Public Storage (NYSE:PSA) announced today operating results for

the three and six months ended June 30, 2018.

Operating Results for the Three Months

Ended June 30, 2018

For the three months ended June 30, 2018, net income allocable

to our common shareholders was $348.3 million or $2.00 per diluted

common share, compared to $276.7 million or $1.59 per diluted

common share in 2017 representing an increase of $71.6 million or

$0.41 per diluted common share. The increase is due primarily to

(i) a $12.3 million increase in self-storage net operating income

(described below), (ii) our $24.0 million equity share of a gain on

sale of assets recorded by PS Business Parks in the three months

ended June 30, 2018, (iii) a $47.4 million increase due to the

impact of foreign currency exchange gains and losses associated

with our euro denominated debt and (iv) a $14.6 million allocation

to preferred shareholders associated with preferred share

redemptions in the three months ended June 30, 2017. These

increases were offset partially by a $13.0 million increase in

general and administrative expense due to the acceleration of

share-based compensation expense accruals for our CEO and CFO in

2018 as a result of their upcoming retirement and the reversal of

share-based compensation accruals forfeited by retiring executives

in 2017.

The $12.3 million increase in self-storage net operating income

is a result of a $4.7 million increase in our Same Store Facilities

(as defined below) and a $7.6 million increase in our Non Same

Store Facilities (as defined below). Revenues for the Same Store

Facilities increased 1.5% or $8.5 million in the three months ended

June 30, 2018 as compared to 2017, due primarily to higher realized

annual rent per occupied square foot. Cost of operations for the

Same Store Facilities increased by 2.6% or $3.8 million in the

three months ended June 30, 2018 as compared to 2017, due primarily

to increased property taxes. The increase in net operating income

of $7.6 million for the Non Same Store Facilities is due primarily

to the impact of 137 self-storage facilities acquired and developed

since January 2016.

Operating Results for the Six Months

Ended June 30, 2018

For the six months ended June 30, 2018, net income allocable to

our common shareholders was $636.1 million or $3.65 per diluted

common share, compared to $557.8 million or $3.20 in 2017

representing an increase of $78.3 million or $0.45 per diluted

common share. The increase is due primarily to (i) a $25.9 million

increase in self-storage net operating income, (ii) our $34.9

million equity share of gains recorded by PS Business Parks in the

six months ended June 30, 2018, (iii) a $41.1 million increase due

to the impact of foreign currency exchange gains and losses

associated with our euro denominated debt and (iv) a $14.6 million

allocation to preferred shareholders associated with preferred

share redemptions in the six months ended June 30, 2017. These

increases were offset partially by a $21.0 million increase in

general and administrative expense due to the acceleration of

share-based compensation expense accruals for our CEO and CFO in

2018 as a result of their upcoming retirement and the reversal of

share-based compensation accruals forfeited by retiring executives

in 2017.

The $25.9 million increase in self-storage net operating income

is a result of an $11.2 million increase in our Same Store

Facilities and $14.7 million increase in our Non Same Store

Facilities. Revenues for the Same Store Facilities increased 1.8%

or $20.0 million in the six months ended June 30, 2018 as compared

to 2017, due primarily to higher realized annual rent per occupied

square foot. Cost of operations for the Same Store Facilities

increased by 3.0% or $8.8 million in the six months ended June 30,

2018 as compared to 2017, due primarily to increased property

taxes, property manager payroll, and allocated overhead. The

increase in net operating income of $14.7 million for the Non Same

Store Facilities is due primarily to the impact of 137 self-storage

facilities acquired and developed since January 2016.

Funds from Operations

For the three months ended June 30, 2018, funds from operations

(“FFO”) was $2.65 per diluted common share, as compared to $2.31 in

2017, representing an increase of 14.7%. FFO is a non-GAAP

(generally accepted accounting principles) term defined by the

National Association of Real Estate Investment Trusts and generally

represents net income before depreciation, gains and losses and

impairment charges with respect to real estate assets.

For the six months ended June 30, 2018, FFO was $5.02 per

diluted common share, as compared to $4.65 in 2017, representing an

increase of 8.0%.

