Bitwise HOLD 10 Index ETF

July 31 2018 - 1:02PM

ADVFN Crypto NewsWire

Bitcoin Global News (BGN)

July 31, 2018 -- ADVFN Crypto NewsWire -- Bitwise HOLD 10 Cryptocurrency

Index Fund became the world's

first privately-offered cryptocurrency index fund on November 22,

2017. Bitwise Asset Management filed a registration statement on July 24th, 2018 to make it the first

publicly-offered cryptocurrency index exchange-traded fund (ETF).

The portfolio was designed by their subsidiary, Bitwise Index

Services, which specializes in developing indexes and conducting

research on cryptocurrencies.

“By holding a diversified portfolio

of the world’s largest cryptocurrencies, the Index provides

investors with exposure to the cryptocurrency market while

minimizing investment-analysis and administrative

costs.”

HOLD 10

Index

It is an open-ended private

placement vehicle that is open to accredited investors and offers

weekly liquidity. The index is a market-cap-weighted index of the

10 largest cryptocurrencies, rebalanced monthly, and captures

approximately 80% of the total market capitalization of the

cryptocurrency market in the 10 coins. It utilizes a 5-year-diluted

market cap and other criteria to address the challenges of the

cryptocurrency space such as continuously changing supply,

liquidity, trade volume concentration, custody limitations and

volatility.

“Our research shows that an

index-tracking basket of multiple cryptocurrencies behaves

differently than a single coin.”

Bitwise Asset

Management

The firm was founded in 2017 and

works only with cryptocurrency. Their leadership is filled with the

experience needed to bring cryptocurrency to institutional

investors as ETFs.

-

Hunter Horsley CEO - Prior

Product Manager at Facebook and Instagram where he led monetization

efforts from 2015 to 2016. Wharton School graduate, BS in Economics in

2015.

-

Paul Fusaro COO - Prior Senior VP

and Head of Portfolio Management and Capital Markets

at IndexIQ (ETF issuer unit of New

York Life) from 2008 for a suite of alternative strategy ETFs,

Mutual Funds, and Separately Managed Accounts. VP of Portfolio

Management and co-head of Trading and Operations at Direxion

Investments from 2009. Equity derivatives and credit derivatives

trading at Goldman Sachs before that.

-

John T. Hyland CFA - Prior CEO of

PointBreak ETFs from May 2015. Chief Investment Officer of United

States Commodity Funds from 2005.

“Our view is that this new area has

many similarities to the introduction 10 to 15 years ago of

commodity ETFs. At that time, we saw the launch of single-commodity

ETFs tracking gold, silver, crude oil, and other commodities, as

well as ETFs tracking diversified commodity index baskets. We see a

lot of similarities here."

By: BGN Editorial Staff

News:

Cryptocurrencies

Bitwise HOLD 10 Index

ETF

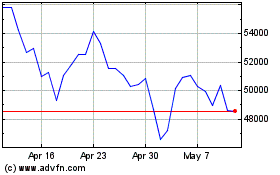

Bitcoin (COIN:BTCGBP)

Historical Stock Chart

From Mar 2024 to Apr 2024

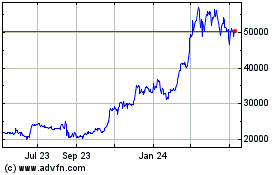

Bitcoin (COIN:BTCGBP)

Historical Stock Chart

From Apr 2023 to Apr 2024

Real-Time news about Bitcoin (Cryptocurrency): 0 recent articles

More Bitcoin News Articles