Stocks Fall as Tariff Jitters Build -- WSJ

August 02 2018 - 3:02AM

Dow Jones News

By Danielle Chemtob and Ben St. Clair

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (August 2, 2018).

The S&P 500 and Dow Jones Industrial Average edged lower

Wednesday as losses in energy and industrial shares offset a

rebound in technology stocks.

Shares of industrial companies lost ground after reports said

administration advisers were urging President Trump to sharply

increase tariffs against China , renewing fears among investors

that global trade frictions could hit the markets.

Heavy-equipment maker Caterpillar lost $5.26, or 3.7%, to

$138.54, while Boeing fell 3.54, or 1%, to 352.76.

"The longer this goes on, the more the market is going to have

to start pricing in the reality that earnings could be hit," said

Tim Courtney, chief investment officer of Exencial Wealth

Advisors.

The Dow industrials lost 81.37 points, or 0.3%, to 25333.82,

erasing gains after rising as much as 75 points earlier in the

session. The S&P 500 fell 2.93 points, or 0.1%, to 2813.36,

notching its fourth loss in five trading days, and the Nasdaq

Composite added 35.50 points, or 0.5%, to 7707.29.

Despite renewed trade worries, strong U.S. economic data and

corporate earnings have helped many U.S. investors remain

cautiously optimistic.

The S&P 500 technology sector gained 1% Wednesday on the

heels of a strong earnings report from Apple. The iPhone maker's

shares rose 11.21, or 5.9%, to a fresh high of 201.50 after the

company reported resilient demand for high-price iPhones and record

revenue from its services business.

"Investors overall are at a place where they know tech long-term

continues to be a great place to be," said Rich Guerrini, president

and chief executive of PNC Investments. "I think they are certainly

taking some of these dips as opportunities, which is why we're not

seeing movement in any one given direction."

Still, other tech companies have posted disappointing earnings,

and concerns over future user growth have weighed down the sector,

sending Facebook and Twitter shares tumbling recently.

While many investors are still attracted to the growth potential

of technology companies, others are beginning to rotate into other

areas of the stock market, said Bryan Keller, managing partner at

Dakota Wealth Management.

Meanwhile, declines in the energy sector also weighed on stocks,

with shares of energy firms in the S&P 500 falling 1.3% after

data showed an unexpected rise in U.S. crude stockpiles.

Elsewhere, the Stoxx Europe 600 edged down 0.5%. The Shanghai

Composite dropped 1.8% while Hong Kong's Hang Seng fell 0.8%.

(END) Dow Jones Newswires

August 02, 2018 02:47 ET (06:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

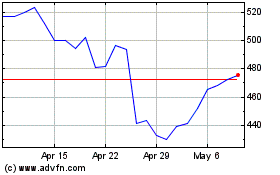

Meta Platforms (NASDAQ:META)

Historical Stock Chart

From Mar 2024 to Apr 2024

Meta Platforms (NASDAQ:META)

Historical Stock Chart

From Apr 2023 to Apr 2024