Current Report Filing (8-k)

July 24 2018 - 4:04PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

____________________

FORM 8-K

Current Report Pursuant to Section 13 or 15(

d

) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

July 20, 2018

HECLA MINING COMPANY

(Exact Name of Registrant as Specified in Its Charter)

|

Delaware

|

1-8491

|

77-0664171

|

|

(State or Other Jurisdiction

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

|

of Incorporation)

|

|

|

6500 North Mineral Drive, Suite 200

Coeur d'Alene, Idaho 83815-9408

(Address of Principal Executive Offices) (Zip Code)

(208) 769-4100

(Registrant's Telephone Number, Including Area Code)

N/A

(Former name or Former Address, if changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12(b))

☐

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.01. Completion of Acquisition or Disposition of Assets

On July 20, 2018, Hecla Mining Company (the “Company” or “Hecla”) and our wholly owned subsidiary, 1156291 B.C. Unlimited Liability Company (“B.C. UNLTD.”) completed the acquisition of Klondex Mines Ltd. (“Klondex”) pursuant to the terms of the March 16, 2018 Arrangement Agreement among the parties, as amended (the “Agreement”). Under the terms of the Agreement, Hecla acquired all of the outstanding common shares of Klondex for $153,205,757 and 75,276,176 shares of Hecla common stock (“Purchase Price”).

The Agreement, filed as exhibit 2.1 to our Current Report on Form 8-K filed on March 19, 2018, as amended by the First Amendment to Arrangement Agreement dated as of June 4, 2018 (filed as exhibit 2.1 to our Current Report on Form 8-K filed on June 4, 2018) and by the Second Amendment to Arrangement Agreement dated as of July 5, 2018 (filed as Exhibit 2.1 to our Current Report on Form 8-K filed on July 5, 2018), is incorporated herein by reference.

The Agreement has been incorporated by reference herein to provide you with information regarding its terms. It is not intended to provide any other factual information about us. Such information can be found elsewhere in other public filings we have made with the Securities and Exchange Commission (“SEC”), which are available without charge at www.sec.gov.

The Agreement contains representations and warranties the Company and Klondex made. The assertions embodied in those representations and warranties are qualified by information in a confidential disclosure letter that the Company has exchanged in connection with signing the Agreement. While the Company does not believe that it contains information securities laws require us to publicly disclose other than information that has already been so disclosed, the disclosure letter does contain information that modifies, qualifies and creates exceptions to the representations and warranties set forth in the Agreement. Accordingly, you should not rely on the representations and warranties as characterizations of the actual state of facts, since they are modified in important part by the disclosure letter. Moreover, information concerning the subject matter of the representations and warranties may have changed since the date of the Agreement, which subsequent information may or may not be fully reflected in public disclosures.

As reported on a Current Report on Form 8-K filed with the SEC on July 16, 2018, on that date we entered into a Fifth Amended and Restated Credit Agreement (“Credit Agreement”) with The Bank of Nova Scotia, ING Capital LLC, Canadian Imperial Bank of Commerce and JPMorgan Chase Bank, N. A. (the “Lenders”) to replace our prior credit agreement. We borrowed $47,000,000 under the Credit Agreement to partially fund the cash portion of the Purchase Price and for related closing expenses. We funded the remainder of the cash portion of the Purchase Price using cash on hand.

Item 3.02. Unregist

ered Sales of Equity Securities

As previously disclosed in our Current Report on Form 8-K filed on March 19, 2018, pursuant to the terms of the Agreement, part of the purchase price for the outstanding common shares of Klondex was to be paid using shares of Hecla common stock. At closing, we issued 75,276,176 shares of our common stock to Klondex shareholders, pursuant to an exemption from registration under Section 3(a)(10) of the Securities Act of 1933.

Item 8.01. Other Events

On July 23, 2018, the Company issued a press release announcing the closing of the Klondex acquisition, effective July 20, 2018. A copy of the news release is attached hereto as Exhibit 99.1, and is incorporated by reference herein.

Item 9.01. Financial Statements and Exhibits

|

|

(a)

|

Financial Statements of Businesses Acquired.

|

The unaudited financial statements of Klondex as of March 31, 2018 and for the three months ended March 31, 2018 and March 31, 2017, are filed as Exhibit 99.2 and incorporated in their entirety herein by reference. The audited financial statements of Klondex as of and for the years ended December 31, 2017 and 2016 are filed as Exhibit 99.3 and incorporated in their entirety herein by reference.

|

|

(b)

|

Pro Forma Financial Information.

|

The unaudited pro forma financial information giving effect to the acquisition of Klondex as of and for the three-month period ended March 31, 2018, and for the year ended December 31, 2017, is furnished as Exhibit 99.4 and incorporated in its entirety herein by reference.

____________________

* Filed herewith.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

HECLA MINING COMPANY

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/

David C. Sienko

|

|

|

|

|

David C. Sienko

|

|

|

|

|

Vice President and General Counsel

|

|

Dated: July 24, 2018

4

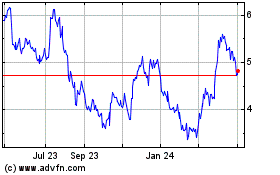

Hecla Mining (NYSE:HL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Hecla Mining (NYSE:HL)

Historical Stock Chart

From Apr 2023 to Apr 2024