Sturm, Ruger & Company, Inc. (NYSE-RGR) announced today that

for the second quarter of 2018 the Company reported net sales of

$128.4 million and diluted earnings of 86¢ per share, compared with

net sales of $131.9 million and diluted earnings of 57¢ per share

in the second quarter of 2017.

For the six months ended June 30, 2018, net sales were $259.6

million and diluted earnings were $1.68 per share. For the

corresponding period in 2017, net sales were $299.2 million and

diluted earnings were $1.79 per share.

The Company also announced today that its Board of Directors

declared a dividend of 34¢ per share for the second quarter for

stockholders of record as of August 17, 2018, payable on August 31,

2018. This dividend varies every quarter because the Company pays a

percentage of earnings rather than a fixed amount per share. This

dividend is approximately 40% of net income.

Chief Executive Officer Christopher J. Killoy made the following

observations related to the Company’s 2018 second quarter

performance:

- In the second quarter of 2018, net

sales decreased 3% and earnings per share increased 51% from the

second quarter of 2017. In addition to improved operating

performance, earnings per share benefitted by the following:

- Effective January 1, 2018, the Company

adopted Accounting Standards Update 2014-09, Revenue from Contracts

with Customers (Topic 606), which modified the timing of revenue

recognition related to certain sales promotion activities involving

the shipment of no charge firearms. Consequently, net sales in the

second quarter of 2018 were increased by $2.6 million. As a result,

quarterly diluted earnings per share was increased by approximately

5¢.

- The reduced effective tax rate in 2018,

resulting from the Tax Cuts and Job Act of 2017, increased the

quarterly diluted earnings per share by 12¢.

- The repurchase of 1.3 million shares of

common stock in 2017 increased the quarterly diluted earnings per

share by 6¢.

- Sales of new products, including the

Pistol Caliber Carbine, the Mark IV pistol, the LCP II pistol, the

EC9s pistol, the Security-9 pistol, and the Precision Rimfire

Rifle, represented $75.5 million or 29% of firearm sales in the

first half of 2018. New product sales include only major new

products that were introduced in the past two years.

- The estimated unit sell-through of the

Company’s products from the independent distributors to retailers

decreased 1% in the first half of 2018 from the comparable prior

year period. For the same period, the National Instant Criminal

Background Check System background checks (as adjusted by the

National Shooting Sports Foundation) decreased 3%. The slight

decrease in estimated sell-through of the Company’s products from

the independent distributors to retailers is attributable to

decreased overall consumer demand in the first half of 2018,

partially offset by increased demand for some of the Company’s

recently introduced products.

- During the second quarter of 2018, the

Company’s finished goods inventory increased by 3,700 units and

distributor inventories of the Company’s products increased by

30,400 units. However, the Company’s finished goods inventory and

the distributor inventories have decreased 67% and 25%,

respectively, from the 2017 second quarter.

- Cash generated from operations during

the first half of 2018 was $81 million. At June 30, 2018, our cash

totaled $132 million. Our current ratio is 3.3 to 1 and we have no

debt.

- In the first half of 2018, capital

expenditures totaled $2 million. We expect our 2018 capital

expenditures to total approximately $10 million.

- In the first half of 2018, the Company

returned $10 million to its shareholders through the payment of

dividends.

- At June 30, 2018, stockholders’ equity

was $249 million, which equates to a book value of $14.29 per

share, of which $7.54 per share is cash.

Today, the Company filed its Quarterly Report on Form 10-Q. The

financial statements included in this Quarterly Report on Form 10-Q

are attached to this press release.

Tomorrow, August 2, 2018, Sturm, Ruger will host a webcast at

9:00 a.m. ET to discuss the second quarter operating results.

Interested parties can access the webcast at Ruger.com/corporate or

by dialing 855-871-7398, participant

code 2195388.

The Quarterly Report on Form 10-Q is available on the SEC

website at SEC.gov and the Ruger website at Ruger.com/corporate.

Investors are urged to read the complete Quarterly Report on Form

10-Q to ensure that they have adequate information to make informed

investment judgments.

About Sturm, Ruger & Co.,

Inc.

Sturm, Ruger & Co., Inc. is one of the nation's leading

manufacturers of rugged, reliable firearms for the commercial

sporting market. As a full-line manufacturer of American-made

firearms, Ruger offers consumers over 600 variations of more than

40 product lines. For more than 60 years, Ruger has been a model of

corporate and community responsibility. Our motto, “Arms Makers for

Responsible Citizens®,” echoes the importance of these principles

as we work hard to deliver quality and innovative firearms.

