By Saabira Chaudhuri and Annie Gasparro

An American walks into a bar. "What'll it be?" says the

bartender.

For years, more likely than not, the answer would have been:

"Make it a beer."

Not anymore. Last year, for the first time, Americans reaching

for a drink more often chose a glass of wine or a cocktail.

U.S. drinkers, particularly young ones, are having relationship

problems with the national beverage. It's no longer true they start

out favoring mild pilsners and low-calorie beers, then graduate to

harder stuff later in life, if at all. Now they are thinking about

other things: taste, value, beer bellies.

Brenden Kennedy, a 32-year-old New York marketing executive,

can't remember the last time he drank a beer. His parents drank Bud

Light. When he hit drinking age, he tended to reach for a

prosecco.

"When I drink beer, it always feels very heavy, like empty

calories, and I don't find it's refreshing unless it's super, super

cold," he says. "The flavor has never really appealed to me, and it

doesn't feel sophisticated."

According to the Beer Institute, a trade group, drinkers chose

beer just 49.7% of the time last year, down from 60.8% in the

mid-90s. Among 21- to 27-year-olds, the decline has been sharper.

Anheuser-Busch InBev SA, Budweiser's owner, found that in 2016,

just 43% of alcohol consumed by young drinkers was beer. In 2006,

it was 65%.

Per-capita beer consumption in the U.S. fell to 73.4 liters last

year, from 80.2 in 2010 and 83.2 liters in 2000, according to IWSR,

a drinks market research firm. Germany, by comparison, consumed 103

liters a person last year.

John Saputo owns beer distributorships in Florida and Ohio. He

realized the industry had a problem a few years ago when he went

out with a team of young radio-ad sales people who wanted him to

advertise Budweiser and Bud Light on a local station.

When it came to their own drinks, some of them ordered wine --

and "even a liquor drink with a freaking umbrella in it," he

recalls. "These kids, they don't even drink our product."

In some ways, big brewers are facing the same seismic shifts in

taste as other large consumer-goods and packaged-food giants.

Consumers, especially younger ones, are gravitating toward smaller

brands marketed as healthier, more natural or made closer to home.

Brands such as Kellogg's cereal, Campbell's soup and Aunt Jemima

pancake mix are all feeling the pinch.

Mass-market beer makers are losing drinkers to an explosion of

spirits brands, such as Tito's vodka, owned by Fifth Generation

Inc. Craft beer brewers rode that wave, too, but their volumes

haven't come close to making up for declines in mainstream beer.

More recently, craft-beer sales also have slowed.

Miller Lite, Coors Light, Bud and Bud Light have all lost share

to upstart labels. "The big things are declining. The smaller

things are growing," AB InBev Chief Executive Carlos Brito told

investors in March.

Demographics also are at work. Industry research has shown young

white males still prefer beer, but their numbers are declining as a

percentage of the population. African-Americans favor spirits, and

the percentage of liquor consumers that are Hispanic is rising, the

research shows.

Women's per-capita alcohol consumption has risen, but they

prefer wine and cocktails. Millennials drink less than older

generations, hitting alcohol volumes more broadly.

Nashville-based Mike Baker, 26, drinks only a couple of times a

week. "A lot of friends of mine are very health conscious," he

says. "They think drinking might add a few extra pounds and have

long-term consequences." When Mr. Baker does drink, he reaches for

a bourbon or a craft beer.

The beer industry has tried to make up for declining volume by

increasing prices. That has helped make whiskey and wine relatively

more affordable. Beer prices rose 42% between 2000 and 2017,

compared with 11% for wine and 19% for spirits, according to a

Brewers Association analysis of data from the Bureau of Labor

Statistics.

As sales slide, a sense of crisis has taken hold of the

industry. In May, Molson Coors Brewing Co. reported a 3.1% drop in

U.S. second-quarter sales driven by lower volumes of its light

beers. Last week, AB InBev -- which swallowed SABMiller PLC in 2016

to solidify its title as world's biggest brewer -- also reported

U.S. revenue fell 3.1% in the second quarter on lower volumes. On

Monday, Dutch brewer Heineken NV reported its U.S. beer volumes

declined in the first half, blaming the consumer shift from lager

to craft beer and spirits.

"Every consumer today drinks on average one bottle of beer less

a week than they did 20 years ago," Heineken's U.S. CEO, Ronald den

Elzen, told an industry conference last year. "If this is not a

wake-up call that we have to do something, I don't know what

is."

America has long been a nation of beer drinkers. Through the

1600s, the "ordinary," akin to the local pub, flourished across New

England. The Dutch West India Co. built America's first large

brewer in 1632.

Today's big beer brands trace their ancestry to German-style

lagers that made their way to the U.S. in the mid-1800s, along with

waves of German immigrants. Adolphus Busch was one of them. He

married the daughter of Eberhard Anheuser, another local brewer,

and eventually went to work for his father-in-law. In 1876, he

rolled out America's first Budweiser.

Mr. Busch was the first U.S. brewer to pasteurize beer to

prevent spoilage. He built a network of ice houses near railroad

lines, allowing him to distribute his brew widely. Anheuser-Busch,

having survived Prohibition by using its refrigerated trucks to

sell ice cream, eventually surpassed Schlitz as America's biggest

brewer.

In the 70s, Philip Morris Cos.-owned Miller mounted a serious

challenge, eventually creating Miller Lite. Anheuser-Busch answered

with "Budweiser Light." Bud Light, as it was later re-christened,

was brewed and marketed as a lower-alcohol, low-calorie,

mild-tasting "sessionable" beer. You could drink more in a single

session without feeling too drunk or bloated.

