As filed with the Securities and Exchange Commission on July 19, 2018

Registration

No. 333-222235

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

POST-EFFECTIVE

AMENDMENT NO. 2 ON

FORM S-3

TO

FORM S-4

REGISTRATION STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

MARVELL TECHNOLOGY GROUP LTD.

(Exact Name of Registrant as Specified in Its Charter)

|

|

|

|

|

Bermuda

|

|

77-0481679

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(IRS Employer

Identification No.)

|

Canon’s Court

22 Victoria Street

Hamilton HM 12, Bermuda

(441)

296-6395

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Mitchell L. Gaynor

Chief

Administration and Legal Officer and Secretary

Marvell Semiconductor, Inc.,

5488 Marvell Lane, Santa Clara, California 95054

(408) 222-2500

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

|

|

|

Richard E. Climan

Christopher R. Moore

Hogan Lovells US LLP

4085

Campbell Avenue, Suite 100

Menlo Park, California 94025

Tel.: (650)

463-4000

Fax: (650)

463-4199

|

Approximate date of commencement of proposed sale of the securities to the public

: From time to time after this registration statement becomes

effective.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the

following box: ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis

pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box: ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and

list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this

Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ☐

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that

shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If

this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the

following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a

non-accelerated

filer, or a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting

company” and “emerging growth company” in

Rule 12b-2

of the Exchange Act.

|

|

|

|

|

|

|

|

|

Large accelerated filer

|

|

☒

|

|

Accelerated filer

|

|

☐

|

|

|

|

|

|

|

Non-accelerated filer

|

|

☐ (Do not check if a smaller reporting company)

|

|

Smaller reporting company

|

|

☐

|

|

|

|

|

|

|

|

|

|

|

Emerging growth company

|

|

☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period

for comply with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of Securities Act ☐

CALCULATION OF

REGISTRATION FEE

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of each class of

securities to be registered

|

|

Amount

to be

registered

|

|

Proposed

maximum

offering price

per share

|

|

Proposed

maximum

aggregate

offering price

|

|

Amount of

registration fee

|

|

Common Shares, par value $0.002 per share

|

|

489,813 shares (1)

|

|

N/A

|

|

N/A

|

|

(2)

|

|

|

|

(1)

|

Pursuant to Rule 416 of the Securities Act of 1933, as amended, this Registration Statement also covers such additional and indeterminate number of Common Shares as may become offered or issuable by reason of any stock

dividend, stock split, recapitalization or other similar transaction.

|

|

(2)

|

The registration fees in respect of such Common Shares were paid in connection with the original filing on December 21, 2017 of the Registrant’s Registration Statement on Form

S-4

(File

No. 333-222235),

as amended. Such Registration Statement on Form

S-4

was declared effective on February 5,

2018.

|

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date

until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the

registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

EXPLANATORY NOTE

Marvell Technology Group Ltd. (“Marvell,” the “Registrant,” “we” or “our”) hereby amends its Registration Statement on

Form

S-4

(Registration

No. 333-222235)

filed on December 21, 2017 (as amended, the “Form

S-4”),

by filing

this Post-Effective Amendment No. 2 to Form

S-4

on Form

S-3

(the “Form

S-3”)

containing an updated prospectus

relating to the offer and sale of up to 489,813 common shares of Marvell issuable upon the exercise of outstanding stock options (the “Assumed Options”) issued by Cavium, Inc. (“Cavium”).

The Assumed Options are held by former employees of Cavium and previously represented options to purchase shares of Cavium common stock (the “Cavium

Options”). The Cavium Options were converted into the Assumed Options in connection with the merger contemplated by the Agreement and Plan of Merger, dated as of November 19, 2017 (the “Merger Agreement”), by and among Marvell,

Kauai Acquisition Corp., a Delaware corporation and an indirect wholly owned subsidiary of Marvell (“Merger Sub”), and Cavium.

On July 6,

2018, Merger Sub was merged with and into Cavium (the “Merger”), with Cavium continuing as the surviving corporation and an indirect wholly owned subsidiary of Marvell. Pursuant to the Merger Agreement, each Cavium Option that was

outstanding immediately prior to the effective time of the Merger (the “Effective Time”) was converted into an option to purchase that number of Marvell’s common shares (rounded down to the nearest whole number) equal to the product

of (a) the number of shares of Cavium common stock subject to such Cavium stock option and (b) 4.0339, at an exercise price per share (rounded up to the nearest whole cent) equal to the quotient obtained by dividing (1) the exercise

price per share for such option immediately prior to the effective time of the Merger, by (2) 4.0339.

The Assumed Options were initially registered

by Marvell on the Form

S-4,

which became effective on February 5, 2018. The

Form S-3

is being filed to convert the Form

S-4

into a

Form S-3.

PROSPECTUS

MARVELL TECHNOLOGY GROUP LTD.

Canon’s Court

22

Victoria Street

Hamilton HM 12, Bermuda

(441)

296-6395

489,813 Common Shares, $0.002 Par Value Per Share

This prospectus relates to up to 489,813

common shares, par value $0.002 per share (“common shares”), of Marvell Technology Group Ltd. (“Marvell,” the “Registrant,” “we” or “our”) issuable upon the exercise of certain outstanding stock

options to purchase common shares held by former employees of Cavium, Inc. (“Cavium”) under the Cavium, Inc. 2007 Equity Incentive Plan and the Cavium, Inc. 2016 Equity Incentive Plan (the “Assumed Options”). The Assumed Options

were assumed by Marvell in connection with the Agreement and Plan of Merger, dated as of November 19, 2017 (the “Merger Agreement”), by and among Marvell, Kauai Acquisition Corp., a Delaware corporation and an indirect wholly owned

subsidiary of Marvell (“Merger Sub”), and Cavium. On July 6, 2018, Merger Sub was merged with and into Cavium (the “Merger”), with Cavium continuing as the surviving corporation and an indirect wholly owned subsidiary of

Marvell.