We also present “Core FFO per share,” a non-GAAP measure that

represents FFO per share excluding the impact of (i) foreign

currency exchange gains and losses, (ii) EITF D-42 charges related

to the redemption of preferred securities and (iii) accelerations

of accruals due to the upcoming retirement of our CEO and CFO and

reversals of accruals with respect to share-based awards forfeited

by retiring senior executive officers. We review Core FFO per share

to evaluate our ongoing operating performance and we believe it is

used by investors and REIT analysts in a similar manner. However,

Core FFO per share is not a substitute for net income per share.

Because other REITs may not compute Core FFO per share in the same

manner as we do, may not use the same terminology or may not

present such a measure, Core FFO per share may not be comparable

among REITs.

The following table reconciles from FFO per share to Core FFO

per share (unaudited):

Three Months Ended June 30, Six Months Ended June 30,

Percentage Percentage 2018 2017 Change 2018 2017 Change FFO

per share $ 2.65 $ 2.31 14.7 % $ 5.02 $ 4.65 8.0 % Eliminate the

per share impact of

items excluded from Core FFO, including

our equity share from investments:

Foreign currency exchange (gain) loss (0.13 ) 0.15 (0.06 ) 0.18

Application of EITF D-42 - 0.08 - 0.08

Acceleration (reversal) of share-based

compensation expense due to executive officer retirement

0.04 (0.03 ) 0.09 (0.03 ) Other items 0.01 -

- - Core FFO per share $ 2.57

$ 2.51 2.4 % $ 5.05 $ 4.88 3.5 %

Property Operations – Same Store

Facilities

The Same Store Facilities represent those facilities that have

been owned and operated on a stabilized level of occupancy,

revenues and cost of operations since January 1, 2016. We review

the operations of our Same Store Facilities, which excludes

facilities whose operating trends are significantly affected by

factors such as casualty events, as well as recently developed or

acquired facilities, to more effectively evaluate the ongoing

performance of our self-storage portfolio in 2016, 2017 and 2018.

We believe the Same Store information is used by investors and REIT

analysts in a similar manner. The Same Store pool decreased from

2,052 facilities at March 31, 2018 to 2,048 facilities at June 30,

2018. The following table summarizes the historical operating

results of these 2,048 facilities (131.3 million net rentable

square feet) that represent approximately 82% of the aggregate net

rentable square feet of our U.S. consolidated self-storage

portfolio at June 30, 2018.

Selected

Operating Data for the Same

Store Facilities

(2,048 facilities)

(unaudited):

Three Months Ended June 30, Six Months Ended June 30, Percentage

Percentage 2018 2017 Change 2018 2017 Change (Dollar amounts

in thousands, except for per square foot amounts) Revenues: Rental

income $ 534,997 $ 526,249 1.7 % $ 1,058,876 $ 1,039,210 1.9 % Late

charges and administrative fees 23,654 23,887

(1.0 )% 48,318 47,998 0.7 %

Total revenues (a) 558,651 550,136 1.5

% 1,107,194 1,087,208 1.8 % Cost

of operations: Property taxes 59,174 56,066 5.5 % 117,566 111,928

5.0 % On-site property manager payroll 27,847 27,554 1.1 % 56,511

55,061 2.6 % Supervisory payroll 9,296 9,895 (6.1 )% 18,891 20,035

(5.7 )% Repairs and maintenance 10,948 11,203 (2.3 )% 20,352 20,873

(2.5 )% Snow removal 654 194 237.1 % 2,787 2,216 25.8 % Utilities

9,556 9,339 2.3 % 20,379 19,552 4.2 % Advertising and selling 7,706

8,138 (5.3 )% 14,229 14,937 (4.7 )% Other direct property costs

14,521 14,247 1.9 % 29,557 28,520 3.6 % Allocated overhead

11,100 10,335 7.4 % 24,182

22,533 7.3 % Total cost of operations (a)

150,802 146,971 2.6 % 304,454

295,655 3.0 % Net operating income (b) $ 407,849

$ 403,165 1.2 % $ 802,740 $ 791,553 1.4

% Gross margin 73.0 % 73.3 % (0.4 )% 72.5 % 72.8 % (0.4 )%

Weighted average for the period: Square foot occupancy 94.0

% 94.6 % (0.6 )% 93.1 % 93.8 % (0.7 )% Realized annual rental

income per (c): Occupied square foot $ 17.35 $ 16.95 2.4 % $ 17.32

$ 16.87 2.7 % Available square foot (“REVPAF”)

