Nasdaq meetings with crypto-currency players to give the industry legitimacy

July 27 2018 - 12:49PM

ADVFN Crypto NewsWire

Among topics discussed

were the implications of future regulation for crypto-currencies,

what the necessary tools are, and what surveillance will be

needed

New York — The road to shaking its

history of shady transactions and fraud is proving to be a long one

for crypto-currencies, but Nasdaq thinks it can help get the

industry on the path to legitimacy.

It hosted a closed-door meeting

earlier this week in Chicago with representatives from about half a

dozen companies, including traditional exchanges as well as Gemini

and other crypto-markets, according to a person familiar with the

event. The focus of the gathering, the person said, was to

encourage the industry to do things that will improve its image and

validate its potential role in global markets.

A Nasdaq spokesperson declined to

comment, but confirmed the event took place. Gemini didn’t respond

to a request for comment.

Among topics discussed were the

implications of future regulation for crypto-currencies, what the

necessary tools are, and what surveillance will be needed. Nasdaq

CEO Adena Friedman has been outspoken about the need for

regulation, with her firm now partnering with a number of exchanges

to help on several of these issues. Earlier this year, for

instance, Cameron and Tyler Winklevoss’s Gemini exchange hired

Nasdaq to conduct market surveillance for bitcoin and ether

trading, as well as the auction that helps price Cboe Global

Markets’s bitcoin futures.

"I do believe that, over time,

we’re going to find there is really utility" in crypto-currencies,

Friedman said at a Bloomberg event in June. Nasdaq disclosed this

week that it’s supplying technology to five crypto-exchanges,

including Gemini and SBI Virtual Currencies. It hasn’t named the

other three.

This will not be the last meeting

of this nature, the person said, adding there will be an ongoing

dialogue among the participants. Due to its history of illiquidity,

theft, fraud and the lack of custody services, Wall Street has been

slow to move into the space.

Earlier this year, for instance,

Bloomberg reported that the US justice department had opened a

criminal probe into whether traders are manipulating the price of

bitcoin and other digital currencies.

Source: Bloomberg

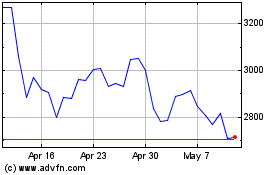

Ethereum (COIN:ETHEUR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ethereum (COIN:ETHEUR)

Historical Stock Chart

From Apr 2023 to Apr 2024