CorEnergy Infrastructure Trust, Inc. (“CorEnergy” or the

“Company”) today announced financial results for the second

quarter, ended June 30, 2018.

Second Quarter Performance Summary

Second quarter financial highlights are as follows:

For the Three Months Ended June 30,

2018 Per Share Total Basic

Diluted Net Income (Attributable to Common

Stockholders)1 $ 5,413,974 $ 0.45 $ 0.45 NAREIT Funds from

Operations (NAREIT FFO)1 $ 11,553,145 $ 0.97 $ 0.89 Funds From

Operations (FFO)1 $ 12,213,745 $ 1.02 $ 0.94 Adjusted Funds From

Operations (AFFO)1 $ 12,348,559 $ 1.04 $ 0.93 Dividends Declared to

Common Stockholders $ 0.75

1 Management uses AFFO as a measure of long-term sustainable

operational performance. NAREIT FFO, FFO, and AFFO are non-GAAP

measures. Reconciliations of NAREIT FFO, FFO and AFFO, as

presented, to Net Income Attributable to CorEnergy Stockholders are

included at the end of this press release. See Note 1 for

additional information.

Recent Developments

- Maintained

dividend: Declared common stock dividend of $0.75 per share

for the second quarter 2018, in line with the previous eleven

quarterly dividends

- Pinedale LGS

participating rents: Continued receipt of participating

rents on the Pinedale LGS

- Grand Isle

Gathering System: Tenant, Energy XXI Gulf Coast, announced

acquisition by Cox Oil

- MoGas

Pipeline: Filed its FERC rate case on May 31, 2018

- Repurchase

Program: The Board of Directors authorized the repurchase of

up to $10 million of preferred stock over a period of 12 months,

effective August 6, 2018. Any such repurchase will be subject to

the covenants under our Credit Facility.

"The CorEnergy team was focused on portfolio management

activities during the second quarter. We filed a general rate case

with the FERC for our MoGas Pipeline and engaged in the evaluation

of prospects for the Grand Isle Gathering System,” said CorEnergy

President and CEO Dave Schulte. "Success of our stewardship is

exhibited in the $1.1 million of participating rents CorEnergy

received in the second quarter from the utilization of our Pinedale

Liquids Gathering System. We expect to use excess cash flows such

as these to reduce our leverage profile, and plan to implement

repurchases of preferred shares to accomplish that goal.”

Portfolio Update

Grand Isle Gathering System: On

June 18, 2018, the tenant of our GIGS asset, Energy XXI Gulf Coast,

announced a definitive agreement to be acquired by the privately

held Gulf of Mexico operator, Cox Oil, for approximately $322

million. The transaction is expected to close in the third quarter

2018 and is subject to stockholder approval. Since the announcement

of the acquisition, the Company and EGC have had no further

discussions about CorEnergy assisting EGC in its efforts to

generate adequate liquidity to fund further development.

Pinedale LGS: Despite actual and

forward Rockies gas prices pressuring Ultra Petroleum's earnings

and market capitalization, UPL continues to see promising results

from its horizontal drilling program in the Pinedale field. The

company plans to temporarily pause vertical well development and

focus drilling on horizontal wells, due to their superior economic

returns, and anticipates the development and drilling of 25 to 30

wells in 2018. Success in production resulted in utilization of the

Pinedale LGS at levels which resulted in $1.1 million of

participating rents in the second quarter.

MoGas Pipeline: On May 31, 2018,

MoGas filed a general rate case before the FERC. The proposed

change in rates seeks to recover increases in capital, operating

and maintenance expenditures incurred, mitigate decreased revenues

from certain customer contracts and reflect changes in the

corporate tax rate. The case is progressing as expected. MoGas

anticipates the proposed revenue requirements would be

approximately $20 million annually, and that the requested rates

will go into effect on December 1, 2018, subject to a refund upon

final ruling.

Outlook

CorEnergy regularly assesses its ability to pay and grow its

dividend to common stockholders above the current level of $0.75

per quarter. The Company targets long-term revenue growth of 1-3%

annually from existing contracts, through inflation-based and

participating rent adjustments, and additional growth from

acquisitions. There can be no assurance that any potential

acquisition opportunities will result in consummated

transactions.