We will not receive any proceeds from the sale of the common shares covered by this prospectus other than proceeds from the exercise of the

Assumed Options whose underlying common shares are covered by this prospectus. Our common shares are listed on the NASDAQ Global Select Market (“Nasdaq”) under the symbol “MRVL.” On July 18, 2018, the last reported sale

price of our common shares on Nasdaq was $21.58 per share.

You should carefully read and consider the risk factors included in our periodic reports

and other information that we file with the Securities and Exchange Commission before you invest in our securities. See “Risk Factors” on page 2 of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this

prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

This prospectus is dated

, 2018

TABLE OF CONTENTS

We have not authorized any person to give any information or to represent anything not contained or incorporated by reference into this prospectus, any

accompanying prospectus supplement or any free writing prospectus filed by us with the Securities and Exchange Commission, or SEC. We do not take any responsibility for, or provide any assurance as to the reliability of, any other information that

others may provide. This prospectus and any accompanying prospectus supplement constitute an offer to sell only under circumstances and in jurisdictions where it is lawful to do so. The information contained or incorporated by reference into this

prospectus, any accompanying prospectus supplement and any free writing prospectus filed by us with the SEC is current only as of the date of the document containing such information. Our business, financial condition, results of operations and

prospects may have changed since any such date.

i

ABOUT THIS PROSPECTUS

This prospectus contains an overview of plan participant’s rights under the Cavium, Inc. 2007 Equity Incentive Plan and the Cavium, Inc. 2016 Equity

Incentive Plan (collectively, the “Cavium Plans”), each of which was assumed by Marvell upon completion of Merger. As a result of the Merger, certain assumed awards granted under the Cavium Plans relate to Marvell common shares instead of

shares of Cavium common stock.

The description of the Cavium Plans in this prospectus is merely a summary of key terms and conditions of the Cavium

Plans. This prospectus does not contain all of the terms and conditions of the official plan documents for the Cavium Plans, and is expressly qualified by reference to the Cavium Plan documents for the plans and the terms and conditions of a

specific grant or award. See “Where You Can Find More Information” for instructions on how to obtain copies of the plan documents.

In this

prospectus, unless otherwise specified, currency amounts in this prospectus and any prospectus supplement are stated in U.S. dollars, or “$.”

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly and current reports, proxy statements and other information with the SEC. You may read and copy any document that we file at the

SEC’s public reference room located at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at

(800) SEC-0330

for further information on the operation of the public reference room. Our SEC

filings are also available to the public from the SEC’s website at www.sec.gov, and at the offices of Nasdaq.

INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE

The SEC allows us to “incorporate by reference” the information we file with the SEC,

which means that we can disclose important information to you by referring you to those documents. We are incorporating by reference certain information filed previously with the SEC into this prospectus. The information incorporated by reference is

considered to be part of this prospectus, and later information that we file with the SEC will automatically update this prospectus. We incorporate by reference the documents listed below, and any filings we hereafter make with the SEC under

Section 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934, as amended, or the Exchange Act (in each case excluding any documents or information deemed to have been furnished and not filed in accordance with SEC rules), prior to

the termination of the offering under this prospectus:

|

|

•

|

|

Annual Report on Form

10-K

for the fiscal year ended February 3, 2018 as filed with the SEC on March 29, 2018;

|

|

|

•

|

|

Quarterly Report on

Form 10-Q for

the fiscal quarter ended May 5, 2018 as filed with the SEC on June 5, 2018;

|

|

|

•

|

|

Current Reports on Form

8-K

filed with the SEC on March 9, 2018, March 15, 2018, March 16, 2018, May 8, 2018, May 24, 2018, two on June 13, 2018,

June 22, 2018, June 29, 2018 and July 6, 2018; and

|

|

|

•

|

|

The description of Marvell’s common shares contained in Marvell’s registration statement on Form

8-A

filed under the Exchange Act on June 22, 2000, including any

amendment or report filed for the purpose of updating such description.

|

ii

We will provide to each person, including any beneficial owner, to whom this prospectus is delivered copies of

this prospectus and any of the documents incorporated by reference into this prospectus, excluding any exhibit to those documents unless the exhibit is specifically incorporated by reference into those documents, without charge, by written or oral

request directed to:

Marvell Technology Group Ltd.

c/o Marvell Semiconductor, Inc.

5488 Marvell Lane

Santa Clara,

California 95054

Attention: Investor Relations

(408)

222-0777

ir@marvell.com

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and the documents incorporated by reference into this prospectus

contain certain “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, as amended. Forward-looking statements provide current expectations of

future events based on certain assumptions and include any statement that does not directly relate to any historical or current fact. Words such as “anticipates,” “expects,” “intends,” “plans,”

“predicts,” “believes,” “seeks,” “estimates,” “targets,” “goals,” “could,” “would,” “will,” “may,” “can,” “continue,”

“potential,” “should,” and the negative of these terms or other comparable terminology often identify forward-looking statements. Forward-looking statements are not guarantees of future performance and our actual results may

differ significantly from the results discussed in the forward-looking statements. Factors that might cause such differences include, but are not limited to, those discussed in Part I, Item 1A of our most recent Annual Report on Form

10-K

and Part II, Item 1A of our most recent Quarterly Report on Form

10-Q

under the heading “Risk Factors,” which are incorporated herein by reference. We assume no

obligation to revise or update any forward-looking statements for any reason, except as required by law.

iii

SUMMARY

This section summarizes selected information presented in greater detail elsewhere in this prospectus. However, this summary may not contain all of the

information that may be important to you in determining whether to invest in our securities. You are urged to carefully read the remainder of this prospectus, any prospectus supplement and the other information incorporated by reference herein or

therein which contain additional important information about Marvell.

MARVELL TECHNOLOGY GROUP LTD.

We are a fabless semiconductor provider of application-specific semiconductor products. As a fabless semiconductor company, we focus on the

design, development and marketing of semiconductor products and form relationships with foundries, assembly and test facilities for the manufacture of these products. Our semiconductors perform analog, mixed-signal and digital signal processing, and

we design both stand-alone and embedded semiconductors. Our core strength lies in the development of complex integrated circuits that incorporate all components of an electronic system in

onechip—so-called SoC

devices. Whereas electronic systems previously required multiple chips or systems to function, these electronic systems are increasingly performed by

all-in-one

devices. Our

all-in-one

devices, including its SoCs, microcontrollers, and embedded

processors, are more efficient and cost-effective than multi-chip or multi-system products.

