 Adjustments to

reconcile net income to net cash provided by operating activities:

Depreciation and amortization 5,260 4,969 10,536 9,910 Loss (gain)

associated with derivative instruments (386 ) 401 (1,410 ) 612

Settlement of derivative contracts — 91 (38 ) 390 Unit based

compensation expense 1,558 1,218 2,895 2,016 Other (1,031 ) 570

(2,035 ) 802 Changes in operating assets and liabilities: Accounts

receivable 5,735 (459 ) (2,614 ) (424 ) Accounts receivable —

related party (2,593 ) (34 ) (1,380 ) 179 Prepaid expenses,

inventory and other assets (2,299 ) (2,947 ) (2,460 ) (1,065 )

Other assets — related party 20 — 40 — Accounts payable and accrued

expenses 1,752 (1,409 ) 865 (1,316 ) Accounts payable and accrued

expenses — related party 2,491 (77 ) 2,113 230 Deferred revenue and

other liabilities (5,760 ) (2,428 ) (261 ) (3,666 ) Deferred

revenue — related party 25 929

25 929 Net cash provided by operating

activities

11,484 9,465

19,588 22,301 Cash

flows from investing activities: Additions of property and

equipment (124 ) (25,647 ) (202 ) (25,773 ) Proceeds from the sale

of assets — — 236

— Net cash provided by (used in) investing activities

(124 ) (25,647 )

34 (25,773 ) Cash flows from

financing activities: Distributions (9,904 ) (8,239 ) (19,593 )

(16,142 ) Vested phantom units used for payment of participant

taxes — (2 ) (1,346 ) (1,072 ) Net proceeds from issuance of common

units — 33,700 — 33,700 Proceeds from long-term debt 9,000 35,000

18,000 40,000 Repayments of long-term debt (7,000 )

(41,000 ) (15,000 ) (57,342 ) Net cash provided by

(used in) financing activities

(7,904 )

19,459 (17,939 )

(856 ) Effect of exchange rates on cash (175 )

98 (853 ) 247

Net change in cash, cash equivalents and

restricted cash

3,281 3,375 830 (4,081 ) Cash, cash equivalents and restricted cash

– beginning of period 11,337 9,682

13,788 17,138 Cash, cash equivalents

and restricted cash – end of period

$ 14,618

$ 13,057 $ 14,618

$ 13,057 USD Partners LP

Consolidated Balance Sheets (unaudited)

June 30, December 31, 2018

2017 ASSETS (in thousands) Current assets Cash and

cash equivalents $ 8,926 $ 7,874 Restricted cash 5,692 5,914

Accounts receivable, net 6,727 4,171 Accounts receivable — related

party 899 410 Prepaid expenses 2,190 2,545 Inventory 2,783 — Other

current assets 1,684 226 Other current assets — related party

79 79 Total current assets 28,980

21,219 Property and equipment, net 139,603 146,573 Intangible

assets, net 93,009 99,312 Goodwill 33,589 33,589 Other non-current

assets 136 145 Other non-current assets — related party 134

174

Total assets $

295,451 $ 301,012

LIABILITIES AND PARTNERS’ CAPITAL Current liabilities

Accounts payable and accrued expenses $ 3,530 $ 2,670 Accounts

payable and accrued expenses — related party 1,042 244

Deferred revenue

2,913 3,291

Deferred revenue — related party

1,940 1,986

Other current liabilities

2,614 2,339 Total current liabilities

12,039 10,530 Long-term debt, net 204,057 200,627 Deferred income

tax liability, net 1,823 4,490

Other non-current liabilities

416 475

Total liabilities

218,335 216,122 Commitments and

contingencies Partners’ capital Common units 114,822 136,645 Class

A units 950 1,468 Subordinated units (37,797 ) (55,237 ) General

partner units 95 180 Accumulated other comprehensive income (loss)

(954 ) 1,834

Total partners’ capital

77,116 84,890 Total

liabilities and partners’ capital $ 295,451

$ 301,012 USD Partners

LP GAAP to Non-GAAP Reconciliations For the Three and

Six Months Ended June 30, 2018 and 2017 (unaudited)

For the

Three Months Ended For the Six Months Ended June

30, June 30, 2018 2017 2018

2017 (in thousands)

Net cash provided by operating

activities $ 11,484 $ 9,465

$ 19,588 $ 22,301 Add (deduct):

Amortization of deferred financing costs (215 ) (215 ) (430 ) (430

) Deferred income taxes 1,248 (346 ) 2,538 (354 ) Changes in

accounts receivable and other assets (863 ) 3,440 6,414 1,310

Changes in accounts payable and accrued expenses (4,243 ) 1,486

(2,978 ) 1,086 Changes in deferred revenue and other liabilities

5,735 1,499 236 2,737 Interest expense, net 2,713 2,513 5,198 5,116

Benefit from income taxes (910 ) (2,336 ) (1,817 ) (1,201 ) Foreign

currency transaction loss (gain) (1) 117 (100 ) (94 ) (70 ) Other

income — (6 ) — (21 ) Non-cash contract asset (2) (52 )

— (103 ) —

Adjusted

EBITDA 15,014 15,400 28,552 30,474

Add (deduct): Cash paid for income taxes (3) (267 ) (798 ) (449 )

(1,414 ) Cash paid for interest (2,530 ) (2,575 ) (4,821 ) (4,937 )

Maintenance capital expenditures (31 ) (72 )

(80 ) (198 )

Distributable cash flow $

12,186 $ 11,955 $

23,202 $ 23,925 (1)

Represents foreign exchange transaction amounts associated

with activities between the Partnership's U.S. and Canadian

subsidiaries. (2) Represents the change in non-cash contract assets

associated with revenue recognized in advance at blended rates

based on the escalation clauses in certain of the Partnership's

agreements. (3) Includes a partial refund of $0.7 million

(representing C$0.9 million) received in the three months ended

March 31, 2017, for the Partnership's 2015 foreign income taxes.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180806005644/en/

USD Partners LPAdam Altsuler, 281-291-3995Senior Vice

President, Chief Financial Officeraaltsuler@usdg.comorJennifer

Waller, 832-991-8383Financial Reporting Managerjwaller@usdg.com

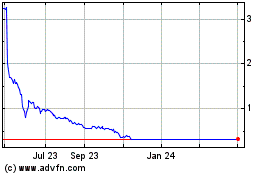

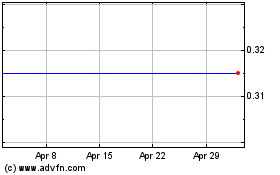

USD Partners (NYSE:USDP)

Historical Stock Chart

From Mar 2024 to Apr 2024

USD Partners (NYSE:USDP)

Historical Stock Chart

From Apr 2023 to Apr 2024