As

filed with the Securities and Exchange Commission on July 20, 2018

Registration

No. 333-

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Form

S-3

REGISTRATION

STATEMENT UNDER THE SECURITIES ACT OF 1933

VBI

VACCINES INC.

(Exact

Name of Registrant as Specified in Its Charter)

|

British

Columbia, Canada

|

|

2836

|

|

N/A

|

|

(State

or other jurisdiction of

incorporation

or organization)

|

|

(Primary

Standard Industrial

Classification

Code Number)

|

|

(I.R.S.

Employer

Identification

No.)

|

222

Third Street, Suite 2241

Cambridge,

MA 02142

(617)

830-3031

(Address,

including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Jeff

R. Baxter

President

and Chief Executive Officer

VBI

Vaccines Inc.

222

Third Street, Suite 2241

Cambridge,

MA 02142

(617)

830-3031

(Name,

address, including zip code, and telephone number, including area code, of agent for service)

With

Copies to:

Rick

A. Werner, Esq.

Jayun

Koo, Esq.

Haynes and Boone, LLP

30 Rockefeller Plaza, 26

th

Floor

New York, New York 10112

Tel. (212) 659-7300

Fax (212) 884-8234

Approximate

date of commencement of proposed sale to the public:

From time to time after the effective date of this registration statement,

as determined by market conditions and other factors.

If

the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please

check the following box. [ ]

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under

the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check

the following box. [X]

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please

check the following box and list the Securities Act registration statement number of the earlier effective registration statement

for the same offering. [ ]

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list

the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If

this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become

effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. [ ]

If

this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register

additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following

box. [ ]

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

Large

accelerated filer [ ]

|

|

Accelerated

filer [X]

|

|

|

Non-accelerated

filer [ ] (Do not check if a smaller reporting company)

|

|

Smaller

reporting company [ ]

Emerging

growth company [X]

|

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act. [X]

CALCULATION

OF REGISTRATION FEE

Title of each class of

securities to be registered(1)

|

|

Proposed

maximum

aggregate

offering price (2)

|

|

|

Amount of

registration fee (3)

|

|

|

Common shares, no par value

|

|

$

|

-

|

|

|

$

|

-

|

|

|

Warrants

|

|

|

-

|

|

|

|

-

|

|

|

Units

|

|

|

-

|

|

|

|

-

|

|

|

Subscription rights

|

|

|

-

|

|

|

|

-

|

|

|

Total

|

|

$

|

150,000,000

|

|

|

$

|

18,675.00

|

|

|

|

(1)

|

There

are being registered hereunder such indeterminate number of common shares, warrants to purchase common shares, units and subscription

rights as shall have an aggregate initial offering price not to exceed $150,000,000, less the aggregate dollar amount of all

securities previously sold hereunder. Any securities registered hereunder may be sold separately or as units with the other

securities registered hereunder. The proposed maximum offering price per unit will be determined, from time to time, by the

registrant in connection with the issuance by the registrant of the securities registered hereunder. The securities registered

hereunder also include such indeterminate number of common shares as may be issued upon exercise of warrants or pursuant to

the anti-dilution provisions of any of such securities. In addition, pursuant to Rule 416 under the Securities Act of 1933,

as amended, the shares being registered hereunder include such indeterminate number of common shares as may be issuable with

respect to the shares being registered hereunder as a result of share splits, share dividends or similar transactions.

|

|

|

|

|

|

|

(2)

|

The

proposed maximum offering price per security will be determined from time to time by the registrant in connection with, and

at the time of, the issuance of the securities and is not specified as to each class of security pursuant to General Instruction

II.D. of Form S-3, as amended.

|

|

|

|

|

|

|

(3)

|

Calculated

pursuant to Rule 457(o) under the Securities Act of 1933, as amended, based on the proposed maximum aggregate offering price

of all securities listed.

|

THE

REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL

THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME

EFFECTIVE IN ACCORDANCE WITH SECTION 8(a) OF THE SECURITIES ACT OF 1933, AS AMENDED, OR UNTIL THE REGISTRATION STATEMENT SHALL

BECOME EFFECTIVE ON SUCH DATE AS THE SECURITIES AND EXCHANGE COMMISSION, ACTING PURSUANT TO SAID SECTION 8(a), MAY DETERMINE.

The

information in this prospectus is not complete and may be changed. We may not sell these securities until the Securities and Exchange

Commission declares our registration statement effective. This prospectus is not an offer to sell these securities and it is not

soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT

TO COMPLETION, DATED

July

20, 2018

PROSPECTUS

$150,000,000

Common

Shares

Warrants

Units

Subscription

Rights

We

may offer and sell from time to time, in one or more series or issuances and on terms that we will determine at the time of the

offering, any combination of the securities described in this prospectus, up to an aggregate amount of $150,000,000.

We

will provide specific terms of any offering in a supplement to this prospectus. Any prospectus supplement may also add, update,

or change information contained in this prospectus. You should carefully read this prospectus and the applicable prospectus supplement

as well as the documents incorporated or deemed to be incorporated by reference in this prospectus before you purchase any of

the securities offered hereby.

These

securities may be offered and sold in the same offering or in separate offerings; to or through underwriters, dealers, and agents;

or directly to purchasers. The names of any underwriters, dealers, or agents involved in the sale of our securities, their compensation

and any over-allotment options held by them will be described in the applicable prospectus supplement. See “Plan of Distribution.”

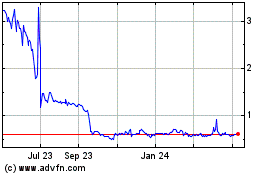

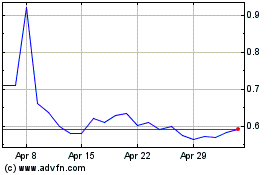

Our

common shares are listed on the NASDAQ Capital Market under the symbol “VBIV.” On July 19, 2018, the last reported

sale price of our common shares as reported by the NASDAQ Capital Market was $2.83 per share. We recommend that you obtain

current market quotations for our common shares prior to making an investment decision. We will provide information in any applicable

prospectus supplement regarding any listing of securities other than our common shares on any securities exchange.

You

should carefully read this prospectus, any prospectus supplement relating to any specific offering of securities, and all information

incorporated by reference herein and therein.

Investing

in our securities involves a high degree of risk. These risks are discussed in this prospectus under “Risk Factors”

beginning on page 3 and in the documents incorporated by reference into this prospectus.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or

passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The

date of this prospectus is , 2018

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS

This

prospectus is part of a registration statement on Form S-3 that we filed with the Securities and Exchange Commission using a “shelf”

registration process. Under this shelf process, we may, from time to time, sell any combination of the securities described in

this prospectus in one or more offerings up to a total amount of $150,000,000.