Dividend Declaration

Common Stock: A second quarter 2018

dividend of $0.75 per share was declared for CorEnergy's common

stock. The dividend is payable on August 31, 2018, to stockholders

of record on August 17, 2018.

Preferred Stock: For the Company's

7.375% Series A Cumulative Redeemable Preferred Stock, a cash

dividend of $0.4609375 per depositary share was declared. The

preferred stock dividend, which equates to an annual dividend

payment of $1.84375 per depositary share, is payable on August 31,

2018, to stockholders of record on August 17, 2018.

Second Quarter Earnings Call

CorEnergy will host a conference call on Thursday, August

2, 2018, at 1:00 p.m. Central Time to discuss its

financial results. Please dial into the call at 877-407-8035 (for

international, 1-201-689-8035) approximately five to ten minutes

prior to the scheduled start time. The call will also be webcast in

a listen-only format. A link to the webcast will be accessible at

corenergy.reit.

A replay of the call will be available until 1:00 p.m.

Central Time on November 2, 2018 by dialing 877-481-4010 (for

international, 1-919-882-2331). The Conference ID is 34308. A

replay of the conference call will also be available on the

Company’s website.

About CorEnergy Infrastructure Trust, Inc.

CorEnergy Infrastructure Trust, Inc. (NYSE: CORR, CORRPrA), is a

real estate investment trust (REIT) that owns essential energy

assets, such as pipelines, storage terminals, and transmission and

distribution assets. We receive long-term contracted revenue from

operators of our assets, primarily under triple-net participating

leases. For more information, please visit corenergy.reit.

Forward-Looking Statements

This press release contains certain statements that may include

"forward-looking statements" within the meaning of Section 27A of

the Securities Act of 1933 and Section 21E of the Securities

Exchange Act of 1934. All statements, other than statements of

historical fact, included herein are "forward-looking statements."

Although CorEnergy believes that the expectations reflected in

these forward-looking statements are reasonable, they do involve

assumptions, risks and uncertainties, and these expectations may

prove to be incorrect. Actual results could differ materially from

those anticipated in these forward-looking statements as a result

of a variety of factors, including those discussed in CorEnergy’s

reports that are filed with the Securities and Exchange Commission.

You should not place undue reliance on these forward-looking

statements, which speak only as of the date of this press release.

Other than as required by law, CorEnergy does not assume a duty to

update any forward-looking statement. In particular, any

distribution paid in the future to our stockholders will depend on

the actual performance of CorEnergy, its costs of leverage and

other operating expenses and will be subject to the approval of

CorEnergy’s Board of Directors and compliance with leverage

covenants.

Notes

1NAREIT FFO represents net income (computed in accordance with

GAAP), excluding gains (or losses) from sales of depreciable

operating property, impairment losses of depreciable properties,

real estate-related depreciation and amortization (excluding

amortization of deferred financing costs or loan origination costs)

and other adjustments for unconsolidated partnerships and

non-controlling interests. Adjustments for non-controlling

interests are calculated on the same basis. FFO as we have

presented it here, is derived by further adjusting NAREIT FFO for

distributions received from investment securities, income tax

expense (benefit) from investment securities, net distributions and

dividend income and net realized and unrealized gain or loss on

other equity securities. CorEnergy defines AFFO as FFO Adjusted for

Securities Investment plus (gain) loss on extinguishment of debt,

provision for loan losses, net of tax, transaction costs,

amortization of debt issuance costs, amortization of deferred lease

costs, accretion of asset retirement obligation, income tax expense

(benefit) unrelated to securities investments, non-cash costs

associated with derivative instruments, and certain costs of a

nonrecurring nature, less maintenance, capital expenditures (if

any), amortization of debt premium, and other adjustments as deemed

appropriate by Management. Reconciliations of NAREIT FFO, FFO

Adjusted for Securities Investments and AFFO to Net Income

Attributable to CorEnergy Stockholders are included in the

additional financial information attached to this press

release.

