Current Report Filing (8-k)

July 20 2018 - 5:17PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES

EXCHANGE ACT OF 1934

Date

of report (Date of earliest event reported): July 20, 2018 (July 20, 2018)

Manhattan

Bridge Capital, Inc.

(Exact

Name of Registrant as Specified in Charter)

|

New

York

|

|

000-25991

|

|

11-3474831

|

(State

or Other Jurisdiction

of Incorporation)

|

|

(Commission

File

Number)

|

|

(IRS

Employer

Identification

No.)

|

|

60

Cutter Mill Road, Great Neck, NY

|

|

11021

|

|

(Address

of Principal Executive Offices)

|

|

(Zip

Code)

|

(516)

444-3400

(Registrant’s

telephone number,

including

area code)

Not

applicable

(Former

Name or Former Address, if Changed Since Last Report)

Check

the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

|

[ ]

|

Written

communications pursuant to Rule 425 under the Section Act (17 CFR 230.425).

|

|

[ ]

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12).

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240-14d-2(b)).

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)).

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act

of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company [ ]

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Item

1.01. Entry into a Material Definitive Agreement.

On

July 20, 2018, Manhattan Bridge Capital, Inc. (the “Company”) entered into an underwriting agreement (the “Underwriting

Agreement”) with National Securities Corporation (the “Underwriter”) in connection with a public offering (the

“Offering”) of 1,428,572 of the Company’s common shares, $0.001 par value per share (the “Common Shares”).

Pursuant to the Underwriting Agreement, the Underwriter agreed to buy, on an underwritten firm commitment basis, 1,428,572 Common

Shares. Pursuant to the Underwriting Agreement, the Company granted the Underwriter a 45-day option to purchase from the Company

up to an additional 214,286 Common Shares at a price of $7.00 per share to cover over allotments, if any.

National

Securities Corporation was the sole book-running manager for the Offering. The Offering is expected to close on July 24, 2018,

subject to the satisfaction of customary closing conditions.

In

connection with the Offering, the Company agreed to pay the Underwriter a cash commission of 7% of the aggregate gross proceeds

of the sale of the Common Shares and to cover other expenses.

The

net proceeds to the Company are expected to be approximately $9.1 million, assuming no exercise of the over-allotment option

and after deducting underwriting discounts and commissions and estimated expenses payable by the Company associated with the Offering.

The Offering is being made pursuant to the Company’s shelf registration statement on Form S-3 (Registration No. 333-224955),

which was declared effective by the Securities and Exchange Commission (the “SEC”) on May 24, 2018. A prospectus supplement

relating to the Offering will be filed with the SEC.

The

foregoing description of the Offering is qualified in its entirety by reference to the Underwriting Agreement, a copy of which

is filed as Exhibit 1.1 to this Current Report on Form 8-K and which is hereby incorporated by reference into this Item 1.01.

This

Current Report on Form 8-K shall not constitute an offer to sell or the solicitation of an offer to buy nor shall there be any

sale of these securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration

or qualification under the securities laws of any such state or jurisdiction.

Item

9.01. Financial Statements and Exhibits.

(d)

Exhibits

Forward-Looking

Statements

This

Current Report on Form 8-K contains forward-looking statements within the meaning of the “safe harbor” provisions

of the Private Securities Litigation Reform Act of 1995 and other Federal securities laws. Because such statements deal with future

events and are based on the Company’s current expectations, they are subject to various risks and uncertainties and actual

results, performance or achievements of the Company could differ materially from those described in or implied by the statements

in this Current Report on Form 8-K. For example, forward-looking statements include statements regarding the potential exercise

by the Underwriter of its over-allotment option to purchase of additional Common Shares, the successful closing of the Offering

and planned use of the net proceeds from the Offering. The forward-looking statements contained or implied in this Current Report

on Form 8-K are subject to other risks and uncertainties, including market conditions and the satisfaction of customary closing

conditions related to the Offering, and other risk factors discussed in the Company’s Annual Report on Form 10-K for the

fiscal year ended December 31, 2017, filed with the SEC and in subsequent filings with the SEC. Except as otherwise required by

law, the Company disclaims any intention or obligation to update or revise any forward-looking statements, which speak only as

of the date they were made, whether as a result of new information, future events or circumstances or otherwise.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned, hereunto duly authorized.

|

|

MANHATTAN BRIDGE CAPITAL, INC.

|

|

|

|

|

|

Dated:

July 20, 2018

|

By:

|

/s/

Assaf Ran

|

|

|

Name:

|

Assaf Ran

|

|

|

Title:

|

President and

Chief Executive Officer

|

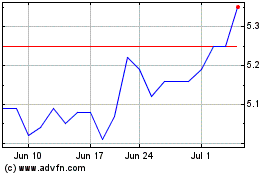

Manhattan Bridge Capital (NASDAQ:LOAN)

Historical Stock Chart

From Mar 2024 to Apr 2024

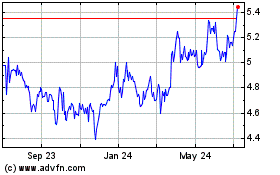

Manhattan Bridge Capital (NASDAQ:LOAN)

Historical Stock Chart

From Apr 2023 to Apr 2024