This

prospectus provides you with a general description of the securities we may offer. Each time we sell securities, we will provide

a prospectus supplement that will contain specific information about the terms of that offering. The prospectus supplement may

also add to, update or change information contained in the prospectus and, accordingly, to the extent inconsistent, information

in this prospectus is superseded by the information in the prospectus supplement.

The

prospectus supplement to be attached to the front of this prospectus may describe, as applicable: the terms of the securities

offered; the public offering price; the price paid for the securities; net proceeds; and the other specific terms related to the

offering of the securities.

You

should only rely on the information contained or incorporated by reference in this prospectus and any prospectus supplement or

issuer free writing prospectus relating to a particular offering. No person has been authorized to give any information or make

any representations in connection with this offering other than those contained or incorporated by reference in this prospectus,

any accompanying prospectus supplement and any related issuer free writing prospectus in connection with the offering described

herein and therein, and, if given or made, such information or representations must not be relied upon as having been authorized

by us. Neither this prospectus nor any prospectus supplement nor any related issuer free writing prospectus shall constitute an

offer to sell or a solicitation of an offer to buy offered securities in any jurisdiction in which it is unlawful for such person

to make such an offering or solicitation. This prospectus does not contain all of the information included in the registration

statement. For a more complete understanding of the offering of the securities, you should refer to the registration statement,

including its exhibits.

You

should read the entire prospectus and any prospectus supplement and any related issuer free writing prospectus, as well as the

documents incorporated by reference into this prospectus or any prospectus supplement or any related issuer free writing prospectus,

before making an investment decision. Neither the delivery of this prospectus or any prospectus supplement or any issuer free

writing prospectus nor any sale made hereunder shall under any circumstances imply that the information contained or incorporated

by reference herein or in any prospectus supplement or issuer free writing prospectus is correct as of any date subsequent to

the date hereof or of such prospectus supplement or issuer free writing prospectus, as applicable. You should assume that the

information appearing in this prospectus, any prospectus supplement or any document incorporated by reference is accurate only

as of the date of the applicable documents, regardless of the time of delivery of this prospectus or any sale of securities. Our

business, financial condition, results of operations and prospects may have changed since that date.

In

this prospectus, unless the context otherwise requires, references to the terms “VBI,” “we,” “us,”

“our” and the “Company” refer to VBI Vaccines Inc. and its subsidiaries.

Unless

indicated otherwise, all references to the U.S. Dollar, Dollar or $ are to the United States Dollar, the legal currency of the

United States of America and all references to € mean Euros, the legal currency of the European Union. We may also refer

to NIS, which is the New Israeli Shekel, the legal currency of Israel, and the Canadian Dollar or CAD, which is the legal currency

of Canada.

SPECIAL

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus, each prospectus supplement and the information incorporated by reference in this prospectus and each prospectus supplement

contain “forward-looking statements,” which include information relating to future events, future financial performance,

strategies, expectations, competitive environment and regulation. Words such as “may,” “should,” “could,”

“would,” “predicts,” “potential,” “continue,” “expects,” “anticipates,”

“future,” “intends,” “plans,” “believes,” “estimates,” and similar

expressions, as well as statements in future tense, identify forward-looking statements. Forward-looking statements should not

be read as a guarantee of future performance or results and will probably not be accurate indications of when such performance

or results will be achieved. Forward-looking statements are based on information we have when those statements are made or our

management’s good faith belief as of that time with respect to future events, and are subject to risks and uncertainties

that could cause actual performance or results to differ materially from those expressed in or suggested by the forward-looking

statements. Important factors that could cause such differences include, but are not limited to:

|

●

|

the

timing of, and our ability to, obtain and maintain regulatory approvals for our clinical trials, products and product candidates;

|

|

|

|

|

●

|

the

timing and results of our ongoing and planned clinical trials for products and product candidates;

|

|

|

|

|

●

|

the

amount of funds we require for our immuno-oncology and infectious disease vaccine candidate pipeline;

|

|

|

|

|

●

|

the

potential benefits of strategic partnership agreements and our ability to enter into strategic partnership arrangements;

|

|

|

|

|

●

|

our

ability to effectively execute and deliver our plans related to commercialization, marketing and manufacturing capabilities

and strategy;

|

|

|

|

|

●

|

our

ability to license our intellectual property;

|

|

|

|

|

●

|

our

ability to maintain a good relationship with our employees;

|

|

|

|

|

●

|

the

ability of our contract research organizations, third party investigators, and independent sites to fulfill their contractual

obligations or meet expected deadlines in conducting our clinical trials;

|

|

|

|

|

●

|

the

suitability and adequacy of our office, manufacturing and research facilities and our ability to secure term extensions or

expansions of leased space;

|

|

|

|

|

●

|

our

ability to manufacture, or to have manufactured, any products we develop to the standards and requirements of regulatory agencies;

|

|

|

|

|

●

|

the

ability of our vendors to manufacture and deliver materials that meet regulatory agency and our standards and requirements

in order to meet planned timelines and milestones;

|

|

|

|

|

●

|

any

disruption in the operations of our manufacturing facility where we manufacture all of our clinical and commercial supplies

of Sci-B-Vac™;

|

|

|

|

|

●

|

our

compliance with all laws, rules and regulations applicable to our business and products;

|

|

|

|

|

●

|

our

ability to continue as a going concern;

|

|

|

|

|

●

|

our

history of losses;

|

|

|

|

|

●

|

our

ability to generate revenues and achieve profitability;

|

|

|

|

|

●

|

emerging

competition and rapidly advancing technology in our industry that may outpace our technology;

|

|

●

|

customer

demand for our products and product candidates;

|

|

|

|

|

●

|

the

impact of competitive or alternative products, technologies and pricing;

|

|

|

|

|

●

|

general

economic conditions and events and the impact they may have on us and our potential customers;

|

|

|

|

|

●

|

our

ability to obtain adequate financing in the future on reasonable terms, as and when we need it;

|

|

|

|

|

●

|

our

ability to implement network systems and controls that are effective at preventing cyber-attacks, malware intrusions, malicious

viruses and ransomware threats;

|

|

|

|

|

●

|

our

ability to secure and maintain protection over our intellectual property;

|

|

|

|

|

●

|

changes

to legal and regulatory processes for biosimilar approval and marketing could reduce the duration of market exclusivity for

our products;

|

|

|

|

|

●

|

our

ability to maintain our existing licenses for intellectual property; and

|

|

|

|

|

●

|

our

success at managing the risks involved in the foregoing items.

|

You

should review carefully the section entitled “Risk Factors” beginning on page 3 of this prospectus for

a discussion of these and other risks that relate to our business and investing in our securities. The forward-looking statements

contained or incorporated by reference in this prospectus or any prospectus supplement are expressly qualified in their entirety

by this cautionary statement. We do not undertake any obligation to publicly update any forward-looking statement to reflect events

or circumstances after the date on which any such statement is made or to reflect the occurrence of unanticipated events.