Our broad product portfolio includes devices

for storage, networking and connectivity, as further described below, and our market segments include the enterprise, cloud, automotive, industrial and consumer markets.

|

|

•

|

|

Storage

: We develop data storage products, with applications spanning consumer, client, cloud data center and enterprise markets. Products include controllers for hard disk drives (HDDs) and solid-state

drives (SSDs) that store and retrieve data at reduced energy consumption and with greater speed and reliability. These products are incorporated into HDDs and SSDs for many different applications, including cloud and enterprise servers, all flash

arrays (AFAs), enterprise storage arrays, desktop and laptop personal computers, surveillance systems, game consoles, automotive and similar devices.

|

|

|

•

|

|

Networking

: We develop networking products that

serve end-users in

cloud, enterprise, small and medium business, and service provider networks. Products

include (i) physical layer transceivers that are used in a wide range of products, including switch systems, printers, game consoles, automobiles and other systems that require Ethernet connectivity; (ii) Ethernet switch integrated

circuits to provide switching and packet processing; and

(iii) embedded ARM-based processors.

|

|

|

•

|

|

Connectivity

: We develop wireless connectivity products that serve enterprise, service provider, automotive and high performance consumer markets. Products include client and access point chips that

enable wireless communication using WiFi and Bluetooth standards.

|

We were incorporated in Bermuda in January 1995. Our

registered and mailing address is Canon’s Court, 22 Victoria Street, Hamilton HM 12, Bermuda, and our telephone number there is

(441) 296-6395. The

address of our U.S. operating subsidiary is

Marvell Semiconductor, Inc., 5488 Marvell Lane, Santa Clara, California 95054, and our telephone number there is

(408) 222-2500. We

also have subsidiaries and operations in many countries, including

China, India, Israel, Japan, Singapore, South Korea, Taiwan and Vietnam. Our fiscal year is

the 52- or 53-week period

ending on the Saturday closest

to January 31. Accordingly, every fifth or sixth fiscal year will have

a 53-week period.

The additional week in

a 53-week year

is added to the

fourth quarter, making such quarter consist of 14 weeks. Fiscal 2017 had a

52-week

year. Fiscal 2018 was a

53-week

year.

On July 6, 2018, we completed the merger contemplated by the Merger Agreement, by and among Marvell, Merger Sub and Cavium. Pursuant to

the Merger Agreement, Merger Sub was merged with and into Cavium, with Cavium continuing as the surviving corporation and an indirect wholly owned subsidiary of Marvell.

As of February 3, 2018, the end of our fiscal year 2018, we had a total of approximately 3,749 employees. As of May 5, 2018, we held

approximately 9,300 U.S. and foreign patents issued and approximately 1,650 U.S. and foreign patent applications pending on various aspects of our technology. We maintain a website at www.marvell.com where general information about us is available.

We are not incorporating the contents of the website into this prospectus.

1

THE OFFERING

|

|

|

|

|

Issuer

|

|

Marvell Technology Group, Ltd., an exempted Bermuda company

|

|

|

|

|

Common shares offered

|

|

Up to 489,813 common shares of Marvell, par value $0.002 per share

|

|

|

|

|

Use of proceeds

|

|

We will not receive any proceeds from the sale of our common shares covered by this prospectus other than proceeds from the exercise of the options whose underlying shares

are covered by this prospectus. We have no plans for the application of any of these proceeds other than for general corporate purposes.

|

|

|

|

|

NASDAQ Global Select Market symbol

|

|

MRVL

|

RISK FACTORS

Investing in our securities involves risks. Before making a decision to invest in our securities, in addition to the other information contained in this

prospectus and any prospectus supplement, you should carefully consider the risks described under “Risk Factors” in Part I, Item 1A of our most recent Annual Report on

Form 10-K

and

Part II, Item 1A of our Quarterly Report

on Form 10-Q for

the fiscal quarter ended May 5, 2018 and in other documents that we include or incorporate by reference in this

prospectus. See “Where You Can Find More Information.”

USE OF PROCEEDS

We will not receive any proceeds from the sale of our common shares covered by this prospectus other than proceeds from the exercise of the Assumed Options

whose underlying shares are covered by this prospectus. We have no plans for the application of any of these proceeds other than for general corporate purposes. We have no assurance that any of the options will be exercised.

PLAN OF DISTRIBUTION

We are registering 489,813 common shares issuable upon the exercise of the Assumed Options.

Pursuant to the terms of the applicable options, our shares will be issued to those option holders who elect to exercise and provide payment of the exercise

price. We do not know if or when the options will be exercised. We also do not know whether any of the shares acquired upon exercise of any Assumed Options will subsequently be resold. We are not using an underwriter in connection with this

offering.

2

DESCRIPTION OF MARVELL CAPITAL STOCK

Our authorized share capital consists of $2,000,000, divided into 1,000,000,000 common shares, and no preferred shares are currently issued.

Pursuant to

our bye-laws (“Bye-laws”), our

board of directors is authorized to issue any of our authorized but unissued shares. There are no limitations on

the right

of non-Bermudians or non-residents of

Bermuda to hold our common shares.

Common Shares

As of July 9, 2018,

we had 655,278,780 common shares issued and outstanding.

In the event of our liquidation, dissolution or winding up, holders of common

shares would be entitled to receive all of our assets, pro rata, after payment in full of all our debts and liabilities, and any liquidation payment that we may be required to pay to our preferred shareholders on the date of liquidation.

The common shares do not have preemptive or conversion rights or other subscription rights and there are no redemption or sinking fund

provisions. The outstanding common shares are, and the common shares offered hereby, when issued and upon our receipt of the full purchase price therefore, will be, fully paid and nonassessable.