$

16.30 $ 16.03 1.7 % $ 16.13 $ 15.83 1.9 % At June 30: Square foot

occupancy 93.7 % 94.7 % (1.1 )%

Annual contract rent per occupied square

foot (d)

$ 17.93 $ 17.63 1.7 % (a)

Revenues and cost of operations do not include ancillary revenues

and expenses generated at the facilities with respect to tenant

reinsurance and retail sales. (b) See attached

reconciliation of self-storage net operating income (“NOI”) to

operating income. (c) Realized annual rent per occupied

square foot is computed by dividing annualized rental income,

before late charges and administrative fees, by the weighted

average occupied square feet for the period. Realized annual rent

per available square foot (“REVPAF”) is computed by dividing

annualized rental income, before late charges and administrative

fees, by the total available rentable square feet for the period.

These measures exclude late charges and administrative fees in

order to provide a better measure of our ongoing level of revenue.

Late charges are dependent upon the level of delinquency and

administrative fees are dependent upon the level of move-ins. In

addition, the rates charged for late charges and administrative

fees can vary independently from rental rates. These measures take

into consideration promotional discounts, which reduce rental

income. (d) Contract rent represents the applicable

contractual monthly rent charged to our tenants, excluding the

impact of promotional discounts, late charges and administrative

fees.

The following table summarizes selected quarterly financial data

with respect to the Same Store Facilities (unaudited):

For the

Quarter Ended March 31 June 30 September 30 December 31 Entire Year

(Amounts in thousands, except for per square foot amounts) Total

revenues: 2018 $ 548,543 $ 558,651 2017 $ 537,072 $ 550,136 $

568,429 $ 555,588 $ 2,211,225 Total cost of operations: 2018

$ 153,652 $ 150,802 2017 $ 148,684 $ 146,971 $ 148,198 $ 118,351 $

562,204 Property taxes: 2018 $ 58,392 $ 59,174 2017 $ 55,862

$ 56,066 $ 55,855 $ 32,332 $ 200,115

Repairs and maintenance, including snow

removal expenses:

2018 $ 11,537 $ 11,602 2017 $ 11,692 $ 11,397 $ 11,421 $ 11,983 $

46,493 Advertising and selling expense: 2018 $ 6,523 $ 7,706

2017 $ 6,799 $ 8,138 $ 6,972 $ 6,802 $ 28,711 REVPAF: 2018 $

15.96 $ 16.30 2017 $ 15.63 $ 16.03 $ 16.54 $ 16.17 $ 16.09

Weighted average realized annual rent per

occupied square foot:

2018 $ 17.30 $ 17.35 2017 $ 16.79 $ 16.95 $ 17.49 $ 17.37 $ 17.15

Weighted average occupancy levels for the

period:

2018 92.3 % 94.0 % 2017 93.1 % 94.6 % 94.6 % 93.1 % 93.8 %

Property Operations – Non Same Store

Facilities

The Non Same Store Facilities at June 30, 2018 represent 355

facilities that were not stabilized with respect to occupancies or

rental rates since January 1, 2016 or that we did not own as of

January 1, 2016. The following table summarizes operating data with

respect to the Non Same Store Facilities (unaudited). Additional

data and metrics with respect to these facilities is included in

the MD&A in our June 30, 2018 Form 10-Q.

NON SAME STORE Three Months Ended June 30, Six Months Ended

June 30,

FACILITIES 2018 2017 Change 2018 2017 Change

(Dollar amounts in thousands, except for per square foot amounts)

Revenues: 2018 acquisitions $ 459 $ - $ 459 $ 526 $ - $ 526

2017 acquisitions 7,116 799 6,317 13,976 1,138 12,838 2016

acquisitions 9,761 9,031 730 19,190 17,612 1,578 2016 - 2018 new

developments 8,618 3,630 4,988 15,738 5,957 9,781 2013 - 2015 new

developments 6,591 6,151 440 12,992 11,949 1,043 Other facilities

54,010 54,452 (442 ) 107,127

108,113 (986 ) Total revenues 86,555 74,063

12,492 169,549 144,769 24,780

Cost of operations before depreciation

and amortization expense:

2018 acquisitions 165 - 165 187 - 187 2017 acquisitions 2,459 229

2,230 4,966 380 4,586 2016 acquisitions 3,521 3,502 19 7,158 6,984

174 2016 - 2018 new developments 4,937 2,918 2,019 8,992 5,214

3,778 2013 - 2015 new developments 2,098 1,913 185 4,197 3,780 417

Other facilities 15,894 15,662 232

32,109 31,160 949 Total cost of

operations 29,074 24,224 4,850

57,609 47,518 10,091

Net operating

income: 2018 acquisitions 294 - 294 339 - 339 2017 acquisitions

4,657 570 4,087 9,010 758 8,252 2016 acquisitions 6,240 5,529 711

12,032 10,628 1,404 2016 - 2018 new developments 3,681 712 2,969

6,746 743 6,003 2013 - 2015 new developments 4,493 4,238 255 8,795

8,169 626 Other facilities 38,116 38,790 (674

) 75,018 76,953 (1,935 ) Net operating income

(a) $ 57,481 $ 49,839 $ 7,642 $ 111,940 $ 97,251 $ 14,689

(a) See attached reconciliation of

self-storage net operating income (“NOI”) to operating income.

Investing and Capital

Activities

During the three months ended June 30, 2018, we acquired three

self-storage facilities (one each in Indiana, Kentucky and South

Carolina) with 0.2 million net rentable square feet for $16.0

million. For the six months ended June 30, 2018, we acquired five

self-storage facilities (one each in Indiana, Kentucky, Nebraska,

South Carolina and Tennessee) with 0.4 million net rentable square

feet for $33.9 million. Subsequent to June 30, 2018, we acquired or

were under contract to acquire fourteen self-storage facilities

(six in Minnesota, two in Texas, one each in Colorado, Florida,

Kentucky, Ohio, South Carolina and Tennessee) with 0.8 million net

rentable square feet for $95.2 million.

During the three months ended June 30, 2018, we completed seven

newly developed facilities and various expansion projects (1.2

million net rentable square feet) costing $135 million. For the six

months ended June 30, 2018, we completed eleven newly developed

facilities and various expansion projects (1.7 million net rentable

square feet) costing an aggregate of $195 million. At June 30,

2018, we had various facilities in development (2.2 million net

rentable square feet) estimated to cost $315 million and various

expansion projects (3.9 million net rentable square feet) estimated

to cost $364 million. The remaining $445 million of development

costs for these projects is expected to be incurred primarily in

the next 18 months.

As previously reported, Shurgard Europe is considering an

initial public offering. On July 13, 2018, we received a cash

distribution from Shurgard Europe totaling $145.4 million,

representing our 49% share of an aggregate dividend totaling $296.8

million. The dividend was funded by Shurgard Europe in part through

proceeds from a bank loan. During the three months ended June 30,

2018, Shurgard Europe acquired five self-storage facilities in

Sweden (0.3 million net rentable square feet) for an aggregate of

$46 million.

Distributions Declared

On July 25, 2018, our Board of Trustees declared a regular

common quarterly dividend of $2.00 per common share. The Board also

declared dividends with respect to our various series of preferred

shares. All the dividends are payable on September 27, 2018 to

shareholders of record as of September 12, 2018.

Second Quarter Conference

Call

A conference call is scheduled for August 2, 2018 at 11:00 a.m.

(PDT) to discuss the second quarter earnings results. The domestic

dial-in number is (866) 406-5408, and the international dial-in

number is (973) 582-2770 (conference ID number for either domestic

or international is 5787104). A simultaneous audio webcast may be

accessed by using the link at www.publicstorage.com under “Company

Info, Investor Relations, News and Events, Events Calendar.” A

replay of the conference call may be accessed through August 15,

2018 by calling (800) 585-8367 (domestic), (404) 537-3406

(international) or by using the link at www.publicstorage.com under

“Company Info, Investor Relations, News and Events, Events

Calendar.” All forms of replay utilize conference ID number

5787104.

About Public Storage

Public Storage, a member of the S&P 500 and FT Global 500,

is a REIT that primarily acquires, develops, owns and operates

self-storage facilities. The Company’s headquarters are located in

Glendale, California. At June 30, 2018, we had interests in 2,402

self-storage facilities located in 38 states with approximately 160

million net rentable square feet in the United States and 228

storage facilities located in seven Western European nations with

approximately 12 million net rentable square feet operated under

the “Shurgard” brand. We also own a 42% common equity interest in

PS Business Parks, Inc. (NYSE:PSB) which owned and operated

approximately 28 million rentable square feet of commercial space

at June 30, 2018.