PROSPECTUS

SUMMARY

This

summary provides an overview of selected information contained elsewhere or incorporated by reference in this prospectus and does

not contain all of the information you should consider before investing in our securities. You should carefully read the prospectus,

the information incorporated by reference and the registration statement of which this prospectus is a part in their entirety

before investing in our securities, including the information discussed under “Risk Factors” in this prospectus and

the documents incorporated by reference and our financial statements and related notes that are incorporated by reference in this

prospectus.

Overview

We

are a commercial stage biopharmaceutical company developing next generation vaccines to address unmet needs in infectious disease

and immuno-oncology. Our first marketed product is Sci-B-Vac® a third-generation hepatitis B virus vaccine that contains all

three viral surface antigens of the hepatitis B virus. Sci-B-Vac is approved for use in Israel and 14 other countries. In December

2017, we initiated a global Phase III program for Sci-B-Vac designed to achieve licensure for the vaccine in the United States,

Europe and Canada. Our wholly-owned subsidiary, SciVac Ltd., manufactures Sci-B-Vac in Rehovot, Israel.

We

are also advancing our “enveloped” virus-like particle (“eVLP”) platform technology. Our eVLP platform

technology enables the development of enveloped virus-like particle vaccines that closely mimic the target virus to elicit a potent

immune response. We are advancing a pipeline of eVLP vaccines, with lead programs in both infectious disease, with our congenital

cytomegalovirus vaccine candidate, and in immuno-oncology, with our therapeutic glioblastoma multiforme vaccine candidate.

Corporate

Information

Our

headquarters are located at 222 Third Street, Suite 2241, Cambridge, Massachusetts, 02142. Our telephone number at our headquarters

is (617) 830-3031. Our manufacturing operations are located at 13 Gad Feinstein Road, POB 580, Rehovot, Israel 7610303 and our

research operations are located at 310 Hunt Club Road East, Suite 201, Ottawa, Ontario Canada K1V 1C1. Our registered office is

located at Suite 1700, Park Place, 666 Burrard Street, Vancouver, British Columbia V6C 2X8.

Additional

information about us is available on our website at www.vbivaccines.com. The information contained on or that may be obtained

from our website is not, and shall not be deemed to be, a part of this prospectus.

For

a description of our business, financial condition, results of operations and other important information regarding us, we refer

you to our filings with the Securities and Exchange Commission incorporated by reference in this prospectus. For instructions

on how to find copies of these documents, see “

Where You Can Find More Information

.”

The

Securities We May Offer

We

may offer up to $150,000,000 of common shares, warrants, units and/or subscription rights in one or more offerings and in any

combination. This prospectus provides you with a general description of the securities we may offer. A prospectus supplement,

which we will provide each time we offer securities, will describe the specific amounts, prices and terms of these securities.

Common

Shares

We

may issue our common shares from time to time. Each holder of our common shares is entitled to one vote for each such share outstanding

in the holder’s name. No holder of common shares is entitled to cumulate votes in voting for directors. Holders of our common

shares are entitled to such dividends as may be declared by our board of directors out of funds legally available for such purpose;

however, the current policy of our board of directors is to retain earnings, if any, for operations and growth. In the event of

our liquidation, dissolution or winding up, the holders of our common shares are entitled to receive pro rata our assets which

are legally available for distribution, after payments of all debts and other liabilities. The common shares are neither redeemable

nor convertible. Holders of common shares have no preemptive or subscription rights to purchase any of our securities.

Warrants

We

may issue warrants for the purchase of our common shares in one or more series. We may issue warrants independently or together

with common shares, and the warrants may be attached to or separate from these securities. We will evidence each series of warrants

by warrant certificates that we will issue under a separate agreement. We may enter into warrant agreements with a bank or trust

company that we select to be our warrant agent. We will indicate the name and address of the warrant agent in the applicable prospectus

supplement relating to a particular series of warrants.

In

this prospectus, we have summarized certain general features of the warrants. We urge you, however, to read the applicable prospectus

supplement related to the particular series of warrants being offered, as well as the warrant agreements and warrant certificates

that contain the terms of the warrants. We will file as exhibits to the registration statement of which this prospectus is a part,

or will incorporate by reference from reports that we file with the Securities and Exchange Commission, the form of warrant agreement

or warrant certificate containing the terms of the warrants we are offering before the issuance of the warrants.

Units

We

may issue units consisting of one or more of the other securities described in this prospectus in any combination in one or more

series. In this prospectus, we have summarized certain general features of the units. We urge you, however, to read the applicable

prospectus supplement related to the series of units being offered, as well as the unit agreements that contain the terms of the

units. We will file as exhibits to the registration statement of which this prospectus is a part, or will incorporate by reference

reports that we file with the Securities and Exchange Commission, the form of unit agreement and any supplemental agreements that

describe the terms of the series of units we are offering before the issuance of the related series of units.

Subscription

Rights

We

may issue subscription rights to purchase common shares or other securities. These subscription rights may be issued independently

or together with any other security offered hereby and may or may not be transferable by the shareholder receiving the subscription

rights in such offering. In connection with any offering of subscription rights, we may enter into a standby arrangement with

one or more underwriters or other purchasers pursuant to which the underwriters or other purchasers may be required to purchase

any securities remaining unsubscribed for after such offering. We will file as exhibits to the registration statement of which

this prospectus is a part, or will incorporate by reference reports that we file with the Securities and Exchange Commission,

the form of such agreement and any supplemental agreements that describe the terms of the subscription rights we are offering

before the issuance of such subscription rights.

RISK

FACTORS

An

investment in our securities involves a high degree of risk. The prospectus supplement applicable to each offering of our securities

will contain a discussion of the risks applicable to an investment in our securities. Before deciding whether to invest in our

securities, you should carefully consider the specific factors discussed under the heading “Risk Factors” in the applicable

prospectus supplement, together with all of the other information contained or incorporated by reference in the prospectus supplement

or appearing or incorporated by reference in this prospectus. You should also consider the risks, uncertainties and assumptions

discussed under Item 1A, “Risk Factors,” in our Annual Report on Form 10-K for the fiscal year ended December 31,

2017, all of which are incorporated herein by reference, as updated or superseded by the risks and uncertainties described under

similar headings in the other documents that are filed after the date hereof and incorporated by reference into this prospectus

and any prospectus supplement related to a particular offering. The risks and uncertainties we have described are not the only

ones we face. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also affect

our operations. Past financial performance may not be a reliable indicator of future performance, and historical trends should

not be used to anticipate results or trends in future periods. If any of these risks actually occurs, our business, business prospects,

financial condition or results of operations could be seriously harmed. This could cause the trading price of our common share

to decline, resulting in a loss of all or part of your investment. Please also read carefully the section below entitled “Special

Note Regarding Forward-Looking Statements.”