Preferred Shares

Our board of directors

is authorized to issue preferred shares in one or more series. Our board of directors may, without any further approval of our shareholders:

|

|

•

|

|

determine or alter the rights, preferences, privileges and restrictions of the preferred shares, including dividend rights, dividend rates, conversion rights, voting rights, terms of redemption, redemption prices, and

liquidation preferences; and

|

|

|

•

|

|

fix the number of shares and designation of any series of preferred shares.

|

Although our

board of directors presently does not intend to do so, it could issue preferred shares with voting and conversion rights which could adversely affect the voting power and other rights of the holders of common shares, including the loss of voting

control to others, without obtaining further approval of our shareholders. The issuance of preferred shares could delay or prevent a change in control of this company, without further action by our shareholders.

Bermuda Law

We were incorporated as an

exempted Bermuda company under The Companies Act, 1981 of Bermuda (“Companies Act”). This means that we are exempted from the provisions of Bermuda law which currently stipulate that at least 60% of our equity must be beneficially owned by

Bermudians.

The rights of our shareholders, including those persons who will become our shareholders in connection with this offering,

are governed by Bermuda law, our Memorandum of Association

and Bye-laws. The

following is a summary of certain provisions of Bermuda law and our organizational documents.

Because this summary does not contain all of the information set forth in the Bermuda law provisions or our organizational documents, we

encourage you to read those documents.

Dividends

. Bermuda law authorizes a company to declare or pay a dividend or make a

distribution out of contributed surplus, unless there are reasonable grounds for believing that,

|

|

•

|

|

the company would not be able to pay its debts as they become due; or

|

|

|

•

|

|

the realizable value of the company’s assets would thereby be less than its liabilities.

|

3

Our Bye-laws provide

that our board of

directors may from time to time declare dividends or distributions out of contributed surplus to be paid to the shareholders according to their rights and interests, such dividend may be paid in cash or wholly or partly in specie.

Voting Rights

. Unless otherwise provided by the Companies Act or a

company’s bye-laws, under

Bermuda law, questions brought before a general meeting of shareholders are decided by a simple majority vote of shareholders present at the meeting. Each shareholder

has one vote, regardless of the number of shares held, unless a poll is requested. If a poll is requested, each shareholder present in person or by proxy has one vote for each share held. A poll may be requested by:

|

|

•

|

|

the chairman of the meeting;

|

|

|

•

|

|

at least three shareholders present in person or by proxy;

|

|

|

•

|

|

any shareholder or shareholders present in person or represented by proxy and holding between them not less

than one-tenth of

the total voting rights of all the

shareholders having the right to vote; or

|

|

|

•

|

|

any shareholder or shareholders present in person or represented by proxy holding shares conferring the right to vote at the meeting, and the total paid up on those shares has been paid up equal to at

least one-tenth of

the total sum paid up on all shares conferring the right vote at the meeting.

|

Our Bye-laws provide

that, subject to the provisions of the Companies Act, any questions

sent to a shareholder vote will be decided by the affirmative votes of a majority of the votes cast. In case of an equality of votes, the resolution shall fail. No shareholder shall (unless otherwise entitled under the Companies Act) be entitled to

vote at any general meeting unless such shareholder has paid all the calls on all shares held by such shareholder.

Rights in

Litigation

. Under Bermuda law, in the event of liquidation, dissolution or winding up of a company, the proceeds of such liquidation, dissolution or winding up are distributed pro rata among the holders of common shares, after satisfaction

in full of all claims of creditors and subject to the preferential rights accorded to any series of preferred stock.

Repurchase of

Shares

. At its discretion and without the sanction of a resolution, our board of directors may authorize the purchase by our company of our own shares, of any class, at any price. To the extent permitted by Bermuda law, the shares to be

purchased may be selected in any manner whatsoever, upon such terms as our board of directors may determine in its discretion.

Meetings of Shareholders

. Under Bermuda law, a company is required to convene at least one general shareholders’ meeting

per calendar year unless waived by the shareholders. Bermuda law provides that a special general meeting must be called by our board of directors and must be called upon the request of shareholders holding not less than 10% of such of

the paid-up capital

of the company having the right to vote.

Bermuda law also requires that

shareholders be given at least five days’ advance notice of a general meeting, but the accidental omission of notice to any person does not invalidate the proceedings at such meeting.

Our Bye-laws require

at least five days’ notice be given to each shareholder of the annual general meeting and of any special general meeting.

Under Bermuda law, the number of shareholders constituting a quorum at any general meeting of shareholders is determined by

the bye-laws of

the company.

Our Bye-laws provide

that two persons present in person and representing in person or by proxy at least 50% of the total

issued voting shares throughout the meeting constitutes a quorum.

Shareholder Written Resolutions

. Subject to certain

exceptions in

our Bye-laws and

provisions of the Companies Act, anything which may be done by resolution of us in general meeting may without a meeting and without any previous notice being required,

be done by resolution in writing signed by all the shareholders who at the date of the resolution would be entitled to attend the meeting and vote on the resolution.

Such exceptions in

our Bye-laws include

resolutions passed for the purpose of

(a) appointing and removing its auditors before the expiration of its term of office; or (b) removing a director before the expiration of his term of office.

4

Access to Books and Records and Dissemination of Information

. Members of the

general public have the right to inspect the public documents of a company available at the office of the Registrar of Companies in Bermuda. These documents include:

|

|

•

|

|

our Memorandum of Association (including its objects and powers); and

|

|

|

•

|

|

any amendment of our Memorandum of Association.

|

In addition, our shareholders have the right

to inspect:

|

|

•

|

|

our minutes of general meetings; and

|

|

|

•

|

|

our audited financial statements, which must be presented at the annual general meeting.

|

Our

register of shareholders is also open to inspection by our shareholders and to members of the general public without charge.

We are

required to maintain our share register in Bermuda but may, subject to the provisions of the Companies Act, establish a branch register outside Bermuda. We are required to keep at our registered office a register of our directors and officers which

is open for inspection for not less than two hours each day by members of the public without charge. However, Bermuda law does not provide a general right for shareholders to inspect or obtain copies of any other corporate records.