The Company may, from time to time, make forward-looking

statements and projections concerning future expectations. Such

statements are based on current expectations and are subject to

certain qualifying risks and uncertainties, such as market demand,

sales levels of firearms, anticipated castings sales and earnings,

the need for external financing for operations or capital

expenditures, the results of pending litigation against the

Company, the impact of future firearms control and environmental

legislation, and accounting estimates, any one or more of which

could cause actual results to differ materially from those

projected. Readers are cautioned not to place undue reliance on

these forward-looking statements, which speak only as of the date

made. The Company undertakes no obligation to publish revised

forward-looking statements to reflect events or circumstances after

the date such forward-looking statements are made or to reflect the

occurrence of subsequent unanticipated events.

STURM, RUGER & COMPANY, INC. CONDENSED

CONSOLIDATED BALANCE SHEETS

(Dollars in thousand)

June 30, 2018 December 31, 2017

Assets Current Assets Cash $ 131,711 $

63,487 Trade receivables, net 50,138 60,082 Gross

inventories 71,104 87,592 Less LIFO reserve (45,097 ) (45,180 )

Less excess and obsolescence reserve (1,994 )

(2,698 ) Net inventories 24,013

39,714 Prepaid expenses and other current

assets 2,597 3,501 Total

Current Assets 208,459 166,784 Property, plant and equipment

360,554 365,013 Less allowances for depreciation

(270,576 ) (261,218 ) Net property, plant and

equipment 89,978 103,795

Other assets 14,321

13,739 Total Assets $ 312,758 $ 284,318

STURM, RUGER & COMPANY, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS (Continued)

(Dollars in thousands, except per share

data)

June 30, 2018 December 31, 2017

Liabilities and Stockholders’ Equity

Current Liabilities Trade accounts payable and accrued expenses $

28,900 $ 32,422 Contract liabilities with customers (Note 3) 6,674

- Product liability 813 729 Employee compensation and benefits

19,755 14,315 Workers’ compensation 4,997 5,211 Income taxes

payable 1,221 - Total

Current Liabilities 62,360 52,677 Product liability 78 90

Deferred income taxes 889 1,402 Contingent liabilities - -

Stockholders’ Equity Common Stock, non-voting, par

value $1: Authorized shares 50,000; none issued - - Common Stock,

par value $1: Authorized shares – 40,000,000 2018 – 24,123,418

issued, 17,458,020 outstanding 2017 – 24,092,488 issued, 17,427,090

outstanding 24,123 24,092 Additional paid-in capital 30,150 28,329

Retained earnings 338,753 321,323 Less: Treasury stock – at cost

2018 – 6,665,398 shares 2017 – 6,665,398 shares

(143,595 ) (143,595 ) Total Stockholders’ Equity

249,431 230,149 Total

Liabilities and Stockholders’ Equity $ 312,758

$ 284,318 STURM, RUGER & COMPANY, INC.

CONDENSED CONSOLIDATED STATEMENTS OF

INCOME AND COMPREHENSIVE INCOME

(UNAUDITED)

(Dollars in thousands, except per share

data)

Three Months Ended Six Months Ended

June 30,2018

July 1,2017

June 30,2018

July 1,2017

Net firearms sales $ 127,017 $ 130,510 $

256,899 $ 296,876 Net castings sales 1,394

1,344 2,670

2,334 Total net sales 128,411 131,854 259,569 299,210

Cost of products sold 91,812 96,908 187,150 208,511

Gross profit

36,599 34,946

72,419 90,699 Operating

expenses: Selling 9,785 12,505 18,123 26,044 General and

administrative 7,446 7,145

16,332 15,488

Total operating expenses 17,231

19,650 34,455 41,532

Operating income 19,368

15,296 37,964

49,167 Other income: Interest expense, net (22 ) (32

) (49 ) (66 ) Other income, net 703

426 1,035 780

Total other income, net 681

394 986 714

Income before income taxes 20,049 15,690 38,950 49,881

Income taxes 4,860 5,491

9,497 17,458

Net income and comprehensive income $ 15,189

$ 10,199 $ 29,453 $ 32,423

Basic earnings per share $ 0.87

$ 0.58 $ 1.69 $ 1.81

Diluted earnings per share $ 0.86 $ 0.57

$ 1.68 $ 1.79 Cash

dividends per share $ 0.32 $ 0.48

$ 0.55 $ 0.92 STURM,

RUGER & COMPANY, INC. CONDENSED CONSOLIDATED STATEMENTS

OF CASH FLOWS (UNAUDITED)