USE

OF PROCEEDS

Unless

we specify another use in the applicable prospectus supplement, we will use the net proceeds from the sale of the securities offered

by us for general corporate purposes, including funding of our development programs, commercial planning and sales and marketing

expenses, general and administrative expenses, acquisition or licensing of additional product candidates or businesses and working

capital.

Investors

are cautioned, however, that expenditures may vary substantially from these uses. Investors will be relying on the judgment of

our management, who will have broad discretion regarding the application of the proceeds of this offering. The amounts and timing

of our actual expenditures will depend upon numerous factors, including the amount of cash generated by our operations, the amount

of competition and other operational factors. We may find it necessary or advisable to use portions of the proceeds from this

offering for other purposes.

From

time to time, we evaluate these and other factors and we anticipate continuing to make such evaluations to determine if the existing

allocation of resources, including the proceeds of this offering, is being optimized. Circumstances that may give rise to a change

in the use of proceeds include:

|

|

●

|

a

change in development plan or strategy;

|

|

|

●

|

the

addition of new products or applications;

|

|

|

●

|

technical

delays;

|

|

|

●

|

delays

or difficulties with our clinical trials;

|

|

|

●

|

negative

results from our clinical trials;

|

|

|

●

|

difficulty

obtaining U.S. Food and Drug Administration approval;

|

|

|

●

|

failure

to achieve sales as anticipated; and

|

|

|

●

|

the

availability of other sources of cash including cash flow from operations and new bank debt financing arrangements, if any.

|

Pending

other uses, we intend to invest the proceeds to us in short-term, investment grade, interest-bearing bank accounts or securities.

We cannot predict whether the proceeds invested will yield a favorable, or any, return.

DESCRIPTION

OF CAPITAL STOCK

The

following description of common shares summarizes the material terms and provisions of the common shares that we may offer under

this prospectus, but is not complete. For the complete terms of our common shares, please refer to our Articles, a copy of which

are filed as exhibits to our registration statement on Form S-3, of which this prospectus forms a part. See “Where You Can

Find More Information.”

Description

of Common Shares

We

are authorized to issue an unlimited number of common shares with no par value. We are governed by the BCBCA and other relevant

laws, which may affect the rights of shareholders differently than those of a company governed by the laws of a U.S. jurisdiction,

and may, together with our charter documents, including the advance notice provisions in our Articles for the nomination of directors,

have the effect of delaying, deferring or discouraging another party from acquiring control of our company by means of a tender

offer, a proxy contest or otherwise, or may affect the price an acquiring party would be willing to offer in such an instance.

The material differences between the BCBCA and Delaware General Corporation Law, or DGCL, that may have the greatest such effect

include, but are not limited to, the following: (i) for material corporate transactions (such as mergers and amalgamations, other

extraordinary corporate transactions or amendments to our articles) the BCBCA generally requires a two-thirds majority vote by

shareholders, whereas DGCL generally only requires a majority vote; and (ii) under the BCBCA a holder of 5% or more of our common

shares can requisition a special meeting of shareholders, whereas such right does not exist under the DGCL.

As

of July 11, 2018, we had 64,383,391 common shares outstanding. Our authorized but unissued common shares are available for issuance

without further action by our shareholders, unless such action is required by applicable law or the rules of any stock exchange

or automated quotation system on which our securities may be listed or traded.

As

of July 11, 2018, there are 3,799,828 outstanding equity grants and awards which include: 3,421,341 common shares issuable upon

the exercise of outstanding options having a weighted average exercise price of $4.34 per share; and 378,487 common shares issuable

upon the vesting of stock awards having a weighted average fair value at grant date of $4.09 per share.

Holders

of our common shares are entitled to such dividends as may be declared by our board of directors out of funds legally available

for such purpose. The common shares are neither redeemable or convertible. Holders of common shares have no preemptive or subscription

rights to purchase any of our securities.

Each

holder of our common shares is entitled to one vote for each such share outstanding in the holder’s name. No holder of common

shares is entitled to cumulate votes in voting for directors.

In

the event of our liquidation, dissolution or winding up, the holders of our common shares are entitled to receive pro rata our

assets which are legally available for distribution, after payments of all debts and other liabilities. All of the outstanding

common shares are fully paid and non-assessable. The common shares offered by this prospectus will also be fully paid and non-assessable.

On July 19, 2018, the

last sale price of our common shares on the NASDAQ Capital Market was $2.83 per share. The transfer agent and registrar

for our common shares is Computershare. Its address is 510 Burrard Street, 2nd Floor, Vancouver, British Columbia V6C 3B9, and

its telephone number is (604) 661-9442.

Registration

Rights

Pursuant

to the warrants issued to Perceptive Credit Holdings, LP (the “Lender”) in accordance with that certain Amended and

Restated Credit Agreement and Guaranty, as may be amended from time to time in accordance with its terms, at any time after the

one hundred eightieth day following the original issue date of the warrant, which was December 6, 2016, the Lender, or its assignees,

may request that we register all or any portion of the common shares underlying the warrants for sale on a registration statement

under the Securities Act.

In

addition, if at any time we propose to register any of our common shares under the Securities Act for public sale either for our

own account or for the account of other shareholders, the holder of the warrants are entitled to notice of the registration and

may request that we include all or a portion of the common shares in the registration. These piggyback registration rights are

subject to specified conditions and limitations, including the right of the underwriters to limit the number of shares included

in any such registration under specified circumstances. The Lender has waived these rights as they may apply to the filing of

the registration statement of which this prospectus is a part.

As

of July 11, 2018, there are 2,618,824 common shares issuable upon the exercise of outstanding warrants having a weighted average

exercise price of $3.57 per share.

DESCRIPTION

OF WARRANTS

As

of July 11, 2018, there were 2,618,824 common shares that may be issued upon exercise of outstanding warrants.

We

may issue warrants for the purchase of common shares in one or more series. We may issue warrants independently or together with

common shares, and the warrants may be attached to or separate from common shares.

We

will evidence each series of warrants by warrant certificates that we may issue under a separate agreement. We may enter into

a warrant agreement with a warrant agent. Each warrant agent may be a bank that we select which has its principal office in the

United States or in Canada. We may also choose to act as our own warrant agent. We will indicate the name and address of any such

warrant agent in the applicable prospectus supplement relating to a particular series of warrants.