Additional information about Public Storage is available on our

website, www.publicstorage.com.

Forward-Looking

Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. All statements in this press release, other than statements

of historical fact, are forward-looking statements which may be

identified by the use of the words “expects,” “believes,”

“anticipates,” “should,” “estimates” and similar expressions. These

forward-looking statements involve known and unknown risks and

uncertainties, which may cause our actual results and performance

to be materially different from those expressed or implied in the

forward-looking statements. Factors and risks that may impact

future results and performance include, but are not limited to,

those described in Part 1, Item 1A, “Risk Factors” in our most

recent Annual Report on Form 10-K filed with the Securities and

Exchange Commission (the “SEC”) on March 1, 2018 and in our other

filings with the SEC and the following: general risks associated

with the ownership and operation of real estate, including changes

in demand, risk related to development of self-storage facilities,

potential liability for environmental contamination, natural

disasters and adverse changes in laws and regulations governing

property tax, real estate and zoning; risks associated with

downturns in the national and local economies in the markets in

which we operate, including risks related to current economic

conditions and the economic health of our customers; the impact of

competition from new and existing self-storage and commercial

facilities and other storage alternatives; difficulties in our

ability to successfully evaluate, finance, integrate into our

existing operations and manage acquired and developed properties;

risks associated with international operations including, but not

limited to, unfavorable foreign currency rate fluctuations, changes

in tax laws, and local and global economic uncertainty that could

adversely affect our earnings and cash flows; risks related to our

participation in joint ventures; the impact of the regulatory

environment as well as national, state and local laws and

regulations including, without limitation, those governing

environmental, taxes, our tenant reinsurance business and labor,

and risks related to the impact of new laws and regulations; risks

of increased tax expense associated either with a possible failure

by us to qualify as a REIT, or with challenges to the determination

of taxable income for our taxable REIT subsidiaries; changes in

federal or state tax laws related to the taxation of REITs and

other corporations; security breaches or a failure of our networks,

systems or technology could adversely impact our business, customer

and employee relationships; risks associated with the

self-insurance of certain business risks, including property and

casualty insurance, employee health insurance and workers

compensation liabilities; difficulties in raising capital at a

reasonable cost; delays in the development process; ongoing

litigation and other legal and regulatory actions which may divert

management’s time and attention, require us to pay damages and

expenses or restrict the operation of our business; and economic

uncertainty due to the impact of war or terrorism. These

forward-looking statements speak only as of the date of this press

release. All of our forward-looking statements, including those in

this press release, are qualified in their entirety by this

statement. We expressly disclaim any obligation to update publicly

or otherwise revise any forward-looking statements, whether as a

result of new information, new estimates, or other factors, events

or circumstances after the date of this press release, except where

expressly required by law. Given these risks and uncertainties, you

should not rely on any forward-looking statements in this press

release, or which management may make orally or in writing from

time to time, as predictions of future events nor guarantees of

future performance.

PUBLIC STORAGE

SELECTED INCOME STATEMENT DATA

(Amounts in thousands, except per share

data)

(Unaudited)

Three Months Ended Six Months Ended June 30, June 30, 2018

2017 2018 2017

Revenues: Self-storage facilities $ 645,206 $

624,199 $ 1,276,743 $ 1,231,977 Ancillary operations 40,322

40,113 78,709 77,882

685,528 664,312 1,355,452

1,309,859

Expenses: Self-storage

cost of operations 179,876 171,195 362,063 343,173 Ancillary cost

of operations 11,101 11,383 21,741 22,307 Depreciation and

amortization 119,777 110,177 237,756 221,106 General and

administrative 31,329 14,992

62,849 40,020 342,083

307,747 684,409 626,606

Operating income 343,445 356,565 671,043 683,253

Other

income (expense): Interest and other income 6,328 4,155 11,872

8,153 Interest expense (8,388 ) (1,116 ) (16,495 ) (2,164 ) Equity

in earnings of unconsolidated real estate entities 41,963 20,068

72,758 40,017 Gain on real estate investment sales - 975 424 975

Foreign currency exchange gain (loss) 21,944

(25,440 ) 10,126 (31,006 ) Net income 405,292

355,207 749,728 699,228 Allocation to noncontrolling interests

(1,490 ) (1,505 ) (2,929 ) (3,084 ) Net

income allocable to Public Storage shareholders 403,802 353,702

746,799 696,144 Allocation of net income to: Preferred shareholders

– distributions (54,077 ) (61,281 ) (108,158 ) (121,402 ) Preferred

shareholders – redemptions - (14,638 ) - (14,638 ) Restricted share

units (1,425 ) (1,102 ) (2,522 ) (2,292

) Net income allocable to common shareholders $ 348,300 $

276,681 $ 636,119 $ 557,812

Per common

share:

Net income per common share – Basic $ 2.00 $ 1.59 $

3.66 $ 3.22 Net income per common share – Diluted $

2.00 $ 1.59 $ 3.65 $ 3.20 Weighted

average common shares – Basic 173,932 173,602

173,912 173,483 Weighted average

common shares – Diluted 174,224 174,075

174,186 174,072

PUBLIC STORAGE

SELECTED BALANCE SHEET DATA

(Amounts in thousands, except share and

per share data)

June 30, 2018 December 31, 2017

ASSETS (Unaudited)

Cash and equivalents $ 338,419 $ 433,376 Operating

real estate facilities: Land and buildings, at cost 14,944,632

14,665,989 Accumulated depreciation (5,923,687 )

(5,700,331 ) 9,020,945 8,965,658 Construction in process 234,044

264,441 Investments in unconsolidated real estate entities 762,247

724,173 Goodwill and other intangible assets, net 207,390 214,957

Other assets 129,917 130,287 Total

assets $ 10,692,962 $ 10,732,892

LIABILITIES AND EQUITY Senior unsecured notes $

1,392,516 $ 1,402,109 Mortgage notes 28,318 29,213 Accrued and

other liabilities 351,336 337,201 Total

liabilities 1,772,170 1,768,523 Equity: Public Storage

shareholders’ equity:

Cumulative Preferred Shares, $0.01 par

value, 100,000,000 shares authorized, 161,000 shares issued (in

series) and outstanding, (161,000 at December 31, 2017) at

liquidation preference

4,025,000 4,025,000

Common Shares, $0.10 par value,

650,000,000 shares authorized, 173,937,035 shares issued and

outstanding, (173,853,370 shares at December 31, 2017)

17,394 17,385 Paid-in capital 5,673,078 5,648,399 Accumulated

deficit (735,065 ) (675,711 ) Accumulated other comprehensive loss

(84,601 ) (75,064 ) Total Public Storage

shareholders’ equity 8,895,806 8,940,009 Noncontrolling interests

24,986 24,360 Total equity

8,920,792 8,964,369 Total liabilities and

equity $ 10,692,962 $ 10,732,892

PUBLIC STORAGE

SELECTED FINANCIAL DATA

Computation of Funds from Operations

and Funds Available for Distribution

(Unaudited – amounts in thousands)

Three Months Ended Six Months Ended June 30, June 30, 2018

2017 2018 2017

Computation of

FFO per Share:

Net income allocable to common shareholders $ 348,300 $

276,681 $ 636,119 $ 557,812 Eliminate items excluded from FFO:

Depreciation and amortization 119,777 110,177 237,756 221,106

Depreciation from unconsolidated real estate investments 19,308

17,368 38,623 34,581

Depreciation allocated to noncontrolling

interests and restricted share unitholders

(1,014 ) (837 ) (1,932 ) (1,799 )

Gains on sale of real estate investments,

including our equity share from investments

(23,873 ) (1,466 ) (35,764 ) (3,077 )

FFO allocable to common shares (a) $ 462,498 $ 401,923

$ 874,802 $ 808,623 Diluted weighted average

common shares 174,224 174,075

174,186 174,072 FFO per share (a) $ 2.65

$ 2.31 $ 5.02 $ 4.65

Reconciliation of

Earnings per Share to FFO per Share:

Earnings per share—Diluted $ 2.00 $ 1.59 $ 3.65 $ 3.20

Eliminate per share amounts excluded from FFO:

Depreciation and amortization allocable to

common shareholders

0.79 0.73 1.58 1.46

Gains on sale of real estate investments,

including our equity share from investments and other

(0.14 ) (0.01 ) (0.21 ) (0.01 ) FFO per

share (a) $ 2.65 $ 2.31 $ 5.02 $ 4.65

Computation of

Funds Available for Distribution ("FAD"):

