Manhattan Bridge Capital Announces Partial Exercise of Over-Allotment Option by Underwriter

August 01 2018 - 1:04PM

Manhattan Bridge Capital, Inc. (NasdaqCM: LOAN), or Manhattan

Bridge Capital, a real estate finance company specializing in

originating, funding, servicing, and managing a portfolio of

short-term loans secured by first mortgage liens on real estate,

announced today that the underwriter of its previously announced

underwritten public offering of 1,428,572 of its common shares has

partially exercised its option to purchase an additional 117,214

shares at a price to the public of $7.00 per share to cover over

allotments, bringing the total gross proceeds from the offering to

approximately $10.8 million. The aggregate net proceeds are

expected to be approximately $9.9 million, after deducting

underwriting discounts, commissions and estimated offering expenses

payable by Manhattan Bridge Capital. The exercise of the

over-allotment option closed on August 1, 2018.

National Securities Corporation, a wholly owned

subsidiary of National Holdings Corporation (Nasdaq: NHLD), acted

as sole book-running manager for the offering.

Manhattan Bridge Capital intends to use the net

proceeds of the offering to reduce the outstanding balance of its

existing credit line, and in the event that additional proceeds

remain, to increase its loan portfolio and for general corporate

purposes and working capital.

The securities described above were issued by

Manhattan Bridge Capital pursuant to a "shelf" registration

statement on Form S-3 (File No. 333-224955), as declared effective

by the Securities and Exchange Commission, or the SEC, on May 24,

2018. A final prospectus supplement and an accompanying prospectus

relating to the offering have been filed with the SEC on July 20,

2018, and are available on the SEC’s website located at

http://www.sec.gov. Electronic copies of the prospectus supplement

and the accompanying prospectus relating to the offering may be

obtained from National Securities Corporation, Attention:

Marguerite Rogers, 200 Vesey St, 25th Floor, New York, NY 10281, or

by telephone at (212) 417-8227, or by e-mail at

prospectusrequest@nationalsecurities.com.

This press release shall not constitute an offer

to sell or the solicitation of an offer to buy nor shall there be

any sale of these securities in any state or jurisdiction in which

such offer, solicitation or sale would be unlawful prior to

registration or qualification under the securities laws of any such

state or jurisdiction.

About Manhattan Bridge Capital

We are a New York-based real estate finance

company that specializes in originating, servicing and managing a

portfolio of first mortgage loans. We offer short-term, secured,

non–banking loans (sometimes referred to as “hard money” loans) to

real estate investors to fund their acquisition, renovation,

rehabilitation or development of residential or commercial

properties located in the New York metropolitan area. We are

organized and conduct our operations to qualify as a real estate

investment trust (“REIT”) for federal income tax purposes.

For more information about Manhattan Bridge

Capital, visit Manhattan Bridge Capital’s website at

https://www.manhattanbridgecapital.com

Forward-Looking Statements

This press release contains forward-looking

statements within the meaning of the "safe harbor" provisions of

the Private Securities Litigation Reform Act of 1995 and other

Federal securities laws. Because such statements deal with future

events and are based on Manhattan Bridge Capital’s current

expectations, they are subject to various risks and uncertainties

and actual results, performance or achievements of Manhattan Bridge

Capital could differ materially from those described in or implied

by the statements in this press release. For example,

forward-looking statements include statements regarding Manhattan

Bridge Capital’s planned use of the net proceeds from the offering.

The forward-looking statements contained or implied in this press

release are subject to other risks and uncertainties, including the

risk factors discussed in Manhattan Bridge Capital’s final

prospectus supplement and in Manhattan Bridge Capital’s Annual

Report on Form 10-K for the fiscal year ended December 31, 2017,

filed with the SEC and in subsequent filings with the SEC. Except

as otherwise required by law, Manhattan Bridge Capital disclaims

any intention or obligation to update or revise any forward-looking

statements, which speak only as of the date they were made, whether

as a result of new information, future events or circumstances or

otherwise.

Contacts:

Assaf Ran, CEO

(516) 444-3400

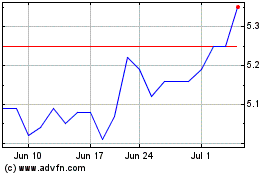

Manhattan Bridge Capital (NASDAQ:LOAN)

Historical Stock Chart

From Mar 2024 to Apr 2024

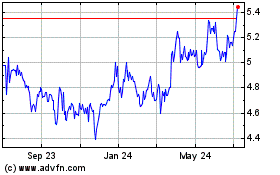

Manhattan Bridge Capital (NASDAQ:LOAN)

Historical Stock Chart

From Apr 2023 to Apr 2024