Election or Removal of Directors

. Under Bermuda law and

our Bye-laws, directors

are elected at the annual general meeting for a term of one year or until their successors are elected or appointed, unless they resign or are earlier removed. Pursuant to

our Bye-laws, our

board of directors shall consist of not less than two directors or such number in excess thereof as our board of directors may from time to time determine.

Under Bermuda law, unless otherwise provided in a

company’s bye-laws, a

director may be

removed at a special general meeting of shareholders specifically called for that purpose, provided that the director was served with at least 14 days’ notice of the meeting. The director has a right to be heard at such meeting. Any vacancy

created by the removal of a director at a special general meeting may be filled at such meeting by the election of another director in his or her place or, in the absence of any such election, by our board of directors.

Amendment of Memorandum of Association and

Bye-laws

.

Bermuda law provides that the memorandum of association of a company may be amended by a resolution passed at a general meeting of shareholders after due notice has been given. An amendment to the memorandum of association, other than an amendment

which alters or reduces a company’s share capital, also requires the approval of the Registrar of Companies, who may grant or withhold approval at his or her discretion. The directors may amend

the bye-laws, but

the amendment must be approved by the shareholders at a general meeting and approved by the affirmative votes of a majority of the votes cast in accordance with the provisions of

the bye-laws and

in case of an equality of votes the resolutions shall fail.

Under

Bermuda law, the holders of a total of at least 20% in par value of any class of a company’s issued share capital have the right to apply to the Bermuda courts for an annulment of any amendment of the memorandum of association adopted by

shareholders at any general meeting, other than an amendment which alters or reduces a company’s share capital as provided in the Companies Act. Where such an application is made, the amendment becomes effective only to the extent that it is

confirmed by the Bermuda courts. An application for annulment of any amendment of the memorandum of association must be made within 21 days after the date on which the resolution altering the company’s memorandum is passed and may be made on

behalf of the persons entitled to make the application by one or more of their number as they may appoint in writing for that purpose. No such application may be made by persons voting in favor of the amendment.

Appraisal Rights and Shareholder Suits

. Under Bermuda law, in the event of a merger or amalgamation of a Bermuda company with

another company, a shareholder of the Bermuda company who is not satisfied that fair value has been offered for his or her shares may apply to the Bermuda courts to appraise the fair value of his or her shares. The merger or amalgamation of a

company with another company requires the approval of the merger or amalgamation agreement by our board of directors and by the shareholders, and of the holders of each class of such shares.

5

Class actions and derivative actions are generally not available to shareholders under

Bermuda law. However, the Bermuda courts would ordinarily be expected to follow English case law precedent, which would permit a shareholder to commence an action in the name of a company to remedy a wrong done to the company where the act

complained of is alleged:

|

|

•

|

|

to be beyond the corporate power of the company;

|

|

|

•

|

|

to violate the company’s memorandum of association

or bye-laws.

|

Furthermore, consideration would be given by the Bermuda courts to acts that are alleged to constitute a fraud against the minority

shareholders or, for instance where an act requires the approval of a greater percentage of the company’s shareholders than those who actually approve it.

When the affairs of a company are being conducted in a manner oppressive or prejudicial to the interests of some of the shareholders, one or

more shareholders may apply to the Bermuda courts for an order to regulate the company’s conduct of affairs in the future or order the purchase of the shares by any shareholder, by other shareholders or by the company.

Board Actions

. Under Bermuda law, the directors of a Bermuda company owe their fiduciary duties to the company, rather than to

individual shareholders.

Our Bye-laws provide

that some actions are required to be approved by our board of directors. Actions must be approved by a majority of the votes present and entitled to be

cast at a properly convened meeting of our board of directors.

Our Bye-laws contain

a

provision by virtue of which our shareholders waive any claim or right of action that they have, both individually and on our behalf, against any director or officer in relation to any action or failure to take action by such director or officer,

except in respect of any fraud or dishonesty of such director or officer.

Our Bye-laws also

indemnify our directors and officers in respect of their actions and omissions, except in respect of their

fraud or dishonesty. The indemnification provided in

our Bye-laws is

not exclusive of other indemnification rights to which a director or officer may be entitled, provided these rights do not extend

to his or her fraud or dishonesty.

Our Bye-laws provide

that our business is to be

managed and conducted by our board of directors. Bermuda law does not require that our directors be individuals, and there is no requirement in

our Bye-laws or

Bermuda law that directors hold any of

our shares. There is also no requirement in

our Bye-laws or

Bermuda law that our directors must retire at a certain age.

Related Party Transactions and Loans

. Pursuant to

our Bye-laws, provided

a

director discloses a direct or indirect interest in any contract or arrangement with us as required by Bermuda law, such director is may be counted in the quorum and vote in respect of any such contract or arrangement in which he or she is

interested unless he or she is disqualified from voting by the chairman of the relevant board meeting.

Discontinuance/Continuation

. Under Bermuda law, an exempted company may be discontinued in Bermuda and continued in a

jurisdiction outside Bermuda as if it had been incorporated under the laws of that other jurisdiction.

Our Bye-laws provide

that our board of directors may exercise all our power to discontinue to

another jurisdiction.

Foreign Exchange Controls

. We have been designated as

a “non-resident” of

Bermuda by the Bermuda Monetary Authority for the purposes of the Exchange Control Act, 1972 and regulations made under it and there is no restriction or requirement of

Bermuda binding on us which limits the availability or transfer of foreign exchange (i.e. monies denominated in currencies other than Bermuda dollars).

Transfer of Common Shares

to

Non-Residents

of Bermuda

. The Bermuda Monetary Authority has given its general permission for the issue and free transferability of

securities of Bermuda companies, which would include the common shares that are the subject of this offering, to and between

non-residents of

Bermuda for exchange control purposes, provided that our

common shares remain listed on an appointed stock exchange, which includes NASDAQ. Approvals or permissions given by the Bermuda Monetary Authority do not constitute a guarantee by the Bermuda Monetary Authority as to our performance or our

creditworthiness. Accordingly, in giving such consent or permissions, the Bermuda Monetary Authority shall not be liable for the financial soundness, performance or default of our business or for the correctness of any opinions or statements

expressed in this prospectus.