"Through the 90s, the brand was ripping," says Andy Goeler who

ran it in the 1990s. "It was a time when big was good. Levi's was

good. McDonald's was good. Budweiser was good."

Bud Light eventually overtook Budweiser as America's

best-selling beer -- a title it still holds.

Yet there were signs of trouble. European and Mexican imports

and upstart craft brews, such as Samuel Adams, attracted drinkers

looking for something new. A bourbon renaissance -- and the

Cosmo-sipping cast of "Sex and the City" -- helped reinvigorate

America's cocktail culture.

After liquor makers ended a decades-old voluntary ban on TV and

radio ads, Diageo PLC, the spirits giant that owns Johnnie Walker

and Smirnoff, ramped up U.S. advertising.

"We didn't see that as competition," says Tony Ponturo, a former

marketing executive at Anheuser-Busch. "It wasn't beer."

Budweiser volumes peaked in 1988. Bud Light hit its own peak in

2008, according to estimates from Beer Marketer's Insights, a trade

publication.

The same year, SABMiller and Molson Coors Brewing Co. merged

their U.S. operations. A few months later, August Adolphus Busch

IV, the great-great grandson of Anheuser-Busch's co-founder,

orchestrated a sale to InBev, the beer giant controlled by

Brazilian private-equity firm 3G Capital Partners.

Anyssa Armbrust, 24, says that when she started tending bar in

the Chicago area a few years ago, craft beer was on the rise. Now,

she says, a lot of young people are opting for vodka with either

club soda or water. "They think if they get vodka and water,

they're hydrating at the same time, so it's healthier."

Beer makers have begun trying to work together to do something

about the threat -- a departure for an industry that has been a

hotbed of infighting and litigation. "We need to be pro-beer first

and try to differentiate our category from wine and spirits, and we

need to do that together," said Molson Coors's U.S. CEO Gavin

Hattersley at an industry conference last year.

Early this year, top executives from AB InBev, Heineken and

Molson Coors gathered in Arlington, Va., to discuss ways to pool

resources and market beer more generally. No concrete plans have

sprung from the summit, and companies haven't committed any

funding, executives say.

This spring, AB InBev bought a company that owns a string of

small gin, vodka and whiskey brands and took a stake in a

California winemaker. Executives are targeting Hispanics with

Spanish-language ads. Last week, the company said it was creating a

new position: a head of nonalcoholic drinks.

AB InBev's CEO, Mr. Brito, says the future is still bright for

big beer brands in the U.S., and that AB InBev has become more

focused on profitability. Higher-price beers such as Michelob

Ultra, Stella Artois and Bud Ice, he says, are gaining market

share. "If you look at our portfolio in the U.S., we've been trying

to rejig it, trying to add new things that we think are growth

engines for the future," he said in March.

Budweiser teamed up this summer with whiskey maker Jim Beam,

offering shot-and-chaser specials at bars across the country. It

also is rolling out a new Budweiser beer, aged with bourbon-barrel

staves.

"It brings normal bourbon drinkers to beer," says Travis Moore,

senior brewmaster at Budweiser's St. Louis brewery.

The new brew, which hits stores and restaurants in August, is

called Budweiser Reserve Copper Lager. It is aimed at "entry-level

drinkers," age 21 to 24, says Julia Mize, who promotes beer for AB

InBev. "People who are in their 50s grew up with Bud because it was

the No. 1 beer when they turned 21." Now, she says, young adults

have so many other options.

Another recent limited-edition Budweiser is Freedom Reserve Red

Lager, which began appearing on shelves this summer. And last fall,

the company began selling 1933 Repeal Reserve Amber Lager, which

has a slightly higher alcohol content.

The company is hoping the new products will reinvigorate

drinkers' interest in Budweiser, which last year fell off the list

of America's top three best-selling beers. It now ranks fourth.

AB InBev is working to persuade consumers to choose some of its

other beers over wine or cocktails during meals. Among other

things, it has launched an organic version of Michelob Ultra and

fruit-flavored versions of Bud Light.

The company put Mr. Goeler, who managed the brand in the 1990s,

back in charge of Bud Light, and the company launched a big-budget

ad campaign about a medieval king with a penchant for Bud Light and

a made-up toast, "Dilly Dilly."

AB InBev says Bud Light is luring drinkers from similarly priced

rivals. But the brand is still losing volume and overall market

share. Last year, Bud Light held 15.2% of the market, down from

19.5% at its peak, according to Beer Marketer's Insights'

estimates. AB InBev sold 31.6 million barrels of Bud Light in 2017,

down from 41.7 million barrels in 2008.

Kaitlin Meyer, 30, works in the financial industry in Chicago.

She says she hasn't drunk beer since college. "You get full after

beer," she says. "Wine is more drinkable. I'll drink vodka if I'm

at a bar that has cheap wine."

--Nick Kostov contributed to this article.

Write to Saabira Chaudhuri at saabira.chaudhuri@wsj.com and

Annie Gasparro at annie.gasparro@wsj.com

(END) Dow Jones Newswires

August 01, 2018 10:32 ET (14:32 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

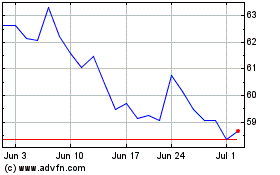

Anheuser Busch Inbev SA NV (NYSE:BUD)

Historical Stock Chart

From Mar 2024 to Apr 2024

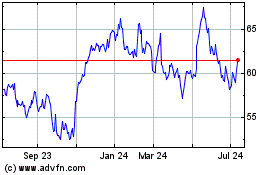

Anheuser Busch Inbev SA NV (NYSE:BUD)

Historical Stock Chart

From Apr 2023 to Apr 2024