Consolidated Balance Sheets

June 30, 2018 December 31, 2017 Assets

(Unaudited) Leased property, net of accumulated depreciation of

$82,749,089 and $72,155,753 $ 455,363,130 $ 465,956,467 Property

and equipment, net of accumulated depreciation of $14,312,665 and

$12,643,636 111,514,726 113,158,872 Financing notes and related

accrued interest receivable, net of reserve of $4,600,000 and

$4,100,000 1,000,000 1,500,000 Other equity securities, at fair

value 2,091,181 2,958,315 Cash and cash equivalents 14,175,860

15,787,069 Deferred rent receivable 25,769,989 22,060,787 Accounts

and other receivables 3,373,602 3,786,036 Deferred costs, net of

accumulated amortization of $956,999 and $623,764 3,171,680

3,504,916 Prepaid expenses and other assets 1,068,526 742,154

Deferred tax asset, net 4,115,834 2,244,629 Goodwill 1,718,868

1,718,868

Total Assets $ 623,363,396 $

633,418,113

Liabilities and Equity Secured credit

facilities, net of debt issuance costs of $237,302 and $254,646 $

38,998,698 $ 40,745,354 Unsecured convertible senior notes, net of

discount and debt issuance costs of $1,574,323 and $1,967,917

112,425,677 112,032,083 Asset retirement obligation 9,426,350

9,170,493 Accounts payable and other accrued liabilities 2,512,598

2,333,782 Management fees payable 1,814,105 1,748,426 Income tax

liability 36,971 2,204,626 Unearned revenue 5,321,069

3,397,717

Total Liabilities $ 170,535,468 $

171,632,481

Equity Series A Cumulative Redeemable Preferred

Stock 7.375%, $130,000,000 liquidation preference ($2,500 per

share, $0.001 par value), 10,000,000 authorized; 52,000 issued and

outstanding at June 30, 2018 and December 31, 2017 $ 130,000,000 $

130,000,000 Capital stock, non-convertible, $0.001 par value;

11,933,774 and 11,915,830 shares issued and outstanding at June 30,

2018 and December 31, 2017 (100,000,000 shares authorized) 11,934

11,916 Additional paid-in capital 322,815,994 331,773,716

Total Equity 452,827,928 461,785,632

Total

Liabilities and Equity $ 623,363,396 $ 633,418,113

Consolidated Statements of Income and

Comprehensive Income (Unaudited)

For the Three Months Ended

For the Six Months Ended June 30, 2018 June 30,

2017 June 30, 2018 June 30, 2017 Revenue

Lease revenue $ 18,275,859 $ 17,050,092 $ 35,867,718 $ 34,116,618

Transportation and distribution revenue 3,874,157 4,775,780

7,827,136 9,786,370

Total Revenue

22,150,016 21,825,872 43,694,854 43,902,988

Expenses Transportation and distribution expenses

1,534,524 1,362,980 3,107,420 2,698,550 General and administrative

3,107,776 2,558,339 5,834,833 5,619,579 Depreciation, amortization

and ARO accretion expense 6,290,082 6,005,995 12,579,412 12,011,903

Provision for loan losses — — 500,000 —

Total Expenses 10,932,382 9,927,314 22,021,665

20,330,032

Operating Income $ 11,217,634

$ 11,898,558 $ 21,673,189 $ 23,572,956

Other Income (Expense) Net distributions and dividend income

$ 55,714 $ 221,440 $ 59,665 $ 264,902 Net realized and unrealized

gain (loss) on other equity securities (881,100 ) 614,634 (867,134

) 70,426 Interest expense (3,196,248 ) (3,202,837 ) (6,406,838 )

(6,657,234 )

Total Other Expense (4,021,634 ) (2,366,763 )

(7,214,307 ) (6,321,906 )

Income before income taxes

7,196,000 9,531,795 14,458,882 17,251,050

Taxes Current tax expense (benefit) (10,785 ) 57,651

(46,334 ) 23,891 Deferred tax expense (benefit) (604,064 ) 38,084

(1,013,341 ) (260,762 )

Income tax expense (benefit),

net (614,849 ) 95,735 (1,059,675 ) (236,871 )