6

In accordance with Bermuda law, share certificates are only issued in the names of companies,

partnerships or individuals. In the case of a shareholder acting in a special capacity (for example as a trustee), certificates may, at the request of the shareholder, record the capacity in which the shareholder is acting. Notwithstanding such

recording of any special capacity, we are not bound to investigate or see to the execution of any such trust. We will take no notice of any trust applicable to any of our common shares, whether or not we have been notified of such trust.

7

DESCRIPTION OF CAVIUM PLANS

Introduction

This prospectus contains an overview

of eligible individuals’ rights under the Cavium Plans, which were assumed by Marvell upon completion of the Merger. As a result of that Merger, the assumed stock options granted under the Cavium Plans relate to Marvell common shares instead of

shares of Cavium common stock.

The description of the Cavium Plans in this prospectus is merely a summary of key terms and conditions of the Cavium

Plans. This prospectus does not contain all of the terms and conditions of the official plan documents for the Cavium Plans, and is expressly qualified by reference to the plan documents for the Cavium Plans and the terms and conditions of a

specific grant or award. In the event of any inconsistency between this prospectus, any plan documents or the terms and conditions of a grant or award, the plan documents and the terms and conditions of the grant or award will govern. See

“Where You Can Find More Information” for instructions on how to obtain copies of the official plan documents.

Administration of the

Cavium Plans

Since the Merger, the Cavium Plans are being administered by the Executive Compensation Committee of Marvell’s Board of

Directors (the “ECC”). Subject to the terms of the Cavium Plans, the ECC has the authority to interpret the terms of the Cavium Plans and make all decisions related to the operation of the Cavium Plans. The ECC may delegate the power to

make all determinations under the Cavium Plans with respect to those awards to one or more executive officers of Marvell to the extent permitted by law. The ECC’s determinations under the Cavium Plans need not be uniform. All determinations and

decisions that the ECC makes pursuant to the provisions of the Cavium Plans are final, conclusive and binding on all parties.

Governing Law

The Cavium Plans and the terms of all outstanding stock options are governed by and administered in accordance with the laws of the State of

California.

Types of Awards Outstanding

The

Cavium Plans permit the grant of various types of awards. This prospectus relates only to the offering of Marvell common shares relating to outstanding stock options held by former Cavium employees.

Option Awards

In general, an option is a

contractual right granted to an individual to purchase up to a specified number of common shares at a specified exercise price within a specified period of time, subject to certain conditions. The shares subject to an option may be purchased

(referred to generally as the “exercise

”

of the option) as allowed by the vesting and exercisability rules set forth in the award agreement. The award agreement will provide that the option is exercisable in

accordance with a vesting schedule. In addition, the right to exercise might terminate when certain events occur, such as termination of employment, as specified in the award agreement. An option holder is not required to exercise an option when it

first becomes exercisable. The option holder may exercise the option (or the exercisable portion of the option, as the case may be) at any time within the remaining term of the option, subject to the rules in the award agreement.

To exercise an option, the option holder must deliver written notice of exercise to Marvell in a form designated by Marvell (or follow any other method of

notice set forth in the award agreement) and pay the exercise price and any applicable withholding taxes.

Shares purchased upon exercise of an option

must be paid in full at the time of purchase in accordance with the terms of the award agreement evidencing the option. No shares will be issued pursuant to any option until full payment of the exercise price has been made to Marvell. An option

holder will have none of the rights of a shareholder of Marvell until the shares are issued.

8

An award agreement might provide that the purchase price is to be paid (i) in cash, check, bank draft or

money order payable to Marvell, (ii) pursuant to a program developed under Regulation T as promulgated by the Federal Reserve Board that, prior to the issuance of the common shares subject to the option, resulting in either the receipt of cash

(or check) by Marvell or the receipt of irrevocable instructions to pay the aggregate exercise price to the Marvell from the sales proceeds, (iii) by delivery to Marvell (either by actual delivery or attestation) of common shares; (iv) by

a “net exercise” arrangement pursuant to which Marvell will reduce the number of common shares issued upon exercise by the largest whole number of shares with a Fair Market Value (as defined in the Cavium Plans) that does not exceed the

aggregate exercise price; provided, however, that Marvell shall accept a cash or other payment from the option holder to the extent of any remaining balance of the aggregate exercise price not satisfied by such reduction in the number of whole

shares to be issued; provided, further, that common shares will no longer be outstanding under an option and will not be exercisable thereafter to the extent that (A) shares are used to pay the exercise price pursuant to the “net

exercise,” (B) shares are delivered to the option holder as a result of such exercise, and (C) shares are withheld to satisfy tax withholding obligations; or (v) in any other form of legal consideration that may be acceptable to the

ECC and specified in the applicable award agreement.

Transfer of Awards

Except as otherwise determined by the ECC, no award granted under the Cavium Plans is transferable by an award recipient otherwise than by will or the laws of

descent and distribution or pursuant to the terms of a domestic relations order. Unless otherwise determined by the ECC in accord with the provisions of the immediately preceding sentence, an award may be exercised during the lifetime of the

recipient only by the recipient.

LEGAL MATTERS

The validity of the Marvell common shares offered by this prospectus has been passed upon for Marvell by Appleby (Bermuda) Limited, Hamilton, Bermuda.

EXPERTS

The

consolidated financial statements and the related consolidated financial statement schedule, incorporated in this prospectus by reference from Marvell Technology Group Ltd.’s Annual Report on

Form 10-K, and

the effectiveness of Marvell Technology Group Ltd.’s internal control over financial reporting have been audited by Deloitte & Touche LLP, an independent registered

public accounting firm, as stated in their reports, which are incorporated herein by reference. Such financial statements and financial statement schedule have been so incorporated in reliance on the reports of such firm given upon their authority

as experts in accounting and auditing.

The financial statements of Cavium, Inc. and management’s assessment of the effectiveness of internal control

over financial reporting (which is included in Management’s Report on Internal Control over Financial Reporting) incorporated in this prospectus by reference to Marvell Technology Group Ltd.’s Current Report on Form

8-K

dated June 13, 2018 have been so incorporated in reliance on the report of PricewaterhouseCoopers LLP, an independent registered public accounting firm, given on the authority of said firm as experts in

auditing and accounting.