We

will describe in the applicable prospectus supplement the terms of the series of warrants, including:

|

|

●

|

the

offering price and aggregate number of warrants offered;

|

|

|

●

|

if

applicable, the designation and terms of the securities with which the warrants are issued and the number of warrants issued

with each such security or each principal amount of such security;

|

|

|

●

|

if

applicable, the date on and after which the warrants and the related securities will be separately transferable;

|

|

|

●

|

the

number or amount of common shares purchasable upon the exercise of one warrant and the price at which and currency in which

these shares may be purchased upon such exercise;

|

|

|

●

|

the

manner of exercise of the warrants, including any cashless exercise rights;

|

|

|

●

|

the

warrant agreement under which the warrants will be issued;

|

|

|

●

|

the

effect of any merger, consolidation, sale or other disposition of our business on the warrant agreement and the warrants;

|

|

|

●

|

anti-dilution

provisions of the warrants, if any;

|

|

|

●

|

the

terms of any rights to redeem or call the warrants;

|

|

|

●

|

any

provisions for changes to or adjustments in the exercise price or number of securities issuable upon exercise of the warrants;

|

|

|

●

|

the

dates on which the right to exercise the warrants will commence and expire or, if the warrants are not continuously exercisable

during that period, the specific date or dates on which the warrants will be exercisable;

|

|

|

●

|

the

manner in which the warrant agreement and warrants may be modified;

|

|

|

●

|

the

identities of the warrant agent and any calculation or other agent for the warrants;

|

|

|

●

|

U.S.

or Canadian federal income tax consequences of holding or exercising the warrants;

|

|

|

●

|

the

terms of the securities issuable upon exercise of the warrants;

|

|

|

●

|

any

securities exchange or quotation system on which the warrants or any securities deliverable upon exercise of the warrants

may be listed or quoted; and

|

|

|

●

|

any

other specific terms, preferences, rights or limitations of or restrictions on the warrants.

|

Before

exercising their warrants, holders of warrants will not have any of the rights of holders of the securities purchasable upon such

exercise, including, in the case of warrants to purchase common shares, the right to receive dividends, if any, or, payments upon

our liquidation, dissolution or winding up or to exercise voting rights, if any.

Exercise

of Warrants

Each

warrant will entitle the holder to purchase the securities that we specify in the applicable prospectus supplement at the exercise

price that we describe in the applicable prospectus supplement. Unless we otherwise specify in the applicable prospectus supplement,

holders of the warrants may exercise the warrants at any time up to 5:00 P.M. Eastern Time, the close of business, on the expiration

date that we set forth in the applicable prospectus supplement. After the close of business on the expiration date, unexercised

warrants will become void.

Holders

of the warrants may exercise the warrants by delivering the warrant certificate representing the warrants to be exercised together

with specified information, and paying the required exercise price by the methods provided in the applicable prospectus supplement.

We will set forth on the reverse side of the warrant certificate, and in the applicable prospectus supplement, the information

that the holder of the warrant will be required to deliver to the warrant agent.

Upon

receipt of the required payment and the warrant certificate properly completed and duly executed at the corporate trust office

of the warrant agent or any other office indicated in the applicable prospectus supplement, we will issue and deliver the securities

purchasable upon such exercise. If fewer than all of the warrants represented by the warrant certificate are exercised, then we

will issue a new warrant certificate for the remaining amount of warrants.

Enforceability

of Rights By Holders of Warrants

Any

warrant agent will act solely as our agent under the applicable warrant agreement and will not assume any obligation or relationship

of agency or trust with any holder of any warrant. A single bank or trust company may act as warrant agent for more than one issue

of warrants. A warrant agent will have no duty or responsibility in case of any default by us under the applicable warrant agreement

or warrant, including any duty or responsibility to initiate any proceedings at law or otherwise, or to make any demand upon us.

Any holder of a warrant may, without the consent of the related warrant agent or the holder of any other warrant, enforce by appropriate

legal action the holder’s right to exercise, and receive the securities purchasable upon exercise of, its warrants in accordance

with their terms.

Warrant

Agreement Will Not Be Qualified Under Trust Indenture Act

No

warrant agreement will be qualified as an indenture, and no warrant agent will be required to qualify as a trustee, under the

Trust Indenture Act. Therefore, holders of warrants issued under a warrant agreement will not have the protection of the Trust

Indenture Act with respect to their warrants.

Governing

Law

Each

warrant agreement and any warrants issued under the warrant agreements will be governed by New York law.

DESCRIPTION

OF UNITS

We

may issue units comprised of one or more of the other securities described in this prospectus or any prospectus supplement in

any combination. Each unit will be issued so that the holder of the unit is also the holder, with the rights and obligations of

a holder, of each security included in the unit. The unit agreement under which a unit is issued may provide that the securities

included in the unit may not be held or transferred separately, at any time or at any times before a specified date or upon the

occurrence of a specified event or occurrence.

The

applicable prospectus supplement will describe:

|

|

●

|

the

designation and the terms of the units and of the securities comprising the units, including whether and under what circumstances

those securities may be held or transferred separately;

|

|

|

●

|

any

unit agreement under which the units will be issued;

|

|

|

●

|

any

provisions for the issuance, payment, settlement, transfer or exchange of the units or of the securities comprising the units;

and

|

|

|

●

|

whether

the units will be issued in fully registered or global form.

|

DESCRIPTION

OF SUBSCRIPTION RIGHTS

The

following is a general description of the terms of the subscription rights we may issue from time to time. Particular terms of

any subscription rights we offer will be described in the prospectus supplement relating to such subscription rights, and may

differ from the terms described herein.

We

may issue subscription rights to purchase common shares or other securities offered hereby. These subscription rights may be issued

independently or together with any other security offered hereby and may or may not be transferable by the shareholder receiving

the subscription rights in such offering. In connection with any offering of subscription rights, we may enter into a standby

arrangement with one or more underwriters or other purchasers pursuant to which the underwriters or other purchasers may be required

to purchase any securities remaining unsubscribed for after such offering.

The

applicable prospectus supplement will describe the specific terms of any offering of subscription rights for which this prospectus

is being delivered, including the following:

|

|

●

|

whether

common shares or other securities will be offered under the shareholder subscription rights;

|

|

|

|

|

|

|

●

|

the

price, if any, for the subscription rights;

|

|

|

|

|

|

|

●

|

the

exercise price payable for each security upon the exercise of the subscription rights;

|

|

|

|

|

|

|

●

|

the

number of subscription rights issued to each shareholder;

|

|

|

|

|

|

|

●

|

the

number and terms of the securities which may be purchased per each subscription right;

|

|

|

|

|

|

|

●

|

the

extent to which the subscription rights are transferable;

|

|

|

|

|

|

|

●

|

any

other terms of the subscription rights, including the terms, procedures and limitations relating to the exchange and exercise

of the subscription rights;

|

|

|

|

|

|

|

●

|

the

date on which the right to exercise the subscription rights shall commence, and the date on which the subscription rights

shall expire;

|

|

|

|

|

|

|

●

|

the

extent to which the subscription rights may include an over-subscription privilege with respect to unsubscribed securities;

|

|

|

|

|

|

|

●

|

if

appropriate, a discussion of material U.S. or Canadian federal income tax considerations; and

|

|

|

|

|

|

|

●

|

if

applicable, the material terms of any standby underwriting or purchase arrangement entered into by us in connection with the

offering of subscription rights.

|

The

description in the applicable prospectus supplement of any subscription rights we offer will not necessarily be complete and will

be qualified in its entirety by reference to the applicable subscription rights certificate or subscription rights agreement,

which will be filed with the Securities and Exchange Commission if we offer subscription rights.