Net

Income 7,810,849 9,436,060 15,518,557 17,487,921 Less: Net

Income attributable to non-controlling interest — 435,888

— 818,271

Net Income attributable to

CorEnergy Stockholders $ 7,810,849 $ 9,000,172 $ 15,518,557 $

16,669,650 Preferred dividend requirements 2,396,875

2,123,129 4,793,750 3,160,238

Net Income

attributable to Common Stockholders $ 5,413,974 $

6,877,043 $ 10,724,807 $ 13,509,412 Net

Income $ 7,810,849 $ 9,436,060 $ 15,518,557 $ 17,487,921 Other

comprehensive income: Changes in fair value of qualifying hedges /

AOCI attributable to CorEnergy stockholders — 3,006 — 5,978 Changes

in fair value of qualifying hedges / AOCI attributable to

non-controlling interest — 702 — 1,396

Net Change in Other Comprehensive Income $ — $ 3,708

$ — $ 7,374

Total Comprehensive Income

7,810,849 9,439,768 15,518,557 17,495,295 Less: Comprehensive

income attributable to non-controlling interest — 436,590

— 819,667

Comprehensive Income attributable

to CorEnergy Stockholders $ 7,810,849 $ 9,003,178

$ 15,518,557 $ 16,675,628 Earnings Per Common Share:

Basic $ 0.45 $ 0.58 $ 0.90 $ 1.14 Diluted $ 0.45 $ 0.58 $ 0.90 $

1.14 Weighted Average Shares of Common Stock Outstanding: Basic

11,928,297 11,896,616 11,923,627 11,892,670 Diluted 11,928,297

11,896,616 11,923,627 11,892,670 Dividends declared per share $

0.750 $ 0.750 $ 1.500 $ 1.500

Consolidated

Statements of Cash Flows (Unaudited)

For the Six Months Ended June 30, 2018 June

30, 2017 Operating Activities Net Income $ 15,518,557 $

17,487,921 Adjustments to reconcile net income to net cash provided

by operating activities: Deferred income tax, net (1,013,341 )

(260,762 ) Depreciation, amortization and ARO accretion 13,286,595

12,949,644 Provision for loan losses 500,000 — Non-cash settlement

of accounts payable — (171,609 ) Gain on sale of equipment (3,724 )

— Net distributions and dividend income, including

recharacterization of income — 148,649 Net realized and unrealized

(gain) loss on other equity securities 867,134 (70,426 ) Unrealized

gain on derivative contract — (16,453 ) Common stock issued under

directors compensation plan 37,500 30,000 Changes in assets and

liabilities: Increase in deferred rent receivable (3,709,202 )

(3,588,136 ) Decrease in accounts and other receivables 412,434

1,162,548 (Increase) decrease in prepaid expenses and other assets

(326,372 ) 134,023 Increase in management fee payable 65,679 10,301

Increase (decrease) in accounts payable and other accrued

liabilities 433,853 (53,621 ) Decrease in current income tax

liability (2,167,655 ) — Increase (decrease) in unearned revenue

(1,383,757 ) 29,695 Net cash provided by operating

activities $ 22,517,701 $ 27,791,774

Investing

Activities Purchases of property and equipment (47,883 )