9

PART II — INFORMATION NOT REQUIRED IN PROSPECTUS

|

Item 14.

|

Other Expenses of Issuance and Distribution

|

The following table sets forth the estimated costs and

expenses payable by Marvell in connection with the sale of the securities being registered hereby.

|

|

|

|

|

|

|

|

|

Amount to be Paid

|

|

|

SEC registration fee

|

|

$

|

*

|

|

|

Accounting fees and expenses

|

|

|

22,500

|

|

|

Legal fees and expenses

|

|

|

30,000

|

|

|

Printing fees

|

|

|

5,000

|

|

|

TOTAL

|

|

$

|

57,500

|

|

|

*

|

Previously paid in connection with the original filing of this Registration Statement on Form

S-4.

|

|

Item 15.

|

Indemnification of Directors and Officers

|

Marvell was incorporated under the laws of

Bermuda. Set forth below is a description of certain provisions of the Companies Act, 1981 of Bermuda (the “Companies Act”), Marvell’s Memorandum of Association, and

Marvell’s Bye-laws, as

such provisions relate to the indemnification of Marvell’s directors and officers. This description is intended only as a summary and is qualified in its entirety by

reference to the applicable provisions of the Companies Act, Marvell’s Memorandum of Association, and

Marvell’s Bye-laws, which

are incorporated herein by reference.

The Companies Act permits Marvell to indemnify its directors or officers in their capacity as such in respect of any loss arising or liability

attaching to them by virtue of any rule of law in respect of any negligence, default, breach of duty or breach of trust of which a director or officer may be guilty in relation to Marvell other than in respect of his or her own fraud or dishonesty.

Marvell’s Bye-laws provide

that every director, secretary and other officers

(including any committee member appointed by Marvell’s board of directors (“Committee Member”)) of Marvell be indemnified and secured harmless out of the assets of Marvell from and against all actions, costs, charges, losses, damages

or expenses incurred or sustained in such capacity, and none of them shall be answerable for the acts, receipts, neglects or defaults of the others of them subject to limitations imposed in the Companies Act and provided that the indemnity shall not

extend to any matter in respect of any fraud or dishonesty which may attach to any of said persons.

Bye-law 32

of

Marvell’s Bye-laws stipulates

that each shareholder and Marvell agree to waive any claim or right of action against any director, officer or Committee Member, in respect of any failure to act or

any action taken by such director, officer or Committee Member in the performance of his or her duties with or for Marvell. The waiver does not extend to claims arising under United States federal securities laws or any claims, rights of action

arising from the fraud or dishonesty of such director, officer or Committee Member.

II-1

See the exhibit index attached to this registration statement and incorporated by reference

herein.

|

(a)

|

The undersigned registrant hereby undertakes:

|

|

|

(1)

|

To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

|

|

|

(i)

|

To include any prospectus required by Section 10(a)(3) of the Securities Act of 1933;

|

|

|

(ii)

|

To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a

fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was

registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price

represent no more than 20% change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement; and

|

|

|

(iii)

|

To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement;

|

provided, however

, that paragraphs (1)(i), (1)(ii) and (1)(iii) do not apply if the information required to be included in a

post-effective amendment by those paragraphs is contained in reports filed with or furnished to the Commission by the registrant pursuant to section 13 or section 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in the

registration statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of the registration statement.

|

|

(2)

|

That, for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and

the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

|

|

|

(3)

|

To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

|

|

|

(4)

|

That, for the purpose of determining liability under the Securities Act of 1933 to any purchaser:

|

|

|

(i)

|

Each prospectus filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date the filed prospectus was deemed part of and included in the registration

statement; and

|

II-2

|

|

(ii)

|

Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration statement in reliance on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii) or

(x) for the purpose of providing the information required by Section 10(a) of the Securities Act of 1933 shall be deemed to be part of and included in the registration statement as of the earlier of the date such form of prospectus is

first used after effectiveness or the date of the first contract of sale of securities in the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that is at that date an underwriter,

such date shall be deemed to be a new effective date of the registration statement relating to the securities in the registration statement to which that prospectus relates, and the offering of such securities at that time shall be deemed to be the

initial bona fide offering thereof. Provided, however, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the

registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such effective date, supersede or modify any statement that was made in the registration statement or

prospectus that was part of the registration statement or made in any such document immediately prior to such effective date.

|

|

|

(5)

|

That, for the purpose of determining liability of the registrant under the Securities Act of 1933 to any purchaser in the initial distribution of the securities, the undersigned registrant undertakes that in a primary

offering of securities of the undersigned registrant pursuant to this registration statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities are offered or sold to such purchaser by means of any

of the following communications, the undersigned registrant will be a seller to the purchaser and will be considered to offer or sell such securities to such purchaser:

|

|

|

(i)

|

Any preliminary prospectus or prospectus of the undersigned registrant relating to the offering required to be filed pursuant to Rule 424;

|

|

|

(ii)

|

Any free writing prospectus relating to the offering prepared by or on behalf of the undersigned registrant or used or referred to by the undersigned registrant;

|

|

|

(iii)

|

The portion of any other free writing prospectus relating to the offering containing material information about the undersigned registrant or its securities provided by or on behalf of the undersigned registrant; and

|

|

|

(iv)

|

Any other communication that is an offer in the offering made by the undersigned registrant to the purchaser.

|

|

|

(b)

|

The undersigned registrant hereby undertakes that, for purposes of determining any liability under the Securities Act of 1933, each filing of the registrant’s annual report pursuant to section 13(a) or section

15(d) of the Securities Exchange Act of 1934 (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to section 15(d) of the Securities Exchange Act of 1934) that is incorporated by reference in the registration

statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

|

|

|

(c)

|

Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling persons of the registrant pursuant to the foregoing provisions, or otherwise,

the registrant has been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Act and is, therefore, unenforceable. In the event that a claim for indemnification

against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director,

officer or controlling person in connection with the securities being registered, the registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the

question whether such indemnification by it is against public policy as expressed in the Act and will be governed by the final adjudication of such issue.