PLAN

OF DISTRIBUTION

We

may sell the securities being offered pursuant to this prospectus to or through underwriters, through dealers, through agents,

or directly to one or more purchasers or through a combination of these methods. The applicable prospectus supplement will describe

the terms of the offering of the securities, including:

|

|

●

|

the

name or names of any underwriters, if any, and if required, any dealers or agents;

|

|

|

●

|

the

purchase price of the securities and the proceeds we will receive from the sale;

|

|

|

●

|

any

underwriting discounts and other items constituting underwriters’ compensation;

|

|

|

●

|

any

discounts or concessions allowed or reallowed or paid to dealers; and

|

|

|

●

|

any

securities exchange or market on which the securities may be listed or traded.

|

We

may distribute the securities from time to time in one or more transactions at:

|

|

●

|

a

fixed price or prices, which may be changed;

|

|

|

●

|

market

prices prevailing at the time of sale, directly by us or through a designated agent;

|

|

|

●

|

in

“at the market” offerings within the meanings of Rule 415(a)(4) under the Securities Act of 1933 or through a

market maker or into an existing market, on an exchange, or otherwise;

|

|

|

●

|

prices

related to such prevailing market prices; or

|

|

|

●

|

negotiated

prices.

|

Only

underwriters named in the prospectus supplement are underwriters of the securities offered by the prospectus supplement.

We

may also make direct sales through subscription rights distributed to our existing shareholders on a pro rata basis, which may

or may not be transferable. In any distribution of subscription rights to our shareholders, if all of the underlying securities

are not subscribed for, we may then sell the unsubscribed securities directly to third parties or may engage the services of one

or more underwriters, dealers or agents, including standby underwriters, to sell the unsubscribed securities to third parties.

In addition, whether or not all of the underlying securities are subscribed for, we may concurrently offer additional securities

to third parties directly or through underwriters, dealers or agents.

If

underwriters are used in an offering, we will execute an underwriting agreement with such underwriters and will specify the name

of each underwriter and the terms of the transaction (including any underwriting discounts and other terms constituting compensation

of the underwriters and any dealers) in a prospectus supplement. The securities may be offered to the public either through underwriting

syndicates represented by managing underwriters or directly by one or more investment banking firms or others, as designated.

If an underwriting syndicate is used, the managing underwriter(s) will be specified on the cover of the prospectus supplement.

If underwriters are used in the sale, the offered securities will be acquired by the underwriters for their own accounts and may

be resold from time to time in one or more transactions, including negotiated transactions, at a fixed public offering price or

at varying prices determined at the time of sale. Any public offering price and any discounts or concessions allowed or reallowed

or paid to dealers may be changed from time to time. Unless otherwise set forth in the prospectus supplement, the obligations

of the underwriters to purchase the offered securities will be subject to conditions precedent, and the underwriters will be obligated

to purchase all of the offered securities, if any are purchased.

We

may grant to the underwriters options to purchase additional securities to cover over-allotments, if any, at the public offering

price, with additional underwriting commissions or discounts, as may be set forth in a related prospectus supplement. The terms

of any over-allotment option will be set forth in the prospectus supplement for those securities.

If

we use a dealer in the sale of the securities being offered pursuant to this prospectus or any prospectus supplement, we will

sell the securities to the dealer, as principal. The dealer may then resell the securities to the public at varying prices to

be determined by the dealer at the time of resale. The names of the dealers and the terms of the transaction will be specified

in a prospectus supplement.

We

may sell the securities directly or through agents we designate from time to time. We will name any agent involved in the offering

and sale of securities and we will describe any commissions we will pay the agent in the prospectus supplement. Unless the prospectus

supplement states otherwise, any agent will act on a best-efforts basis for the period of its appointment.

We

may authorize agents or underwriters to solicit offers by institutional investors to purchase securities from us at the public

offering price set forth in the prospectus supplement pursuant to delayed delivery contracts providing for payment and delivery

on a specified date in the future. We will describe the conditions to these contracts and the commissions we must pay for solicitation

of these contracts in the prospectus supplement.

In

connection with the sale of the securities, underwriters, dealers or agents may receive compensation from us or from purchasers

of the securities for whom they act as agents, in the form of discounts, concessions or commissions. Underwriters may sell the

securities to or through dealers, and those dealers may receive compensation in the form of discounts, concessions or commissions

from the underwriters or commissions from the purchasers for whom they may act as agents. Underwriters, dealers and agents that

participate in the distribution of the securities, and any institutional investors or others that purchase securities directly

for the purpose of resale or distribution, may be deemed to be underwriters, and any discounts or commissions received by them

from us and any profit on the resale of the common shares by them may be deemed to be underwriting discounts and commissions under

the Securities Act of 1933, as amended.

We

may provide agents, underwriters and other purchasers with indemnification against particular civil liabilities, including liabilities

under the Securities Act of 1933, as amended, or contribution with respect to payments that the agents, underwriters or other

purchasers may make with respect to such liabilities. Agents and underwriters may engage in transactions with, or perform services

for, us in the ordinary course of business.

To

facilitate the public offering of a series of securities, persons participating in the offering may engage in transactions that

stabilize, maintain, or otherwise affect the market price of the securities. This may include over-allotments or short sales of

the securities, which involves the sale by persons participating in the offering of more securities than have been sold to them

by us. In addition, those persons may stabilize or maintain the price of the securities by bidding for or purchasing securities

in the open market or by imposing penalty bids, whereby selling concessions allowed to underwriters or dealers participating in

any such offering may be reclaimed if securities sold by them are repurchased in connection with stabilization transactions. The

effect of these transactions may be to stabilize or maintain the market price of the securities at a level above that which might

otherwise prevail in the open market. Such transactions, if commenced, may be discontinued at any time. We make no representation

or prediction as to the direction or magnitude of any effect that the transactions described above, if implemented, may have on

the price of our securities.

Unless

otherwise specified in the applicable prospectus supplement, any common shares sold pursuant to a prospectus supplement will be

eligible for listing on the NASDAQ Capital Market, subject to official notice of issuance. Any underwriters to whom securities

are sold by us for public offering and sale may make a market in the securities, but such underwriters will not be obligated to

do so and may discontinue any market making at any time without notice.