(13,745 ) Proceeds from sale of property and equipment 11,499 —

Return of capital on distributions received — 61,828

Net cash (used in) provided by investing activities $ (36,384 ) $

48,083

Financing Activities Debt financing costs

(264,010 ) (2,512 ) Net offering proceeds on Series A preferred

stock — 71,170,611 Dividends paid on Series A preferred stock

(4,793,750 ) (3,433,984 ) Dividends paid on common stock

(17,270,766 ) (17,318,618 ) Distributions to non-controlling

interest — (480,488 ) Payments on revolving line of credit —

(44,000,000 ) Principal payments on secured credit facilities

(1,764,000 ) (4,389,261 ) Net cash (used in) provided by financing

activities $ (24,092,526 ) $ 1,545,748 Net Change in Cash

and Cash Equivalents $ (1,611,209 ) $ 29,385,605 Cash and Cash

Equivalents at beginning of period 15,787,069 7,895,084

Cash and Cash Equivalents at end of period $ 14,175,860

$ 37,280,689

Supplemental Disclosure of

Cash Flow Information Interest paid $ 5,546,660 $ 5,777,328

Income taxes paid (net of refunds) 2,121,321 132,202

Non-Cash Financing Activities Change in accounts payable and

accrued expenses related to debt financing costs $ (255,037 ) $ —

Reinvestment of distributions by common stockholders in additional

common shares 610,219 516,565

NAREIT FFO, FFO

Adjusted for Securities Investment and AFFO Reconciliation

(Unaudited) For the Three Months Ended

For the Six Months Ended June 30, 2018

June 30, 2017 June 30, 2018

June 30, 2017 Net Income attributable to

CorEnergy Stockholders $ 7,810,849 $ 9,000,172 $ 15,518,557 $

16,669,650 Less: Preferred Dividend Requirements 2,396,875

2,123,129 4,793,750 3,160,238

Net Income

attributable to Common Stockholders $ 5,413,974 $ 6,877,043 $

10,724,807 $ 13,509,412 Add: Depreciation 6,139,171 5,822,383

12,277,590 11,644,679 Less: Non-Controlling Interest attributable

to NAREIT FFO reconciling items (1) — 411,455 —

822,910

NAREIT funds from operations (NAREIT

FFO) $ 11,553,145 $ 12,287,971 $ 23,002,397 $ 24,331,181 Add:

Distributions received from investment securities 55,714 252,213

59,665 475,379 Less: Net distributions and dividend income 55,714

221,440 59,665 264,902 Net realized and unrealized gain (loss) on

other equity securities (881,100 ) 614,634 (867,134 ) 70,426 Income

tax (expense) benefit from investment securities 220,500

(310,622 ) 241,987 (114,862 )

Funds from operations

adjusted for securities investments (FFO) $ 12,213,745 $

12,014,732 $ 23,627,544 $ 24,586,094 Add: Provision for loan

losses, net of tax — — 500,000 — Transaction costs 24,615 211,269

56,896 470,051 Amortization of debt issuance costs 353,637 468,871

707,181 937,742 Amortization of deferred lease costs 22,983 22,983

45,966 45,966 Accretion of asset retirement obligation 127,928

160,629 255,856 321,258 Less: Non-cash settlement of accounts

payable — 171,609 — 171,609 Non-cash gain (loss) associated with

derivative instruments — (10,619 ) — 16,453 Income tax benefit

394,349 214,887 817,688 351,733 Non-Controlling Interest

attributable to AFFO reconciling items (1) — 3,358 —

6,709

Adjusted funds from operations (AFFO) $

12,348,559 $ 12,499,249 $ 24,375,755 $

25,814,607 Weighted Average Shares of Common Stock

Outstanding: Basic 11,928,297 11,896,616 11,923,627 11,892,670

Diluted 15,382,843 15,351,161 15,378,172 15,347,215

NAREIT FFO

attributable to Common Stockholders Basic $ 0.97 $ 1.03 $ 1.93

$ 2.05 Diluted (2) $ 0.89 $ 0.94 $ 1.78 $ 1.87

FFO attributable

to Common Stockholders Basic $ 1.02 $ 1.01 $ 1.98 $ 2.07

Diluted (2) $ 0.94 $ 0.93 $ 1.82 $ 1.89

AFFO attributable to

Common Stockholders Basic $ 1.04 $ 1.05 $ 2.04 $ 2.17 Diluted

(3) $ 0.93 $ 0.94 $ 1.84 $ 1.94

(1)

There is no noncontrolling interest

outstanding for the three and six months ended June 30, 2018.

(2)

Diluted per share calculations include

dilutive adjustments for convertible note interest expense,

discount amortization and deferred debt issuance amortization.

(3)

Diluted per share calculations include a

dilutive adjustment for convertible note interest expense.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180801006017/en/

CorEnergy Infrastructure Trust, Inc.Investor

RelationsLesley Schorgl, 877-699-CORR (2677)info@corenergy.reit

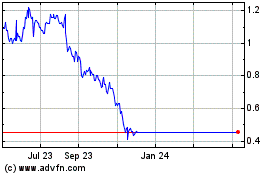

CorEnergy Infrastructure (NYSE:CORR)

Historical Stock Chart

From Mar 2024 to Apr 2024

CorEnergy Infrastructure (NYSE:CORR)

Historical Stock Chart

From Apr 2023 to Apr 2024