FFO allocable to common shares $ 462,498 $ 401,923 $ 874,802

$ 808,623 Eliminate effect of items included in FFO but not FAD:

Share-based compensation expense in excess

of cash paid

17,080 4,085 22,989 799 Foreign currency exchange (gain) loss

(21,944 ) 25,440 (10,126 ) 31,006

Application of EITF D-42, including our

equity share from investments

- 14,638 - 14,638 Less: Capital expenditures to maintain real

estate facilities (28,883 ) (26,490 ) (53,227

) (53,540 ) FAD (a) $ 428,751 $ 419,596

$ 834,438 $ 801,526

Distributions paid to common shareholders

and restricted share units

$ 348,984 $ 348,372 $ 697,995 $ 696,585

Distribution payout ratio 81.4 % 83.0 %

83.6 % 86.9 % Distributions per common share $ 2.00

$ 2.00 $ 4.00 $ 4.00

(a) FFO and FFO per share are non-GAAP

measures defined by the National Association of Real Estate

Investment Trusts and, along with the non-GAAP measure FAD, are

considered helpful measures of REIT performance by REITs and many

REIT analysts. FFO represents net income before real estate

depreciation, gains or losses and impairment charges, which are

excluded because they are based upon historical real estate costs

and assume that building values diminish ratably over time, while

we believe that real estate values fluctuate due to market

conditions. FAD represents FFO adjusted to exclude certain non-cash

charges and to deduct capital expenditures. We utilize FAD in

evaluating our ongoing cash flow available for investment, debt

repayment and common distributions. We believe investors and

analysts utilize FAD in a similar manner. FFO and FFO per share are

not a substitute for net income or earnings per share. FFO and FAD

are not substitutes for GAAP net cash flow in evaluating our

liquidity or ability to pay dividends, because they exclude

investing and financing activities presented on our statements of

cash flows. In addition, other REITs may compute these measures

differently, so comparisons among REITs may not be helpful.

PUBLIC STORAGE

SELECTED FINANCIAL DATA

Reconciliation of Self-Storage Net

Operating Income to

Operating Income

(Unaudited – amounts in thousands)

Three Months Ended Six Months Ended June 30, June 30, 2018

2017 2018 2017 Self-storage revenues for: Same Store

Facilities $ 558,651 $ 550,136 $ 1,107,194 $ 1,087,208 Non Same

Store Facilities 86,555 74,063

169,549 144,769 Self-storage revenues 645,206

624,199 1,276,743 1,231,977 Self-storage cost of operations

for: Same Store Facilities 150,802 146,971 304,454 295,655 Non Same

Store Facilities 29,074 24,224

57,609 47,518 Self-storage cost of operations

179,876 171,195 362,063 343,173 Self-storage net operating

income for: Same Store Facilities 407,849 403,165 802,740 791,553

Non Same Store Facilities 57,481 49,839

111,940 97,251 Self-storage net

operating income (a) 465,330 453,004 914,680 888,804 Ancillary

revenues 40,322 40,113 78,709 77,882 Ancillary cost of operations

(11,101 ) (11,383 ) (21,741 ) (22,307 ) Depreciation and

amortization (119,777 ) (110,177 ) (237,756 ) (221,106 ) General

and administrative expense (31,329 ) (14,992 )

(62,849 ) (40,020 ) Operating income on our income statement

$ 343,445 $ 356,565 $ 671,043 $ 683,253

(a) Net operating income

or “NOI” is a non-GAAP financial measure that excludes the impact

of depreciation and amortization expense, which is based upon

historical real estate costs and assumes that building values

diminish ratably over time, while we believe that real estate

values fluctuate due to market conditions. We utilize NOI in

determining current property values, evaluating property

performance, and in evaluating operating trends. We believe that

investors and analysts utilize NOI in a similar manner. NOI is not

a substitute for net income, net operating cash flow, or other

related GAAP financial measures, in evaluating our operating

results. This table reconciles from NOI for our self-storage

facilities to the operating income presented on our income

statement.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180801005984/en/

Public StorageRyan Burke(818) 244-8080, Ext. 1141

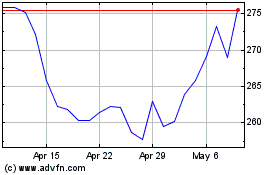

Public Storage (NYSE:PSA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Public Storage (NYSE:PSA)

Historical Stock Chart

From Apr 2023 to Apr 2024