(Dollars in thousands)

Six Months Ended June 30, 2018

July 1, 2017 Operating Activities Net income $ 29,453 $

32,423 Adjustments to reconcile net income to cash provided by

operating activities: Depreciation and amortization 16,344 18,653

Slow moving inventory valuation adjustment (348 ) 321 Stock-based

compensation 2,668 1,643 (Gain) loss on sale of assets (4 ) 31

Deferred income taxes (513 ) 428 Changes in operating assets and

liabilities: Trade receivables 9,944 13,880 Inventories 16,049

1,973 Trade accounts payable and accrued expenses (3,736 ) (14,158

) Contract liability to customers 4,447 - Employee compensation and

benefits 5,242 (10,612 ) Product liability 73 (305 ) Prepaid

expenses, other assets and other liabilities 155 (4,704 ) Income

taxes payable 1,221 333

Cash provided by operating activities 80,995

39,906 Investing Activities Property,

plant and equipment additions (2,360 ) (10,875 ) Proceeds from sale

of assets 4 3 Cash used

for investing activities (2,356 )

(10,872 ) Financing Activities Remittance of taxes withheld

from employees related to share-based compensation (816 ) (2,482 )

Repurchase of common stock - (53,469 ) Dividends paid

(9,599 ) (16,255 ) Cash used for financing activities

(10,415 ) (72,206 ) Increase

(decrease) in cash and cash equivalents 68,224 (43,172 )

Cash and cash equivalents at beginning of period 63,487 87,126

Cash and cash equivalents at end

of period $ 131,711 $ 43,954

Non-GAAP Financial Measure

In an effort to provide investors with additional information

regarding its financial results, the Company refers to various

United States generally accepted accounting principles (“GAAP”)

financial measures and one non-GAAP financial measure, EBITDA,

which management believes provides useful information to investors.

This non-GAAP financial measure may not be comparable to similarly

titled financial measures being disclosed by other companies. In

addition, the Company believes that the non-GAAP financial measure

should be considered in addition to, and not in lieu of, GAAP

financial measures. The Company believes that EBITDA is useful to

understanding its operating results and the ongoing performance of

its underlying business, as EBITDA provides information on the

Company’s ability to meet its capital expenditure and working

capital requirements, and is also an indicator of profitability.

The Company believes that this reporting provides better

transparency and comparability to its operating results. The

Company uses both GAAP and non-GAAP financial measures to evaluate

the Company’s financial performance.

EBITDA is defined as earnings before interest, taxes, and

depreciation and amortization. The Company calculates its EBITDA by

adding the amount of interest expense, income tax expense, and

depreciation and amortization expenses that have been deducted from

net income back into net income, and subtracting the amount of

interest income that was included in net income from net

income.

Non-GAAP Reconciliation – EBITDA

EBITDA

(Unaudited, dollars in thousands)

Three Months Ended Six Months Ended

June 30,2018

July 1,2017

June 30,2018

July 1,2017

Net income $ 15,189 $ 10,199 $ 29,453 $ 32,423

Income tax expense 4,860 5,491 9,497 17,458 Depreciation and

amortization expense

8,172

9,326

16,344

18,653

Interest expense, net 22 32

49 66 EBITDA $ 28,243 $ 25,048

$ 55,343 $ 68,600

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180801005820/en/

Sturm, Ruger & Company, Inc.One Lacey PlaceSouthport, CT

06890www.ruger.com203-259-7843

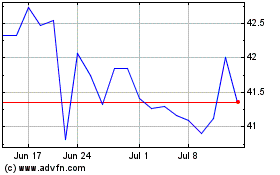

Sturm Ruger (NYSE:RGR)

Historical Stock Chart

From Mar 2024 to Apr 2024

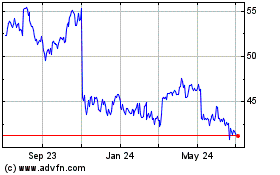

Sturm Ruger (NYSE:RGR)

Historical Stock Chart

From Apr 2023 to Apr 2024