In

order to comply with the securities laws of some states, if applicable, the securities offered pursuant to this prospectus will

be sold in those states only through registered or licensed brokers or dealers. In addition, in some states securities may not

be sold unless they have been registered or qualified for sale in the applicable state or an exemption from the registration or

qualification requirement is available and complied with.

LEGAL

MATTERS

Certain

legal matters with respect to the United States of America and New York law with respect to the validity of certain of the offered

securities will be passed upon for us by Haynes and Boone LLP, New York, New York. Certain legal matters with respect to Canadian

law with respect to the validity of certain of the offered securities will be passed upon for us by Stikeman Elliott LLP, Toronto,

Ontario. If the validity of any securities is also passed upon by counsel for the underwriters of an offering of those securities,

that counsel will be named in the prospectus supplement relating to that offering.

EXPERTS

The

consolidated balance sheets of VBI Vaccines Inc. and subsidiaries as of December 31, 2017, and 2016, and the related consolidated

statements of operations and comprehensive loss, stockholders’ equity and cash flows for each of the years then ended, included

in our Annual Report on Form 10-K for the year ended December 31, 2017, have been audited by EisnerAmper LLP, independent registered

public accounting firm, as stated in their report which is incorporated by reference in this prospectus, which report includes

an explanatory paragraph about the existence of substantial doubt concerning our ability to continue as a going concern. Such

financial statements have been incorporated by reference in reliance on the report of such firm given upon their authority as

experts in accounting and auditing.

Smythe

LLP, independent registered public accounting firm, has audited our consolidated balance sheet as of December 31, 2015, and the

related consolidated statements of operations and comprehensive loss, stockholders’ equity and cash flows for the year then

ended, included in our Annual Report on Form 10-K for the year ended December 31, 2017, as set forth in their report, which is

incorporated by reference in this prospectus. Our consolidated financial statements are incorporated by reference in reliance

on Smythe LLP’s report, given on their authority as experts in accounting and auditing.

Peterson

Sullivan LLP, independent registered public accounting firm, has audited the consolidated financial statements of VBI Vaccines

(Delaware) Inc., our wholly-owned subsidiary, as set forth in its report thereon which is included in our prospectus filed on

April 8, 2016 pursuant to Rule 424(b)(3) (Securities and Exchange Commission File No. 333-208761) and incorporated by reference

in this prospectus, which report includes an explanatory paragraph about the existence of substantial doubt concerning VBI Vaccines

(Delaware) Inc.’s ability to continue as a going concern. Such consolidated financial statements are incorporated herein

by reference in reliance upon such report given on the authority of such firm as experts in accounting and auditing.

WHERE

YOU CAN FIND MORE INFORMATION

We

are subject to the informational requirements of the Securities Exchange Act of 1934, as amended, and in accordance therewith

file annual, quarterly and current reports, proxy statements and other information with the Securities and Exchange Commission.

Such reports, proxy statements and other information can be read and copied at the Securities and Exchange Commission’s

public reference facilities at 100 F Street, N.E., Washington, D.C. 20549, at prescribed rates. Please call the Securities and

Exchange Commission at 1-800-732-0330 for further information on the operation of the public reference facilities. In addition,

the Securities and Exchange Commission maintains a website that contains reports, proxy and information statements and other information

regarding registrants that file electronically with the Securities and Exchange Commission. The address of the Securities and

Exchange Commission’s website is www.sec.gov.

We

make available free of charge on or through our website at http://www.vbivaccines.com, our Annual Reports on Form 10-K, Quarterly

Reports on Form 10-Q, Current Reports on Form 8-K, amendments to those reports, and other information that we filed or furnished

pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended, as soon as reasonably practicable after

we electronically file such material with or otherwise furnish it to the Securities and Exchange Commission.

We

have filed with the Securities and Exchange Commission a registration statement under the Securities Act of 1933, as amended,

relating to the offering of these securities. The registration statement, including the attached exhibits, contains additional

relevant information about us and the securities. This prospectus does not contain all of the information set forth in the registration

statement. You can obtain a copy of the registration statement, at prescribed rates, from the Securities and Exchange Commission

at the address listed above, or for free at www.sec.gov. The registration statement and the documents referred to below under

“Incorporation of Certain Information By Reference” are also available on our website, http://www.vbivaccines.com.

We

have not incorporated by reference into this prospectus the information on our website, and you should not consider it to be a

part of this prospectus.

INFORMATION

INCORPORATED BY REFERENCE

The

Securities and Exchange Commission allows us to “incorporate by reference” the information we have filed with it,

which means that we can disclose important information to you by referring you to those documents. The information we incorporate

by reference is an important part of this prospectus, and later information that we file with the Securities and Exchange Commission

could automatically update and supersede this information. We incorporate by reference the documents listed below and any future

documents (excluding information furnished pursuant to Items 2.02 and 7.01 of Form 8-K) we file with the Securities and Exchange

Commission pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934, as amended, subsequent to the

date of this prospectus and prior to the termination or completion of the offering:

|

|

●

|

our

Annual Report on Form 10-K for the fiscal year ended December 31, 2017, filed with the Securities and Exchange Commission

on February 26, 2018;

|

|

|

|

|

|

|

●

|

The

portions of our definitive proxy statement on Schedule 14A that are deemed “filed” with the Securities and Exchange

Commission under the Securities Exchange Act of 1934, as amended, filed on April 10, 2018;

|

|

|

|

|

|

|

●

|

our

Quarterly Report on Form 10-Q for the quarter ended March 31, 2018, filed with the Securities

and Exchange Commission on May 1, 2018;

|

|

|

●

|

our

Current Reports on Form 8-K, filed with the Securities and Exchange Commission on each of January 17, 2018, January 29,

2018, February 23, 2018, March 12, 2018, April 17, 2018, April 20, 2018, May 20, 2018 (Item 8.01), May 29, 2018, June 19,

2018, and July 19, 2018;

|

|

|

|

|

|

|

●

|

the

description of our common shares which is included in the Form 8-A filed with the Securities and Exchange Commission on May

5, 2016; and

|

|

|

|

|

|

|

●

|

the

consolidated financial statements of VBI Vaccines (Delaware) Inc. for the year ended December 31, 2015 included in our prospectus

filed on April 8, 2016 pursuant to Rule 424(b)(3).

|

All

filings filed by us pursuant to the Securities Exchange Act of 1934, as amended, after the date of the initial filing of this

registration statement and prior to the effectiveness of such registration statement (excluding information furnished pursuant

to Items 2.02 and 7.01 of Form 8-K) shall also be deemed to be incorporated by reference into the prospectus.