|

II-3

EXHIBIT INDEX

|

|

|

|

|

Exhibit

Number

|

|

Description of Exhibit

|

|

|

|

|

3.1

|

|

Certificate of Incorporation of Marvell Technology Group Ltd. (incorporated by reference to Exhibit 3.2 to Registrant’s Quarterly

Report on Form

10-Q

filed with the SEC on June 5, 2018).

|

|

|

|

|

3.2

|

|

Memorandum of Association of Marvell Technology Group Ltd. (incorporated by reference to Exhibit 3.1 to Registrant’s Annual Report

on Form

10-K

filed with the SEC on March 29, 2018, File

No. 000-30877).

|

|

|

|

|

3.3

|

|

Memorandum of Reduction of Share Premium of Marvell Technology Group Ltd. (incorporated by reference to Exhibit 3.4 to Registrant’s

Quarterly Report on Form

10-Q

filed with the SEC on June 5, 2018).

|

|

|

|

|

3.4

|

|

Memorandum of Increase of Share Capital of Marvell Technology Group Ltd. dated June 29, 2006, June 7, 2004, April

25, 2000, July 16, 1999, July 22, 1998, September

26, 1996 and March 10, 1995 (incorporated by reference to Exhibit 3.5 to Registrant’s Quarterly Report on Form

10-Q

filed with the SEC on June 5, 2018).

|

|

|

|

|

3.5

|

|

Fourth Amended and Restated

Bye-laws

of Marvell Technology Group Ltd. (incorporated by reference to Exhibit

3.1 to Registrant’s Current Report on Form

8-K

filed with the SEC on November 10, 2016).

|

|

|

|

|

5.1*

|

|

Opinion of Appleby (Bermuda) Limited regarding the validity of the Marvell common shares being registered hereby.

|

|

|

|

|

10.1

|

|

Cavium, Inc. 2016 Equity Incentive Plan (incorporated by reference to Exhibit 4.1 to Registrant’s Registration Statement on Form

S-8

filed with the SEC on July 6, 2018).

|

|

|

|

|

10.2

|

|

Cavium, Inc. 2007 Equity Incentive Plan (incorporated by reference to Exhibit 4.2 to Registrant’s Registration Statement on Form

S-8

filed with the SEC on July 6, 2018).

|

|

|

|

|

23.1*

|

|

Consent of Deloitte & Touche LLP, independent registered public accounting firm

|

|

|

|

|

23.2*

|

|

Consent of PricewaterhouseCoopers LLP, independent registered public accounting firm

|

|

|

|

|

23.3*

|

|

Consent of Appleby (Bermuda) Limited for legality opinion (included in the opinion filed as Exhibit 5.1 and incorporated herein by reference)

|

|

|

|

|

24.1**

|

|

Power of Attorney

|

|

**

|

Previously filed as an exhibit to the Registration Statement on Form

S-4

filed with the SEC on December 21, 2017.

|

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the Registrant certifies that it has reasonable grounds to believe that it meets

all of the requirements for filing on

Form S-3 and

has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Santa Clara,

State of California, on July 19, 2018.

|

|

|

|

|

|

|

MARVELL TECHNOLOGY GROUP LTD.

|

|

|

|

|

By:

|

|

/s/ JEAN HU

|

|

|

|

Name:

|

|

Jean Hu

|

|

|

|

Title:

|

|

Chief Financial Officer

|

Pursuant to the requirements of the Securities Act of 1933, this registration statement has been signed by the following

persons in the capacities indicated on July 19, 2018.

|

|

|

|

|

|

|

Name and

Signature

|

|

Title

|

|

Date

|

|

|

|

|

|

/s/ MATTHEW J. MURPHY

Matthew J. Murphy

|

|

Director, President and Chief Executive Officer

(Principal Executive Officer)

|

|

July 19, 2018

|

|

|

|

|

|

/s/ JEAN HU

Jean Hu

|

|

Chief Financial Officer

(Principal Financial Officer)

|

|

July 19, 2018

|

|

|

|

|

|

/s/ WILLEM MEINTJES

Willem Meintjes

|

|

Chief Accounting Officer

(Principal Accounting Officer)

|

|

July 19, 2018

|

|

|

|

|

|

**

Richard Hill

|

|

Chairman of the Board

|

|

July 19, 2018

|

|

|

|

|

|

**

Tudor Brown

|

|

Director

|

|

July 19, 2018

|

|

|

|

|

|

**

Oleg Khaykin

|

|

Director

|

|

July 19, 2018

|

|

|

|

|

|

/s/ BETHANY MAYER

Bethany Mayer

|

|

Director

|

|

July 19, 2018

|

|

|

|

|

|

/s/ DONNA MORRIS

Donna Morris

|

|

Director

|

|

July 19, 2018

|

|

|

|

|

|

**

Michael Strachan

|

|

Director

|

|

July 19, 2018

|

|

|

|

|

|

**

Robert E. Switz

|

|

Director

|

|

July 19, 2018

|

|

|

|

|

|

|

|

|

|

|

|

/s/ SYED B. ALI

Syed B. Ali

|

|

Director

|

|

July 19, 2018

|

|

|

|

|

|

/s/ BRAD W. BUSS

Brad W. Buss

|

|

Director

|

|

July 19, 2018

|

|

|

|

|

|

Edward H. Frank

|

|

Director

|

|

July 19, 2018

|

|

|

|

|

|

|

|

|

|

**By:

|

|

/s/ Jean Hu

|

|

|

|

|

|

|

|

Attorney-in-fact

|

|

|

|

|

|

**

|

Signatures included with Power of Attorney in the Registration Statement on Form

S-4

filed with the SEC on December 21, 2017.

|

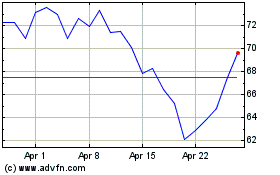

Marvell Technology (NASDAQ:MRVL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Marvell Technology (NASDAQ:MRVL)

Historical Stock Chart

From Apr 2023 to Apr 2024