You

should rely only on the information incorporated by reference or provided in this prospectus. We have not authorized anyone else

to provide you with different information. Any statement contained in a document incorporated by reference into this prospectus

will be deemed to be modified or superseded for the purposes of this prospectus to the extent that a later statement contained

in this prospectus or in any other document incorporated by reference into this prospectus modifies or supersedes the earlier

statement. Any statement so modified or superseded will not be deemed, except as so modified or superseded, to constitute a part

of this prospectus. You should not assume that the information in this prospectus is accurate as of any date other than the date

of this prospectus or the date of the documents incorporated by reference in this prospectus.

We

will provide without charge to each person to whom a copy of this prospectus is delivered, upon written or oral request, a copy

of any or all of the reports or documents that have been incorporated by reference in this prospectus but not delivered with this

prospectus (other than an exhibit to these filings, unless we have specifically incorporated that exhibit by reference in this

prospectus). Any such request should be addressed to us at:

VBI

Vaccines Inc.

222

Third Street, Suite 2241

Cambridge,

MA 02142

Attention:

Chief Business Officer

Telephone:

(617) 830-3031 x128

You

may also access the documents incorporated by reference in this prospectus through our website at http://www.vbivaccines.com.

Except as set forth above, no information available on or through our website shall be deemed to be incorporated in this prospectus,

the accompanying prospectus or the registration statement of which it forms a part.

$150,000,000

Common

Shares

Warrants

Units

Subscription

Rights

Prospectus

,

2018

PART

II

INFORMATION

NOT REQUIRED IN PROSPECTUS

Item

14. Other Expenses of Issuance and Distribution.

The

fees and expenses payable by us in connection with this registration statement are estimated as follows:

|

Securities and Exchange Commission Registration Fee

|

|

$

|

18,675

|

|

|

Accounting Fees and Expenses

|

|

|

15,000

|

|

|

Legal Fees and Expenses

|

|

|

25,000

|

|

|

Printing Fees and Expenses

|

|

|

5,000

|

|

|

Transfer Agent Fees and Expenses

|

|

|

5,000

|

|

|

Miscellaneous Fees and Expenses

|

|

|

5,000

|

|

|

Total

|

|

$

|

73,675

|

|

Item

15. Indemnification of Officers and Directors.

Article

21, Section 21.2 of VBI’s articles requires VBI, subject to the British Columbia Business Corporations Act (the “BCA”),

to indemnify a director, former director or alternate director and his or her heirs and legal representatives against all eligible

penalties to which such person is or may be liable and after the disposition of an eligible proceeding pay the expenses actually

and reasonably incurred by such person in respect of that proceeding.

Pursuant

to Article 21, Section 21.3, VBI may indemnify any other person subject to the restrictions of the BCA.

Prior

to the final disposition, VBI may pay, as they are incurred, the expenses actually and reasonably incurred by an eligible party,

or the heirs and personal or other legal representatives in respect of that proceeding, if VBI first receives from such person

a written undertaking that if the indemnification is ultimately determined to be prohibited pursuant to the BCA, such person will

repay the amounts advanced.

Indemnification

under the BCA is prohibited if any of the following circumstances apply: (1) if the indemnity or payment is made under an earlier

agreement and at the time the agreement to indemnify or pay expenses was made the company was prohibited from doing so under its

memorandum or articles; (2) if the indemnity or payment is made otherwise than under an earlier agreement and at the time the

indemnity or payment is made, the company is prohibited from doing so under its memorandum or articles; (3) if, in relation to

the subject matter of the eligible proceeding, the eligible party did not act honestly and in good faith with a view to the best

interests of the company or the associated corporation; or (4) in the case of an eligible proceeding other than a civil proceeding,

if the eligible party did not have reasonable grounds for believing that the eligible party’s conduct in respect of which

the proceeding was brought was lawful.

Additionally,

if an eligible proceeding is brought against an eligible party, or the heirs and personal or other legal representatives in respect

of that proceeding, by or on behalf of VBI or an associated corporation, VBI must not indemnify that person for any penalties

such person is or may be liable for and must not pay the expenses of that person in respect of the proceeding.

Item

16. Exhibits.

The

following exhibits are included herein or incorporated herein by reference:

|

Exhibit

No.

|

|

Description

of Document

|

|

1.1

|

|

Underwriting

Agreement*

|

|

4.1

|

|

Articles (incorporated by reference to Exhibit 3.1 to the registration statement on Form F-4 (SEC File No. 333-208761), filed with the Securities and Exchange Commission on December 23, 2015).

|

|

4.2

|

|

Notice of Articles (incorporated by reference to Exhibit 3.2 to Amendment No. 1 to the registration statement on Form F-4 (SEC File No. 333-208761), filed with the Securities and Exchange Commission on February 5, 2016).

|

|

4.3

|

|

Form of Notice of Alteration (incorporated by reference to Exhibit 3.3 to Amendment No. 1 to the registration statement on Form F-4 (SEC File No. 333-208761) filed with the Securities and Exchange Commission on February 5, 2016).

|

|

4.4

|

|

Specimen form of share certificate

|

|

4.5

|

|

Form

of Warrant Agreement (including form of Warrant)*

|

|

4.6

|

|

Form

of Unit Agreement (including form of Unit)*

|

|

4.7

|

|

Form

of Subscription Rights Agreement (including form of Subscription Rights Certificate)*

|

|

5.1

|

|

Opinion of Stikeman Elliott LLP regarding the validity of certain of the securities being registered

|

|

5.2

|

|

Opinion

of Haynes and Boone LLP regarding the validity of certain of the securities being registered*

|

|

10.1

|

|

Waiver Agreement, dated as of July 17, 2018, by and between VBI Vaccines Inc. and Perceptive Credit Holdings, LP

|

|

23.1

|

|

Consent of EisnerAmper LLP, Independent Registered Public Accounting Firm

|

|

23.2

|

|

Consent of Smythe LLP, Independent Registered Public Accounting Firm

|

|

23.3

|

|

Consent of Peterson Sullivan LLP, Independent Registered Public Accounting Firm

|

|

23.4

|

|

Consent of Stikeman Elliott LLP (included in Exhibit 5.1)

|

|

23.5

|

|

Consent

of Haynes and Boone LLP (included in Exhibit 5.2)*

|

|

24.1

|

|

Power of Attorney (incorporated by reference to the signature page of this Registration Statement).

|

*

To be filed, if necessary, after effectiveness of this registration statement by an amendment to the registration statement or

incorporated by reference to a Current Report on Form 8-K filed in connection with an underwritten offering of the shares offered

hereunder.

Item

17. Undertakings.

The

undersigned registrant hereby undertakes:

|

|

(a)

|

(1)

|

To

file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

|

|

|

(i)

|

To

include any prospectus required by Section 10(a)(3) of the Securities Act of 1933;

|

|

|

|

|

|

|

(ii)

|

To

reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most

recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information

set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered

(if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low

or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant

to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than a 20% change in the maximum aggregate